Cryptocurrency, with its promise of high rewards, often comes with significant risks.

As more investors turn to digital currencies, protecting these assets becomes crucial.

That’s where crypto options insurance steps in.

It acts as a safety net, shielding your investments from unexpected events like theft or fraud.

This type of insurance helps you manage risks and maintain confidence in your investments.

Understanding crypto options insurance is vital as the digital landscape evolves.

Many providers, like Canopius, offer tailored policies to cover different aspects of crypto-related risks.

By exploring these options, you can ensure that your digital assets are secure, giving you peace of mind when navigating the crypto world.

Crypto options insurance isn’t just about protecting your assets—it also offers a way to stay ahead in a fast-moving market.

As you explore the possibilities, knowing that your investments are insured can open new avenues and opportunities.

Understanding Crypto Options

Crypto options allow you to make decisions about buying or selling digital assets at a future date.

This plays a crucial role in protecting against losses and capitalizing on market trends.

Definition of Crypto Options

Crypto options are financial contracts that give you the right, but not the obligation, to buy or sell a specific amount of a cryptocurrency at a predetermined price.

You can decide to trade the asset before the contract expires.

These options are similar to traditional options used in stock markets, bridging conventional finance with digital currencies.

With crypto options, you gain a tool for speculating on market movements.

If you predict a price increase, you could choose to buy options.

Conversely, if you expect prices to fall, you might buy sell options.

Types of Crypto Options

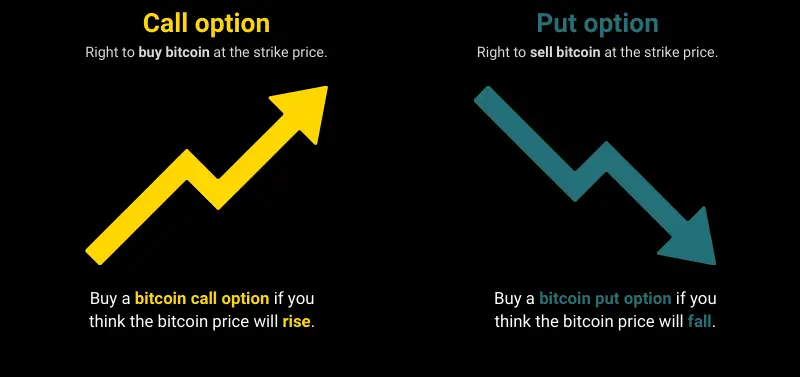

Crypto options come in two main types: call options and put options.

Call options let you purchase cryptocurrency at a set price, while put options allow you to sell.

Both types offer flexibility and control over how and when you trade.

Some platforms also offer American and European options, differing in terms of execution time.

American options let you exercise at any point before expiration, while European options only allow exercise on the expiration date.

How Crypto Options Work

To enter a crypto option contract, you pay a premium, which is the cost of securing the option.

If you exercise a call option, you buy the asset at the agreed price, potentially profiting if the market price goes higher.

For put options, exercising allows you to sell an asset at the option price, advantageous if the market dips.

Market conditions, volatility, and expiry dates impact your strategy with crypto options.

Volatility greatly influences the worth of the options, as it affects the potential for market price swings.

By paying close attention, you can craft strategies that maximize returns while minimizing risks.

Importance of Insurance in Crypto Options

Insurance plays a vital role in securing investments in crypto options by reducing potential financial losses due to market volatility and unforeseen events. It provides a safety net against risks that are particular to the crypto world.

Risks in Trading Crypto Options

Trading crypto options involves a range of risks that you should be aware of.

Market volatility is a significant risk, as cryptocurrency prices can change rapidly and unpredictably. This volatility can lead to large losses if the market moves against your position.

Security threats are another concern.

Crypto wallets and exchanges are often targets for hackers, putting your assets at risk.

Additionally, the lack of regulation in many parts of the crypto space can pose risks, as there may be limited legal recourse if things go wrong.

Liquidity issues can also arise. Some crypto options markets may not always have enough buyers or sellers, which can make it difficult to enter or exit positions.

Role of Insurance in Mitigation

Insurance can help mitigate these risks by providing coverage that protects you against financial losses.

This coverage can include protection against theft, fraud, and technical failures.

If your crypto is stolen or compromised, the right insurance policy can reimburse your losses.

Furthermore, insurance can help offset losses from market crashes.

In volatile environments, having an insurance policy can provide peace of mind, knowing that your investments are safer.

Tailored insurance solutions can offer specific coverage depending on your trading strategies and the particular risks you face.

Evolution of Crypto Insurance Markets

The world of crypto insurance is changing fast.

Traditional insurance has faced many challenges in covering digital assets, while new crypto insurance providers are quickly growing and adapting.

Traditional Insurance vs. Crypto Insurance

In traditional insurance, companies often struggle to cover the unique risks of digital assets like cryptocurrencies.

Blockchain technology poses problems for old systems not used to handling digital security or value volatility. This has made many standard insurers hesitant or slow to enter the crypto space.

In contrast, crypto insurance is designed to deal with these challenges.

These new policies support decentralized finance (DeFi) needs and shield users from crypto risks such as hacks and fraud.

Some insurers even use smart contracts for greater efficiency and transparency, which makes them a strong fit for the blockchain’s requirements.

Growth of Crypto Insurance Providers

As cryptocurrencies have grown, so has demand for more specialized insurance. New companies focus purely on providing coverage for digital assets.

These providers are essential as the value and adoption of cryptocurrencies rise, pushing for insurance options that can match their needs.

Crypto insurance firms are increasingly supported by venture capital and strategic partnerships.

This allows them to innovate quickly and expand services to meet the demands of crypto investors and businesses.

As more people look for reliable ways to protect their digital wealth, the crypto insurance market is expected to keep growing and changing.

Assessing Crypto Options Insurance Coverage

When considering crypto options insurance, you need to make sure that the given coverage suits your needs.

What Insurance Covers

Crypto options insurance usually covers losses due to theft, hacking, and other cyber-related incidents.

Coverage might also include risks related to operational failures, like system outages that impact trading.

Some policies extend to physical damage or loss of access devices, offering a more comprehensive safeguard.

It’s important to know that not all insurance policies will cover market volatility or investment losses.

Always read the terms closely and ask the insurer to explain any confusing parts. Knowing exactly what is covered can prevent unpleasant surprises during a claim process.

Policy Evaluation Criteria

To choose the best insurance policy, you should consider several key criteria.

First, evaluate the premiums and coverage limits.

Make sure they match your investment size and risk tolerance. A low premium might be tempting, but don’t compromise on necessary coverage.

Claims procedures are another crucial aspect.

A straightforward claims process can save you time and stress.

Check reviews or ask for references to understand previous policyholders’ experiences.

Also, verify that the insurer has a history of working with crypto assets, as this expertise can make a significant difference in both coverage and claims handling.

Key Players in Crypto Options Insurance

In the evolving world of crypto options insurance, the landscape features both dedicated crypto insurers and established insurance brokers. These players offer tailored solutions that protect your digital assets from various risks.

Crypto Insurers

Canopius is a notable player offering specialized cryptocurrency insurance.

It provides coverage against theft and fraud, which is critical for safeguarding digital assets.

Such insurance policies are tailored, addressing the unique vulnerabilities in the crypto space.

Coincover also makes significant strides, focusing on preventing asset loss rather than just compensating for it afterward.

Their approach helps users secure their investments actively.

As the demand for crypto protection increases, companies like Evertas and Lloyd’s of London consistently refine their services to meet the advanced needs of digital finance.

Insurance Brokers and Agents

Hotaling Insurance Services stands out for its innovative offerings in crypto insurance.

They provide options for life insurance in Bitcoin denominations, catering to the crypto-savvy audience looking to invest in familiar terms.

Aon and Marsh are traditional brokers entering the crypto space by partnering with specialized insurers.

Their extensive experience in the insurance industry allows them to bridge the gap between traditional and digital asset markets.

Meanwhile, agents like Chubb provide policies tailored to crypto companies, addressing specific operational risks.

Working with knowledgeable brokers and agents ensures you have access to the best coverage options available.

Regulatory Landscape

Understanding the regulatory landscape for crypto options insurance is crucial. Key aspects include how global regulations affect insurance policies in this domain and what compliance measures providers must follow.

Global Insurance Regulations

Global regulations for crypto options insurance vary by region.

In the European Union, the Markets in Crypto-assets Regulation (MiCA) sets the framework.

This regulation aims to provide clarity and safety in the crypto market, including insurance aspects. MiCA requires transparency and accountability from crypto businesses.

In the United States, regulations differ by state. Some states have specific guidelines for crypto insurance.

Regulatory bodies, like the Securities and Exchange Commission (SEC), oversee these regulations to protect investors and maintain market integrity.

Countries like Japan and Australia also have specific rules designed to safeguard the interests of stakeholders in the crypto sector.

Regulatory Compliance for Providers

Providers of crypto options insurance need to adhere to strict compliance measures to operate legally.

Anti-money laundering (AML) and Know Your Customer (KYC) protocols are critical.

These help prevent illegal activities and protect consumer data.

Providers must also manage risks by ensuring they have enough financial reserves to cover potential claims.

This involves meeting capital adequacy requirements, which vary by region.

Meeting these compliance standards helps providers build trust with policyholders and regulatory authorities.

Risk Management in Crypto Options Insurance

Managing risks in crypto options insurance involves evaluating potential threats and using strategies to protect investments. Understanding risk assessment and hedging techniques is key to creating effective insurance solutions.

Risk Assessment Strategies

Risk assessment involves identifying and evaluating risks in the crypto options market.

You must evaluate the volatility of cryptocurrencies, as prices can change rapidly.

Regularly monitor market trends to understand potential threats.

Another strategy is to assess counterparty risk, which arises from the possibility that a partner in an option contract could default.

Evaluating the financial stability and reputation of trading partners is crucial.

Conducting a technical analysis of assets helps in predicting price movements.

Use software tools and statistical methods to assess risk levels.

These strategies help create a clear picture of the risks involved in the market.

Hedging Techniques in Insurance

Hedging techniques are essential for managing risk in crypto options insurance.

One method is diversification, spreading investments across different assets to reduce potential losses. This limits exposure to any single market fluctuation.

Options contracts themselves are a tool for hedging.

Buying options gives the right to buy or sell an asset at a specific price. This protects against unfavorable price changes.

Consider using contingent insurance contracts that activate only if certain conditions are met.

This kind of flexibility helps insurers manage unexpected market shifts.

These methods help in balancing potential gains and avoiding excessive risks in crypto investments.

The Cost of Crypto Options Insurance

When considering crypto options insurance, it’s important to understand how premiums are determined and how these costs compare to other types of insurance. This can help in making informed decisions.

Factors Influencing Premiums

Crypto options insurance costs depend on several factors.

The value of the crypto assets is one of the primary considerations.

For example, insuring higher valued assets generally results in higher premiums.

Another factor is the level of coverage.

Policies offering more comprehensive protection, like coverage against both theft and loss, tend to be more expensive.

Some insurers provide tiered plans, offering different levels of protection based on your needs.

The volatility of the cryptocurrency market also plays a significant role.

Due to frequent price changes, insurers might increase premiums to offset potential risks.

Moreover, your history and experience with trading options can affect costs.

Individuals with more experience may be perceived as lower-risk and might receive better rates.

Comparing Insurance Costs

Crypto options insurance can be compared to other types of crypto insurance.

For instance, individual crypto insurance might cost around 2.5% of the investment, as noted in sources.

When comparing costs, look at the coverage limits provided.

Policies with higher limits or extensions, for example, covering up to 125% of the value due to market changes, may cost more.

Understanding what’s covered and the specific terms of each policy is essential to evaluate if the costs align with the value offered.

Challenges and Limitations

When dealing with crypto options insurance, you face various challenges. Key issues include the difficulty of adopting such coverage and handling claims properly in this digital landscape.

Adoption Barriers

One of the main barriers to adopting crypto options insurance is the lack of historical data.

Due to the relatively new nature of cryptocurrencies, insurers struggle to assess risk accurately.

Without past trends, it’s difficult for them to predict future patterns, making premium calculations more challenging.

Regulatory uncertainty adds another layer of complexity.

Different regions have varying laws and regulations concerning cryptocurrency, which can deter insurers from entering the market.

Navigating these regulations can be complex and time-consuming.

Furthermore, the volatility of cryptocurrencies presents a problem.

Prices can fluctuate significantly, causing difficulties in valuing assets and setting premiums.

Insurers must account for these rapid changes, which can make pricing strategies harder to develop.

Claims and Reimbursement Issues

Handling claims in crypto insurance involves unique difficulties.

The digital nature of cryptocurrencies requires specific expertise to assess losses accurately.

Insurers may face challenges in evaluating whether a claim is legitimate due to the complex technical aspects of cryptocurrency transactions.

Fraud is another major concern.

The potential for fraudulent claims is higher, given the anonymity and lack of transparency in some crypto transactions.

Insurers need to implement strict measures to detect and prevent fraud, which can be resource-intensive.

Reimbursements can be complicated by the volatile prices of cryptocurrencies.

The value of crypto holdings can change rapidly, affecting the amount that should be paid out for claims.

This instability requires insurers to regularly update their evaluation methods to ensure fair reimbursements.

Future of Crypto Options Insurance

Crypto options insurance is set to grow as digital assets gain popularity. New trends are emerging, and innovative coverage solutions are being developed to address complex risks.

Emerging Trends

Crypto options insurance is evolving rapidly.

One key trend is the increased demand for coverage against cyber threats.

As more people invest in cryptocurrencies, the need for protection against hacking and theft is crucial.

This demand is pushing insurance companies to offer specialized policies.

Another trend is the use of blockchain technology.

Blockchain provides a secure way to track and validate transactions, which can enhance trust and transparency in the insurance process.

This technology can also streamline claims, making them faster and more efficient.

You’ll see more insurers adopting blockchain to improve service and reduce costs.

Innovations in Coverage

Insurance providers are creating new products specifically designed for cryptocurrencies.

One innovation is the introduction of smart contracts.

These digital agreements automatically execute when certain conditions are met, ensuring quicker and more precise claims processing.

Additionally, insurers are offering more comprehensive policies.

These may include coverage for volatile market movements, which can significantly impact crypto investments.

Companies are developing ways to predict and mitigate losses related to these fluctuations, providing you with more robust protection.

Frequently Asked Questions

When it comes to cryptocurrency options insurance, understanding the different factors and players in the market can be complex. This section addresses key questions about cost, providers, acquisition, and specific roles in the industry.

What factors determine the cost of cryptocurrency options insurance?

The cost can vary based on several factors, including the value of the assets, the volatility of the market, and the level of coverage needed.

Insurers also consider the security measures in place to protect your assets.

Which companies offer the best insurance for cryptocurrency options?

Several companies provide coverage, with some notable names being Lloyd’s of London and BitGo.

These firms are known for their expertise in the field and offer a range of insurance options tailored to digital assets.

How can individuals acquire insurance for their cryptocurrency holdings?

To acquire insurance, you typically need to contact an insurer directly or through a broker.

You may need to provide information about your holdings and security practices.

Some exchanges also offer integrated insurance solutions for user assets.

What role does Lloyd’s play in the cryptocurrency insurance market?

Lloyd’s has been a pioneer in developing insurance solutions for cryptocurrencies.

They work with various syndicates to provide tailored coverage options.

Their role involves assessing risks and establishing protocols for insuring digital assets.

Are there any specific protocols that provide insurance for crypto assets?

Some blockchain protocols, such as Nexus Mutual, offer decentralized insurance options.

These protocols use a community-based approach to coverage, allowing users to pool funds and share risks.

What are the risks associated with insuring cryptocurrency options?

Cryptocurrency insurance faces risks such as hacking incidents, regulatory changes, and market volatility.

Insurers must also consider the possibility of fraud and the rapidly evolving landscape of digital currencies.