Looking for the right cryptocurrency exchange can be challenging with so many options available. FameEX and MEXC are two popular platforms that traders often compare when searching for their ideal trading environment. Each offers unique features, fee structures, and supported cryptocurrencies that might make one better suited to your trading needs.

Understanding the differences between FameEX and MEXC can help you choose the exchange that best aligns with your trading goals, risk tolerance, and experience level. Both exchanges provide leverage trading options and a variety of cryptocurrencies, but they differ in important ways including user interface, security measures, and available trading pairs.

By examining these exchanges side by side, you can make an informed decision based on factors that matter most to you. Whether you prioritize lower fees, more crypto options, or specific trading features, this comparison will guide you through what each platform offers in 2025.

FameEX Vs MEXC: At A Glance Comparison

When choosing between FameEX and MEXC for your crypto trading needs, understanding their key differences is essential.

MEXC is a well-established exchange that appears in cryptocurrency exchange rankings. It offers leverage trading and has built a reputation based on trading volumes and liquidity.

FameEX is a newer competitor in the market that aims to provide an alternative trading experience for crypto enthusiasts.

Trading Features Comparison:

| Feature | FameEX | MEXC |

|---|---|---|

| Leverage Trading | Available | Available |

| User Interface | Modern, streamlined | Feature-rich |

| Mobile App | Yes | Yes |

| Trading Fees | Competitive | Competitive |

Both exchanges support a variety of cryptocurrencies, but their token selection differs slightly. MEXC is known for listing a wider range of altcoins and newer tokens.

Security is a priority for both platforms, with each implementing standard protection measures like two-factor authentication and cold storage for funds.

Trading volumes on MEXC tend to be higher, which can mean better liquidity for your trades. This is especially important if you plan to trade less common cryptocurrencies.

Customer support quality varies between the two platforms, with response times and support channels being key differences you’ll want to consider before choosing your exchange.

FameEX Vs MEXC: Trading Markets, Products & Leverage Offered

FameEX and MEXC both offer a wide range of trading options, but there are key differences between them.

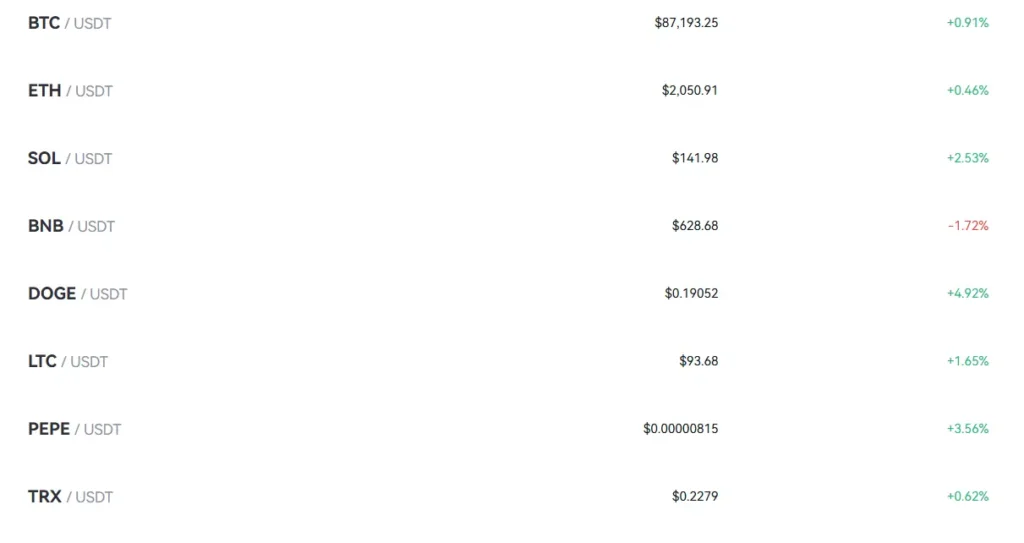

MEXC provides an impressive variety of cryptocurrencies for spot trading with over 1,500 trading pairs. They’re known for listing newer altcoins faster than many competitors.

In contrast, FameEX offers fewer trading pairs but focuses on providing high-quality, reliable tokens with strong market fundamentals.

Leverage Trading Capabilities:

- MEXC: Up to 200x leverage

- FameEX: Up to 125x leverage

When it comes to derivatives, both exchanges offer futures contracts. MEXC has a more extensive selection, including inverse perpetual contracts and delivery contracts.

FameEX’s platform includes user-friendly features for both beginners and experienced traders. Their interface is designed to make navigation simpler even with complex trading products.

Product Comparison

| Feature | MEXC | FameEX |

|---|---|---|

| Spot Trading | 1,500+ pairs | Fewer pairs, quality focus |

| Max Leverage | 200x | 125x |

| Futures | Diverse options | Standard offerings |

| New Coin Listings | Very frequent | More selective |

MEXC appears to prioritize quantity and variety, making it appealing if you’re looking for obscure altcoins or maximum leverage.

FameEX takes a more curated approach with its offerings, potentially reducing risk for traders who prefer established cryptocurrencies.

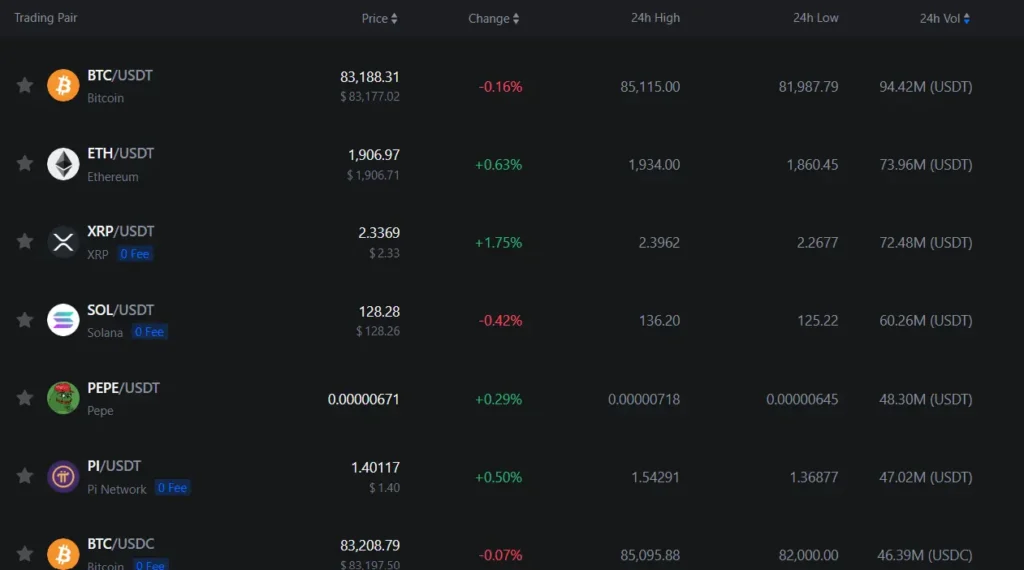

FameEX Vs MEXC: Supported Cryptocurrencies

When choosing between FameEX and MEXC for your crypto trading needs, the range of available cryptocurrencies is a key factor to consider.

MEXC stands out with an impressive selection of over 2,960 cryptocurrencies and more than 2,110 trading pairs. This makes it an excellent choice if you’re looking to trade less common or newer altcoins.

FameEX offers a more modest but still substantial selection of cryptocurrencies. While not matching MEXC’s extensive catalog, FameEX provides access to most major coins and many popular altcoins.

MEXC Benefits:

- Huge selection of 2,960+ cryptocurrencies

- Over 2,110 trading pairs

- Early listings of new projects

- More niche and micro-cap options

FameEX Benefits:

- Focused selection of established cryptocurrencies

- Major coins and popular altcoins

- Potentially easier navigation for beginners

If you’re interested in exploring newer projects or niche cryptocurrencies, MEXC likely offers what you need. The platform frequently adds new tokens before they appear on other exchanges.

For traders focused mainly on established cryptocurrencies, FameEX’s offering should be sufficient. The more streamlined selection might actually be beneficial if you find too many options overwhelming.

Both platforms support the major cryptocurrencies like Bitcoin, Ethereum, and other top coins by market capitalization.

FameEX Vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between FameEX and MEXC, understanding their fee structures is crucial for maximizing your trading profits.

MEXC offers competitive fees with makers for both spot and futures trading completely free. This zero-fee structure for makers gives MEXC an edge for high-volume traders.

For withdrawals, both exchanges charge variable fees depending on the cryptocurrency being withdrawn. These fees typically cover the blockchain transaction costs necessary to process your withdrawal.

Deposit fees are an area where both exchanges perform well. MEXC provides free crypto deposits, allowing you to fund your account without additional costs.

Fee Comparison Table:

| Fee Type | MEXC | FameEX |

|---|---|---|

| Maker Fees (Spot) | Free (0%) | Variable |

| Taker Fees (Spot) | Variable | Variable |

| Crypto Deposits | Free | Free |

| Crypto Withdrawals | Variable by coin | Variable by coin |

You should consider your trading style when comparing these platforms. If you primarily place maker orders (limit orders not immediately filled), MEXC’s free maker fees could save you significant money.

For frequent traders, these fee differences can substantially impact your overall trading costs and profitability over time.

Remember to check the specific withdrawal fees for your preferred cryptocurrencies, as they vary by coin and can change as network conditions fluctuate.

FameEX Vs MEXC: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your trading strategy. Both FameEX and MEXC offer various order options to meet different trading needs.

FameEX Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels Other)

- Post-only orders

FameEX provides a standard selection that covers most trading scenarios. Their interface makes it relatively straightforward to select and execute these orders.

MEXC Order Types:

- Market orders

- Limit orders

- Trigger-limit orders

- Stop orders

- Post-only orders

MEXC offers robust risk management through their order types. According to search results, MEXC allows traders to manage risks effectively using their variety of order options.

Both platforms support the essential market and limit orders that most traders rely on daily. Market orders execute immediately at current prices, while limit orders let you set specific price points.

The advanced order types on both exchanges give you more control over your trading strategy. Stop orders help protect your investments by automatically executing when prices reach certain thresholds.

Your trading style will determine which platform’s order system works better for you. If you prefer more complex risk management, MEXC’s trigger-limit orders might be advantageous. For simpler trading approaches, both platforms offer comparable basic functionality.

FameEX Vs MEXC: KYC Requirements & KYC Limits

When choosing between FameEX and MEXC, understanding their KYC (Know Your Customer) policies can help you decide which platform better suits your privacy preferences.

MEXC KYC Policy:

- MEXC offers a more flexible approach to KYC

- Primary verification level doesn’t require KYC for basic trading

- Advanced verification levels exist for higher limits and full platform access

MEXC’s KYC isn’t mandatory for all users, allowing you to start trading with minimal verification. However, some regions may now face KYC requirements as MEXC updates its policies.

FameEX KYC Requirements:

- FameEX typically requires some form of verification for account setup

- Different verification tiers may exist with increasing trading limits

You should note that cryptocurrency exchanges frequently update their KYC policies to comply with changing regulations across different regions.

Some users report unexpected KYC requirements appearing on MEXC after they’ve been trading for some time. This might impact your experience if you’re specifically seeking a no-KYC platform.

When choosing between these exchanges, consider how important KYC-free trading is to your strategy. If maintaining privacy is your priority, you’ll want to carefully review the current policies for your specific region.

Remember that higher withdrawal limits and additional features generally require completing more extensive verification on both platforms.

FameEX Vs MEXC: Deposits & Withdrawal Options

When choosing between FameEX and MEXC for your crypto trading needs, understanding their deposit and withdrawal options is crucial.

MEXC offers flexible funding methods to accommodate different trader preferences. You can deposit using various cryptocurrencies or fiat currencies through peer-to-peer (P2P) transactions.

For withdrawals, MEXC provides multiple options with varying processing times and fees. This flexibility allows you to select the method that best suits your speed, cost, and convenience requirements.

FameEX similarly provides several deposit and withdrawal methods, though specific details may vary. When comparing to competitors like Phemex (which offers similar flexibility), FameEX aims to provide competitive options.

Comparison Points to Consider:

- Processing times for withdrawals

- Fee structures for different methods

- Supported currencies (both crypto and fiat)

- Geographical restrictions that may apply

- Security measures during transactions

Before making your choice, check the most current information on both platforms as these details can change. Your optimal choice will depend on which currencies you trade most frequently and your typical transaction size.

Remember to verify withdrawal limits and KYC requirements, as these can impact your ability to access funds when needed.

FameEX Vs MEXC: Trading & Platform Experience Comparison

When choosing between FameEX and MEXC for your trading needs, the platform experience plays a crucial role in your decision.

User Interface

FameEX offers a clean, intuitive interface designed for beginners. MEXC provides a more feature-rich dashboard that might feel overwhelming at first but gives you access to advanced tools.

Trading Tools

MEXC stands out with its comprehensive charting capabilities and technical analysis tools. FameEX focuses on simplicity while still providing essential trading functions.

Mobile Experience

Both platforms offer mobile apps, but MEXC’s app has higher ratings and better performance. FameEX’s mobile version is functional but lacks some features found on the desktop version.

Trading Fees

| Feature | FameEX | MEXC |

|---|---|---|

| Spot Trading | 0.1% | 0.1% |

| Futures Trading | 0.05% | 0.02% |

| Withdrawal Fees | Varies by coin | Varies by coin |

Liquidity

MEXC offers higher liquidity across more trading pairs, which means faster execution and less price slippage for your trades. This is especially important when trading less popular cryptocurrencies.

Order Types

Both platforms support limit, market, and stop orders. MEXC additionally offers OCO (One-Cancels-the-Other) orders and more advanced conditional orders for strategic trading.

Platform Stability

MEXC has built a reputation for reliability during high market volatility. FameEX has improved its infrastructure but still experiences occasional slowdowns during peak trading times.

FameEX Vs MEXC: Liquidation Mechanism

Liquidation is a critical aspect of crypto futures trading that affects your risk management strategy. Both FameEX and MEXC implement liquidation systems to protect their platforms from excessive losses.

MEXC’s liquidation process begins when your margin reaches the maintenance margin level. This triggers forced liquidation of your position to prevent further losses.

FameEX follows a similar approach but differs in some implementation details. Both platforms aim to reduce the risk of traders going into negative balance territory.

MEXC uses a fair price mechanism to prevent forced liquidations caused by insufficient liquidity or market manipulation. This helps protect you from unnecessary liquidations during brief price spikes or drops.

Key MEXC Liquidation Features:

- Fair price calculations to prevent manipulation-based liquidations

- Maintenance margin requirements that trigger liquidation

- Protection systems to help prevent excessive losses

FameEX’s liquidation system also incorporates risk management tools, though they may have different thresholds and calculation methods compared to MEXC.

When trading on either platform, you should monitor your margin levels carefully. Setting stop-loss orders and not overextending your leverage can help you avoid forced liquidations.

Both platforms offer liquidation protection features, but they differ in implementation details and effectiveness. Understanding these differences can help you choose the platform that best matches your risk tolerance.

FameEX Vs MEXC: Insurance

When comparing cryptocurrency exchanges, insurance protection is a crucial factor to consider. Both FameEX and MEXC offer different approaches to safeguarding your assets.

FameEX provides a protection fund that covers potential losses from system failures or security breaches. Their insurance system aims to compensate users if unauthorized activities affect their accounts.

MEXC, on the other hand, maintains an Investor Protection Fund to secure user assets. According to recent 2025 data, they allocate a portion of trading fees to strengthen this protection fund.

Key Insurance Differences:

| Feature | FameEX | MEXC |

|---|---|---|

| Protection Fund | System-oriented coverage | Investor Protection Fund |

| Fund Source | Company reserves | Percentage of trading fees |

| Coverage Areas | System failures, breaches | Account security, theft protection |

| Claim Process | Direct application | Verification required |

You should note that neither exchange offers complete coverage for all potential losses. Market volatility and trading losses typically remain your responsibility.

Both platforms use cold storage for most digital assets, adding an extra layer of security before insurance even becomes necessary.

The insurance options may change based on your region, so it’s worth checking the specific coverage available in your location before making your final decision.

FameEX Vs MEXC: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both FameEX and MEXC offer support options, but there are some key differences to consider.

FameEX provides customer support through email, live chat, and a help center with FAQs. Their response times typically range from a few hours to 24 hours. Many users report that FameEX’s support team is helpful and knowledgeable.

MEXC offers more comprehensive support options. They provide 24/7 customer service through multiple channels including:

- Live chat

- Email support

- Ticket system

- Social media assistance

- Extensive knowledge base

MEXC’s multilingual support team serves users worldwide. Their average response time is often faster than FameEX, with many inquiries addressed within minutes on live chat.

Both platforms offer community forums where you can find answers to common questions. However, MEXC’s community is larger and more active, giving you better chances of finding user-generated solutions.

For new crypto traders, MEXC’s support resources are more beginner-friendly with detailed guides and tutorials. FameEX’s documentation tends to be more technical and may require some prior knowledge.

If you value quick resolution times and multiple support channels, MEXC holds an advantage in this category. However, both platforms maintain decent customer service standards compared to industry averages.

FameEX Vs MEXC: Security Features

When choosing a crypto platform, security should be your top priority. Both FameEX and MEXC have implemented various measures to protect your assets.

MEXC prioritizes user security with multiple protection layers. According to recent 2025 analyses, they offer two-factor authentication (2FA), anti-phishing codes, and advanced encryption protocols.

FameEX also provides robust security features including 2FA, cold wallet storage for most assets, and regular security audits. Their risk management system helps detect unusual activities on your account.

Key Security Comparisons:

| Feature | FameEX | MEXC |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Cold wallet storage | ✓ | ✓ |

| Insurance fund | Limited | Comprehensive |

| KYC requirements | Standard | Tiered system |

| Risk management | Automated | Both automated and manual |

MEXC has developed a strong reputation for security, with no major breaches reported as of March 2025. Their security team actively monitors the platform to prevent potential threats.

FameEX implements real-time monitoring systems and regular penetration testing to identify vulnerabilities before they can be exploited. Their withdrawal confirmation process adds an extra layer of security.

Both platforms offer IP whitelisting features that let you restrict account access to trusted devices only. This can significantly reduce the risk of unauthorized access to your account.

Is FameEX A Safe & Legal To Use?

FameEX was established in 2018 and officially launched in 2020. According to some sources, it claims to be a fully compliant cryptocurrency exchange.

However, there are concerning indicators about FameEX’s safety and legitimacy. As of March 2025, FameEX is not regulated by any recognized financial authority, which means users lack standard financial protections.

Some users report that transactions on FameEX’s official platform are secure and efficient. But without proper regulation, your funds may be at risk regardless of platform performance.

Warning Signs:

- No recognized regulatory oversight

- Lack of consumer protections

- Possible concerns about legitimacy

Some consumer protection agencies have issued warnings about FameEX. At least one financial institution has urged consumers to exercise “extreme caution” before using their services.

When using any cryptocurrency exchange, you should verify its regulatory status. Regulated exchanges offer better protection for your investments and personal information.

You should also be aware that some exchanges operate without KYC (Know Your Customer) requirements until problems arise. This inconsistent application of security measures can create additional risks for users.

Before depositing funds with FameEX, research thoroughly and consider alternatives with established regulatory compliance and security track records.

Is MEXC A Safe & Legal To Use?

MEXC is considered a safe and legitimate cryptocurrency exchange that has been operating since 2018. As of 2025, the platform has maintained a strong security record with no reported hacks or loss of user funds.

The exchange implements several safety measures to protect users’ assets. These include:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Advanced encryption protocols

- Regular security audits

MEXC operates legally in many jurisdictions worldwide and holds licenses in several countries. However, you should verify if MEXC is permitted in your specific location before registering.

Some users have reported issues with account restrictions. According to search results, there are allegations that MEXC has banned profitable traders and withheld funds in some cases. These claims should be considered alongside the platform’s overall positive reputation.

The exchange provides proof of reserves, which allows users to verify that their deposits are fully backed. This transparency measure helps build trust with customers.

For your protection when using MEXC:

- Start with small amounts

- Use strong passwords

- Enable all security features

- Withdraw large holdings to personal wallets

MEXC offers crypto-to-crypto trading but may require purchasing cryptocurrencies first rather than direct fiat deposits in some regions.

Frequently Asked Questions

Traders often have specific concerns when choosing between cryptocurrency exchanges. Here are answers to common questions about FameEX and MEXC to help you make an informed decision.

What security measures do FameEX and MEXC employ to protect user assets?

FameEX uses multi-signature cold wallets to store most user assets offline, protecting them from online threats. They also implement two-factor authentication (2FA) and regular security audits to maintain platform integrity.

MEXC employs similar security protocols with cold storage solutions and advanced encryption. They feature real-time monitoring systems to detect suspicious activities and maintain an asset protection fund for emergency situations.

Both exchanges use anti-phishing codes in email communications and offer IP address restrictions for account access.

Can traders from all countries access services offered by FameEX and MEXC?

FameEX has a global reach but restricts services in several jurisdictions including the United States, Iran, North Korea, and other countries under international sanctions. Their terms of service are regularly updated to reflect changing regulations.

MEXC also operates internationally but maintains a restricted countries list. They have a stronger presence in Asian markets while expanding their user base in Europe and South America.

Always check the current terms of service before signing up, as regulatory compliance requirements change frequently.

What are the differences in trading fees between FameEX and MEXC platforms?

FameEX typically charges spot trading fees ranging from 0.1% to 0.2% per transaction, with discounts available for high-volume traders. Their fee structure for futures trading starts at 0.05% maker fee and 0.06% taker fee.

MEXC offers competitive fees with a similar base rate structure. They often provide fee discounts during promotional periods and for holders of their native token.

Both platforms reduce fees for users who stake their respective platform tokens, though the specific discount rates differ between exchanges.

How do the customer support experiences compare between FameEX and MEXC?

FameEX provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. Their response times average between 1-4 hours for most inquiries.

MEXC also offers round-the-clock support but has received mixed reviews regarding response quality. They provide multilingual support which is helpful for international users.

Both exchanges maintain active social media presences where users can find updates and sometimes receive assistance for general questions.

What variety of cryptocurrencies are available for trading on FameEX versus MEXC?

FameEX supports over 300 cryptocurrencies with regular additions of emerging tokens. They focus on established coins and carefully vetted newer projects to maintain quality listings.

MEXC offers a wider selection with more than 1,500 cryptocurrency pairs. They’re known for listing new and emerging tokens earlier than many competitors, which appeals to traders seeking early investment opportunities.

Both exchanges support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins, but MEXC generally provides access to more niche tokens.

What are the key features and tools that distinguish FameEX from MEXC?

FameEX has recently enhanced its futures trading platform with user-friendly tools designed for both beginners and advanced traders. Their interface prioritizes simplicity without sacrificing functionality.

MEXC offers more advanced trading options including margin trading with higher leverage limits. Their platform includes a wider range of derivative products and trading competitions.

FameEX focuses on educational resources for new cryptocurrency investors, while MEXC targets experienced traders with more complex trading instruments and higher risk options.

MEXC Vs FameEX Conclusion: Why Not Use Both?

When choosing between MEXC and FameEX, you don’t necessarily need to pick just one. Each platform has distinct advantages that might benefit different aspects of your trading strategy.

MEXC stands out with its competitive fee structure. According to search results, they offer zero fees on some spot trading pairs and lower futures trading fees than competitors. With over 6 million users and daily trading volumes around $1 billion, MEXC has established itself as a reliable option since its launch in 2018.

FameEX, on the other hand, offers an intuitive user interface that new traders might find appealing. Their competitive fees and user-friendly design make them accessible for beginners starting their crypto journey.

Benefits of using both platforms:

- Fee optimization – Use MEXC for pairs with zero fees

- Risk distribution – Spread your assets across multiple exchanges

- Different trading options – Access unique coins and features on each platform

- Backup access – If one platform experiences downtime, you have alternatives

Remember to practice safe trading regardless of which platform you choose. Use stop losses and take profits where appropriate, as suggested by MEXC users.

The best approach might be to test both platforms with small amounts first. This hands-on experience will help you determine which interface, fee structure, and coin selection works best for your specific trading needs.