Choosing the right crypto exchange can make a big difference for your investments. Crypto.com and Bitget are two popular options in 2025, each with its own strengths and weaknesses.

When comparing fees, Bitget generally offers lower costs with maker fees of 0.02% and taker fees of 0.06%, which can help maximize your trading profits. Crypto.com, while slightly more expensive fee-wise, offers a broader ecosystem including a cryptocurrency chain, which Bitget’s utility token BGB doesn’t provide despite having a market cap 2.5 times larger than CRO.

You’ll want to consider factors beyond just fees when making your decision. Both platforms differ in available coins, security features, and user experience. The right choice depends on your specific trading needs, whether you’re just starting out or are an experienced trader looking for advanced features.

Crypto.com vs Bitget: At A Glance Comparison

When choosing between Crypto.com and Bitget, understanding their key differences can help you make an informed decision.

Fee Structure:

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| Crypto.com | Varies | Varies |

Bitget offers lower trading fees compared to many competitors in the market. You can even pay commission with bonus funds on Bitget.

Token Comparison:

- Bitget’s BGB token has a market cap approximately 2.5 times larger than Crypto.com’s CRO token

- CRO has the advantage of the Cronos blockchain ecosystem, which BGB lacks

- Trading volume on Crypto.com typically exceeds Bitget’s volume

Exchange Rankings:

Both platforms appear on top cryptocurrency exchange lists, but their rankings vary depending on metrics like traffic, liquidity, and trading volumes.

You’ll find more coins and trading pairs available on Crypto.com compared to Bitget, giving you a wider selection of assets to trade.

Security features and user interfaces differ between the platforms. Crypto.com has invested heavily in security certifications and user-friendly design.

The best choice depends on your specific trading needs – Bitget may appeal if fee savings are your priority, while Crypto.com offers a more comprehensive ecosystem.

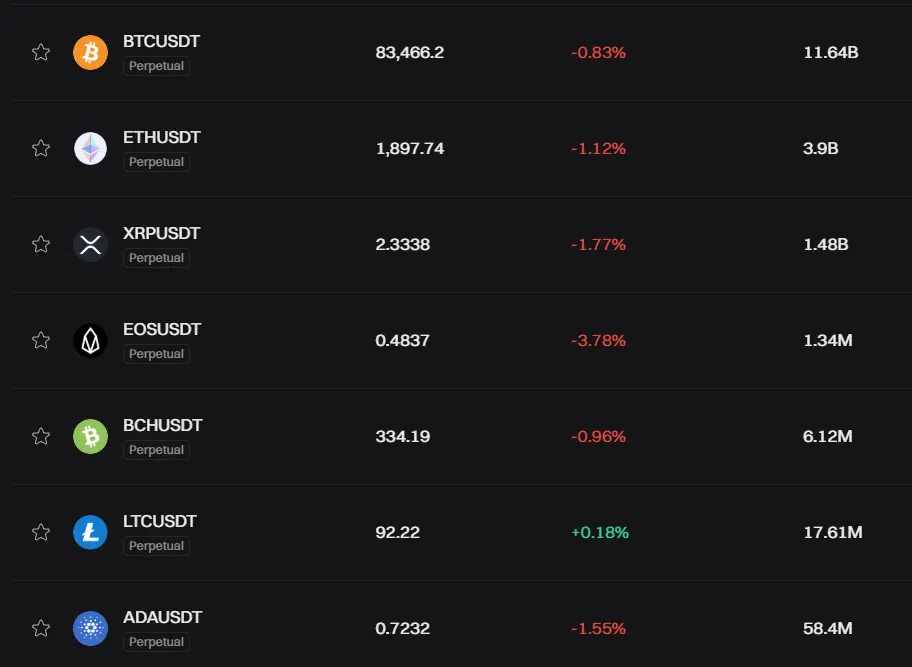

Crypto.com vs Bitget: Trading Markets, Products & Leverage Offered

Both Crypto.com and Bitget offer diverse trading options, but they differ in what they specialize in.

Crypto.com provides access to over 250 cryptocurrencies for spot trading. You can also access their Exchange platform for more advanced trading features. Their margin trading offers lower leverage compared to competitors.

Bitget, on the other hand, shines with its derivatives options. You can trade futures with up to 125x leverage on certain trading pairs. This high leverage can amplify potential profits but also increases risk significantly.

Product Comparison:

| Feature | Crypto.com | Bitget |

|---|---|---|

| Spot Trading | 250+ coins | 200+ coins |

| Max Leverage | 3x (margin) | Up to 125x (futures) |

| Derivatives | Limited options | Extensive futures products |

| Copy Trading | Limited | Advanced with BitgetCopy |

Bitget has made a name for itself with its copy trading feature, letting you automatically mirror experienced traders’ strategies.

Crypto.com offers a broader ecosystem including a Visa card, NFT marketplace, and the Cronos blockchain. These additional products may appeal if you want more than just trading.

For futures and high-leverage trading, Bitget provides more options. If you’re looking for a platform with a wide range of services beyond just trading, Crypto.com might be more suitable.

Both exchanges continue to expand their offerings as they compete for market share in 2025.

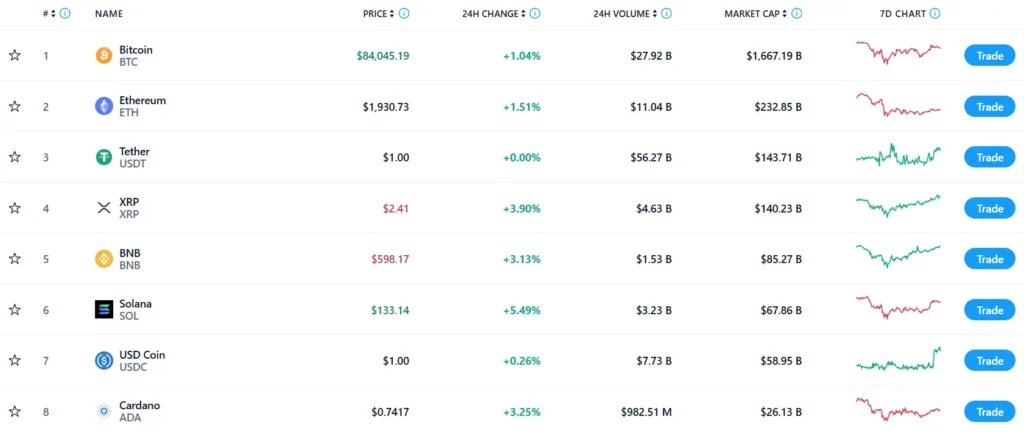

Crypto.com vs Bitget: Supported Cryptocurrencies

Both Crypto.com and Bitget offer a wide range of cryptocurrencies for trading, but there are some notable differences in their selections.

Crypto.com supports over 250 cryptocurrencies, making it one of the more comprehensive exchanges for coin variety. You’ll find all major coins like Bitcoin, Ethereum, and Solana, plus many altcoins and DeFi tokens.

Bitget offers around 200+ cryptocurrencies for trading. While slightly fewer than Crypto.com, it still covers all the major coins and many popular altcoins.

Key Differences in Supported Coins:

| Feature | Crypto.com | Bitget |

|---|---|---|

| Total cryptocurrencies | 250+ | 200+ |

| Native token | CRO | BGB |

| Stablecoins | USDT, USDC, DAI, etc. | USDT, USDC, etc. |

| New coin listings | Regular but selective | Frequent additions |

Crypto.com is known for its careful vetting process before adding new coins. This might mean fewer coins overall but potentially higher quality options.

Bitget tends to add new tokens more frequently, which gives you access to emerging projects earlier. However, this comes with increased risk of exposure to less established coins.

Both platforms support staking for multiple cryptocurrencies, allowing you to earn passive income on your holdings while deciding which platform works best for you.

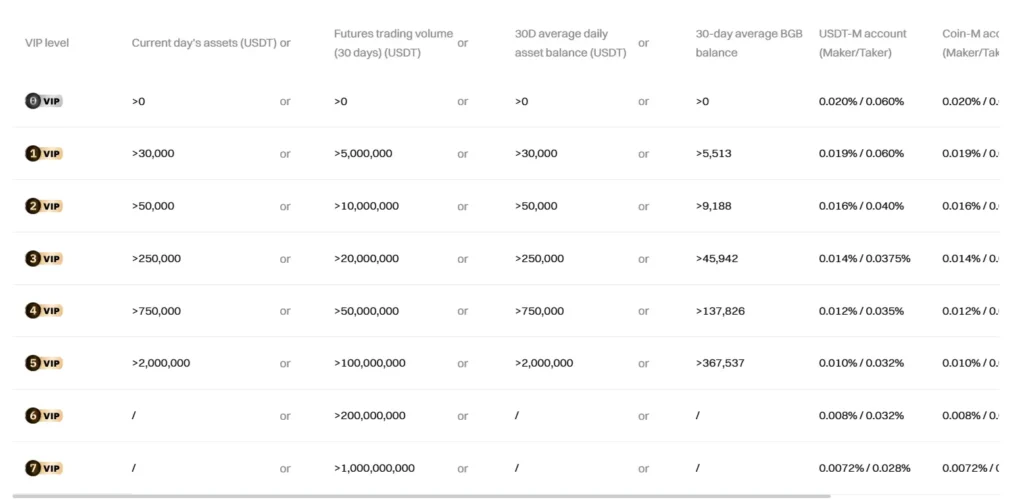

Crypto.com vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Crypto.com and Bitget, understanding their fee structures can help you make a better decision for your trading needs.

Spot Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.1% (can drop to 0.08%) | 0.1% (can drop to 0.08%) |

| Crypto.com | Varies | Varies |

Bitget offers a straightforward fee structure for spot trading with both maker and taker fees at 0.1%. You can get discounts that lower these fees to 0.08%.

Futures Trading Fees

Bitget charges around 0.02% for futures maker fees, while Crypto.com doesn’t offer this information in the search results.

Deposit Fees

Both platforms don’t charge deposit fees, making it free to fund your account.

Withdrawal Fees

Bitget has variable withdrawal fees depending on the cryptocurrency. For Crypto.com, the withdrawal fee appears to be around 0.0005 BTC for Bitcoin transactions.

P2P Trading Fees

Bitget’s P2P taker fees range from 0.06% to 10%, while Crypto.com charges between 0.16% and 0.20%.

Bitget is generally considered a cheap crypto exchange, especially for altcoin traders. Many users praise Bitget for competitive prices and low fees compared to other exchanges.

Your trading volume and specific cryptocurrencies will affect the actual fees you pay on either platform.

Crypto.com vs Bitget: Order Types

When trading on crypto exchanges, understanding order types is essential for executing your trading strategy effectively. Both Crypto.com and Bitget offer several order types to help you manage your trades.

Bitget provides three basic order types across both spot and futures trading: Market Orders, Limit Orders, and Trigger Orders. Market orders execute immediately at the current market price, while limit orders allow you to set a specific price for buying or selling.

Trigger orders (sometimes called stop orders) on Bitget activate when the market reaches a certain price point, giving you more control over your entry and exit positions.

Crypto.com similarly offers market and limit orders on its platform. The exchange also provides stop-limit orders, which combine features of stop and limit orders to give traders more precise control.

Both platforms support OCO (One-Cancels-Other) orders, allowing you to place two orders simultaneously with the execution of one automatically canceling the other.

For advanced traders, Bitget may have a slight edge with its more specialized futures trading options. However, Crypto.com’s interface is often considered more user-friendly for beginners.

The order execution speed is comparable on both platforms, though this can vary depending on market conditions and trading volume.

When choosing between these exchanges, consider which order types best match your trading style and experience level.

Crypto.com vs Bitget: KYC Requirements & KYC Limits

Both Crypto.com and Bitget require KYC verification from their users, but their approaches differ slightly.

Crypto.com implements a tiered KYC system where your verification level determines your account limits. Basic verification requires your name, date of birth, and photo ID, allowing you to access core platform features.

For higher transaction limits on Crypto.com, you’ll need to complete advanced verification, which may include proof of address and additional documentation.

Bitget has made KYC mandatory since January 2024 for all trading activities, including crypto deposits, fiat transactions, and P2P trading. Without completing verification, your account functionality will be severely restricted.

The verification process on Bitget is straightforward. You’ll need to provide personal information, a valid government-issued ID, and possibly a selfie for facial recognition.

KYC Limits Comparison:

| Feature | Crypto.com | Bitget |

|---|---|---|

| Withdrawal without KYC | Not available | Not available |

| Basic KYC requirements | ID, name, DOB | ID, personal info, selfie |

| KYC implementation | Tiered system | Mandatory for all trading |

| Time to verify | Usually 1-2 business days | Typically within 24 hours |

Remember that KYC requirements exist to prevent fraud and comply with regulations. Both platforms use these verification steps to protect users and maintain regulatory compliance.

Many users prefer exchanges with robust KYC procedures as they often provide better security and support if issues arise with your account.

Crypto.com vs Bitget: Deposits & Withdrawal Options

When comparing Crypto.com and Bitget, understanding their deposit and withdrawal options is essential for your trading experience.

Both exchanges offer no deposit fees, which is a plus for users looking to fund their accounts without extra costs. This feature is common across major crypto exchanges in 2025.

For withdrawals, Bitget charges variable fees depending on the cryptocurrency, while Crypto.com has fixed fees like 0.0005 BTC for Bitcoin withdrawals. These fees can impact your overall trading profits, especially if you make frequent withdrawals.

Payment Methods Comparison:

| Feature | Bitget | Crypto.com |

|---|---|---|

| Deposit Fee | None | None |

| Withdrawal Fee | Variable | Fixed (e.g., 0.0005 BTC) |

| P2P Options | Available (0.06-10% fees) | Available (0.16-0.20% fees) |

Bitget offers more competitive P2P trading fees compared to Crypto.com, which might be beneficial if you frequently use peer-to-peer transactions.

For deposit methods, both platforms support standard cryptocurrency transfers. Crypto.com also provides additional fiat on-ramp options through bank transfers and credit cards in many regions.

Processing times for withdrawals vary between the two exchanges. Your withdrawal speed depends on network congestion and the specific cryptocurrency you’re transferring.

Always verify the current fee structure before making large deposits or withdrawals, as these rates may change based on market conditions.

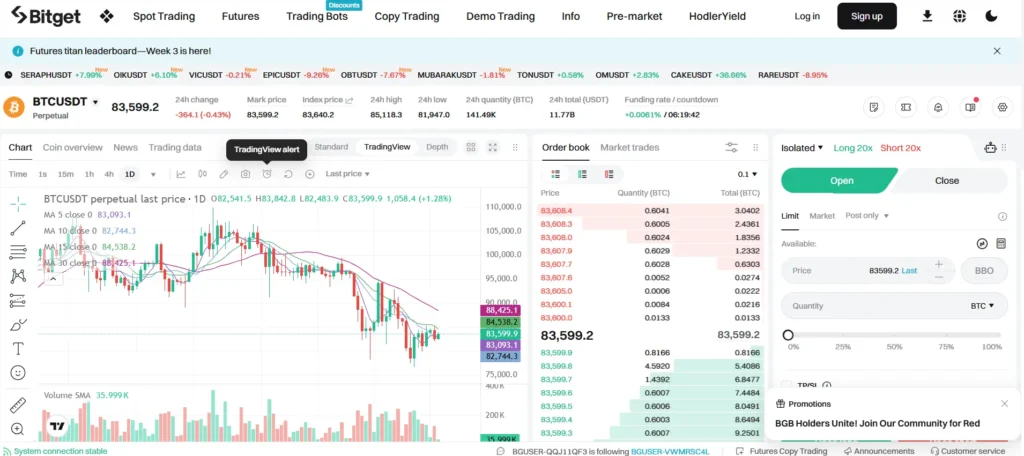

Crypto.com vs Bitget: Trading & Platform Experience Comparison

When choosing between Crypto.com and Bitget, the trading experience differs significantly. Both platforms offer unique features that cater to different types of crypto traders.

Bitget stands out with its competitive fee structure. They charge just 0.1% for both makers and takers in spot trading, which is lower than many competitors. According to recent data, their maker fees can be as low as 0.02% with taker fees at 0.06%.

Crypto.com, while having slightly higher fees, offers a more comprehensive ecosystem. Their platform integrates exchange services with a popular mobile app, visa card options, and the Cronos blockchain.

Platform Features Comparison:

| Feature | Bitget | Crypto.com |

|---|---|---|

| Trading Fees | Lower (starting at 0.1%) | Higher |

| Coin Selection | 1240+ cryptocurrencies | Fewer options |

| Copy Trading | Yes | Limited |

| Additional Tools | Staking, loans, savings | Visa cards, NFT marketplace |

Bitget’s copy trading feature gives you the ability to automatically mirror the trades of successful traders. This makes it appealing if you’re newer to crypto trading.

Crypto.com’s platform experience focuses more on accessibility and its broader ecosystem. The Cronos blockchain provides additional utility for their CRO token.

If you prioritize lower fees and copy trading, Bitget might be your better option. For a more complete crypto ecosystem with spending options, Crypto.com could be more suitable.

Crypto.com vs Bitget: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding liquidation mechanisms is crucial for your risk management. Both Crypto.com and Bitget have specific approaches to handle liquidations.

Bitget uses the Mark price for liquidation calculations rather than the last traded price. This approach helps protect traders from flash crashes or price manipulation that might trigger unnecessary liquidations.

Your total position risk in a specific margin currency determines how Bitget measures leverage and risk. This system allows for a more comprehensive assessment of your portfolio’s vulnerability.

Crypto.com also employs liquidation protection mechanisms, but with some differences in implementation. They focus on maintaining position stability by gradually reducing exposure as prices approach liquidation thresholds.

Key Differences:

| Feature | Bitget | Crypto.com |

|---|---|---|

| Price Reference | Mark Price | Index Price |

| Liquidation Process | Based on total position risk | Gradual reduction approach |

| Warning System | Multi-stage alerts | Early warning notifications |

You should consider these liquidation differences when choosing between platforms. Bitget might appeal to traders who want clear Mark price references, while Crypto.com offers a somewhat different approach to position management.

The liquidation threshold also varies between these platforms based on the leverage you choose to use and the specific cryptocurrency pairs being traded.

Crypto.com vs Bitget: Insurance

When choosing a crypto exchange, insurance coverage is a critical factor for your security. Both Crypto.com and Bitget offer protection for user funds, but their approaches differ.

Crypto.com provides up to $750 million in insurance coverage through partnerships with leading insurers. This coverage helps protect your digital assets against hacks, theft, or security breaches affecting their platform.

Bitget also maintains insurance protection, though with a smaller fund size. Their protection fund is valued at approximately $300 million. This fund serves as a safety net for users in case of security incidents.

Insurance Coverage Comparison:

| Exchange | Insurance Amount | Coverage Type |

|---|---|---|

| Crypto.com | $750 million | Third-party insurance |

| Bitget | $300 million | Protection fund |

Both exchanges store the majority of user funds in cold wallets, which adds an extra layer of security for your assets. Cold storage means your crypto is kept offline, making it much harder for hackers to access.

Neither exchange offers FDIC insurance, as this is typically only available for fiat deposits in traditional banking. This is standard across the crypto industry.

You should verify the current insurance details before making your decision, as coverage policies can change. Insurance terms may also have specific conditions that limit what types of incidents are covered.

Crypto.com vs Bitget: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your experience. Both Crypto.com and Bitget offer support options, but they differ in important ways.

Crypto.com provides 24/7 customer support through live chat, email, and an extensive help center. You can access help directly through their app or website. Many users appreciate the quick response times, especially through live chat.

Bitget also offers 24/7 support through similar channels. Their support team can be reached via chat, email, and ticket systems. Bitget has worked to improve their support response times in recent years.

Response Time Comparison:

- Crypto.com: Typically responds within minutes on live chat, 24-48 hours for email

- Bitget: Usually responds within 30 minutes on chat, 24-72 hours for email

Both exchanges offer support in multiple languages, which is helpful for international users. English, Spanish, Russian, and Chinese are commonly supported on both platforms.

Self-help resources are available on both exchanges. Crypto.com’s knowledge base is more extensive with detailed guides and FAQs. Bitget offers basic tutorials but has fewer in-depth resources.

For new users, Crypto.com tends to provide more beginner-friendly support. Their step-by-step guides make it easier for you to navigate the platform if you’re new to crypto trading.

Crypto.com vs Bitget: Security Features

When choosing a crypto exchange, security should be your top priority. Both Crypto.com and Bitget offer several security measures to protect your assets.

Bitget implements two-factor authentication (2FA) to add an extra layer of protection for your account. This means you’ll need both your password and a temporary code from your mobile device to log in.

Crypto.com also uses 2FA, but goes further with additional security features. They store most user funds in cold wallets that aren’t connected to the internet, making them less vulnerable to hacking attempts.

Both platforms conduct regular security audits to identify and fix potential vulnerabilities. This helps keep your funds safe from emerging threats.

Bitget has lower trading fees compared to many competitors, with maker fees of 0.02% and taker fees of 0.06%. While this isn’t directly a security feature, lower fees can mean less financial risk on each trade.

Key Security Differences:

- Crypto.com has a more established security reputation

- Bitget focuses on user-friendly security features

- Both offer fund protection systems

- Crypto.com emphasizes cold storage for most assets

You should enable all available security options regardless of which platform you choose. This includes using strong, unique passwords and keeping your recovery phrases in a secure location.

Is Crypto.com Safe & Legal To Use?

Crypto.com is generally considered safe for users based on current information. The platform implements industry-standard security measures and often exceeds requirements for U.S. residents.

For legal status, Crypto.com operates legally in most countries where it provides services. You should check your local regulations to confirm it’s permitted in your specific location.

The platform offers these safety features:

- Two-factor authentication (2FA)

- Cold storage for majority of user assets

- Regular security audits

- Account protection measures

According to search results, users find Crypto.com acceptable for holding and accumulating cryptocurrency, though fees are higher compared to some competitors.

You should note that Crypto.com lacks regulation in some jurisdictions. The search results indicate it’s not regulated in Spain, UAE, Singapore, or Australia.

When comparing to other platforms like Bitget, Crypto.com offers similar core services but with different fee structures and security approaches.

Remember that all cryptocurrency platforms carry inherent risks. Crypto assets aren’t typically covered by government insurance programs like bank deposits.

For maximum security, consider using hardware wallets for long-term storage of significant cryptocurrency amounts rather than keeping everything on the exchange.

Is Bitget Safe & Legal To Use?

Bitget has not faced major attacks or lost user funds, suggesting a basic level of security. The platform has implemented security measures including a 300 Million USDT Protection Fund and proof of reserves to protect users’ assets.

Forbes has listed Bitget among the world’s most trustworthy crypto exchanges. The platform earned this recognition partly due to its strong BTC-ETH holding score and focus on transparency.

However, safety concerns exist. Some users have reported negative experiences, with claims about scams appearing in community forums. These reports should be considered when making your decision.

Regarding regulation, Bitget appears to lack official regulation in key markets:

- Spain: Not regulated

- UAE (DFSA): Not regulated

- Singapore: Not regulated

- Australia: Not regulated

This limited regulatory oversight may create additional risk for your funds. Without proper regulation, you have fewer protections if something goes wrong.

When deciding if Bitget is right for you, weigh these security features against the regulatory gaps and user complaints. Consider your risk tolerance and the amount you plan to invest.

You might want to start with smaller amounts to test the platform before making larger deposits. Always enable all available security features like two-factor authentication to protect your account.

Frequently Asked Questions

Choosing between Crypto.com and Bitget involves comparing several key aspects that affect your trading experience. These platforms differ in their fee structures, available cryptocurrencies, security features, and specialized services.

What distinguishable features set Crypto.com apart from Bitget?

Crypto.com offers the Cronos blockchain ecosystem, which Bitget doesn’t have. This gives you additional functionality through the CRO token.

Crypto.com provides a wider range of services including a visa card program with cashback rewards and an NFT marketplace.

Bitget focuses more on copy and social trading features, allowing you to follow successful traders automatically.

Are there any significant differences in fees between Crypto.com and Bitget?

Bitget generally offers lower trading fees with maker fees of 0.02% and taker fees of 0.06%. These fees are competitive in the market.

Crypto.com’s fee structure is typically higher but can be reduced when using their native CRO token.

Bitget allows commission payments with bonus funds, which provides additional flexibility for frequent traders.

Which platform, Crypto.com or Bitget, offers a wider variety of cryptocurrencies?

Crypto.com typically offers a larger selection of cryptocurrencies for trading and investing. Their platform supports over 250 different tokens.

Bitget has a smaller but still substantial range of cryptocurrencies available for trading.

Both platforms regularly add new tokens, but Crypto.com generally leads in terms of variety and new listings.

How do user security measures compare between Crypto.com and Bitget?

Both platforms implement two-factor authentication to protect user accounts. This adds an essential layer of security beyond passwords.

Bitget uses cold storage for a portion of user funds, keeping them offline and safe from online threats.

Crypto.com employs a range of security measures including cold storage, multi-signature technology, and regular security audits.

Can users expect different levels of customer support on Crypto.com versus Bitget?

Crypto.com offers 24/7 customer support through multiple channels including live chat, email, and social media.

Bitget also provides around-the-clock support but may have fewer support representatives, potentially resulting in longer response times.

User reviews suggest that response times can vary significantly for both platforms during peak periods.

What are the advantages of using a larger platform like Coinbase compared to Crypto.com and Bitget?

Coinbase offers greater regulatory compliance and licensing in numerous countries, which may provide more security for your funds.

Larger platforms typically have higher liquidity, allowing you to execute larger trades with less price slippage.

Established platforms like Coinbase often have more robust security infrastructure and insurance policies to protect user assets.

Crypto.com vs Bitget Conclusion: Why Not Use Both?

After comparing these exchanges, you might wonder which one to choose. The answer could be both.

Crypto.com offers an all-in-one platform with NFT capabilities and the Cronos blockchain. It’s designed to be user-friendly for beginners while still offering advanced features.

Bitget stands out with competitive prices, low fees, and excellent customer service. Though unavailable in the US, UK, and Canada, it’s known for its extensive altcoin offerings.

Using both platforms might give you the best of both worlds. Here’s why:

- Diversify your options: Access more trading pairs and features

- Risk management: Avoid keeping all assets on one exchange

- Different strengths: Use each platform for what it does best

You could use Crypto.com for its comprehensive ecosystem and Bitget for its competitive fees when trading specific coins.

Remember that Bitget’s utility token (BGB) has 2.5 times the market cap of CRO despite lower exchange volume. This suggests strong user support and potential growth.

The best strategy often involves using multiple exchanges rather than limiting yourself to just one. This approach gives you flexibility and access to more opportunities in the crypto market.

Choose the right tool for each job rather than trying to find one perfect solution for everything.