Looking for the right crypto exchange can be tough with so many options available. Crypto.com stands out in March 2025 as one of the top platforms, especially for mobile users and Bitcoin traders. Comparing Crypto.com with exchanges like BitMEX, Gate.io, KuCoin, Poloniex, PrimeXBT, and WhiteBIT will help you find the platform that best suits your trading needs and preferences.

Each exchange offers unique features, fee structures, and security measures that might appeal to different types of crypto traders. While Crypto.com excels in mobile trading, other platforms like KuCoin might offer a wider selection of altcoins, or BitMEX might provide more advanced trading tools. Understanding these differences is crucial before you commit to any platform.

Crypto.com Vs BitMEX: At A Glance Comparison

Crypto.com and BitMEX offer different experiences for crypto traders. According to recent data, Crypto.com has a higher overall score of 9.1 compared to BitMEX.

Trading Focus:

- Crypto.com: Full-service platform with spot trading, staking, and visa cards

- BitMEX: Primarily focused on derivatives and futures trading

User Experience:

| Feature | Crypto.com | BitMEX |

|---|---|---|

| Interface | User-friendly, mobile-first | Complex, designed for advanced traders |

| KYC Requirements | Strict verification | Less stringent in some regions |

| Mobile App | Comprehensive | Basic functionality |

Crypto.com supports over 250 cryptocurrencies while BitMEX offers fewer coins but more advanced trading options for those assets.

You’ll find lower fees on BitMEX for futures trading specifically. Crypto.com charges tiered fees based on your 30-day trading volume and CRO staking status.

Security features differ between the platforms. Crypto.com has earned SOC 2 compliance and offers insurance on custodial assets. BitMEX uses multi-signature wallets and cold storage systems.

BitMEX caters to experienced traders looking for leverage options up to 100x on certain contracts. If you’re a beginner, Crypto.com’s intuitive design might better suit your needs.

Both exchanges have faced regulatory challenges in different markets. You should check if either platform is fully available in your region before signing up.

Crypto.com Vs BitMEX: Trading Markets, Products & Leverage Offered

Crypto.com and BitMEX offer different trading options for crypto investors. Understanding these differences helps you choose the platform that best fits your trading style.

Crypto.com provides a wide range of cryptocurrencies with over 250 coins available for trading. It’s especially good for Bitcoin-focused traders according to recent 2025 reviews. The platform offers spot trading, margin trading, and a variety of derivative products.

BitMEX, in contrast, focuses more heavily on derivatives trading. It offers fewer cryptocurrencies but specializes in futures and perpetual contracts.

Leverage Options:

| Platform | Maximum Leverage |

|---|---|

| Crypto.com | Up to 20x leverage |

| BitMEX | Up to 100x leverage |

BitMEX clearly offers higher leverage options, which might appeal to experienced traders looking for greater potential returns. However, higher leverage also means higher risk.

Trading Products Comparison:

- Crypto.com: Spot trading, margin trading, futures, options, and staking services

- BitMEX: Primarily futures and perpetual contracts with a focus on Bitcoin trading pairs

Crypto.com includes more beginner-friendly features and a mobile-first approach, making it better for on-the-go trading. BitMEX tends to attract more experienced traders who want advanced derivatives tools.

Trading fees vary between the platforms, with different structures for makers and takers. You’ll find Crypto.com generally offers competitive fees, especially if you stake their native CRO token.

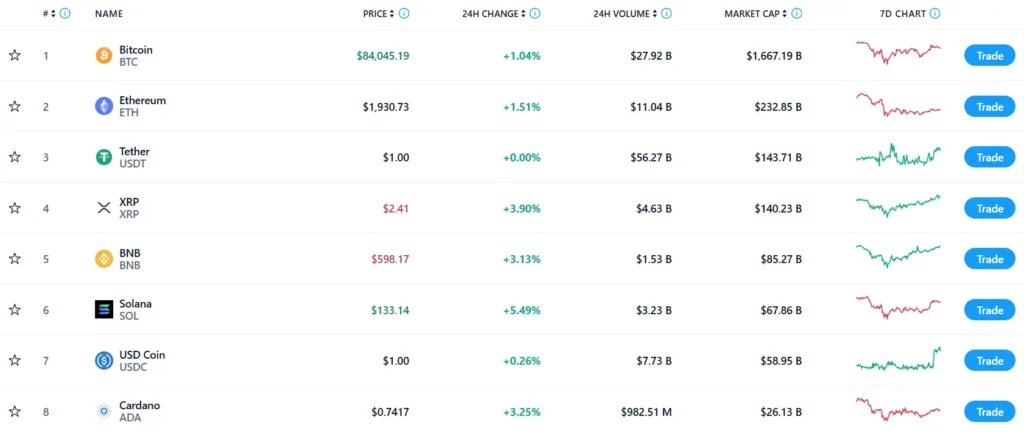

Crypto.com Vs BitMEX: Supported Cryptocurrencies

Crypto.com and BitMEX offer different cryptocurrency selections for traders. Understanding what each platform supports can help you choose the right exchange for your needs.

Crypto.com provides access to over 250 cryptocurrencies, making it a comprehensive option for diverse trading. You can trade popular coins like Bitcoin and Ethereum, as well as numerous altcoins and emerging tokens.

BitMEX, in contrast, focuses primarily on derivative trading with a more limited selection of about 20 cryptocurrencies. Its main strength lies in Bitcoin futures and perpetual contracts rather than spot trading variety.

Here’s a comparison of supported cryptocurrencies:

| Feature | Crypto.com | BitMEX |

|---|---|---|

| Total cryptocurrencies | 250+ | ~20 |

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Altcoin variety | Extensive | Limited |

| Stablecoins | Multiple options | Few options |

| New tokens | Regular additions | Infrequent additions |

Crypto.com stands out if you want to explore emerging cryptocurrencies or build a diverse portfolio. The platform regularly adds new tokens as they gain popularity in the market.

BitMEX is better suited for traders specifically interested in Bitcoin and major cryptocurrency derivatives. You’ll find fewer options but more sophisticated trading instruments for the supported coins.

Your trading strategy should guide your choice between extensive variety or specialized derivative options.

Crypto.com Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing crypto exchanges, fees can significantly impact your trading profits. Crypto.com and BitMEX have different fee structures worth examining.

Crypto.com offers lower trading fees with rates up to 0.3%. BitMEX, on the other hand, typically charges higher trading fees for most users.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Fee Discounts |

|---|---|---|---|

| Crypto.com | 0.1% – 0.3% | 0.1% – 0.3% | Available with CRO staking |

| BitMEX | 0.025% – 0.075% | 0.075% – 0.25% | Available with volume |

For deposit fees, Crypto.com offers free crypto deposits, while some blockchain network fees may apply. BitMEX also has minimal deposit fees, mostly related to network costs.

Withdrawal fees vary based on the cryptocurrency you’re transferring. Crypto.com’s withdrawal fees change depending on the coin and current network congestion.

BitMEX typically has fixed withdrawal fees for each cryptocurrency. These fees can be higher than some competitors but remain consistent regardless of network traffic.

Your trading volume and account level can reduce fees on both platforms. Crypto.com offers additional discounts when you stake their native CRO token.

For frequent traders dealing in large volumes, these fee differences can add up quickly over time.

Crypto.com Vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types can significantly impact your trading experience. Crypto.com and BitMEX offer different order options to suit various trading strategies.

Crypto.com provides basic order types that are user-friendly for beginners. You can place market orders, limit orders, and stop-loss orders on the platform. These cover most everyday trading needs without overwhelming new users.

BitMEX, being more focused on derivatives trading, offers a more extensive range of advanced order types. You can access market orders, limit orders, stop orders, take-profit orders, and trailing stop orders.

Crypto.com Order Types:

- Market orders

- Limit orders

- Stop-loss orders

BitMEX Order Types:

- Market orders

- Limit orders

- Stop orders

- Take-profit orders

- Trailing stop orders

- Post-only orders

- Reduce-only orders

BitMEX also offers specialized features like post-only orders that ensure you only pay maker fees, and reduce-only orders that prevent you from opening new positions when closing existing ones.

If you’re new to cryptocurrency trading, Crypto.com’s simpler order selection might be more appropriate. However, if you’re an experienced trader looking for precise control over your positions, BitMEX provides more sophisticated tools for risk management and trading strategy execution.

The right choice depends on your trading experience level and whether you need advanced order types for your trading strategy.

Crypto.com Vs BitMEX: KYC Requirements & KYC Limits

Crypto.com and BitMEX have different approaches to KYC (Know Your Customer) requirements. Understanding these differences helps you choose the right platform for your needs.

Crypto.com implements a comprehensive KYC process for all users. You must verify your identity by providing personal information, a government-issued ID, and sometimes a selfie before trading.

BitMEX has historically been known for more relaxed verification requirements. However, as of 2025, BitMEX now requires basic KYC for all users to comply with global regulations.

Crypto.com KYC Levels:

- Basic: Email verification, personal information

- Intermediate: ID verification, face verification

- Advanced: Proof of address

BitMEX KYC Levels:

- Basic: Email and phone verification

- Full: ID verification, proof of address

Crypto.com enforces stricter withdrawal limits on unverified accounts. You’ll need to complete full verification to access higher withdrawal limits and all platform features.

BitMEX allows limited trading with basic verification, but you’ll face restrictions on withdrawal amounts. Complete verification removes these limits.

For US users, Crypto.com offers regulated services through proper verification. BitMEX has historically limited access to US traders due to regulatory concerns.

Both exchanges store your KYC information securely, but their data retention policies differ. Crypto.com typically keeps verification data longer for compliance purposes.

Crypto.com Vs BitMEX: Deposits & Withdrawal Options

Crypto.com offers more diverse deposit and withdrawal options than BitMEX. With Crypto.com, you can fund your account using bank transfers, credit/debit cards, and cryptocurrency deposits.

BitMEX primarily supports cryptocurrency deposits and withdrawals, with Bitcoin being the main option. The platform doesn’t currently offer direct fiat currency deposits or withdrawals.

Deposit Methods Comparison:

| Method | Crypto.com | BitMEX |

|---|---|---|

| Bank Transfer | ✅ | ❌ |

| Credit/Debit Card | ✅ | ❌ |

| Cryptocurrency | ✅ | ✅ (Limited) |

Crypto.com typically processes deposits quickly, with credit card deposits being nearly instant. Bank transfers may take 1-3 business days depending on your location.

BitMEX cryptocurrency deposits require network confirmations and can take between 30 minutes to 1 hour to become available in your account.

For withdrawals, Crypto.com gives you options to cash out directly to bank accounts, credit cards, or external crypto wallets. Withdrawal fees vary based on the cryptocurrency and method chosen.

BitMEX withdrawals are limited to cryptocurrencies, with a focus on Bitcoin. The platform has specific withdrawal processing times, typically handling requests once per day.

If you need flexibility with fiat currencies, Crypto.com provides more convenient options. However, if you primarily trade Bitcoin and don’t need fiat on/off ramps, BitMEX’s simplified approach might suit your needs.

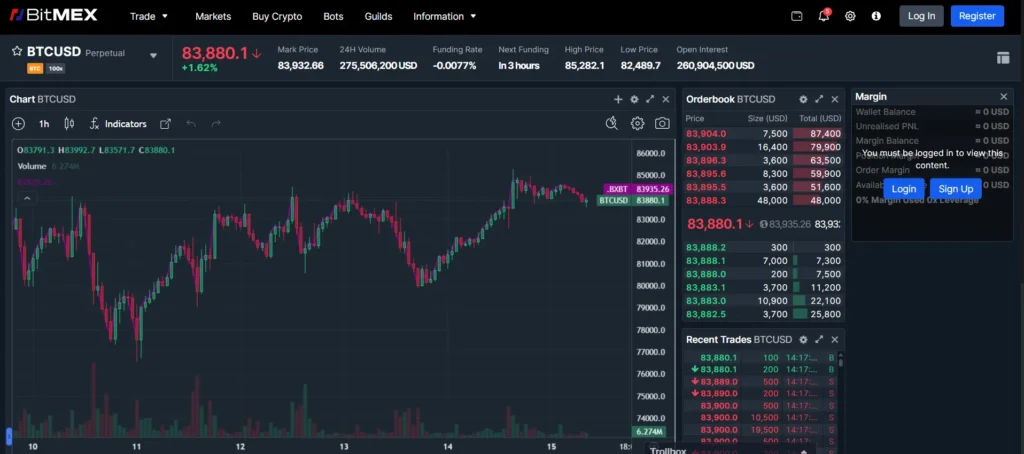

Crypto.com Vs BitMEX: Trading & Platform Experience Comparison

Crypto.com and BitMEX offer distinct trading experiences that cater to different types of crypto traders. Based on recent comparisons, Crypto.com has earned a higher overall score of 9.1 compared to BitMEX.

Crypto.com is designed with mobile users in mind, making it ideal if you trade frequently on your smartphone. The platform offers a clean, intuitive interface that beginners can navigate easily while still providing advanced features for experienced traders.

BitMEX, in contrast, targets more advanced traders with its sophisticated derivatives trading options. The platform is known for its powerful trading tools but has a steeper learning curve.

Key Trading Features Comparison:

| Feature | Crypto.com | BitMEX |

|---|---|---|

| Mobile Experience | Excellent | Good |

| Beginner Friendly | Yes | No |

| Advanced Trading Tools | Good | Excellent |

| Trading Fees | Competitive | Variable |

| Available Assets | Wide range | Primarily derivatives |

Crypto.com stands out as the better option for Bitcoin-focused traders and investors based on recent evaluations. Their app allows you to quickly execute trades, monitor your portfolio, and access crypto services all in one place.

BitMEX excels in offering leverage trading options and futures contracts. If you’re comfortable with more complex trading strategies and risk management, BitMEX provides powerful tools for these approaches.

When choosing between these platforms, consider your trading style and experience level. Crypto.com works better for everyday crypto users and beginners, while BitMEX appeals more to traders looking for advanced derivatives trading capabilities.

Crypto.com Vs BitMEX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for managing your risk. Both Crypto.com and BitMEX have systems in place to protect themselves when your positions lose too much value.

BitMEX uses a progressive liquidation system. When your position approaches the liquidation price, BitMEX first tries to close your position gradually through its liquidation engine. This gives you a better chance of recovering some funds rather than losing everything at once.

Crypto.com takes a different approach with its liquidation process. Their system monitors your account’s margin ratio and will automatically liquidate positions when they fall below required maintenance margins. The process is typically more straightforward but can be less forgiving.

Key Differences:

| Feature | Crypto.com | BitMEX |

|---|---|---|

| Warning System | Limited warnings | More extensive notifications |

| Liquidation Speed | Typically faster | More gradual approach |

| Partial Liquidations | Less common | More frequently used |

| Fee Structure | Standard liquidation fees | Includes auto-deleveraging possibility |

BitMEX offers an insurance fund to help manage liquidations during volatile market conditions. This fund acts as a buffer to prevent socialized losses among traders.

You should consider these liquidation mechanisms carefully when choosing between these platforms. Your trading style and risk tolerance will determine which approach better suits your needs.

Crypto.com Vs BitMEX: Insurance

When choosing a crypto exchange, insurance protection is a key safety feature you should consider. Both Crypto.com and BitMEX offer some form of insurance to protect user funds, but with notable differences.

Crypto.com provides robust insurance coverage through its Secure Asset Fund for Users (SAFU). This fund holds $750 million in insurance protection for user assets stored in their cold wallets. This coverage helps protect you against potential hacks or security breaches.

BitMEX, in comparison, offers a more limited insurance framework. They maintain an Insurance Fund designed primarily to prevent auto-deleveraging during volatile market conditions rather than covering user assets directly against theft or exchange failures.

Insurance Comparison

| Feature | Crypto.com | BitMEX |

|---|---|---|

| Insurance Fund | $750 million SAFU | Yes, but mainly for preventing auto-deleveraging |

| Cold Storage Coverage | Yes | Limited |

| Third-party Insurance | Yes | No |

| Regular Security Audits | Yes | Yes |

Both platforms use cold storage for most user funds, with Crypto.com storing approximately 90% of assets offline for added security.

Neither exchange offers FDIC insurance since cryptocurrency holdings aren’t considered bank deposits. This is standard across the crypto industry.

You should note that insurance doesn’t guarantee complete protection of all assets under all circumstances. Reading the specific terms and conditions of each platform’s insurance policy is recommended before making substantial deposits.

Crypto.com Vs BitMEX: Customer Support

When choosing between crypto exchanges, customer support can make a big difference in your trading experience. Both Crypto.com and BitMEX offer support options, but they differ in several key ways.

Crypto.com provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and their help center. Many users appreciate their quick response times, especially through the live chat feature.

BitMEX offers customer support primarily through email and a ticket system. They don’t provide live chat support, which might be inconvenient if you need immediate help with trading issues.

Response times vary between the platforms. Crypto.com typically responds to queries within minutes on live chat and within 24 hours via email. BitMEX might take longer, with response times averaging 24-48 hours.

Support Comparison

| Feature | Crypto.com | BitMEX |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | No |

| Email Support | Yes | Yes |

| Help Center | Comprehensive | Basic |

| Response Time | Fast (minutes to hours) | Moderate (hours to days) |

Both platforms offer support in multiple languages, making them accessible to global users. Crypto.com supports more languages overall, which might be important if English isn’t your primary language.

For new users, Crypto.com’s support system is more beginner-friendly with detailed guides and tutorials. BitMEX’s support tends to be more technical, assuming users have some trading knowledge.

Crypto.com Vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Crypto.com and BitMEX offer strong security features, but they differ in several important ways.

Crypto.com uses multi-factor authentication (MFA) to protect your account. This means you need more than just a password to log in. They also store most user funds in cold wallets, keeping them offline and away from hackers.

BitMEX provides similar security with their multi-signature wallets. This requires multiple approvals before any transaction can be completed, adding an extra layer of protection for your assets.

Insurance Coverage:

- Crypto.com: Up to $750 million insurance against theft

- BitMEX: Limited insurance coverage

Both platforms use encryption to protect your personal data. They also have anti-phishing measures to help you avoid fake websites that try to steal your information.

Crypto.com stands out with its regular security audits by independent firms. This helps find and fix potential weaknesses before they become problems.

BitMEX has a strong track record of security but has faced regulatory challenges in the past. They’ve since improved their compliance measures to address these issues.

For withdrawal security, both exchanges require email confirmation. Crypto.com adds an extra step with a 24-hour delay for new withdrawal addresses, which can be frustrating but offers better protection.

Your trading experience will feel more secure with Crypto.com’s ISO/IEC 27001:2013 certification, which BitMEX currently lacks.

Is Crypto.com A Safe & Legal To Use?

Crypto.com is generally considered safe to use. It stores 100% of customer funds in cold wallets, which provides strong protection against online threats. This security approach is comparable to other major exchanges.

The platform offers robust insurance coverage, making it a safer option in the cryptocurrency exchange landscape. This insurance helps protect your assets in case of certain security incidents.

Crypto.com maintains reasonable fee structures while providing excellent security infrastructure. These features make it particularly suitable for Bitcoin traders and investors who prioritize safety.

Yes, Crypto.com is legal to use in most countries where cryptocurrency trading is permitted. However, availability of specific services may vary by region due to local regulations.

When comparing security with other platforms like Coinbase, Crypto.com offers similar safety levels. Some users note that while fees might be higher than some competitors, the platform provides additional features that may justify the cost.

For those mainly holding and accumulating cryptocurrency rather than frequent trading, Crypto.com offers a secure environment for your digital assets.

To maximize your security when using Crypto.com:

- Enable two-factor authentication

- Use a strong, unique password

- Be cautious of phishing attempts

- Consider transferring large holdings to a personal wallet

Is BitMEX A Safe & Legal To Use?

BitMEX has established itself as a major cryptocurrency exchange with a focus on margin trading. When it comes to safety, BitMEX employs strong security measures including multi-signature wallets and cold storage for funds.

The platform has faced regulatory challenges in the past. In 2020, BitMEX dealt with legal issues from the U.S. Commodity Futures Trading Commission, which led to leadership changes and improved compliance measures.

For U.S. residents, it’s important to know that BitMEX does not allow trading from the United States. If you’re based in the U.S., you’ll need to look at other exchange options.

BitMEX offers:

- Strong security features for protecting user funds

- Insurance fund to protect traders against losses

- Two-factor authentication for account protection

The exchange is considered safe for users in supported countries, but you should always use caution when trading cryptocurrencies. Never invest more than you can afford to lose.

If you’re new to crypto trading, BitMEX’s leverage options might be risky. The platform allows up to 100x leverage, which can lead to significant losses if you’re inexperienced.

Before using BitMEX, verify it’s legal in your country of residence. Regulations around cryptocurrency exchanges change frequently, so staying informed about current rules is essential.

Frequently Asked Questions

Crypto.com and its competitors each have unique strengths and weaknesses that matter when choosing where to trade. The following questions address key comparison points that traders consider most important.

What are the main advantages of using Crypto.com versus other exchanges like BitMEX or Gate.io?

Crypto.com offers a more comprehensive ecosystem than most competitors. You get access to a visa card that lets you spend crypto in real-world situations, which BitMEX and Gate.io don’t provide.

The app-first approach makes Crypto.com more accessible for beginners compared to BitMEX’s complex trading interface. Crypto.com also has better regulatory compliance in more regions than Gate.io.

The CRO token provides additional benefits like reduced fees and higher earnings on staked assets, creating a loyalty system that rewards long-term users more generously than most competitors.

How do various fee structures compare between Crypto.com, KuCoin, and Poloniex?

Crypto.com’s fee structure starts at 0.4% for makers and takers but drops to as low as 0.04% based on your 30-day trading volume and CRO staking level. This tiered approach rewards high-volume traders.

KuCoin offers slightly lower base fees starting at 0.1% for both makers and takers, with discounts available when using KCS tokens. This makes KuCoin potentially cheaper for casual traders.

Poloniex fees begin at 0.2% for makers and 0.4% for takers, positioning them between the other exchanges. None of these platforms charge deposit fees, but withdrawal fees vary by cryptocurrency.

Which exchange offers the best security features: Crypto.com, PrimeXBT, or WhiteBIT?

Crypto.com leads in security with $750 million in insurance coverage, cold storage for most assets, and ISO/IEC 27001:2013 certification. They also require 2FA for all accounts and use anti-phishing codes.

PrimeXBT implements multi-signature technology and cold storage but lacks the same level of insurance coverage as Crypto.com. Their security focus leans more toward their trading infrastructure.

WhiteBIT offers similar security basics with 2FA and cold storage for 96% of assets. They include CAPTCHA protection on login attempts but have less transparent insurance policies than Crypto.com.

What features make Crypto.com stand out against competitors like KuCoin and Poloniex for new traders?

Crypto.com’s intuitive mobile app design makes it significantly easier for beginners to navigate compared to KuCoin’s feature-packed but sometimes overwhelming interface. The simplified buy/sell options reduce confusion.

The learn-and-earn program on Crypto.com rewards new users with free crypto for completing educational modules, a feature not available on Poloniex. This helps newcomers gain knowledge while earning.

Crypto.com offers a wider range of payment methods including credit/debit cards, bank transfers, and even Apple Pay in some regions. KuCoin and Poloniex have more limited fiat on-ramps for beginners.

Can users find more advanced trading options on platforms like BitMEX and PrimeXBT compared to Crypto.com?

BitMEX definitely offers more advanced derivatives trading with up to 100x leverage on futures contracts, while Crypto.com caps leverage at 20x. BitMEX also provides more sophisticated order types for professional traders.

PrimeXBT stands out with its ability to trade traditional assets like indices and commodities alongside crypto, something Crypto.com doesn’t offer. This creates more diverse portfolio opportunities.

Both BitMEX and PrimeXBT provide advanced charting tools with more technical indicators than Crypto.com’s simplified charts. Serious traders might find these additional analytical features essential.

How do customer support and user experience on Crypto.com compare to that of exchanges like Gate.io and WhiteBIT?

Crypto.com offers 24/7 live chat support in multiple languages, which responds faster than Gate.io’s primarily ticket-based system. Most user issues see responses within hours rather than days.

The Crypto.com interface emphasizes visual simplicity compared to Gate.io’s data-heavy screens. This makes daily trading less overwhelming, though experienced traders might prefer Gate.io’s depth of information.

WhiteBIT’s customer support is comparable to Crypto.com in responsiveness but serves fewer regions and languages. Crypto.com’s more extensive help center documentation also gives users better self-service options.

BitMEX Vs Crypto.com Conclusion: Why Not Use Both?

Both BitMEX and Crypto.com offer unique advantages that might benefit different parts of your crypto journey. Crypto.com stands out with its user-friendly interface and comprehensive ecosystem that includes a visa card, exchange, and app.

BitMEX excels in futures trading and was the first to introduce perpetual contracts, making it attractive for experienced traders looking for advanced trading options.

When choosing between these platforms, consider your specific needs:

Crypto.com might be better if you:

- Value ease of use

- Want an all-in-one crypto platform

- Need a crypto visa card for daily purchases

- Prefer a smoother user experience

BitMEX might be better if you:

- Focus on futures trading

- Have more trading experience

- Want access to perpetual contracts

- Prefer advanced trading options

Using both platforms could give you the best of both worlds. You might use Crypto.com for everyday transactions, staking, and its user-friendly features, while turning to BitMEX for specialized futures trading and advanced contract options.

The crypto market in 2025 offers enough room for multiple exchanges in your strategy. Many users maintain accounts on several platforms to take advantage of different features, promotions, and trading pairs.

Remember to consider fees, security measures, and available cryptocurrencies when making your final decision.