Choosing the right cryptocurrency exchange can make a big difference in your trading experience. DigiFinex and MEXC are two popular platforms that offer various features for crypto traders. Each has its own strengths when it comes to fees, available cryptocurrencies, and user experience.

Both exchanges rank among the top platforms based on trading volume, with different trust scores and offerings that might suit different types of traders. DigiFinex and MEXC differ in several key areas including fee structures, deposit methods, and the number of supported cryptocurrencies and trading pairs.

If you’re considering either platform for your trading needs, understanding their differences is crucial. User reviews and sentiment can vary widely, with some traders expressing concerns about certain aspects of these exchanges. Looking at factors like security features, interface usability, and customer support will help you determine which exchange better fits your trading style and needs.

DigiFinex vs MEXC: At A Glance Comparison

DigiFinex and MEXC are popular cryptocurrency exchanges competing for traders’ attention. Based on recent data, these platforms differ in several key areas.

Trading Volume & Liquidity

| Feature | MEXC | DigiFinex |

|---|---|---|

| Liquidity | Very High | Moderate |

| Trading Volume | 2x higher than closest competitors | Lower than MEXC |

MEXC stands out with significantly higher liquidity—about double that of its closest competitor, Bitget, and approximately 10 times more than other major platforms.

Fee Structure

MEXC offers zero-fee transactions for spot market makers, providing a compelling advantage for frequent traders. They also provide a 20% discount on other transaction types.

User Experience

Both exchanges rank based on traffic, legitimacy, and trading volumes. MEXC has gained popularity since 2022, with some users reporting they find it better than alternatives.

Available Features

| Feature | MEXC | DigiFinex |

|---|---|---|

| Cryptocurrencies | Wide selection | Diverse options |

| Trading Types | Multiple | Multiple |

| Deposit Methods | Various | Various |

When choosing between these exchanges, consider your specific trading needs. MEXC might be preferable if you prioritize liquidity and lower fees, while DigiFinex may offer other advantages depending on your trading style.

You should review current trust scores and user ratings before making your final decision, as these metrics can change in the cryptocurrency market.

DigiFinex vs MEXC: Trading Markets, Products & Leverage Offered

DigiFinex and MEXC both offer a wide range of trading options, but they differ in several key areas.

DigiFinex provides access to over 300 cryptocurrencies and supports spot trading, margin trading, and futures contracts. Their leverage options typically reach up to 100x for futures trading.

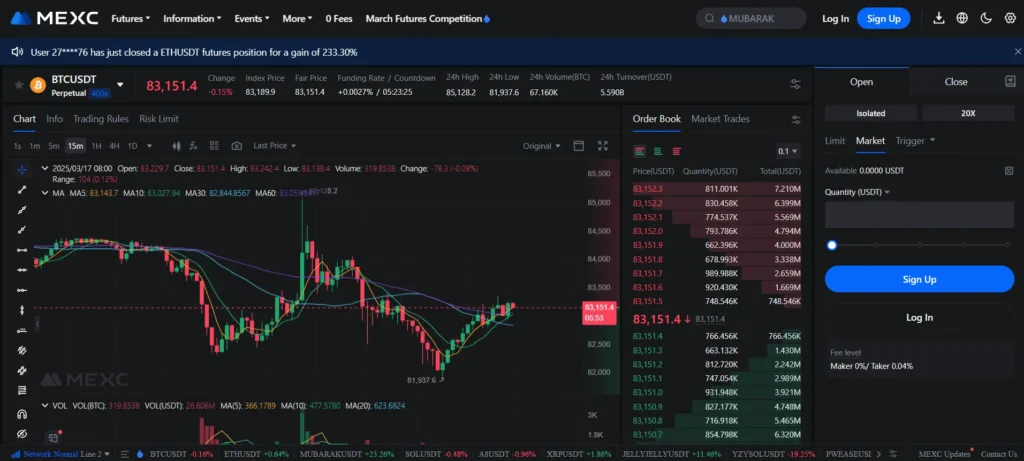

MEXC offers more extensive cryptocurrency choices with over 1,500 tokens available. This makes it one of the largest exchanges by number of supported assets.

Trading Products Comparison:

| Feature | DigiFinex | MEXC |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Max Leverage | Up to 100x | Up to 200x |

| Token Count | ~300+ | ~1,500+ |

MEXC stands out with its zero-fee spot trading for makers, while takers pay only 0.05%. DigiFinex typically charges both makers and takers, though rates are competitive.

For derivatives traders, MEXC offers higher leverage options up to 200x on certain futures contracts. This can be appealing if you’re looking for higher risk/reward opportunities.

DigiFinex distinguishes itself with a more user-friendly interface that might be easier to navigate for beginners. Both platforms support advanced order types including limit, market, and stop-loss orders.

If you trade lesser-known altcoins regularly, MEXC’s extensive token selection gives you more options. DigiFinex focuses more on established cryptocurrencies and quality over quantity.

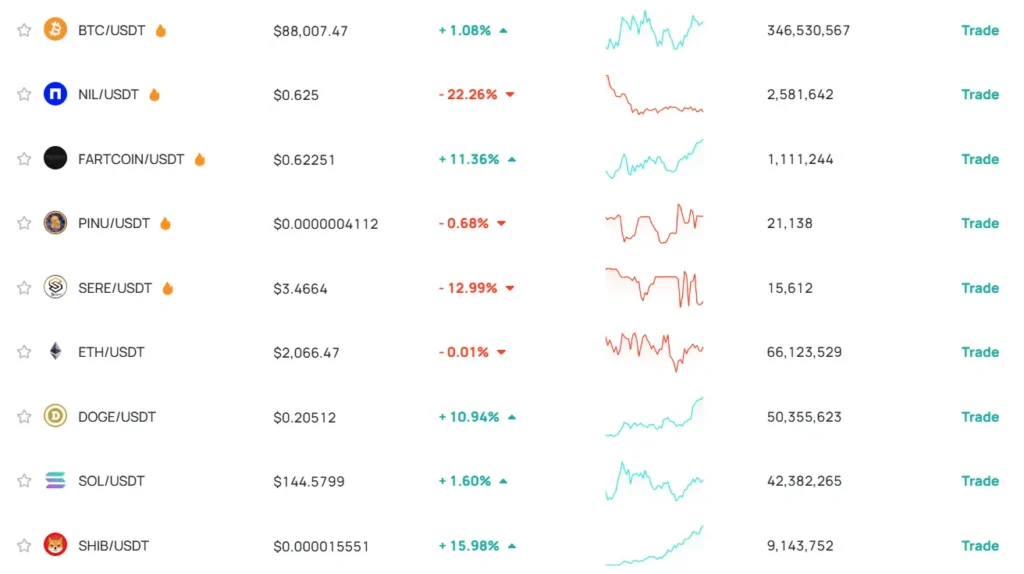

DigiFinex vs MEXC: Supported Cryptocurrencies

When choosing between DigiFinex and MEXC exchanges, the variety of cryptocurrencies available for trading is an important factor to consider.

DigiFinex offers a substantial range of cryptocurrencies. You can access major coins like Bitcoin and Ethereum, along with numerous altcoins and tokens from emerging projects. This exchange has established itself as a fully fledged crypto ecosystem with various trading options.

MEXC also provides a competitive selection of cryptocurrencies. The exchange is known for listing new projects and tokens earlier than many other platforms. This can give you access to emerging cryptocurrencies before they reach larger exchanges.

Both exchanges support:

- Bitcoin (BTC)

- Ethereum (ETH)

- Major altcoins

- DeFi tokens

- NFT-related cryptocurrencies

The key difference is in their approach to listing new cryptocurrencies. MEXC tends to list new tokens more quickly, which might appeal if you’re interested in early-stage projects. However, this can sometimes mean less thorough vetting.

DigiFinex appears to take a more measured approach to adding new cryptocurrencies, which may provide additional security but fewer early opportunities.

You should check both exchanges’ current listings before deciding, as supported cryptocurrencies change frequently. Each platform regularly adds new coins and occasionally removes others based on trading volume and regulatory considerations.

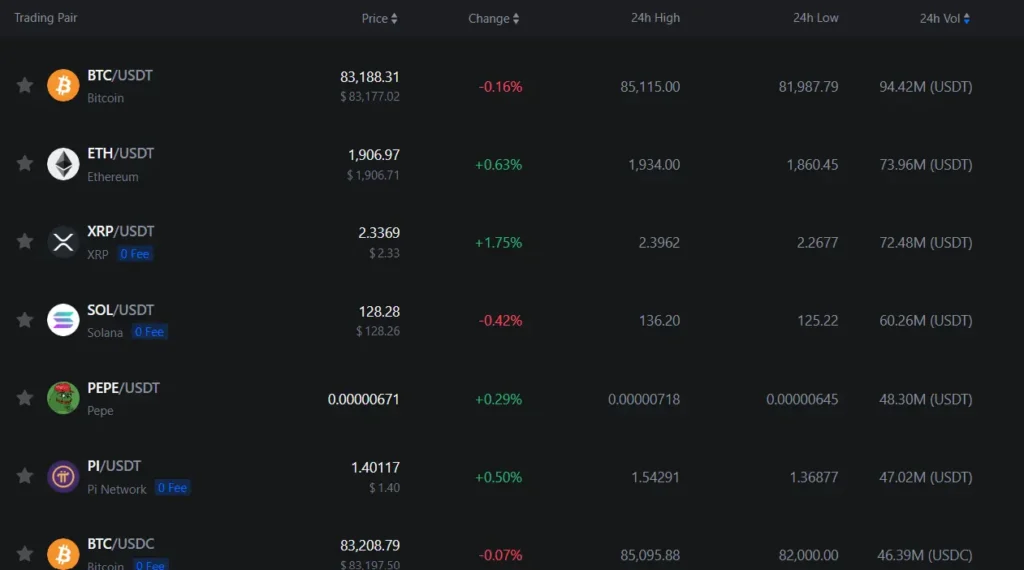

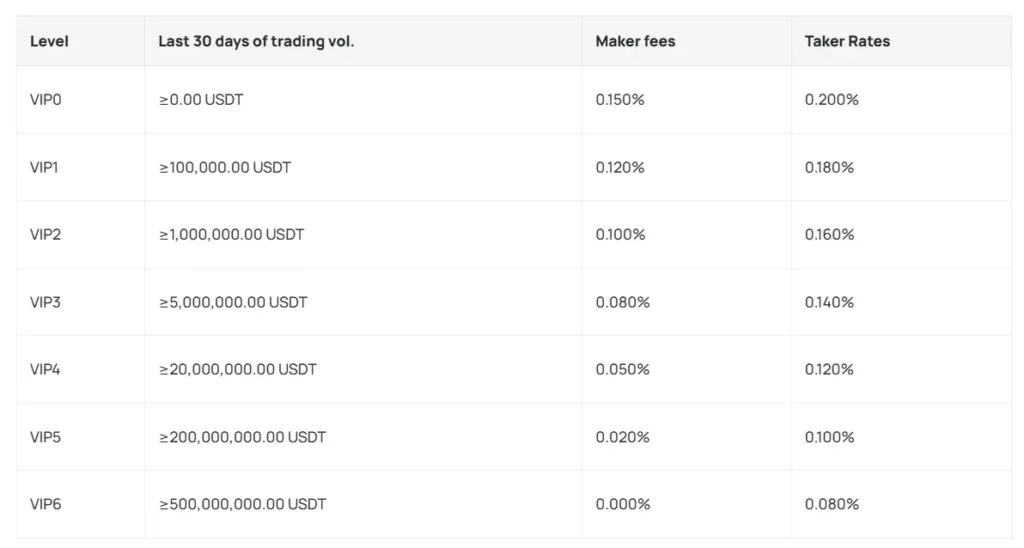

DigiFinex vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between DigiFinex and MEXC, understanding their fee structures can help you make the right decision for your trading needs.

Deposit Fees

Both exchanges offer free crypto deposits. This is standard across most cryptocurrency exchanges and allows you to transfer your digital assets without extra costs.

Trading Fees

MEXC stands out with completely free maker fees for both spot and futures trading. This is quite beneficial if you’re providing liquidity to the market.

DigiFinex, on the other hand, charges trading fees but specific rates aren’t detailed in the search results. The platform does work with third-party merchants for buying crypto, which includes additional fees.

Withdrawal Fees

Both exchanges charge withdrawal fees that vary depending on the cryptocurrency. These fees help cover the blockchain transaction costs when you move your assets off the platform.

Here’s a simple comparison table:

| Fee Type | DigiFinex | MEXC |

|---|---|---|

| Crypto Deposits | Free | Free |

| Trading (Maker) | Charged (rate varies) | Free for spot and futures |

| Trading (Taker) | Charged (rate varies) | Charged (rate varies) |

| Withdrawals | Varies by crypto | Varies by crypto |

When selecting between these platforms, consider your trading volume and style. If you’re a market maker placing limit orders, MEXC’s free maker fees could save you money in the long run.

DigiFinex vs MEXC: Order Types

Both DigiFinex and MEXC offer a variety of order types to help you execute your trading strategies effectively.

DigiFinex provides the standard market and limit orders that most traders are familiar with. Market orders execute immediately at the best available price, while limit orders allow you to set a specific price.

MEXC offers these basic order types too, but also includes stop-limit orders, which combine features of stop orders and limit orders. These trigger when the market reaches a certain price.

For more advanced trading, DigiFinex supports OCO (One-Cancels-the-Other) orders, allowing you to place two orders simultaneously with the execution of one automatically canceling the other.

MEXC goes further with advanced order types including:

- Post-only orders

- FOK (Fill-or-Kill) orders

- IOC (Immediate-or-Cancel) orders

Here’s a quick comparison of order types:

| Order Type | DigiFinex | MEXC |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| OCO | ✓ | ✗ |

| Post-only | ✗ | ✓ |

| FOK | ✗ | ✓ |

| IOC | ✗ | ✓ |

MEXC tends to offer more specialized order types, making it potentially better for advanced traders who need precise execution options.

DigiFinex’s order types are sufficient for most trading strategies, though not as extensive as MEXC’s offerings.

DigiFinex vs MEXC: KYC Requirements & KYC Limits

Both DigiFinex and MEXC offer different approaches to KYC (Know Your Customer) requirements, which can be an important factor when choosing an exchange.

DigiFinex allows users to trade without completing KYC verification, making it attractive for those valuing privacy. Non-KYC users can withdraw up to $50,000 per day, which is quite generous compared to other exchanges.

MEXC also advertises itself as a “no KYC exchange,” but this comes with a caveat. According to user reports, MEXC operates as non-KYC until certain situations arise where they may suddenly require verification.

This inconsistent approach can create problems for users who specifically chose the platform for its supposed lack of KYC requirements.

KYC Comparison Table:

| Exchange | Initial KYC Required | Withdrawal Limits without KYC | KYC Policy |

|---|---|---|---|

| DigiFinex | No | Up to $50,000 daily | Consistent policy |

| MEXC | No | Varies | May require KYC unexpectedly |

When choosing between these exchanges, consider how important KYC flexibility is to you. If you value predictability and higher non-KYC limits, DigiFinex appears to offer a more consistent experience.

Remember that KYC requirements can change based on regulations in different countries, so always check the most current policies before making your decision.

DigiFinex vs MEXC: Deposits & Withdrawal Options

Both DigiFinex and MEXC offer multiple ways to fund your account and withdraw your assets, but they differ in some important aspects.

DigiFinex supports cryptocurrency deposits with relatively standard processing times. You can deposit a wide range of cryptocurrencies directly to your wallet address on the platform.

MEXC also offers crypto deposits across numerous supported coins and tokens. Their processing times are comparable to DigiFinex in most cases.

For fiat options, DigiFinex provides limited fiat deposit methods depending on your region. Some users may find these options more restricted compared to larger exchanges.

MEXC offers several fiat deposit methods including bank transfers, credit/debit cards, and various third-party payment processors depending on your location.

Withdrawal fees vary between the exchanges:

| Exchange | Crypto Withdrawal Fees | Processing Time |

|---|---|---|

| DigiFinex | Varies by asset | 1-24 hours typically |

| MEXC | Generally competitive | 1-24 hours typically |

Both platforms implement withdrawal limits based on your verification level. Higher verification tiers allow for larger daily and monthly withdrawal amounts.

Security for withdrawals is robust on both platforms, with two-factor authentication (2FA) required for all withdrawal requests. Both exchanges also implement withdrawal address whitelisting as an additional security feature.

The choice between these platforms for deposits and withdrawals may depend on which payment methods are available in your region and which cryptocurrencies you plan to trade.

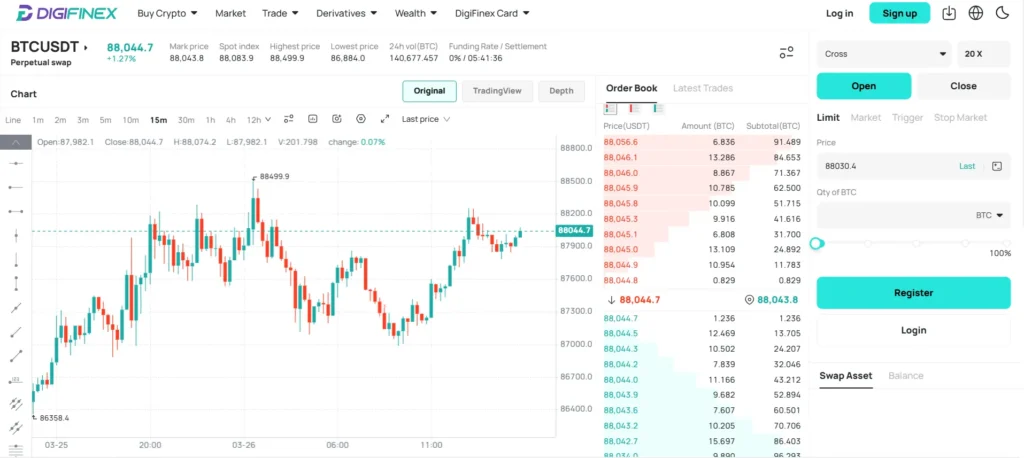

DigiFinex vs MEXC: Trading & Platform Experience Comparison

When comparing DigiFinex and MEXC trading platforms, several key differences stand out that might affect your trading experience.

MEXC offers significantly higher liquidity than many competitors, including DigiFinex. According to recent data, MEXC has about double the liquidity of its closest competitor and approximately 10 times more than other large platforms.

User Interface:

- DigiFinex: Clean design with straightforward navigation

- MEXC: Modern interface with comprehensive trading tools

Trading fees vary between the platforms. DigiFinex typically charges competitive fees that align with industry standards, while MEXC offers fee structures that appeal to both beginners and high-volume traders.

Available Trading Pairs:

| Exchange | Number of Coins | Trading Pairs |

|---|---|---|

| DigiFinex | 300+ | 400+ |

| MEXC | 700+ | 1000+ |

User reviews for both platforms show mixed feedback. MEXC has faced some criticism regarding customer support response times, while DigiFinex users generally report satisfaction with platform stability.

Both exchanges offer mobile apps for trading on the go, but MEXC’s app tends to receive higher ratings for functionality and ease of use.

Security features are robust on both platforms, with two-factor authentication and cold storage solutions protecting your assets.

The choice between these exchanges ultimately depends on your specific trading needs – MEXC might be better if you value high liquidity and a wide selection of tokens, while DigiFinex could be preferable if you prioritize a streamlined experience.

DigiFinex vs MEXC: Liquidation Mechanism

When trading on margin or futures platforms, understanding the liquidation mechanism is crucial. Both DigiFinex and MEXC have systems to manage risk when positions move against traders.

DigiFinex uses a tiered liquidation system that warns users before full liquidation occurs. You’ll receive notifications when your margin ratio approaches dangerous levels, typically around 110% of required margin.

MEXC, on the other hand, employs a more direct approach. Their system monitors positions continuously and may liquidate without multiple warnings when margin falls below maintenance requirements.

Key Differences in Liquidation Processes:

| Feature | DigiFinex | MEXC |

|---|---|---|

| Warning System | Multi-tiered alerts | Limited warnings |

| Liquidation Speed | Gradual | Can be immediate |

| Partial Liquidation | Available | Limited availability |

| Fee Structure | Lower liquidation fees | Higher liquidation fees |

Both exchanges can manipulate price movements that may trigger liquidations during high volatility. This practice has been noted by traders, though is not exclusive to these platforms.

You should regularly monitor your positions on both platforms, as liquidation parameters can change during market volatility. Setting stop-losses is recommended rather than relying on exchange liquidation mechanisms.

The transparency of liquidation processes varies between the exchanges. DigiFinex provides more detailed documentation about their liquidation procedures compared to MEXC.

DigiFinex vs MEXC: Insurance

When choosing a crypto exchange, insurance is a key factor to consider for your asset protection. Both DigiFinex and MEXC offer some security measures, but their insurance policies differ.

DigiFinex maintains a security fund to protect user assets in case of security breaches. This fund works as a safety net, though specific coverage details aren’t widely publicized.

MEXC also has security measures in place, including a risk reserve fund. This fund is designed to compensate users if the exchange faces security issues that result in asset losses.

Neither exchange provides the comprehensive insurance coverage you might find with larger platforms like Coinbase or Binance. This is an important point to keep in mind when deciding where to trade.

Key insurance differences:

| Feature | DigiFinex | MEXC |

|---|---|---|

| Insurance Fund | Security fund | Risk reserve fund |

| Coverage Transparency | Limited details | Limited details |

| User Protection Level | Basic | Basic |

You should note that both exchanges focus more on preventative security than insurance guarantees. They use methods like cold storage, two-factor authentication, and other security protocols to protect assets.

Before choosing either exchange, consider how much risk you’re willing to accept. If insurance is your top priority, you might want to research both platforms further or consider larger exchanges with more robust insurance policies.

DigiFinex vs MEXC: Customer Support

When choosing between DigiFinex and MEXC, customer support can be a deciding factor for your trading experience.

DigiFinex offers a live chat option that allows you to get help quickly when facing issues. They also maintain a comprehensive blog to keep you informed about platform updates and cryptocurrency news.

MEXC also provides customer support services, though recent changes have affected user access. According to the search results, MEXC is no longer available to U.S. customers, which is important to note if you’re located in the United States.

Support Features Comparison:

| Feature | DigiFinex | MEXC |

|---|---|---|

| Live Chat | Yes | Yes |

| Knowledge Base | Extensive blog | Available |

| U.S. Customer Access | Available | No longer available |

Response times can vary on both platforms depending on the complexity of your issue and current user demand.

Both exchanges offer help sections with guides and FAQs to assist with common questions about deposits, withdrawals, and trading functionalities.

If you’re new to cryptocurrency trading, the quality of customer support becomes even more important. DigiFinex seems to put significant emphasis on their support resources, which might make it more beginner-friendly.

Always check the most current support options before making your decision, as exchanges frequently update their customer service offerings.

DigiFinex vs MEXC: Security Features

When choosing a crypto exchange, security should be your top priority. Both DigiFinex and MEXC have implemented various security measures, but there are some notable differences.

DigiFinex stands out with its industry-leading security features. The platform employs multi-signature wallets and cold storage solutions to protect user assets from potential threats.

MEXC also takes security seriously, offering two-factor authentication (2FA) and advanced encryption protocols. Their security system includes regular security audits to identify and address vulnerabilities.

Key Security Features Comparison:

| Feature | DigiFinex | MEXC |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Multi-signature Wallets | ✓ | Partial |

| Insurance Fund | Limited | ✓ |

| Regular Security Audits | ✓ | ✓ |

DigiFinex has received praise for its excellent customer service, which can be crucial during security-related incidents. Quick response times help you resolve issues faster.

MEXC offers security features across all its platforms, including dedicated apps for Android, iOS, and Windows. This consistency helps maintain security standards regardless of how you access the exchange.

Both exchanges use KYC (Know Your Customer) procedures to verify user identities, adding another layer of protection against fraud and unauthorized access.

Remember to always enable all available security features when using either platform to maximize your protection.

Is DigiFinex Safe & Legal To Use?

DigiFinex has operated for six years without any security incidents, making it relatively secure for crypto trading. The exchange has built a user base of over four million people worldwide.

However, DigiFinex’s lack of mandatory KYC (Know Your Customer) verification raises some concerns. This policy might attract users involved in illicit activities, which could pose regulatory risks.

For legal status, DigiFinex appears to be based in Hong Kong, though it serves customers globally. The exchange is not listed among registered crypto asset trading platforms in Ontario, Canada, according to the OSC (Ontario Securities Commission).

Before using DigiFinex, you should check if it’s regulated in your country. Regulations vary widely across different regions, and what’s legal in one jurisdiction may not be in another.

When considering safety for your assets, remember that keeping large amounts of cryptocurrency on any exchange comes with inherent risks. Consider using hardware wallets for long-term storage.

Key Safety Features:

- Six-year operation without security breaches

- Serves over four million users globally

Potential Concerns:

- Lack of mandatory KYC verification

- Unclear regulatory status in many countries

- Not listed on some official registered exchange lists

You should research your local regulations before using DigiFinex to ensure compliance with your country’s laws regarding cryptocurrency trading.

Is MEXC Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or loss of user funds. This track record helps establish its legitimacy in the cryptocurrency exchange space.

The exchange was previously known as a “no KYC” platform, but as of 2024, they have made KYC verification mandatory for users. This change aligns with global regulatory trends and may enhance security.

MEXC is available in most countries, including some regions with strict regulatory environments. However, always check your local laws before using any cryptocurrency exchange, as regulations vary by location.

The platform offers competitive trading fees with no hidden charges, making it financially transparent for users. This pricing structure is important when assessing the overall reliability of an exchange.

Some users have reported issues with MEXC’s KYC requirements being inconsistently applied. The exchange appears to operate as “non-KYC until it suits them,” which could create unexpected access problems for your funds in certain situations.

When using MEXC, consider these safety precautions:

- Enable two-factor authentication

- Use strong, unique passwords

- Withdraw large amounts to private wallets

- Keep records of all transactions

While MEXC appears to be a legitimate exchange, remember that all cryptocurrency platforms carry inherent risks. Only invest funds you can afford to lose.

Frequently Asked Questions

These common questions highlight key differences between DigiFinex and MEXC exchanges to help you make informed trading decisions in 2025.

What are the main differences in features between DigiFinex and MEXC?

DigiFinex offers a comprehensive crypto ecosystem with wealth management tools and even a crypto card. The platform charges slightly higher fees but provides additional services like staking and yield farming.

MEXC typically features lower trading fees compared to DigiFinex, making it attractive for frequent traders. The exchange also supports a wider range of altcoins and newer tokens.

Both platforms offer spot and futures trading, but MEXC has gained popularity for its early listings of emerging cryptocurrencies.

How do user reviews compare for DigiFinex and MEXC?

DigiFinex users frequently praise its intuitive interface and comprehensive trading tools. The exchange has earned positive feedback for its stable platform performance during high volatility periods.

MEXC receives favorable reviews for its extensive coin selection and competitive fee structure. Users particularly appreciate the exchange’s quick customer service response times.

Some DigiFinex users have reported occasional withdrawal delays, while MEXC has faced criticism for its complex verification processes in certain regions.

What are the security measures implemented by DigiFinex and MEXC?

DigiFinex employs multi-signature cold wallets to protect user funds and maintains regular security audits. The platform also uses two-factor authentication and anti-phishing codes to secure accounts.

MEXC implements similar security protocols including cold storage for majority of assets and advanced encryption for user data. The exchange also features risk control systems that flag unusual account activities.

Both platforms maintain insurance funds to protect users against potential losses from security breaches, though coverage details differ.

What has been the historical performance comparison between DigiFinex and MEXC’s traded assets?

DigiFinex has shown steady growth in its native token (DFT) throughout 2024, with price predictions suggesting continued upward momentum into 2025.

MEXC’s exchange token has experienced more volatility but generally follows broader market trends. Both exchanges have maintained reliable trading environments during major market movements.

The exchanges have comparable performance metrics for major cryptocurrencies, though MEXC’s wider selection of altcoins has occasionally led to higher gains during alt seasons.

How does the liquidity and trading volume contrast between DigiFinex and MEXC?

MEXC typically maintains higher daily trading volumes across more trading pairs than DigiFinex. This results in tighter spreads for popular trading pairs on MEXC.

DigiFinex focuses on ensuring deep liquidity for major cryptocurrencies, making it suitable for larger trades without significant slippage.

Both exchanges use market makers to improve liquidity, but MEXC’s larger user base often translates to more natural trading volume across its supported assets.

What are the available customer support options for DigiFinex and MEXC users?

DigiFinex provides 24/7 customer support through live chat, email, and ticket systems. The exchange also maintains active community channels on Telegram and Discord for peer assistance.

MEXC offers similar support channels with the addition of phone support in select regions. Their multilingual support team covers major languages including English, Chinese, Korean, and Russian.

Both platforms provide extensive knowledge bases, but MEXC’s tutorial section is particularly comprehensive for new users learning about crypto trading.

MEXC vs DigiFinex Conclusion: Why Not Use Both?

After comparing these two exchanges, it’s clear that both MEXC and DigiFinex offer valuable features for crypto traders in 2025.

MEXC stands out with its impressive selection of 1,576 coins and 2,226 trading pairs—more than DigiFinex and Binance combined. It also offers zero fees on some spot trading pairs and lower futures trading fees.

DigiFinex provides a complete crypto ecosystem with various trading options, wealth management tools, and even a crypto card. However, some users have raised concerns about their market-making practices.

When it comes to security, neither platform is perfect. As with any exchange, you should be cautious about leaving large amounts of crypto on either platform long-term.

Why consider using both platforms:

- Use MEXC when you need access to a wider variety of coins or want lower trading fees

- Use DigiFinex when you need their unique wealth management tools or crypto card

- Spread your risk across multiple platforms rather than relying on just one

Remember to use strong security practices with both exchanges—enable two-factor authentication, use unique passwords, and consider moving larger holdings to personal wallets.

By strategically using both platforms, you can take advantage of their different strengths while minimizing their weaknesses.