Choosing the right cryptocurrency exchange is essential for your trading success. DigiFinex and OKX are two popular platforms that offer various services for crypto enthusiasts. Both exchanges provide cryptocurrency trading and digital asset management, but they differ in terms of fees, supported cryptocurrencies, and available features.

When comparing DigiFinex and OKX, you’ll want to consider several key factors that could impact your trading experience. These include the fee structures, deposit methods, types of trading available, and user ratings. Each platform has its strengths and unique offerings that might better suit your specific needs.

The cryptocurrency exchange landscape is competitive, with platforms constantly evolving their services. By understanding the differences between DigiFinex and OKX, you can make a more informed decision about which exchange aligns with your trading goals and preferences.

DigiFinex vs OKX: At A Glance Comparison

DigiFinex and OKX are popular cryptocurrency exchanges that offer trading services for digital assets. Let’s compare their key features to help you decide which platform might suit your needs better.

Trading Volume & Ranking:

OKX typically ranks higher among global exchanges by trading volume. It has established itself as one of the top cryptocurrency exchanges according to metrics from CoinMarketCap and CoinGecko.

Services Offered:

| Feature | DigiFinex | OKX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Wealth Management | ✓ | ✓ |

| Interest Earning | ✓ (rates vary) | ✓ (1% for BTC) |

| Compounding | Limited | Yes |

User Experience:

DigiFinex focuses on being a comprehensive digital asset platform with various financial services. OKX (formerly OKEx) offers a more robust trading environment with advanced tools.

Fees:

Both platforms have competitive fee structures. Your actual costs will depend on your trading volume and whether you use their native tokens for fee discounts.

Coin Selection:

Both exchanges support a wide range of cryptocurrencies and trading pairs. You’ll find most major coins on either platform, though specific altcoin availability may differ.

Security:

Security features are important on both platforms. You should check their latest security protocols as these constantly evolve in the crypto space.

DigiFinex vs OKX: Trading Markets, Products & Leverage Offered

DigiFinex and OKX both offer a variety of trading options for crypto enthusiasts. Let’s compare what each platform provides.

Available Markets

- DigiFinex: Supports spot trading, futures, and margin trading

- OKX: Offers spot trading, futures, options, and perpetual swaps

DigiFinex provides margin trading with up to 10x leverage, which meets the industry average for most trading platforms. This makes it suitable for traders looking to amplify their positions.

OKX generally offers more diverse trading products. Their derivatives selection is particularly robust, placing them among the top cryptocurrency derivatives exchanges globally.

Trading Features Comparison:

| Feature | DigiFinex | OKX |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | ✅ | ✅ |

| Options | ❌ | ✅ |

| Margin Trading | ✅ (up to 10x) | ✅ (up to 20x) |

| Perpetual Swaps | ❌ | ✅ |

OKX gives you access to more advanced trading tools and typically higher leverage options. This makes it better for experienced traders who need sophisticated instruments.

DigiFinex focuses more on providing solid wealth management services alongside its trading platform. Their 10x leverage is suitable for moderate risk-takers.

For derivative trading specifically, OKX ranks higher in global volume and liquidity compared to DigiFinex. This can result in better pricing and execution for your trades.

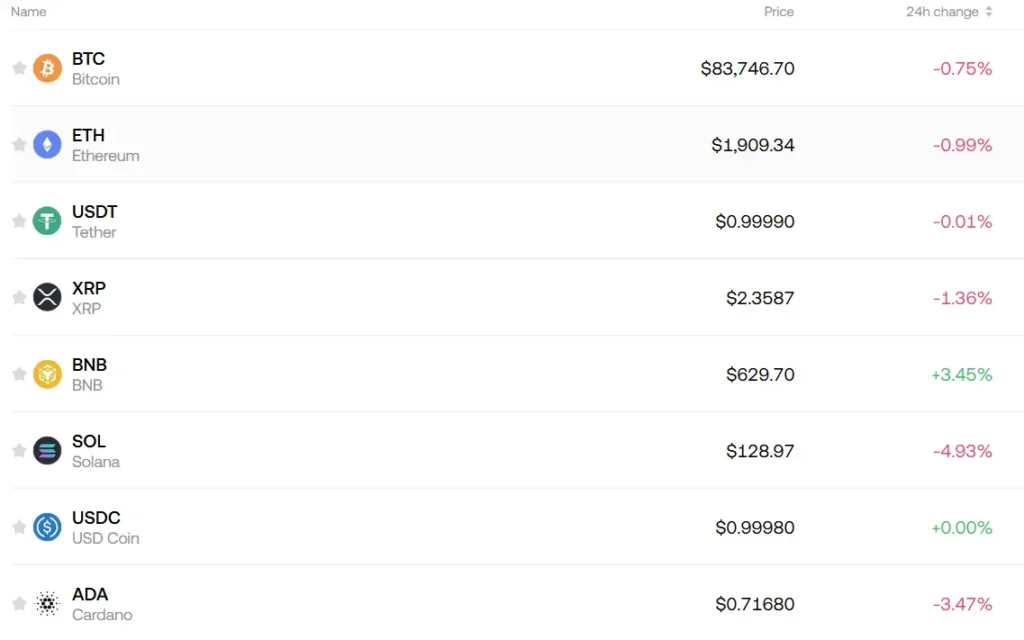

DigiFinex vs OKX: Supported Cryptocurrencies

When choosing between DigiFinex and OKX, the range of available cryptocurrencies plays a crucial role in your decision. Both exchanges offer a wide selection of digital assets, but they differ in their offerings.

OKX supports over 350 cryptocurrencies, making it one of the more comprehensive exchanges in terms of coin variety. You’ll find all major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), plus many altcoins and emerging tokens.

DigiFinex provides access to approximately 300 cryptocurrencies. While slightly fewer than OKX, it still covers all the major coins and many popular altcoins.

Comparison of Supported Assets:

| Feature | DigiFinex | OKX |

|---|---|---|

| Total cryptocurrencies | ~300 | 350+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| DeFi tokens | Most popular ones | Extensive selection |

| New/emerging coins | Moderate additions | Regular new listings |

Both platforms regularly add new tokens, but OKX typically introduces new cryptocurrencies more frequently. This can be important if you’re looking to invest in newer projects or more obscure altcoins.

If you’re mainly interested in major cryptocurrencies, either exchange will meet your needs. However, if you want access to a wider variety of smaller or newer tokens, OKX might give you more options.

Trading pairs also differ between the platforms, with OKX generally offering more combinations for each listed cryptocurrency.

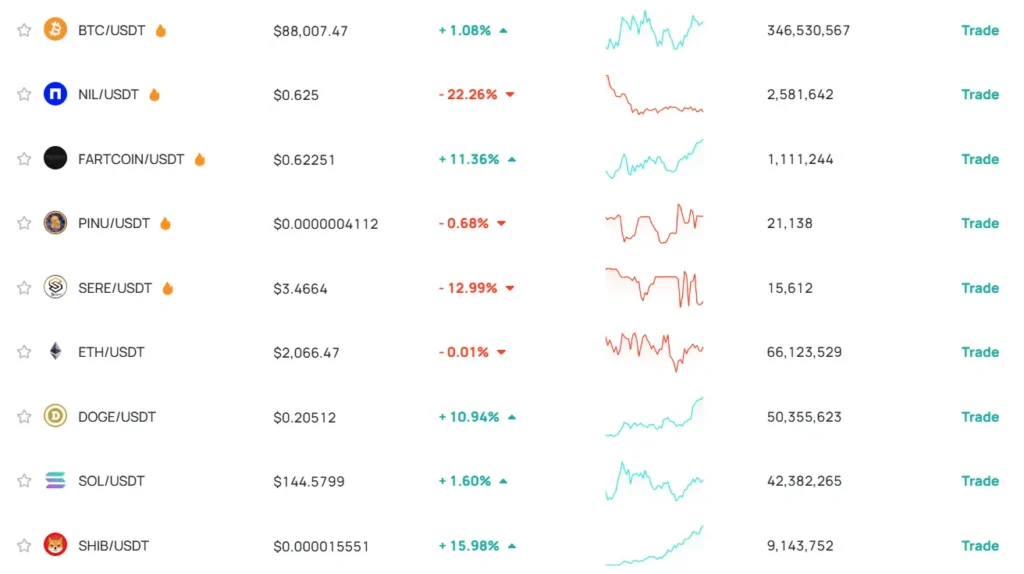

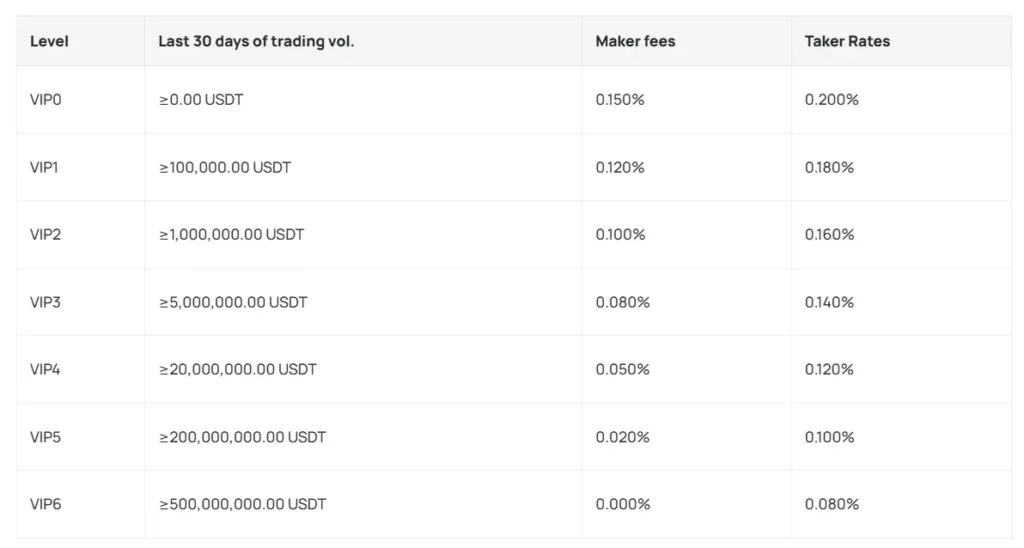

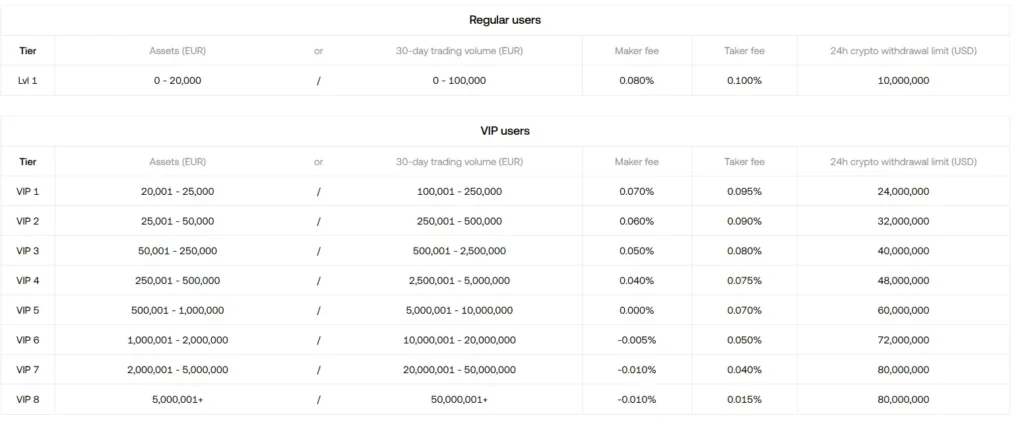

DigiFinex vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing DigiFinex and OKX, trading fees are an important factor to consider for your cryptocurrency trading experience.

DigiFinex charges a standard trading fee of 0.02% per transaction. This rate applies to most regular trades on their platform.

OKX offers a slightly lower trading fee at 0.01%, giving you a small advantage for frequent trading activities. This difference may seem small but can add up significantly if you trade in high volumes.

Both exchanges offer tiered fee structures based on your trading volume. The more you trade, the lower your fees can become.

For deposit fees, both DigiFinex and OKX generally offer free cryptocurrency deposits. This is standard across most major exchanges.

Withdrawal Fee Comparison:

| Exchange | Trading Fee | Crypto Deposits | Withdrawal Fees |

|---|---|---|---|

| DigiFinex | 0.02% | Free | Varies by cryptocurrency |

| OKX | 0.01% | Free | Varies by cryptocurrency |

Withdrawal fees on both platforms depend on the specific cryptocurrency you’re withdrawing. These fees can change based on network conditions and token values.

You should check the current fee schedules on both platforms before making large transactions, as these rates may have updated since early 2025.

DigiFinex vs OKX: Order Types

Both DigiFinex and OKX offer a variety of order types to help you execute trades according to your strategy. Understanding these options can give you more control over your trading experience.

DigiFinex provides standard market and limit orders for basic trading needs. You can place market orders to execute trades immediately at current prices, or limit orders to set specific buy/sell prices.

The platform also supports stop-loss and take-profit orders to manage risk. These automatic triggers help protect your investments when prices move in unexpected directions.

OKX (formerly OKEx) offers a more extensive selection of order types. Beyond the basics, you’ll find advanced options like iceberg orders, which hide the true size of large orders to prevent market impact.

OKX also features post-only orders and time-weighted average price (TWAP) orders for sophisticated trading strategies. These tools can be particularly useful if you’re an active or algorithmic trader.

Here’s a quick comparison of order types:

| Order Type | DigiFinex | OKX |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Iceberg | ✗ | ✓ |

| Post-Only | ✗ | ✓ |

| TWAP | ✗ | ✓ |

For derivatives trading, both exchanges offer additional specialized order types. OKX generally provides more advanced order functionalities that cater to experienced traders who need precise execution control.

DigiFinex vs OKX: KYC Requirements & KYC Limits

DigiFinex offers more flexibility when it comes to KYC (Know Your Customer) requirements. You can trade on DigiFinex without completing identity verification, making it accessible for users who prefer privacy.

However, if you want higher withdrawal limits on DigiFinex, you’ll need to complete their KYC process. This verification helps them comply with regulatory standards while giving verified users additional benefits.

OKX has recently implemented stricter policies. They now require mandatory KYC verification for withdrawals, even for users accessing the platform through VPNs. This change represents a significant shift in their approach to compliance.

Here’s a quick comparison of KYC requirements:

| Exchange | KYC Required for Trading | KYC Required for Withdrawals | Benefits of Verification |

|---|---|---|---|

| DigiFinex | No | No, but limits apply | Higher withdrawal limits |

| OKX | No | Yes | Necessary for any withdrawals |

If maintaining privacy is your priority, DigiFinex might be more suitable for your needs. You can start trading immediately without providing personal information.

For users who plan to move large amounts of cryptocurrency, completing KYC on either platform is beneficial. The verification process typically requires submitting government-issued ID and proof of address.

Remember that regulations change frequently in the crypto space, so these requirements might be updated without much notice.

DigiFinex vs OKX: Deposits & Withdrawal Options

When choosing between DigiFinex and OKX, understanding their deposit and withdrawal options is crucial for managing your crypto assets effectively.

DigiFinex offers limited options for moving funds in and out of the platform. Based on recent information, the exchange has restricted fiat deposit and withdrawal methods, which may create challenges for users who want to convert between traditional currency and crypto.

OKX provides more comprehensive options, supporting various fiat deposit methods including bank transfers, credit/debit cards, and third-party payment processors. This flexibility makes OKX more accessible for new users entering the crypto space.

Both platforms support crypto deposits and withdrawals for major cryptocurrencies like Bitcoin, Ethereum, and numerous altcoins. However, OKX generally supports a wider range of tokens.

Withdrawal fees vary between the platforms:

| Exchange | Crypto Withdrawal Fees | Fiat Withdrawal Options |

|---|---|---|

| DigiFinex | Varies by cryptocurrency | Limited |

| OKX | Generally competitive | Multiple options available |

Processing times for withdrawals are comparable on both platforms, with crypto withdrawals typically processing within minutes to hours depending on network congestion.

You should verify the specific deposit and withdrawal options available in your region, as both exchanges may have different services available based on your location.

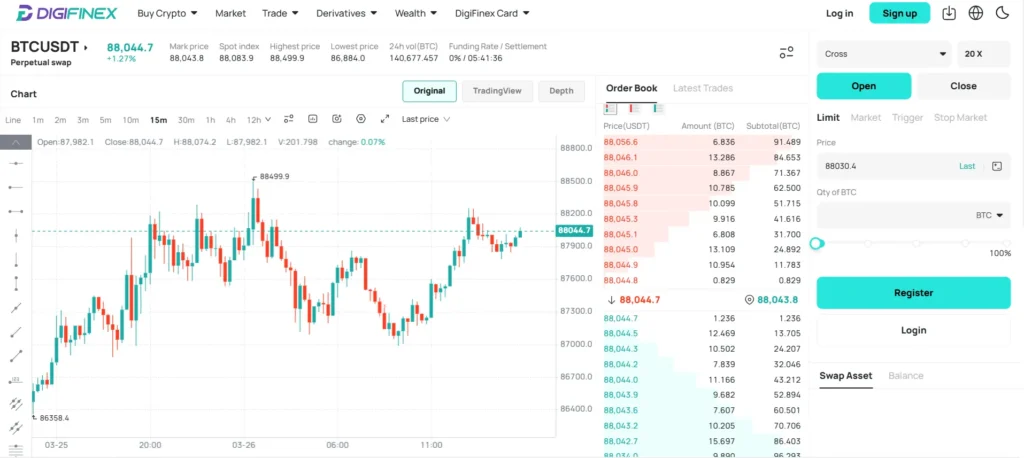

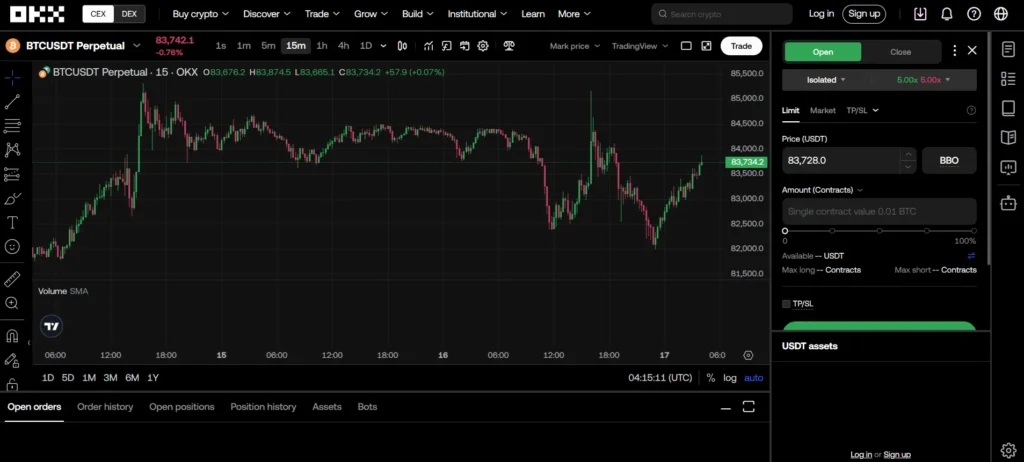

DigiFinex vs OKX: Trading & Platform Experience Comparison

DigiFinex and OKX offer different trading experiences that appeal to various types of crypto traders. Both platforms support spot and derivatives trading, but with notable differences in their interfaces and features.

OKX provides a more robust trading platform with advanced charting tools and a cleaner user interface. You’ll find their trading screens highly customizable, allowing you to arrange your workspace according to your preferences.

DigiFinex offers a straightforward platform that newer traders might find less intimidating. Its simplified layout makes basic trading functions easy to locate and use.

Trading Features Comparison:

| Feature | DigiFinex | OKX |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | ✅ | ✅ |

| Options | ❌ | ✅ |

| Copy Trading | Limited | Extensive |

| Mobile App | Good | Excellent |

OKX stands out with its deeper liquidity pools, which can result in tighter spreads and less slippage when executing large orders. This makes it particularly valuable for active traders looking for efficient order execution.

DigiFinex offers competitive trading fees, especially for beginners who don’t qualify for VIP tiers on larger exchanges. You might find their fee structure more straightforward to understand.

Both platforms offer demo accounts where you can practice trading strategies risk-free. OKX’s demo environment more closely mirrors real trading conditions with its paper trading feature.

Mobile trading is available on both platforms, but OKX’s app provides more functionality and tools that closely match its desktop experience.

DigiFinex vs OKX: Liquidation Mechanism

When trading cryptocurrencies with leverage, understanding each platform’s liquidation mechanism is crucial for managing risk. Both DigiFinex and OKX have systems in place to protect the exchange when markets move against leveraged positions.

OKX has developed a specialized system liquidation mechanism focused on efficiency. Their approach aims to liquidate positions without negatively affecting market liquidity. This helps maintain stability even during volatile market conditions.

DigiFinex also employs a liquidation system, though with different parameters. Both platforms will automatically close your positions when they reach certain threshold levels, but the specific margin requirements and liquidation prices vary.

Key differences to consider:

| Feature | OKX | DigiFinex |

|---|---|---|

| Liquidation warning | Earlier notifications | Standard alerts |

| Partial liquidation | Available | Limited options |

| Liquidation fees | Competitive | Standard market rates |

You should be aware of potential liquidity risks on both platforms. During extreme market conditions, you might face challenges withdrawing funds or quickly selling assets.

Both exchanges use liquidation to protect themselves from losses when traders can’t meet margin requirements. Understanding these mechanisms helps you trade more safely with leverage.

Remember to set appropriate stop-loss orders and avoid excessive leverage to minimize your liquidation risk regardless of which platform you choose.

DigiFinex vs OKX: Insurance

When comparing cryptocurrency exchanges, insurance protection is a crucial factor to consider for your assets’ safety.

DigiFinex maintains a risk reserve fund to protect user assets against potential security breaches or hacks. However, specific details about the insurance coverage amount or percentage of assets protected are not clearly disclosed on their platform.

OKX offers more transparent insurance protection through their User Protection Fund. This fund currently holds over $300 million to safeguard user assets against unexpected losses.

Both exchanges implement cold storage solutions for the majority of user funds as an additional security measure. This practice keeps most assets offline, making them less vulnerable to online attacks.

Key insurance differences:

| Feature | DigiFinex | OKX |

|---|---|---|

| Insurance Fund | Risk reserve fund (amount not clearly disclosed) | User Protection Fund (over $300M) |

| Transparency | Limited details available | More detailed information provided |

| Cold Storage | Yes | Yes |

You should note that neither exchange offers complete protection for all assets or scenarios. Standard insurance typically covers security breaches but may not protect against market volatility or personal account compromise.

Before choosing between these platforms, you might want to research their recent security track records and any past incidents to better understand their real-world protection capabilities.

DigiFinex vs OKX: Customer Support

When choosing between DigiFinex and OKX, customer support can make a big difference in your trading experience.

DigiFinex offers 24/7 customer support through email and live chat. You can reach their team any time you have questions about trading or account issues. They also provide a helpful FAQ section on their website.

OKX also features 24/7 support with multiple contact options including email, live chat, and a ticket system. Their response times are generally quick, often within minutes for live chat inquiries.

Both exchanges offer support in multiple languages. DigiFinex supports English, Chinese, Korean, and several other languages. OKX provides support in more languages, including English, Chinese, Vietnamese, Russian, and Spanish.

For self-help options, OKX has a more extensive knowledge base with detailed guides and video tutorials. Their help center is well-organized, making it easier for you to find answers quickly.

DigiFinex’s community support is active on Telegram and Twitter, where you can get additional help from other users. OKX maintains active communities across more platforms, including Telegram, Discord, and Reddit.

Response times can vary between the two exchanges:

| Exchange | Live Chat | Average Response | |

|---|---|---|---|

| DigiFinex | 24/7 | 24/7 | 1-3 hours |

| OKX | 24/7 | 24/7 | 30 min – 2 hours |

Neither exchange offers phone support, which is a drawback for users who prefer direct voice communication.

DigiFinex vs OKX: Security Features

When choosing a crypto exchange, security should be your top priority. Both DigiFinex and OKX have implemented various security measures to protect user assets.

DigiFinex requires strong passwords with a mix of uppercase and lowercase letters to secure your account. This basic security feature helps prevent unauthorized access.

OKX, similar to Binance, maintains high security standards that many users trust. Their security infrastructure is designed to protect against various cyber threats.

Both exchanges offer two-factor authentication (2FA) to add an extra layer of protection to your account. This requires you to verify your identity through a second device when logging in.

Key Security Features Comparison:

| Feature | DigiFinex | OKX |

|---|---|---|

| 2FA Authentication | ✓ | ✓ |

| Cold Storage | Partial | Majority |

| Security Audits | Regular | Comprehensive |

| Insurance Fund | Limited | Substantial |

OKX stores a larger portion of user funds in cold wallets (offline storage), which provides better protection against online hacking attempts.

DigiFinex has improved its security protocols over time, but still lags behind OKX in comprehensive security infrastructure.

You should also consider enabling all available security features regardless of which platform you choose. This includes email notifications for withdrawals and changing account settings.

Is DigiFinex A Safe & Legal To Use?

DigiFinex raises some safety concerns that you should consider before trading. The exchange’s lack of mandatory KYC (Know Your Customer) verification is a major red flag, as this could potentially attract users involved in illegal activities.

Several user reviews and feedback suggest caution when using DigiFinex. Some users have reported issues with the platform, leading to questions about its legitimacy.

Security is another important factor to evaluate. While DigiFinex claims to offer security measures, keeping large amounts of cryptocurrency on any exchange is generally not recommended.

The legal status of DigiFinex varies by country. You should verify whether using this exchange is permitted in your region before creating an account.

When comparing DigiFinex to more established exchanges like OKX, there are noticeable differences in regulatory compliance and security protocols. OKX generally has stronger security measures in place.

For your protection, consider these safety practices if you choose to use DigiFinex:

- Enable two-factor authentication

- Use strong, unique passwords

- Transfer larger holdings to personal wallets

- Start with small amounts to test the platform

The platform does offer various cryptocurrency trading options and wealth management services, but these benefits must be weighed against the potential risks.

Is OKX A Safe & Legal To Use?

OKX is considered a safe cryptocurrency exchange in 2025. The platform has implemented several advanced security measures to protect user assets and information.

These security features include two-factor authentication (2FA), cold storage for most cryptocurrencies, withdrawal address whitelisting, and anti-phishing codes.

OKX has never experienced major security breaches or hacks, which adds to its reputation for reliability in the crypto space.

For legal compliance, OKX follows relevant regulations in countries where it operates. This includes KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures that users must complete.

The exchange recently demonstrated its commitment to fighting fraud by collaborating with Tether and the U.S. Department of Justice. They froze $225 million linked to “pig butchering” scams, showing their willingness to work with authorities.

When you use OKX, your trading activities are protected by SSL encryption, helping to secure your personal data and transactions.

While OKX is available in many countries, you should check if it’s legal in your specific location. Regulations vary between regions, and some countries have restrictions on cryptocurrency exchanges.

For beginners and experienced traders alike, OKX provides a relatively secure platform to buy and sell cryptocurrencies in 2025.

Frequently Asked Questions

Both DigiFinex and OKX offer distinct features, security measures, and fee structures that appeal to different types of crypto traders. These exchanges have key differences in their cryptocurrency offerings, geographical restrictions, and overall user experiences.

What are the primary differences between DigiFinex and OKX trading platforms?

DigiFinex focuses on providing a straightforward trading experience with wealth management services. The platform is known for its easy-to-navigate interface and decent selection of trading pairs.

OKX offers a more comprehensive suite of trading tools, including futures trading, margin trading, and DeFi services. It generally provides more advanced features for experienced traders.

The trading interface on OKX tends to be more sophisticated, while DigiFinex aims for simplicity. This makes DigiFinex potentially better for beginners, while OKX caters to more experienced traders.

How do the security features of DigiFinex compare to those of OKX?

Both exchanges implement standard security measures like two-factor authentication and cold storage for most assets. DigiFinex has built a solid security reputation with no major hacks reported.

OKX has invested heavily in security infrastructure and employs sophisticated risk management systems. Their security team actively monitors for suspicious activities.

Neither platform is perfect, but OKX generally offers more robust security features overall. Both exchanges recommend using all available security options to protect your account.

What are the fee structures for DigiFinex and OKX, and how do they affect traders?

DigiFinex typically charges trading fees ranging from 0.2% for makers to 0.2% for takers. The fee structure is straightforward but slightly higher than some competitors.

OKX offers a tiered fee structure based on trading volume and OKB token holdings. Fees start at 0.1% for makers and 0.15% for takers, potentially decreasing with higher volumes.

For high-volume traders, OKX’s fee structure may offer better value. However, casual traders might find DigiFinex’s simpler approach more accessible.

Which exchange offers a wider variety of cryptocurrencies, DigiFinex or OKX?

OKX clearly leads in this category with support for hundreds of cryptocurrencies and trading pairs. Their selection includes most major coins and many smaller altcoins.

DigiFinex offers a decent selection but falls behind OKX in terms of variety. They focus on established cryptocurrencies rather than newer tokens.

If you’re looking to trade less common altcoins, OKX would likely be your better option. DigiFinex is sufficient for those focusing on major cryptocurrencies.

Are there any restrictions for international users on DigiFinex similar to OKX?

Both exchanges face regulatory challenges in certain regions. OKX has more clearly defined restrictions for users from the United States and some other jurisdictions.

DigiFinex also has geographical limitations but tends to be less transparent about specific restricted regions. Always check the current terms of service before signing up.

Neither platform is fully available worldwide, and accessibility can change as regulations evolve. It’s important to verify if either exchange accepts users from your country.

How do user experiences differ when using DigiFinex versus OKX?

DigiFinex provides a more straightforward user interface that newer crypto traders might find less intimidating. The platform focuses on essential features without overwhelming users.

OKX offers a feature-rich experience that can initially seem complex. However, advanced traders appreciate the depth of tools available for analysis and trading.

Mobile experiences also differ, with OKX offering a more comprehensive app. DigiFinex’s mobile version is functional but offers fewer features compared to its desktop counterpart.

OKX vs DigiFinex Conclusion: Why Not Use Both?

After comparing OKX and DigiFinex, you might wonder which platform to choose. The answer could be to use both for different purposes.

DigiFinex offers simple trading options with Limit, Market, and Stop Limit orders. This makes it easy for beginners to start trading without getting confused by too many choices.

OKX provides more advanced trading tools that experienced traders might need. If you’re looking to use complex strategies, OKX might better serve your needs.

Both exchanges offer cryptocurrency trading and wealth management services. However, they differ in their specific offerings and user experience.

Key considerations when choosing:

- Trading needs: DigiFinex is simpler, while OKX offers more advanced options

- Risk tolerance: Both platforms involve cryptocurrency volatility risks

- User interface: Try both to see which one you find easier to use

You can open accounts on both platforms to test them out. This gives you a chance to compare their features directly based on your own experience.

Remember that cryptocurrency prices can change quickly on any exchange. Don’t invest more than you can afford to lose, regardless of which platform you choose.