Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Two popular platforms that often come up in comparison are Deepcoin Exchange and WhiteBIT. These exchanges offer various features that cater to different types of traders and investors.

Both Deepcoin and WhiteBIT provide secure environments for cryptocurrency trading, but they differ in terms of fees, available cryptocurrencies, and trading options. WhiteBIT complies with KYC and AML requirements, offering secure storage solutions for your digital assets. Meanwhile, Deepcoin competes with its own set of features that might appeal to certain traders.

When deciding between these exchanges, you’ll want to consider factors like trading volumes, user interface, deposit methods, and the number of supported cryptocurrencies. Each platform has its strengths that might align better with your specific trading needs and preferences.

Deepcoin Vs WhiteBIT: At A Glance Comparison

When choosing between Deepcoin and WhiteBIT, it’s helpful to see their key differences side by side. Both exchanges offer cryptocurrency trading services but have distinct features that may appeal to different users.

WhiteBIT serves about 8 million users directly and reaches over 30 million through its larger ecosystem. This makes it one of the larger centralized exchanges in the market as of 2025.

Deepcoin focuses on competitive fee structures while WhiteBIT emphasizes its large user base and ecosystem.

| Feature | Deepcoin | WhiteBIT |

|---|---|---|

| User Base | Smaller but growing | 8 million direct users |

| Trading Fees | Competitive | Industry standard |

| Supported Cryptocurrencies | Various options | Wide selection |

| Trading Types | Spot, derivatives | Spot, margin, futures |

| Security Features | Standard protection | Enhanced security protocols |

Both exchanges are ranked based on factors like trading volume, liquidity, and trust scores by platforms like CoinMarketCap and CoinGecko.

You should consider deposit methods when choosing between them. WhiteBIT offers several fiat options, while Deepcoin may have different availability.

The trading interface differs between these platforms. WhiteBIT provides a more comprehensive ecosystem experience, which might appeal if you’re looking for an all-in-one solution.

For 2025, both exchanges have continued to evolve their offerings to stay competitive in the fast-changing crypto market.

Deepcoin Vs WhiteBIT: Trading Markets, Products & Leverage Offered

Deepcoin and WhiteBIT offer different trading options for crypto enthusiasts. Let’s look at what each platform provides.

Deepcoin features a robust trading layout with various products. They offer spot trading, futures, and options contracts. Their platform is known for competitive fees and diverse trading options.

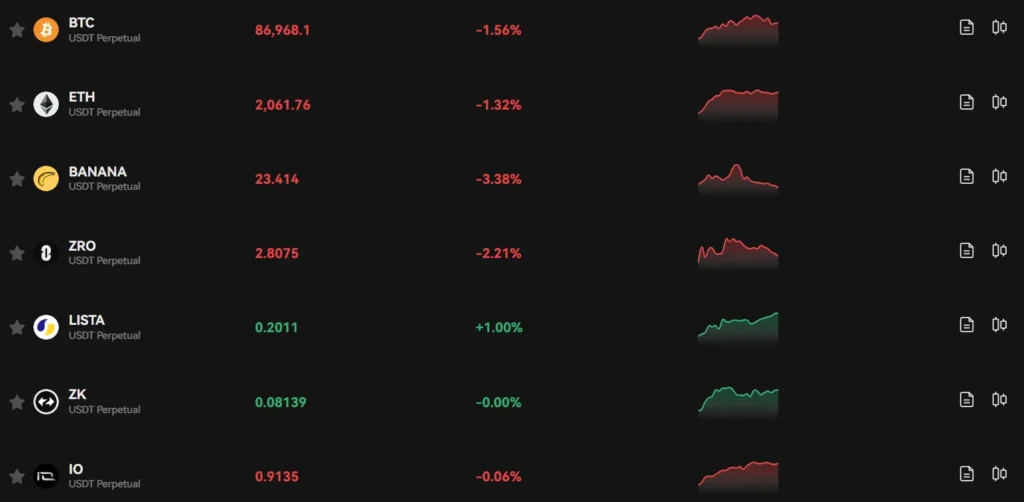

WhiteBIT, as one of Europe’s biggest crypto exchange providers, offers spot trading and derivatives. The Ukrainian-developed exchange has established itself as a significant player in the European market.

Trading Markets Comparison:

| Feature | Deepcoin | WhiteBIT |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Margin Trading | High leverage | Available |

When it comes to leverage, Deepcoin offers competitive options that many competitors find challenging to match. Their affordable trading rates make leveraged trading more accessible to users of various experience levels.

WhiteBIT provides standard leverage options for derivative trading, though specific limits may vary by product and user verification level.

Both exchanges support numerous cryptocurrencies, though their exact offerings differ. You’ll find major coins like Bitcoin and Ethereum on both platforms, along with various altcoins.

Trading interfaces differ between the exchanges. Deepcoin is noted for its comprehensive trading layout, while WhiteBIT focuses on a clean user experience suitable for European traders.

Deepcoin Vs WhiteBIT: Supported Cryptocurrencies

When choosing between Deepcoin and WhiteBIT, the variety of cryptocurrencies available for trading is an important factor to consider.

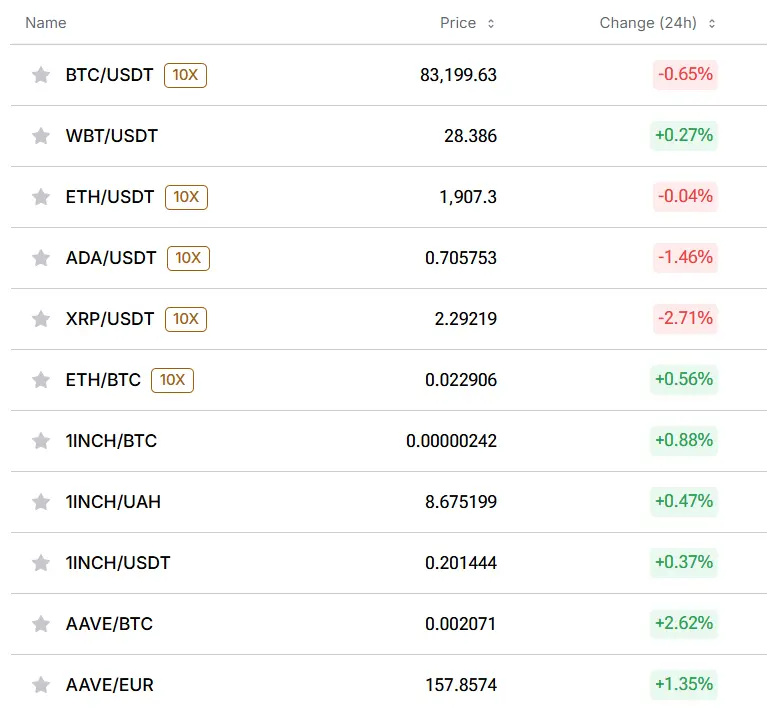

WhiteBIT offers a strong selection of popular cryptocurrencies. The platform makes it easy to trade well-known coins and tokens that most investors look for. Their ecosystem continues to grow, adding new trading options regularly.

Deepcoin also provides access to numerous cryptocurrencies, though the specific selection differs from WhiteBIT. Both exchanges support major coins like Bitcoin and Ethereum, but their offerings of altcoins and newer tokens may vary.

WhiteBIT Highlights:

- Popular cryptocurrencies widely available

- Support for WhiteBIT Coin (WBT), their native token

- Regular additions to their cryptocurrency lineup

Deepcoin Highlights:

- Diverse range of trading pairs

- Support for major cryptocurrencies

- Selection of alternative coins for diverse portfolios

When deciding between these exchanges, you should check if they support the specific cryptocurrencies you want to trade. Their offerings change over time as they add new coins and sometimes remove others.

Both platforms aim to provide a comprehensive selection, but they may prioritize different cryptocurrencies based on their market focus and user base preferences.

Deepcoin Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

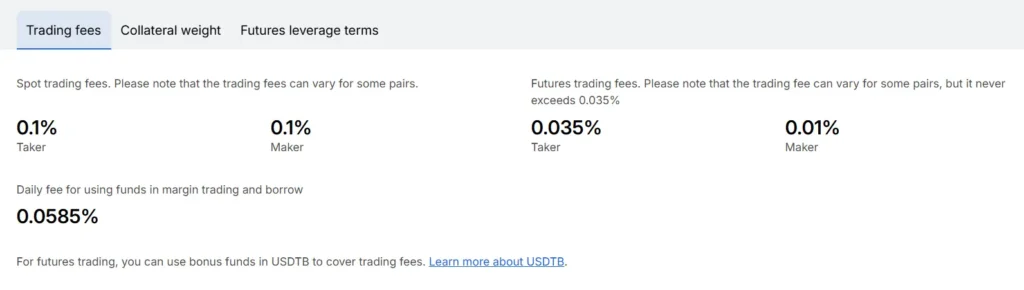

Both Deepcoin and WhiteBIT charge a standard 0.1% trading fee for makers and takers. This rate is competitive compared to many other cryptocurrency exchanges in 2025.

WhiteBIT offers special discounts for holders of its native token, WBT. If you hold WBT tokens, you can get up to 100% discount on maker fees, which is a significant advantage for frequent traders.

Deepcoin has defined minimum order amounts for trades but doesn’t appear to offer token-based discounts like WhiteBIT does.

| Exchange | Standard Trading Fee | Special Discounts |

|---|---|---|

| Deepcoin | 0.1% | None mentioned |

| WhiteBIT | 0.1% | Up to 100% off maker fees for WBT holders |

For deposit fees, both exchanges generally offer free crypto deposits, which is standard across most platforms. Withdrawal fees vary by cryptocurrency and network used.

The fee structures make both exchanges affordable options for trading cryptocurrency. If you plan to trade frequently as a maker (placing limit orders), WhiteBIT might save you more money through its WBT token discount program.

When choosing between these exchanges, consider your trading volume and whether you’d benefit from holding WBT tokens for fee discounts at WhiteBIT.

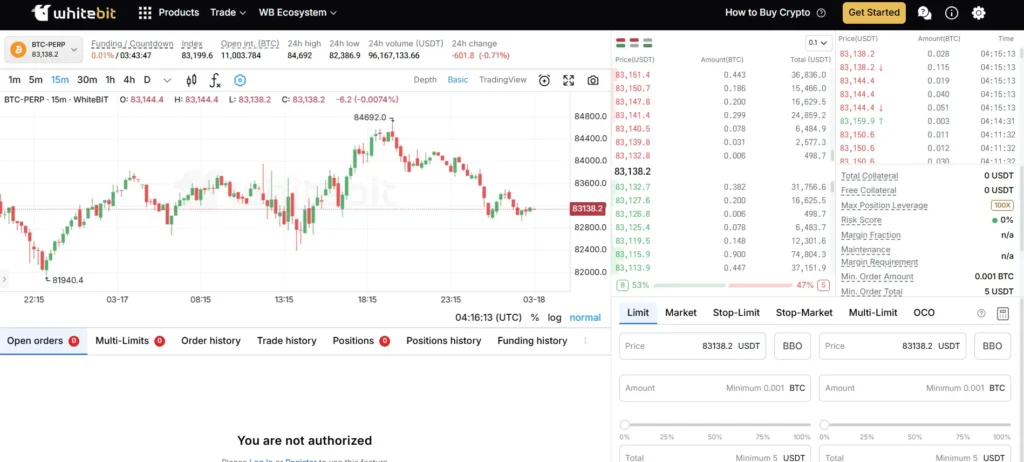

Deepcoin Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both Deepcoin and WhiteBIT offer various order options to meet different trading needs.

Deepcoin Order Types:

- Market Orders (instant execution at current price)

- Limit Orders (execution at specified price)

- Stop Orders (triggers at a set price)

- OCO (One Cancels Other)

- Trailing Stop Orders

WhiteBIT Order Types:

- Market Orders

- Limit Orders

- Stop Limit Orders

- Stop Market Orders

- Conditional Orders

WhiteBIT provides a slightly more comprehensive set of conditional orders, which can be helpful for advanced trading strategies. These tools allow you to set specific price conditions before your orders execute.

Deepcoin’s trailing stop feature is particularly useful for maximizing profits in volatile markets. This order type automatically adjusts your stop price as the market moves in your favor.

Both exchanges support basic order types that will satisfy most traders. However, if you’re implementing more complex strategies, you should examine the specific order execution options on each platform.

Trading fees may vary depending on which order types you use. Market orders typically incur higher fees than limit orders on both platforms.

Remember to practice with different order types using small amounts before committing to larger trades. This approach helps you understand how each order functions under various market conditions.

Deepcoin Vs WhiteBIT: KYC Requirements & KYC Limits

Deepcoin and WhiteBIT have different approaches to KYC (Know Your Customer) verification, which affects how you can use these platforms.

Deepcoin stands out for its user-friendly approach to KYC. The exchange doesn’t force users to complete verification processes to start trading. This means you can begin using Deepcoin quickly without lengthy identity checks.

WhiteBIT, on the other hand, implements strict KYC measures as part of its security framework. The exchange fully complies with both KYC and AML (Anti-Money Laundering) requirements, which means you’ll need to complete identity verification to access all features.

WhiteBIT KYC Process:

- Identity verification is mandatory for full access

- Complies with both KYC and AML requirements

- Verification may take some time to complete

Deepcoin KYC Process:

- No forced KYC verification to begin trading

- Faster onboarding process

- May have some limitations without verification

WhiteBIT’s strict approach contributes to its security reputation, with 96% of funds stored in cold wallets for added protection.

Your choice between these exchanges may depend on how quickly you want to start trading versus your comfort with providing identity documents. If immediate access is important, Deepcoin offers a faster path to trading.

Deepcoin Vs WhiteBIT: Deposits & Withdrawal Options

Both Deepcoin and WhiteBIT offer various deposit and withdrawal options for traders, but they differ in several key aspects.

WhiteBIT Deposit Methods:

- Cryptocurrency deposits (free)

- Credit/debit cards (Mastercard)

- Apple Pay

- Bank transfers

WhiteBIT makes deposits simple with a yellow “Deposit” button in the top menu. You can also find it on their homepage banner.

Deepcoin Deposit Methods:

- Cryptocurrency deposits

- Limited fiat options

Withdrawal Fees Comparison:

| Exchange | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| WhiteBIT | Varies by crypto | Varies by method |

| Deepcoin | Competitive rates | Limited options |

WhiteBIT charges different withdrawal fees for each cryptocurrency. You’ll need to check their fee schedule for specific coins you plan to trade.

Both platforms require identity verification for higher withdrawal limits. This helps with security but might slow down your first withdrawal request.

WhiteBIT provides more detailed information about their fee structure. You can easily find costs for different transaction methods like Mastercard or Apple Pay.

Deepcoin tends to focus more on crypto-to-crypto transactions, making it slightly more specialized than WhiteBIT’s broader payment options.

Processing times vary between the exchanges. WhiteBIT typically processes crypto withdrawals faster, while Deepcoin may have advantages for certain trading pairs.

Deepcoin Vs WhiteBIT: Trading & Platform Experience Comparison

WhiteBIT offers a user-friendly experience designed with beginners in mind. The platform is well-developed and easy to understand, making it accessible for new traders and investors.

With 8 million users and daily trading volumes reaching $11 billion, WhiteBIT has established itself as Europe’s largest cryptocurrency exchange by traffic.

Deepcoin Exchange, while less mentioned in the search results, competes with WhiteBIT on several fronts. Both exchanges offer various trading types to suit different trader needs.

User Interface Comparison:

- WhiteBIT: Clean, intuitive interface focused on ease of use

- Deepcoin: Trading platform designed for both beginners and experienced traders

Trading Volume:

| Exchange | Daily Trading Volume |

|---|---|

| WhiteBIT | Up to $11 billion |

| Deepcoin | Data not specified |

When choosing between these platforms, you should consider your trading experience level. WhiteBIT might be better if you’re new to crypto trading due to its focus on user experience.

Both exchanges offer multiple trading pairs and cryptocurrencies. The specific coins available on each platform may differ, so check if your preferred cryptocurrencies are supported before signing up.

Trading fees vary between the platforms, which can impact your overall trading costs. You should compare fee structures based on your expected trading volume and frequency.

Deepcoin Vs WhiteBIT: Liquidation Mechanism

Both Deepcoin and WhiteBIT have liquidation processes that activate when your margin funds become insufficient to maintain an open trading position.

WhiteBIT follows standard liquidation protocols where your position is forcibly closed when your margin drops below requirements. This helps prevent negative account balances and manages platform risk.

Deepcoin offers more advanced liquidation features, including a unique dual price liquidation system. This means your position isn’t liquidated based on a single price point, potentially giving you more flexibility during market volatility.

Deepcoin’s K-Line trading trailing stop is another tool that can help you manage liquidation risks. You can also split and merge positions on Deepcoin, giving you more control over your trading strategy and liquidation exposure.

For leverage traders, both platforms provide liquidation warnings, but Deepcoin’s tools might offer more options to avoid reaching liquidation points.

If you’re new to trading, WhiteBIT’s more straightforward liquidation mechanism might be easier to understand. For experienced traders, Deepcoin’s advanced features could provide better risk management tools.

Remember that higher leverage trading increases your liquidation risk on both platforms. Always use proper risk management strategies to protect your funds regardless of which exchange you choose.

Deepcoin Vs WhiteBIT: Insurance

When trading cryptocurrency, insurance is a crucial safety net for your funds. Both Deepcoin and WhiteBIT offer some form of insurance protection, but they differ in important ways.

Deepcoin maintains an insurance fund to protect users against potential losses during extreme market volatility. This fund helps prevent auto-liquidations of positions when prices fluctuate dramatically.

WhiteBIT, on the other hand, complies with strict KYC and AML requirements and offers secure storage solutions. The exchange keeps up to 96% of user assets in cold wallets, providing an additional layer of security against hacking attempts.

Neither exchange offers full insurance coverage like traditional financial institutions. Your funds are primarily protected through their security measures rather than formal insurance policies.

Here’s a quick comparison of their insurance and security features:

| Feature | Deepcoin | WhiteBIT |

|---|---|---|

| Insurance Fund | Yes | Limited |

| Cold Storage | Partial | Up to 96% |

| KYC/AML Compliance | Yes | Strict |

| Fund Protection | Against market volatility | Against unauthorized access |

You should consider these insurance differences when choosing between these platforms. Your comfort with risk and need for security may make one exchange more suitable than the other for your trading needs.

Remember that even with insurance protections, cryptocurrency trading involves inherent risks that no insurance can fully eliminate.

Deepcoin Vs WhiteBIT: Customer Support

When choosing a crypto exchange, customer support quality can make or break your experience. Both Deepcoin and WhiteBIT offer support services, but there are notable differences.

WhiteBIT provides 24/7 customer service in 10 languages, including English and Ukrainian. This multilingual approach makes the platform accessible to users worldwide. The search results highlight WhiteBIT’s reputation for reliable customer service.

However, some reviews note that WhiteBIT has limited customer support options. There is no live chat feature, which might slow down response times when you need immediate assistance.

Deepcoin’s customer support structure includes multiple channels for user inquiries. You can reach their team through email, social media, and their help center.

Support Comparison Table:

| Feature | Deepcoin | WhiteBIT |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | No |

| Email Support | Yes | Yes |

| Languages | Multiple | 10 languages |

| Response Time | Generally fast | Varies |

WhiteBIT has built a positive track record for customer protection and service quality. This can be especially important when dealing with technical issues or account problems.

Your experience may vary depending on your specific needs and the complexity of your issue. Both exchanges make efforts to support their users, but with different approaches to accessibility and communication methods.

Deepcoin Vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and WhiteBIT offer robust security features to protect your assets.

WhiteBIT stores 96% of user funds in cold wallets, keeping them offline and safe from online threats. This approach significantly reduces the risk of hacking attempts.

The exchange also enforces two-factor authentication (2FA) for all accounts and uses advanced encryption for private keys. WhiteBIT employs a Web Application Firewall (WAF) that detects and blocks common attacks like cross-site scripting and SQL injections.

Deepcoin also prioritizes security with multi-signature cold wallets for asset storage. Their security system includes real-time monitoring and risk control mechanisms to detect unusual activities.

Key Security Features Comparison:

| Feature | WhiteBIT | Deepcoin |

|---|---|---|

| Cold Storage | 96% of funds | Multi-signature wallets |

| Authentication | 2FA required | 2FA supported |

| Firewall Protection | Web Application Firewall | Advanced firewall |

| Compliance | Certified, regulatory compliant | Follows industry standards |

| Encryption | Advanced encryption for keys | High-level encryption |

WhiteBIT stands out for its industry certifications and compliance with regulations. The exchange has established itself as a security pioneer in the cryptocurrency space.

Both platforms offer security features that meet industry standards, but WhiteBIT’s higher percentage of cold storage and certified security measures might give you more peace of mind.

Is Deepcoin A Safe & Legal To Use?

Deepcoin is generally considered a safe cryptocurrency exchange with robust security measures. According to recent reviews, the exchange uses a self-developed third-generation security system to protect user assets.

For legal considerations, Deepcoin’s status varies by location. The platform does technically allow US investors to use the service, but this comes with significant caveats.

US traders should be aware that using Deepcoin provides no fund protection. This is a major risk factor to consider before using the platform if you’re based in the United States.

The exchange does implement standard security protocols found on reputable platforms. These likely include:

- Two-factor authentication (2FA)

- Cold storage for most assets

- Regular security audits

When comparing to WhiteBIT, it’s worth noting that WhiteBIT explicitly complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, which are important regulatory standards.

Before using Deepcoin, you should:

- Verify if it’s legal in your jurisdiction

- Consider the level of protection offered for your funds

- Research the latest security measures they’ve implemented

The crypto landscape changes rapidly, so always check for the most current information about any exchange’s legal status and security features.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT stands out as a safe cryptocurrency exchange with impressive security features. The platform has earned an AAA security rating and ranks among the top 3 safest trading platforms according to CER.live’s 2022 audits and certifications.

The exchange employs robust security measures including a Web Application Firewall (WAF) that detects and blocks online attacks like cross-site scripting and SQL injection attempts.

WhiteBIT complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, making it legally compliant in regions where it operates. This regulatory compliance helps protect you and your assets.

When you trade on WhiteBIT, your funds benefit from secure storage systems designed to prevent unauthorized access. The platform’s commitment to security has earned it a reputation as a well-established and reliable trading platform.

Key Security Features:

- AAA security rating

- Web Application Firewall protection

- KYC and AML compliance

- Secure fund storage

- Regular security audits

Before using WhiteBIT, you should verify it’s legal in your country as cryptocurrency regulations vary worldwide. While the exchange maintains high security standards, always use strong passwords and two-factor authentication for additional protection.

Frequently Asked Questions

When comparing Deepcoin and WhiteBIT exchanges, several key differences affect trading costs, available features, and overall user experiences. Here are answers to common questions about these platforms.

What are the main differences in fees between Deepcoin and WhiteBIT?

Deepcoin typically offers lower trading fees compared to WhiteBIT. Deepcoin’s fee structure starts at around 0.075% for makers and 0.075% for takers.

WhiteBIT charges slightly higher fees at approximately 0.1% for both makers and takers on standard accounts. Both exchanges offer fee discounts based on trading volume and native token holdings.

Withdrawal fees vary by cryptocurrency on both platforms, with WhiteBIT generally having higher withdrawal costs for most major cryptocurrencies.

How does the user experience compare on Deepcoin versus WhiteBIT?

WhiteBIT offers a more polished and user-friendly interface that beginners find easier to navigate. The platform includes helpful guides and a responsive customer support system.

Deepcoin’s interface is functional but may feel more complex to newcomers. It provides more advanced trading tools that experienced traders appreciate.

Mobile app experiences differ significantly, with WhiteBIT’s app receiving better ratings for stability and feature parity with the desktop version.

What level of security do Deepcoin and WhiteBIT provide to their users?

WhiteBIT emphasizes security compliance, following both KYC and AML requirements. The exchange stores most assets in cold wallets and offers two-factor authentication.

Deepcoin has fewer regulatory compliance features but maintains standard security practices like cold storage and encryption protocols.

Neither exchange has reported major security breaches as of March 2025, though WhiteBIT’s regulatory compliance gives some users added confidence.

Which cryptocurrencies are available on Deepcoin and WhiteBIT?

Both exchanges support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. WhiteBIT offers around 350+ cryptocurrencies and 500+ trading pairs.

Deepcoin provides access to approximately 300+ cryptocurrencies with a focus on derivatives trading options for major tokens.

WhiteBIT typically lists new cryptocurrencies faster and offers more specialized tokens and regional cryptocurrencies.

Can users from the USA legally trade on Deepcoin and WhiteBIT?

Neither Deepcoin nor WhiteBIT officially supports users from the United States due to regulatory constraints. American users cannot legally access either platform.

Attempts to access these platforms from the USA may result in account restrictions or closure. US residents should seek exchanges that are licensed to operate in their country.

VPN usage to circumvent these restrictions violates the terms of service of both platforms and may lead to account freezes or loss of funds.

What are the staking options and their safety on WhiteBIT?

WhiteBIT offers staking services for multiple cryptocurrencies with competitive APY rates ranging from 5-15% depending on the asset and lock-up period.

The platform’s staking options include flexible and fixed terms, with higher rewards for longer commitment periods. Popular staking options include ETH, DOT, and WhiteBIT’s native token.

WhiteBIT’s staking program operates within their security framework, though as with any staking service, there are inherent risks related to smart contract vulnerabilities and market fluctuations.

WhiteBIT Vs Deepcoin Conclusion: Why Not Use Both?

Both WhiteBIT and Deepcoin offer unique benefits that might suit different aspects of your trading strategy. WhiteBIT has established itself as a leading European exchange with over 5 million users, known for competitive fees and strong liquidity.

Deepcoin, meanwhile, doesn’t restrict users in different trading markets and provides separate options for various trading styles.

You might consider using WhiteBIT for its security features and established reputation. The platform is recognized as secure and reliable with a feature-rich trading experience.

On the other hand, Deepcoin could be valuable for its flexibility across different market types.

The WhiteBIT token offers additional benefits, including free AML checks and ERC20 withdrawal options, making it potentially more attractive for certain transactions.

Why use both platforms:

- Different trading needs: Use each exchange for its strengths

- Risk diversification: Avoid keeping all assets on one platform

- Fee optimization: Take advantage of better rates for specific trades

- Feature access: Utilize unique tools available on each platform

You don’t need to limit yourself to just one exchange. By understanding the strengths of both WhiteBIT and Deepcoin, you can strategically use each platform when it offers the best advantage for your specific trading activity.