Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Both Deepcoin and KuCoin have gained attention in the crypto world, but they offer different features and benefits that might suit various trading needs.

KuCoin currently has a higher overall score of 7.8 compared to Deepcoin, according to recent comparisons. This difference in rating reflects several factors including user experience, available trading options, and overall platform reliability.

When selecting between these exchanges, you’ll want to consider their fee structures, the cryptocurrencies they support, and their security measures. Each platform has its own strengths that might align better with your specific trading goals and experience level.

Deepcoin Vs KuCoin: At A Glance Comparison

When choosing between Deepcoin and KuCoin, you’ll want to compare their key features side by side. Based on recent comparisons, KuCoin holds a higher overall score of 7.8 compared to Deepcoin.

Trading Experience

KuCoin offers a smoother user experience than Deepcoin. This makes it easier for you to navigate the platform and execute trades efficiently.

Features Comparison:

| Feature | KuCoin | Deepcoin |

|---|---|---|

| Overall Score | 7.8 | Lower than KuCoin |

| User Experience | Smooth | Less intuitive |

| Coin Selection | Wide variety | More limited |

| Trading Options | Comprehensive | Basic |

KuCoin stands out for users looking for more trading functions and options. The platform provides a broader range of services that cater to both beginners and experienced traders.

Both exchanges offer cryptocurrency trading, but they differ in their fee structures and deposit methods. KuCoin typically offers more supported cryptocurrencies and trading types.

When deciding between these exchanges, consider what matters most to you. If you value ease of use and variety, KuCoin might be your better option.

Remember to check the most current fees and available cryptocurrencies before making your final decision, as these details can change over time.

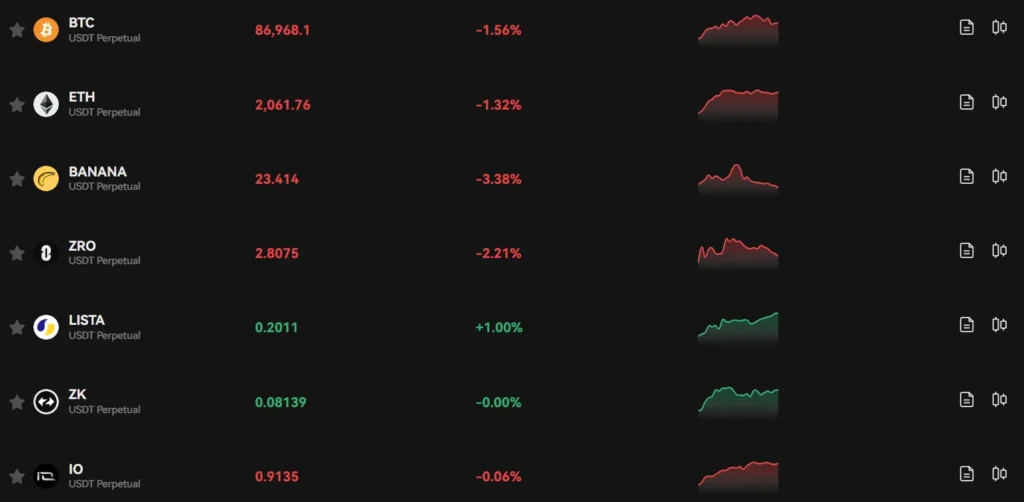

Deepcoin Vs KuCoin: Trading Markets, Products & Leverage Offered

When choosing between Deepcoin and KuCoin, understanding their trading options is essential for your investment strategy.

KuCoin offers a comprehensive suite of trading products. You can access spot trading with hundreds of cryptocurrencies and futures trading with up to 100x leverage. This gives you significant flexibility when making trading decisions.

Deepcoin also provides spot and futures markets, though with a slightly different focus. The platform supports derivatives trading, but specific leverage details are less prominently mentioned in available information.

Both exchanges offer:

- Spot trading

- Futures trading

- Margin trading options

KuCoin stands out with its wider range of derivative products compared to Deepcoin. This might matter if you’re looking for advanced trading instruments.

| Feature | KuCoin | Deepcoin |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Up to 100x leverage | Yes (leverage limits vary) |

| Derivative Products | More extensive selection | Basic options |

| Supported Cryptocurrencies | Extensive list | Moderate selection |

You should consider your trading experience level when choosing between these platforms. KuCoin might better serve advanced traders looking for various derivative options.

For newer traders, both platforms offer the essential markets you’ll need, though KuCoin’s educational resources may provide additional support.

Deepcoin Vs KuCoin: Supported Cryptocurrencies

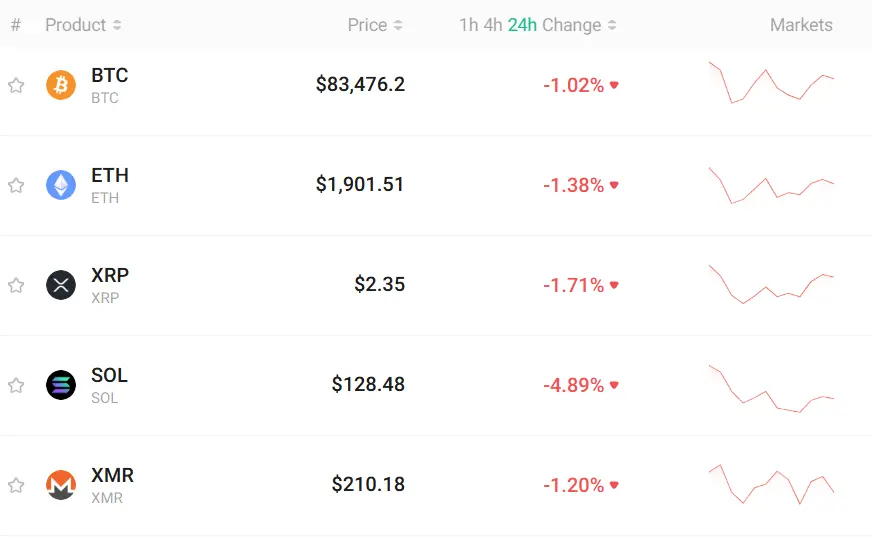

When comparing Deepcoin and KuCoin, one key factor to consider is the range of cryptocurrencies each platform supports.

KuCoin offers an impressive selection with over 700 cryptocurrencies available for trading. This extensive variety includes major coins like Bitcoin and Ethereum, along with numerous altcoins and tokens from emerging projects.

Deepcoin, while having a smaller selection than KuCoin, still provides access to most major cryptocurrencies. The platform supports approximately 300+ digital assets, covering the most popular options traders typically seek.

KuCoin’s Supported Cryptocurrencies:

- 700+ cryptocurrencies

- Wide range of altcoins

- Support for new token launches

- Multiple trading pairs

Deepcoin’s Supported Cryptocurrencies:

- 300+ cryptocurrencies

- Coverage of major coins

- Fewer altcoin options

- Growing selection

If you’re looking to trade popular cryptocurrencies, both exchanges will meet your needs. However, if you want access to more obscure or newly launched tokens, KuCoin likely offers better options.

The difference in cryptocurrency selection partly explains why KuCoin has attracted a larger user base of around 30 million users compared to Deepcoin’s approximately 1 million users.

For new traders, either platform provides enough variety to build a diverse portfolio. More experienced traders might prefer KuCoin’s broader selection for advanced trading strategies.

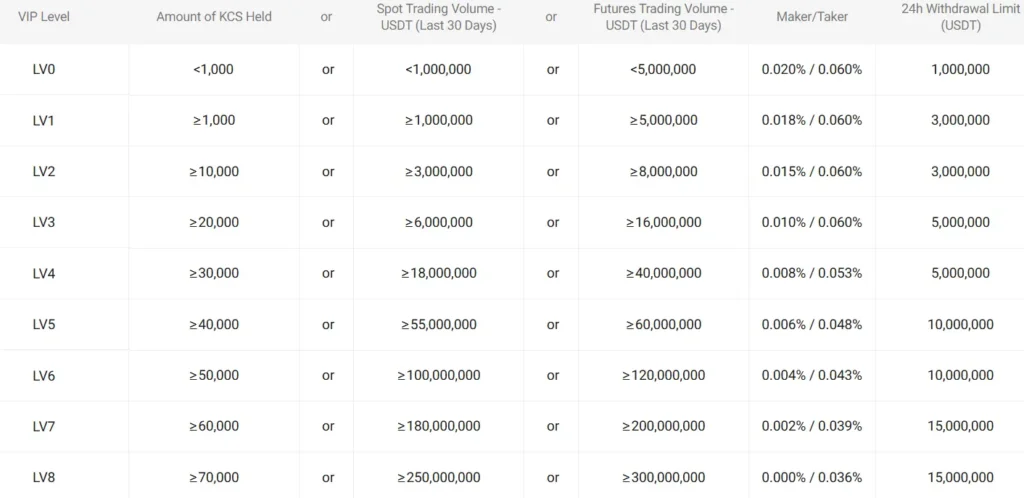

Deepcoin Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Deepcoin and KuCoin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Deepcoin | 0.1% | 0.1% |

| KuCoin | 0.1% | 0.1% |

Both platforms offer the same standard trading fee of 0.1% for makers and takers. This makes them equally competitive for regular traders.

Fee Reduction Options

KuCoin allows you to reduce fees by holding their native KCS token or increasing your trading volume. This tiered structure can benefit high-volume traders.

Deepcoin has specific minimum order amounts that you need to be aware of before trading. This might affect your trading strategy, especially for smaller transactions.

Deposit Fees

Both exchanges typically offer free crypto deposits, which is standard across most platforms.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. KuCoin often adjusts these fees based on network conditions and transaction costs.

You should check the current withdrawal fees for your specific cryptocurrencies before making a decision, as they can change based on market conditions.

For fiat withdrawals, additional fees may apply depending on your payment method and location.

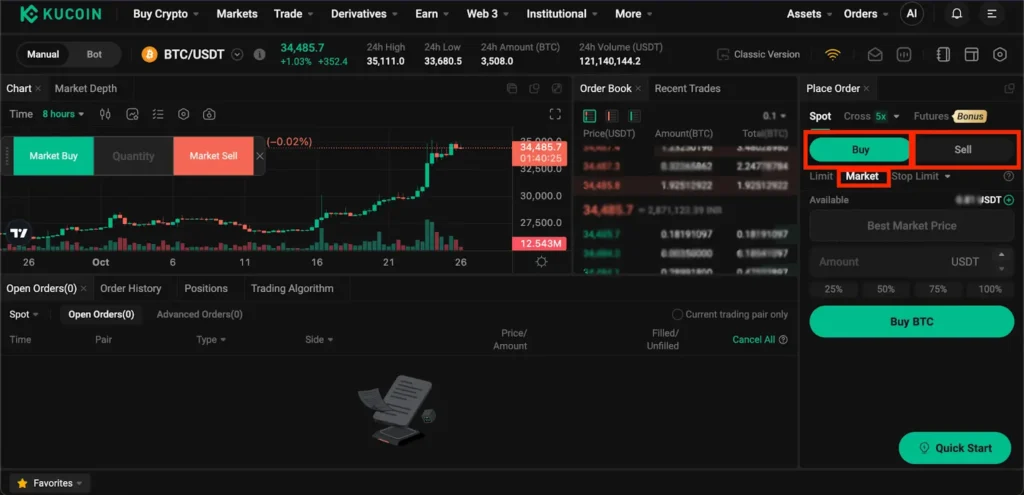

Deepcoin Vs KuCoin: Order Types

Both Deepcoin and KuCoin offer various order types for traders to execute their strategies effectively. Understanding these options can help you make better trading decisions.

KuCoin provides two primary order types on its Spot Market: market orders and limit orders. Market orders execute immediately at the current market price, while limit orders execute only when the price reaches your specified level.

KuCoin also offers advanced order types like Stop Limit Orders. These allow you to buy or sell at a limit price once the market reaches your predetermined trigger price.

Deepcoin similarly provides basic order types including market and limit orders for spot trading. However, KuCoin generally offers a more comprehensive range of advanced order types.

Both platforms support tools for risk management, but KuCoin’s interface is often noted for being more intuitive for setting parameters like stop-loss and take-profit levels.

When choosing between these exchanges, consider which order types best match your trading style. Day traders might prefer platforms with more sophisticated conditional orders, while beginners may value simpler interfaces.

KuCoin’s overall score of 7.8 compared to Deepcoin’s lower rating suggests it may provide a more robust trading experience, including its order type functionality.

Remember that advanced order types can help you automate your strategy and potentially reduce emotional trading decisions.

Deepcoin Vs KuCoin: KYC Requirements & KYC Limits

KYC (Know Your Customer) policies differ significantly between Deepcoin and KuCoin, which might affect your choice depending on privacy preferences.

Deepcoin stands out with no mandatory KYC verification. You can trade without submitting personal identification documents, making it appealing if privacy is your priority.

KuCoin also allows trading without mandatory KYC, contrary to many other centralized exchanges. However, there are important limits to consider.

Without KYC verification on KuCoin, you can still access most platform functions and complete transactions. This makes it more flexible than exchanges requiring verification upfront.

KYC Limits Comparison:

| Feature | Deepcoin (No KYC) | KuCoin (No KYC) |

|---|---|---|

| Trading | Full access | Full access |

| Withdrawal limits | Higher | Restricted |

| Features | All features | Most features |

KuCoin’s Identity Verification process becomes necessary if you want to increase your withdrawal limits or access certain advanced features.

Both exchanges offer a rare combination in the crypto world: centralized exchange security with optional KYC requirements. This allows you to start trading quickly without the verification delays.

Your choice might come down to which platform offers better withdrawal limits without KYC if maintaining privacy is important to you.

Deepcoin Vs KuCoin: Deposits & Withdrawal Options

Both Deepcoin and KuCoin offer various options for depositing and withdrawing your funds. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Methods

KuCoin supports cryptocurrency deposits across hundreds of coins and tokens. You can transfer your crypto from other wallets directly to your KuCoin account.

Deepcoin also allows cryptocurrency deposits but supports fewer assets compared to KuCoin. Both exchanges provide clear instructions for deposits with network selection options to ensure your funds arrive safely.

Withdrawal Options

KuCoin offers crypto withdrawals with varying fees depending on the network and token. Their withdrawal process includes security measures like email and SMS verification.

Deepcoin has similar withdrawal procedures but may have different fee structures. Based on user reports, KuCoin typically processes withdrawals faster than Deepcoin.

Fiat Support

KuCoin offers limited fiat deposit options through third-party payment providers. You can use credit/debit cards or P2P trading to convert fiat to crypto.

Deepcoin’s fiat support is more restricted, focusing primarily on crypto-to-crypto transactions.

Withdrawal Limits

| Exchange | Unverified Daily Limit | Verified Limit |

|---|---|---|

| KuCoin | 1-2 BTC equivalent | 200+ BTC |

| Deepcoin | More restricted | Varies by level |

Your withdrawal limits on both platforms will depend on your verification level, with higher tiers allowing larger daily withdrawals.

Deepcoin Vs KuCoin: Trading & Platform Experience Comparison

Both Deepcoin and KuCoin offer comprehensive trading platforms, but they differ in several key aspects that might affect your trading experience.

KuCoin scores higher overall with a 7.8 rating compared to Deepcoin, suggesting better general user satisfaction. This higher score likely reflects KuCoin’s more refined user interface and broader feature set.

User Interface

- KuCoin: Clean design with intuitive navigation

- Deepcoin: Functional but slightly less polished experience

Trading on KuCoin tends to be smoother for beginners, while Deepcoin might require a steeper learning curve. You’ll find KuCoin’s dashboard easier to navigate when checking prices or placing orders.

Trading Features

| Feature | KuCoin | Deepcoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin | ✓ | ✓ |

| Trading Bots | ✓ | Limited |

KuCoin offers more advanced trading tools like Trading Bots and a wider range of order types. This gives you more flexibility when executing complex trading strategies.

Mobile apps are available for both platforms, letting you trade on the go. KuCoin’s mobile app mirrors most desktop features, while Deepcoin’s app covers basic functionality.

Both exchanges support a wide range of cryptocurrencies, but KuCoin typically lists new tokens faster than Deepcoin. This gives you earlier access to emerging projects and potential opportunities.

Deepcoin Vs KuCoin: Liquidation Mechanism

Liquidation happens when your trading position can’t meet the margin requirements. Both Deepcoin and KuCoin have liquidation mechanisms to protect themselves when markets move against your position.

KuCoin uses a tiered liquidation system. When your margin ratio falls below certain thresholds, you’ll receive warnings before full liquidation occurs. From search results, some users report getting liquidated on KuCoin Futures within minutes of entering trades when using high leverage.

Deepcoin also employs an automated liquidation system. However, specific details about their exact approach aren’t available in the search results.

Key differences to consider:

- Liquidation warnings: Both exchanges typically send alerts when your position approaches liquidation levels

- Partial liquidation: KuCoin sometimes allows partial liquidation to give you a chance to add funds

- Leverage impact: Higher leverage on either platform significantly increases liquidation risk

To avoid liquidation on both platforms:

- Use lower leverage (especially as a beginner)

- Set stop-loss orders

- Monitor positions regularly

- Maintain adequate margin balance

Remember that volatile market conditions can trigger liquidations quickly on both exchanges. The best protection is conservative position sizing and proper risk management strategies.

Deepcoin Vs KuCoin: Insurance

When comparing cryptocurrency exchanges, security features like insurance are crucial to protect your assets. Both Deepcoin and KuCoin offer certain protections, but with key differences.

KuCoin maintains a “Safeguard Fund” that serves as insurance against security breaches. This fund allocates a portion of trading fees to protect user assets in case of hacks or other security incidents.

Deepcoin also provides insurance protection through its security system. However, specific details about Deepcoin’s insurance fund size and coverage limits aren’t as widely publicized as KuCoin’s.

KuCoin experienced a major hack in 2020, when approximately $281 million worth of assets were stolen. Impressively, the exchange managed to recover most funds and compensated affected users, demonstrating their commitment to customer protection.

Deepcoin has not reported any major security breaches to date, which speaks to its security infrastructure.

Insurance Comparison:

| Feature | KuCoin | Deepcoin |

|---|---|---|

| Insurance Fund | Safeguard Fund | Available but less documented |

| Track Record | Recovered from 2020 hack | No major reported breaches |

| Transparency | More detailed disclosures | Less comprehensive information |

You should review the exact insurance terms on both platforms before making significant deposits. Remember that insurance policies may change and might not cover all types of losses.

Deepcoin Vs KuCoin: Customer Support

When choosing between Deepcoin and KuCoin, customer support can be a deciding factor for your trading experience.

Deepcoin offers a strong customer support system with live chat functionality. You can connect instantly with available agents when you have questions or issues. This real-time assistance is valuable when you need immediate help with your trades or account.

KuCoin also provides multiple support channels including live chat, email support, and an extensive knowledge base. Their larger user base (approximately 30 million compared to Deepcoin’s 1 million) means they have more resources dedicated to customer service.

Support Options Comparison:

| Feature | Deepcoin | KuCoin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Knowledge Base | Limited | Extensive |

| Response Time | Generally quick | May vary during peak times |

Both exchanges offer support in multiple languages, though KuCoin tends to have more language options due to its larger global presence.

You might find that Deepcoin’s smaller user base works to your advantage in terms of personalized support. With fewer customers, agents may have more time to address your specific concerns.

KuCoin’s mature support infrastructure includes detailed tutorials and guides that can help you solve problems independently.

Deepcoin Vs KuCoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and KuCoin offer various security measures to protect your assets.

KuCoin implements a comprehensive risk control system that includes account verification, risk identification, and secure login processes. Their platform uses two-factor authentication (2FA) to add an extra layer of protection for your account.

Deepcoin also utilizes 2FA security protocols and employs cold storage solutions to keep most user funds offline and safe from online threats.

KuCoin Security Features:

- Risk control system

- Account verification

- Two-factor authentication

- Secure login and withdrawal processes

- Anti-phishing measures

Deepcoin Security Features:

- Two-factor authentication

- Cold storage for majority of assets

- Regular security audits

- DDoS protection

- Advanced encryption

Both exchanges maintain insurance funds to protect users against potential losses. However, KuCoin has a more established track record in handling security incidents.

You should note that KuCoin requires more comprehensive KYC/AML procedures than Deepcoin. This might affect your privacy preferences but adds security to the platform.

Neither exchange has reported major security breaches recently, which speaks to their ongoing commitment to safeguarding user assets.

Is Deepcoin A Safe & Legal To Use?

Deepcoin appears to have some safety measures in place. According to search results, it’s described as “one of the safest cryptocurrency exchanges” with a self-developed third-generation security system.

However, the legal status of Deepcoin varies by country. For US investors, the situation is complicated. While Deepcoin allows US users on its platform, they operate with no fund protection. This creates significant risk for American users.

Deepcoin has a smaller user base of around 1 million active users compared to KuCoin’s 30 million. A smaller user base sometimes indicates less market testing of security systems.

When comparing safety profiles, KuCoin is often described as “trusted and secure” in the cryptocurrency community. Some experts suggest it’s generally safer to use regulated exchanges that comply with legal standards.

Key Safety Considerations:

- Regulation status unclear

- No fund protection for US users

- Smaller user base (1M vs KuCoin’s 30M)

- Self-developed security system

If you’re considering using Deepcoin, you should research the current regulatory status for your specific country. The cryptocurrency exchange landscape changes rapidly, and what’s permitted today may change tomorrow.

You might want to consider the risk level you’re comfortable with. During uncertain times in the crypto market, some users prefer to withdraw funds from exchanges with questionable legal standing.

Is KuCoin A Safe & Legal To Use?

KuCoin has established itself as a major cryptocurrency exchange with approximately 30 million active users. However, safety and legality concerns exist that you should be aware of.

In terms of security, KuCoin experienced a significant hack in 2020. Following this incident, the exchange implemented stronger security measures to better protect user assets.

The exchange’s legal status is currently questionable in the United States. Recent reports indicate that KuCoin and two of its founders have been accused of violating US anti-money laundering laws.

Many users consider KuCoin a reputable exchange in the cryptocurrency space. However, like all exchanges, it carries certain risks that cannot be completely eliminated.

Some experts recommend caution when using KuCoin, especially during uncertain times. One suggestion is to avoid keeping large amounts of cryptocurrency on the exchange for extended periods.

If you choose to use KuCoin, consider these safety practices:

- Enable two-factor authentication

- Use a strong, unique password

- Withdraw large holdings to a personal wallet

- Stay informed about regulatory developments

- Monitor your account regularly

KuCoin’s legal status varies by country, so it’s important to check regulations in your specific location before using the platform.

Frequently Asked Questions

Traders often want quick answers about cryptocurrency exchange differences. The following questions address key comparison points between Deepcoin and KuCoin based on fees, security, available cryptocurrencies, and user experience.

How do the trading fees compare between Deepcoin and KuCoin?

KuCoin generally offers a more competitive fee structure with maker/taker fees starting at 0.1%. These fees can be reduced further if you hold their native KCS token.

Deepcoin’s fee structure is slightly higher for standard users. However, both exchanges offer fee discounts for high-volume traders and those who use their native tokens.

Trading fees on both platforms vary by the type of trading (spot, futures, margins). Always check their current fee schedules before trading as these rates change periodically.

What are the security features of Deepcoin versus those of KuCoin?

KuCoin implements industry-standard security protocols including two-factor authentication, multi-signature wallets, and regular security audits. They maintain most user funds in cold storage to protect against online threats.

Deepcoin similarly employs cold storage for the majority of user assets. This offline storage method significantly reduces the risk of hacking.

Both exchanges offer anti-phishing measures and withdrawal protections. KuCoin has a longer track record in the industry, which some users consider an additional security factor.

Which of the two platforms, Deepcoin or KuCoin, offers a wider range of cryptocurrencies?

KuCoin has earned the nickname “People’s Exchange” partly due to its extensive cryptocurrency selection. They list over 700 different tokens and consistently add new projects.

Deepcoin offers a more limited selection of cryptocurrencies. Their focus appears to be on major tokens and select altcoins rather than the comprehensive approach KuCoin takes.

If you’re looking to trade rare or newly launched tokens, KuCoin typically provides more options. Deepcoin covers most major cryptocurrencies but doesn’t match KuCoin’s variety.

Can users from the USA access services on Deepcoin as they can on KuCoin?

Neither exchange officially supports USA-based traders due to regulatory concerns. KuCoin doesn’t enforce strict KYC requirements for basic accounts, allowing some US users to access limited services.

Deepcoin similarly operates without significant geographical restrictions for basic trading functions. However, this doesn’t mean using either platform from the USA complies with local regulations.

Users from restricted regions should be aware that both exchanges might limit functionality or request verification if they detect access from unsupported locations.

How does the user experience and interface differ between Deepcoin and KuCoin?

KuCoin’s interface is feature-rich but can appear complex to beginners. They offer advanced trading tools, charts, and multiple order types that experienced traders appreciate.

Deepcoin provides a relatively streamlined interface that some users find more approachable. Their mobile app receives positive feedback for its user-friendly design.

Both platforms offer similar core functions, but KuCoin generally provides more advanced trading features and educational content. Deepcoin focuses on essential functions with a cleaner layout.

What are the differences in customer support quality between Deepcoin and KuCoin?

KuCoin offers 24/7 customer support through multiple channels including live chat, email, and ticket systems. Their response times average between a few hours to a day depending on request complexity.

Deepcoin’s customer support infrastructure is less developed. Users report longer wait times and fewer support channels compared to KuCoin.

Both exchanges provide extensive FAQs and knowledge bases. KuCoin edges ahead with more comprehensive support options and generally faster response times based on user feedback.

KuCoin Vs Deepcoin Conclusion: Why Not Use Both?

When comparing KuCoin and Deepcoin, each platform offers distinct advantages that might appeal to different trading needs.

KuCoin stands out with its massive user base of approximately 30 million active users, compared to Deepcoin’s 1 million. This larger community often translates to better liquidity and more trading options.

Deepcoin uses a hybrid wallet system combining hot and cold storage, which provides solid security for your funds. This approach helps isolate your assets and reduces online risks.

For US-based traders, it’s important to note that while Deepcoin allows US investors on its platform, they operate without fund protection. This presents a significant risk you should consider before choosing this exchange.

Key Differences:

| Feature | KuCoin | Deepcoin |

|---|---|---|

| Active Users | ~30 million | ~1 million |

| Security | Standard | Hybrid wallet system |

| US Trader Support | Limited | Allowed but unprotected |

You don’t necessarily need to choose between these exchanges. Many experienced traders maintain accounts on multiple platforms to take advantage of:

- Different fee structures

- Unique trading pairs

- Varying liquidity pools

- Exclusive features on each platform

By using both KuCoin and Deepcoin strategically, you can maximize your trading opportunities while minimizing individual platform limitations.