Choosing the right cryptocurrency exchange is key for your trading success. When comparing Deepcoin vs BitMEX, it’s important to look at their features, fees, and overall performance.

BitMEX scores higher with an overall rating of 6.0 compared to Deepcoin, making it the stronger option for many traders. However, Deepcoin still handles impressive trading volume, with recent data showing over $12 billion in transactions.

Both platforms offer cryptocurrency derivatives trading, but they differ in important ways. BitMEX has established itself as one of the major players in the crypto derivatives market, while Deepcoin is working to build its reputation. Understanding these differences will help you pick the platform that best fits your trading needs and experience level.

Deepcoin vs BitMEX: At A Glance Comparison

When choosing between Deepcoin and BitMEX, understanding their key differences can help you make an informed decision for your crypto trading needs.

Based on overall scores, BitMEX ranks higher with a score of 6.0 compared to Deepcoin. This indicates better performance across various metrics that matter to traders.

Trading Features Comparison:

| Feature | BitMEX | Deepcoin |

|---|---|---|

| Established | 2014 | 2018 |

| Trading Focus | Derivatives, futures | Spot and derivatives |

| Leverage Options | Up to 100x | Up to 125x |

| User Interface | Advanced, technical | More beginner-friendly |

| Mobile App | Yes | Yes |

BitMEX specializes in Bitcoin products with various contract lengths and settlement options. This makes it particularly attractive if you’re focused on Bitcoin trading.

Deepcoin offers a wider range of cryptocurrencies but doesn’t have the same level of trust score as BitMEX according to exchange ranking systems.

Fee Structure:

- BitMEX uses a maker-taker fee model with competitive rates for high-volume traders

- Deepcoin offers slightly higher fees but may include more promotions for new users

Security is robust on both platforms, but BitMEX has been in the industry longer, weathering various market cycles and establishing stronger credibility.

Your trading experience level should factor into your choice. BitMEX caters to more experienced traders with its advanced features, while Deepcoin might be more accessible if you’re newer to crypto trading.

Deepcoin vs BitMEX: Trading Markets, Products & Leverage Offered

Deepcoin and BitMEX offer different cryptocurrency trading options for investors. Understanding these differences can help you choose the platform that best fits your trading needs.

BitMEX is known for its Bitcoin derivatives trading. It allows you to trade Bitcoin and other cryptocurrencies with up to 100x leverage, which means you can control large positions with a small amount of capital.

Deepcoin provides a wider range of trading products including spot trading, futures, and options. Its leverage offerings are competitive, though typically not as high as BitMEX’s maximum 100x leverage.

Available Products Comparison:

| Feature | BitMEX | Deepcoin |

|---|---|---|

| Futures Trading | Yes | Yes |

| Spot Trading | Limited | Yes |

| Options | No | Yes |

| Maximum Leverage | 100x | Up to 50x |

BitMEX focuses primarily on perpetual contracts and futures. These products allow you to speculate on price movements without owning the actual cryptocurrency.

Deepcoin offers a more diverse trading environment with spot markets where you can buy and hold actual cryptocurrencies. This gives you more flexibility if you want to both invest long-term and trade derivatives.

The trading interfaces differ significantly between the platforms. BitMEX has a reputation for a more complex interface that caters to experienced traders.

When considering trading volume, BitMEX has historically maintained strong liquidity, especially for Bitcoin derivatives. This means your larger orders may experience less slippage compared to smaller exchanges.

Deepcoin vs BitMEX: Supported Cryptocurrencies

When choosing between Deepcoin and BitMEX, the range of supported cryptocurrencies can influence your decision significantly.

BitMEX focuses primarily on Bitcoin and offers futures contracts for a select group of major cryptocurrencies. Their platform supports trading for Bitcoin, Ethereum, Litecoin, XRP, and a few other established coins.

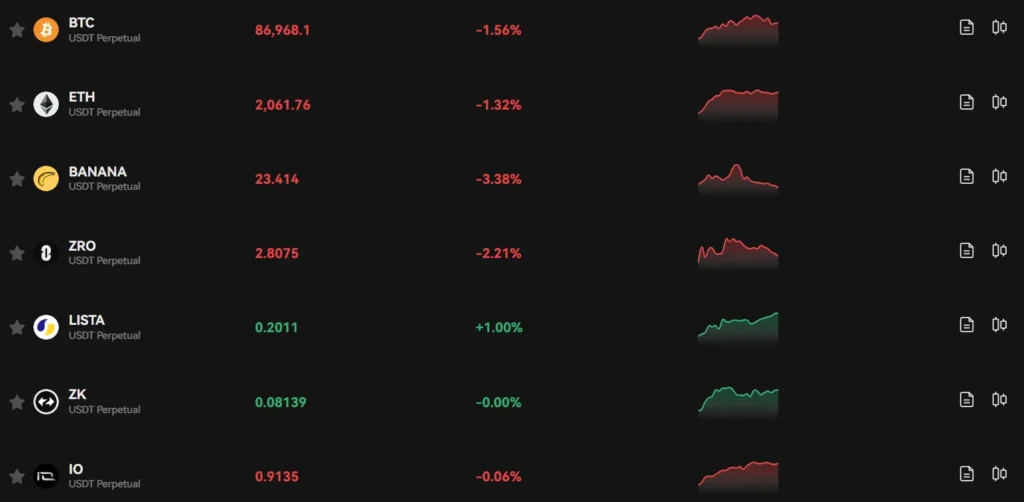

Deepcoin typically offers a wider selection of cryptocurrencies. They support mainstream options like Bitcoin and Ethereum, but also include more altcoins and emerging tokens compared to BitMEX.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Bitcoin | Ethereum | XRP | Litecoin | Altcoins |

|---|---|---|---|---|---|

| BitMEX | ✓ | ✓ | ✓ | ✓ | Limited |

| Deepcoin | ✓ | ✓ | ✓ | ✓ | Extended |

BitMEX built its reputation on Bitcoin futures trading, which explains their more focused approach. Their name itself (Bitcoin Mercantile Exchange) highlights this specialization.

Deepcoin aims to provide more variety for traders interested in diversifying their cryptocurrency derivatives portfolio. This makes it potentially more appealing if you want to trade beyond the most established coins.

Both platforms regularly evaluate adding new cryptocurrencies, so it’s worth checking their current offerings before making your final decision. The cryptocurrency selection might impact your trading strategy and potential diversification options.

Deepcoin vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Deepcoin and BitMEX, understanding their fee structures is essential for your trading strategy.

Trading Fees

Deepcoin offers a straightforward fee structure with a fixed 0.1% trading fee for both makers and takers. This flat rate makes it easy to calculate your costs.

BitMEX has a different approach with a maker-taker model. While exact rates may vary, BitMEX typically charges less for makers (those adding liquidity) and more for takers (those removing liquidity).

Minimum Order Requirements

Deepcoin has specific minimum order amounts you must meet when trading. This is important to consider if you plan to start with smaller trades.

BitMEX also implements minimum order sizes that vary by cryptocurrency pair.

Deposit Fees

Both exchanges generally don’t charge fees for cryptocurrency deposits, which is standard across most crypto exchanges.

Withdrawal Fees

Withdrawal fees vary based on the cryptocurrency you’re withdrawing. Both platforms charge network fees, but the exact amounts differ.

BitMEX withdrawal fees tend to be competitive within the industry.

Fee Discounts

Both exchanges may offer fee discounts based on trading volume or token holdings. As you trade more, you might qualify for lower fees on either platform.

Before choosing between these exchanges, consider how their fee structures align with your trading volume and preferred cryptocurrencies.

Deepcoin vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in executing your strategy effectively. Both Deepcoin and BitMEX offer various order types to help you trade with precision.

BitMEX provides several order options for traders. Its main types include Limit orders, which let you set a specific price for buying or selling. These are helpful when you want to control the maximum or minimum price you’re willing to trade at.

BitMEX also offers Take Profit orders in two forms: Take Profit Market Orders and Take Profit Limit Orders. The Market version executes immediately when the market reaches your trigger price.

Market orders on BitMEX execute at the best available price, providing quick entry or exit from positions. This is useful during fast-moving market conditions.

Deepcoin also provides standard order types like Limit and Market orders for its users. However, based on available information, BitMEX appears to have a more diverse range of specialized order types for advanced trading strategies.

Both platforms designed their order systems to accommodate various trading styles, from beginners to experienced traders. The right choice depends on your specific trading needs and experience level.

When choosing between these exchanges, consider which order types best match your trading strategy. BitMEX seems to offer more technical options for precise trade execution.

Deepcoin vs BitMEX: KYC Requirements & KYC Limits

When trading cryptocurrencies, KYC (Know Your Customer) requirements can significantly impact your experience. BitMEX and Deepcoin take different approaches to identity verification.

BitMEX has somewhat conflicting information regarding its KYC policies. Based on the search results, some sources suggest BitMEX doesn’t require KYC verification for withdrawals. However, other information indicates BitMEX was planning to introduce KYC measures.

Deepcoin appears to operate with fewer restrictions regarding documentation. According to the search results, Deepcoin is described as a global crypto exchange without significant restrictions or document requirements that might negatively affect traders’ experience.

For users prioritizing privacy, Deepcoin may be the more appealing option. The exchange seems to fall into the category of platforms with minimal KYC requirements.

BitMEX KYC Overview:

- Historically allowed Bitcoin deposits and withdrawals without extensive verification

- May have implemented or planned to implement KYC measures

- Uses Bitcoin as the primary currency for deposits and withdrawals

Deepcoin KYC Overview:

- Operates with minimal documentation requirements

- Provides a more restriction-free trading environment

- Appeals to users seeking fewer identity verification hurdles

Your trading needs and privacy preferences should guide your choice between these exchanges. If maintaining anonymity is important to you, Deepcoin’s approach might better align with your priorities.

Deepcoin vs BitMEX: Deposits & Withdrawal Options

When trading crypto, how easily you can move your money matters. Both Deepcoin and BitMEX offer various options, but they differ in important ways.

Deepcoin supports deposits and withdrawals in multiple cryptocurrencies. You can move funds in and out using popular coins like Bitcoin, Ethereum, and various stablecoins. The platform processes most transactions quickly, usually within 1-2 hours.

BitMEX primarily focuses on Bitcoin for deposits and withdrawals. While this simplifies the process, it limits your options compared to Deepcoin. BitMEX typically processes withdrawals once daily at a scheduled time.

Withdrawal Fees Comparison:

| Platform | Bitcoin Fee | Processing Time |

|---|---|---|

| Deepcoin | Variable | 1-2 hours |

| BitMEX | 0.0005 BTC | Once daily |

Neither exchange directly supports fiat deposits (USD, EUR, etc.). This means you’ll need to already own crypto to begin trading on either platform.

BitMEX requires all users to complete verification before withdrawals, which enhances security but might delay access to your funds. Deepcoin also implements security measures but generally provides more flexibility with withdrawal options.

For traders who work with multiple cryptocurrencies, Deepcoin’s wider range of deposit and withdrawal options provides greater convenience. If you primarily trade Bitcoin, BitMEX’s focused approach might be sufficient for your needs.

Deepcoin vs BitMEX: Trading & Platform Experience Comparison

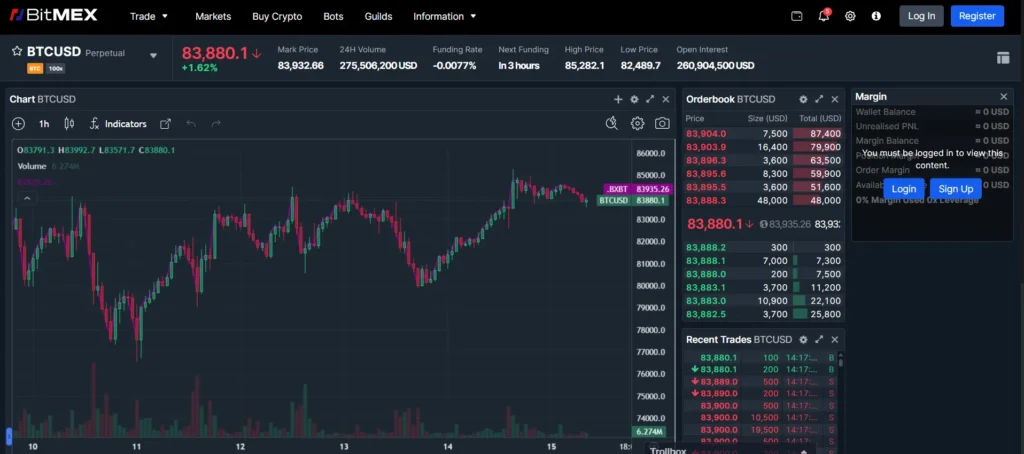

BitMEX and Deepcoin offer different trading experiences for cryptocurrency users. BitMEX has a higher overall trust score of 6.0 compared to Deepcoin, according to BitDegree’s evaluation.

BitMEX specializes in Bitcoin products with various contract lengths and settlement options. The platform is known for its advanced trading features that appeal to experienced traders.

Deepcoin positions itself as a multipurpose cryptocurrency exchange. It aims to provide users with an ultimate trading experience and serves as a gateway to emerging cryptocurrency opportunities.

When trading on BitMEX, you’ll encounter a platform designed primarily for derivatives trading. The interface can be complex for beginners but offers powerful tools for technical analysis and trade execution.

Deepcoin’s platform is built to be more accessible while still offering advanced features. You’ll find both spot trading and derivatives options available within a unified interface.

Both exchanges provide mobile apps, but their user experiences differ. BitMEX tends to maintain its technical focus on mobile, while Deepcoin aims for a more streamlined experience.

Trading fees vary between the platforms. You should compare their fee structures based on your expected trading volume and preferred cryptocurrency pairs.

Platform reliability is another important factor. BitMEX has been operating longer, which may contribute to its higher trust score, while Deepcoin is working to build its reputation in the market.

Deepcoin vs BitMEX: Liquidation Mechanism

Liquidation happens when exchanges forcefully close a trader’s leveraged position due to losses that approach the initial margin. Both Deepcoin and BitMEX have their own approaches to this process.

BitMEX uses an index price system for liquidations rather than market price. This gives traders some protection against market manipulation and price spikes. Your position on BitMEX won’t be liquidated unless the actual index price moves against your position.

Some traders have reported issues with BitMEX’s liquidation system. In rare cases, profitable positions may be liquidated if one of BitMEX’s two indexes experiences technical problems.

Deepcoin’s liquidation mechanism appears more standard, though it scores lower overall compared to BitMEX’s 6.0 rating according to comparison data.

When trading on either platform, you should understand their liquidation mechanisms to protect your investments. Here are key points to remember:

- Set stop losses to exit positions before liquidation occurs

- Monitor your margin levels carefully

- Use lower leverage to reduce liquidation risk

- Understand each platform’s specific liquidation triggers

BitMEX’s index-based liquidation offers some advantages against market manipulation, but technical issues with their indexes can sometimes cause problems for traders.

Always maintain sufficient margin in your account and avoid using maximum leverage to prevent sudden liquidations on either platform.

Deepcoin vs BitMEX: Insurance

When trading cryptocurrencies, insurance protection is crucial for your peace of mind. Both Deepcoin and BitMEX offer some form of insurance, but with key differences.

BitMEX maintains an insurance fund that’s designed to prevent auto-deleveraging of profitable traders’ positions. This fund has grown substantially over time and serves as a buffer against market volatility.

According to the search results, Deepcoin offers regulatory deposit insurance, though specific details about the coverage amount and conditions aren’t clearly outlined.

Insurance coverage can be a deciding factor when choosing an exchange. It protects your funds in case of unexpected events like hacks or platform failures.

BitMEX’s insurance fund is primarily focused on derivatives trading protection rather than covering actual user deposits against exchange insolvency or security breaches.

Neither exchange provides the comprehensive deposit insurance that you might find with traditional financial institutions. This is a common limitation in the cryptocurrency industry.

When evaluating these platforms, you should consider:

- Insurance fund size

- What exactly is covered

- Conditions for receiving compensation

- Track record of handling incidents

Remember that even with insurance protection, you should practice good security habits like using strong passwords and two-factor authentication to protect your crypto assets.

Deepcoin vs BitMEX: Customer Support

When choosing a cryptocurrency exchange, customer support can be a deciding factor. Both Deepcoin and BitMEX offer support options, but they differ in availability and methods.

Deepcoin provides live chat support with agents available to help you immediately. This instant access to help can be valuable when you face urgent issues with your account or trades.

BitMEX takes a different approach with their support system. They primarily use a ticket-based email support structure. You submit your question or problem, and their team responds within their working hours.

Response times vary between the two platforms. Deepcoin typically offers faster resolution with their instant chat feature. BitMEX might take longer to respond, sometimes hours or even days depending on their queue.

Both exchanges provide knowledge bases and FAQs to help you solve common problems without contacting support. These resources cover topics like account verification, deposit methods, and trading basics.

Language support is another important aspect. BitMEX offers support in English and a few other major languages. Deepcoin appears to focus on English support with some additional language options.

Neither platform currently offers phone support, which is worth noting if you prefer speaking with representatives directly.

When trading during volatile market conditions, fast support can be crucial. Deepcoin’s live chat gives them an advantage in emergency situations where immediate assistance is needed.

Deepcoin vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and BitMEX offer various security features to protect your assets, but they differ in some important ways.

BitMEX has built a reputation as a professional derivatives exchange with strong security protocols. They use multi-signature wallets to store funds and maintain most assets in cold storage, keeping them offline and away from potential hackers.

BitMEX also offers two-factor authentication (2FA) to add an extra layer of protection to your account. This means you’ll need both your password and a temporary code to log in.

Deepcoin, while newer to the market, also emphasizes security. They provide similar 2FA options and implement SSL encryption to protect your data during transmission.

Key Security Features Comparison:

| Feature | BitMEX | Deepcoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Most funds | Partial |

| Multi-signature Wallets | ✓ | Limited |

| Insurance Fund | Large | Smaller |

BitMEX maintains a substantial insurance fund to protect traders against auto-deleveraging events. This adds an extra layer of security for your trading positions.

It’s worth noting that BitMEX has faced regulatory challenges in the past, which some users consider when evaluating platform security. The exchange has worked to address these concerns by improving compliance measures.

Both platforms require KYC (Know Your Customer) verification, helping to prevent fraud and unauthorized account access. This protects you and other users from potential scams.

Is Deepcoin A Safe & Legal To Use?

Deepcoin is considered one of the safer cryptocurrency exchanges available today. It features a self-developed third-generation security system to protect user assets and information.

The exchange implements standard security measures like two-factor authentication (2FA) and encryption protocols to safeguard your account.

Regarding legality, Deepcoin does allow US investors on its platform. However, this comes with an important caveat – US users will have no fund protection.

This lack of legal protection is a significant risk factor you should consider before trading. If something goes wrong, you may have limited recourse.

Key Security Features:

- Self-developed security system

- Two-factor authentication

- Encrypted transactions

Legal Considerations:

- Available to US traders

- No fund protection for US users

- Potential regulatory uncertainty

When comparing safety with BitMEX, both exchanges face similar risks including potential hacking, regulatory interference, and limited legal protection in certain jurisdictions.

Always use strong passwords, enable all security features, and consider keeping only trading amounts on the exchange. For long-term storage, hardware wallets offer better security than keeping funds on any exchange.

Remember that cryptocurrency exchanges operate in a rapidly evolving regulatory landscape. Rules can change quickly, potentially affecting your ability to access or withdraw funds.

Is BitMEX A Safe & Legal To Use?

BitMEX has faced some regulatory challenges in recent years. In 2020, the exchange ran into trouble with US authorities for violating derivatives trading laws by allowing US customers on its platform.

Since those legal issues, BitMEX has worked hard to rebuild its reputation. They’ve enhanced their compliance and security features to meet regulatory standards.

Today, BitMEX operates with better compliance protocols than before. However, it’s important to note that BitMEX is not available for US residents. If you live in the US, you cannot legally use this platform.

For users in permitted countries, BitMEX implements strong security measures:

- Two-factor authentication (2FA)

- Address whitelisting

- Cold storage for funds

- Insurance fund to protect against losses

BitMEX now requires all users to complete KYC (Know Your Customer) verification to use its services. This helps prevent illegal activities like money laundering.

When deciding if BitMEX is safe for you, consider these factors:

- Where you live (legal jurisdiction)

- Your trading experience

- Risk tolerance

- Security needs

The platform is best suited for experienced traders who understand derivatives trading. If you’re new to crypto, other exchanges might be more appropriate for your needs.

Frequently Asked Questions

Many traders have questions about differences between Deepcoin and BitMEX platforms. These exchanges offer distinct features, security measures, and trading experiences that affect your crypto derivatives trading options.

What are the key differences in features between Deepcoin and BitMEX?

BitMEX specializes in crypto derivatives with over 100 products including Perpetual Swaps, Futures, Pre-Launch futures, and Prediction Markets contracts. The platform is known for its advanced trading features and sophisticated tools.

Deepcoin offers a similar range of derivatives products but with a different interface and user experience. BitMEX only accepts Bitcoin deposits, while Deepcoin supports multiple cryptocurrencies for funding your account.

BitMEX has established itself as a pioneer in crypto derivatives trading with more mature trading tools. Its mark price system helps prevent unfair liquidations during market volatility.

Which platform, Deepcoin or BitMEX, offers superior security for crypto derivatives trading?

Both exchanges implement security measures to protect user funds, but they approach security differently. BitMEX has been operating longer and has weathered various market cycles, giving it more time to strengthen security protocols.

BitMEX uses multi-signature wallets and stores most user funds in cold storage. The platform has faced regulatory scrutiny which has led to enhanced compliance and security measures.

Deepcoin is newer to the market and continues to build its security reputation. When choosing between platforms, you should research recent security audits and insurance policies for both exchanges.

How does the liquidity and trading volume compare between Deepcoin and BitMEX?

BitMEX historically has maintained strong liquidity, especially for Bitcoin perpetual contracts. As one of the original crypto derivatives platforms, it attracts significant trading volume from experienced traders.

Deepcoin reports growing liquidity but generally has lower trading volumes compared to BitMEX. This can result in wider spreads for some trading pairs on Deepcoin, particularly for altcoin derivatives.

The difference in liquidity becomes most noticeable during high market volatility when order execution speed and slippage matter most.

What are the advantages of using Deepcoin over BitMEX for futures crypto trading?

Deepcoin often appeals to newer traders with a potentially more intuitive user interface. The platform might offer more competitive fees for certain trading pairs compared to BitMEX.

Deepcoin supports more cryptocurrencies for deposits and withdrawals, unlike BitMEX which only accepts Bitcoin. This makes it easier to diversify your trading without converting everything to BTC first.

Some traders report that Deepcoin offers more promotional activities and trading competitions with rewards, which might appeal to active traders looking for additional incentives.

Can users from the USA legally trade on Deepcoin and BitMEX, and how do the services differ?

Neither BitMEX nor Deepcoin currently accepts users from the United States due to regulatory constraints. Both platforms actively block US IP addresses and require KYC verification to prevent US traders from accessing their services.

The restrictions stem from US regulations regarding derivatives trading and the platforms’ lack of registration with US regulatory bodies like the CFTC. Attempting to bypass these restrictions can lead to account termination.

For US traders, regulated alternatives like CME Bitcoin futures or US-licensed exchanges offer compliant options for derivatives trading.

What have users reported about the customer service experience when comparing Deepcoin and BitMEX?

BitMEX offers support through their help center, email tickets, and FAQ section. Users generally report professional responses, though sometimes with longer wait times during peak periods or market volatility.

Deepcoin customer service experiences vary, with some users reporting faster initial response times. Both platforms primarily use ticket-based support systems rather than live chat for complex issues.

Response quality and speed often depend on the complexity of your issue and current market conditions. For technical problems or account security concerns, both exchanges prioritize verification steps before resolving issues.

BitMEX vs Deepcoin Conclusion: Why Not Use Both?

BitMEX scores higher overall with a 6.0 rating compared to Deepcoin, according to recent comparisons. This doesn’t mean you should dismiss Deepcoin entirely.

BitMEX offers unique advantages as the first exchange to launch perpetual contracts. You don’t need to worry about rolling positions at fixed future points, which simplifies certain trading strategies.

However, BitMEX has experienced flash crashes in the past. These incidents typically occur when users make mistakes with their orders, potentially affecting your investments.

It’s worth noting that BitMEX is considered an advanced trading platform. It’s not designed for everyone, especially beginners in the cryptocurrency space.

Key considerations:

- BitMEX has regulatory challenges, especially regarding US users

- Deepcoin may offer different fee structures and features

- Your trading needs should determine which platform works best

Why use both platforms?

- Diversify your trading options

- Access different coin offerings

- Take advantage of varying fee structures

- Protect yourself from platform-specific outages

You might find that each platform serves different needs in your trading strategy. Using both could give you more flexibility and backup options when one platform experiences issues.

Remember to consider regulatory compliance based on your location. BitMEX faced enforcement action related to US users accessing their platform.