Choosing the right crypto exchange can make a big difference in your trading journey. Crypto.com and KuCoin are two popular platforms that offer various features for crypto enthusiasts. When comparing Crypto.com vs KuCoin in 2025, you’ll find KuCoin offers more trading options and features like trading bots, while Crypto.com provides a more streamlined user experience.

Both exchanges have their strengths. KuCoin is praised for its wide range of cryptocurrencies and advanced trading tools, making it a favorite among US users with limited options. Crypto.com, on the other hand, focuses on ease of use and security measures that might appeal to newer traders.

Your choice between these platforms will depend on what you value most. Do you prefer more trading options and advanced features, or do you want a simpler experience with strong security? This comparison will help you decide which exchange better fits your crypto trading needs.

Crypto.com vs KuCoin: At A Glance Comparison

When choosing between Crypto.com and KuCoin, you’ll want to consider how these platforms stack up against each other in key areas.

Fees: KuCoin generally offers lower fees compared to Crypto.com. Many users find KuCoin’s fee structure more competitive, which can save you money on trades.

User Experience:

- Crypto.com: Known for a sleek, user-friendly interface with mobile app focus

- KuCoin: Offers more advanced trading features that experienced traders appreciate

Available Cryptocurrencies:

- Crypto.com: Supports 250+ cryptocurrencies

- KuCoin: Offers 700+ cryptocurrencies, giving you more options

Special Features:

| Feature | Crypto.com | KuCoin |

|---|---|---|

| Card Program | Visa cards with crypto cashback | Not available |

| Native Token | CRO | KCS (offers trading discounts) |

| Lending | Yes | Yes (more options) |

| API Services | Basic | Advanced |

Security: Both platforms invest in security, but they use different approaches. You should research their specific measures if security is your top priority.

KuCoin seems to excel in trading functionality and variety of coins, while Crypto.com offers more integrated services like visa cards and a simpler experience for beginners.

Your choice depends on what you value more: KuCoin’s lower fees and wider selection or Crypto.com’s user-friendly ecosystem.

Crypto.com vs KuCoin: Trading Markets, Products & Leverage Offered

Both Crypto.com and KuCoin offer diverse trading options, but they differ in important ways.

Available Markets

| Exchange | Spot Trading | Futures | Margin Trading | Other Products |

|---|---|---|---|---|

| Crypto.com | Yes | Yes | Yes | NFT marketplace, Visa cards |

| KuCoin | Yes | Yes | Yes | Trading bots, Lending |

KuCoin stands out with its leverage options, offering up to 125x leverage in futures markets and 5x for margin trading. This makes it attractive for traders seeking higher risk positions.

Crypto.com offers more conservative leverage limits but compensates with a wider range of products including crypto Visa cards that connect your digital assets to real-world spending.

Trading Variety

KuCoin typically lists more cryptocurrencies and trading pairs than Crypto.com. This gives you access to newer, smaller-cap tokens that might not be available elsewhere.

Both platforms support spot trading for beginners and more advanced trading features for experienced users. KuCoin’s trading bots are particularly popular for automating strategies without requiring constant monitoring.

For US traders, KuCoin offers more options as Crypto.com has more restrictions for US customers. However, this comes with regulatory considerations you should research based on your location.

The exchanges differ in their focus – Crypto.com aims to be a complete ecosystem for crypto usage, while KuCoin positions itself as “the people’s exchange” with more diverse trading options.

Crypto.com vs KuCoin: Supported Cryptocurrencies

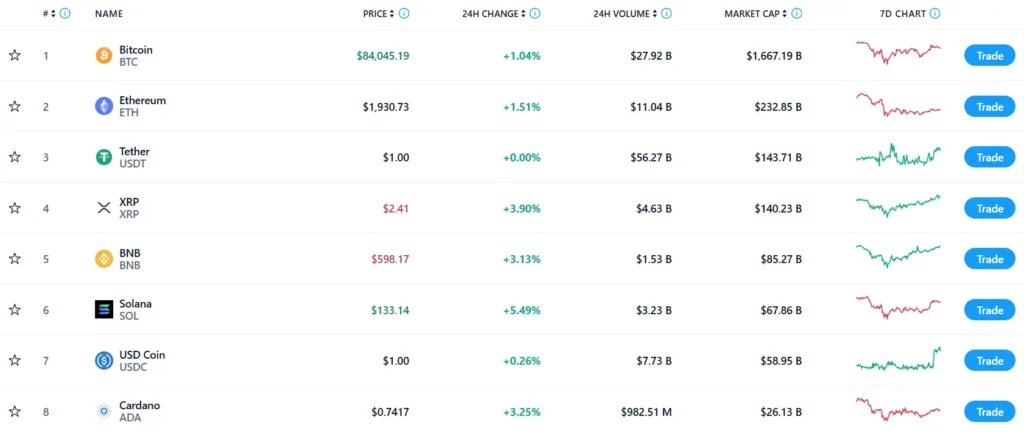

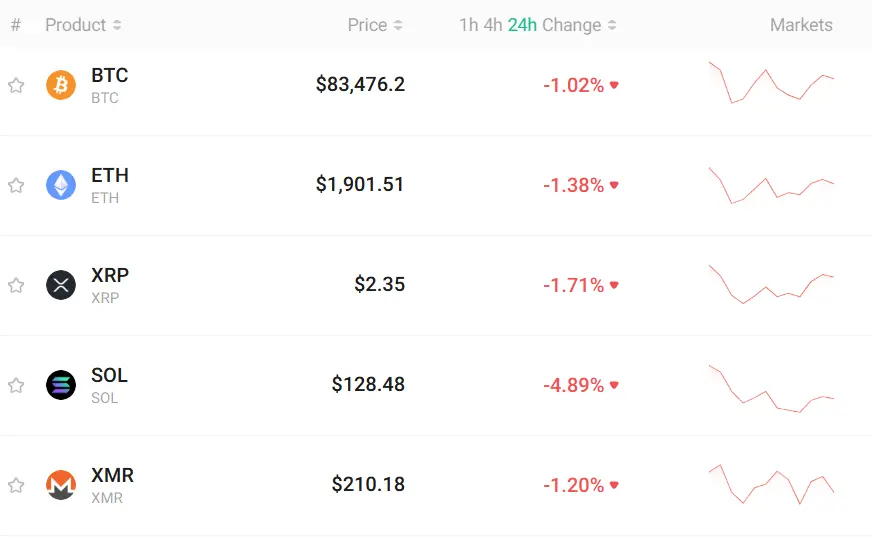

When choosing between Crypto.com and KuCoin, the variety of available cryptocurrencies is an important factor to consider. Based on current information, Crypto.com offers more cryptocurrencies than KuCoin.

Crypto.com supports over 250 cryptocurrencies, giving you access to both established coins and emerging tokens. You’ll find all the major options like Bitcoin, Ethereum, and Solana, plus many smaller altcoins.

KuCoin hosts approximately 200 cryptocurrencies. While slightly fewer than Crypto.com, KuCoin still provides a robust selection that covers most investor needs.

Both platforms support these popular cryptocurrencies:

| Cryptocurrency | Crypto.com | KuCoin |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Cardano (ADA) | ✓ | ✓ |

| Solana (SOL) | ✓ | ✓ |

| Dogecoin (DOGE) | ✓ | ✓ |

If you’re interested in newer, emerging tokens, both platforms regularly add new listings. However, Crypto.com tends to be more selective about which new coins they add.

KuCoin often lists newer, smaller-cap coins faster, earning it the nickname “People’s Exchange.” This makes KuCoin potentially better if you want to invest in very new projects.

Your choice ultimately depends on which specific cryptocurrencies you want to trade. For most common coins, either platform will meet your needs.

Crypto.com vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

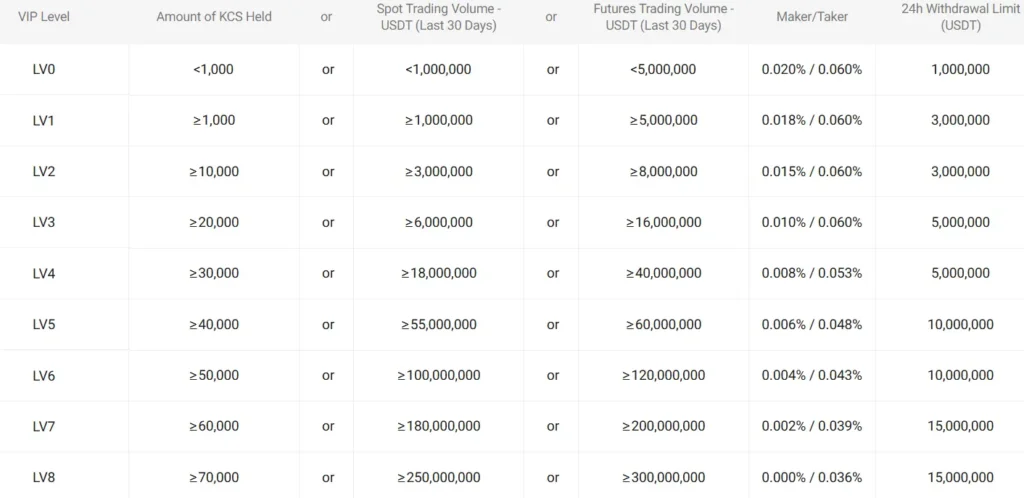

When choosing between Crypto.com and KuCoin, understanding their fee structures can help you save money on your crypto transactions.

Trading Fees

KuCoin offers competitive spot trading fees starting at 0.1% for both makers and takers. You can get discounts down to 0.08% when paying with KuCoin Token (KCS).

Crypto.com’s trading fees vary, but are generally competitive. The platform offers different fee tiers based on your trading volume and whether you stake their native token.

Deposit Fees

Both exchanges offer free deposits, making it easy to fund your account without extra costs.

Withdrawal Fees

KuCoin charges specific withdrawal fees depending on the cryptocurrency. For example, Bitcoin withdrawals cost 0.0002 BTC (about $16.78) and Ethereum withdrawals cost 0.0027 ETH (about $5.22) as of March 2025.

Crypto.com charges $25 for all fiat withdrawals. For crypto withdrawals, the fees vary by asset, with Bitcoin costing around 0.0005 BTC per withdrawal.

P2P Fees

KuCoin doesn’t charge P2P taker fees, while Crypto.com charges between 0.16% and 0.20% for P2P transactions.

Choosing between these platforms may depend on which cryptocurrencies you trade most often and how frequently you make withdrawals.

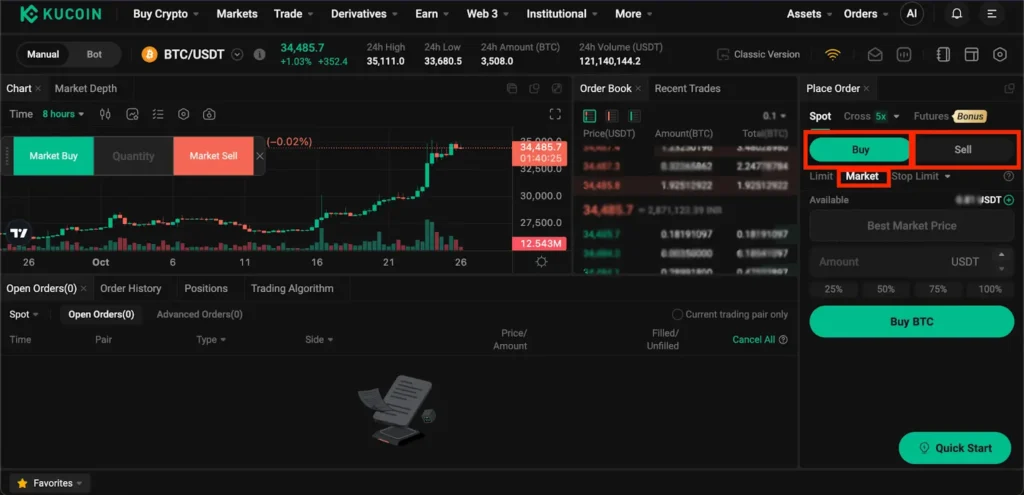

Crypto.com vs KuCoin: Order Types

When trading on cryptocurrency exchanges, order types are essential tools that help you execute your trading strategy. Both Crypto.com and KuCoin offer various order types to meet different trading needs.

KuCoin provides two primary order types on its Spot Market: market orders and limit orders. Market orders execute immediately at the current market price, which is ideal when you need quick transactions. Limit orders let you set a specific price at which you want to buy or sell.

KuCoin also offers more advanced options like stop-limit orders and post-only orders for experienced traders. These give you greater control over your trading strategies.

Crypto.com similarly provides basic market and limit orders. Their platform also includes stop-loss and take-profit orders to help manage risk in volatile markets.

Both platforms support:

- Market Orders: Execute immediately at current prices

- Limit Orders: Set your desired price for execution

- Stop Orders: Trigger at specified price points

Crypto.com’s interface is often described as more user-friendly for beginners. KuCoin tends to offer more complex order types that appeal to advanced traders.

Your trading style will determine which platform’s order types work better for you. If you prefer simple, straightforward orders, Crypto.com might be more suitable. For more advanced trading strategies requiring specialized order types, KuCoin offers more options.

Crypto.com vs KuCoin: KYC Requirements & KYC Limits

Both Crypto.com and KuCoin enforce Know Your Customer (KYC) requirements, but they differ in their approaches and limitations.

KuCoin has required identity verification since November 1, 2018. However, until around July 2023, many users could still trade with limited or no KYC requirements. Today, KuCoin implements daily limits for non-verified accounts.

Crypto.com generally has stricter KYC policies from the start of your account creation. You’ll need to verify your identity before accessing most features on the platform.

KuCoin KYC Levels:

- No KYC: Limited trading capabilities

- Basic Verification: Increased daily withdrawal limits

- Advanced Verification: Full platform access

Crypto.com KYC Levels:

- All accounts require basic identity verification

- Additional verification needed for higher withdrawal limits

- Mandatory verification for accessing most features

If privacy is your priority, KuCoin historically offered more flexibility, though this has changed in recent years. When KuCoin implements KYC requirements on daily limits, your trading capabilities become restricted without verification.

Many Reddit users prefer Crypto.com’s straightforward approach to compliance over KuCoin’s changing requirements. This provides more predictability for your trading experience.

Remember that KYC requirements continue to evolve as regulations change across different countries. What applies today might change by the time you’re reading this in 2025.

Crypto.com vs KuCoin: Deposits & Withdrawal Options

When choosing between Crypto.com and KuCoin, understanding their deposit and withdrawal options is crucial for your trading experience.

KuCoin supports both bank transfers and credit/debit card deposits. This gives you flexibility in how you fund your account based on your preferences.

Crypto.com offers bank transfer options but appears to have limitations with credit/debit card deposits according to recent data.

Withdrawal Fees:

- Crypto.com: Up to $60

- KuCoin: Up to 0.0006 BTC or about 0.1% of the transaction

Deposit Methods Comparison:

| Method | KuCoin | Crypto.com |

|---|---|---|

| Bank Transfer | ✅ Yes | ✅ Yes |

| Credit/Debit Card | ✅ Yes | ❌ No |

| Crypto Deposits | ✅ Yes | ✅ Yes |

KuCoin tends to offer more competitive withdrawal fees in many cases, which can save you money if you make frequent withdrawals.

Both platforms support cryptocurrency deposits, allowing you to transfer existing crypto holdings directly to your exchange wallet.

Remember that actual fees may vary based on the specific cryptocurrency and network congestion at the time of your transaction.

Crypto.com vs KuCoin: Trading & Platform Experience Comparison

When you choose between Crypto.com and KuCoin, the trading experience differs in several key ways.

Crypto.com offers a cleaner, more beginner-friendly interface. You’ll find it easier to navigate if you’re new to crypto trading. The app version is particularly well-designed, making mobile trading straightforward.

KuCoin, while slightly more complex, provides advanced trading tools that experienced traders value. The platform includes trading bots and more detailed charting options.

Trading Features Comparison:

| Feature | Crypto.com | KuCoin |

|---|---|---|

| User Interface | Clean, simple | Feature-rich, technical |

| Mobile App | Highly rated | Good functionality |

| Trading Bots | Limited | Extensive options |

| Order Types | Basic | Advanced |

| Trading Pairs | 250+ | 700+ |

KuCoin excels with its Trading Bot feature, which lets you automate your trading strategies. This is especially useful if you want to trade while you sleep.

Crypto.com’s Exchange and App are separate platforms, which can be confusing at first. However, the main app is perfect for buying and holding crypto with minimal fuss.

Both platforms offer staking options, but KuCoin’s Pool-X and Soft Staking features give you more flexible earning options.

Crypto.com vs KuCoin: Liquidation Mechanism

Both Crypto.com and KuCoin have liquidation mechanisms in place to protect their platforms when trading with leverage. These systems automatically close positions when your account falls below certain thresholds.

KuCoin uses a tiered liquidation system that begins with margin calls when your risk rate reaches 97%. If your position continues to decline and hits 100% risk rate, partial liquidation begins.

Crypto.com takes a more straightforward approach. They issue a margin call when your margin ratio falls to 120%. Full liquidation occurs if your margin ratio drops to 110%, leaving you with less time to respond.

Liquidation Fees Comparison:

| Platform | Liquidation Fee | Margin Call Threshold |

|---|---|---|

| KuCoin | 0.1% – 0.3% | 97% risk rate |

| Crypto.com | 0.5% – 0.8% | 120% margin ratio |

KuCoin offers more granular control through its partial liquidation system. This gives you a chance to save portions of your position rather than losing everything at once.

Crypto.com’s higher liquidation fees might be a drawback for frequent traders. However, their system is easier to understand for beginners.

Both platforms send notifications before liquidation begins, but you need to act quickly. Setting up stop-loss orders is recommended to avoid automatic liquidations regardless of which platform you choose.

Crypto.com vs KuCoin: Insurance

When choosing between Crypto.com and KuCoin, understanding their insurance policies is crucial for protecting your investments. Both platforms offer different approaches to securing user funds.

Crypto.com provides a more comprehensive insurance package. They maintain a $750 million insurance policy through Arch Underwriting at Lloyd’s Syndicate 2012. This coverage protects user assets against theft and security breaches.

KuCoin also provides insurance through their Safeguard Fund. However, this fund is smaller than Crypto.com’s coverage. KuCoin allocates 10% of trading fees to this fund, which grows over time but offers less immediate protection.

Insurance Comparison Table:

| Feature | Crypto.com | KuCoin |

|---|---|---|

| Insurance Amount | $750 million | Smaller Safeguard Fund |

| Coverage Type | Third-party insurance | Self-insurance fund |

| Cold Storage | 100% of user assets | ~90% of assets |

| Fund Source | Professional underwriters | 10% of trading fees |

You should note that neither platform insures against market losses or price fluctuations. Their insurance only covers security incidents and theft.

Crypto.com stores all user funds in cold storage for added security. KuCoin maintains approximately 90% of assets in cold storage, with the remainder in hot wallets for daily operations.

If security and insurance are your top priorities, Crypto.com offers stronger protections. However, KuCoin’s approach still provides basic safety measures that may be sufficient for many traders.

Crypto.com vs Kucoin: Customer Support

When choosing between cryptocurrency exchanges, customer support quality can make a significant difference in your experience. Both Crypto.com and KuCoin offer various support options, but they differ in key ways.

Crypto.com Support Options:

- 24/7 live chat support

- Email ticket system

- Extensive help center documentation

- Active social media response team

Based on user reviews, Crypto.com generally receives higher ratings for support responsiveness. Many users report getting help within minutes through the live chat feature.

KuCoin Support Options:

- 24/7 chat support

- Email support

- Help center with tutorials

- Community forums

KuCoin’s support team handles a large volume of requests, which sometimes leads to longer response times. Some users report waiting several hours or even days for complex issues to be resolved.

Both platforms offer support in multiple languages, but Crypto.com tends to have more language options available. This can be important if English isn’t your primary language.

Security issues receive priority attention on both platforms. You can expect faster responses when reporting potential account compromises or unauthorized transactions.

For new users, Crypto.com’s support resources appear more beginner-friendly with clearer guides and more intuitive navigation. KuCoin’s support materials often assume some prior cryptocurrency knowledge.

Crypto.com vs KuCoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Crypto.com and KuCoin offer strong security measures, but they differ in key ways.

Crypto.com employs multi-factor authentication (MFA) to protect your account. They also use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

KuCoin similarly offers MFA and implements a micro-withdrawal system that flags suspicious transactions. Their security team monitors activity 24/7 to detect unusual patterns.

Insurance Coverage:

- Crypto.com: Up to $750 million insurance on custodial assets

- KuCoin: $100 million insurance policy

Both platforms conduct regular security audits by third-party firms. This helps identify vulnerabilities before they can be exploited.

KuCoin experienced a security breach in 2020 but demonstrated strong crisis management by fully reimbursing affected users. Crypto.com has had fewer reported incidents but did face a hack in January 2022.

Security Features Comparison:

| Feature | Crypto.com | KuCoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance | $750M | $100M |

| Whitelisted Addresses | ✓ | ✓ |

| Anti-Phishing Code | ✓ | ✓ |

| Prior Major Incidents | 1 | 1 |

You should enable all available security features regardless of which platform you choose. This includes using a strong password, enabling MFA, and being cautious of phishing attempts.

Is Crypto.com Safe & Legal To Use?

Crypto.com is generally considered a safe and legitimate cryptocurrency exchange. The platform holds proper licenses and follows regulatory requirements in many regions around the world.

When it comes to security, Crypto.com has implemented strong measures to protect user funds. They use cold storage for most assets and have security features like two-factor authentication (2FA).

The platform is legally allowed to operate in most countries where cryptocurrency trading is permitted. However, availability of specific services may vary by location due to local regulations.

Safety Features:

- Cold storage for majority of assets

- Two-factor authentication (2FA)

- Regular security audits

- Insurance against certain types of theft

User reviews suggest that Crypto.com is trustworthy, though some mention higher fees compared to other exchanges. If you’re mainly holding and accumulating crypto, these fees may be less of a concern.

The exchange complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which adds an extra layer of legitimacy but requires you to verify your identity.

While no exchange is completely risk-free, Crypto.com has maintained a solid reputation for security. They haven’t experienced major hacks that resulted in significant customer losses, which is a positive sign in the volatile crypto industry.

Is KuCoin Safe & Legal To Use?

KuCoin has faced some regulatory challenges and legal issues recently, which might raise concerns about its safety. The exchange operates in a gray area in many countries without specific licenses or registrations.

When it comes to safety, KuCoin has implemented standard security measures like two-factor authentication and encryption. However, the exchange experienced a major hack in 2020, though it did manage to recover most of the stolen funds.

Legal status by region:

- United States: Not officially licensed to operate

- Europe: No clear regulatory compliance in most countries

- Asia: Varies by country, with limited formal recognition

You should be aware that keeping large amounts of cryptocurrency on any exchange comes with risks. Many users recommend moving your assets to a private wallet if you’re not actively trading.

KuCoin’s regulatory situation appears less established than some competitors like Crypto.com, which has secured more formal licensing in various jurisdictions.

The search results indicate uncertainty about KuCoin’s future stability. Some users advise withdrawing funds as a precaution and potentially returning later if the exchange stabilizes its regulatory position.

Before using KuCoin, you should check its current legal status in your country and assess your own risk tolerance.

Frequently Asked Questions

Investors choosing between Crypto.com and KuCoin need clarity on several key aspects of these popular exchanges. Each platform has distinct offerings in security, fees, cryptocurrency options, and user experience that may influence your decision.

What are the differences in security features between Crypto.com and KuCoin?

Crypto.com provides insurance coverage for funds stored in their cold wallets, which protects users against certain types of breaches. They implement multi-factor authentication and advanced encryption practices.

KuCoin uses a combination of cold and hot wallet storage systems with most assets kept offline. Their security protocol includes micro-withdrawal wallets and industry-standard encryption.

Both exchanges offer similar security features like anti-phishing codes and withdrawal protection. However, Crypto.com has received higher overall security ratings from independent reviewers with a score of 9.1 compared to KuCoin.

How do the trading fees compare between Crypto.com and KuCoin?

Crypto.com’s standard trading fees start at 0.4% for makers and takers but can drop significantly for high-volume traders or those staking CRO tokens.

KuCoin offers slightly lower starting fees at 0.1% for makers and 0.1% for takers. You can reduce these fees further by holding KCS tokens or maintaining higher trading volumes.

Both exchanges offer discount programs, but KuCoin generally maintains lower base fees for most users. The difference becomes particularly noticeable for casual traders who don’t qualify for higher tier discounts.

Which exchange offers a wider range of cryptocurrencies, Crypto.com or KuCoin?

KuCoin provides access to over 700 cryptocurrencies and 1,200+ trading pairs, making it one of the most diverse exchanges for crypto selection. Their platform is known for listing newer, emerging tokens.

Crypto.com offers approximately 250 cryptocurrencies, focusing more on established coins and tokens. Their selection is still substantial but noticeably smaller than KuCoin’s extensive offerings.

For traders seeking exposure to micro-cap or newer projects, KuCoin typically lists these assets earlier and more frequently than Crypto.com.

Can users earn interest on their holdings with Crypto.com or KuCoin, and how do the rates differ?

Crypto.com offers Earn products with rates up to 14.5% on certain cryptocurrencies, though most popular coins earn between 3-8%. Rates vary based on the lockup period and your CRO staking tier.

KuCoin provides similar earning opportunities through KuCoin Earn and Soft Staking, with rates ranging from 1-12% depending on the asset. Their Lending platform allows for additional yield opportunities.

Both exchanges adjust rates based on market conditions. Crypto.com tends to offer slightly higher rates for stablecoins when users commit to longer terms, while KuCoin often provides more flexible earning options.

What are the customer service experiences like on Crypto.com vs KuCoin?

Crypto.com offers 24/7 customer support through live chat and email. Users generally report quick response times for basic issues, though complex problems may take longer to resolve.

KuCoin provides support through multiple channels including live chat, email, and an extensive help center. Their response times can vary widely depending on current trading volumes and market activity.

Both exchanges have faced criticism during high-volume periods. However, Crypto.com typically receives higher ratings for customer service accessibility and response quality.

How do the mobile app user experiences of Crypto.com and KuCoin compare?

Crypto.com’s mobile app is known for its clean interface and beginner-friendly design. It focuses on simplicity with easy navigation between buying, selling, and staking functions.

KuCoin’s app provides more advanced trading features and technical analysis tools. This complexity makes it preferred by experienced traders but potentially overwhelming for newcomers.

Both apps support biometric authentication and push notifications. Crypto.com’s app receives higher ratings for overall usability, while KuCoin’s app is praised for its comprehensive trading capabilities and wider feature set.

KuCoin vs Crypto.com Conclusion: Why Not Use Both?

After comparing these platforms, you might wonder if you need to choose just one. The truth is, many crypto investors use both KuCoin and Crypto.com for different purposes.

KuCoin stands out with its extensive range of over 1,000 cryptocurrencies and robust API services. It’s particularly popular among US users who face limited options elsewhere.

Crypto.com, on the other hand, offers a smoother user experience according to many reviews. Its interface is more beginner-friendly, making it accessible if you’re new to crypto trading.

Key Advantages of Using Both:

| Platform | Best For |

|---|---|

| KuCoin | Wide crypto selection, trading bots, lower fees |

| Crypto.com | User-friendly experience, stronger regulation |

You can leverage KuCoin for access to a broader range of altcoins and potentially lower fees. Meanwhile, Crypto.com might serve as your platform for more straightforward transactions and a cleaner interface.

Consider your trading frequency, crypto preferences, and comfort level with each platform’s security measures. Some users keep larger holdings on the more regulated platform while using the other for specific coins or features.

Remember that both platforms have their limitations. KuCoin may have liquidity issues with certain pairs, while Crypto.com might not offer all the coins you’re interested in.

By maintaining accounts on both exchanges, you maximize your crypto opportunities while minimizing the drawbacks of relying on a single platform.