Choosing between cryptocurrency exchanges can be a tough decision. Huobi and KuCoin are two major platforms that traders often consider when looking for places to buy and sell digital assets. Both Huobi and KuCoin offer a wide range of cryptocurrencies and trading features, but they differ in fees, available services, and regional popularity.

Huobi stands as one of the oldest exchanges in the industry, having survived China’s crypto trading bans while expanding globally. KuCoin, sometimes called the “People’s Exchange,” has gained traction for its user-friendly interface and diverse coin offerings. Each platform has unique strengths that might match your specific trading needs.

As you evaluate these exchanges in 2025, you’ll want to consider factors like security measures, trading fees, supported cryptocurrencies, and available features. Understanding the key differences between Huobi and KuCoin will help you make a better choice for your crypto trading journey.

Huobi Vs KuCoin: At A Glance Comparison

Huobi and KuCoin stand as two major players in the cryptocurrency exchange market. Both have survived through market volatility and regulatory changes to become trusted platforms for crypto traders.

Huobi is one of the oldest exchanges globally, having weathered China’s Bitcoin trading ban. This longevity speaks to its resilience in the crypto space.

KuCoin offers 469 trading pairs, giving users plenty of options for cryptocurrency trading. The platform has gained popularity for its variety of available assets.

| Feature | Huobi | KuCoin |

|---|---|---|

| Founded | 2013 | 2017 |

| Trading Volume | Higher (~ $666 million) | Lower than Huobi |

| Trading Pairs | Extensive selection | 469 pairs |

| User Interface | Professional-oriented | User-friendly |

| Trading Fees | Competitive | Competitive |

When choosing between these exchanges, you should consider your specific trading needs. Huobi might appeal to you if you value established history and higher trading volumes.

KuCoin could be your better choice if you’re looking for a diverse selection of trading pairs. Its user-friendly interface also makes it attractive to newer traders.

Both exchanges offer competitive fee structures, though they differ slightly in their approaches to discounts and membership tiers.

Your trading experience will likely be similar on either platform, as both provide reliable service with strong security measures and similar feature sets.

Huobi Vs KuCoin: Trading Markets, Products & Leverage Offered

Both Huobi and KuCoin offer extensive cryptocurrency trading options, but they differ in several key areas.

Trading Pairs and Market Depth

Huobi stands out with deep liquidity, especially in popular trading pairs like BTC/USDT and ETH/USDT. This makes it easier for you to execute large trades without significant price slippage.

KuCoin offers a wider variety of altcoins, making it appealing if you’re looking to trade less common cryptocurrencies.

Leverage Trading Options

Both exchanges support leverage trading, allowing you to amplify potential returns. As of 2025, they’re among the top platforms for this feature.

Product Offerings:

| Feature | Huobi | KuCoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | Up to 5x | Up to 10x |

| Token Launchpad | ✓ | ✓ |

| Staking Services | ✓ | ✓ |

Huobi caters more to intermediate and advanced traders with its sophisticated trading tools. Its derivatives market is particularly robust.

KuCoin offers a more user-friendly approach while still providing advanced features. Their “Trading Bot” feature helps you automate strategies without needing coding knowledge.

When choosing between these exchanges, consider your trading style and which cryptocurrencies you want to access.

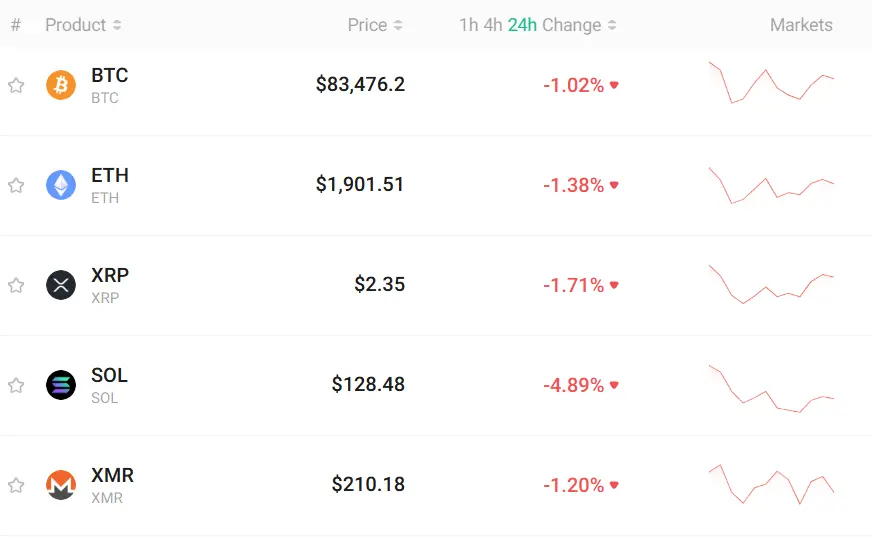

Huobi Vs KuCoin: Supported Cryptocurrencies

When choosing between Huobi and KuCoin, the variety of available cryptocurrencies matters a lot for your trading options. Based on the latest information as of 2025, KuCoin offers a more extensive selection of cryptocurrencies compared to Huobi.

KuCoin supports a higher number of cryptocurrencies, giving you more choices for diversifying your portfolio. This wider selection can be particularly beneficial if you’re interested in trading newer or less mainstream tokens.

Huobi, despite supporting fewer cryptocurrencies, still offers a solid range of options. The exchange has been operating globally for many years, surviving even through China’s ban on Bitcoin trading.

Cryptocurrency Support Comparison:

| Feature | Huobi | KuCoin |

|---|---|---|

| Total cryptocurrencies | Fewer | More |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoins | Many | More variety |

| New token listings | Regular | More frequent |

Both exchanges support all major cryptocurrencies like Bitcoin, Ethereum, and other top tokens. However, if you’re looking to trade more obscure or newly launched altcoins, KuCoin might be the better option for you.

The difference in supported cryptocurrencies could impact your trading strategy, especially if you focus on specific tokens or want exposure to a wider range of digital assets.

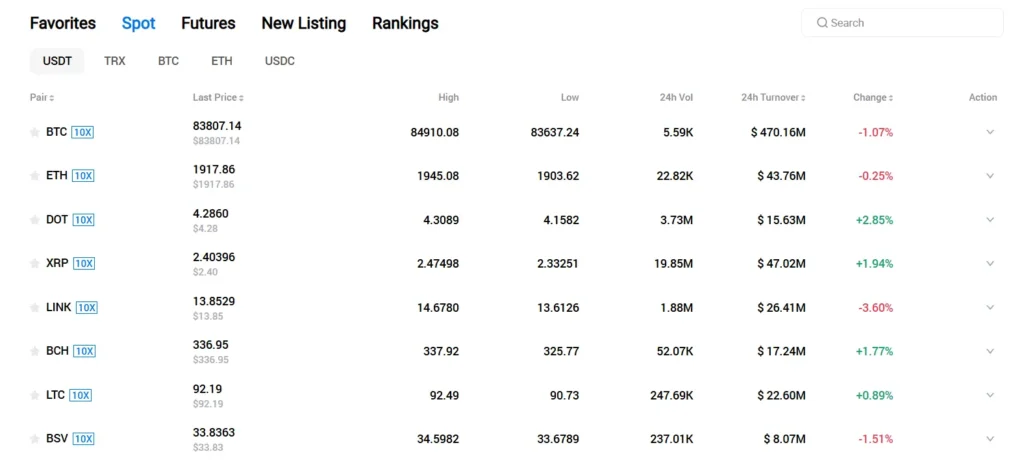

Huobi Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Huobi and KuCoin, understanding their fee structures is crucial for maximizing your trading profits.

Trading Fees:

KuCoin offers more competitive standard trading fees at 0.1% per transaction, while Huobi charges 0.2%. This difference might seem small but can significantly impact your profits with frequent trading.

| Exchange | Standard Trading Fee |

|---|---|

| KuCoin | 0.1% |

| Huobi | 0.2% |

Withdrawal Fees:

According to recent 2025 data, withdrawal fees vary by cryptocurrency. Comparisons show KuCoin often has lower withdrawal fees for many popular tokens.

For example, ENS token withdrawals cost approximately $1.59 at Huobi Global compared to only $0.35 at KuCoin as of March 17, 2025.

Deposit Methods:

Both exchanges offer similar deposit options. However, their fees and processing times may differ depending on your payment method and location.

You should consider checking both platforms’ current fee schedules before making large deposits or withdrawals, as these rates can change.

The fee difference becomes more noticeable with higher trading volumes. If you’re an active trader, KuCoin’s lower fees could save you significant money over time.

Huobi Vs KuCoin: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Huobi and KuCoin offer several order types to meet different trading needs.

Huobi Order Types:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- OCO (One Cancels the Other)

- Trailing Stop Orders

Huobi provides a solid range of order types that cater to both beginners and advanced traders. Their platform supports three main trading orders: Market, Limit, and Stop Orders.

KuCoin Order Types:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- Stop Market Orders

- Post Only Orders

- Iceberg Orders

KuCoin edges ahead with more specialized order types. The addition of Iceberg Orders allows you to hide the true size of your large orders from the market, which can be valuable for large-volume traders.

Both exchanges support the essential Market and Limit orders that most traders use regularly. These basic order types let you buy or sell at the current market price or set your own price point.

For those using more complex trading strategies, KuCoin offers slightly more versatility with its additional specialized order types. This can give you more control over your trading execution.

The interface for placing these orders is relatively straightforward on both platforms, though new traders might find the variety of options somewhat overwhelming at first.

Huobi Vs KuCoin: KYC Requirements & KYC Limits

Both Huobi and KuCoin handle identity verification differently, which affects how much you can withdraw and which features you can access.

Huobi KYC System:

- Uses a three-tier KYC process

- KYC is not mandatory, but withdrawal limits apply

- Without KYC, daily withdrawals are limited to approximately 0.06 BTC

- Higher tiers require more personal information for increased limits

KuCoin KYC System:

- Allows crypto withdrawals without strict KYC verification

- Non-KYC accounts can still access basic trading features

- Higher withdrawal limits are available after completing verification

- KYC process (also called Identity Verification) is optional but recommended

KuCoin has gained popularity partly because of its more flexible KYC requirements compared to some exchanges.

For casual traders who value privacy, KuCoin might be the better option since you can use many features without providing extensive personal information.

If you need to withdraw larger amounts, completing KYC on either platform will raise your limits significantly.

Both exchanges allow basic trading without full verification, but be aware that regulations are constantly changing in the crypto space.

The verification process on both platforms is relatively straightforward, requiring personal information and document uploads depending on the verification level you need.

Huobi Vs KuCoin: Deposits & Withdrawal Options

Both Huobi and KuCoin offer several methods to deposit and withdraw funds. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Methods:

- Crypto deposits (both platforms)

- Bank transfers (both platforms)

- Credit/debit cards (both platforms)

KuCoin generally offers faster deposit processing times compared to Huobi. This can be important if you need quick access to your funds for trading opportunities.

Withdrawal Options:

- Cryptocurrency withdrawals (both platforms)

- Fiat withdrawals (limitations vary by region)

Withdrawal Fees Comparison:

| Exchange | Average Fee | BTC Fee |

|---|---|---|

| KuCoin | Up to 0.1% | 0.0004 BTC |

| Huobi | Up to $60 | Varies by tier |

KuCoin typically has more competitive withdrawal fees than Huobi. The difference becomes significant if you make frequent withdrawals.

Huobi implements a tiered system for withdrawals based on your account level and verification status. Higher-tier accounts enjoy lower fees and higher withdrawal limits.

Processing times for withdrawals are generally faster on KuCoin. You can typically expect your funds within minutes to a few hours, while Huobi might take longer depending on network congestion.

Both platforms support a wide range of cryptocurrencies for deposits and withdrawals. However, the exact coins available may differ, so check if your preferred crypto is supported before choosing.

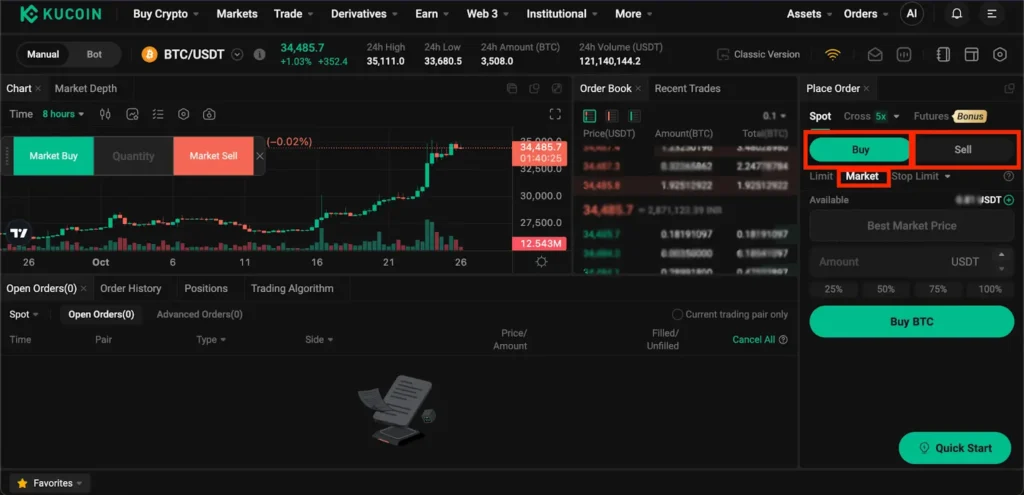

Huobi Vs KuCoin: Trading & Platform Experience Comparison

Huobi and KuCoin offer distinct trading experiences that cater to different types of crypto users. Both platforms support a wide range of cryptocurrencies but differ in their interface design and user experience.

KuCoin’s interface is known for being more intuitive for beginners while still offering advanced trading features. You’ll find their mobile app particularly responsive, making it easier to trade on the go.

Huobi (now also known as HTX) provides a more technical trading environment that experienced traders might prefer. Their platform includes more detailed charting tools and technical analysis options.

Trading Features Comparison:

| Feature | Huobi | KuCoin |

|---|---|---|

| Supported Cryptocurrencies | 350+ | 700+ |

| Trading Types | Spot, Futures, Margin | Spot, Futures, Margin, P2P |

| Mobile App | Yes (4.2/5 rating) | Yes (4.5/5 rating) |

| API Access | Yes | Yes |

Both exchanges offer margin trading, but KuCoin typically provides higher leverage options. You can access up to 10x leverage on Huobi for most pairs, while KuCoin offers up to 20x for certain cryptocurrencies.

The liquidity on both platforms is strong, though Huobi traditionally has higher trading volumes for major coin pairs. KuCoin excels with its selection of smaller altcoins and emerging tokens.

Security features are robust on both platforms, with two-factor authentication and advanced encryption. You’ll find Huobi’s risk management system slightly more conservative, which some traders appreciate for added protection.

Huobi Vs KuCoin: Liquidation Mechanism

When trading with leverage on exchanges like Huobi and KuCoin, understanding their liquidation mechanisms is crucial for protecting your investments.

Huobi uses a tiered liquidation system that gradually reduces your position size as you approach your maintenance margin. This gives you more opportunities to avoid complete liquidation compared to some other exchanges.

KuCoin employs an insurance fund approach that activates when your margin ratio falls below a specific threshold. The platform sends notifications when you reach 80% of your margin requirements, giving you time to add funds or reduce positions.

Key differences in liquidation approaches:

| Feature | Huobi | KuCoin |

|---|---|---|

| Warning system | Multiple alerts | Early notifications at 80% |

| Liquidation process | Partial liquidations possible | Generally full liquidation |

| Fee structure during liquidation | Higher fees during volatile periods | Standard liquidation fees |

| Recovery options | Position reduction before full liquidation | Limited recovery once threshold reached |

Both exchanges use mark prices rather than last-traded prices to determine liquidations, which helps protect you from price manipulation and flash crashes.

KuCoin offers slightly more generous margin requirements for most trading pairs, which might give you a bit more breathing room before liquidation occurs.

Neither exchange uses a socialized loss system anymore, meaning your account won’t be affected by other traders’ liquidations.

Huobi Vs KuCoin: Insurance

When trading cryptocurrency, security and insurance are key concerns. Both Huobi and KuCoin have implemented insurance funds to protect users, but they differ in approach and coverage.

Huobi maintains a Security Reserve Fund that holds approximately 20% of the exchange’s revenue. This fund exists specifically to compensate users in case of security breaches or hacks affecting the platform.

KuCoin also features an insurance mechanism called the Safeguard Program. After experiencing a significant hack in 2020, KuCoin demonstrated its commitment to user protection by fully reimbursing affected customers.

Insurance Coverage Comparison:

| Feature | Huobi | KuCoin |

|---|---|---|

| Insurance Fund | Security Reserve Fund | Safeguard Program |

| Fund Source | 20% of exchange revenue | Portion of trading fees |

| Track Record | No major compensation events | Successfully reimbursed users after 2020 hack |

| Transparency | Limited public information | Moderate transparency |

Neither exchange provides comprehensive insurance for all potential losses. Your funds may not be covered in cases of:

- Personal account compromises

- Phishing attacks

- Market volatility

- Technical errors during trading

To maximize your protection when using either exchange, enable all available security features like two-factor authentication, anti-phishing codes, and trading passwords.

Huobi Vs KuCoin: Customer Support

When choosing between Huobi and KuCoin, customer support can be a deciding factor for your trading experience. Both exchanges offer several ways to get help, but there are some key differences worth noting.

KuCoin provides 24/7 customer support through multiple channels including live chat, email tickets, and social media. Their response times typically range from a few minutes to several hours depending on query complexity.

Huobi also maintains round-the-clock support with similar contact options. They’ve worked to improve their response times since their founding in 2013, making them competitive in the customer service arena.

Support Channels Comparison:

| Feature | Huobi | KuCoin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| FAQ Knowledge Base | Extensive | Comprehensive |

| Social Media Support | Twitter, Telegram | Twitter, Telegram, Discord |

| Multilingual Support | Multiple languages | Multiple languages |

Both exchanges offer helpful knowledge bases where you can find answers to common questions without contacting support directly.

User feedback suggests KuCoin might have a slight edge in response time for complex issues, while Huobi is often praised for the thoroughness of their responses.

For English-speaking users, both platforms provide adequate support, though you may occasionally encounter language barriers with support agents.

Huobi Vs KuCoin: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both Huobi and KuCoin have implemented strong security measures to protect your digital assets.

KuCoin values security highly and has established multiple safeguards against cyber threats. They use multi-factor authentication (MFA) to verify your identity when logging in or making transactions.

Huobi also employs MFA along with advanced encryption protocols to secure user data. Their risk control system monitors transactions 24/7 for suspicious activity.

Cold Storage Practices:

| Exchange | Cold Wallet Storage | Insurance Fund |

|---|---|---|

| KuCoin | Majority of assets | Yes |

| Huobi | 98% of assets | Yes |

Both exchanges maintain most user funds in cold wallets (offline storage), which significantly reduces the risk of hacking attacks.

KuCoin experienced a security breach in 2020 but handled it professionally by reimbursing affected users. This incident led to enhanced security protocols.

Huobi features a dedicated security team that regularly conducts vulnerability assessments and penetration testing to identify potential weaknesses.

Both platforms offer additional security features like:

- IP login restrictions

- Anti-phishing codes

- Email alerts for account activity

- Withdrawal whitelisting

For extra protection, you can set trading passwords on both platforms that differ from your login credentials. This adds another layer of security for your trading activities.

Is Huobi A Safe & Legal To Use?

Huobi (now known as HTX) offers strong security features that make it a generally safe choice for crypto trading. According to search results, Huobi “takes all of the concerns that you might have, security-wise, and throws them out of the window.”

However, there are some important legal considerations. The UK’s Financial Conduct Authority (FCA) has added Huobi to its watchlist, warning users to “avoid dealing with this firm.” This suggests potential regulatory issues in some jurisdictions.

Your experience may vary depending on your location. Some countries have stricter regulations on cryptocurrency exchanges than others.

When considering safety, Huobi implements several security measures:

- Two-factor authentication (2FA)

- Cold storage for most assets

- Anti-phishing protection

- Regular security audits

The exchange has been operating since 2013, which gives it a relatively long track record in the crypto industry. This longevity suggests a certain level of reliability and business stability.

Before using Huobi, you should check whether it’s licensed to operate in your country. Some users have expressed concerns about Huobi’s trustworthiness, with some considering alternatives like Kraken.

Always use strong passwords and enable all available security features if you choose to use Huobi. Remember that even secure exchanges can be vulnerable to hacking attempts.

Is KuCoin A Safe & Legal To Use?

KuCoin has faced serious legal challenges recently. On March 26, 2024, the exchange and two of its founders were criminally charged with Bank Secrecy Act violations and unlicensed money transmission offenses.

This raises significant concerns about KuCoin’s legal status, especially for U.S. users. The exchange appears to be operating in a regulatory gray area in several jurisdictions.

Regarding safety, KuCoin experienced a major hack in 2020 where approximately $280 million in crypto assets were stolen. Though the exchange has reportedly improved security measures since then, including two-factor authentication and cold storage solutions.

Recent reports suggest KuCoin might also be violating U.S. and European sanctions by accepting Russian Sberbank’s debit cards. This could lead to additional legal complications.

Key Security Features:

- Two-factor authentication

- Cold storage for majority of assets

- Anti-phishing security measures

Legal Concerns:

- Criminal charges in the U.S.

- Potential sanctions violations

- Unclear regulatory compliance in many countries

If you’re considering using KuCoin, you should weigh these risks carefully. Some users on forums like Reddit recommend withdrawing assets from KuCoin until the legal situation becomes clearer.

Always use additional security measures if you choose to use KuCoin, including strong passwords and enabling all available security features.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Huobi and KuCoin. These platforms differ in several key areas including fees, security measures, and available cryptocurrencies.

What are the main differences in trading fees between Huobi and KuCoin?

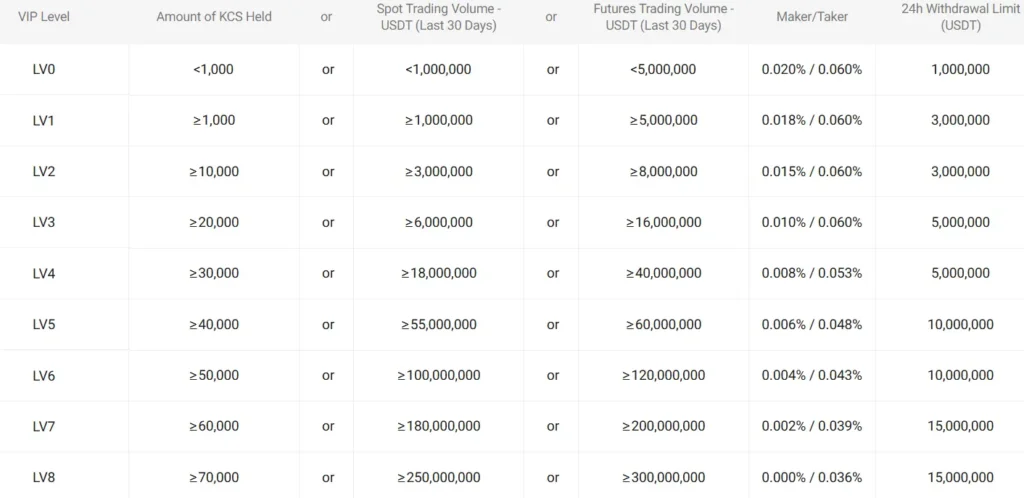

KuCoin typically offers slightly more competitive trading fees compared to Huobi. KuCoin’s standard trading fees start at 0.1% for makers and takers.

Huobi’s standard fees also begin at 0.2% but can be reduced based on trading volume and holdings of their native token. Both exchanges offer fee discounts when using their respective platform tokens.

KuCoin’s KCS token and Huobi’s HT token provide similar benefits, but KuCoin’s token generally offers better fee reduction percentages for comparable holdings.

How do the security features of Huobi compare to those of KuCoin?

Both exchanges implement strong security measures including two-factor authentication, anti-phishing codes, and advanced encryption. Huobi has a dedicated security fund to protect user assets in case of breaches.

KuCoin operates a similar protection mechanism and recovered from a significant hack in 2020, demonstrating their crisis management capabilities. Huobi implements strict KYC procedures which some users find more thorough than KuCoin’s.

Both platforms use cold storage for the majority of user funds, but Huobi has historically been viewed as slightly more secure due to its longer track record in the industry.

Can you outline the customer support experiences of Huobi versus KuCoin?

KuCoin generally receives better reviews for customer support, offering 24/7 live chat and faster ticket resolution times. Their support team typically responds within 1-2 hours for urgent matters.

Huobi provides multilingual support through tickets and email, but response times can sometimes extend to 24 hours or more. Both exchanges offer comprehensive knowledge bases and FAQs.

User feedback suggests KuCoin’s support team is more helpful for complex issues, while Huobi’s automated systems handle basic inquiries efficiently.

Which exchange, Huobi or KuCoin, offers a wider range of cryptocurrencies?

KuCoin typically lists more cryptocurrencies, earning its nickname as “The People’s Exchange.” KuCoin currently supports over 700 cryptocurrencies and 1,200+ trading pairs.

Huobi offers around 600 cryptocurrencies and focuses more on established tokens with higher market capitalizations. KuCoin is often faster to list new and emerging cryptocurrencies.

If you’re looking for obscure altcoins or new projects, KuCoin generally provides better options. Huobi tends to be more selective about which tokens it lists.

How do Huobi and KuCoin rank in terms of liquidity and trading volume?

Huobi historically maintains higher overall trading volume than KuCoin, particularly for major cryptocurrencies like Bitcoin and Ethereum. This often results in tighter spreads for popular trading pairs.

KuCoin has been steadily closing this gap in recent years. For smaller altcoins, KuCoin sometimes offers better liquidity due to its wider selection of cryptocurrencies.

Daily trading volumes fluctuate, but both exchanges consistently rank among the top 10 cryptocurrency exchanges globally by volume.

What advantages does KuCoin offer that might not be found on Huobi?

KuCoin’s Trading Bot features allow automated trading strategies that aren’t as developed on Huobi. These include grid trading, DCA bots, and futures bots accessible to average users.

KuCoin’s Spotlight token launch platform has gained popularity for introducing promising new projects. Their KCS token also offers dividend-like rewards based on exchange performance.

KuCoin’s lending platform allows users to earn interest on holdings more easily than Huobi’s comparable services. The exchange also tends to implement innovative features faster than most competitors.

KuCoin Vs Huobi Conclusion: Why Not Use Both?

When comparing KuCoin and Huobi, it’s clear both exchanges have unique strengths. KuCoin scores higher overall with a 7.8 rating compared to Huobi’s slightly lower score.

KuCoin stands out for its wide variety of altcoins and user-friendly interface. Many traders appreciate its competitive fee structure and the KCS token benefits for regular users.

Huobi, meanwhile, offers robust security features and has maintained a strong reputation in the crypto market. The Huobi Token (HT) provides valuable benefits that can enhance your trading experience.

Why choose just one? Many experienced traders maintain accounts on both platforms to:

- Access a wider range of cryptocurrencies

- Take advantage of different fee structures

- Capitalize on varying liquidity pools

- Reduce risk through exchange diversification

Remember that both exchanges have faced regulatory scrutiny, as noted by the UK’s FCA. This highlights the importance of staying informed about compliance issues regardless of which platform you choose.

For beginners, starting with one platform might be less overwhelming. You can always expand to the second exchange as you gain confidence and experience.

Your trading volume, preferred coins, and geographic location will ultimately determine which platform—or combination of platforms—works best for your needs.