Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Deepcoin and BingX are two popular exchanges that offer different features and benefits for crypto traders in 2025.

When comparing Deepcoin vs BingX, you’ll find that Deepcoin has higher trading volumes ($9.68B) compared to BingX ($896.12M), while both platforms differ in their fee structures, available cryptocurrencies, and trading options. These differences can impact your trading costs and opportunities.

You should consider factors like deposit methods, withdrawal fees, and user ratings when deciding between these exchanges. Each platform has its strengths, and understanding how they compare will help you select the one that best matches your trading needs and preferences.

Deepcoin vs BingX: At A Glance Comparison

When choosing between Deepcoin and BingX, understanding key differences can help you make the right decision for your trading needs.

Trading Platform Features

| Feature | Deepcoin | BingX |

|---|---|---|

| User Interface | Clean, technical | User-friendly, intuitive |

| Trading Types | Spot, futures, options | Spot, futures, copy trading |

| Mobile App | Available for iOS/Android | Available for iOS/Android |

| Social Trading | Limited | Extensive copy trading features |

Fee Structure

BingX typically offers maker/taker fees starting at 0.1%/0.1%, with discounts available for higher trading volumes. Deepcoin’s fee structure is comparable but may vary slightly across different trading pairs.

Security Measures

Both exchanges implement two-factor authentication and cold storage solutions. BingX has gained recognition for its security protocols, while Deepcoin continues to strengthen its security framework.

Trading Volume & Liquidity

BingX generally maintains higher trading volumes, which can result in better liquidity for popular trading pairs. This means you might experience less slippage when executing larger trades.

Unique Selling Points

- BingX: Stands out with its social trading features that allow you to follow and copy successful traders

- Deepcoin: Offers a more comprehensive range of trading options, including advanced derivatives

Supported Cryptocurrencies

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum, along with numerous altcoins. The exact number and selection vary between platforms.

Deepcoin vs BingX: Trading Markets, Products & Leverage Offered

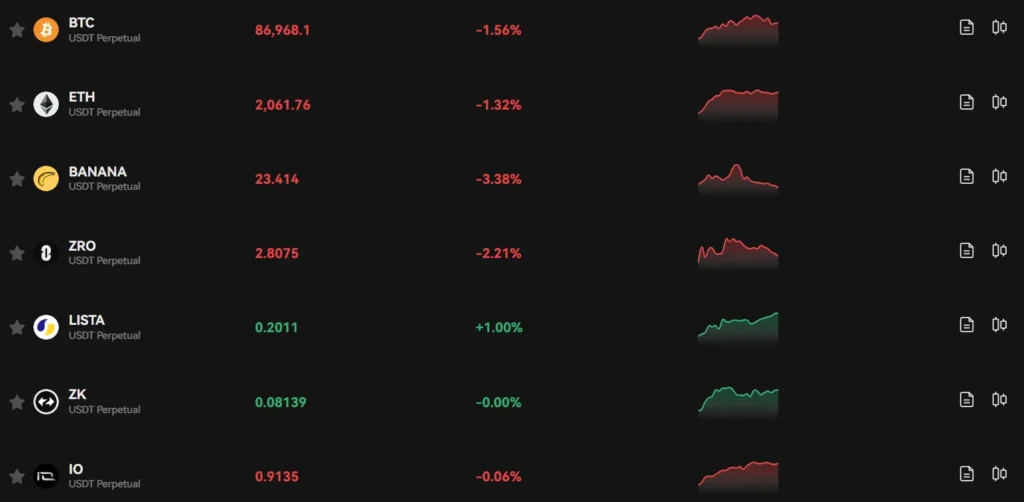

Both Deepcoin and BingX offer a variety of trading options for cryptocurrency enthusiasts. These platforms provide different markets and leverage opportunities that can help you maximize your trading potential.

Trading Markets Available:

| Feature | Deepcoin | BingX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Copy Trading | Limited | Extensive |

| Social Trading | ✗ | ✓ |

BingX stands out with its comprehensive copy trading feature that allows you to follow and automatically replicate trades from successful traders. This makes it particularly appealing if you’re new to cryptocurrency trading.

Deepcoin focuses more on traditional derivatives trading with competitive leverage options. Both platforms support a wide range of cryptocurrencies including major coins like Bitcoin and Ethereum.

Leverage Options:

BingX offers leverage up to 100x on futures trading, giving you the ability to amplify your position sizes. This can increase potential profits but also comes with higher risk.

Deepcoin also provides high leverage options, typically in the same range. You should approach leveraged trading cautiously as it can lead to significant losses.

Both exchanges offer perpetual contracts and futures trading with various settlement options. These products allow you to speculate on price movements without owning the underlying asset.

Your choice between these platforms may depend on whether you prefer BingX’s social trading features or Deepcoin’s focus on derivatives trading.

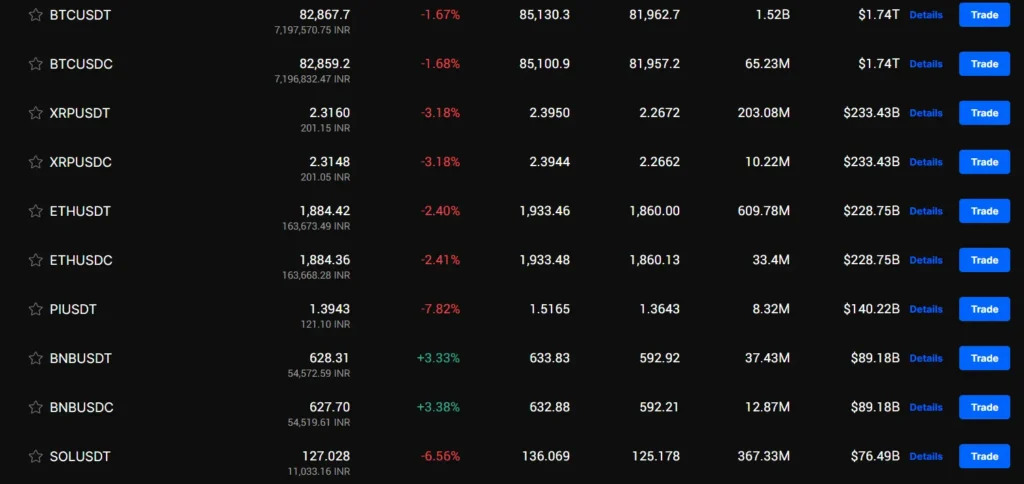

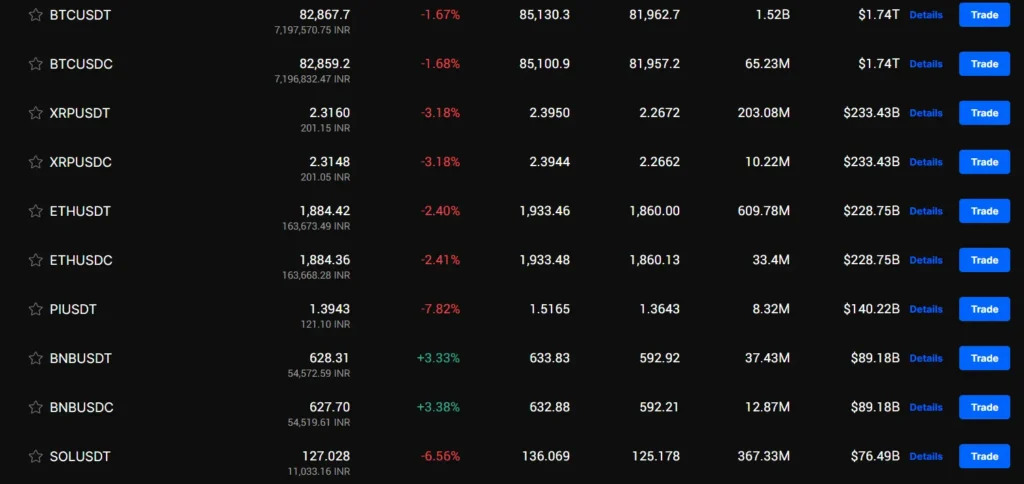

Deepcoin vs BingX: Supported Cryptocurrencies

When choosing between Deepcoin and BingX, the range of available cryptocurrencies is an important factor to consider.

BingX stands out with support for over 750 cryptocurrencies, including major ones like Bitcoin, Ethereum, and Solana. This extensive selection gives you many trading options on a single platform.

Deepcoin also offers a variety of cryptocurrencies, though specific numbers aren’t mentioned in the search results. It’s worth noting that Deepcoin has recently gained attention for its exchange services.

BingX Cryptocurrency Highlights:

- 750+ supported cryptocurrencies

- Major coins (Bitcoin, Ethereum, Solana)

- Wide variety of trading pairs

BingX also recently listed the Deeplink Protocol (DLC) coin, which is a decentralized cloud gaming protocol powered by AI and blockchain technology.

Both exchanges support popular cryptocurrencies, but BingX currently appears to offer a wider selection. This might be important if you’re looking to trade less common altcoins.

When making your decision, consider which specific cryptocurrencies you want to trade. If you need access to a vast array of options, BingX’s extensive lineup might better suit your needs.

Deepcoin vs BingX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Deepcoin and BingX, understanding their fee structures can help you make the right decision for your trading needs.

BingX charges a standard 0.1% fee for spot trading. For futures trading, they offer a maker fee of 0.02% and a taker fee of 0.04%. This tiered structure rewards those who provide liquidity to the market.

While specific Deepcoin fees aren’t mentioned in the search results, cryptocurrency exchanges typically compete on their fee structures. You should compare both platforms directly on their websites for the most current rates.

Withdrawal Fees Comparison:

- BingX: Varies by cryptocurrency

- Deepcoin: Varies by cryptocurrency

Both exchanges likely offer VIP or membership tiers that can reduce your trading fees. BingX specifically mentions trading fee discounts tied to withdrawal limits for different membership levels.

Deposit Methods:

Both Deepcoin and Deepcoin Exchange support various deposit methods, though the search results don’t specify exact options. Most major exchanges accept bank transfers, credit cards, and cryptocurrency deposits.

When comparing these exchanges, look beyond just the base fees. Consider factors like:

- Trading volume discounts

- Holding native tokens for fee reductions

- Special promotions for new users

- Network fees for cryptocurrency withdrawals

Remember that fees can change frequently in the crypto world, so always check the exchanges’ official fee pages before making your decision.

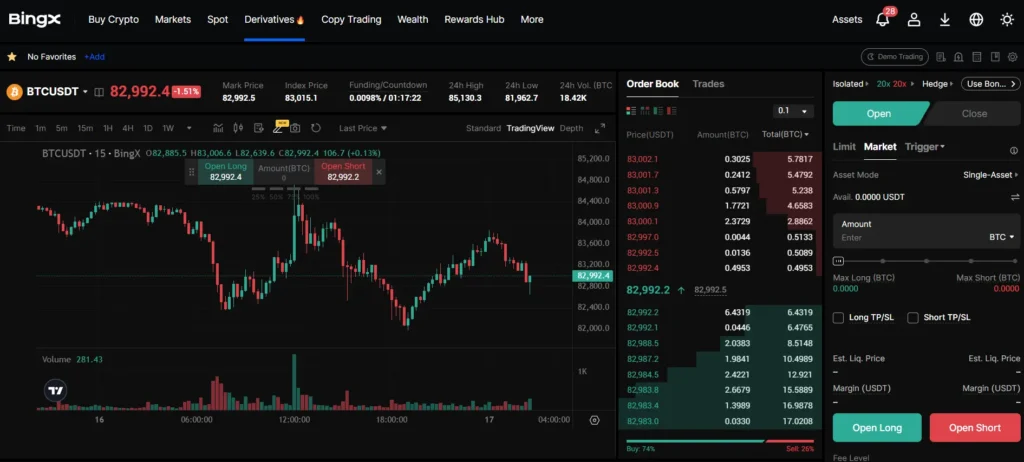

Deepcoin vs BingX: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your strategy. Both Deepcoin and BingX offer several order options to help you execute trades effectively.

BingX provides two main order types for spot trading: Market orders and Limit orders. Market orders execute immediately at the current market price, while Limit orders allow you to set a specific price at which you want to buy or sell.

BingX also features a unique dual price mechanism that uses mark price and last price to handle market fluctuations. This can provide more stability during volatile trading periods.

Deepcoin similarly offers Market and Limit orders for basic trading needs. However, the platform may include additional order types to give traders more flexibility.

Both exchanges support spot trading, but they differ slightly in their interface and execution process. On BingX, you can easily place spot trades through their website with a straightforward process.

Advanced traders should note that order type availability may vary between the mobile apps and desktop platforms of both exchanges.

The order execution speed and reliability are important factors to consider when choosing between these platforms. Each exchange processes orders according to their own systems and liquidity pools.

Remember to familiarize yourself with each platform’s order types before trading to maximize your strategy effectiveness and minimize potential errors.

Deepcoin vs BingX: KYC Requirements & KYC Limits

Both Deepcoin and BingX offer flexibility with their KYC (Know Your Customer) requirements, but they handle verification differently.

BingX KYC Requirements:

- KYC is optional on BingX

- Verified and unverified users have different access levels

- Higher-level KYC verification provides greater flexibility in fund management

BingX KYC Limits:

- Different verification levels have varying daily deposit limits

- Users who complete higher-level verification enjoy increased withdrawal limits

- Unverified users can still access basic platform features

BingX is often considered a privacy-focused exchange that allows you to trade without mandatory KYC verification. This makes it appealing if you value privacy or prefer anonymous trading.

Deepcoin KYC Requirements:

- Similar to BingX, Deepcoin offers basic access without KYC

- Verification tiers exist to increase your account privileges

- Identity verification becomes necessary for higher withdrawal limits

When choosing between these platforms, consider your trading volume needs. If you plan to deposit or withdraw large amounts, completing KYC verification on either platform will benefit you by raising your limits.

Both exchanges allow you to start trading with minimal information, making them accessible for beginners or those testing the platforms before committing to full verification.

Deepcoin vs BingX: Deposits & Withdrawal Options

When choosing between Deepcoin and BingX, understanding your deposit and withdrawal options is crucial for smooth trading.

BingX Deposit Options

- Cryptocurrency transfers

- No deposit fees for crypto transfers

- May have minimum deposit requirements

Deepcoin Deposit Options

- Primarily supports cryptocurrency deposits

- Similar to other major exchanges in supported crypto options

Both exchanges focus on crypto-to-crypto transactions, which is standard in the industry. This means you’ll need to already own cryptocurrency or purchase it elsewhere before transferring to these platforms.

For withdrawals, both exchanges implement security measures like two-factor authentication to protect your funds. Processing times typically depend on blockchain network congestion.

Fee Comparison:

| Exchange | Deposit Fees | Withdrawal Fees |

|---|---|---|

| BingX | None for crypto | Varies by cryptocurrency |

| Deepcoin | None for crypto | Network-based fees |

It’s worth noting that withdrawal fees can change based on market conditions and the specific cryptocurrency you’re withdrawing.

Both platforms support a wide range of cryptocurrencies for deposits and withdrawals, giving you flexibility in managing your digital assets.

Remember to verify the current supported payment methods and any minimum deposit requirements, as these can change over time as the exchanges expand their services.

Deepcoin vs BingX: Trading & Platform Experience Comparison

When comparing Deepcoin and BingX, you’ll notice significant differences in their trading platforms and overall user experience.

User Interface

- BingX offers a cleaner, more intuitive interface that beginners find easier to navigate

- Deepcoin’s platform has more advanced features but might feel overwhelming to new traders

Trading Tools

| Feature | BingX | Deepcoin |

|---|---|---|

| Copy Trading | Extensive options | Limited options |

| Charts | TradingView integration | Basic charting |

| Mobile App | Highly rated, smooth | Functional but less refined |

BingX stands out with its social and copy trading features, allowing you to follow and automatically copy successful traders’ strategies.

Deepcoin focuses more on futures trading with higher leverage options up to 125x, while BingX typically offers up to 100x leverage.

Trading Fees

Both platforms offer competitive fee structures, but BingX often edges out with slightly lower spot trading fees for regular users.

Supported Assets

You’ll find a wider variety of trading pairs on BingX, though both platforms cover all major cryptocurrencies and many altcoins.

The platform experience ultimately depends on your trading style. BingX is better suited for beginners and social traders, while Deepcoin might appeal to those focusing on futures trading and advanced order types.

Deepcoin vs BingX: Liquidation Mechanism

When trading on crypto exchanges, understanding the liquidation mechanism is crucial for managing risk. Both Deepcoin and BingX have systems in place to handle liquidations, but they work differently.

BingX uses a dual price mechanism that includes both mark price and last price. This system helps protect traders from mass liquidations during volatile market conditions. The mark price serves as a reference that reduces the impact of short-term price spikes.

By using this dual approach, BingX aims to prevent market manipulation and create a more stable trading environment for you. This mechanism is especially important during times of high volatility when sudden price movements could trigger unnecessary liquidations.

Deepcoin, on the other hand, uses a more traditional liquidation approach. Their system monitors your position’s maintenance margin continuously. When your margin falls below the required threshold, liquidation may occur.

Both platforms allow you to take long and short positions in futures trading, but how they handle liquidation differs in important ways:

| Feature | BingX | Deepcoin |

|---|---|---|

| Price Reference | Dual price (mark & last) | Single price system |

| Liquidation Protection | Higher resistance to price manipulation | Standard protection measures |

| User Control | More options to prevent liquidation | Basic risk management tools |

You should consider these differences when choosing between the platforms, especially if you plan to use leverage in your trading strategy.

Deepcoin vs BingX: Insurance

When trading cryptocurrency, safety nets matter. Both Deepcoin and BingX offer insurance options to protect your assets, but they differ in significant ways.

Deepcoin provides a protection fund that safeguards users against unexpected market volatility and potential system failures. This insurance covers losses that might occur during extreme market conditions.

BingX also features an insurance fund, primarily focused on preventing auto-liquidations during volatile trading periods. Their system is designed to protect futures traders from losing more than their initial investment.

The coverage amounts vary between the exchanges. Deepcoin’s insurance fund reportedly maintains a substantial reserve, though exact figures fluctuate based on market conditions and platform growth.

BingX tends to be more transparent with their insurance metrics, regularly publishing updates about the size and usage of their protection fund.

For your assets’ safety, both platforms implement multiple security measures alongside their insurance options. These include cold storage for most funds, two-factor authentication, and advanced encryption protocols.

Neither exchange guarantees complete protection against all types of losses. Hacking incidents, while rare, might not be fully covered under standard insurance terms.

When choosing between these platforms, consider reviewing their latest insurance policies, as these offerings evolve frequently in response to market demands and regulatory changes.

Deepcoin vs BingX: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both Deepcoin and BingX offer support services, but there are some differences worth noting.

BingX provides 24/7 customer support according to the search results. This means you can get help at any time, regardless of your time zone. You can contact their support team via email at [email protected].

The availability of round-the-clock support is crucial when dealing with time-sensitive cryptocurrency transactions or account issues.

For Deepcoin, specific details about their customer support hours aren’t clearly mentioned in the search results. However, like most major exchanges, they likely offer some form of customer assistance.

Support Channels Comparison:

| Exchange | 24/7 Support | Email Support | Live Chat | Other Channels |

|---|---|---|---|---|

| BingX | Yes | Yes | Likely | Unknown |

| Deepcoin | Unknown | Likely | Unknown | Unknown |

When evaluating customer support quality, consider factors beyond availability. Response time, helpfulness of responses, and knowledge of support agents are equally important.

You might want to test each platform’s customer support with a simple question before committing to trading significant amounts on either exchange.

Deepcoin vs BingX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Deepcoin and BingX offer several security features to protect your assets, but they differ in some ways.

BingX implements robust security measures including two-factor authentication (2FA), which adds an extra layer of protection to your account. They also maintain proof of reserve, allowing you to verify that your funds are actually backed by assets.

For withdrawals, BingX requires a fund password, separate from your login credentials. This helps prevent unauthorized transfers even if someone gains access to your account.

BingX also offers address whitelisting, letting you restrict withdrawals to only pre-approved addresses. Their data encryption protocols help keep your personal information safe from hackers.

Deepcoin also focuses on security, though specific details about their security features are less widely documented. Like BingX, they likely implement standard security measures common in the industry.

Both exchanges claim to prioritize user asset protection, but BingX appears to be more transparent about their specific security protocols.

Neither exchange is immune to all risks, so you should always use strong passwords, enable all available security features, and consider keeping large holdings in cold storage rather than on any exchange.

Before choosing either platform, you might want to check their latest security track records and any history of breaches or incidents.

Is Deepcoin A Safe & Legal To Use?

Deepcoin has developed a reputation as one of the safer cryptocurrency exchanges available today. According to search results, the platform uses a self-developed third-generation security system to protect user assets.

For most users worldwide, Deepcoin provides a legitimate trading experience. However, there’s an important distinction for US-based traders.

While Deepcoin technically allows US investors to use its platform, they do so without fund protection. This creates a significant risk for American users compared to those from other regions.

The exchange implements standard security features that you’d expect from a cryptocurrency platform. These include two-factor authentication (2FA), cold storage for most assets, and regular security audits.

Legal Status by Region:

- United States: Accessible but with no fund protection

- Most other countries: Legal with standard protections

Before signing up, you should verify Deepcoin’s current regulatory status in your specific country. Cryptocurrency regulations change frequently, and what’s permitted today might not be tomorrow.

It’s also wise to use additional security measures when using any exchange. This includes strong passwords, enabling all available security features, and never storing large amounts of crypto on the exchange long-term.

Compared to competitors like BingX, Deepcoin offers similar security features, though with potentially different regulatory compliance depending on your location.

Is BingX A Safe & Legal To Use?

BingX operates as a legitimate cryptocurrency exchange that follows regulatory requirements in various jurisdictions. Established in 2018, the platform has built a user base of over one million people worldwide.

The exchange implements strict compliance protocols and advanced security measures to protect users. These security features help safeguard your funds and personal information when trading on the platform.

BingX is registered as a financial services provider, which adds another layer of legitimacy to its operations. This registration requires the company to maintain certain standards and follow specific rules.

Users generally report positive experiences with BingX’s reliability. The platform offers diverse trading options while maintaining transparent practices about fees and services.

Key safety features of BingX include:

- Advanced security protocols

- Regulatory compliance

- Transparent fee structures

- Proven track record since 2018

When comparing to other major exchanges like Binance or Kraken, BingX may not have the same global reach. However, it compensates with competitive fees and a comprehensive VIP program for regular traders.

For most crypto traders, BingX provides a balance of security and functionality. The platform continues to develop its safety measures while expanding its offerings to meet user needs.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges. Here are answers to common questions about Deepcoin and BingX to help you make an informed decision.

What are the key differences in trading fees between Deepcoin and BingX?

Deepcoin and BingX have different fee structures. BingX typically charges 0.1% for spot trading, with discounts available for BGB token holders. Trading fees can be reduced further with increased trading volume.

Deepcoin’s fees are competitive, starting at around 0.06% for makers and 0.1% for takers. Both platforms offer fee discounts for high-volume traders and users who hold their native tokens.

How do the security features of Deepcoin compare to those of BingX?

BingX employs multi-signature wallets, two-factor authentication, and stores most assets in cold storage. The platform regularly undergoes security audits to ensure user funds remain protected.

Deepcoin also uses cold wallet storage technology and offers two-factor authentication. Both exchanges have risk management systems in place, though BingX has a more established security track record with fewer reported incidents.

How do the user interface and trading experience differ between Deepcoin and BingX?

BingX offers a more beginner-friendly interface with a clean design and intuitive navigation. Its copy trading feature allows you to follow successful traders automatically.

Deepcoin provides a more technical interface that experienced traders might prefer. Both platforms offer mobile apps, but BingX’s app tends to receive higher user ratings for reliability and ease of use.

What variety of cryptocurrencies can be traded on Deepcoin versus BingX?

BingX supports over 300 cryptocurrencies and numerous trading pairs. The exchange regularly adds new tokens and maintains liquid markets for major cryptocurrencies.

Deepcoin offers a smaller selection but still covers most major cryptocurrencies and some altcoins. If you’re looking for niche tokens, you’ll likely find more options on BingX.

What are the account verification requirements for Deepcoin compared to BingX?

BingX has a tiered verification system. Basic accounts require email verification, while higher limits need ID verification and facial recognition. Complete verification allows access to all platform features.

Deepcoin follows similar KYC procedures but may have different document requirements. Both exchanges comply with global regulations, though verification times can vary between platforms.

How do the customer support services of Deepcoin and BingX differ?

BingX offers 24/7 customer support through live chat, email, and a comprehensive help center. Response times are generally quick, with most issues resolved within 24 hours.

Deepcoin provides support through similar channels but may have longer response times. BingX typically receives better reviews for customer service quality and responsiveness, particularly for English-speaking users.

BingX vs Deepcoin Conclusion: Why Not Use Both?

After comparing BingX and Deepcoin, you might wonder which platform to choose. The answer could be using both exchanges for different purposes.

BingX is recognized as a legitimate platform with robust security measures. It offers multiple trading services and competitive fees as of 2025. Many users find its interface user-friendly and appreciate its range of supported cryptocurrencies.

Deepcoin also has its strengths, with different fee structures and trading options that might better suit certain trading strategies.

Benefits of using both platforms:

- Risk diversification – Don’t keep all your crypto assets on one exchange

- Feature access – Take advantage of unique tools on each platform

- Trading opportunities – Some coins may be available on one but not the other

- Fee optimization – Use whichever platform offers better rates for specific trades

You can start by testing both platforms with small amounts. This lets you experience their interfaces, customer support, and trading features firsthand.

Remember that crypto exchanges can change their policies and offerings. What works best for your needs today might change tomorrow. Staying flexible with multiple exchange options gives you more control over your crypto journey.

The best choice depends on your specific trading goals, experience level, and the cryptocurrencies you’re interested in trading.