Choosing between eToro and Binance can be challenging when you’re looking to invest in cryptocurrencies. These two popular platforms offer different experiences tailored to various types of traders and investors. Understanding their key differences will help you make an informed decision based on your specific needs.

Both eToro and Binance provide reliable crypto trading platforms, but they serve different user preferences with eToro offering a more regulated, user-friendly experience while Binance delivers greater crypto variety and advanced trading features. eToro focuses on social trading and supports various financial assets beyond cryptocurrencies, making it suitable for beginners who want to copy experienced traders.

Binance, on the other hand, specializes in cryptocurrency with a wider selection of coins and more technical trading options. Your choice ultimately depends on whether you prioritize regulation and ease of use or prefer access to more cryptocurrencies and advanced trading tools. The right platform for you will align with your trading goals, experience level, and the features you value most.

eToro Vs Binance: At A Glance Comparison

When choosing between eToro and Binance, understanding their key differences helps you make the right decision for your trading needs.

User Experience

- eToro: More user-friendly interface with a focus on social trading

- Binance: More complex interface designed for advanced traders

Cryptocurrency Selection

- eToro: Limited selection of cryptocurrencies

- Binance: Extensive range of cryptocurrencies available for trading

Fees

- eToro: Generally higher fees, especially for withdrawals

- Binance: Lower trading fees overall (0.1% standard fee)

Special Features

| Platform | Unique Features |

|---|---|

| eToro | Social trading, CopyTrading, ready-made portfolios |

| Binance | Advanced trading options, staking, futures trading |

Regulation

eToro is more heavily regulated across multiple countries. This provides better protection for your investments but may limit some features depending on your location.

Binance offers more trading options but has faced regulatory challenges in certain regions. You should check availability in your country before signing up.

Target Users

eToro works best if you’re new to crypto trading or value learning from others. The platform makes it easy to follow successful traders.

Binance is ideal if you want more advanced trading tools and access to a wider variety of cryptocurrencies. You’ll benefit from lower fees if you trade frequently.

eToro Vs Binance: Trading Markets, Products & Leverage Offered

Both eToro and Binance offer cryptocurrency trading, but they differ significantly in what they provide to traders.

Binance offers over 350 cryptocurrencies for trading. It provides spot trading, futures, options, and margin trading with leverage up to 20x. Binance also features staking, savings products, and an NFT marketplace.

eToro supports around 70 cryptocurrencies, which is fewer than Binance. However, eToro stands out by offering stocks, ETFs, and forex trading alongside crypto. This makes it more of an all-in-one platform for diverse investments.

For leverage, eToro provides up to 2x leverage for crypto trading, which is more conservative than Binance’s offerings. This might be better for beginners who want to limit risk.

Trading Products Comparison:

| Feature | eToro | Binance |

|---|---|---|

| Cryptocurrencies | ~70 | 350+ |

| Stocks & ETFs | Yes | No |

| Forex | Yes | No |

| Futures | No | Yes |

| Max Leverage | 2x | 20x |

| NFT Marketplace | No | Yes |

eToro’s social and copy trading features let you follow and automatically copy successful traders. This is especially helpful if you’re new to trading.

Binance caters more to experienced crypto traders who need advanced tools and higher leverage options.

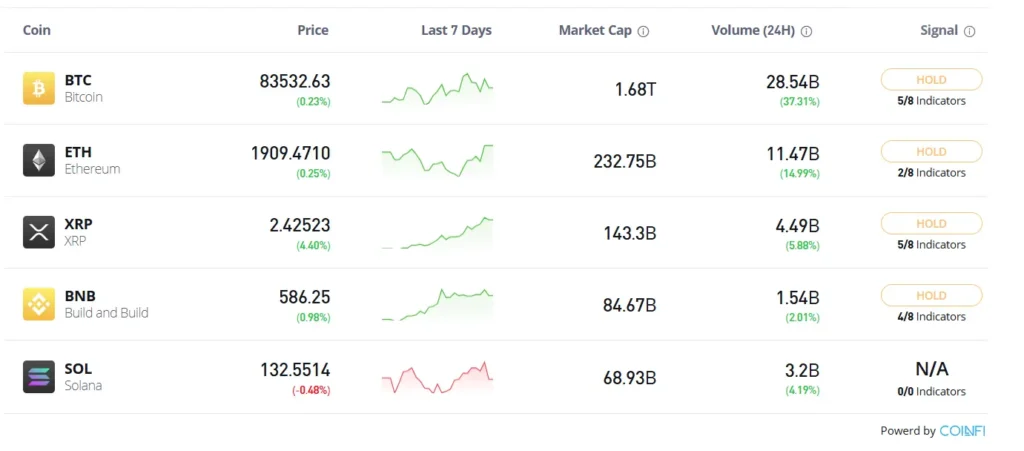

eToro Vs Binance: Supported Cryptocurrencies

When choosing between eToro and Binance, the range of available cryptocurrencies is an important factor to consider.

Binance clearly leads in this category, offering over 350 different cryptocurrencies for trading. This extensive selection includes both major coins and smaller altcoins, giving you access to almost any digital asset you might want to trade.

eToro supports fewer cryptocurrencies, with approximately 70+ coins available on the platform. While this covers all major cryptocurrencies like Bitcoin, Ethereum, and Solana, you’ll find fewer niche or emerging tokens.

Binance Cryptocurrency Support:

- 350+ cryptocurrencies

- Extensive altcoin selection

- Regular additions of new tokens

- Support for most emerging projects

eToro Cryptocurrency Support:

- 70+ cryptocurrencies

- All major coins included

- More selective about adding new tokens

- Focus on established cryptocurrencies

If you’re interested in trading obscure or newly launched cryptocurrencies, Binance will likely be your better option. The platform typically adds new coins faster than eToro.

For beginners or those focused on mainstream cryptocurrencies, eToro’s more curated selection might actually be beneficial. You won’t get overwhelmed by too many choices, and the platform ensures the coins it offers meet certain quality standards.

Your trading strategy should influence which platform you choose. Diverse portfolio builders and altcoin traders will appreciate Binance’s variety, while those focused on top market coins might find eToro’s selection perfectly adequate.

eToro Vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between eToro and Binance, understanding their fee structures is crucial for your trading strategy.

eToro Fees:

- Uses spread fees (the difference between buy and sell prices)

- Charges overnight and weekend fees for CFD positions

- Has withdrawal fees ($5 in most markets)

- Applies inactivity fees for dormant accounts

Binance Fees:

- Offers a flat trading fee structure starting at 0.1% per trade

- Provides discounts when you pay fees using BNB (Binance’s native token)

- Charges minimal withdrawal fees that vary by cryptocurrency

- No inactivity fees

Deposit Methods & Fees:

| Platform | Credit/Debit | Bank Transfer | Crypto |

|---|---|---|---|

| eToro | Free | Free | N/A |

| Binance | 1-2% fee | Free/Minimal | Free |

Binance generally offers lower trading fees for active traders, especially if you hold BNB. However, eToro’s fee structure is simpler to understand for beginners.

For withdrawals, eToro has a fixed fee regardless of the amount, while Binance’s fees depend on the cryptocurrency you’re withdrawing.

Your trading volume and preferred assets will determine which platform offers better value. High-volume traders typically benefit more from Binance’s tiered fee structure.

eToro Vs Binance: Order Types

When trading cryptocurrency, the types of orders available can greatly impact your trading strategy. Both eToro and Binance offer different order options to meet various trading needs.

eToro provides a simpler range of order types, making it more accessible for beginners. You can place market orders, limit orders, and stop-loss orders on eToro.

Binance, on the other hand, offers a more comprehensive selection of order types. Besides the basic options, you can use:

- Market Orders: Buy or sell at current market price

- Limit Orders: Set specific buy/sell prices

- Stop-Limit Orders: Combine stop and limit orders

- OCO (One Cancels Other): Place two orders where filling one cancels the other

- Post Only: Ensure your order provides liquidity

- Trailing Stop: Adjust stop prices as the market moves

This wider variety of order types on Binance gives experienced traders more flexibility in executing complex strategies.

For new traders, eToro’s streamlined options might be less overwhelming. The platform focuses on simplicity rather than offering every possible order variation.

Trading professionals often prefer Binance for its advanced order capabilities that allow for precise position management and risk control.

Your choice between these platforms should consider how important diverse order types are to your trading approach.

eToro Vs Binance: KYC Requirements & KYC Limits

Both eToro and Binance require KYC (Know Your Customer) verification, but they have different approaches and limits.

eToro KYC Requirements:

- Full verification required before you can trade

- Must submit personal information including name, date of birth, and address

- Photo ID verification mandatory

- Typically takes 1-2 business days to complete

eToro’s process is more straightforward with fewer tiers. Their emphasis on security means you must complete verification before accessing trading features.

Binance KYC Requirements:

- Basic account access with email verification only

- Different verification tiers with increasing withdrawal limits

- Full KYC required for higher withdrawal limits and advanced features

- May include anti-phishing codes as part of security

Binance allows you to start with minimal verification, but you’ll need to complete KYC to access most features.

Withdrawal Limits Comparison:

| Platform | Unverified | Basic Verification | Full Verification |

|---|---|---|---|

| eToro | Not allowed | Limited access | Up to $10,000/day |

| Binance | 0.06 BTC/day | 2 BTC/day | 100+ BTC/day |

Both platforms prioritize security through KYC procedures, but Binance offers more flexibility with tiered verification levels. If you value quick access with minimal verification, Binance might be preferable.

eToro Vs Binance: Deposits & Withdrawal Options

Both eToro and Binance offer multiple ways to fund your account, but they differ in fees and processing times.

eToro Deposit Options:

- Credit/debit cards

- Bank transfers

- PayPal

- Neteller

- Skrill

- Other e-wallets

eToro deposits are generally free, but you’ll need to meet a minimum deposit requirement which varies by country (typically $50-$1000).

Binance Deposit Options:

- Bank transfers

- Credit/debit cards

- P2P trading

- Third-party payment processors

Binance allows free crypto deposits, while fiat deposits may incur fees depending on your payment method.

Withdrawal Fees Comparison:

| Platform | Withdrawal Fee |

|---|---|

| eToro | Up to $60 |

| Binance | 0.0001 BTC (for Bitcoin) |

eToro charges a flat $5 fee for withdrawals plus potential conversion fees if you’re withdrawing to a different currency than your account currency.

Binance withdrawal fees vary by cryptocurrency. For example, Bitcoin withdrawals cost 0.0001 BTC.

Processing times also differ between platforms. eToro withdrawals typically take 1-2 business days to process plus additional time for the funds to reach your account.

Binance usually processes crypto withdrawals within 2 hours, though fiat withdrawals can take 1-3 business days depending on your bank.

You should consider these deposit and withdrawal options when choosing between eToro and Binance for your trading needs.

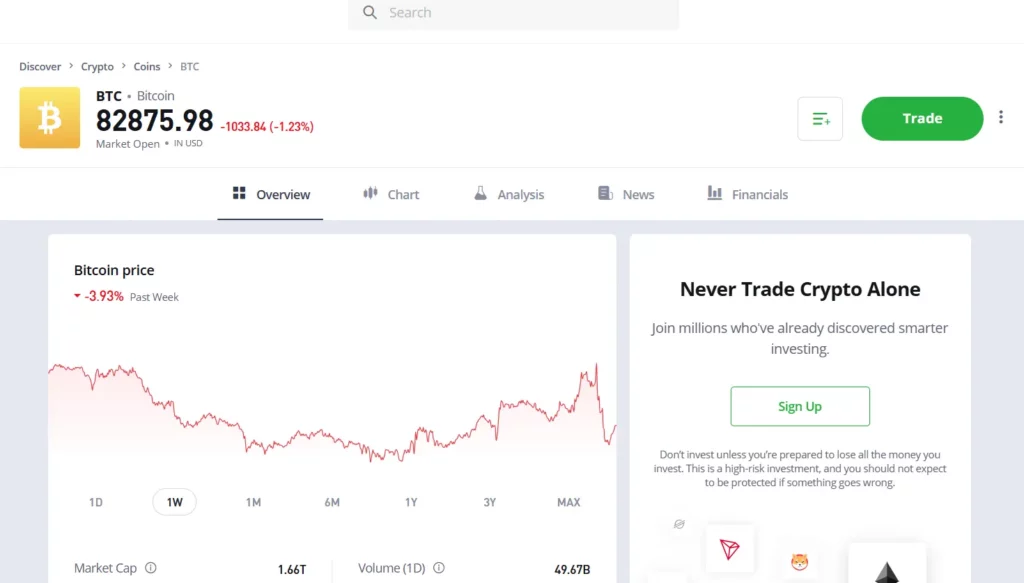

eToro Vs Binance: Trading & Platform Experience Comparison

eToro offers a user-friendly interface that beginners will find easy to navigate. Its standout feature is social trading, which lets you copy successful traders automatically.

Binance provides a more complex platform with advanced trading tools that experienced traders appreciate. You’ll find more detailed charts, indicators, and order types here.

For cryptocurrency selection, Binance clearly wins with hundreds of coins available. eToro offers fewer options but focuses on the most popular cryptocurrencies.

Fee Comparison:

| Fee Type | eToro | Binance |

|---|---|---|

| Trading Fees | Spread fees (varies) | Flat fee (typically 0.1%) |

| Withdrawal Fees | $5 flat fee | Varies by cryptocurrency |

| Inactivity Fee | Yes | No |

eToro’s copy trading feature is perfect if you want to learn from others. You can see what successful investors do and automatically mirror their trades.

Binance excels with its variety of trading options including spot, margin, futures, and options trading. This gives you more ways to potentially profit from market movements.

The mobile experience differs too. eToro’s app continues its social-focused approach with an intuitive design. Binance’s app maintains most desktop functionality but can feel overwhelming to newcomers.

Your trading style should guide your choice. Choose eToro for simplicity and social features. Pick Binance for advanced tools and cryptocurrency variety.

eToro Vs Binance: Liquidation Mechanism

When trading with leverage on either eToro or Binance, understanding their liquidation mechanisms is essential for managing risk. These systems protect platforms from losses when markets move against traders’ positions.

eToro uses a simple liquidation system. When your equity falls below the maintenance margin requirement (usually 50% of the initial margin), the platform will close your position automatically. eToro also offers negative balance protection, ensuring you can’t lose more than your account balance.

Binance employs a more complex liquidation process for futures trading. It uses a three-tier system:

| Liquidation Stage | Description |

|---|---|

| Initial Warning | Alert sent when margin ratio approaches liquidation threshold |

| Partial Liquidation | Gradual reduction of position size to avoid market impact |

| Full Liquidation | Complete closure of position if margin ratio continues to decline |

Binance’s Insurance Fund serves as a buffer during volatile market conditions. This fund absorbs losses that occur when liquidations happen at prices worse than the bankruptcy price.

The key difference is eToro’s simpler approach versus Binance’s tiered system. eToro is more forgiving for beginners with its negative balance protection. Binance offers more control but requires a deeper understanding of margin mechanics.

You should consider these liquidation mechanisms when deciding which platform aligns with your trading experience and risk tolerance.

eToro Vs Binance: Insurance

When comparing eToro and Binance, insurance protection is an important factor to consider for your investments.

eToro provides insurance coverage through various regulatory protections. If you’re in the UK, your funds are protected up to £85,000 under the Financial Services Compensation Scheme (FSCS). European users benefit from protection under their local financial authorities.

Binance offers a different approach with its Secure Asset Fund for Users (SAFU). This emergency insurance fund holds 10% of all trading fees to protect users in case of security breaches.

Neither platform offers complete protection for all cryptocurrency holdings. Traditional insurance typically doesn’t cover crypto market volatility or price fluctuations.

Here’s a quick comparison of their insurance features:

| Feature | eToro | Binance |

|---|---|---|

| Insurance Type | Regulatory protection (varies by region) | SAFU fund |

| Coverage Limit | Up to £85,000 (UK), varies elsewhere | Based on fund size |

| What’s Covered | Cash deposits primarily | Security breaches primarily |

| Cryptocurrency Coverage | Limited | Limited |

You should note that both platforms implement additional security measures like cold storage and two-factor authentication to protect your assets.

Remember to review the specific insurance policies for your region, as coverage details may change and vary depending on where you live.

eToro Vs Binance: Customer Support

When choosing between eToro and Binance, customer support can make a big difference in your trading experience. Both platforms offer assistance, but they differ in important ways.

eToro provides multi-language support, making it accessible to traders worldwide. You can reach their team through email, a ticket system, and live chat. Many users find eToro’s support to be responsive and helpful for beginners.

Binance also offers multi-channel support through email, chat, and a comprehensive help center. However, response times can vary, especially during high-volume periods or market volatility.

Support Channel Comparison:

| Feature | eToro | Binance |

|---|---|---|

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Limited | No |

| Response Time | Generally quick | Can vary |

| Languages | Multiple | Multiple |

One advantage of eToro is its focus on user-friendly support for newcomers. You’ll find more hand-holding and guidance compared to Binance.

Binance’s support system is robust but sometimes feels more technical. Their extensive knowledge base can help you solve many issues without contacting support directly.

For beginners, eToro’s support approach might feel more welcoming. Experienced traders might appreciate Binance’s comprehensive documentation, even if direct support sometimes takes longer.

eToro Vs Binance: Security Features

When choosing between eToro and Binance, security should be a top priority for your investments. Both platforms have implemented strong protective measures, but they differ in specific approaches.

eToro Security Features:

- Regulated by multiple financial authorities worldwide

- Two-factor authentication (2FA)

- SSL encryption for data protection

- Stores most cryptocurrency in offline cold storage

- Account verification requirements to prevent fraud

eToro’s regulation by established financial authorities adds an extra layer of legitimacy and oversight that many traders find reassuring.

Binance Security Features:

- Advanced anti-phishing codes

- Regular security audits

- SAFU fund (Secure Asset Fund for Users) to protect against hacks

- Address whitelisting for withdrawals

- Comprehensive risk management systems

Binance conducts frequent security audits and has implemented technical safeguards to protect user assets. Their SAFU fund acts as insurance against potential breaches.

Both platforms encrypt your data and offer two-factor authentication, which you should always enable. This simple step greatly reduces the risk of unauthorized account access.

For extra protection on either platform, you should consider using unique passwords and being cautious about phishing attempts. Never click suspicious links claiming to be from these exchanges.

Your trading needs will determine which security approach feels more appropriate. eToro might appeal if you value regulatory oversight, while Binance offers robust technical security features.

Is eToro Safe & Legal To Use?

eToro is considered a safe and legal platform for trading cryptocurrencies and other assets. It operates under the oversight of several respected financial regulatory bodies, including the UK’s Financial Conduct Authority (FCA) and Australia’s ASIC.

This regulatory compliance means you can trust that eToro follows strict standards for security and customer protection. These regulations help safeguard your investments and personal information.

eToro has been operating since 2007, giving it a long track record in the financial industry. Many users have been with the platform for years without significant issues. One Reddit user mentioned using eToro since 2013 without problems.

Key Security Features:

- Account verification procedures

- Two-factor authentication

- SSL encryption for data protection

- Segregated client funds

When comparing safety between eToro and Binance, eToro often comes out ahead in terms of regulatory compliance. This may provide you with more peace of mind, especially if you’re new to cryptocurrency trading.

The platform is available in many countries worldwide, though restrictions may apply depending on your location. You should check if eToro’s services are available in your country before signing up.

While eToro does charge higher fees than some competitors (around a 1% fee for crypto trades), this can be viewed as the cost of using a more regulated and secure platform.

Is Binance Safe & Legal To Use?

Binance is generally considered safe due to its robust security features. The platform uses two-factor authentication (2FA), address whitelisting, and advanced encryption to protect user accounts and funds.

The legality of Binance varies by location. In many countries, Binance operates legally, but some regions have restrictions or bans.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for most crypto assets

- Anti-phishing codes

- Device management tools

Regulatory status is complex and changes frequently. Binance has faced scrutiny from regulators in several countries, including the UK, Japan, and the US.

For US users specifically, Binance.US operates as a separate entity to comply with US regulations. This version offers fewer features than the international platform.

Regional Restrictions:

| Region | Status |

|---|---|

| United States | Binance.US available (restricted version) |

| UK | Limited services |

| Europe | Available with varying restrictions |

| Asia | Varies by country |

You should check your local laws before using Binance. The platform may require KYC (Know Your Customer) verification depending on your location and trading volume.

Remember that while Binance has strong security measures, no exchange is completely immune to risks. Using hardware wallets for large amounts and enabling all security features is recommended.

Frequently Asked Questions

Traders and investors often have specific questions when comparing eToro and Binance. Here are answers to the most common questions about these popular cryptocurrency exchanges.

What are the main differences in fees between eToro and Binance?

Binance typically offers lower trading fees, with standard fees starting at 0.1% per trade. These fees can be reduced further by using Binance’s native BNB token or increasing your trading volume.

eToro’s fees are generally higher, with spreads starting at 1% for cryptocurrencies. eToro also charges withdrawal fees and may have inactivity fees for dormant accounts.

For regular traders who prioritize cost-efficiency, Binance’s fee structure provides better value, especially with high-volume trading.

How do eToro’s and Binance’s platforms differ in terms of user experience?

eToro offers a more beginner-friendly interface with its social trading features. You can easily copy experienced traders’ portfolios and engage with a community of investors.

Binance provides a more comprehensive trading experience with advanced charting tools and order types. The platform has both basic and advanced views to accommodate different skill levels.

eToro focuses on accessibility and simplicity, while Binance caters to serious traders who need advanced functionality and detailed market analysis tools.

Can I transfer cryptocurrency assets between eToro and Binance, and if so, how?

Yes, you can transfer crypto assets between eToro and Binance. To do this, you’ll need to withdraw your crypto from eToro to an external wallet first.

From eToro, go to your Portfolio, select the cryptocurrency, click “Transfer” or “Withdraw,” and enter your Binance wallet address. Make sure to double-check the network type (like ERC-20 for Ethereum-based tokens) before confirming.

Remember that eToro has minimum withdrawal amounts and fees. The process typically takes a few hours to complete depending on network congestion.

Which platform offers a wider range of cryptocurrencies, eToro or Binance?

Binance offers a significantly larger selection of cryptocurrencies, with support for hundreds of different tokens and coins. You’ll find both major cryptocurrencies and smaller altcoins on Binance.

eToro provides a more limited selection, focusing on established cryptocurrencies like Bitcoin, Ethereum, and other major altcoins. The platform supports approximately 30-40 cryptocurrencies.

If you’re looking to diversify into lesser-known tokens or newly launched projects, Binance provides far more options.

What security measures do eToro and Binance each have in place to protect users’ funds?

Both platforms employ strong security measures. eToro is regulated by multiple financial authorities and uses SSL encryption, two-factor authentication, and stores most user funds in offline cold storage.

Binance implements its Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. They also offer advanced security features like anti-phishing codes, address whitelisting, and hardware security keys.

Both exchanges conduct regular security audits, though Binance has experienced hacking attempts in the past and has since strengthened its security infrastructure.

How do eToro and Binance compare in terms of their customer support services?

eToro provides customer support through a ticket system, live chat, and has an extensive help center. Response times vary but are generally within 24-48 hours for standard inquiries.

Binance offers 24/7 support through chat, a comprehensive knowledge base, and community forums. For complex issues, their ticket system can sometimes have longer resolution times.

Neither platform consistently outperforms the other in customer service, with both receiving mixed reviews from users regarding response speed and issue resolution.

Binance Vs eToro Conclusion: Why Not Use Both?

Both Binance and eToro have unique strengths that appeal to different types of traders. Instead of choosing one over the other, using both platforms might be your best strategy.

Binance offers a wider selection of cryptocurrencies and advanced trading features. You’ll benefit from its lower fees and comprehensive trading options if you’re comfortable with a steeper learning curve.

eToro shines with its social trading features and user-friendly interface. If you’re new to trading or value learning from others, eToro’s copy trading function gives you a significant advantage.

Your trading needs may evolve over time. Starting with eToro’s simpler interface might make sense if you’re a beginner. As you gain experience, you can expand to Binance for its advanced features.

Consider using eToro for its regulated environment and social aspects, while utilizing Binance for its broader cryptocurrency selection and lower fees.

Key Benefits of Using Both:

| Platform | Best For |

|---|---|

| eToro | Social trading, beginner-friendly interface, regulated environment |

| Binance | Lower fees, wider crypto selection, advanced trading options |

You don’t need to limit yourself to just one platform. By leveraging the strengths of both Binance and eToro, you can create a more flexible and comprehensive trading strategy.