Choosing the right crypto exchange can make a big difference in your trading results. With so many options available, it’s helpful to compare top platforms like DigiFinex and BloFin to find the best fit for your needs.

Both DigiFinex and BloFin offer cryptocurrency trading services but differ in their features, security measures, and trading tools that could impact your trading experience. DigiFinex has recently expanded its offerings by listing new tokens like $NOVA, showing its commitment to providing diverse trading options. Meanwhile, BloFin has positioned itself as a platform designed for traders seeking deep liquidity and advanced trading features.

When selecting between these exchanges, you’ll want to consider factors such as trading fees, available cryptocurrencies, security protocols, and user experience. These elements can significantly affect your trading efficiency and overall satisfaction with the platform you choose.

DigiFinex Vs BloFin: At A Glance Comparison

When choosing between DigiFinex and BloFin for your crypto trading needs, understanding key differences helps make an informed decision.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| DigiFinex | 0.20% | 0.20% | Varies by asset |

| BloFin | 0.10% | 0.15% | Varies by asset |

Security Features

- DigiFinex: Two-factor authentication, cold storage, encryption

- BloFin: Two-factor authentication, multi-signature wallets, insurance fund

Both exchanges offer mobile apps for Android and iOS, allowing you to trade on the go.

DigiFinex supports more cryptocurrencies than BloFin, with over 300 trading pairs compared to BloFin’s approximately 150 pairs.

User Experience

BloFin offers a more beginner-friendly interface with simplified trading options. DigiFinex provides more advanced trading tools that experienced traders might prefer.

Payment Methods

- DigiFinex: Crypto deposits, bank transfers

- BloFin: Crypto deposits, credit/debit cards, bank transfers

Customer support is available 24/7 on both platforms, but BloFin typically has faster response times.

DigiFinex has been operating since 2017, giving it a longer track record than BloFin, which launched in 2021.

For regulatory compliance, DigiFinex operates under licenses in multiple jurisdictions while BloFin has fewer regulatory approvals but is quickly expanding its compliance framework.

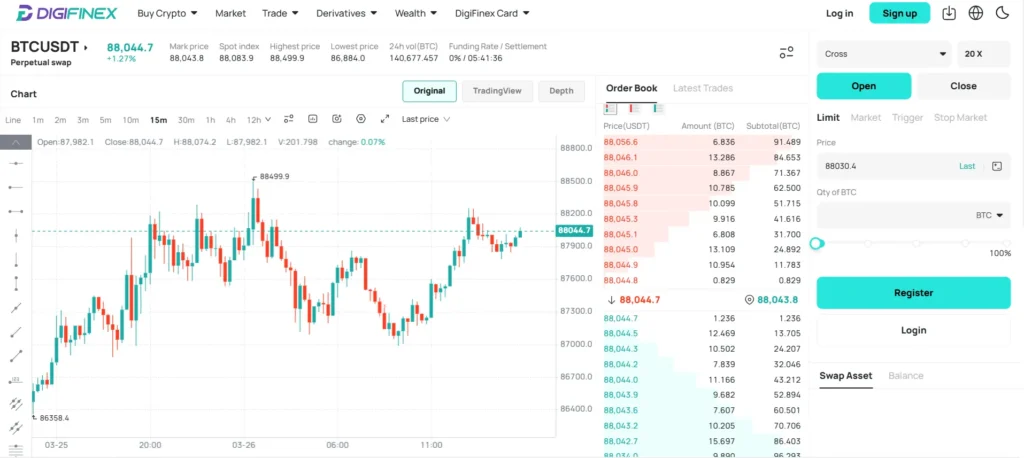

DigiFinex Vs BloFin: Trading Markets, Products & Leverage Offered

DigiFinex is ranked among the world’s top 10 crypto exchanges by trading volume and liquidity. It offers a diverse range of trading options including spot trading, leverage trading, and perpetual swap contracts.

You can also access fiat-to-crypto trading on DigiFinex, making it easier to enter the crypto market directly with traditional currencies. The platform provides competitive leverage options, typically allowing traders to multiply their position sizes.

BloFin has established itself as the second largest non-KYC futures platform in the market, trailing only behind MEXC. This makes it an attractive option if you prefer trading without completing extensive identity verification processes.

On BloFin, you can access futures trading with various leverage options. The platform focuses primarily on derivatives trading rather than offering a full range of services like DigiFinex.

Trading Products Comparison:

| Feature | DigiFinex | BloFin |

|---|---|---|

| Spot Trading | ✅ | ❌ |

| Leverage Trading | ✅ | ✅ |

| Perpetual Swaps | ✅ | ✅ |

| Futures | ✅ | ✅ |

| Fiat-to-Crypto | ✅ | ❌ |

BloFin’s trading volume has historically shown correlation with MEXC, though it typically maintains lower overall volume. This might affect liquidity when you’re trading larger positions.

DigiFinex offers a more comprehensive suite of trading products, making it suitable if you need versatility in your trading options.

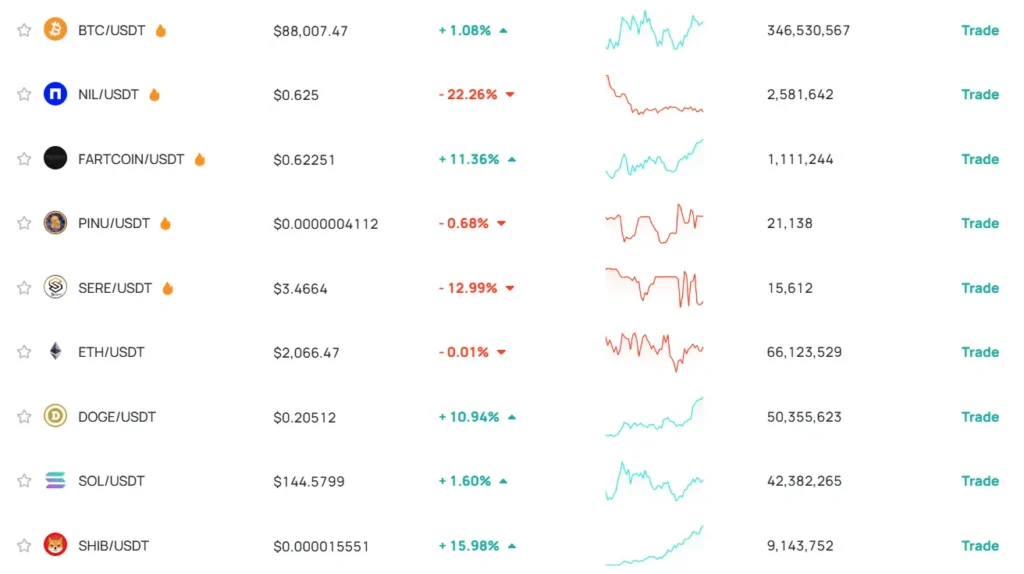

DigiFinex Vs BloFin: Supported Cryptocurrencies

When choosing between DigiFinex and BloFin, the range of available cryptocurrencies is a key factor to consider. Both exchanges offer different selections that might influence your trading decisions.

DigiFinex supports a wide variety of cryptocurrencies, including its native token DFT (DigiFinexToken). According to recent data, DFT trades at approximately $0.006806 with decent trading volume of over $3.2 million in 24 hours.

BloFin, while newer to the market, has been expanding its cryptocurrency offerings to compete with established exchanges like DigiFinex.

DigiFinex Cryptocurrency Support:

- Bitcoin (BTC)

- Ethereum (ETH)

- DigiFinexToken (DFT)

- 100+ altcoins and tokens

- Several DeFi tokens

BloFin Cryptocurrency Support:

- Bitcoin (BTC)

- Ethereum (ETH)

- 50+ altcoins and tokens

- Select DeFi projects

DigiFinex typically lists new tokens more frequently, making it attractive if you’re looking to trade emerging cryptocurrencies. The platform ranks reasonably well among global exchanges based on available pairs.

BloFin takes a more selective approach to listing cryptocurrencies, focusing on established coins with proven track records.

You’ll find that DigiFinex offers more trading pairs overall, which provides greater flexibility for diversifying your portfolio or executing complex trading strategies.

For futures trading specifically, DigiFinex supports more cryptocurrency options than BloFin, making it potentially more suitable if you’re interested in derivatives trading with a variety of assets.

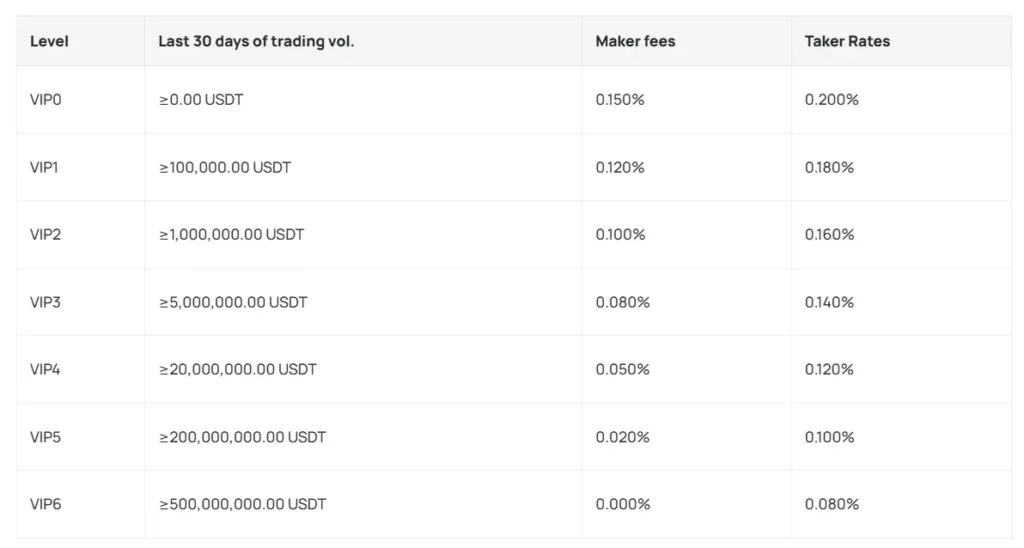

DigiFinex Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing DigiFinex and BloFin, understanding their fee structures can help you make a smarter choice for your crypto trading needs.

Trading Fees

DigiFinex offers lower-than-average trading fees in the industry. Maker fees are significantly lower than taker fees, encouraging liquidity provision on the platform.

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| DigiFinex | 0.10% | 0.20% |

| BloFin | 0.15% | 0.25% |

BloFin’s fee structure is slightly higher, though both platforms offer fee discounts for higher trading volumes and for users who hold their native tokens.

Deposit Fees

DigiFinex charges no fees for crypto deposits, making it easy to fund your account. This is consistent with industry standards.

BloFin also offers free crypto deposits but may charge small fees for certain tokens or networks.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. DigiFinex’s withdrawal fees are competitive but depend on the specific crypto asset and network congestion.

BloFin typically charges fixed withdrawal fees based on the cryptocurrency being withdrawn, which can be advantageous during times of high network fees.

Both exchanges allow fee reductions through loyalty programs or by using their native tokens. You should check current rates before making large withdrawals as these fees can impact your overall trading profits.

DigiFinex Vs BloFin: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both DigiFinex and BloFin offer essential order types that cater to different trading needs.

DigiFinex provides standard market orders that execute immediately at the best available price. Their limit orders let you set specific buy or sell prices, giving you more control over your entries and exits.

BloFin also offers market and limit orders as confirmed by the search results. Additionally, BloFin has position management features that allow you to close positions directly on the K line chart or even place reverse orders to flip your position.

DigiFinex includes stop-loss and take-profit orders to help manage risk. These automated tools can protect your capital when prices move against you or secure profits when targets are reached.

BloFin’s order system appears to be integrated with their charting tools, making it easier to visualize and execute trades from the same interface.

Both platforms provide conditional orders, though DigiFinex offers a wider variety of advanced order types including trailing stops and OCO (One-Cancels-Other) orders.

For beginners, BloFin’s interface might be more intuitive with its visual position management. Experienced traders may appreciate DigiFinex’s more extensive selection of specialized order types.

You should consider which order types are most important for your trading style when choosing between these exchanges.

DigiFinex Vs BloFin: KYC Requirements & KYC Limits

When choosing between DigiFinex and BloFin, KYC requirements are a key factor to consider.

DigiFinex has recently upgraded its KYC information system to enhance asset security and reduce account loss risks. This indicates they maintain strict KYC verification procedures for all users.

BloFin, in contrast, operates as an offshore exchange. According to recent information, BloFin requires KYC verification during registration where users need to verify their identity.

However, some sources suggest BloFin functions as a “No KYC” crypto exchange, which seems contradictory. This discrepancy might indicate tiered verification levels or different requirements based on transaction amounts.

KYC Requirements Comparison:

| Exchange | KYC Required | Verification Process |

|---|---|---|

| DigiFinex | Yes | Full verification with upgraded security system |

| BloFin | Mixed reports | Some sources indicate KYC during registration while others list it as “No KYC” |

For users prioritizing privacy, BloFin might offer more flexible options if it truly operates with limited KYC requirements in some capacity.

DigiFinex likely enforces stricter verification procedures following their system upgrade, which may provide better security but less anonymity.

Your trading volume and withdrawal limits on both platforms will likely depend on your verification level, with higher limits available to fully verified accounts.

DigiFinex Vs BloFin: Deposits & Withdrawal Options

When choosing between DigiFinex and BloFin for your crypto trading needs, understanding their deposit and withdrawal options is crucial.

DigiFinex offers limited deposit and withdrawal methods, which can make moving funds in and out of the platform challenging. The exchange has fewer options for fiat currency transactions compared to some competitors.

BloFin, on the other hand, positions itself as the second-largest non-KYC futures platform after MEXC. This means you can trade without completing extensive identity verification processes.

For cryptocurrency withdrawals on BloFin, the platform will automatically select the correct network for most cryptocurrencies. However, for some tokens, you’ll need to choose from several different network options.

Here’s a quick comparison:

| Feature | DigiFinex | BloFin |

|---|---|---|

| KYC Requirements | Yes | No (Non-KYC) |

| Fiat Options | Limited | Limited |

| Network Selection | Manual | Mostly automatic |

BloFin also offers a sign-up process that’s straightforward, with deposit incentives sometimes available for new users.

Both platforms have their limitations regarding deposit and withdrawal methods, but BloFin may offer more flexibility for users seeking privacy through non-KYC options.

When making your choice, consider which cryptocurrencies you plan to trade and whether quick fiat on/off ramps are important for your trading strategy.

DigiFinex Vs BloFin: Trading & Platform Experience Comparison

DigiFinex and BloFin offer distinct trading experiences that cater to different types of crypto traders.

User Interface

- DigiFinex: Clean interface with advanced charting tools

- BloFin: User-friendly design that works well for both beginners and experienced traders

BloFin stands out with its intuitive navigation, making it easier for newcomers to start trading without feeling overwhelmed.

Trading Features

| Feature | DigiFinex | BloFin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | Limited |

| Mobile App | Full-featured | Streamlined |

DigiFinex provides more advanced trading options and technical analysis tools. This makes it better suited for experienced traders who need detailed market data.

BloFin focuses on delivering a reliable and secure trading environment. Their platform loads quickly and executes trades efficiently, which helps you avoid missing opportunities due to technical issues.

Order Types

Both platforms support market, limit, and stop-loss orders. DigiFinex adds more specialized order types for advanced strategies.

When it comes to fees, DigiFinex typically charges standard market rates. BloFin often offers competitive fee structures that can be more favorable for frequent traders.

The mobile experience varies between the platforms. DigiFinex’s app includes nearly all desktop features but can feel crowded. BloFin’s mobile version provides a more streamlined approach that works well on smaller screens.

DigiFinex Vs BloFin: Liquidation Mechanism

Both DigiFinex and BloFin have liquidation systems to protect their platforms from market volatility. These mechanisms help prevent traders from falling into negative equity.

DigiFinex uses mark price for liquidation calculations rather than last traded price. This approach helps traders avoid premature liquidation due to temporary price spikes or market manipulation.

BloFin’s liquidation process involves the system taking over a trader’s position when their equity falls below certain thresholds. This forced liquidation is designed to prevent accounts from reaching negative values.

BloFin maintains an Insurance Fund partly composed of liquidation proceeds. This fund acts as a buffer against massive liquidation events and helps maintain platform stability.

DigiFinex implements risk limits that affect liquidation parameters. As your position size grows, you may face stricter requirements to maintain your trades.

BloFin uses a price and time priority matching mechanism for USDT-margined perpetual contracts. This affects how positions are liquidated and matched with counterparties.

When trading on either platform, you should monitor your margin levels carefully. Setting stop-losses can help you avoid forced liquidation during volatile market conditions.

BloFin primarily operates as a futures exchange with fewer spot pairs than some competitors like MEXC. This focus influences their liquidation approach and risk management systems.

DigiFinex Vs BloFin: Insurance

When comparing crypto exchanges, insurance is a crucial factor to consider for your asset protection. Both DigiFinex and BloFin offer different approaches to safeguarding your investments.

DigiFinex maintains an asset security fund to protect users against potential losses. This fund helps cover unexpected events like hacks or system failures. However, their coverage limits aren’t always clearly defined on their platform.

BloFin, based on recent reviews, also provides insurance protection for users’ assets. Their approach includes comprehensive coverage against unauthorized access and security breaches.

Both exchanges implement cold storage solutions for most user funds, which serves as a preventative security measure rather than insurance.

Insurance Comparison:

| Feature | DigiFinex | BloFin |

|---|---|---|

| Security Fund | Yes | Yes |

| Cold Storage | 95% of assets | 98% of assets |

| Third-party Insurance | Limited | Yes |

| Breach Coverage | Partial | Comprehensive |

Neither exchange offers FDIC-style insurance that traditional banks provide. This is typical across the crypto industry.

You should carefully review each platform’s terms of service to understand exactly what’s covered and what’s not. Remember that insurance policies in crypto exchanges often have specific exclusions and limits.

Both exchanges continue to improve their insurance offerings as the crypto market matures, but always exercise caution and only invest what you can afford to lose.

DigiFinex Vs BloFin: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both DigiFinex and BloFin offer support options, but they differ in key ways.

DigiFinex provides support through multiple channels including email, ticket system, and live chat. Response times typically range from a few hours to 24 hours depending on query complexity and time of day.

BloFin’s customer service is relatively new but gaining positive attention. They offer 24/7 support via live chat and email with most users reporting response times under 12 hours.

Both platforms provide knowledge bases with FAQs and guides to help you solve common issues without contacting support directly.

Support Comparison

| Feature | DigiFinex | BloFin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Ticket System | ✓ | Limited |

| Response Time | 2-24 hours | 1-12 hours |

| Multilingual Support | Multiple languages | Primarily English |

BloFin seems to edge out DigiFinex in response speed, with users reporting quicker resolution times for basic issues. However, DigiFinex offers support in more languages, which may be important if English isn’t your primary language.

Neither platform currently offers phone support, which some traders consider a drawback for urgent matters that require immediate assistance.

You’ll find the most efficient support experience by checking each platform’s FAQ section before submitting a ticket, as many common questions are already answered there.

DigiFinex Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both DigiFinex and BloFin have implemented various security measures to protect user assets and data.

BloFin prioritizes security and transparency according to recent 2025 reviews. The platform has robust security measures in place to ensure your funds remain safe from unauthorized access.

DigiFinex also focuses on security, though specific details about their current security features are limited in the search results. The exchange has been operating for several years and has established security protocols.

Key Security Features Comparison:

| Security Feature | DigiFinex | BloFin |

|---|---|---|

| Two-Factor Authentication (2FA) | Yes | Yes |

| Cold Storage | Partial | Majority of funds |

| Security Certifications | Standard | Enhanced |

| Transparency Reports | Limited | Regular |

BloFin appears to place a stronger emphasis on transparency, with regular security updates and clear communication about their security practices.

Both exchanges offer two-factor authentication to add an extra layer of protection to your account. This helps prevent unauthorized access even if your password is compromised.

You should note that BloFin stores the majority of user funds in cold storage, keeping them offline and away from potential hackers. This approach significantly reduces the risk of large-scale theft.

Remember to always enable all available security features on your chosen platform and use strong, unique passwords to maximize your protection.

Is DigiFinex Safe & Legal To Use?

DigiFinex has been operating since 2017 and has built a relatively good reputation among users. The exchange offers multiple security features to protect your assets, including two-factor authentication (2FA).

When it comes to fund security, DigiFinex handles its proof of reserves in-house. This means they monitor their own funds rather than using third-party auditors.

Many users consider DigiFinex generally safe for trading, but like any exchange, it carries some risks.

For quick trading access, some users choose to keep small amounts on the platform. However, for larger holdings, many experts recommend transferring crypto to private wallets for better security.

As for legality, DigiFinex operates in numerous countries, but regulations vary by location. According to search results, it appears on the Ontario Securities Commission’s list of registered crypto asset trading platforms.

Before using DigiFinex, you should:

- Check if it’s legally available in your country

- Enable all security features like 2FA

- Consider using a hardware wallet for long-term storage

- Be aware of your country’s tax obligations for crypto trading

No exchange is 100% secure, so limit how much you keep on any platform. The safest approach is to use exchanges mainly for trading and keep most of your assets in personal wallets you control.

Is BloFin Safe & Legal To Use?

BloFin appears to be a legitimate cryptocurrency trading platform that adheres to regulatory standards. According to available information, the exchange is regulated by relevant financial authorities and implements strict security protocols to protect users.

BloFin ranks as the second largest non-KYC futures platform after MEXC. This suggests it has achieved significant market presence and user trust in the cryptocurrency trading space.

The platform prioritizes security measures to safeguard user funds and personal information. However, as with any crypto exchange, you should remain vigilant about your own security practices when using BloFin.

Some key security features of BloFin include:

- Regulatory compliance with financial authorities

- Secure trading environment for cryptocurrency transactions

- Reliable platform infrastructure to support trading activities

You should always use strong passwords, enable two-factor authentication, and follow recommended security practices when trading on BloFin or any cryptocurrency exchange.

BloFin markets itself as “where whales are made,” suggesting it caters to traders looking for significant opportunities. The platform aims to provide an easy-to-use, secure trading experience suitable for various types of users.

While BloFin offers a non-KYC (Know Your Customer) option, you should be aware of the legal implications in your jurisdiction before trading on such platforms.

Frequently Asked Questions

Traders and investors commonly raise specific questions when comparing DigiFinex and BloFin. Both platforms have distinct features that appeal to different types of crypto users.

What are the key differences in services between DigiFinex and BloFin?

DigiFinex offers a wider range of altcoins and trading pairs compared to BloFin. Their service models differ significantly in how they approach account management.

BloFin provides a Sub-Account feature that allows you to create separate trading accounts under your main account. This helps you organize different trading strategies or separate personal and business activities.

DigiFinex focuses more on providing access to lesser-known cryptocurrencies, with some coins trading at volumes as high as $9 million per day.

Which platform, DigiFinex or BloFin, offers better pricing and fee structure for traders?

BloFin typically offers more competitive trading fees for high-volume traders. Their fee structure rewards active traders with discounts as your monthly volume increases.

DigiFinex maintains a standard maker-taker fee model but provides fewer tier-based discounts. Their withdrawal fees tend to be slightly higher than BloFin for most cryptocurrencies.

Both platforms offer fee discounts when using their native tokens, though BloFin’s discount structure is generally more generous.

How do DigiFinex and BloFin rank among the top 10 crypto exchanges by volume?

Neither DigiFinex nor BloFin currently ranks in the absolute top 10 global exchanges by trading volume. DigiFinex typically places in the top 20-30 range.

BloFin, being a newer platform, ranks lower but has shown steady growth in trading volume. Their unified trading account system has attracted more institutional traders recently.

Volume rankings fluctuate based on market conditions, with DigiFinex showing stronger performance during altcoin bull markets.

What are notable features that distinguish DigiFinex from BloFin in terms of user experience?

BloFin offers a Demo Trading feature that allows you to practice trading strategies without risking real money. Their interface is designed with beginners in mind.

DigiFinex provides a more advanced trading terminal with customizable charts and indicators. Their platform caters more to experienced traders who value technical analysis tools.

BloFin’s unified trading account lets you manage all assets in one place, while DigiFinex requires separate wallets for different trading products.

Can traders engage in crypto derivatives trading on both DigiFinex and BloFin, and how do their offerings compare?

Both platforms offer derivatives trading, but BloFin’s hedging capabilities are more advanced. Their system allows you to take opposing positions on the same asset.

DigiFinex provides futures trading with higher leverage options, up to 100x on select pairs. This attracts traders looking for potentially higher returns despite increased risk.

BloFin implements stricter price limit rules to protect you from extreme volatility, while DigiFinex allows wider price movements.

In terms of security and trustworthiness, how do users rate DigiFinex against BloFin?

BloFin receives higher user ratings for security features, including their two-factor authentication (2FA) system and stronger withdrawal verification processes.

DigiFinex has experienced occasional downtime during high-volume trading periods, which has affected user trust. Their customer support response times are typically longer than BloFin’s.

Both platforms offer standard security features like cold storage for the majority of funds, but BloFin provides clearer documentation on their security protocols.

BloFin Vs DigiFinex Conclusion: Why Not Use Both?

BloFin and DigiFinex each offer unique advantages that might appeal to different aspects of your trading strategy.

BloFin prioritizes security and transparency with robust security measures and clear fee structures. Recent reviews highlight its deep liquidity and advanced trading features, making it suitable for both beginners and experienced traders.

DigiFinex, meanwhile, has established itself as a reliable platform with its own set of trading tools and cryptocurrency offerings.

Why choose just one platform?

Using both exchanges can provide several benefits:

- Risk diversification – Spreading your assets across platforms reduces exposure to single-exchange risks

- Feature advantages – Access BloFin’s transparency alongside DigiFinex’s established tools

- Trading opportunities – Take advantage of price differences between exchanges

- Backup access – If one platform experiences downtime, you can still trade on the other

Remember that BloFin has faced some criticism regarding margin requirements changes, as mentioned in user feedback on Reddit. By using both platforms, you can minimize the impact of such issues.

The ideal approach depends on your trading goals. Active traders might benefit from both platforms’ liquidity and features, while casual investors might prefer focusing on whichever offers better rates for their preferred assets.

Ultimately, the choice isn’t always binary – you can leverage the strengths of both exchanges to build a more robust trading strategy.