Cryptocurrency traders often face tough choices when picking exchanges for trading. Deepcoin and BloFin have emerged as popular platforms for derivative trading in 2025, each with unique features that might suit different trading styles.

BloFin ranks as the second largest non-KYC futures platform in the market, right behind MEXC, offering deep liquidity and advanced trading tools for serious traders. This positioning makes it particularly attractive if you value privacy while still wanting access to sophisticated trading options.

Both exchanges compete with strong reward programs and security features, but their fee structures and available trading pairs differ significantly. Understanding these differences can help you choose the right platform for your trading strategy and potentially increase your profits in the volatile crypto market.

Deepcoin Vs BloFin: At A Glance Comparison

When choosing between Deepcoin and BloFin for your crypto trading needs, understanding their key differences can help you make the right choice.

Exchange Overview:

- Deepcoin: A cryptocurrency exchange with a moderate trust score

- BloFin: An advanced centralized exchange focusing on futures trading

Trading Features:

| Feature | Deepcoin | BloFin |

|---|---|---|

| Futures Trading | Available | Extensive (300+ perpetual swap contracts) |

| Copy Trading | Limited | Available |

| Trust Score | Lower than some competitors | Competitive |

BloFin stands out with its advanced trading features, particularly for futures traders. The platform offers over 300 perpetual swap contracts, making it attractive if you’re looking for trading variety.

Deepcoin provides standard cryptocurrency exchange services but appears to have a lower overall score compared to some competitors like BlockFi (which scored 6.0 in comparative rankings).

Target Users:

- Choose BloFin if you want advanced futures trading options and copy trading features

- Consider Deepcoin if you prefer a more traditional cryptocurrency exchange experience

Both platforms serve different needs in the crypto trading ecosystem. Your choice should depend on your trading style, experience level, and specific requirements.

Remember to review current fee structures and available coins before making your final decision, as these details can change frequently in the crypto exchange market.

Deepcoin Vs BloFin: Trading Markets, Products & Leverage Offered

Deepcoin and BloFin both offer cryptocurrency derivatives trading, but they differ in several key aspects of their trading markets and products.

Trading Markets

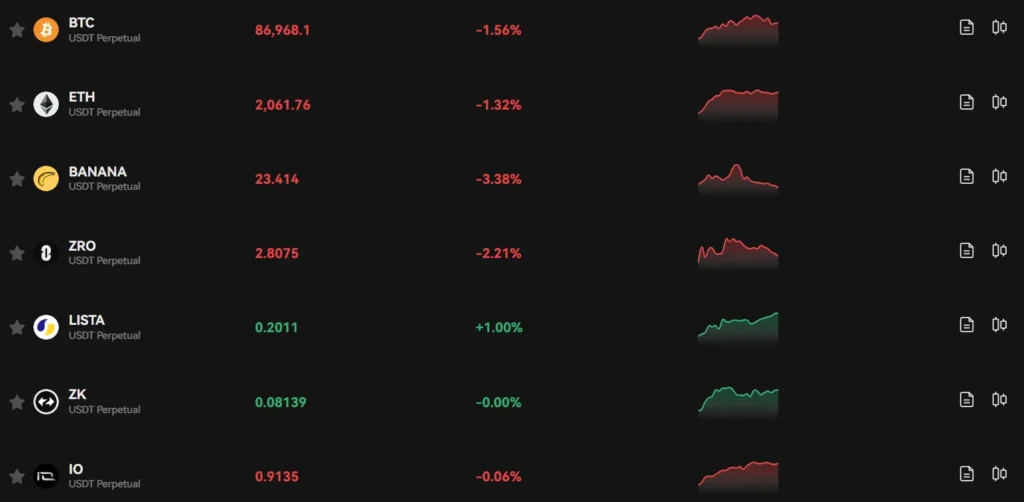

Deepcoin provides access to a wide range of cryptocurrency pairs, including major coins like Bitcoin and Ethereum as well as numerous altcoins. BloFin also offers diverse trading pairs but is particularly known for supporting some less common tokens.

Product Types

| Platform | Spot Trading | Futures | Options | Other Products |

|---|---|---|---|---|

| Deepcoin | Yes | Yes | Yes | Copy trading |

| BloFin | Yes | Yes | Limited | Grid trading |

BloFin has established itself as a significant non-KYC futures platform, ranking as the second largest in this category according to recent data. Their platform is designed to be user-friendly for traders of all experience levels.

Leverage Options

Both exchanges offer leveraged trading, allowing you to amplify your position sizes. Deepcoin typically offers leverage up to 125x on major pairs, while BloFin provides similar high leverage options for futures trading.

Trading Tools

Deepcoin features advanced charting tools and technical indicators for market analysis. BloFin focuses on creating an easy-to-use and reliable trading experience with secure transaction processing.

When choosing between these platforms, consider which specific cryptocurrencies you want to trade and which features matter most to your trading strategy.

Deepcoin Vs BloFin: Supported Cryptocurrencies

When choosing between Deepcoin and BloFin for your crypto trading needs, the range of supported cryptocurrencies is a crucial factor to consider.

BloFin offers an extensive selection of cryptocurrencies for trading. Based on recent information, BloFin supports most major coins and tokens, providing users with diverse trading options. The platform is known for its deep liquidity and comprehensive trading features.

Deepcoin also maintains a robust cryptocurrency selection, though specific numbers may vary. Both exchanges regularly update their offerings to include popular and emerging digital assets.

Here’s a quick comparison of supported cryptocurrencies:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Major Cryptocurrencies | Bitcoin, Ethereum, etc. | Bitcoin, Ethereum, etc. |

| Altcoins | Wide selection | Comprehensive range |

| Token Support | Strong | Strong |

| New Listings | Regular updates | Regular updates |

BloFin markets itself as a platform “where whales are made,” suggesting it caters to both retail and high-volume traders with its cryptocurrency selection.

Both exchanges allow you to trade cryptocurrency derivatives, not just spot trading. This gives you more options for your trading strategy.

When deciding between these platforms, consider checking their current listings directly on their websites for the most up-to-date information on supported cryptocurrencies, as available coins can change as the market evolves.

Deepcoin Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Deepcoin and BloFin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees Comparison

| Exchange | Maker Fee | Taker Fee | VIP Discounts |

|---|---|---|---|

| Deepcoin | 0.05% | 0.06% | Yes |

| BloFin | 0.06% | 0.08% | Yes (based on VIP levels) |

BloFin offers trading fee discounts according to your VIP level. The higher your level, the more you save on each trade.

Deposit Fees

Both exchanges typically offer free crypto deposits, which is standard across most platforms in 2025.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. BloFin’s withdrawal fees are competitive but depend on the specific crypto asset you’re withdrawing.

Other Fee Considerations

- Deepcoin occasionally runs promotions with reduced fees for new users

- BloFin may offer lower fees for high-volume traders

- Both platforms charge network fees for blockchain transactions

You should check each exchange’s current fee schedule before trading, as rates may change based on market conditions.

Remember that the lowest fee exchange isn’t always the best choice. Consider other factors like security, available trading pairs, and platform reliability alongside the fee structure.

Deepcoin Vs BloFin: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Deepcoin and BloFin offer various order types to help you execute trades effectively.

BloFin provides several fundamental order types for traders. Their platform supports market orders for immediate execution at current prices and limit orders that execute only when the price reaches your specified level.

BloFin also lets you close positions directly on the K line chart or place reverse orders when you already have an open position. This makes managing your trades more convenient.

For futures traders, BloFin offers over 300 perpetual swap contracts with different order types to manage risk and maximize potential gains.

Deepcoin similarly provides market and limit orders as standard options. They also support stop-loss and take-profit orders to help protect your positions and lock in profits automatically.

Key Differences:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Basic Orders | Market, Limit | Market, Limit |

| Chart Trading | Position closing on K line | Available |

| Advanced Orders | Reverse orders | Stop-loss, Take-profit |

Both platforms cater to different trading styles, from beginners to advanced traders. Your choice might depend on which specific order types better suit your trading strategy.

The availability of these order types allows you to implement more sophisticated trading strategies on both platforms.

Deepcoin Vs BloFin: KYC Requirements & KYC Limits

When choosing a crypto exchange, KYC (Know Your Customer) requirements can be a deciding factor for many traders. Both Deepcoin and BloFin offer options for users who prefer minimal identity verification.

BloFin operates as an offshore exchange that generally doesn’t require KYC verification for basic trading. You can create an account and start trading without submitting personal documents.

However, BloFin does implement withdrawal limits for non-verified accounts. If you want to withdraw more than 20,000 USDT, you’ll need to complete personal verification.

Deepcoin also positions itself as a no-KYC or minimal-KYC platform. Like BloFin, it allows basic trading functionality without extensive identity verification.

Both exchanges follow this approach by operating outside strict regulatory jurisdictions, giving you more privacy when trading.

KYC Comparison Table:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Basic Trading | No KYC required | No KYC required |

| Withdrawal Limit Without KYC | 20,000 USDT | Similar limits apply |

| Location | Offshore | Offshore |

For traders prioritizing privacy, both exchanges offer suitable options. Remember that while avoiding KYC might seem convenient, it can sometimes limit your account’s functionality and withdrawal capabilities.

Trading on no-KYC platforms may also restrict access to certain features or higher trading tiers that are available to verified users.

Deepcoin Vs BloFin: Deposits & Withdrawal Options

When choosing between Deepcoin and BloFin for your crypto trading needs, deposit and withdrawal options are important factors to consider.

BloFin stands out by offering easy deposits and withdrawals in over 80 fiat currencies. This makes it accessible for traders from many different countries who want to use their local currency.

Deepcoin, on the other hand, has more limited fiat options but provides smooth crypto deposit and withdrawal processes for many major tokens.

Payment Methods Comparison:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Fiat Currencies | 80+ | Limited selection |

| Crypto Options | Extensive | Extensive |

| Processing Time | Fast | Average |

| Withdrawal Fees | Competitive | Varies by token |

Both platforms aim to make funding your account straightforward, but BloFin’s wider range of fiat options gives it an edge for beginners or those who prefer traditional banking methods.

For withdrawal speed, BloFin typically processes requests quickly, while Deepcoin’s times can vary based on network congestion.

Each platform has different fee structures for deposits and withdrawals. BloFin is known for competitive trading fees, which may extend to their withdrawal processes as well.

Remember to verify the specific deposit and withdrawal methods available in your region, as options can change based on your location and local regulations.

Deepcoin Vs BloFin: Trading & Platform Experience Comparison

When comparing Deepcoin and BloFin’s trading platforms, several key differences become apparent. Both exchanges offer robust trading experiences but cater to slightly different trader needs.

BloFin provides deep liquidity and advanced trading features that appeal to serious traders. Their platform includes comprehensive analytical tools and supports a wide range of order types for precise trade execution.

Deepcoin focuses on an intuitive user interface that works well for both beginners and experienced traders. Their platform offers simplified trading views alongside more complex options.

Trading Fees Comparison:

| Fee Type | Deepcoin | BloFin |

|---|---|---|

| Maker Fee | 0.02-0.05% | 0.02-0.04% |

| Taker Fee | 0.04-0.07% | 0.04-0.06% |

| Withdrawal Fee | Variable | Variable |

BloFin stands out with its rewards program that includes daily tasks, giveaways, and contests. These incentives can offset trading costs for active users.

Both platforms offer mobile apps, but BloFin’s app receives higher ratings for stability and feature parity with the desktop version.

For security, both exchanges implement two-factor authentication and cold storage solutions. BloFin edges ahead slightly with more transparent security protocols and regular third-party audits.

Trading pairs are abundant on both platforms, though BloFin typically lists new tokens faster than Deepcoin. This can be an advantage if you’re looking to trade emerging cryptocurrencies early.

Deepcoin Vs BloFin: Liquidation Mechanism

When trading on cryptocurrency exchanges with leverage, understanding liquidation mechanisms is crucial for managing risk. Both Deepcoin and BloFin have systems in place to handle positions that fall below maintenance margin requirements.

BloFin uses an Insurance Fund to protect against massive liquidation events. This fund combines BloFin’s own capital with fees collected from liquidated positions, creating a buffer against market volatility.

Recent reports indicate some traders have experienced issues with BloFin’s liquidation practices. Some users claim the platform has adjusted margin requirements and liquidation thresholds without adequate notice, resulting in unexpected liquidations.

Deepcoin operates a similar derivative trading platform with perpetual and CFD contracts. Their liquidation system aims to protect both traders and the platform from excessive losses when positions move against traders.

Key Differences:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Transparency | Some user complaints | Standard industry practices |

| Liquidation Warning | Variable | Typically provides notices |

Your trading style and risk tolerance should guide your choice between these platforms. If you value predictable liquidation thresholds, examine both platforms’ current policies and user feedback.

Always monitor your positions closely and maintain adequate margin to avoid liquidation on either platform. Setting stop-loss orders can provide additional protection against sudden market movements.

Deepcoin Vs BloFin: Insurance

When comparing Deepcoin and BloFin, insurance policies are a key factor to consider for your crypto trading safety. Both exchanges offer protection, but with notable differences.

BloFin provides a comprehensive insurance fund to protect users against unexpected market events. Based on recent 2025 data, BloFin’s insurance coverage helps secure your assets if the exchange faces liquidity issues or security breaches.

Deepcoin also maintains an insurance system, though its coverage details are less widely advertised than BloFin’s. This insurance primarily focuses on protecting against unauthorized access and system failures.

Key Insurance Differences:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Coverage Amount | Higher overall limit | More modest protection |

| Focus Areas | Trading losses, hacks, system failures | Primarily security breaches |

| Transparency | Clear policy documentation | Less detailed public information |

| Claim Process | Streamlined procedure | More complex requirements |

You should note that neither exchange’s insurance covers all possible scenarios. Market losses from your trading decisions aren’t covered by either platform.

BloFin’s insurance fund appears more robust for traders seeking maximum protection. However, Deepcoin’s security measures may reduce the likelihood of needing to make claims in the first place.

Before choosing either platform, carefully review their current insurance terms as policies can change over time with evolving market conditions.

Deepcoin Vs BloFin: Customer Support

When trading crypto, reliable customer support can make a big difference in your experience. Both Deepcoin and BloFin offer support services, but they differ in a few key ways.

Deepcoin provides customer support mainly through email tickets and social media channels. Response times vary depending on the issue and current demand.

BloFin offers more comprehensive support options. According to search results, they feature a 24/7 live chat service alongside email support. Many users in BloFin reviews express satisfaction with their customer service experience.

For urgent issues, BloFin’s live chat may give them an edge over Deepcoin. You can get answers to your questions immediately rather than waiting for an email response.

Both platforms offer support in multiple languages, which is helpful if English isn’t your first language.

Support Comparison Table:

| Feature | Deepcoin | BloFin |

|---|---|---|

| Live Chat | Limited | 24/7 Available |

| Email Support | Yes | Yes |

| Response Time | Variable | Generally quick |

| User Satisfaction | Mixed | Mostly positive |

If you’re new to crypto trading, strong customer support becomes even more important. BloFin’s more accessible support system might be better suited for beginners who need quick answers.

Remember that support quality can change over time, so checking recent user reviews is always a good idea before choosing a platform.

Deepcoin Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and BloFin offer strong security features, but they differ in specific ways.

BloFin emphasizes robust security measures and transparency. The exchange implements multi-layer protection systems including two-factor authentication (2FA) and cold storage for most user assets.

Deepcoin is known for being secure and reliable according to comparison data. They also use industry-standard security protocols to protect user funds.

Key Security Features Comparison:

| Feature | BloFin | Deepcoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | Limited | Yes |

| Security Audits | Regular | Regular |

BloFin positions itself as an exchange that “prioritizes security and transparency” with clear fee structures. This focus on transparency helps users feel more confident about their fund safety.

For identity verification, Deepcoin offers KYC options while BloFin appears to provide no-KYC trading according to recent information. This might be important if you value privacy.

Both platforms use encryption technologies to secure transactions and personal data. However, you should always use strong passwords and enable all available security features regardless of which platform you choose.

Remember to research the latest security updates for both exchanges before making your decision, as security features are frequently updated in the crypto space.

Is Deepcoin Safe & Legal To Use?

Deepcoin operates in a legal gray area for many users, especially those in the United States. Based on the search results, Deepcoin does not restrict users from different countries, but this doesn’t mean it’s legal everywhere.

Important safety concerns:

- Not regulated in the USA

- No asset loss prevention for US traders

- No security guarantees

- Operated by Clear Markets Ltd., registered in Intershore Chambers

If you’re a US resident, using Deepcoin comes with significant risks. The platform explicitly doesn’t offer trading accounts to US residents.

Unlike regulated exchanges, Deepcoin can’t provide the same level of protection for your funds. Without regulatory oversight, you have little recourse if something goes wrong with your account or funds.

For non-US users, the platform offers trading across different markets. However, the lack of strong regulatory backing still presents risks compared to more established exchanges.

Before using Deepcoin, you should:

- Check if it’s legal in your jurisdiction

- Understand you trade without consumer protections

- Consider alternatives with stronger regulatory compliance

- Assess your personal risk tolerance

Trading on unregulated platforms always carries extra risk. Your funds could be vulnerable to hacks, insolvency issues, or other problems with limited legal protection.

Is BloFin Safe & Legal To Use?

BloFin demonstrates a strong commitment to security and regulatory compliance in the cryptocurrency market. The platform appears to be legitimate based on available information as of March 2025.

Security is a priority for BloFin, which helps protect users’ funds and personal information. The exchange implements various security measures to safeguard assets on their platform.

While BloFin seems to be a safe option for cryptocurrency trading, you should always practice caution. Enable all available security features like two-factor authentication (2FA) and use strong, unique passwords for your account.

BloFin operates as a no-KYC (Know Your Customer) exchange, offering both spot and futures trading. This means you can trade without submitting identity verification documents.

Important safety considerations:

- Enable all security features

- Use complex passwords

- Keep your recovery phrases offline

- Be cautious of phishing attempts

- Regularly monitor your account activity

The exchange provides access to deep liquidity and advanced trading features that may appeal to both beginners and experienced traders.

Remember that cryptocurrency trading involves risk, regardless of the platform you choose. Always do your own research and only invest funds you can afford to lose.

Frequently Asked Questions

Traders comparing Deepcoin and BloFin need answers to several key questions about features, fees, and reliability. Both platforms offer distinctive advantages for cryptocurrency trading that impact user experience and profitability.

What factors should be considered when comparing Deepcoin and BloFin?

When comparing these exchanges, evaluate their trading fees, available cryptocurrencies, and user interface design. Security measures are crucial, including two-factor authentication and cold storage policies.

Trading tools like leverage options, chart functionality, and order types significantly impact your trading experience. Mobile app availability and quality matter for trading on the go.

Regulatory compliance and the exchange’s operational history should factor into your decision, as these elements affect long-term reliability.

Which platform offers better pricing and fees between Deepcoin and BloFin?

Fee structures vary between the platforms, with BloFin typically offering competitive maker-taker fees for spot trading. Their fee schedule often rewards higher trading volume with discounts.

Deepcoin may have different withdrawal fee structures, which can impact your overall costs depending on how frequently you move funds off the exchange.

Both platforms occasionally offer fee discounts through trading competitions or holding their native tokens, so check current promotions before deciding.

What are the top differentiators when evaluating the best crypto derivatives exchange?

Liquidity depth is a critical differentiator, as it affects order execution and slippage. BloFin stands out with its high liquidity and over 300 perpetual swap contracts.

Advanced trading features like cross-margin or isolated margin options, stop-loss mechanisms, and take-profit tools vary between platforms.

Risk management tools, including liquidation prevention mechanisms and insurance funds, protect traders during volatile market conditions.

How do Deepcoin and BloFin rank among the top crypto exchanges in terms of user trust?

Trust indicators include transparent company information, clear regulatory status, and published security protocols. BloFin has built a reputation for reliable trading experiences and security.

User reviews and community feedback provide real-world insights into exchange reliability. Check independent review sites for current user experiences.

Operational history and the exchange’s response to past incidents or market volatility can demonstrate their stability and commitment to users.

Can you list the key features of the best derivative trading platforms currently available?

Top derivative platforms offer high leverage options, typically up to 100x or more, allowing for amplified position sizes. They provide diverse contract types including perpetuals, futures, and options.

Advanced order types such as conditional orders, OCO (One-Cancels-the-Other), and trailing stops enhance trading precision.

Copy trading functionality, like that offered by BloFin, allows newer traders to mirror successful traders’ strategies automatically.

What is the reputation of BloFin’s customer service compared to Deepcoin’s?

BloFin has developed a reputation for providing responsive customer support through multiple channels including live chat and email. Their support team handles both basic and complex trading questions.

Response times vary between platforms, with some users reporting faster resolution times with one exchange over the other.

Both exchanges offer knowledge bases and tutorials, but the quality and comprehensiveness of these resources differ. Check recent user feedback for the most current service quality assessments.

BloFin Vs Deepcoin Conclusion: Why Not Use Both?

Both BloFin and Deepcoin offer unique advantages for crypto traders. BloFin provides robust security measures, transparent fee structures, and various ways to earn crypto. Its interface is designed for traders seeking deep liquidity and advanced trading features.

Deepcoin stands out with its “derivatives-first” approach, allowing access to multiple trading pairs and high-end tools. This makes it particularly attractive for traders focused on derivative markets.

However, be aware of potential issues. Some users have reported that BloFin adjusted margin requirements and liquidation thresholds without proper notice. Geographic restrictions may also limit access for some users.

Why consider using both platforms?

- Risk diversification – Spreading your trading across platforms reduces exposure to any single exchange’s issues

- Feature optimization – Use each platform for its strengths

- Market opportunities – Access more trading pairs and products

You might use BloFin for its earning opportunities and security features, while turning to Deepcoin for its derivatives trading tools. This dual approach gives you flexibility.

Remember to carefully review the fee structures of both platforms to maximize your trading efficiency. Also check their availability in your region before setting up accounts.

By strategically using both exchanges, you can create a more comprehensive trading strategy that leverages the best aspects of each platform.