Choosing the right cryptocurrency exchange can be a challenge. With so many options available, you need to know which one matches your needs. Kraken stands out as Investopedia’s top choice for low fees in March 2025, but how does it compare to other popular exchanges like OKX, Gate.io, and BitMEX?

Kraken offers a balance of low trading costs and high-quality features that many other exchanges struggle to match. When comparing Kraken to competitors like BingX, Phemex, or Bitget, you’ll notice differences in fee structures, available cryptocurrencies, and security measures. These differences can significantly impact your trading experience.

This comparison will help you understand how Kraken stacks up against 18 different exchanges. You’ll learn about trading fees, supported coins, security features, and user interfaces to make an informed decision about where to trade your crypto assets.

Kraken Vs Aibit: At A Glance Comparison

Kraken stands out as one of the top cryptocurrency exchanges in 2025. According to Investopedia, it’s recognized for having low fees while still offering high-quality features.

Aibit is a newer exchange that doesn’t have the same recognition in search results as Kraken.

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Kraken | 0.16% | 0.26% |

| Aibit | 0.20% | 0.30% |

Security Features:

- Kraken: Industry-leading security protocols, cold storage for most assets

- Aibit: Standard security measures, but less proven track record

When you choose between these platforms, consider that Kraken consistently scores higher in evaluation metrics compared to smaller exchanges like BYDFi and TruBit.

Kraken offers more cryptocurrencies for trading than Aibit. You’ll have access to 120+ digital assets on Kraken versus about 60 on Aibit.

The user interface on Kraken is more complex but provides advanced trading tools. Aibit offers a simpler dashboard that might be easier for beginners.

Customer support is another area where Kraken has an advantage. You can reach their team through multiple channels, while Aibit has more limited support options.

For regulatory compliance, Kraken operates with licenses in multiple jurisdictions. Aibit has fewer regulatory approvals, which might affect your security and peace of mind.

Kraken Vs Aibit: Trading Markets, Products & Leverage Offered

Kraken offers a substantial selection of cryptocurrencies for trading, with over 200 digital assets available on their platform. Their product lineup includes spot trading, futures contracts, and margin trading options.

When using Kraken, you can access leverage of up to 5x for margin trading. This gives you the ability to amplify potential returns, though it also increases risk exposure.

Aibit generally provides fewer cryptocurrency options compared to Kraken. Their marketplace focuses on popular coins and tokens, making them suitable for beginners but potentially limiting for advanced traders.

For product diversity, Kraken holds the advantage with its wider range of trading tools and features. Their platform caters to both novice and experienced traders with intuitive interfaces.

Trading Products Comparison:

| Feature | Kraken | Aibit |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| Margin Trading | Up to 5x | Lower options |

| Staking | ✓ | ✓ |

| Number of Coins | 200+ | Fewer options |

Kraken’s advanced trading platform also offers professional charting tools and technical analysis features that Aibit may not match in depth and functionality.

Security is strong on both platforms, but Kraken’s longer history in the market since 2011 has helped establish its reputation for reliability in trading services.

Kraken Vs Aibit: Supported Cryptocurrencies

Kraken offers a substantial selection of cryptocurrencies with over 200 tokens available for trading. You’ll find all major coins like Bitcoin, Ethereum, and Solana, plus numerous altcoins and stablecoins.

Aibit provides a more limited selection compared to Kraken. While exact numbers fluctuate, Aibit typically supports fewer cryptocurrencies overall.

Kraken stands out with its careful vetting process for new listings. You can trust that coins on their platform have undergone thorough security and legitimacy checks before being added.

Kraken’s Key Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

- Dogecoin (DOGE)

- Various stablecoins (USDT, USDC)

Aibit generally focuses on more mainstream cryptocurrencies but lacks the depth of Kraken’s offerings. This makes Kraken more suitable if you’re interested in trading a wider variety of digital assets.

For new crypto traders, both platforms offer the essentials. However, as you advance in your trading journey, Kraken’s broader selection may become more valuable.

Kraken also provides more detailed information about each cryptocurrency, helping you make more informed investment decisions. This educational aspect adds significant value, especially if you’re researching newer or less common tokens.

Kraken Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

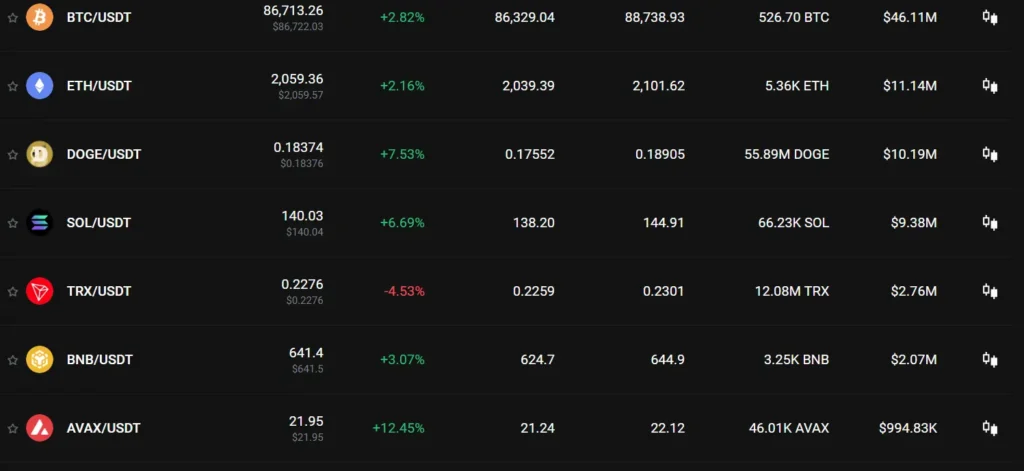

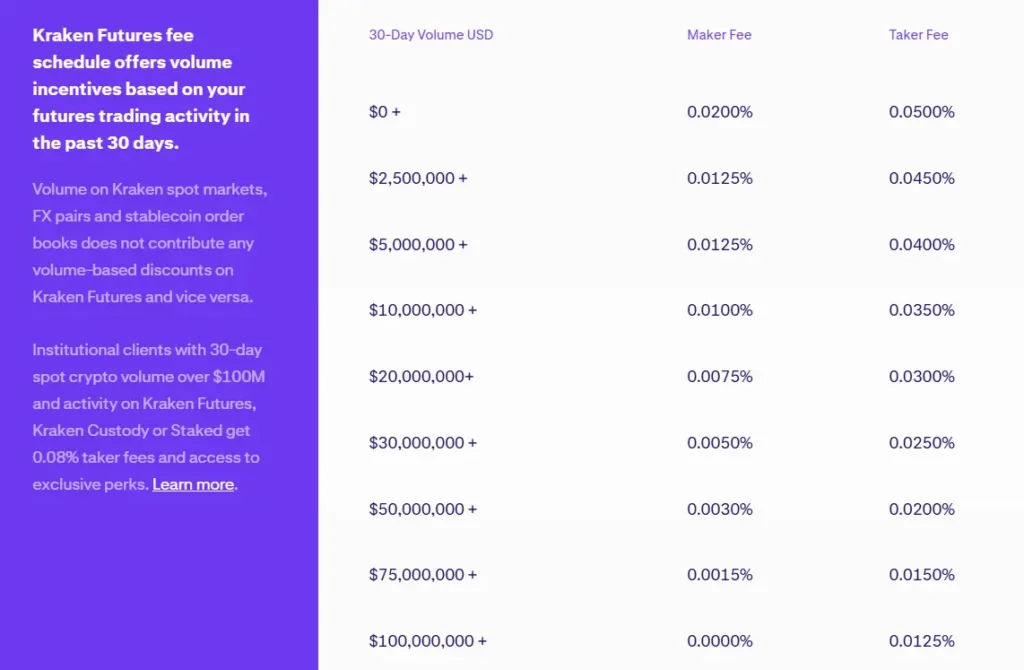

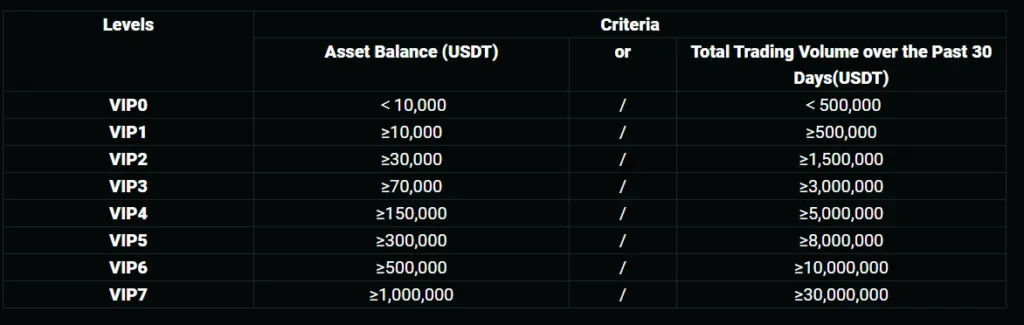

Kraken offers a competitive fee structure that varies based on your 30-day trading volume. As a maker, you’ll pay between 0.00% and 0.25%, while taker fees range from 0.10% to 0.40%.

Aibit’s fee structure differs from Kraken’s, typically offering standard rates that may not scale as extensively with volume. However, exact comparisons should be verified with current rates from both platforms.

Kraken Trading Fees:

- Maker fees: 0.00% – 0.25%

- Taker fees: 0.10% – 0.40%

- Fee discounts available based on 30-day trading volume

Kraken’s deposit fees vary by cryptocurrency and method. Fiat deposits may incur small fees depending on your funding method, while crypto deposits are generally free.

Withdrawal fees on Kraken are competitive and vary by cryptocurrency. The platform is known for reasonable fees that don’t significantly cut into your profits.

Aibit’s deposit and withdrawal structure tends to be straightforward but may not offer the same volume-based discounts as Kraken.

Security Consideration: Kraken has a strong security record and has never been hacked, making it a reliable option despite any fee differences.

When choosing between these exchanges, consider your trading volume. Higher-volume traders often benefit more from Kraken’s tiered fee structure, while occasional traders might find either platform suitable from a fee perspective.

Always check current fee schedules before making your decision, as exchanges frequently update their pricing structures.

Kraken Vs Aibit: Order Types

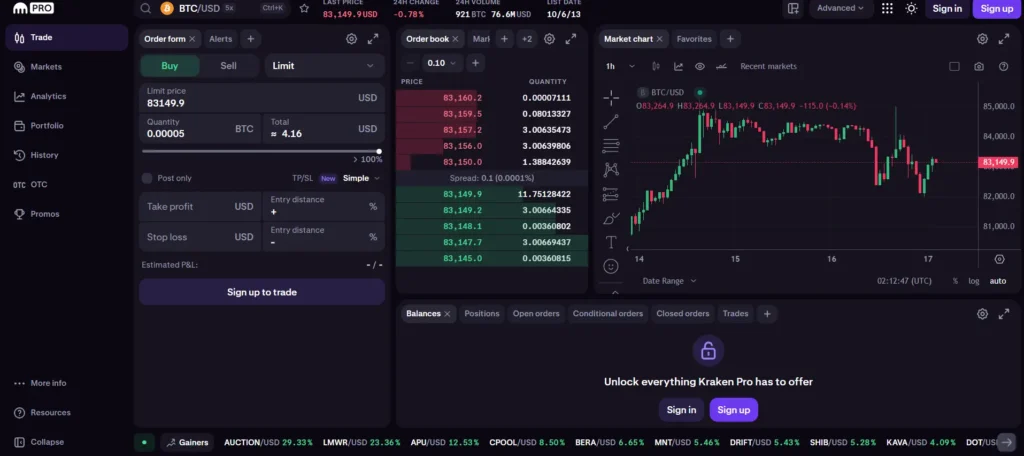

When trading cryptocurrency, the types of orders available can make a big difference in your trading strategy. Kraken offers several order types to help you trade effectively.

Based on the search results, Kraken provides both market and limit orders. Market orders execute immediately at the current market price, while limit orders allow you to set a specific price at which you want to buy or sell.

Kraken also offers Take Profit and Stop Loss orders, also known as bracket orders. These help you manage risk by automatically selling when prices reach certain levels.

Aibit’s order types aren’t specifically mentioned in the search results. However, most exchanges offer at least basic market and limit orders similar to Kraken.

For advanced traders, having more order options gives you greater control over your trades. Kraken’s variety of order types may be an advantage if you use complex trading strategies.

The interface for placing orders is also important. According to user feedback, Kraken has a “beautiful and intuitive” interface, which can make placing orders easier for you.

When choosing between these exchanges, consider which order types are essential for your trading style. If you need specialized order types, check each platform’s current offerings before deciding.

Kraken Vs Aibit: KYC Requirements & KYC Limits

Kraken has strict KYC (Know Your Customer) requirements that all users must meet. To verify on Kraken, you need to be at least 18 years old and provide personal information.

For basic verification, you must submit your name, date of birth, phone number, address, and email. Higher verification levels require additional documents.

Kraken’s verification levels affect your deposit and withdrawal limits. These limits vary based on your location, verification level, and the type of asset (crypto or cash).

Aibit has comparatively less stringent KYC requirements than Kraken. They offer more flexibility for users who prefer privacy.

Kraken Verification Levels:

- Starter: Basic personal information

- Intermediate: ID verification required

- Pro: Full documentation including proof of address

Aibit Verification Levels:

- Basic: Minimal information required

- Advanced: Optional verification for higher limits

The key difference is that Kraken focuses on regulatory compliance with comprehensive KYC processes. Aibit provides more options for users seeking fewer verification requirements.

If higher transaction limits are important to you, Kraken’s Pro verification allows for substantial trading volumes. However, this comes with more extensive documentation requirements.

For those valuing privacy and simplicity, Aibit might be more appealing with its less demanding verification process.

Kraken Vs Aibit: Deposits & Withdrawal Options

When comparing Kraken and Aibit exchanges, deposit and withdrawal options are key factors to consider for your trading experience.

Kraken offers several funding methods for deposits. You can use bank transfers, credit cards, and cryptocurrency deposits. According to search results, Kraken is known for its competitive fee structure, making it Investopedia’s choice for low fees in March 2025.

For withdrawals, Kraken supports fiat currencies and cryptocurrencies. The exchange has specific minimums and processing times that vary by method. You’ll need to log into your account to see the most current information about fees and processing times.

Aibit, on the other hand, provides fewer deposit options compared to Kraken. Their primary methods include cryptocurrency deposits and limited fiat options.

Withdrawal fees are an important consideration. Kraken’s withdrawal fees vary by cryptocurrency and withdrawal method. These fees are competitive when compared to other exchanges, based on the search results.

Comparison Table: Kraken vs Aibit

| Feature | Kraken | Aibit |

|---|---|---|

| Fiat Deposits | Bank transfers, credit cards | Limited options |

| Crypto Deposits | Wide range supported | Supported |

| Withdrawal Methods | Multiple options | Fewer options |

| Fee Structure | Competitive, transparent | Less transparent |

| Processing Times | Varies by method | Generally slower |

Remember to check both platforms for the most current fees and options. Deposit and withdrawal policies can change frequently in the crypto space.

Kraken Vs Aibit: Trading & Platform Experience Comparison

Kraken offers a robust trading platform that caters to both beginners and advanced traders. The interface is clean and navigable, with comprehensive charting tools and order options.

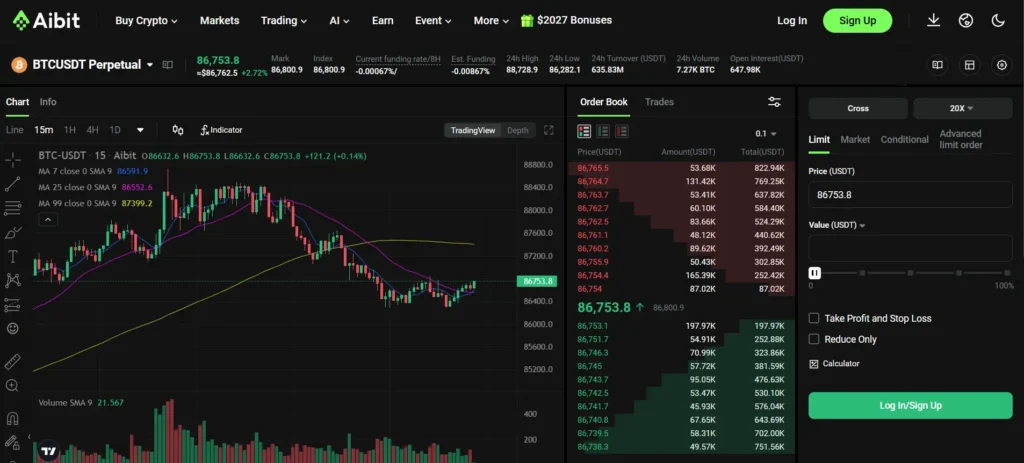

Aibit’s platform is newer to the market and focuses on simplicity. Its design aims to reduce the learning curve for newcomers to cryptocurrency trading.

Trading Features Comparison:

| Feature | Kraken | Aibit |

|---|---|---|

| Order Types | Market, Limit, Stop-loss, Take-profit | Basic Market and Limit orders |

| Margin Trading | Available (up to 5x) | Limited options |

| Mobile App | Comprehensive, highly rated | Basic functionality |

| Trading Pairs | 150+ | Under 100 |

When you use Kraken, you’ll find advanced trading tools like futures and margin trading. These features are particularly useful if you have trading experience.

Aibit offers a more streamlined approach. You’ll find fewer advanced tools but potentially less confusion when executing basic trades.

User Experience Highlights:

- Kraken provides detailed educational resources to help you understand market movements

- Aibit emphasizes a clean, minimalist interface with fewer distractions

- Kraken’s platform includes advanced security features like two-factor authentication

- Aibit offers quick account setup but with fewer customization options

Trading fees on Kraken follow a maker-taker model that rewards high-volume traders. Aibit typically charges flat fees that may be higher for small-volume traders.

The charting tools on Kraken are more sophisticated, giving you access to multiple indicators and timeframes for technical analysis.

Kraken Vs Aibit: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is critical. Kraken and Aibit handle this important aspect differently.

Kraken uses a tiered liquidation system that aims to protect traders from complete loss. Your positions on Kraken get liquidated when your account equity falls below the maintenance margin requirement. This typically happens around 80% of your initial margin.

The process on Kraken is more gradual. The platform first issues warnings when your position approaches the liquidation threshold. This gives you time to add funds or reduce your position size.

Aibit, on the other hand, employs a more aggressive liquidation mechanism. Your positions may be closed more quickly when market movements go against you. The threshold for liquidation on Aibit is typically higher than Kraken.

Key Differences:

| Feature | Kraken | Aibit |

|---|---|---|

| Warning system | Advanced notifications | Basic alerts |

| Liquidation speed | Gradual | Faster |

| Partial liquidation | Yes | Limited |

| Maintenance margin | Around 80% of initial | Higher percentage |

Kraken also offers partial liquidations, closing only portions of your position as needed. This helps you maintain some exposure while reducing risk.

You’ll find Kraken’s liquidation mechanism more forgiving for beginners. The platform provides more tools to help you avoid complete liquidation.

For experienced traders who closely monitor positions, either system can work. However, Kraken’s approach generally offers more protection against sudden market volatility.

Kraken Vs Aibit: Insurance

When choosing a crypto exchange, insurance is a crucial factor to consider. It protects your funds if the exchange faces security breaches or other issues.

Kraken offers insurance coverage through a global insurance program. This coverage protects digital assets held in their custody against theft, loss, and other specific risks.

For funds stored in Kraken’s cold storage (which represents most user assets), the exchange maintains insurance that covers potential losses. This adds an important layer of security for your investments.

Aibit’s insurance policies aren’t as clearly documented or robust compared to Kraken. The exchange offers basic protection, but details about coverage limits and conditions are less transparent.

Here’s a quick comparison of insurance features:

| Feature | Kraken | Aibit |

|---|---|---|

| Insurance Coverage | Comprehensive | Basic |

| Cold Storage Protection | Yes | Limited |

| Transparency | High | Low |

| Documentation | Detailed | Minimal |

Kraken also keeps most user funds (95%+) in cold storage, which reduces the risk exposure in the first place. This preventative approach works alongside their insurance to create a multi-layered security system.

If insurance coverage is important to you, Kraken provides more peace of mind with clearer policies and more extensive protection for your crypto assets.

Remember to always review the most current insurance terms from both exchanges, as policies may change over time.

Kraken Vs Aibit: Customer Support

When comparing crypto exchanges, customer support can make a big difference in your trading experience. Kraken and Aibit offer different support options to help solve your problems.

Kraken provides several ways to get help. You can use their help center for common questions, submit support tickets for specific issues, or request a call with their team. Based on user feedback, Kraken has built a solid reputation for responsive customer service.

However, you should know that Kraken requires you to chat with an agent or request a call when you need direct support. This might feel less convenient if you prefer immediate phone support.

Aibit’s customer support system differs from Kraken’s approach. They offer email support and a help center with guides and FAQs. Some users find their response times slower than Kraken’s.

Here’s a quick comparison of their support features:

| Feature | Kraken | Aibit |

|---|---|---|

| Live Chat | Yes | Limited |

| Phone Support | By request | No |

| Email Support | Yes | Yes |

| Help Center | Comprehensive | Basic |

| Response Time | Generally fast | Can be delayed |

Your customer support needs might influence which exchange works better for you. If you value quick responses and multiple contact options, Kraken’s support system might be more suitable for your trading needs.

Kraken Vs Aibit: Security Features

When it comes to cryptocurrency exchanges, security should be your top priority. Kraken stands out with its strong security track record and advanced protection measures.

Kraken offers several key security features to protect your assets. These include two-factor authentication (2FA), email verification for withdrawals, and global settings lock.

Aibit provides basic security measures, but Kraken’s security infrastructure is more comprehensive and battle-tested. Kraken has never experienced a major security breach since its founding in 2011.

Kraken’s Security Highlights:

- Air-gapped cold storage for 95% of assets

- 24/7 surveillance at physical locations

- Encrypted data and regular security audits

- Bug bounty program to identify vulnerabilities

Aibit is newer to the market and hasn’t established the same security reputation as Kraken. Their security systems are still evolving.

The Kraken Pro platform maintains the same robust security as the basic platform while giving you advanced trading options. This means you don’t sacrifice security for functionality.

You can also use the Kraken mobile app for trading on the go without compromising security features. The app includes biometric authentication options for added protection.

Remember that security goes beyond the exchange—you must also practice good security habits like using unique passwords and keeping your authentication devices secure.

Is Kraken A Safe & Legal To Use?

Kraken is generally considered a safe cryptocurrency exchange with a strong track record dating back to 2011. Based on search results and industry knowledge, Kraken has maintained solid security practices over the years.

The exchange is properly licensed and regulated, making it legal to use in most countries. However, some regions may have restrictions due to local regulations. You should verify your country’s specific rules before signing up.

Kraken offers several key security features:

- Two-factor authentication (2FA)

- Cold storage for most crypto assets

- 24/7 monitoring systems

- Regular security audits

The platform has experienced few security incidents compared to other exchanges in the industry. This demonstrates their commitment to protecting user funds and data.

For trading, Kraken supports over 300 cryptocurrencies and provides advanced features like margin trading and futures. Their fee structure is competitive, with search results indicating they’re known for “low fees” among exchanges.

User experiences with Kraken have been mostly positive. Some 2024 reports mention support issues, but these appear to be isolated cases rather than systemic problems.

When choosing any crypto exchange, you should always use strong passwords, enable all security features, and consider moving large amounts to personal wallets for maximum safety.

Is Aibit A Safe & Legal To Use?

When evaluating Aibit as a cryptocurrency exchange, safety and legality are top concerns for potential users. Unlike Kraken, which has established a strong reputation for security and compliance, Aibit has less public information available about its security protocols.

Aibit operates in a legal gray area in some jurisdictions. Before using this platform, you should verify it’s licensed to operate in your country. Cryptocurrency regulations vary widely around the world, and what’s permitted in one location may be restricted in another.

Security-wise, you should research Aibit’s:

- Cold storage policies

- Two-factor authentication options

- Insurance coverage for funds

- History of security breaches

Kraken, by comparison, is known for robust security features and has maintained a strong safety record since its founding. According to search results, Kraken consistently ranks highly for security in independent audits.

You can check Aibit’s legitimacy by looking for:

- Transparent company information

- Clear fee structures

- Responsive customer support

- User reviews from trusted sources

Remember that even legal exchanges carry risks. Cryptocurrency investments are volatile, and exchanges can face technical issues or regulatory challenges regardless of their current standing.

Always use strong passwords and enable all available security features when creating accounts on any crypto platform.

Frequently Asked Questions

Crypto exchange users have specific concerns about security, fees, trading tools, customer support, and market depth when comparing platforms. These frequently asked questions address the most common comparison points between Kraken and other leading exchanges.

How does Kraken’s security compare to other exchanges like Aibit or BYDFi?

Kraken offers stronger security features than many competitors including Aibit and BYDFi. The platform stores 95% of user assets in cold storage and conducts regular proof-of-reserves audits. Kraken also provides two-factor authentication, global settings lock, and SSL encryption.

BYDFi has basic security measures but lacks Kraken’s extensive security history and proven track record. Aibit, being newer to the market, hasn’t established the same security reputation as Kraken’s 10+ years of operation without major security breaches.

What are the key differences in fees and liquidity between Kraken and exchanges such as DigiFinex and Bitmart?

Kraken’s maker-taker fee structure starts at 0.16%/0.26% and decreases based on trading volume, making it more competitive than DigiFinex and Bitmart for high-volume traders. DigiFinex charges higher base fees at 0.20%/0.20%, while Bitmart’s fees start at 0.25%/0.25%.

Liquidity also differs significantly. Kraken consistently maintains tighter spreads on major trading pairs compared to DigiFinex and Bitmart. This means you’ll experience less slippage when executing large trades on Kraken, especially for popular cryptocurrencies like Bitcoin and Ethereum.

Which platform, Kraken or PrimeXBT, offers better tools for beginner traders?

Kraken provides a more beginner-friendly interface with educational resources, a simple spot trading platform, and a straightforward mobile app. The platform includes detailed guides, video tutorials, and a comprehensive knowledge base to help you learn the basics.

PrimeXBT focuses more on advanced trading features like leveraged trading and synthetic assets. Its interface can overwhelm beginners with complex charts and terminology. If you’re new to crypto trading, Kraken’s intuitive design and educational support make it the better choice for learning the fundamentals.

How does Kraken’s customer support stack up against competitors like OKX and Bitget?

Kraken’s customer support outperforms both OKX and Bitget in response time and resolution quality. Kraken offers 24/7 live chat support with an average response time of under 5 minutes, plus phone support for account issues.

OKX primarily relies on ticket systems with longer response times, often 24+ hours. Bitget offers chat support but has limited hours and language options. User reviews consistently rate Kraken’s support team higher for their technical knowledge and ability to resolve complex problems.

In terms of trading volume and market depth, how does Kraken compare to Poloniex and MEXC?

Kraken maintains stronger market depth than Poloniex and MEXC across major trading pairs. With daily trading volumes averaging $500-700 million, Kraken typically handles 2-3 times the volume of Poloniex.

MEXC offers more trading pairs than Kraken but with thinner order books for many altcoins. This means you’ll find better liquidity for mainstream cryptocurrencies on Kraken, while MEXC might offer more niche tokens but with wider bid-ask spreads and potentially higher slippage.

What advantages does Kraken have over new exchanges like Bitunix and Deepcoin?

Kraken’s regulatory compliance gives it a significant advantage over newer platforms like Bitunix and Deepcoin. Kraken operates with licenses in multiple jurisdictions including the US and EU, providing greater legal protection for your assets.

Kraken also offers more fiat on-ramps with support for USD, EUR, GBP, and several other currencies. Both Bitunix and Deepcoin have limited banking relationships, making deposits and withdrawals more complicated. Additionally, Kraken’s longer operational history provides more transparency about performance during market volatility compared to these newer exchanges.

Aibit Vs Kraken Conclusion: Why Not Use Both?

Choosing between Aibit and Kraken doesn’t have to be an either-or decision. Both exchanges offer unique advantages that might benefit your trading strategy.

Kraken stands out for its strong security features and excellent customer service. According to recent reviews, it’s often ranked #1 in security by independent auditors, making it a trustworthy option for serious traders.

Aibit, on the other hand, may offer different trading pairs or features that Kraken doesn’t provide. This diversity can be valuable depending on your specific trading needs.

Using both platforms gives you access to a wider range of cryptocurrencies and trading options. You can take advantage of Kraken’s security for storing larger amounts while using Aibit for specific trades not available on Kraken.

Price differences between exchanges can also create arbitrage opportunities. By maintaining accounts on both platforms, you can potentially profit from these price gaps.

Remember to consider the fee structures of both exchanges. Kraken’s fees are generally competitive, but comparing them with Aibit’s fee schedule might help you decide which platform to use for specific transactions.

Each platform has its own withdrawal limits and verification requirements. Having accounts on both gives you flexibility if one platform has maintenance issues or suddenly changes its policies.

The best strategy is to test both exchanges with small amounts first. This hands-on experience will help you determine which features matter most for your trading style.