Trading crypto options in India opens up a world of possibilities for investors looking to maximize their strategies in the dynamic cryptocurrency market. Options offer the possibility to hedge against market volatility by allowing you to set predetermined prices for buying or selling cryptocurrencies. With proper knowledge, you stand to enhance your portfolio effectively.

In India, engaging with licensed and compliant platforms is crucial to protect your investments and meet regulatory requirements. Platforms like Delta Exchange provide robust trading engines, competitive fees, and essential trading tools that cater to both novice and seasoned traders. This regulated environment ensures that your trading activities are secure and compliant with local laws.

Before diving into options trading, it’s vital to understand the tax implications and specific risks involved. Educating yourself on different trading strategies can empower you to make informed decisions and safeguard your investments while exploring potential profits in the Indian crypto landscape.

Legal And Regulatory Landscape In India

Navigating the crypto options market in India requires an understanding of the legal status and taxation framework. Each of these aspects influences how you can participate in this burgeoning market.

Legality

In India, cryptocurrencies are not recognized as legal tender. This means that while you cannot use digital currencies to settle traditional debts, trading and investing in cryptocurrencies like Bitcoin and Ethereum are permitted.

The regulatory environment is marked by a mix of caution and progressive laws. The lack of a formal framework has led to ambiguity, creating challenges for both traders and regulatory bodies like the Reserve Bank of India (RBI), which is cautious about risks such as fraud and money laundering.

Taxation

Since 2022, India has imposed a 30% tax on profits generated from crypto transactions. Additionally, the country introduced a 1% Tax Deducted at Source (TDS) on every crypto trade.

These measures aim to bring more transparency while generating revenue. It’s crucial for you to maintain detailed records of your transactions to comply with tax obligations and avoid any legal repercussions.

This taxation structure impacts the profitability of crypto investments, especially for high-frequency trades. Understanding the tax obligations is essential to managing your trading activities effectively.

Choosing The Right Platform For Crypto Options Trading

When trading crypto options in India, selecting the right platform is crucial. Critical factors include user interface, security measures, the range of available cryptocurrencies, and fee structures. Delta Exchange India offers unique advantages for both beginners and experienced traders.

Delta Exchange India

Delta Exchange provides an intuitive user interface, making it suitable for traders at all levels. You’ll find advanced charting tools, which help analyze market trends effectively.

Delta shines with its high-leverage options, allowing you to maximize your trading position.

In terms of safety, Delta implements robust security measures like two-factor authentication and cold storage to protect assets. Furthermore, the platform supports a wide range of cryptocurrencies, enabling diversified trading opportunities. Competitive fees make Delta Exchange appealing, ensuring that more of your investment goes towards trading rather than expenses.

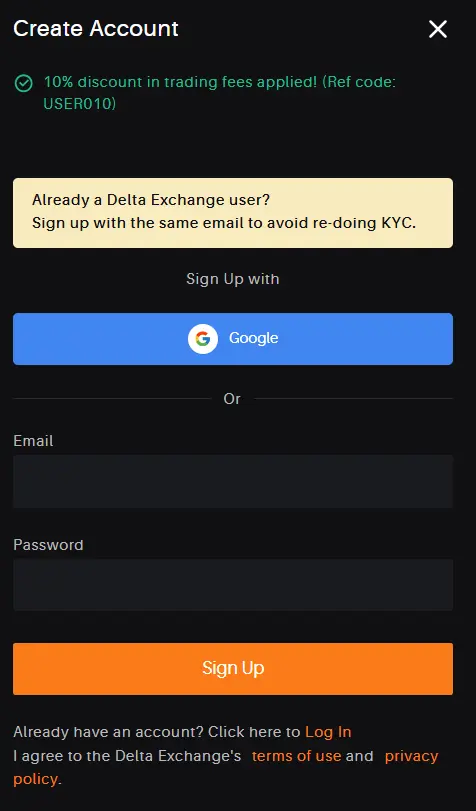

Setting Up Your Trading Account

To start trading crypto options in India, you need a trading account. This involves registration, KYC verification, and linking a bank account for deposits and withdrawals.

Registration

Begin by selecting a trusted cryptocurrency exchange that supports options trading like Bybit. Visit the exchange’s website and navigate to the registration page. Fill in the required personal details, such as your name, email address, and a secure password.

You might receive an email for verification—click the link to confirm your registration. Be sure to enable two-factor authentication (2FA) for increased security against unauthorized access. Choose strong passwords and avoid sharing them to protect your account.

KYC Verification

KYC (Know Your Customer) verification is mandatory for complying with regulatory standards in India. After registration, upload copies of valid identity documents, such as your Aadhaar card or passport, and a recent utility bill or bank statement for address proof.

The process can take a few days, depending on the exchange. KYC helps ensure a secure trading environment, reducing the risk of fraud. Timely and accurate submission of documents can expedite verification.

Linking Bank Account

To facilitate seamless transactions, link your bank account to the trading platform. This involves providing your bank account details and verifying ownership, typically through small deposit verification.

Linking your bank account allows you to transfer funds to and from your trading account. Ensure that the account used is under your name to avoid withdrawal issues. It is beneficial to use a bank account with easy online access for quick fund management.

Depositing Funds

Depositing funds into your cryptocurrency exchange account is a critical step for beginning options trading in India. You’ll focus on INR deposits and understand the minimum deposit requirements to place successful trades.

INR Deposits

To deposit Indian Rupees (INR) into a crypto exchange, select a reliable platform like WazirX or CoinDCX, known for their security and ease of use. Most exchanges allow INR deposits through Unified Payments Interface (UPI), Internet Banking, or direct bank transfers.

UPI transfers are popular due to their convenience and speed. You’ll need to link your bank account or UPI ID to the exchange. Follow the on-screen instructions carefully to ensure a smooth transaction process.

Bank transfers provide an alternative method for depositing funds. While they may take slightly longer compared to UPI, they are highly secure and suitable for larger deposits. Double-check the provided bank account details on the exchange to avoid errors.

Minimum Deposit Requirements

Different exchanges have varied minimum deposit requirements. Typically, these can range from ₹100 to a few thousand INR. It’s crucial to review these requirements for the specific exchange you choose.

Meeting the minimum deposit amount is essential to unlock trading features and access the full range of trading options, including crypto options. Some exchanges may offer varying trade levels based on deposit amounts, so it’s wise to deposit enough to engage in all desired trading activities.

Evaluating these factors will ensure a seamless experience when depositing funds into your crypto trading account in India.

Understanding Crypto Options Trading

Crypto options trading involves strategies with financial derivatives that allow a person to trade on the price movements of cryptocurrencies without actually owning the asset. Essential concepts include the types of options, key terminologies, and strategies that you can leverage for trading.

Types Of Options

Crypto options primarily come in two forms: call options and put options. A call option gives you the right to buy a cryptocurrency at a specified price within a certain timeframe. Conversely, put options provide you with the right to sell under similar terms.

European and American styles differ in exercise terms. You can execute European options only at expiration, while American options can be exercised anytime before expiration. These styles play a critical role in crafting your trading strategy.

Key Terminologies

Getting familiar with key terminologies is vital. Strike price refers to the predetermined price at which you can buy or sell the asset. The expiry date is the deadline by which the option must be exercised.

Premium is the price paid for purchasing the option itself. Intrinsic value represents the actual value if the option were exercised immediately. Time value reflects additional value based on the time until expiration. Understanding these terms helps you grasp market dynamics.

Strategies

Trading strategies vary based on market conditions and your risk appetite. A covered call involves holding the asset while selling a call option, generating additional income. Protective puts limit potential losses by purchasing a put option against a crypto holding.

Straddles and strangles focus on indecisive markets, employing both call and put options to potentially profit from market volatility. Your choice of strategy should align with your market outlook and risk tolerance, ensuring that you’re making informed decisions in your trades.

Placing Your First Trade

When trading crypto options in India, it’s essential to carry out thorough market analysis followed by precise execution of your trades. Each step needs careful attention to detail to mitigate risks and increase potential returns. Also, consider using a crypto options calculator.

Market Analysis

Before placing your first trade, you need to evaluate the current market dynamics. Start by identifying the underlying asset’s market trends through technical analysis tools like moving averages, RSI, and MACD.

Fundamental analysis is also crucial. It involves reviewing news, technological updates, and regulatory developments impacting cryptocurrencies. Use news aggregators and crypto forums for real-time updates.

Choosing the right type of options, American or European, depends on your trading strategy. Ensure your trading platform provides comprehensive data analysis tools to track market trends effectively.

Executing The Trade

Once you’ve analyzed the market, proceed to choose your trading platform. Platforms like Binance offer intuitive interfaces that can facilitate the trading process. You’ll need to set up your account with necessary verifications.

Decide on the option contract type, such as call or put, based on your market predictions. Then, input your desired strike price and expiration date. Monitor the trade closely and adjust your strategy as required.

Using alerts and portfolio tracking tools can be beneficial. They enable you to act swiftly based on price movements, helping you manage risks and maximize potential gains.

Risk Management And Best Practices

Engaging in crypto options trading in India necessitates a focus on key risk management strategies. These involve diversification of your investments, position sizing to mitigate potential losses, and a commitment to continuous learning to stay informed.

Diversification

Diversification involves spreading your investments across different assets to reduce risk. For crypto options, don’t put all your resources into a single asset. Instead, explore a mix of cryptocurrencies. This can buffer against volatility if one asset underperforms.

Use a combination of traditional cryptocurrencies like Bitcoin, Ethereum, and emerging ones. This strategy minimizes the impact of losses on your overall portfolio. It’s one of the most effective ways to achieve a balance, as some assets may perform better under varying market conditions.

Position Sizing

Position sizing refers to the amount of capital you allocate to a single trade. Proper position sizing limits potential losses and helps manage the risks associated with volatile markets. Typically, only a small percentage of your total portfolio should be risked on any one trade.

A common practice is using a percentage-based approach. For example, risking no more than 1-3% of your trading capital on a single options position. This method prevents significant capital loss and allows for longevity in trading, enabling more opportunities for success over time.

Continuous Learning

Continuous learning is crucial in the fast-evolving crypto market. Stay updated with new developments in blockchain technology and trading strategies by subscribing to reputable financial news sources and engaging in online courses or webinars.

Leverage social media and forums to exchange insights with other traders. Continuous education enhances your ability to adapt to changing market conditions, making you a more informed and effective trader. By expanding your knowledge, you’ll be better equipped to navigate complexities and make informed decisions.

Withdrawing Funds

When trading crypto options in India, withdrawing funds involves several important considerations. You need to understand the withdrawal process, be aware of the processing time, and the associated withdrawal fees to avoid surprises.

Process

To withdraw funds, you should log into your crypto exchange account. Navigate to the designated “Funds” or “Wallet” section. Look for the “Withdraw” button and click on it. Select the cryptocurrency you’d like to withdraw. You will then need to enter the wallet address where you wish to send your funds.

Ensure that the address is correct to avoid any loss. Verification steps often follow, such as providing a One-Time Password (OTP) or using Google’s Two-Factor Authentication (2FA) to confirm the withdrawal. This adds a layer of security to the transaction.

Processing Time

The withdrawal processing time can vary based on the exchange and the blockchain network’s current condition. Some exchanges process requests instantly, while others might take a few hours.

Check the specific processing times on your chosen platform. Network congestion may impact how quickly transactions are confirmed on the blockchain. It’s wise to allow for potential delays, especially during periods of high activity.

Reviewing any notifications from the exchange regarding potential trade or withdrawal delays is also beneficial. These updates can help manage your expectations and plan accordingly.

Withdrawal Fees

Withdrawal fees depend on the exchange and the currency being withdrawn. Typically, exchanges charge a small fee to cover network costs associated with processing the transaction.

Fee structures can be flat-rate or varying based on transaction size. Some platforms may offer reduced fees for trading large volumes or holding a certain amount of platform-specific tokens.

Always check the fee schedule on the exchange before initiating a withdrawal. Being informed helps you maximize your returns and minimize unexpected costs. Consider the influence of exchange rates and potential banking fees if converting to INR.

Frequently Asked Questions

When trading crypto options in India, you must choose the right platform, understand legal aspects, and develop effective strategies. Addressing common queries can help you navigate this complex field.

Which is the best platform to trade crypto options in India?

Several platforms offer robust options for trading crypto in India. Binance is one of the largest global exchanges, providing a wide range of features and a secure trading environment.

Can I start crypto options trading with 100 rupees?

Yes, you can start trading crypto options with 100 rupees. Many platforms allow low initial investments, making it accessible for beginners. Always assess the potential risks before investing.

Which crypto broker is legal in India?

Crypto exchanges in India need to be registered with the Financial Intelligence Unit (FIU). WazirX is a popular choice among traders due to its compliance and reliability.

Which crypto options trading strategy is best for beginners?

Beginners might consider starting with simple strategies like buying calls or puts. These strategies are straightforward and help you manage risk while understanding market dynamics.

Is crypto options legal in India?

Yes, trading crypto options is legal in India. However, regulatory frameworks are evolving, so you should stay informed about any changes in legislation that may impact your trading activities.

Are crypto options taxable in India?

Yes, crypto options trading is subject to taxation in India. Profits from trading are usually classified under capital gains, and you should report them in your tax filings. Always consult with a tax professional for detailed advice.

Conclusion

Trading crypto options in India presents a modern financial opportunity. With the right strategy, you can diversify your portfolio and enhance potential returns. This requires a focus on selecting a trusted trading platform. Options like Binance, known for its global reach, and Delta Exchange, popular in India, offer robust trading environments.

Focusing on popular cryptocurrencies, like Bitcoin and Ethereum, can be beneficial. These currencies command a significant share of the market and offer potential advantages in liquidity and stability. Balancing your portfolio with emerging crypto assets can also broaden your investment scope.

A clear approach prioritizing safety is essential. Implementing risk management strategies can help mitigate potential downsides. These can include setting stop losses and limiting the amount traded based on your risk tolerance.

Staying informed about regulatory changes in India is crucial. As regulations evolve, being aware of these changes can impact your trading strategies and decisions. Keeping an eye on news and updates within the cryptocurrency sector can offer valuable insights.