Looking for a reliable crypto exchange can be challenging. With so many options available, comparing platforms like Deepcoin and Bitget is essential to find the right fit for your trading needs.

Both Deepcoin and Bitget offer cryptocurrency trading services but differ in important aspects like fees, available cryptocurrencies, and user experience. As of March 2025, these exchanges continue to compete for traders’ attention with their unique features and offerings.

You’ll want to consider factors such as security measures, supported trading types, deposit methods, and overall user ratings before making your choice. This comparison will help you understand the key differences between these popular exchanges so you can make an informed decision.

Deepcoin Vs Bitget: At A Glance Comparison

When choosing between Deepcoin and Bitget exchanges, understanding their key differences can help you make the right choice for your crypto trading needs.

Overall Rating: Bitget appears to have a higher user score compared to Deepcoin based on available reviews. This suggests better overall user experience with Bitget.

Available Cryptocurrencies:

- Bitget: Approximately 500 cryptocurrencies with around 800 trading pairs

- Deepcoin: Fewer options than Bitget, though exact numbers aren’t specified

Trading Features:

| Feature | Deepcoin | Bitget |

|---|---|---|

| Trading Types | Spot, derivatives | Spot, derivatives |

| User Interface | Basic | More intuitive |

| Mobile Support | Available | Available |

Fees Structure: Both exchanges have competitive fee structures, but detailed comparison would require examining their specific trading, withdrawal, and deposit fees.

Security Measures: Both platforms implement security protocols, though specifics aren’t detailed in the search results.

Deposit Methods: Both exchanges offer various deposit options, but you should check their websites for the most current methods supported in your region.

Remember that exchange features can change rapidly in the crypto world. The comparison above reflects information available as of March 2025.

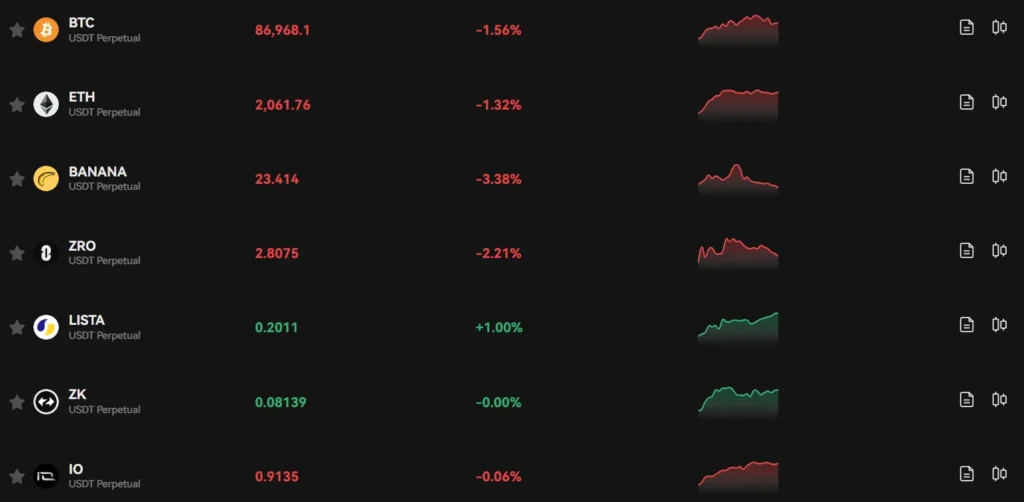

Deepcoin Vs Bitget: Trading Markets, Products & Leverage Offered

Deepcoin and Bitget both offer a variety of trading options for cryptocurrency enthusiasts. These platforms cater to different trading needs with various products and leverage capabilities.

Trading Markets:

Both exchanges support spot trading for numerous cryptocurrencies. Bitget lists more cryptocurrencies overall, giving you access to a wider range of assets. Deepcoin focuses more on popular tokens but still maintains a diverse selection.

Products Available:

| Feature | Deepcoin | Bitget |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Copy Trading | Limited | Extensive |

| Options Trading | ✓ | Limited |

| Margin Trading | ✓ | ✓ |

Deepcoin has established itself as a multipurpose cryptocurrency exchange with strong derivatives offerings. The platform provides you with advanced trading tools specifically designed for futures trading.

Bitget stands out with its social and copy trading features. You can follow successful traders and automatically copy their strategies, making it ideal if you’re newer to trading.

Leverage Options:

Deepcoin offers up to 125x leverage on certain futures contracts, allowing for potentially higher returns but with increased risk. Bitget provides similar high leverage options at up to 100x for futures trading.

Risk management tools are available on both platforms to help you control potential losses when using high leverage. These include stop-loss orders and liquidation warnings.

Deepcoin Vs Bitget: Supported Cryptocurrencies

When choosing between Deepcoin and Bitget, the range of cryptocurrencies available for trading is a key factor to consider.

Deepcoin offers access to major cryptocurrencies and a growing selection of altcoins. You can trade popular options like Bitcoin, Ethereum, and other established tokens on their platform.

Bitget generally provides a wider selection of cryptocurrencies. The platform supports hundreds of digital assets, giving you more options for diversifying your crypto portfolio.

Comparison of Supported Cryptocurrencies:

| Feature | Deepcoin | Bitget |

|---|---|---|

| Major Coins | Bitcoin, Ethereum, etc. | Bitcoin, Ethereum, etc. |

| Total Cryptocurrencies | Moderate selection | Larger selection |

| New/Emerging Tokens | Limited availability | More frequent additions |

Both exchanges support direct purchases of major cryptocurrencies. However, Bitget typically lists new tokens more frequently, which might appeal to you if you’re interested in emerging projects.

Deepcoin has been expanding its offerings recently, integrating more currency options to improve accessibility. This includes support for global fiat currency deposits, making it easier for you to purchase cryptocurrencies directly.

Before choosing either platform, check their current listings to ensure they support the specific cryptocurrencies you’re interested in trading. Available tokens can change as exchanges regularly update their offerings.

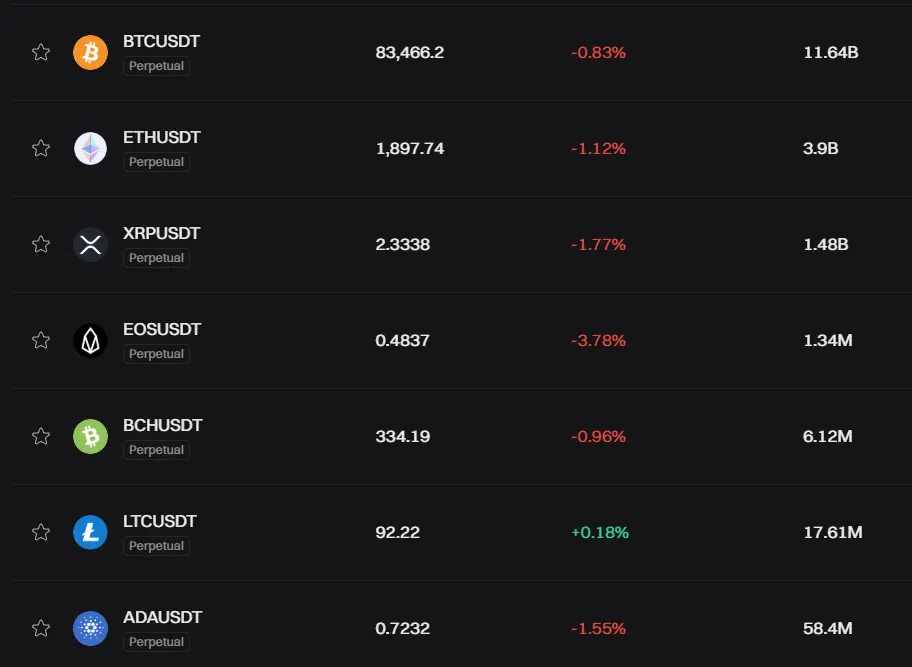

Deepcoin Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Deepcoin and Bitget, understanding their fee structures can help you make a smarter decision for your trading needs.

Deepcoin offers more competitive trading fees with rates up to 0.12% per transaction. This gives you a slight edge compared to many other exchanges in the market.

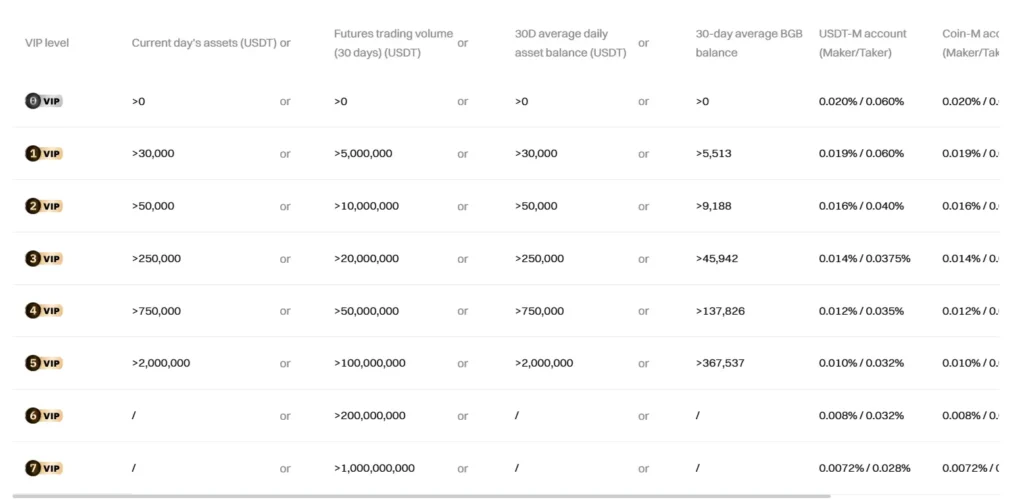

Bitget’s standard trading fees are slightly higher but still competitive within the industry. They offer a VIP program that can reduce your costs as your trading volume increases.

Trading Fee Comparison:

| Exchange | Standard Trading Fee |

|---|---|

| Deepcoin | Up to 0.12% |

| Bitget | Varies by account level |

Both exchanges offer fee discounts for users who hold their native tokens or maintain high trading volumes. This rewards your loyalty and activity on the platform.

For deposits, both platforms typically offer free options for cryptocurrency transfers. However, fiat deposits may incur charges depending on your payment method.

Withdrawal fees vary by cryptocurrency on both exchanges. These fees cover the blockchain transaction costs and are generally comparable between the two platforms.

Before committing to either exchange, you should check their current fee schedules on their official websites. Fee structures in crypto exchanges can change based on market conditions and platform policies.

Deepcoin Vs Bitget: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is crucial for your success. Both Deepcoin and Bitget offer various order options to help you execute trades effectively.

Bitget provides three main order types for futures trading: GTC (Good Till Canceled), FOK (Fill or Kill), and IOC (Immediate or Cancel). These give you flexibility in how your orders are processed.

The GTC order remains active until you manually cancel it or it gets filled. This is useful when you want to set a specific price and are willing to wait.

FOK orders must be filled completely and immediately, or they’re automatically canceled. This helps when you need to execute your entire order at once.

IOC orders attempt to fill as much as possible immediately, but cancel any unfilled portion. This is good for getting the best available price without leaving open orders.

Bitget also supports spot trading with approximately 800 trading pairs across roughly 500 cryptocurrencies. This gives you plenty of options for different trading strategies.

Deepcoin Exchange, while less detailed in the search results, also offers various trading options that compete with Bitget. Both platforms aim to provide comprehensive trading tools for beginners and experienced traders alike.

When choosing between these exchanges, consider which order types best match your trading style and needs. The right combination of order types can significantly improve your trading outcomes.

Deepcoin Vs Bitget: KYC Requirements & KYC Limits

Deepcoin stands out as a crypto exchange that doesn’t require KYC verification for most users. This means you can start trading without sharing personal documents or information. Deepcoin’s approach makes it one of the most accessible platforms for users valuing privacy.

In contrast, Bitget has implemented mandatory KYC requirements as of 2025. They use a two-tier verification system:

Bitget KYC Levels:

- Level 1: Basic verification allowing access to essential services

- Level 2: Advanced verification granting full platform access including spot trading, futures trading, and earning features

Without completing KYC on Bitget, your trading capabilities will be severely limited. The platform requires this verification to comply with global regulations.

Deepcoin’s no-KYC policy gives it an edge for users who prioritize quick setup and privacy. You can register and begin trading almost immediately without documentation delays.

Comparison Table:

| Feature | Deepcoin | Bitget |

|---|---|---|

| KYC Required | No | Yes |

| Verification Levels | None | Two levels |

| Setup Time | Minutes | Hours to days |

| Trading Without KYC | Full access | Limited access |

If anonymity and quick access matter to you, Deepcoin might be the better choice. However, if you prefer trading on a fully regulated platform with complete features, completing Bitget’s KYC process would be necessary.

Deepcoin Vs Bitget: Deposits & Withdrawal Options

When choosing between Deepcoin and Bitget, understanding their deposit and withdrawal options is crucial for your trading experience.

Deepcoin supports a wide range of global fiat currency deposits, making it accessible for users from different countries. This allows you to directly purchase major cryptocurrencies without complicated conversion processes.

Bitget, on the other hand, doesn’t charge fees for crypto deposits, which is a plus for crypto holders. However, if you’re depositing fiat currency through third-party services, you may face fees ranging from 4% to 8%.

Deposit Methods Comparison:

| Exchange | Crypto Deposits | Fiat Deposits | Third-party Integration |

|---|---|---|---|

| Deepcoin | Yes | Multiple currencies supported | Multiple options |

| Bitget | Free | Available with fees | Limited options |

For withdrawals, both exchanges offer cryptocurrency options, but fee structures differ. Withdrawal times can vary based on network congestion and verification requirements.

Deepcoin has recently expanded its capabilities by becoming the 7th overseas exchange to integrate with additional payment services, enhancing its deposit flexibility.

When deciding between these exchanges, consider:

- Which currencies you plan to deposit

- Withdrawal fee structures

- Processing times

- Your country’s supported payment methods

Your trading frequency and volume should also factor into your decision, as regular withdrawals with high fees could significantly impact your overall returns.

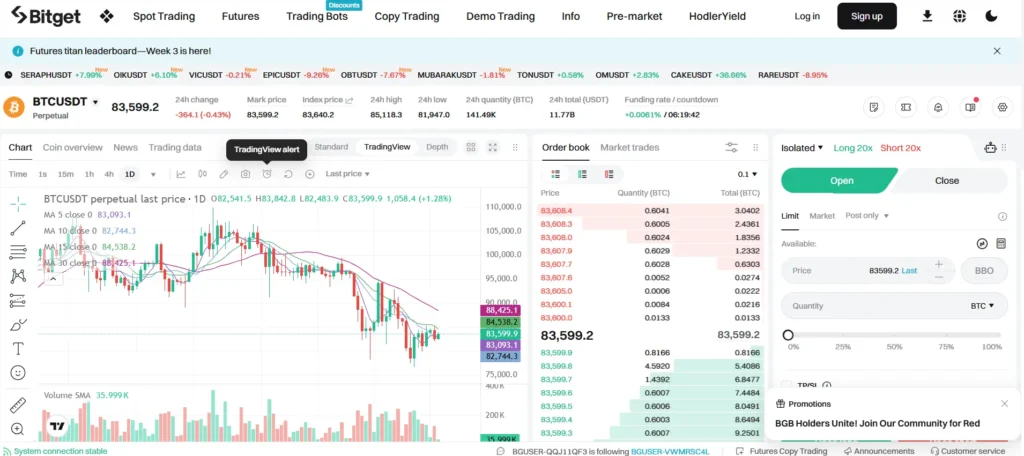

Deepcoin Vs Bitget: Trading & Platform Experience Comparison

When choosing between Deepcoin and Bitget, the trading experience and platform features play a key role in your decision.

User Interface

Bitget offers a clean, intuitive interface that’s easy to navigate even for beginners. Deepcoin’s platform is also user-friendly but some users find it slightly more complex to navigate at first.

Trading Options

Both exchanges support:

- Spot trading

- Futures trading

- Margin trading

- Copy trading

Bitget has gained popularity for its copy trading feature, which lets you automatically mimic successful traders’ strategies. Deepcoin offers similar functionality but with fewer established traders to follow.

Mobile Experience

Both exchanges provide mobile apps for Android and iOS. Bitget’s app receives higher user ratings overall, with better stability and faster execution times.

Trading Tools

| Feature | Deepcoin | Bitget |

|---|---|---|

| Chart types | 8+ | 12+ |

| Technical indicators | 50+ | 100+ |

| API access | Yes | Yes |

| Trading bots | Limited | Extensive |

Bitget provides more advanced technical analysis tools, which you’ll appreciate if you’re an experienced trader.

Execution Speed

Bitget typically offers faster order execution, which is crucial during volatile market conditions. Deepcoin sometimes experiences slight delays during peak trading times.

Liquidity

Bitget maintains higher liquidity across most trading pairs, resulting in tighter spreads and less slippage when you execute large trades.

Deepcoin Vs Bitget: Liquidation Mechanism

When trading with leverage on either Deepcoin or Bitget, understanding the liquidation mechanism is crucial for your trading strategy.

Deepcoin uses a tiered liquidation system that gradually reduces position size as your margin ratio decreases. This gives you more breathing room before complete liquidation occurs.

Bitget employs a strict liquidation threshold where positions are fully closed when your margin ratio hits a specific level. With leverage up to 125x on some pairs, Bitget’s liquidation can happen quickly during high volatility.

Both exchanges utilize mark prices instead of last traded prices to prevent manipulation and unfair liquidations during price spikes.

Deepcoin offers partial liquidation options, allowing you to maintain a portion of your position rather than facing total liquidation. This feature can help preserve some of your trading capital during market swings.

Bitget provides liquidation warnings through email and app notifications when your positions approach dangerous levels. These alerts give you time to add margin or reduce position size.

Liquidation Fee Comparison:

| Feature | Deepcoin | Bitget |

|---|---|---|

| Liquidation Fee | 0.5-1.5% | 0.5-2.0% |

| Insurance Fund | Yes | Yes |

| Partial Liquidation | Available | Limited |

| Warning System | Multi-tiered | Basic alerts |

Both exchanges maintain insurance funds to prevent negative balances in most market conditions, protecting you from owing more than your account balance.

Deepcoin Vs Bitget: Insurance

When choosing a crypto exchange, insurance protection is crucial for your peace of mind. Both Deepcoin and Bitget offer insurance funds to protect users against unexpected losses.

Deepcoin maintains an insurance fund primarily designed to protect traders from auto-deleveraging during volatile market conditions. This fund covers potential losses from liquidations when the market moves rapidly.

Bitget offers a more comprehensive insurance approach with their Protection Fund, which reportedly holds over $300 million in BTC and USDT. This fund is specifically designed to protect user assets in case of security breaches or extreme market events.

Key differences in their insurance approaches:

| Feature | Deepcoin | Bitget |

|---|---|---|

| Insurance Fund Size | Not publicly disclosed | Over $300 million |

| Coverage Focus | Mainly trading losses | Both security and trading issues |

| Transparency | Limited public reporting | Regular updates on fund size |

Neither exchange guarantees complete protection against all potential losses. Your trading activities still carry inherent risks that may not be covered by these insurance mechanisms.

You should note that both exchanges use cold storage for most user funds as an additional security measure, which reduces the likelihood of needing to access insurance funds in the first place.

Deepcoin Vs Bitget: Customer Support

When choosing between Deepcoin and Bitget, customer support can be a deciding factor for your trading experience.

Deepcoin offers live chat support where you can connect instantly with available agents. This real-time assistance helps solve problems quickly without long waiting periods.

Bitget also provides live chat support, but adds multiple communication channels including email support and an extensive help center. Their support team is available 24/7 to address your concerns.

Response times differ between the two platforms. Deepcoin typically responds within minutes through their live chat, while Bitget’s response time varies depending on the support channel you choose.

Both exchanges offer support in multiple languages, making them accessible to global users. However, Bitget supports more languages than Deepcoin, giving it a slight edge for international traders.

For self-help options, Bitget offers a more comprehensive knowledge base with detailed guides and FAQs. Deepcoin’s resources are more limited but still cover basic trading information.

Customer feedback indicates that both exchanges maintain reasonable support quality, though experiences may vary based on the complexity of your issue and peak trading times.

Deepcoin Vs Bitget: Security Features

When choosing between Deepcoin and Bitget exchanges, security should be a top priority for your crypto assets. Both platforms offer various security measures to protect your funds.

Bitget implements several security features for user protection. They use cold storage to keep a portion of user funds offline and safe from online threats. Advanced encryption protects your personal information and transactions.

Two-factor authentication (2FA) is available on Bitget, adding an extra layer of security to your account. The platform also requires Know Your Customer (KYC) verification to prevent fraud and comply with regulations.

Deepcoin also prioritizes security, though specific details are less prominent in the search results. Like most reputable exchanges, they likely employ standard security practices including encryption and secure storage solutions.

Both exchanges operate in multiple countries, with Deepcoin recently expanding its reach. Deepcoin has become the 7th overseas exchange to integrate with Korean fiat currency exchange through a partnership with Coinone.

For maximum protection on either platform, you should:

- Enable all available security features

- Use strong, unique passwords

- Keep your recovery phrases offline

- Be cautious of phishing attempts

- Only use official apps and websites

Compare both exchanges carefully regarding security before deciding which better suits your needs.

Is Deepcoin A Safe & Legal To Use?

Deepcoin offers mixed safety signals for cryptocurrency traders. According to search results, the platform claims to be “one of the safest cryptocurrency exchanges” with a self-developed third-generation security system.

However, safety concerns exist, particularly for US-based traders. If you trade from the United States, Deepcoin provides no asset loss prevention, regulation protection, or security guarantees.

Regulation status is an important factor when evaluating exchange safety. While cryptocurrency exchanges don’t necessarily require regulation to be reliable, regulatory oversight typically provides additional user protection.

The legal status of Deepcoin varies by region. Before using the platform, you should check if Deepcoin is permitted in your country of residence. This is especially important for US traders, where regulatory compliance is strictly enforced.

Safety Features to Consider:

- Self-developed security system

- No asset loss protection for US users

- Lacking regulatory oversight in certain regions

Risk Mitigation Tips:

- Use strong authentication methods

- Keep large holdings in cold storage

- Research local laws regarding Deepcoin usage

When comparing Deepcoin to alternatives like Bitget, safety should be a primary consideration. Both exchanges have different security measures and regulatory compliance levels that might affect your trading experience.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered a safe cryptocurrency exchange with a strong reputation in the global market. The platform has not experienced major security breaches or significant losses of user funds, which speaks to its security infrastructure.

The exchange implements several security features to protect users’ assets. It has received recognition from Forbes as one of the world’s most trustworthy crypto exchanges, scoring well for its BTC-ETH holdings and commitment to transparency.

Bitget operates legally in most countries worldwide. However, it’s important to note that the exchange is not available in the United States, United Kingdom, Canada, and countries under sanctions.

While most sources confirm Bitget’s legitimacy, some user opinions are mixed. A few reports on platforms like Reddit claim the exchange has engaged in questionable practices, with some users calling it “shady.”

For your protection when using Bitget, consider these security practices:

- Enable two-factor authentication

- Use a strong, unique password

- Withdraw large amounts to a secure wallet

- Keep most of your crypto in cold storage

The exchange continues to build its reputation through transparency initiatives and security measures. Before trading, you should verify whether Bitget is authorized to operate in your specific location.

Frequently Asked Questions

Both Deepcoin and Bitget offer unique features and services for crypto traders. Here are answers to common questions about these exchanges to help you decide which platform might better suit your trading needs.

What are the differences in futures trading fees between Deepcoin and Bitget?

Bitget generally offers lower standard trading fees at 0.1% for futures trading. Deepcoin’s fees are slightly higher for futures trading.

Both exchanges offer fee discounts for high-volume traders and those who hold their native tokens.

VIP traders on both platforms can access tiered fee structures that decrease as trading volume increases.

Which features distinguish Deepcoin from Bitget for crypto traders?

Deepcoin focuses on providing a wide range of derivatives trading options with high leverage opportunities. Their platform is designed for more experienced traders.

Bitget offers a more user-friendly interface with copy trading features that allow beginners to mirror successful traders’ strategies.

Bitget also provides a larger variety of trading types including spot, futures, copy trading, and swap features.

Are Deepcoin and Bitget both available to users in the United States?

Neither Deepcoin nor Bitget officially serves users from the United States due to regulatory restrictions.

US residents should be aware that accessing these platforms may violate their terms of service.

Both exchanges implement geo-blocking measures to restrict access from prohibited jurisdictions including the US.

How do the supported cryptocurrencies on Deepcoin and Bitget compare?

Bitget supports a larger variety of cryptocurrencies for trading, including major coins and newer altcoins.

Deepcoin offers fewer overall tokens but focuses on providing more trading pair options for the supported cryptocurrencies.

Both exchanges regularly add new cryptocurrencies based on market demand and after security assessments.

Can users from restricted countries access Deepcoin or Bitget services?

Both exchanges have restrictions for users from certain countries due to regulatory requirements.

Some traders attempt to use VPNs to bypass these restrictions, but this violates the terms of service and may result in account freezes.

Always check the current list of restricted countries on both platforms before signing up, as these lists change with regulatory developments.

What security measures do Deepcoin and Bitget implement to protect their users’ assets?

Both exchanges use cold storage to keep the majority of user funds offline and safe from online threats.

Bitget has established an insurance fund worth over $300 million to protect users against potential losses.

Deepcoin implements multiple security layers including two-factor authentication, withdrawal confirmation emails, and anti-phishing measures to protect user accounts.

Bitget Vs Deepcoin Conclusion: Why Not Use Both?

When comparing Deepcoin and Bitget, both exchanges offer unique advantages that might benefit different aspects of your trading strategy.

Deepcoin stands out with its “derivatives-first” approach and integration with Korean fiat currency exchange. Its hybrid wallet system using hot and cold storage provides strong security for your funds.

Bitget, while lacking margin trading on its spot platform, offers competitive features that many traders appreciate. As of March 2025, both platforms continue to evolve their offerings to stay competitive.

Using both exchanges could give you access to:

- Wider range of trading pairs across both platforms

- Different fee structures to optimize your trading costs

- Varied trading tools specific to each platform

- Risk diversification by not keeping all funds on one exchange

Many experienced traders maintain accounts on multiple exchanges to take advantage of:

- Price differences between platforms

- Exclusive features on each exchange

- Better liquidity for certain trading pairs

- Backup options if one exchange faces technical issues

Consider your trading volume, preferred assets, and security needs when deciding how to distribute your activities between these platforms.

Remember to maintain proper security practices regardless of which exchange you choose, including using strong passwords and two-factor authentication.