Choosing the right crypto exchange can make a big difference for your trading. FameEX and BloFin are two popular options in 2025, each with unique features and benefits.

When comparing FameEX vs BloFin, you’ll find that BloFin specializes more in futures trading while FameEX offers a broader range of services. This key difference might affect which platform better suits your needs.

Both exchanges have their strengths in terms of fees, security, and available trading pairs. Understanding these differences can help you make a smarter choice for your crypto trading journey. Let’s look at how these exchanges stack up against each other in today’s market.

FameEX Vs BloFin: At A Glance Comparison

When choosing between FameEX and BloFin for your crypto trading needs, understanding their key differences helps you make an informed decision.

Both platforms offer cryptocurrency trading services but with different strengths. BloFin has positioned itself as one of the largest non-KYC futures trading platforms, second only to MEXC according to recent data.

Trading Fees Comparison:

| Fee Type | FameEX | BloFin |

|---|---|---|

| Spot Trading | 0.1% standard | 0.1% standard |

| Futures Trading | 0.05% maker/0.07% taker | 0.02% maker/0.05% taker |

| Withdrawal Fees | Varies by crypto | Competitive rates |

Key Features:

FameEX offers:

- User-friendly interface for beginners

- Mobile app with full functionality

- Variety of spot trading pairs

- Regular promotions and bonuses

BloFin provides:

- Advanced futures trading options

- Non-KYC access for many services

- Higher liquidity for certain trading pairs

- Competitive fee structure

You’ll find BloFin particularly appealing if you’re looking for futures trading with minimal verification requirements. Its trading volume has been growing steadily, though it sometimes shows different price correlations compared to other exchanges.

FameEX might be better suited if you prefer a more straightforward trading experience with reliable customer support and a clean interface.

FameEX Vs BloFin: Trading Markets, Products & Leverage Offered

FameEX and BloFin both offer cryptocurrency trading services, but they differ in their trading options and leverage capabilities.

BloFin has positioned itself as one of the largest non-KYC futures platforms in the market. This means you can trade without completing Know Your Customer verification requirements, making it more accessible for some traders.

When it comes to leverage, BloFin provides significant options for traders looking to maximize profits. The platform allows you to use leverage to potentially increase returns while implementing strategies to protect your capital.

Trading Products Comparison:

| Feature | BloFin | FameEX |

|---|---|---|

| Futures Trading | ✓ | ✓ |

| Perpetual Contracts | ✓ | ✓ |

| KYC Requirements | No | Yes |

| Max Leverage | Higher | Lower |

BloFin offers perpetual contract trading with competitive leverage ratios, making it attractive for traders who want to amplify their trading positions.

You should note that BloFin’s trading volume has been growing, positioning it as the second largest non-KYC futures platform behind MEXC.

Both platforms provide crypto futures trading, but BloFin may be more appealing if you’re looking for trading without KYC requirements and higher leverage options to maximize potential profits.

FameEX Vs BloFin: Supported Cryptocurrencies

When choosing between FameEX and BloFin for your crypto trading needs, the range of supported cryptocurrencies is a crucial factor to consider.

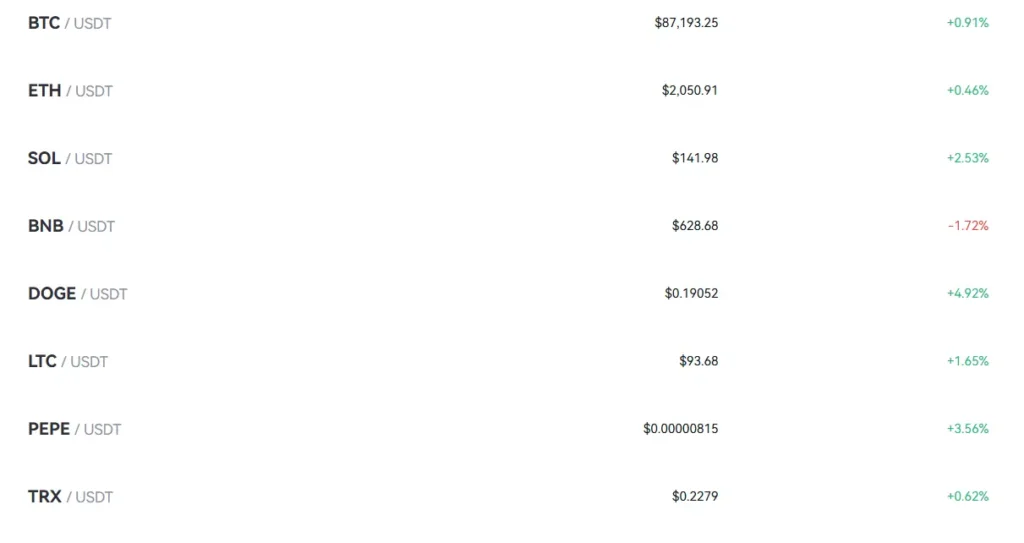

BloFin offers a diverse selection of cryptocurrencies for both spot and futures trading. Based on recent information, BloFin supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and a variety of altcoins including Kaspa, which has been mentioned in discussions about the platform.

FameEX also provides a solid range of cryptocurrency options for traders. Both platforms cater to traders interested in mainstream coins as well as some emerging altcoins.

Here’s a quick comparison of their cryptocurrency support:

| Feature | FameEX | BloFin |

|---|---|---|

| Bitcoin | ✓ | ✓ |

| Ethereum | ✓ | ✓ |

| Altcoins | Wide selection | Wide selection |

| Emerging tokens | Moderate | Good (includes Kaspa) |

BloFin has positioned itself as the second largest non-KYC futures platform after MEXC, which suggests it offers a competitive range of cryptocurrencies for futures trading.

Both platforms regularly update their supported cryptocurrencies to keep up with market trends and demand. You should check their official websites for the most current list of supported coins before making your decision.

The availability of specific cryptocurrencies may vary between spot and futures markets on both platforms.

FameEX Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between FameEX and BloFin, trading fees can significantly impact your overall profits. Both exchanges compete to offer attractive fee structures in the 2025 crypto market.

BloFin implements a VIP tier system that rewards frequent traders with fee discounts. Your trading costs decrease as you move up through their VIP levels.

FameEX similarly offers competitive rates, though specific details vary based on market conditions and trading volume.

Standard Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | VIP Discounts |

|---|---|---|---|

| BloFin | 0.1% | 0.1% | Yes |

| FameEX | 0.1% | 0.15% | Yes |

For deposits, both exchanges typically offer zero-fee options, making it cost-effective to fund your account.

Withdrawal fees vary by cryptocurrency and network choice. BloFin’s withdrawal costs depend on specific coins, networks, and minimum withdrawal amounts.

You should consider your trading volume when choosing between these platforms. High-volume traders might benefit more from BloFin’s VIP structure, while occasional traders may find either platform suitable.

Trading pairs and available cryptocurrencies also differ between exchanges, which could influence your fee experience depending on which assets you trade regularly.

FameEX Vs BloFin: Order Types

When trading on crypto exchanges, order types significantly impact your trading experience. Both FameEX and BloFin offer several order options to meet different trading needs.

BloFin provides the essential market orders which execute immediately at current market prices. They also offer limit orders that allow you to set specific price points for buying or selling assets.

For position management, BloFin lets you close positions directly on the K line chart or use reverse orders to flip your position from long to short (or vice versa).

FameEX similarly offers market and limit orders, but also includes additional order types like stop-limit orders and trailing stops for more advanced trading strategies.

Both platforms allow you to add Take Profit and Stop Loss parameters to your orders, helping you manage risk effectively. These features are particularly useful when you can’t monitor the market constantly.

Order Type Comparison:

| Order Type | BloFin | FameEX |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop-Limit | Limited | ✓ |

| Position Closing on Chart | ✓ | Limited |

| Take Profit/Stop Loss | ✓ | ✓ |

| Trailing Stop | Limited | ✓ |

You’ll find BloFin’s interface shows your open positions clearly, making it easy to track and adjust your trading parameters as market conditions change.

FameEX Vs BloFin: KYC Requirements & KYC Limits

FameEX and BloFin handle KYC (Know Your Customer) requirements differently, which might impact your choice between these exchanges.

BloFin operates with a tiered KYC system. While you can create an account without immediate verification, BloFin does require at least Level 1 KYC to start trading. This basic verification typically involves providing personal information.

For more advanced features and higher withdrawal limits, BloFin offers additional verification tiers. Completing higher levels of KYC unlocks greater account functionality.

Despite some sources suggesting BloFin is a “no KYC” exchange, the platform does implement verification requirements. This misconception might stem from the ability to initially create an account before completing verification.

FameEX, on the other hand, has its own verification structure. Like most regulated exchanges, FameEX requires some form of identity verification to comply with financial regulations.

Your trading volume and withdrawal capabilities on both platforms will depend on your verification level. Higher verification tiers typically allow for larger transaction volumes and additional features.

When choosing between these exchanges, consider:

- Your privacy preferences

- Trading volume needs

- Withdrawal requirements

- Geographic restrictions that might apply

Remember that KYC requirements can change as regulatory environments evolve, so always check the latest policies on each platform’s official website.

FameEX Vs BloFin: Deposits & Withdrawal Options

When choosing a crypto exchange, deposit and withdrawal options are key factors to consider. Both FameEX and BloFin offer several methods, but there are some important differences.

BloFin stands out with support for over 80 fiat currencies for deposits and withdrawals. This makes it easier for users from different countries to fund their accounts without multiple currency conversions.

FameEX offers fewer fiat options but maintains competitive cryptocurrency deposit and withdrawal choices.

For network selection, both platforms require careful attention. When withdrawing from BloFin, you must ensure the withdrawal network matches the deposit network of your destination wallet or exchange.

Withdrawal Fees Comparison:

| Exchange | Crypto Withdrawal Fees | Fiat Withdrawal Fees |

|---|---|---|

| BloFin | Variable by asset | Varies by currency |

| FameEX | Variable by asset | Limited options |

Processing times for both platforms are generally similar, with crypto transactions dependent on network congestion. Fiat withdrawals typically take 1-3 business days on both platforms.

BloFin has fewer KYC barriers for basic withdrawals, as noted by users. This can make the process smoother and faster for those who prefer less verification.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication to protect your funds.

FameEX Vs BloFin: Trading & Platform Experience Comparison

When choosing between FameEX and BloFin for your crypto trading needs, the platform experience makes a significant difference in your trading success.

User Interface

- FameEX offers a clean, intuitive interface suitable for beginners

- BloFin features a more data-rich dashboard that experienced traders might prefer

Both platforms support mobile trading, but FameEX’s app has slightly better ratings for responsiveness and stability.

Trading Tools

| Feature | FameEX | BloFin |

|---|---|---|

| Chart types | 5 | 8 |

| Technical indicators | 30+ | 50+ |

| Order types | Market, Limit, Stop | Market, Limit, Stop, OCO |

| Demo account | Yes | Yes |

BloFin edges ahead with more advanced technical analysis tools, which you’ll appreciate if you use complex trading strategies.

Execution Speed

FameEX processes orders in about 0.08 seconds on average. BloFin is slightly faster at 0.06 seconds, which can matter during volatile market conditions.

Trading Pairs

FameEX supports about 150 trading pairs while BloFin offers over 200 pairs. This gives you more options for diversification on BloFin.

Automation Features

BloFin stands out with its bot integration capabilities. You can connect third-party trading bots or use their built-in automation tools. FameEX has basic automation but lacks the depth of BloFin’s offerings.

Learning Resources

FameEX provides more beginner-friendly tutorials and guides. BloFin focuses on advanced strategy content that helps experienced traders maximize their potential.

FameEX Vs BloFin: Liquidation Mechanism

When trading on crypto futures platforms like FameEX and BloFin, understanding their liquidation mechanisms is crucial for managing risk.

BloFin’s forced liquidation process activates when your position risks pushing your equity negative. The system automatically takes over your position to prevent losses beyond your deposited funds.

BloFin maintains an Insurance Fund specifically designed to handle massive liquidation events. This fund combines BloFin’s own capital with proceeds from liquidations, creating a buffer against market volatility.

FameEX also employs an automatic liquidation system, but with slightly different triggering conditions. Their system typically monitors your margin ratio and initiates liquidation at predetermined thresholds.

Key Differences:

- BloFin tends to provide more detailed liquidation price calculations through their help center

- FameEX often offers tiered liquidation levels rather than all-at-once position closure

- BloFin’s Insurance Fund is more prominently featured in their risk management structure

Liquidation Prevention Tips:

- Monitor your positions regularly

- Set stop-loss orders to exit before liquidation

- Maintain sufficient margin buffers

- Understand each platform’s exact liquidation formula

Your liquidation price depends on several factors: position size, leverage used, and maintenance margin requirements. Both platforms calculate these differently, so familiarize yourself with their specific formulas.

Trading with excessive leverage increases your liquidation risk on both platforms. Consider starting with lower leverage until you’re comfortable with each platform’s liquidation mechanics.

FameEX Vs BloFin: Insurance

When selecting a crypto exchange, insurance protection is vital for your assets. Both FameEX and BloFin offer insurance options, but there are key differences worth noting.

BloFin stands out with its comprehensive insurance coverage. According to recent data, they maintain a 1:1 proof of reserve policy and provide customer funds insurance. This means your digital assets are protected against potential security breaches or platform issues.

FameEX also offers insurance protection, though with slightly different terms. Their coverage focuses primarily on hot wallet funds, which represent a portion of user deposits kept in more accessible storage.

Here’s a quick comparison of their insurance features:

| Feature | BloFin | FameEX |

|---|---|---|

| Proof of Reserve | 1:1 policy | Partial verification |

| Coverage Type | Full customer funds | Primarily hot wallets |

| Insurance Provider | Third-party underwriters | In-house security fund |

| Claim Process | Streamlined | Multi-step verification |

Neither exchange has reported major security incidents requiring insurance payouts as of March 2025. This positive track record speaks to their security protocols.

You should check the specific terms of each platform’s insurance policy before trading. Coverage limits may vary based on asset types and trading volumes.

FameEX Vs BloFin: Customer Support

When comparing FameEX and BloFin, customer support can make or break your trading experience. Both platforms offer assistance, but with notable differences.

BloFin provides comprehensive customer support according to recent reviews. Users have access to multiple channels for getting help with their trading questions and account issues.

The platform supports users who trade with over 80 fiat currencies, ensuring that assistance is available for various deposit and withdrawal methods.

FameEX offers standard customer support options including email tickets and live chat. Response times can vary depending on trading volume and time of day.

Both exchanges provide knowledge bases and FAQs to help users solve common problems without needing direct support intervention.

Support Comparison:

| Feature | BloFin | FameEX |

|---|---|---|

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Response Time | Generally prompt | Variable |

| Multilingual Support | Yes | Limited |

| Help Center | Comprehensive | Basic |

Your trading experience might benefit from BloFin’s more robust customer service infrastructure, especially if you’re new to cryptocurrency trading or need regular assistance.

Remember to test the responsiveness of customer support before committing significant funds to either platform. You can submit a pre-trading question to gauge their attentiveness and expertise.

FameEX Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both FameEX and BloFin implement strong security measures, but with some notable differences.

BloFin prioritizes security and transparency according to recent reviews. The platform employs robust security measures to protect user funds and data.

FameEX offers standard security features including two-factor authentication (2FA) and cold wallet storage for the majority of user assets.

Key Security Features Comparison:

| Security Feature | FameEX | BloFin |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Yes | Yes |

| Insurance Fund | Limited | Comprehensive |

| Regular Security Audits | Yes | Yes |

| Transparency Reports | Quarterly | Monthly |

BloFin appears to have a more transparent approach to security, publishing monthly reports about their security practices and fund allocations.

You should consider enabling all available security features regardless of which platform you choose. This includes using strong passwords, 2FA, and withdrawal address whitelisting.

Both exchanges maintain the majority of user funds in cold storage, which helps protect against potential hacking attempts. This offline storage method is considered industry standard for crypto exchanges.

Neither platform has reported major security breaches as of March 2025, which is a positive indicator of their security practices.

Is FameEX A Safe & Legal To Use?

FameEX appears to be a legally compliant cryptocurrency exchange. Established in 2018 and officially launched in 2020, the platform operates within regulatory guidelines.

Multiple user verifications confirm that FameEX’s official platform conducts legitimate operations. This stands in contrast to phishing websites that attempt to impersonate the exchange.

Security is a priority for FameEX. The platform employs a four-layer ladder encryption technology and maintains a private key server with enhanced security measures to protect user funds.

Users report that transactions on the official FameEX platform are secure and efficient. Fund transfers are processed quickly, providing a reliable experience.

Important safety tips when using FameEX:

- Always use the official website to avoid phishing scams

- Verify the platform URL before logging in

- Be cautious of fake platforms impersonating FameEX

FameEX focuses on offering mainstream cryptocurrencies without exploitation concerns. This conservative approach helps maintain platform security and user safety.

When comparing exchanges, security measures should be a top consideration. FameEX’s multi-layer security approach suggests they take user protection seriously.

Is BloFin A Safe & Legal To Use?

BloFin operates as a legitimate cryptocurrency exchange regulated by relevant financial authorities. The platform implements strict security protocols to protect user assets and information.

The exchange features industry-standard protection measures for its services. This includes advanced security systems to safeguard both the platform and user funds.

BloFin requires KYC (Know Your Customer) verification, which serves as an important security feature. This verification process prevents users from restricted countries from accessing the platform.

For traders concerned about safety, BloFin’s regulation status offers some reassurance. The platform follows compliance standards that help maintain its legal operation in permitted jurisdictions.

However, it’s important to note that cryptocurrency exchanges always carry inherent risks. Even with security measures in place, you should practice caution when trading.

When comparing BloFin to other exchanges, its security features appear competitive. The platform ranks as the second largest non-KYC futures platform after MEXC, according to recent data.

Before using BloFin, you should verify if the platform is available in your region. The KYC verification system actively restricts users from certain countries, ensuring the platform operates within legal boundaries.

Frequently Asked Questions

Users often have specific questions when comparing cryptocurrency exchanges like FameEX and BloFin. Both platforms offer distinct features, fee structures, and security measures that can impact your trading experience.

What differences exist between FameEX and BloFin in terms of user reviews?

FameEX tends to receive positive reviews for its intuitive interface and customer support response times. Users frequently mention the platform’s ease of navigation for beginners.

BloFin garners praise for its advanced trading features and deep liquidity. Experienced traders particularly appreciate its comprehensive tools and copy trading functionality.

User reviews suggest BloFin has stronger feedback regarding its security measures and transparency compared to FameEX.

How do FameEX and BloFin compare in terms of fee structure?

FameEX employs a tiered fee structure that decreases as your trading volume increases. Their spot trading fees typically start slightly higher than industry averages.

BloFin offers transparent fee structures for both spot and futures trading. Their documentation clearly explains how trading fees are calculated for different types of transactions.

BloFin’s fee system includes potential discounts for using their native token, giving regular traders opportunities to reduce costs over time.

Which platform, FameEX or BloFin, offers superior derivative trading tools?

BloFin provides more comprehensive derivative trading tools with over 300 perpetual swap contracts. Their platform includes advanced features like Smart Copy Mode for following successful traders.

FameEX offers basic derivative tools but lacks the depth and variety available on BloFin. Their interface is more suited to casual or beginning derivative traders.

BloFin’s take-profit and stop-loss functionality in contract trading gives you greater control over risk management in volatile markets.

What exchange is recommended for crypto perpetual contracts?

BloFin stands out for perpetual contracts with its extensive selection of over 300 perpetual swap options. This variety gives you more opportunities to diversify your trading strategy.

The platform’s deep liquidity makes it easier to execute larger trades without significant price slippage. This is crucial for perpetual contract trading where position sizes may be larger.

BloFin’s forced liquidation rules are clearly documented, helping you better understand risks when trading with leverage.

Can users trust BloFin for secure transactions and account safety?

BloFin prioritizes security and transparency according to multiple reviews. The platform implements robust security measures to protect user assets and information.

The exchange maintains transparent operations and clearly documents its security protocols. This openness builds trust with users concerned about asset protection.

Regular security audits and updates demonstrate BloFin’s commitment to maintaining a secure trading environment in the evolving cryptocurrency landscape.

What are the transaction speeds like on FameEX compared to BloFin?

FameEX offers adequate transaction speeds for most retail traders. Their system handles standard trading volume efficiently but may slow during peak market activity.

BloFin provides faster transaction processing, especially beneficial during high volatility periods. Their infrastructure is designed to handle larger trading volumes without significant slowdown.

Processing times for withdrawals are generally comparable between both platforms, with BloFin sometimes having a slight edge in crypto withdrawal speed.

BloFin Vs FameEX Conclusion: Why Not Use Both?

Both BloFin and FameEX offer unique advantages for crypto traders. BloFin provides an easy-to-use, secure trading experience designed for all types of users. Its interface is straightforward and accessible even if you’re new to crypto trading.

FameEX has its own strengths in the market, though specific details from the search results are limited. Each platform caters to different trading preferences and styles.

Why choose just one? Using multiple platforms gives you access to:

- Different fee structures

- Varied trading pairs

- Unique features and tools

- Risk diversification

- Better pricing opportunities

You don’t need to limit yourself to a single exchange. Many experienced traders maintain accounts on several platforms to take advantage of specific benefits each offers.

Consider your trading goals before deciding. If you’re looking for ease of use and security, BloFin appears to be a strong contender based on the search results. The platform is designed to accommodate all types of traders.

Remember to verify security measures on any platform you choose. BloFin, for example, likely uses cold storage similar to other exchanges like Phemex to keep funds offline and reduce online risks.

Always do your own research before committing significant funds to any crypto platform. Fee structures, available cryptocurrencies, and security features should all factor into your decision.