Looking for the right cryptocurrency exchange can be tough with so many options available. Two popular platforms that often come up in comparison are Crypto.com and Phemex. Both offer ways to buy, sell, and trade Bitcoin and other cryptocurrencies, but they differ in important areas that might affect which one works better for you.

When choosing between Crypto.com and Phemex in 2025, you’ll want to consider their different fee structures, available cryptocurrencies, trading features, and user experiences. Crypto.com might appeal to some users for certain reasons, while Phemex offers advantages in other areas like security and trading tools.

Each platform has its own strengths that cater to different types of crypto users. Whether you’re a beginner looking for a simple interface or an experienced trader needing advanced features, understanding these key differences will help you make the right choice for your cryptocurrency journey.

Crypto.com Vs Phemex: At A Glance Comparison

When choosing between Crypto.com and Phemex, you need to understand their key differences. Both platforms are popular cryptocurrency exchanges but they serve different needs.

Trading Fees

- Crypto.com: Generally higher trading fees structure

- Phemex: Typically offers lower trading fees, appealing to frequent traders

Leverage Options

- Phemex: Offers up to 100X leverage for derivatives trading

- Crypto.com: Lower leverage options for most trading pairs

Platform Focus

- Crypto.com: More comprehensive ecosystem including card services, NFTs, and DeFi wallet

- Phemex: Stronger focus on derivatives trading and advanced trading features

Supported Cryptocurrencies

- Both support major cryptocurrencies

- Crypto.com typically offers a wider selection of altcoins

User Experience

- Crypto.com: More beginner-friendly interface with additional services

- Phemex: Designed with advanced and day traders in mind

Security Features

| Feature | Crypto.com | Phemex |

|---|---|---|

| 2FA | Yes | Yes |

| Cold Storage | Majority of funds | Majority of funds |

| Insurance | Yes | Limited |

You might prefer Crypto.com if you want a full-service platform with multiple crypto products beyond just trading. Phemex could be your better choice if you’re focused on derivatives trading with high leverage.

Both exchanges offer mobile apps, but they differ in interface complexity and available features.

Crypto.com Vs Phemex: Trading Markets, Products & Leverage Offered

When choosing between Crypto.com and Phemex, understanding their trading options is crucial for your investment strategy.

Trading Markets

Both platforms offer spot trading for popular cryptocurrencies like Bitcoin and Ethereum. Phemex specializes in derivatives trading, while Crypto.com provides a wider range of market types for different trader preferences.

Leverage Options

Phemex stands out with its impressive leverage offerings:

- Up to 100x leverage on futures trading

- Zero-fee trading options available

Crypto.com offers more modest leverage options, typically ranging from 3x to 20x depending on the trading product.

Products Comparison

| Feature | Crypto.com | Phemex |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | ✅ | ✅ |

| Options | Limited | ✅ |

| Margin Trading | ✅ | ✅ |

| Max Leverage | Up to 20x | Up to 100x |

| Derivatives Focus | Moderate | Strong |

Phemex is particularly strong for mobile traders who want high leverage options. Its user-friendly app makes it easy to manage complex trades on the go.

Crypto.com offers a more comprehensive ecosystem with additional products like crypto credit cards and interest-bearing accounts alongside trading options.

Your choice should depend on your trading goals. If you’re looking for high-leverage derivatives trading, Phemex has the edge. For a broader platform with moderate leverage and additional services, Crypto.com might be more suitable.

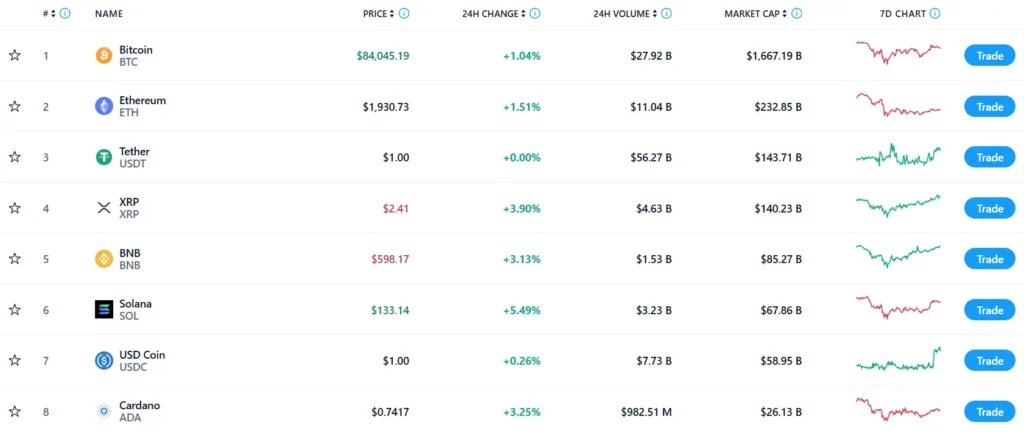

Crypto.com Vs Phemex: Supported Cryptocurrencies

When choosing between Crypto.com and Phemex, the variety of supported cryptocurrencies is an important factor to consider. Based on current information, Crypto.com offers a larger selection of cryptocurrencies compared to Phemex.

Crypto.com supports a wide range of digital assets for trading. Their platform allows you to buy, sell, and trade numerous cryptocurrencies, giving you more options for diversifying your portfolio.

Phemex, while offering fewer cryptocurrencies overall, still provides access to approximately 350 spot cryptocurrencies. The exchange also features over 120 derivatives trading markets, which might be valuable if you’re interested in crypto derivatives trading.

Here’s a quick comparison of their cryptocurrency support:

| Feature | Crypto.com | Phemex |

|---|---|---|

| Number of cryptocurrencies | Higher | Lower |

| Spot trading options | Extensive | ~350 cryptocurrencies |

| Derivatives markets | Available | ~120 markets |

If you’re looking to trade popular cryptocurrencies like Bitcoin, Ethereum, or Solana, both platforms will likely meet your needs. However, if you want access to more obscure or newer altcoins, Crypto.com might be the better option.

Your trading strategy should influence your choice. If you primarily trade major cryptocurrencies, either platform could work well for you. For those seeking maximum variety, Crypto.com appears to have the edge in cryptocurrency selection.

Crypto.com Vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

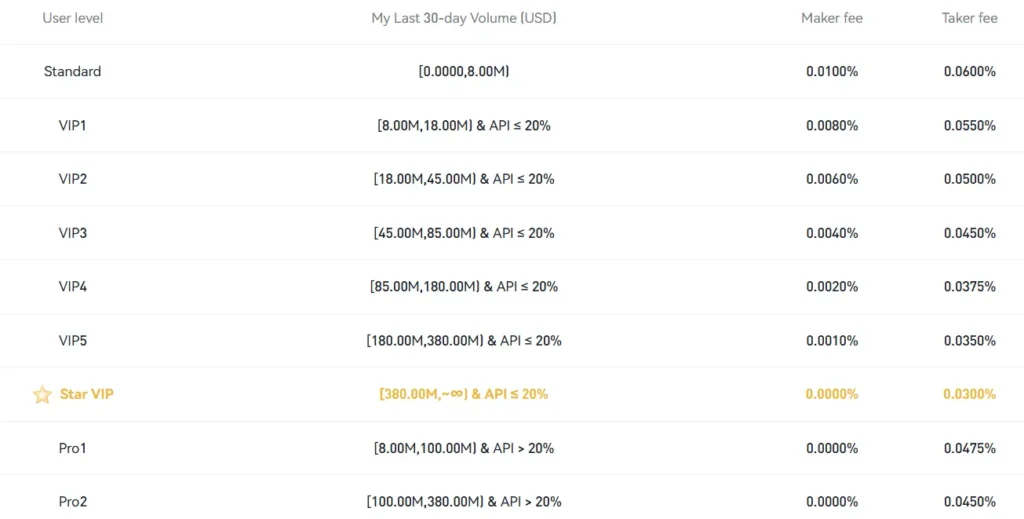

When choosing between Crypto.com and Phemex, fees play a crucial role in your decision-making process. Both platforms offer competitive fee structures, but there are notable differences.

Phemex generally offers lower trading fees starting at 0.1% for makers, while standard fees are around 0.3% to 0.4%. This makes Phemex an attractive option if you trade frequently.

Crypto.com, on the other hand, typically charges similar but slightly higher trading fees compared to Phemex. The exact rates depend on your trading volume and whether you stake their native token.

| Exchange | Standard Trading Fees | Notable Features |

|---|---|---|

| Phemex | 0.3% / 0.4% | 0% withdrawal fees, trading bots |

| Crypto.com | Slightly higher | Deposit minimums for interest earnings |

For withdrawals, Phemex stands out by offering zero fees on many cryptocurrencies. This can save you significant money if you frequently move assets off the exchange.

Crypto.com requires minimum deposits to earn interest on your holdings. This might not affect casual traders but is worth considering if you plan to keep funds on the platform.

Both exchanges provide ways to reduce fees further. Phemex achieves this through higher trading volumes, while Crypto.com offers discounts when you stake their native token.

Your choice should depend on your trading frequency and typical transaction sizes. High-volume traders may benefit more from Phemex’s lower fee structure.

Crypto.com Vs Phemex: Order Types

When trading cryptocurrency, the types of orders available can greatly impact your trading strategy. Both Crypto.com and Phemex offer various order options to help you execute trades effectively.

Phemex provides a comprehensive selection of order types divided into basic and advanced categories. Their platform supports standard market, limit, and stop orders for beginners.

For more experienced traders, Phemex offers advanced order types including trailing stops and conditional orders. These tools help you maximize profit potential while managing risk in volatile markets.

Crypto.com also features a robust set of order types. Their platform maintains high ratings on mobile (4.3/5 stars with over 500,000 downloads) and provides real-time market data for informed decision-making.

Basic Order Types Available on Both Platforms:

- Market Orders

- Limit Orders

- Stop Orders

Advanced Features Comparison:

| Feature | Phemex | Crypto.com |

|---|---|---|

| Trailing Stops | Yes | Yes |

| Conditional Orders | Yes | Yes |

| Mobile Trading | Yes | Yes (higher rated app) |

| Demo/Simulated Trading | Yes | Limited |

Phemex stands out with its simulated trading market, allowing you to practice strategies risk-free before using real funds.

Crypto.com edges ahead in user experience with its highly-rated mobile application that puts advanced order types at your fingertips.

Both platforms support derivatives trading, though Phemex is known for offering up to 100x leverage on certain products.

Crypto.com Vs Phemex: KYC Requirements & KYC Limits

When choosing between Crypto.com and Phemex, understanding their KYC (Know Your Customer) requirements is essential for your trading experience.

Crypto.com KYC Requirements:

- KYC verification is mandatory for all users

- The process can take longer than average to complete

- Multiple verification tiers exist that unlock different features

Crypto.com requires all users to complete KYC verification before trading. The verification process includes submitting identification documents and proof of address.

Phemex KYC Requirements:

- Basic trading is available without KYC

- Full features require KYC verification

- KYC verification unlocks higher withdrawal limits

Phemex offers more flexibility with its KYC approach. You can deposit funds and perform basic trading without completing KYC verification.

Trading Limits Comparison:

| Feature | Crypto.com | Phemex |

|---|---|---|

| Deposit without KYC | Not allowed | Allowed |

| Withdrawal limits without KYC | N/A | Limited |

| Full trading access | Requires KYC | Requires KYC |

Be aware that using Phemex without KYC verification can create problems. Some users report difficulty withdrawing funds later if they can’t complete verification.

For maximum security and accessibility, completing KYC on either platform is recommended. This ensures you won’t face unexpected restrictions when trying to access your funds.

Crypto.com Vs Phemex: Deposits & Withdrawal Options

When choosing between Crypto.com and Phemex, understanding their deposit and withdrawal options is crucial for your trading experience.

Withdrawal Fees

| Platform | Cryptocurrency Withdrawal | Fee Range |

|---|---|---|

| Crypto.com | Varies by cryptocurrency | Up to $60 |

| Phemex | Bitcoin example | 0.0001 BTC |

Phemex generally offers more competitive withdrawal fees compared to Crypto.com. For Bitcoin withdrawals specifically, Phemex charges a flat 0.0001 BTC fee.

Deposit Methods

Both exchanges support cryptocurrency deposits. Crypto.com provides more fiat deposit options through bank transfers, credit cards, and debit cards.

Phemex has fewer fiat deposit methods but focuses on efficient crypto transfers. This might be sufficient if you already hold digital assets.

Withdrawal Speed

Crypto.com processing times vary based on network congestion and verification requirements. Withdrawals typically process within a few hours but can take longer during busy periods.

Phemex aims for faster processing times for cryptocurrency withdrawals, often completing them within 1-2 hours under normal network conditions.

Fiat Options

Crypto.com stands out with better fiat support, allowing deposits and withdrawals in multiple currencies. Some fiat transactions may be free depending on your payment method.

Phemex focuses primarily on cryptocurrency transactions with limited fiat options. This makes Crypto.com more convenient if you need to move between traditional and digital currencies frequently.

Crypto.com Vs Phemex: Trading & Platform Experience Comparison

Crypto.com and Phemex offer distinct trading experiences that cater to different types of crypto traders. Both platforms have evolved significantly by 2025, but they maintain unique characteristics that set them apart.

Crypto.com provides a more comprehensive ecosystem with an intuitive interface that beginners find approachable. You’ll find the navigation straightforward with clear menus and helpful tooltips to guide your trading journey.

Phemex, in contrast, focuses on delivering a more advanced trading experience. Its platform offers more detailed charting tools and technical analysis features that experienced traders value.

Trading Tools Comparison:

| Feature | Crypto.com | Phemex |

|---|---|---|

| Mobile App | ★★★★☆ | ★★★★☆ |

| Trading View Integration | Yes | Yes |

| Advanced Order Types | Limited | Extensive |

| Demo/Practice Account | Limited | Full-featured |

Crypto.com excels in offering a wider range of cryptocurrencies for trading. You can access numerous altcoins and tokens that might not be available on Phemex.

Phemex stands out with its competitive fee structure and derivatives trading options. You’ll appreciate its high-performance engine that can process orders quickly even during market volatility.

The user experience on Crypto.com emphasizes simplicity and integration with other services. Your trading activities can seamlessly connect with the Crypto.com card and earning products.

Phemex focuses on speed and reliability for active traders. You’ll notice faster execution times and less downtime during high-volume trading periods.

Crypto.com Vs Phemex: Liquidation Mechanism

Both Crypto.com and Phemex use liquidation mechanisms to protect their platforms when traders use leverage. These systems automatically close positions when they become too risky.

On Phemex, liquidation happens when your position’s value drops too low. Specifically, when the sum of your Initial Margin, Realized PnL, and Unrealized PnL falls below the Maintenance Margin requirement.

Crypto.com operates similarly, but with its own specific thresholds. Both platforms will close your position automatically to prevent further losses when your collateral isn’t enough to support your trade.

The key difference is in how they notify you and what options you have before liquidation occurs. Phemex provides detailed information about liquidation levels directly in your trading interface.

Important factors to consider:

- Margin calls: Both platforms may alert you before liquidation

- Liquidation thresholds: Different maintenance margin requirements

- Notification systems: How you’re informed about approaching liquidation

- Partial liquidation options: Whether positions can be partially closed

You should check each platform’s current liquidation policies before trading with leverage. This helps you understand exactly when your positions might be at risk.

Higher leverage means higher risk of liquidation on both platforms. Your trading style and risk tolerance should guide which platform’s liquidation mechanisms better suit your needs.

Crypto.com Vs Phemex: Insurance

When comparing cryptocurrency exchanges, insurance coverage is a critical factor to consider for your asset protection. The difference between Crypto.com and Phemex in this area is significant.

Crypto.com maintains substantial insurance coverage of $750 million for your assets. This extensive protection helps safeguard your investments against potential security breaches or hacks. The platform also holds SOC certifications, which indicates compliance with strict security standards.

Phemex, while focusing on security, does not advertise the same level of insurance coverage. Their approach centers more on cold storage solutions to protect user funds rather than extensive insurance policies.

This insurance gap might be important for you if asset protection is a top priority. Higher insurance coverage can provide greater peace of mind when trading or holding significant amounts of cryptocurrency.

Here’s a quick comparison:

| Exchange | Insurance Coverage | Additional Security |

|---|---|---|

| Crypto.com | $750 million | SOC certifications |

| Phemex | Not specified | Focus on cold storage |

You should consider how much value you place on comprehensive insurance when choosing between these platforms. For large investments, the added protection from Crypto.com might be worth considering despite any differences in fees or features.

Crypto.com Vs Phemex: Customer Support

When choosing between cryptocurrency exchanges, customer support can be a deciding factor. Both Crypto.com and Phemex offer support options, but they differ in several key areas.

Crypto.com provides 24/7 customer support through their in-app chat feature. You can also reach their team via email and access their extensive help center for common issues. Their response times typically range from a few minutes to several hours depending on query complexity.

Phemex also maintains a 24/7 support system through live chat and email. They’re known for their quick response times, often under 30 minutes for urgent matters. Their support team is particularly praised for handling technical trading questions.

Support Channels Comparison:

| Feature | Crypto.com | Phemex |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Phone Support | Limited | No |

| Help Center | Comprehensive | Basic |

| Community Forum | Active | Very Active |

| Social Media Support | Moderate | Responsive |

Phemex has built a strong reputation for their active community forums where users can get peer assistance. Their moderators regularly participate in discussions and provide solutions.

You’ll find Crypto.com excels with their detailed knowledge base and step-by-step guides. Their multi-language support is helpful if English isn’t your primary language.

Both platforms offer adequate customer support, but your preference may depend on whether you value extensive documentation (Crypto.com) or faster response times and community engagement (Phemex).

Crypto.com Vs Phemex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Crypto.com and Phemex offer robust security features to protect your digital assets.

Crypto.com implements multi-factor authentication (MFA) to verify your identity when logging in. They also use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

Phemex matches these security measures with their own cold wallet storage system. They store approximately 99% of user assets in cold wallets, significantly reducing the risk of theft.

Key Security Features Comparison:

| Feature | Crypto.com | Phemex |

|---|---|---|

| Cold Storage | Yes (majority of funds) | Yes (99% of funds) |

| Multi-Factor Authentication | Yes | Yes |

| Insurance Coverage | Yes | Limited |

| Regular Security Audits | Yes | Yes |

| Whitelisting | Yes | Yes |

Both platforms use SSL encryption to protect your data during transmission. They also allow you to whitelist withdrawal addresses, adding an extra layer of protection against unauthorized transfers.

Crypto.com holds an edge with its more comprehensive insurance coverage against theft and security breaches. This provides you with additional peace of mind when storing larger amounts on the platform.

Phemex counters with a zero-fee security structure for certain account levels, making it attractive if you’re an active trader concerned about both security and costs.

Neither platform has experienced major security breaches in recent years, which speaks to their commitment to maintaining strong security standards.

Is Crypto.com A Safe & Legal To Use?

Crypto.com is considered one of the safer cryptocurrency exchanges available today. The platform stores 100% of customer funds in cold wallets, keeping them offline and away from potential online threats.

The exchange has implemented strong security measures to protect users. These include multi-factor authentication, which adds an extra layer of protection to your account.

Crypto.com is a legal platform operating in compliance with regulations in countries where it provides services. It follows KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, which are standard requirements for legal operation.

Key Security Features:

- Cold storage for all customer funds

- Physical theft and damage insurance

- Multi-factor authentication

- Regular security audits

When comparing safety aspects, both Crypto.com and Phemex maintain high security standards. However, Crypto.com offers a wider range of cryptocurrencies, which might be important for your investment strategy.

The fees on Crypto.com are generally higher than some competitors. This might be a downside if you’re frequently trading, but it’s less of an issue if you’re mainly holding cryptocurrencies.

You should always use strong, unique passwords and enable all available security features when using any crypto exchange. This adds an extra layer of protection to your investments.

Is Phemex A Safe & Legal To Use?

Phemex has built a reputation as a secure and legitimate cryptocurrency exchange. As of March 2025, it stands as a major centralized exchange that has never experienced a security breach or hack, which is noteworthy in the crypto space.

The platform operates with regulatory compliance in most jurisdictions, though specific regulations vary by country. Always check your local laws before using any crypto exchange.

Phemex enhances security through:

- Two-factor authentication (2FA)

- Cold storage for the majority of user funds

- Regular security audits

- Withdrawal confirmation requirements

The exchange offers trading tools with up to 100x leverage, but this comes with significant risk. High leverage can lead to substantial losses if markets move against your position.

User experiences suggest Phemex has reliable customer support and a stable platform. The interface is designed to be user-friendly while still offering advanced features for experienced traders.

Copy trading and trading contests are additional features that might appeal to users looking to learn or compete. These social elements don’t directly affect safety but show platform stability.

Remember that all cryptocurrency trading carries inherent risks. While Phemex appears to maintain good security practices, you should always use strong passwords, enable all security features, and never invest more than you can afford to lose.

Phemex Vs Crypto.com Conclusion: Why Not Use Both?

Both Phemex and Crypto.com offer unique advantages that can benefit crypto traders and investors. You don’t necessarily need to choose just one platform.

Crypto.com provides a better user experience with a smoother interface that many beginners find easier to navigate. It also offers a wider range of services beyond trading, making it a more comprehensive crypto ecosystem.

Phemex excels in derivatives trading with over 120 markets available. It’s particularly strong for active traders who want to use futures and perpetual contracts. The platform also offers a valuable testnet feature where you can practice trading without risking real money.

Consider using Crypto.com for:

- Everyday crypto transactions

- Simpler user interface

- Broader ecosystem of services

Consider using Phemex for:

- Advanced trading features

- Derivatives and futures trading

- Practice trading on the testnet

Be aware that Phemex charges withdrawal fees for most cryptocurrencies and has minimum withdrawal amounts. It also doesn’t support crypto staking, which might be important if you’re looking to earn passive income.

Your trading needs and experience level should guide your choice. Many experienced traders use multiple platforms to take advantage of different features, fee structures, and available cryptocurrencies.

By using both platforms strategically, you can enjoy the best features each has to offer while minimizing their individual drawbacks.

Frequently Asked Questions

When comparing Crypto.com and Phemex for trading needs, several key questions arise about their fees, trading experience, security measures, and overall platform performance. These concerns directly impact which exchange might better suit your trading style and goals.

What are the main differences in futures trading fees between Crypto.com and Phemex?

Crypto.com and Phemex have different fee structures for futures trading. Phemex typically offers lower maker and taker fees for futures contracts compared to Crypto.com.

Phemex uses a tiered fee structure that rewards higher trading volumes with lower fees. Their base taker fees start around 0.06% and can decrease based on your trading volume.

Crypto.com’s futures trading fees are generally higher, with taker fees starting at about 0.07%. They also offer volume-based discounts but typically remain slightly higher than Phemex at comparable trading levels.

Which platform, Crypto.com or Phemex, is generally considered better for futures trading?

Phemex is often considered better for dedicated futures traders due to its more advanced trading interface and lower fees. The platform was specifically designed with derivatives trading in mind.

Crypto.com offers a more comprehensive ecosystem that includes many services beyond trading, which may appeal to users looking for an all-in-one platform. However, its futures trading tools are not as specialized.

Phemex provides more advanced charting tools and order types that professional futures traders prefer. Its trading engine also tends to handle high-volume trading periods with less lag.

What are the top considerations when choosing an exchange for futures trading?

Fee structure should be a primary consideration as it directly impacts your trading profits. Lower fees can significantly affect your bottom line, especially with frequent trading.

Liquidity is crucial for futures trading to ensure your orders are filled quickly at expected prices. Look at the trading volumes and order book depth for the specific contracts you plan to trade.

Platform reliability and speed matter greatly during volatile market conditions. Exchanges that experience downtime during high-volume trading periods can cost you money.

Trading tools and interface quality impact your trading efficiency. Features like advanced order types, price alerts, and customizable charts can give you an edge.

How do the trading volumes of Crypto.com and Phemex compare for crypto futures?

Crypto.com generally has higher overall trading volumes across its entire platform, but Phemex often shows stronger volume specifically for futures contracts.

Phemex has built a reputation in the futures trading community, which has helped it attract significant trading volume for derivatives despite being a smaller exchange overall.

The liquidity for specific trading pairs can vary between the two platforms. Popular pairs like BTC/USDT futures contracts typically have good liquidity on both exchanges.

Are there significant differences in the security measures between Crypto.com and Phemex?

Both exchanges implement strong security measures including two-factor authentication, cold storage for the majority of funds, and regular security audits.

Crypto.com has invested heavily in security certifications and insurance coverage. They hold ISO/IEC 27001:2013, PCI 3.2.1 certifications and have secured significant insurance coverage for digital assets.

Phemex also maintains strict security protocols but has a shorter track record than Crypto.com. They employ a multi-signature cold wallet system and maintain a dedicated security team.

What has been the user experience with withdraws and deposits on Crypto.com versus Phemex?

Users report that Phemex typically processes withdrawals faster than Crypto.com, with most withdrawals completing within 30 minutes to an hour.

Crypto.com has more deposit options including credit/debit card payments and bank transfers, while Phemex primarily focuses on crypto deposits.

Fee structures for withdrawals differ, with Phemex often charging lower withdrawal fees for most cryptocurrencies. Crypto.com’s withdrawal fees tend to be higher but vary based on your membership tier.

Both platforms experience occasional delays during peak market activity, but Phemex generally receives better feedback regarding consistent withdrawal processing times.