Looking for the right cryptocurrency exchange can be challenging with so many options available. Deepcoin and Crypto.com are two popular platforms that offer different features for crypto traders and investors. Crypto.com has a higher overall score of 9.1 compared to Deepcoin, suggesting it may provide a better overall trading experience.

Both exchanges offer various trading options, with Deepcoin focusing on derivative trading including perpetual and CFD contracts. Crypto.com provides a wider range of services beyond just trading. When choosing between these platforms, you should consider factors like fees, available cryptocurrencies, security measures, and user interface.

Deepcoin vs Crypto.com: At A Glance Comparison

When choosing between Deepcoin and Crypto.com, you’ll want to consider several key factors that differentiate these cryptocurrency exchanges.

Based on overall scores, Crypto.com leads with a 9.1 rating compared to Deepcoin’s lower score. This reflects Crypto.com’s stronger market position and user trust.

Key Differences:

| Feature | Crypto.com | Deepcoin |

|---|---|---|

| Overall Score | 9.1 | Lower than 9.1 |

| Custody Type | Both custodial and non-custodial options | Primarily custodial |

| Platform Maturity | Well-established | Newer to the market |

| Available Features | More comprehensive suite | More limited options |

Crypto.com offers you both the standard exchange (where they custody your assets) and Crypto.com Onchain, where you control your private keys.

The user interface on Crypto.com tends to be more polished and beginner-friendly. You’ll find navigating through features straightforward even if you’re new to crypto trading.

Trading volume and liquidity are important considerations. Crypto.com typically provides better liquidity for most trading pairs, meaning you can execute trades more easily without significant price slippage.

Security features also differ between the platforms. Crypto.com has invested heavily in security protocols and insurance programs to protect your assets.

Both exchanges offer mobile apps, but Crypto.com’s app ecosystem is more developed with additional features like crypto earning options, visa cards, and payment solutions.

Deepcoin vs Crypto.com: Trading Markets, Products & Leverage Offered

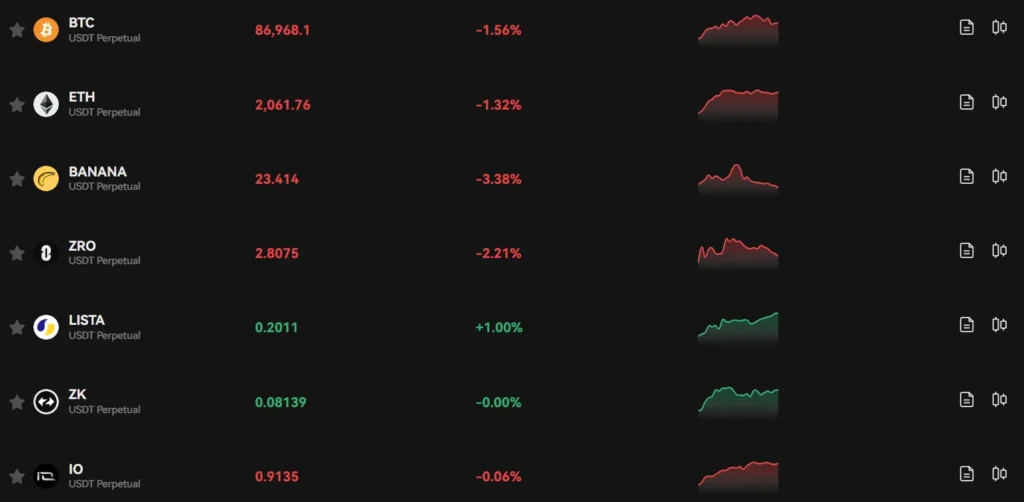

Deepcoin positions itself as a “derivatives-first” platform, offering extensive options for futures traders. You’ll find perpetual contracts and CFDs as their primary products, with leverage options that appeal to experienced traders.

Crypto.com, with its higher overall score of 9.1 compared to Deepcoin, provides a more diverse ecosystem. You can access spot trading, margin trading, and derivatives all in one place.

Products Comparison:

| Feature | Deepcoin | Crypto.com |

|---|---|---|

| Spot Trading | Available | Available |

| Derivatives | Extensive | Available |

| Perpetual Contracts | Primary focus | Offered |

| CFDs | Available | Limited |

When it comes to leverage, Deepcoin emphasizes high-leverage trading options for their derivatives products. This makes them attractive if you’re looking to maximize potential returns, though with higher risk.

Crypto.com takes a more balanced approach, offering leverage but within a broader ecosystem of products including their Visa card, earning opportunities, and NFT marketplace.

For variety of trading pairs, both exchanges perform well. Deepcoin specializes in providing numerous derivative trading pairs, while Crypto.com offers a wide selection across both spot and derivatives markets.

If you prioritize derivatives trading specifically, Deepcoin’s specialized focus might appeal to you. For a more comprehensive crypto experience with moderate leverage options, Crypto.com’s broader ecosystem could be more suitable.

Deepcoin vs Crypto.com: Supported Cryptocurrencies

When choosing between Deepcoin and Crypto.com, the variety of cryptocurrencies available is an important factor to consider.

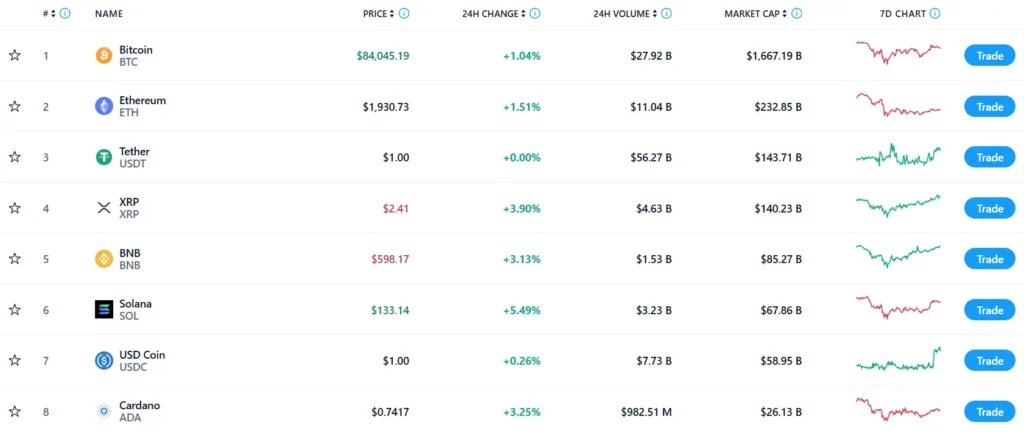

Crypto.com offers a wide selection of cryptocurrencies, supporting over 250 coins and tokens. This includes major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and smaller altcoins.

Deepcoin, as a derivative trading platform, focuses more on futures and CFD trading. It supports fewer cryptocurrencies compared to Crypto.com, but covers the major coins needed for derivative trading.

Crypto.com Cryptocurrency Support:

- 250+ cryptocurrencies

- All major coins (Bitcoin, Ethereum, Solana, etc.)

- Many smaller altcoins and tokens

- Regular additions of new tokens

Deepcoin Cryptocurrency Support:

- Fewer total cryptocurrencies

- Major trading pairs for derivative trading

- Focus on coins with high trading volume

- Specialized in leveraged trading options

You’ll find that Crypto.com is better suited if you want access to a diverse range of cryptocurrencies. The platform regularly adds new tokens and provides access to both popular and emerging projects.

If your primary interest is in derivative trading with popular cryptocurrencies, Deepcoin offers the essential trading pairs needed for this purpose. Their platform specializes in leveraged trading rather than providing access to a wide variety of tokens.

Your choice depends on whether you prioritize variety (Crypto.com) or specialized derivative trading options (Deepcoin).

Deepcoin vs Crypto.com: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Deepcoin and Crypto.com, fees play a crucial role in your decision-making process.

Trading Fees

Crypto.com generally maintains a higher overall score (9.1) compared to Deepcoin in exchange comparisons. This rating reflects its competitive fee structure among popular exchanges.

Deepcoin offers lower trading fees for most transactions, making it attractive for frequent traders. Their maker-taker model typically undercuts Crypto.com’s standard rates.

Withdrawal Fees

Crypto.com has faced criticism for its withdrawal fees. Recent reports show Bitcoin withdrawal fees as high as 0.00138385 BTC, which some users consider excessive.

Deepcoin typically charges lower withdrawal fees across most cryptocurrencies, giving it an advantage for users who regularly move assets off-exchange.

Deposit Methods & Fees

Both exchanges offer multiple deposit methods, but fees vary by currency and payment type:

| Feature | Crypto.com | Deepcoin |

|---|---|---|

| Credit Card Deposits | Higher fees (3-4%) | Lower fees (1-2%) |

| Bank Transfer | Free on some currencies | Free on most currencies |

| Crypto Deposits | Free | Free |

Fee Reduction Options

You can reduce fees on both platforms by:

- Trading higher volumes

- Using platform tokens

- Maintaining higher account levels

Consider your trading frequency and typical transaction size when choosing between these exchanges.

Deepcoin vs Crypto.com: Order Types

When trading on cryptocurrency exchanges, understanding available order types is crucial for your trading strategy. Both Deepcoin and Crypto.com offer various order options, but they differ in several ways.

Deepcoin specializes in derivative trading with a focus on Perpetual and CFD contracts. The platform supports standard order types including market orders for immediate execution at current prices and limit orders where you set your desired price.

Crypto.com provides a more comprehensive set of order types on its exchange. You can place market orders for instant trades, limit orders to buy or sell at specific prices, and stop orders to help manage risk.

Common Order Types on Both Platforms:

- Market orders (execute immediately at market price)

- Limit orders (execute only at your specified price or better)

- Stop orders (trigger when price reaches a certain level)

Deepcoin offers more advanced features for derivative traders, making it suitable if you’re interested in leveraged trading with specialized contract types.

Crypto.com’s exchange includes OCO (one-cancels-the-other) orders, which let you set two conditional orders where executing one automatically cancels the other.

The Crypto.com App has fewer order types than their exchange platform. If you want full trading capabilities, you’ll need to use their dedicated exchange rather than just the app.

Your trading style and experience level should guide your choice between these platforms. Beginners might prefer Crypto.com’s clearer interface, while advanced traders might appreciate Deepcoin’s specialized derivative offerings.

Deepcoin vs Crypto.com: KYC Requirements & KYC Limits

When choosing between Deepcoin and Crypto.com, KYC (Know Your Customer) requirements play a significant role in your experience.

Deepcoin KYC Approach:

- No mandatory KYC verification required to use the platform

- You can trade without submitting identity documents

- Allows for more privacy and faster account setup

This lack of strict verification makes Deepcoin attractive if you value privacy or want to start trading immediately.

Crypto.com KYC Approach:

- Full KYC verification required

- You must provide identity documents before trading

- Identity verification is mandatory to use their services

Crypto.com follows stricter regulatory compliance, which might provide more security but requires more personal information.

Trading Limits:

| Exchange | Without KYC | With KYC |

|---|---|---|

| Deepcoin | Basic trading available | Higher limits available |

| Crypto.com | Not available | Full access after verification |

Your choice depends on priorities. If quick setup and privacy matter most, Deepcoin’s no mandatory KYC policy might appeal to you.

If you prefer platforms with stronger regulatory compliance, Crypto.com’s comprehensive KYC process offers that security, though with more steps to begin trading.

Remember that regulations change frequently, so verification requirements may update over time for both platforms.

Deepcoin vs Crypto.com: Deposits & Withdrawal Options

When choosing between Deepcoin and Crypto.com, understanding how you can move your money in and out is crucial. Both platforms offer various options, but with some key differences.

Crypto.com provides a more user-friendly deposit experience. You can fund your account with credit/debit cards, bank transfers, and of course, cryptocurrency deposits. Their fiat options make it accessible for beginners.

Deepcoin supports cryptocurrency deposits primarily. While their crypto deposit process is straightforward, their fiat options are more limited compared to Crypto.com. However, they recently integrated with Korean fiat currency exchange through a partnership with Coinone.

For withdrawals, both exchanges support crypto transfers to external wallets. Crypto.com also allows fiat withdrawals to bank accounts, giving you more flexibility.

Withdrawal Fees Comparison:

| Exchange | Fee Structure |

|---|---|

| Deepcoin | Variable fees specific to each cryptocurrency |

| Crypto.com | Tiered fees based on user level and token type |

Processing times vary between the platforms. Crypto.com typically processes withdrawals within 24 hours, while Deepcoin’s timeframes can vary by asset type.

Security is strong on both platforms for deposits and withdrawals. They employ two-factor authentication and withdrawal address whitelisting to protect your funds.

Remember to verify the current withdrawal limits and fees before making transactions, as these can change based on market conditions and platform updates.

Deepcoin vs Crypto.com: Trading & Platform Experience Comparison

When choosing between Deepcoin and Crypto.com, the trading platform experience is a crucial factor to consider.

Crypto.com offers a smoother user experience compared to Deepcoin, according to comparison data. The interface is designed to be more intuitive, making it easier for you to navigate and execute trades.

Deepcoin features a self-developed third-generation trading system built from scratch. This platform supports trading for over 150 cryptocurrencies, giving you a wide selection of assets to trade.

User Control Differences:

- Crypto.com offers both custodial and non-custodial options

- With Crypto.com Onchain, you maintain full control of your private keys

- Deepcoin focuses on providing a secure trading environment

Deepcoin has recently added a “Similar K-Line” feature to enhance the trading experience. This tool aims to help you make more informed trading decisions through advanced pattern recognition.

Platform Comparison:

| Feature | Crypto.com | Deepcoin |

|---|---|---|

| User Experience | Smoother, more intuitive | More technical |

| Available Coins | 150+ | 150+ |

| Special Features | Multiple products | Similar K-Line tool |

| Mobile Experience | Highly rated app | Trading-focused interface |

Both platforms prioritize security, but they differ in how they approach the user experience. Crypto.com tends to focus on accessibility for all user levels, while Deepcoin appears to cater more to traders looking for specialized tools.

Deepcoin vs Crypto.com: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial. Liquidation happens when your position’s losses reach a certain threshold of your collateral.

Deepcoin offers a unique dual-price liquidation protection mechanism. This system helps protect traders who use high leverage from experiencing major losses. It uses two reference prices instead of one to determine liquidation levels, making the process more stable.

Crypto.com, on the other hand, uses a standard liquidation model. Their system monitors your positions and will automatically close them when they reach predetermined risk levels. This approach is straightforward but may not offer the same level of protection during volatile market conditions.

Here’s a quick comparison of their liquidation features:

| Feature | Deepcoin | Crypto.com |

|---|---|---|

| Protection Mechanism | Dual-price system | Standard liquidation |

| Benefit for High Leverage | Significant protection | Basic protection |

| Price Reference | Uses two price points | Uses single price point |

| Support During Liquidation | 24/7 multilingual support | Standard customer support |

You should consider your trading style when choosing between these platforms. If you frequently use high leverage, Deepcoin’s dual-price mechanism might provide better protection against sudden market movements.

Remember that both platforms still carry risks. No liquidation protection system can completely eliminate the possibility of losses when trading with leverage.

Deepcoin vs Crypto.com: Insurance

When choosing a crypto exchange, insurance coverage is a key factor to consider for your protection. Crypto.com has made significant strides in this area with an impressive insurance program.

Crypto.com offers a total cryptocurrency insurance coverage of $750 million. This includes both direct and indirect custodian coverage, providing substantial protection for users’ assets.

In contrast, Deepcoin’s insurance coverage details are less transparent. The exchange doesn’t prominently advertise its insurance policies or amounts in the available information.

This insurance difference represents a notable advantage for Crypto.com, especially if security is a top priority for your trading needs.

Insurance coverage becomes particularly important in cases of security breaches or hacks. With Crypto.com’s extensive coverage, you may feel more confident about the safety of your digital assets.

When evaluating these platforms, consider how important insurance protection is for your investment strategy. Higher coverage typically indicates a platform’s commitment to user security.

Remember that insurance policies can change, so it’s always wise to check the current coverage details directly on each platform before making your decision.

Deepcoin vs Crypto.com: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Deepcoin and Crypto.com offer support options, but they differ in quality and responsiveness.

Crypto.com provides 24/7 customer service through live chat and email. However, some users report frustrating experiences with their support team. According to search results, one user was stuck in a support chat for 12 hours, with agents repeatedly asking for the same verification details three times during this period.

Deepcoin also offers customer support, though there’s less specific information available about their support quality. As a global cryptocurrency derivative trading platform, they provide assistance for their trading services.

Response times can vary significantly between platforms. While Crypto.com has a larger support team, users sometimes face long wait times and repetitive questioning processes.

Here’s a quick comparison of support features:

| Feature | Crypto.com | Deepcoin |

|---|---|---|

| 24/7 Support | Yes | Limited information |

| Support Channels | Live chat, email | Limited information |

| Response Time | Variable (reports of long waits) | Limited information |

| User Experience | Mixed reviews | Limited information |

When you need help with account issues or trading problems, you should consider how important responsive customer support is to your trading style. If you trade frequently or handle large transactions, reliable and quick support becomes even more crucial.

Deepcoin vs Crypto.com: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and Crypto.com offer security features, but they differ in several ways.

Crypto.com stands out with its comprehensive security infrastructure. It’s the first cryptocurrency company to achieve ISO 22301:2019 certification, showing its commitment to security standards and practices.

The platform implements strong security measures including two-factor authentication (2FA), which adds an extra layer of protection to your account. This means even if someone gets your password, they still can’t access your funds without the second verification step.

Crypto.com also uses cold storage for most user funds. This keeps your crypto offline and away from potential online threats, significantly reducing hacking risks.

Crypto.com Security Features:

- Two-factor authentication

- Cold storage for funds

- Regular security audits

- ISO 22301:2019 certification

- User-custodied wallet options

Deepcoin, while also focusing on security, doesn’t have the same level of publicly available information about its security practices. It operates as a derivative trading platform with leverage options.

You should note that Crypto.com offers both custodial services (where they manage keys) and non-custodial options through Crypto.com Onchain, giving you full control of your private keys if preferred.

For maximum protection, always enable all available security features on whichever platform you choose. Strong passwords, 2FA, and staying alert to phishing attempts will further enhance your security.

Is Deepcoin Safe & Legal To Use?

Deepcoin offers some security features through its self-developed third-generation trading system. However, safety concerns exist due to regulatory issues.

Deepcoin is based in Singapore and does not operate legally in the United States. This lack of US regulatory compliance means American users have no protection if something goes wrong.

If you’re in the US and use Deepcoin, be aware that you have:

- No asset loss prevention

- No regulatory protection

- No security guarantees

For users outside restricted regions, Deepcoin implements security measures, but these lack the oversight that comes with regulation. While regulation isn’t always required for reliability, it does provide additional user protection.

In contrast, Crypto.com scores higher in overall security with a 9.1 rating compared to Deepcoin. This suggests Crypto.com may be a safer option for most users.

Some users access Deepcoin from restricted regions using VPNs, but this practice may violate terms of service and potentially put your funds at risk.

Before using Deepcoin, verify if it’s legal in your country and consider the risks of using an exchange with limited regulatory oversight.

Is Crypto.com Safe & Legal To Use?

Crypto.com is generally considered safe to use for cryptocurrency trading and investing. The platform keeps 100% of customer funds in cold wallets, which provides strong protection against online threats.

Security is a top priority at Crypto.com. They employ a “Zero Trust – Defense in Depth” security strategy across their systems and platforms, helping to protect user assets.

Crypto.com is also legally compliant in all regions where it operates. This includes following KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, which are important legal standards in the financial industry.

When comparing Crypto.com to Deepcoin, many users find that Crypto.com offers a smoother and better user experience. This can be particularly helpful if you’re new to cryptocurrency exchanges.

While Crypto.com does charge higher fees than some competitors, it’s considered a reliable option if you’re mainly focused on holding and accumulating cryptocurrency.

Key Safety Features:

- Cold wallet storage for all customer funds

- Zero Trust security strategy

- Compliance with regional regulations

- KYC and AML protocols

The exchange is widely regarded as one of the safer cryptocurrency platforms available today, making it a solid choice for both beginners and experienced traders.

Frequently Asked Questions

When comparing Deepcoin and Crypto.com, users often have specific questions about how these exchanges differ. These questions cover everything from fees and security to available cryptocurrencies and user experience.

What are the key differences between Deepcoin and Crypto.com in terms of trading fees?

Crypto.com generally offers lower fees for most users compared to Deepcoin. Crypto.com uses a maker-taker fee structure that becomes more competitive for low-volume traders.

Both exchanges offer fee discounts based on trading volume, but Crypto.com’s overall score of 9.1 (compared to Deepcoin’s lower score) partially reflects its more favorable fee structure.

For beginners just learning to manage their crypto investments, Crypto.com’s fee structure tends to be more straightforward and easier to understand.

How do the security measures of Deepcoin compare to Crypto.com?

Crypto.com has invested heavily in security measures, including cold storage of funds, two-factor authentication, and regulatory compliance in multiple jurisdictions.

While both exchanges implement standard security protocols, Crypto.com has built a stronger reputation for security with its emphasis on compliance and regular security audits.

You’ll find Crypto.com provides more detailed security information in their help center, making their security practices more transparent to users.

Can users from all countries access both Deepcoin and Crypto.com services?

Neither exchange is available in all countries worldwide. Crypto.com has broader global reach but still faces restrictions in certain jurisdictions due to regulatory requirements.

Deepcoin has more limited availability, particularly in regions with strict cryptocurrency regulations.

You should check the most current country availability directly on each platform before signing up, as accessibility can change based on evolving regulations.

What variety of cryptocurrencies do Deepcoin and Crypto.com each support?

Crypto.com supports a wide range of cryptocurrencies, making it suitable for both beginners and experienced traders looking for variety.

Deepcoin typically offers fewer cryptocurrency options than Crypto.com, though both exchanges cover the major coins like Bitcoin and Ethereum.

You can find detailed information about available markets in Crypto.com’s help center, which outlines all supported cryptocurrencies and trading pairs.

How do the user experiences of Deepcoin and Crypto.com differ?

Crypto.com offers a more polished user interface that caters to both beginners and experienced traders. The app is designed to help young investors learn about managing digital assets.

Deepcoin’s interface may require more technical knowledge and can be less intuitive for newcomers to cryptocurrency trading.

You’ll find that Crypto.com integrates more features within one ecosystem, including an exchange, app, debit card options, and earning products.

What are the distinct advantages of using Deepcoin over Crypto.com?

Deepcoin may offer certain specialized trading pairs or features that aren’t available on Crypto.com, potentially appealing to traders seeking specific assets.

Some traders may find Deepcoin’s platform suits their particular trading strategies better, especially for certain derivatives or advanced trading options.

You might encounter lower fees for certain transaction types on Deepcoin, though this varies based on the specific operations you perform most frequently.

Crypto.com vs Deepcoin Conclusion: Why Not Use Both?

After comparing Crypto.com and Deepcoin, you might wonder which platform to choose. The answer could be: use both for different purposes.

Crypto.com offers a smoother user experience with an intuitive interface that many beginners find helpful. It also provides a full ecosystem including a user-custodied wallet option where you control your private keys.

Deepcoin, with its “derivatives-first” approach, excels in providing multiple trading pairs and advanced trading tools. This makes it particularly valuable for experienced traders looking for specific features.

Key considerations for using both:

- Use Crypto.com for its ease of use and broader ecosystem

- Try Deepcoin when you need specialized trading pairs or derivatives options

- Be aware that Crypto.com’s app has higher spreads (10-15% noted in reviews)

- Consider Deepcoin for more advanced trading tools

Remember the golden rule in crypto: “Not your keys, not your coins.” Some users prefer moving tokens to self-custody wallets after purchasing on exchanges.

Your trading needs may change over time, so having accounts on different platforms gives you flexibility. Each exchange has distinct strengths that can complement each other in your trading strategy.

By using both platforms strategically, you can take advantage of the best features each has to offer while minimizing their drawbacks.