Embracing the world of cryptocurrency can seem daunting, but crypto options paper trading offers a valuable way to step into this space with confidence. This trading method provides a risk-free environment, allowing you to practice different strategies without investing real money. Paper trading platforms enable you to simulate real market conditions, giving you invaluable experience before making actual financial commitments.

As you explore crypto options demo trading, you’ll discover platforms that offer a range of features tailored to honing your skills. From evaluating market trends to making split-second decisions, these simulations equip you with the tools to navigate the volatile crypto markets. You’ll benefit from understanding how options work, which will allow you to make informed decisions when you’re ready to trade live.

Taking advantage of platforms like TradingView or Binance, you can refine your strategies and gain insights into market dynamics. This hands-on learning approach helps you build confidence and knowledge, setting a strong foundation for future success. With each simulated trade, you’ll be better prepared to enter the real-world market and make prudent investment choices.

Setting Up a Paper Trading Account

Setting up a paper trading account involves selecting a platform that aligns with your trading preferences and simulating real market conditions to practice strategies without financial risk. These steps are critical for a successful and educational paper trading experience.

Choosing a Platform

When choosing a platform for crypto options paper trading, consider features like user interface, available assets, and real-time data updates. Some platforms may offer extensive market simulations, while others provide simpler, more accessible interfaces. Make a list of priorities in terms of functionality such as automated trading tools, risk management features, and portfolio analysis.

A platform with a user-friendly layout can expedite your learning. Explore different platforms through trial accounts, if available, to identify which one best suits your needs. Check for customer support availability, as responsive support can be invaluable when navigating the intricacies of paper trading.

Simulating Real Market Conditions

To effectively simulate real market conditions, find a platform that offers live market data and realistic order execution. This creates a comprehensive environment for developing and testing trading strategies. Look for platforms providing adjustable parameters like volatility and leverage, which help tailor the simulation to reflect different market scenarios.

Engage with the simulation regularly to gain insights into market reactions and trade dynamics. Remember to document your trades as you would in real trading to evaluate your performance objectively. Leveraging such simulations maximizes the educational benefits of paper trading, preparing you for real-world trading challenges. You can also use a crypto options calculator for making informed trades.

Key Features of Paper Trading Platforms

An effective crypto options paper trading platform should provide realistic market data and a variety of tools and indicators. These features help you practice trading strategies without risking real assets.

Realistic Market Data

Paper trading platforms offer access to real-time market data, essential for simulating real trading conditions. Accurate price feeds and order book data allow you to experience the dynamics of actual markets.

Platforms often mirror the volatility and liquidity of live markets. This realistic environment helps in evaluating how strategies might perform in live trading. Additionally, response times for order execution simulate the speed of responsive trading platforms, providing a near-authentic trading experience.

Tools and Indicators

The best platforms are equipped with a wide range of analytical tools and technical indicators. These might include moving averages, Bollinger Bands, and volume analysis tools, allowing for detailed market analysis.

Customizable charts enable you to adjust your view and focus on specific timeframes or patterns, critical in understanding market trends. Some platforms offer backtesting capabilities, letting you test strategies against historical data. This feature helps refine trading strategies before potential application in live markets.

Benefits of Paper Trading

Paper trading offers a unique opportunity to practice trading in a simulated environment, which helps you learn without any financial risk. This approach is crucial for testing and refining trading strategies, contributing significantly to skill development.

Risk-Free Learning Environment

Paper trading provides a risk-free learning atmosphere where you can gain valuable trading experience without the fear of financial loss. By using virtual money to simulate trades, you practice executing buy and sell orders just as you would with real funds. This risk-free setting is particularly beneficial if you’re just starting out, as it allows you to become familiar with various trading platforms and tools without any pressure.

In this environment, you gain practical insights into how the market operates. It’s a safe space to make mistakes and learn from them, ensuring that you’re better prepared when you start live trading. You’ll also learn to handle psychological aspects of trading, such as dealing with gains and losses, enabling you to become more disciplined and decisive.

Testing and Developing Strategies

With paper trading, you have the capability to test various trading strategies without any financial impact. This is essential, as it allows you to explore different techniques and approaches, understanding what works best under various market conditions. You can analyze outcomes objectively, refining strategies based on performance data.

Using real-time market data, paper trading helps you assess how strategies would perform in actual scenarios. This testing process not only improves your strategies but also boosts your confidence. An opportunity to identify weaknesses and areas for improvement is crucial in strategic development, providing a solid foundation before engaging in live market trades.

Strategies for Crypto Option Paper Trading

Engaging in crypto options paper trading requires precise strategies to optimize learning and enhance performance. Two key approaches, technical and fundamental analysis, provide critical insights and frameworks for decision-making.

Technical Analysis Techniques

Understanding technical analysis can significantly enhance your crypto options trading strategies. It involves studying past market data, primarily price and volume, to forecast future price movements. Key tools include moving averages, trend lines, and candlestick patterns.

You should focus on recognizing patterns that signal potential changes in price trends. For instance, a simple moving average (SMA) smoothens price data to identify emerging trends. Additionally, Bollinger Bands can indicate market volatility, which is crucial in options trading.

Consider incorporating Relative Strength Index (RSI) to monitor overbought or oversold conditions. This indicator can alert you when prices might reverse. Backtesting these techniques within a paper trading environment allows for refinement before applying them to live markets.

Fundamental Analysis Applications

Fundamental analysis involves evaluating economic, financial, and other qualitative and quantitative factors affecting the crypto market. It looks beyond market charts and focuses on the intrinsic value of a cryptocurrency.

You should start by examining metrics like network activity, adoption rates, and regulatory news. Higher network activity often signals stronger market sentiment. Analyzing project development updates and partnership announcements can further inform trading decisions.

Keep track of market news and global financial trends to understand how external factors may influence crypto prices. Evaluating the broader economic environment provides context that can shape your paper trading strategies. This holistic perspective is essential for making informed decisions in the crypto options market.

Risk Management in Paper Trading

Effectively managing risk in crypto options paper trading involves setting appropriate stop losses and ensuring portfolio diversification to minimize potential losses and promote sustainable trading strategies.

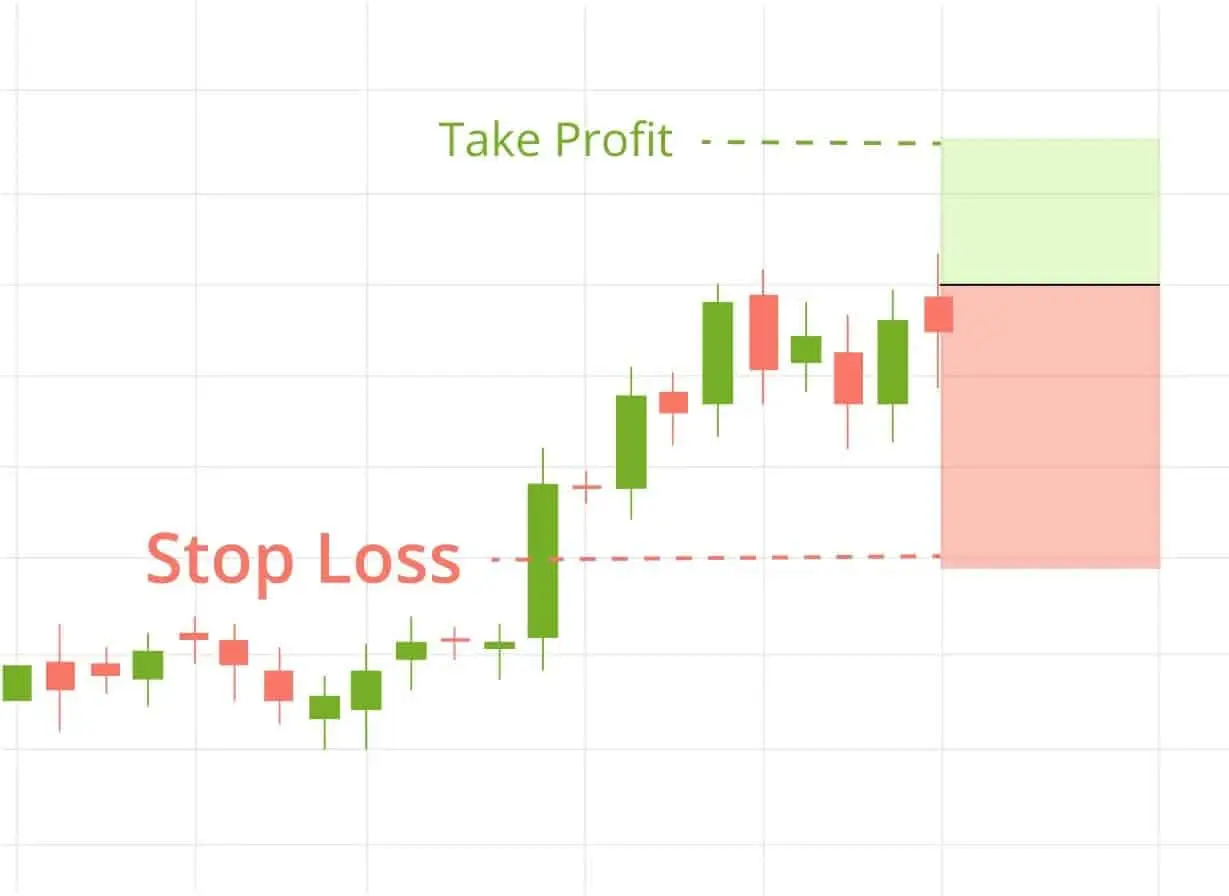

Setting Stop Losses

Stop losses allow you to control potential losses by automatically selling an asset when it reaches a predetermined price. This essential tool helps protect your investments from significant downturns. In paper trading, practice setting stop losses to gauge their impact on your strategies without real financial exposure.

Experiment with different stop loss percentages to understand how small or large buffers affect your trades. Testing various scenarios can enhance your decision-making skills when executing live trades. The key is to balance protecting your capital while allowing room for market fluctuations.

Diversifying Portfolios

Diversifying your portfolio involves spreading investments across multiple assets to reduce risk. In paper trading, this concept is vital for understanding how different crypto options can behave under varying market conditions.

Experiment with various asset combinations, balancing high-risk and low-risk trades to achieve optimal results. Diversification prevents over-reliance on a single asset, ensuring that poor performance in one area doesn’t devastate your entire portfolio. By mastering this approach, you’ll build a stronger, more robust strategy for live trading scenarios.

Practical Exercises for Paper Traders

Engaging in crypto options paper trading provides you with a risk-free environment to hone your trading skills. The following exercises focus on creating and adhering to trading plans and reflecting on your performance.

Creating and Following Trading Plans

A detailed trading plan is crucial for consistency. Identify your trading goals, whether short-term profits or long-term growth. Define your strategy, specifying entry and exit points, and decide on the types of options you’ll trade.

Set risk management rules, such as stop-loss limits to minimize potential losses. Use virtual funds to simulate different scenarios and test the plan’s robustness. Regular practice helps instill discipline.

Track your trades systematically with a trading journal. This process not only enhances learning but also helps in fine-tuning your trading approach. Adapting as you gain insights is key.

Reflecting on Trading Performance

Analyzing your trading performance is essential for growth. After executing trades, take time to review both successful and unsuccessful trades. Evaluate what worked well and where improvements are needed.

Use metrics like win-to-loss ratios and average return per trade to gauge effectiveness. Comparing your outcomes against your original goals can highlight areas to refine. Adjust strategies accordingly.

Keep an introspective outlook to recognize emotional influences. Are you making decisions based on fear or overconfidence? Self-awareness can significantly enhance trading decisions and build resilience.

Regular reflection creates a loop of improvement, reinforcing positive habits and correcting mistakes. Adjustments guided by past experiences ensure better decision-making in future trades.

Transitioning from Paper Trading to Live Trading

Moving from paper trading to live trading in the world of crypto options involves careful planning and mental preparation. It’s crucial to identify the right timing and maintain disciplined trading practices.

When to Make the Switch

Recognizing the timing for transitioning to live trading is pivotal. Ensure that your paper trading records consistently demonstrate a profit over multiple market cycles. This indicates readiness rather than relying solely on short-term success.

Confidence in strategy application is key. Take note of how your strategy performs under different market conditions. Evaluate the economic and market news influences on trading outcomes.

Real money introduces emotional challenges. Consider starting with a small capital and gradually increase investments as your experience grows, minimizing potential losses due to emotional decision-making.

Maintaining Discipline

Discipline is the cornerstone of successful live trading. Start with a well-defined trading plan that outlines your entry and exit criteria. Adhering to your plan can prevent impulsive decisions driven by fear or greed.

Use stop-loss orders to limit downside potential and protect your portfolio. These automated actions minimize risk by selling your position when a certain price level is hit, preventing significant loss.

Track all trades meticulously to build a database of your performance. Maintaining a trading journal will aid in identifying patterns and improving your strategy. Staying objective with this record helps instill self-discipline and continual improvement in your trading practice.

Challenges and Limitations of Paper Trading

Paper trading offers valuable experience in a simulated environment, helping traders test strategies without real financial risks. Yet, it significantly differs from live trading in various psychological aspects, making it easy to fall into habits that could impact real-world performance. Addressing these challenges head-on is crucial for success.

Psychological Differences from Real Trading

When you engage in paper trading, you do not experience the emotional rollercoaster associated with actual trading. There is no real money on the line, so emotions like fear and greed are absent.

This emotional detachment can lead to unrealistic trading behavior and false confidence. In real trading scenarios, psychological pressures play a significant role in decision-making. The absence of stress in paper trading can result in traders underestimating the impact of their emotions when real capital is at stake.

Moreover, you may make riskier trades on a paper platform because the consequences don’t affect your financial status. This behavior might create a gap between your paper trading success and real-life outcomes, necessitating a mindful approach to leverage paper experiences effectively.

Overcoming Complacency

One potential challenge in paper trading is complacency. Without real money involved, you might not take the exercise as seriously, leading to lackluster practice sessions. This lax attitude can hinder your ability to translate paper trading skills into actual market success.

To combat complacency, set clear goals and treat each session as if real funds were at risk. It’s important to review your trades critically and adjust your strategies based on performance outcomes. Maintain a structured routine and keep track of your performance through detailed records.

Incorporating these practices helps you build a disciplined mindset, ensuring that when you transition to live trading, you’re adequately prepared to implement strategies with seriousness and diligence. Regularly assess your progress to actively refine your skills and stay motivated.

Frequently Asked Questions

When you explore paper trading in crypto options, it can serve as a risk-free method to understand the market dynamics and hone your trading strategy. Various platforms and apps are available to guide you through trading without financial risk.

What are the top recommended apps for paper trading crypto options?

Consider using platforms like Binance and OKX, which are well-regarded for crypto paper trading. These platforms provide access to various crypto markets and include features that simulate real trading conditions. Other mentioned platforms include eToro and BitMex, known for their extensive range of trading tools and resources.

How does one practice crypto options trading without real money?

To practice without using real money, you can set up a virtual trading account with a platform that offers crypto options paper trading. This typically involves using demo accounts provided by exchanges or trading apps. These platforms replicate market dynamics, allowing you to test your strategies in a simulated environment.

Is it possible to paper trade crypto options in India?

Yes, paper trading crypto options is possible in India. Many global platforms offering these services are accessible to Indian users. They provide a secure environment to practice trading with virtual funds, enabling you to develop your trading skills without risking actual money.

Explore these crypto option trading exchanges: