Choosing between Kraken and Binance can be a tough decision for crypto traders. Both exchanges offer a wide range of cryptocurrencies and trading options, but they differ in important ways that might affect your trading experience.

While Binance offers lower fees (0-0.10% for spot trading) and more variety in trading options, Kraken stands out for its stronger security measures and transparency. You’ll find that Binance typically appeals to traders looking for more opportunities and competitive pricing, whereas Kraken attracts those who prioritize a trustworthy platform with solid regulatory compliance.

Your decision should ultimately depend on your specific needs as a trader. If you’re new to crypto trading, you might appreciate Kraken’s more straightforward approach. If you’re looking to access a wider variety of coins and potentially save on fees, Binance could be your better option. Consider factors like security, available coins, fees, and user interface when making your choice.

Kraken Vs Binance: At A Glance Comparison

When choosing between Kraken and Binance, understanding their key differences can help you make the right decision for your crypto trading needs.

Trading Fees

- Binance: Lower trading fees at 0.1% per trade

- Kraken: Higher trading fees at 0.26% (taker) and 0.16% (maker)

Features Comparison

| Feature | Kraken | Binance |

|---|---|---|

| Security | Highly rated | Good but has faced hacks |

| Coin Variety | Good selection | Larger selection |

| User Interface | Clean, straightforward | Feature-rich, can be complex |

| Customer Support | Strong reputation | Mixed reviews |

Binance tends to appeal more to high-volume traders who want access to a wide variety of cryptocurrencies and trading pairs. The lower fees make it cost-effective if you trade frequently.

Kraken stands out for its focus on security and transparency. While you’ll pay slightly higher fees, many users feel the added security is worth the cost.

Both exchanges offer mobile apps, staking options, and educational resources for users. Your choice might come down to whether you prioritize lower fees and more trading options (Binance) or better security and customer support (Kraken).

For beginners, Kraken’s simpler interface might be easier to navigate. If you’re an advanced trader looking for more tools and options, Binance provides more sophisticated trading features.

Kraken Vs Binance: Trading Markets, Products & Leverage Offered

Binance offers over 350 cryptocurrencies for trading, while Kraken supports around 200. This difference makes Binance a better choice if you’re looking for more variety in your trading options.

When it comes to trading pairs, Binance provides significantly more combinations. You’ll find thousands of trading pairs on Binance compared to several hundred on Kraken.

Products Available:

- Binance: Spot trading, futures, options, margin trading, NFT marketplace, launchpad, staking, lending, and DeFi integration

- Kraken: Spot trading, futures, margin trading, staking, and OTC services

Binance has integrated Web3 and DeFi functionality directly into its platform. This gives you more investment tools and earnings methods all in one place.

Both exchanges offer leverage trading, but with different limits. Binance allows up to 125x leverage on futures contracts for experienced traders. Kraken offers more conservative leverage options, typically maxing out at 5x for most users.

Trading features also differ between platforms. Binance provides more advanced charting tools and technical indicators. Kraken offers a cleaner interface that might be easier to navigate for beginners.

For institutional investors, both platforms provide OTC (Over-The-Counter) services. However, Kraken has built a stronger reputation in this area with its dedicated OTC desk.

If you’re interested in earning passive income, both exchanges offer staking. Binance provides more options with its flexible savings and locked staking programs.

Kraken Vs Binance: Supported Cryptocurrencies

When choosing between Kraken and Binance, the number of available cryptocurrencies is a key factor to consider for your trading needs.

Binance takes the lead with support for over 350 cryptocurrencies. This extensive selection gives you access to both established coins and emerging altcoins in one platform.

Kraken offers fewer options, supporting approximately 200 cryptocurrencies. While this is still a solid selection, you’ll find fewer obscure or newer tokens compared to Binance.

Cryptocurrency Support Comparison:

| Exchange | Number of Cryptocurrencies | Popular Coins | Stablecoins |

|---|---|---|---|

| Binance | 350+ | BTC, ETH, SOL, ADA | USDT, USDC, BUSD |

| Kraken | ~200 | BTC, ETH, DOT, XRP | USDT, USDC, DAI |

Both exchanges support the major cryptocurrencies like Bitcoin and Ethereum, so you won’t miss out on the market leaders regardless of your choice.

If you’re interested in trading less common altcoins or newly launched tokens, Binance will likely have what you’re looking for.

Kraken focuses more on established, vetted cryptocurrencies, which might appeal to you if security and reliability are top priorities.

Your decision should align with your trading strategy – choose Binance if you want the widest selection, or Kraken if you prefer a more curated list of cryptocurrencies.

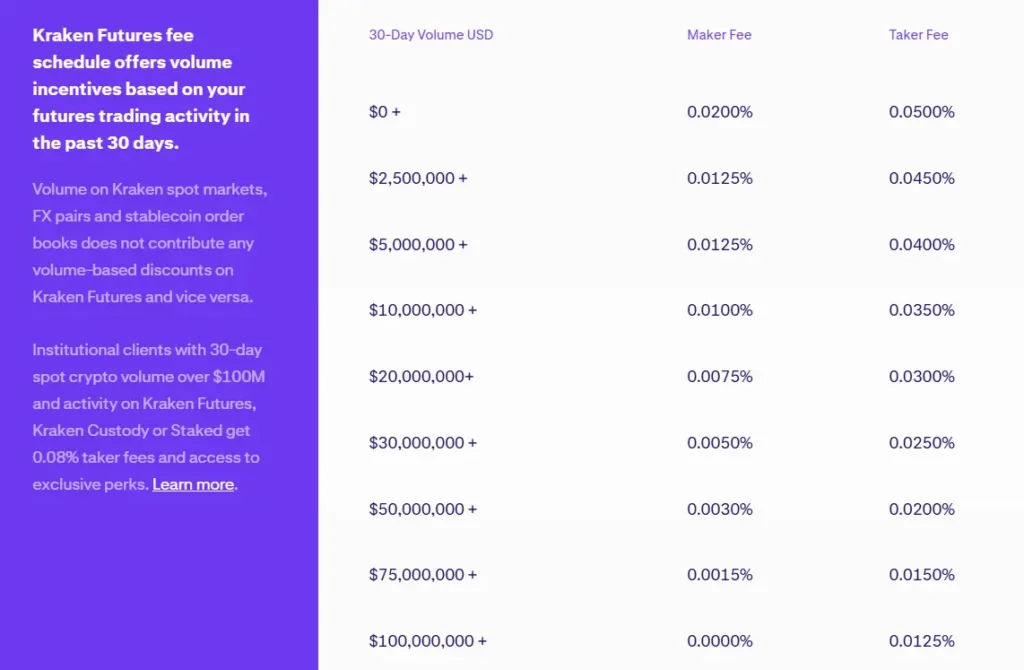

Kraken Vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Kraken and Binance, trading fees are a crucial factor to consider for your investment strategy. Binance offers a more competitive base trading fee at 0.1% compared to Kraken’s higher rate of 0.26%.

For regular traders, this difference can significantly impact your profits over time. If you trade frequently, Binance could save you substantial money on fees.

Both exchanges offer fee discounts based on trading volume and token holdings. However, Binance generally maintains its edge in this area across most trading pairs.

Deposit Fees:

- Binance: Free for most crypto deposits

- Kraken: Free for most crypto deposits

Withdrawal Fees:

- Both platforms charge variable withdrawal fees depending on the cryptocurrency

- Fees fluctuate based on network congestion

For card purchases, Kraken charges approximately 3.75% plus a small fixed fee (€0.75). Binance advertises a 2% fee for card purchases, though actual costs might be closer to 3% in practice.

If you’re focused purely on trading costs, Binance emerges as the more affordable option. The 0.16% difference in base trading fees becomes increasingly significant as your trading volume grows.

Remember that fee structures can change over time. It’s always wise to check both platforms’ current fee schedules before making your decision.

Kraken Vs Binance: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both Kraken and Binance offer a variety of order options, but there are some key differences to consider.

Kraken’s Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

- Conditional close orders

- Settlement orders

Kraken provides a solid foundation of basic order types that will satisfy most traders. Their conditional close orders are particularly useful for setting exit strategies simultaneously with entry positions.

Binance’s Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

- Iceberg orders

Binance offers a more extensive selection of advanced order types. This gives you more flexibility when executing complex trading strategies.

For beginners, both platforms offer the essential market and limit orders you’ll need to get started. However, if you’re an advanced trader, Binance’s additional order options might better suit your needs.

Binance’s OCO orders are especially valuable for traders who want to set both stop-loss and take-profit targets simultaneously. Meanwhile, Kraken’s interface for placing orders tends to be more straightforward and user-friendly for newcomers.

Your trading style and experience level should guide your choice between these exchanges when considering order types.

Kraken Vs Binance: KYC Requirements & KYC Limits

Both Kraken and Binance use Know Your Customer (KYC) procedures to verify user identities. These procedures help prevent fraud and comply with regulations.

Kraken’s KYC Process:

- Basic verification requires your name, date of birth, and address

- Intermediate verification needs a valid ID and proof of residence

- Advanced verification may require additional documentation

Kraken’s KYC process is generally considered straightforward. You’ll need to submit a driver’s license and a selfie to complete basic verification.

Binance’s KYC Process:

- Basic verification requires personal information and ID verification

- Intermediate levels may require facial verification

- Advanced verification needs proof of address and additional documents

Some users find Binance’s KYC requirements more demanding compared to Kraken.

Account Limits:

| Exchange | Unverified | Basic Verification | Full Verification |

|---|---|---|---|

| Kraken | Limited | Higher withdrawal limits | Highest limits based on verification |

| Binance | Very limited | Increased limits | Highest limits for fully verified accounts |

Your withdrawal limits on both platforms depend on your verification level. The more verification steps you complete, the higher your transaction limits will be.

Both exchanges maintain strong security standards, holding most client assets in cold storage while ensuring regulatory compliance through these KYC measures.

Kraken Vs Binance: Deposits & Withdrawal Options

Both Kraken and Binance offer various ways to add or remove funds from your account. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Methods:

- Kraken: Bank transfers (ACH, SWIFT), wire transfers, and cryptocurrency deposits

- Binance: Bank transfers, credit/debit cards, P2P trading, and cryptocurrency deposits

Kraken provides more traditional banking options for US users, making it easier to deposit fiat currency directly from your bank account. Binance offers greater flexibility with peer-to-peer options and card payments.

Withdrawal Methods:

- Kraken: Bank transfers, wire transfers, and cryptocurrency withdrawals

- Binance: Bank transfers, P2P withdrawals, and cryptocurrency withdrawals

When it comes to fees, there’s a notable difference. Binance typically charges lower trading fees (0.1% compared to Kraken’s 0.26%), but Kraken often has more cost-effective fiat withdrawal options.

Kraken stands out with slightly lower cryptocurrency withdrawal fees, which is important if you frequently move assets off the exchange.

Processing times also differ between the platforms. Cryptocurrency transactions usually process within minutes on both exchanges, but fiat withdrawals can take 1-5 business days depending on your location and banking method.

You’ll find that Binance supports more cryptocurrencies overall with 350+ coins available for deposit and withdrawal, while Kraken offers a more curated selection.

Kraken Vs Binance: Trading & Platform Experience Comparison

Binance and Kraken offer different trading experiences that cater to various types of crypto investors. Your choice between these platforms should depend on your trading needs and experience level.

Binance provides a more complex interface with advanced charting tools and trading options. You’ll find over 350 cryptocurrencies available for trading, which exceeds what Kraken offers.

Kraken’s platform is more straightforward and user-friendly, making it better for beginners. Its clean design helps you navigate the trading process with less confusion.

Trading Fee Comparison:

| Exchange | Basic Trading Fee |

|---|---|

| Binance | 0.1% |

| Kraken | 0.26% |

When it comes to trading volumes, Binance typically handles significantly more daily trades. This can mean better liquidity for your transactions, especially with less common cryptocurrencies.

Kraken shines in security and regulatory compliance. You might appreciate their transparent security measures if safety is your top priority.

Binance’s app experience tends to be more feature-rich but potentially overwhelming for new users. Kraken’s mobile app focuses on simplicity and essential functions.

Both platforms offer staking options, but Binance provides a wider range of earning products. Your potential returns might be higher on Binance if you’re interested in passive income options.

Trading pairs are more abundant on Binance, giving you more flexibility with your trading strategies and currency conversions.

Kraken Vs Binance: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding liquidation mechanisms is crucial. Both Kraken and Binance have systems in place to manage risk when positions approach margin requirements.

Kraken uses a tiered liquidation process. Your position faces partial liquidation first, where the exchange reduces your position size to increase your margin. If this doesn’t work, full liquidation occurs.

Binance employs an Insurance Fund to manage liquidations. The exchange uses a “smart liquidation” mechanism that tries to prevent complete loss of funds. Your position gets liquidated when it reaches the maintenance margin threshold.

Liquidation Warning Levels:

- Kraken: Sends notifications at 80% and 90% of margin usage

- Binance: Provides alerts when margin ratio approaches critical levels

Both platforms offer liquidation protection features, but they differ in implementation. Kraken’s system tends to be more gradual, while Binance’s process is often more immediate.

Kraken charges a liquidation fee of 0.5% of the position’s notional value. Binance’s liquidation fees vary by market but generally range from 0.5% to 1.0%.

You can set stop-loss orders on both platforms to exit positions before liquidation occurs. This helps protect your capital and maintain control over your trading strategy.

Kraken Vs Binance: Insurance

When comparing Kraken and Binance, their insurance policies are important to consider for your crypto security.

Kraken maintains a robust insurance policy through its reserves. They keep most user funds (95%) in cold storage, which protects your assets from online threats. Kraken doesn’t rely heavily on third-party insurance but focuses on strong security measures instead.

Binance offers the Secure Asset Fund for Users (SAFU), which sets aside 10% of trading fees into an emergency insurance fund. This fund aims to protect users in case of security breaches or hacks.

Key Insurance Differences:

| Feature | Kraken | Binance |

|---|---|---|

| Insurance Type | Cold storage (95% of funds) | SAFU emergency fund |

| Coverage Source | Self-insurance through reserves | Trading fee contributions (10%) |

| Insurance History | Strong security record, few incidents | Has used SAFU funds for previous incidents |

| User Protection | Focus on prevention through security | Focus on compensation after incidents |

Neither exchange offers complete insurance coverage like traditional banks. Your crypto assets aren’t protected by government programs such as FDIC insurance.

For maximum security, you should consider keeping only trading amounts on these exchanges. Store your long-term holdings in personal wallets for better control over your assets.

Both platforms regularly update their security measures to protect your funds, but their insurance approaches reflect different philosophies toward user protection.

Kraken Vs Binance: Customer Support

When choosing between Kraken and Binance, customer support can be a deciding factor for many traders. Good support becomes crucial when you face account issues or have questions about trading.

Kraken offers 24/7 live customer support, which many users find responsive and helpful. You can reach their team through live chat, email, or phone support. This constant availability gives traders peace of mind, especially during urgent situations.

Binance’s customer support, while extensive, has received mixed reviews. Some users report longer response times compared to Kraken. Binance primarily relies on ticket-based support and chatbots for initial inquiries.

Response Time Comparison:

- Kraken: Generally faster responses, often within minutes for live chat

- Binance: Can take longer, especially during peak trading periods

Support Channels:

- Kraken: Live chat, email, phone support

- Binance: Ticket system, chatbot, email

During market volatility or high-volume trading periods, both platforms may experience delays. However, Kraken’s dedicated live support team often handles these situations better.

If you’re new to crypto trading, Kraken’s more accessible support might give you more confidence. Experienced traders might find either platform sufficient for their needs.

The quality of customer support can significantly impact your trading experience, especially when dealing with large transactions or account security concerns.

Kraken Vs Binance: Security Features

When choosing a crypto exchange, security should be your top priority. Both Kraken and Binance have implemented strong security measures, but there are some key differences.

Kraken stores about 95% of user assets in cold storage, keeping them offline and away from potential hackers. This approach has helped Kraken maintain a clean security record with no major hacks reported.

Binance also uses cold storage but has experienced security breaches in the past. In 2019, hackers stole 7,000 Bitcoin from the platform.

Authentication Methods:

- Both platforms offer two-factor authentication (2FA)

- Both use encrypted data storage

- Kraken provides global settings lock, which freezes account changes

- Binance offers SAFU (Secure Asset Fund for Users), a protection fund

Kraken has built a stronger reputation for reliability and safety in the crypto community. Their security team is well-regarded and they regularly undergo security audits.

For beginners, Kraken’s security features might be easier to navigate and understand. Binance’s security options are comprehensive but can be more complex for new users.

When setting up your account on either platform, always enable all available security features. Use strong passwords, activate 2FA, and consider using a hardware wallet for long-term storage of large crypto holdings.

Is Kraken A Safe & Legal To Use?

Kraken is considered one of the safest cryptocurrency exchanges available today. It employs strict security measures including multiple authentication keys for different functions, which adds layers of protection for your assets.

Kraken uses robust know your customer (KYC) standards similar to Binance. This verification process helps ensure the platform remains compliant with regulations and protects users from fraud.

The exchange stores the vast majority of user funds in cold storage, keeping them offline and away from potential hackers. This significantly reduces the risk of theft through online attacks.

Independent auditors often rank Kraken #1 in both security and customer service. This external validation provides added confidence in the platform’s commitment to protecting your investments.

Kraken is fully legal to use in most countries. The exchange is registered as a Money Services Business with FinCEN in the United States and complies with regulations in other jurisdictions where it operates.

The platform has maintained a strong security record since its founding in 2011. While no exchange is completely immune to issues, Kraken has consistently prioritized security throughout its history.

Key Safety Features:

- Multi-factor authentication

- Global Settings Lock for account changes

- Address whitelisting for withdrawals

- Email confirmations for sensitive actions

- 24/7 security monitoring

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe crypto exchange with some important security features. The platform stores most user funds in “cold wallets” that aren’t connected to the internet, protecting them from online attacks.

Both Binance and Kraken maintain strict Know Your Customer (KYC) standards. These verification procedures help prevent fraud and comply with regulations.

However, Binance has faced some regulatory challenges in different countries. This might affect whether it’s legal for you to use in your location.

Kraken is often rated higher for transparency and security compared to Binance. This is worth considering if safety is your top priority.

For U.S. users, Binance.US operates as a separate entity from the international Binance platform. It offers fewer cryptocurrencies and different fee structures but is considered secure.

Before choosing Binance, check if it’s legal in your country or state. Regulations for crypto exchanges change frequently.

Security Features to Know:

- Cold storage for most assets

- Two-factor authentication (2FA)

- Address whitelisting options

- Anti-phishing measures

Your personal security practices matter too. Always use strong passwords, enable all security features, and be cautious about phishing attempts targeting your account.

Frequently Asked Questions

Traders often need specific details when comparing Kraken and Binance. These platforms differ in fees, security measures, user experience, and available cryptocurrencies.

What are the differences in trading fees between Kraken and Binance?

Binance typically offers lower trading fees than Kraken, starting at 0.1% for makers and takers. This rate can decrease further with higher trading volume or BNB token usage.

Kraken’s fees start slightly higher at around 0.16% for makers and 0.26% for takers. Both exchanges offer fee discounts based on 30-day trading volume.

The fee structure makes Binance more attractive for high-volume traders, while Kraken’s slightly higher fees support its enhanced security and customer service.

How do withdrawal fees compare between Kraken and Binance?

Withdrawal fees vary by cryptocurrency on both platforms. Binance typically charges network fees that match the blockchain’s current congestion level.

Kraken often has slightly higher withdrawal fees for some assets. For example, Bitcoin withdrawals might cost more on Kraken than on Binance.

Both exchanges adjust these fees periodically based on network conditions, so it’s worth checking their current fee schedules before making large withdrawals.

Which platform offers better security features, Kraken or Binance?

Kraken has built a strong reputation for security with zero major hacks since its founding in 2011. It offers robust features like two-factor authentication, email verification, and global settings lock.

Binance has experienced security incidents in the past but has since strengthened its security measures. It now provides similar protection features including two-factor authentication and anti-phishing codes.

Kraken’s 24/7 live customer support gives it an edge when users face security concerns. This responsive support system helps resolve issues quickly.

How do the user experiences of Kraken and Binance differ?

Kraken offers a more straightforward interface that beginners find easier to navigate. Its clean design focuses on essential features without overwhelming new users.

Binance provides a feature-rich experience that appeals to advanced traders. It includes more detailed charts, analysis tools, and trading options.

Customer support is a key difference, with Kraken offering live 24/7 support. Binance primarily relies on ticket systems and automated help, which can be slower to resolve issues.

Can you explain the differences in supported cryptocurrencies on Kraken versus Binance?

Binance supports a wider range of cryptocurrencies, with over 350 different coins and tokens available for trading. This makes it appealing if you want to access newer or less common assets.

Kraken offers fewer cryptocurrencies (around 185) but focuses on thoroughly vetting each listing. This more selective approach prioritizes quality and regulatory compliance over quantity.

Both exchanges support all major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, but you’ll find more niche altcoins on Binance.

What are the key factors to consider when choosing between Kraken and Coinbase?

While this comparison focuses on Kraken vs Binance, Coinbase differs from Kraken in its higher fees but more beginner-friendly interface. Kraken offers lower fees than Coinbase but requires more crypto knowledge.

Security is strong on both platforms, with Kraken and Coinbase maintaining excellent security records. Coinbase may be slightly easier for complete beginners but offers fewer advanced trading options.

Customer support quality varies, with Kraken offering more responsive live support compared to Coinbase’s mainly ticket-based system.

Kraken Vs Binance Conclusion: Why Not Use Both?

Both Kraken and Binance stand out as top crypto exchanges in 2025, each with unique strengths. Instead of choosing just one, using both platforms might be your best strategy.

Kraken offers better security features with multiple authentication keys and keeps most assets in cold storage. Its interface is also more beginner-friendly if you’re new to crypto trading.

Binance shines with its extensive selection of cryptocurrencies and is designed with experienced traders in mind. The platform offers more advanced trading tools that seasoned investors appreciate.

Consider using Kraken for:

- More secure storage of larger holdings

- OTC trading options

- Simpler interface when learning

Try Binance for:

- Access to a wider variety of altcoins

- Advanced trading features

- Higher trading volumes

Your trading needs may change over time. Having accounts on both platforms gives you flexibility to use the best features of each exchange as your strategy evolves.

Remember that crypto regulations change frequently. By maintaining accounts on multiple reputable exchanges, you reduce the risk of being unable to trade if one platform faces regulatory challenges.