Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Coinbase and WhiteBIT are two popular platforms that offer crypto trading services, but they differ in several key ways that might impact your decision.

When comparing Coinbase and WhiteBIT in 2025, you’ll find significant differences in their fee structures, available cryptocurrencies, and trading features that could affect your investment strategy. Coinbase ranks higher in overall popularity and user experience, while WhiteBIT offers more specialized trading options for experienced users.

These exchanges also vary in their deposit methods, security features, and global availability. Understanding these differences will help you determine which platform better suits your crypto trading needs, whether you’re a beginner looking for simplicity or an advanced trader seeking specific tools.

Coinbase Vs WhiteBIT: At A Glance Comparison

When choosing between Coinbase and WhiteBIT for your crypto trading needs in 2025, several key differences stand out. Both platforms offer cryptocurrency exchange services but with distinct features and fee structures.

User Experience

- Coinbase: Known for its beginner-friendly interface

- WhiteBIT: Offers more advanced trading features

Fees

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Trading Fees | Generally higher | Typically lower |

| Withdrawal Fees | Lower | Higher than Coinbase |

Coinbase has established itself as a trusted name in the crypto industry, especially for newcomers. You’ll find its simple design makes getting started with crypto trading straightforward.

WhiteBIT caters more to experienced traders with advanced features. The platform provides more trading pairs and options than Coinbase.

Supported Cryptocurrencies

Coinbase supports fewer cryptocurrencies compared to WhiteBIT. If you’re looking to trade less common altcoins, WhiteBIT may be your better option.

Security

Both exchanges prioritize security, but Coinbase has a longer track record in the industry. You can feel confident that both platforms implement strong security measures to protect your assets.

Deposit Methods

Coinbase offers more traditional payment options for depositing funds. WhiteBIT has fewer deposit methods but provides competitive crypto-to-crypto trading options.

Coinbase Vs WhiteBIT: Trading Markets, Products & Leverage Offered

Coinbase and WhiteBIT offer different trading options to meet various investor needs. Understanding these differences can help you choose the right platform.

Available Markets

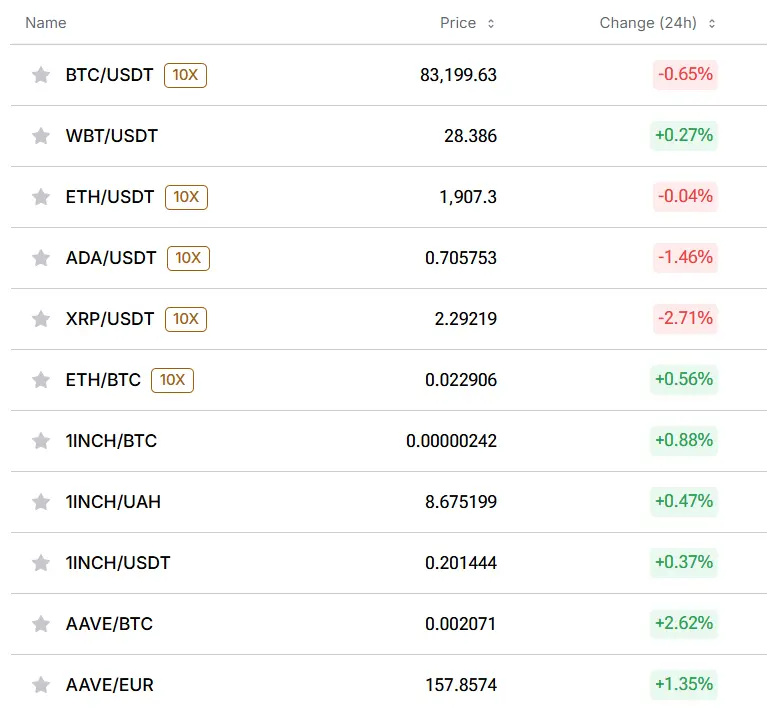

Coinbase provides access to 200+ cryptocurrencies while WhiteBIT supports over 400 trading pairs. WhiteBIT’s larger selection gives you more options if you’re interested in trading altcoins.

Trading Products

- Coinbase: Spot trading, staking, NFT marketplace, Coinbase Card

- WhiteBIT: Spot trading, futures, margin trading, staking, P2P trading

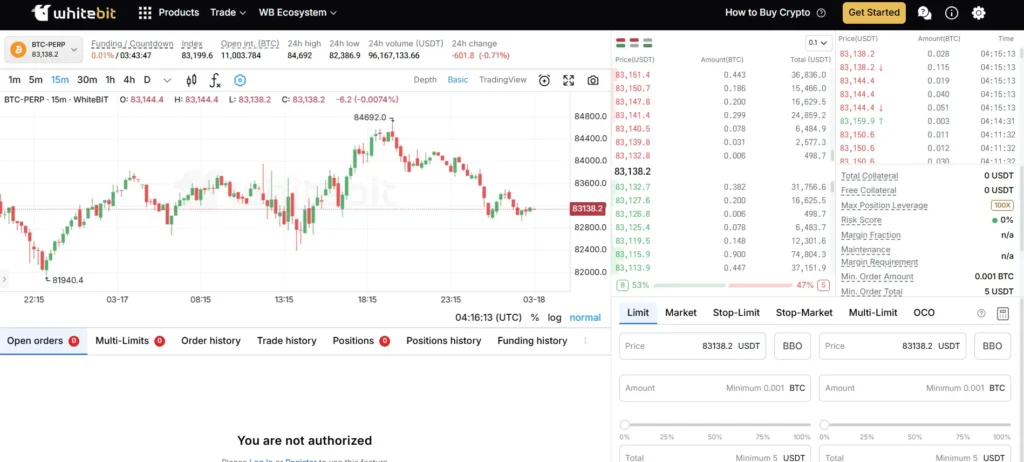

One notable difference is leverage trading. WhiteBIT offers margin trading with up to 5x leverage on certain pairs and futures trading with higher leverage options. Coinbase does not offer leverage trading on its main platform.

Trading Tools

WhiteBIT provides more advanced trading features like conditional orders and cross-margin. Coinbase offers a simpler interface that’s more beginner-friendly.

Fees Structure

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Spot Trading | 0.4-0.6% | 0.1% |

| Margin Fees | Not available | 0.05% + funding rate |

| Futures | Not available | 0.01-0.05% |

If you’re looking for advanced trading options with leverage, WhiteBIT offers more variety. Coinbase is better suited if you prefer a straightforward trading experience with strong regulatory compliance.

Coinbase Vs WhiteBIT: Supported Cryptocurrencies

When choosing between Coinbase and WhiteBIT, the range of supported cryptocurrencies is an important factor to consider.

Coinbase offers access to over 250 cryptocurrencies for trading. You’ll find all major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) available. Coinbase regularly adds new tokens to keep up with market trends.

WhiteBIT supports over 400 cryptocurrencies, giving you a wider selection than Coinbase. This includes both established coins and newer, emerging tokens.

Here’s a quick comparison of supported assets:

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Total cryptocurrencies | 250+ | 400+ |

| Major coins (BTC, ETH) | Yes | Yes |

| Stablecoins | Yes | Yes |

| DeFi tokens | Limited selection | Extensive selection |

WhiteBIT offers more trading pairs than Coinbase, which gives you additional flexibility for direct exchanges between different cryptocurrencies.

Some coins on WhiteBIT require minimum lockup periods. According to the search results, most coins need at least a 10-day minimum lockup, while others may require up to 30 days.

Coinbase tends to be more selective about which cryptocurrencies it lists, often focusing on established coins with proven track records. This can mean fewer options but potentially lower risk.

If you’re looking for rare altcoins or newer tokens, WhiteBIT likely has more options for you. However, if you primarily trade mainstream cryptocurrencies, either platform will meet your needs.

Coinbase Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and WhiteBIT, fees play a crucial role in your decision. Based on the most recent 2025 data, the platforms have notable differences in their fee structures.

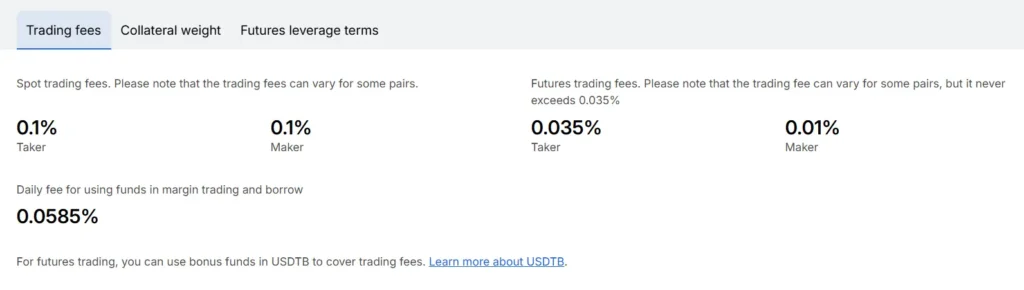

WhiteBIT offers significantly lower trading fees at 0.1% for both maker and taker orders. This flat fee structure makes it easier to calculate your trading costs.

Coinbase, on the other hand, charges higher trading fees. Their standard fees are around 0.4% for maker orders and 0.6% for taker orders. These higher fees reflect Coinbase’s user-friendly interface and robust security features.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| WhiteBIT | 0.1% | 0.1% |

| Coinbase | 0.4% | 0.6% |

For deposit methods, Coinbase provides more options for beginners. You can deposit funds using bank transfers, credit cards, and various payment services. These convenience options often come with additional fees.

WhiteBIT typically offers fewer deposit methods but maintains lower fees across these options. This approach aligns with their overall lower-fee strategy.

Withdrawal fees vary based on the cryptocurrency and method chosen. WhiteBIT generally maintains competitive withdrawal fees compared to Coinbase.

Your trading volume and frequency should influence your platform choice. If you’re an active trader, WhiteBIT’s lower fees could save you significant money over time.

Coinbase Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is essential. Both Coinbase and WhiteBIT offer several order options, but they differ in variety and complexity.

Coinbase provides basic order types for beginners and experienced traders. The most common is the market order, which executes immediately at the current market price. You can also place limit orders to buy or sell at a specific price.

WhiteBIT offers a more comprehensive selection of order types. Besides the standard market and limit orders, you get access to stop orders, stop-limit orders, and trailing stop orders. These advanced options give you more control over your trading strategy.

For day traders, WhiteBIT’s OCO (One-Cancels-the-Other) orders are particularly useful. This feature lets you place two orders simultaneously, and when one executes, the other automatically cancels.

Both platforms support recurring orders for dollar-cost averaging strategies. However, WhiteBIT’s trading interface might feel more complex for beginners.

Here’s a quick comparison of order types:

| Order Type | Coinbase | WhiteBIT |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop | Limited | ✓ |

| Stop-Limit | Limited | ✓ |

| Trailing Stop | ✗ | ✓ |

| OCO | ✗ | ✓ |

WhiteBIT clearly offers more sophisticated order types. This makes it better suited for advanced traders who need precise control over their positions.

Coinbase Vs WhiteBIT: KYC Requirements & KYC Limits

Both Coinbase and WhiteBIT require KYC (Know Your Customer) verification, but they differ in their approaches and requirements.

WhiteBIT KYC:

- Mandatory KYC for all users who signed up after September 21, 2022

- Users who registered before this date can choose whether to complete verification

- Some users report needing to complete KYC twice – once when signing up and again when making withdrawals

- Complies with all KYC and AML (Anti-Money Laundering) requirements

Coinbase KYC:

- Requires verification for all users regardless of sign-up date

- Typically requires ID verification immediately upon account creation

- Uses a tiered verification system that increases limits as you provide more information

The verification process affects your trading and withdrawal limits on both platforms.

Without KYC on WhiteBIT, your functionality will be severely limited. After basic verification, you’ll gain access to most features but with certain withdrawal limits.

Coinbase requires at least basic verification to use the platform at all. As you complete higher verification levels, your buying and selling limits increase accordingly.

Both exchanges prioritize security, but their verification requirements reflect their different approaches to compliance regulations.

You should prepare government-issued ID, proof of address, and possibly a selfie when signing up for either platform to ensure smooth verification.

Coinbase Vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Coinbase and WhiteBIT, understanding the deposit and withdrawal options is crucial for your trading experience.

Coinbase offers a variety of payment methods for most users. You can deposit funds using bank transfers (ACH in the US), credit/debit cards, PayPal (in some regions), and wire transfers. Withdrawal options include bank accounts, PayPal, and direct to crypto wallets.

WhiteBIT supports bank transfers via SEPA for European users and offers P2P options in some markets. The platform also accepts credit/debit cards for crypto purchases in many regions.

Both exchanges allow direct cryptocurrency deposits to your exchange wallet, but their supported networks differ.

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Fiat Deposit Methods | Bank transfer, cards, PayPal, wire | Bank transfer (SEPA), cards, P2P |

| Withdrawal to Bank | Yes (most regions) | Yes (limited regions) |

| Crypto Networks | Most major networks | Multiple networks, varies by coin |

| Processing Time | 1-5 business days (fiat) | 1-3 business days (SEPA) |

Coinbase typically charges higher fees for card deposits (around 3.99%), while bank transfers are more affordable. WhiteBIT’s fee structure for deposits varies by method and region.

For withdrawals, both platforms implement security measures like withdrawal confirmations and address whitelisting to protect your funds.

Your location will significantly impact available options, as both exchanges offer different services based on regional regulations.

Coinbase Vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between Coinbase and WhiteBIT, the trading experience and platform features can greatly influence your decision.

Coinbase offers a user-friendly interface designed for beginners with a clean, straightforward layout. You’ll find it easy to navigate even if you’re new to crypto trading.

WhiteBIT provides a more advanced trading platform with extensive tools for experienced traders. The platform includes detailed charts and multiple order types that technical traders appreciate.

Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| Coinbase | 0.40-0.60% | 0.40-0.60% | Varies by crypto |

| WhiteBIT | 0.10-0.15% | 0.15-0.20% | Varies by crypto |

WhiteBIT generally offers lower trading fees than Coinbase, making it more cost-effective for active traders.

Both platforms provide mobile apps, but users often rate Coinbase’s app higher for its simplicity and reliability.

For market depth and liquidity, Coinbase typically has stronger numbers for major cryptocurrencies. However, WhiteBIT offers more trading pairs overall, especially for altcoins.

Security features are robust on both platforms. Coinbase is known for its strong regulatory compliance in the US market, while WhiteBIT emphasizes its multiple security layers.

You’ll find staking options on both platforms, but they differ in supported assets and interest rates. Coinbase offers staking-as-a-service for several popular cryptocurrencies.

Coinbase Vs WhiteBIT: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding liquidation mechanisms is crucial for your financial safety. Both Coinbase and WhiteBIT have systems in place to manage risk, but they function differently.

Coinbase uses a graduated liquidation process. When your margin ratio approaches dangerous levels, you’ll first receive a margin call notification. This gives you time to add funds before any forced liquidation occurs.

WhiteBIT, on the other hand, employs a more immediate liquidation process when positions reach their threshold. According to the search results, WhiteBIT offers an auto-investment mode that can help preset orders to reduce liquidation risks.

On Coinbase, liquidation typically happens when your collateral falls below maintenance margin requirements. The platform will close positions gradually when possible to minimize market impact.

WhiteBIT’s liquidation engine activates at preset margin levels. Most users report that WhiteBIT’s liquidation happens with less warning than Coinbase, so monitoring your positions closely is essential.

Key Differences:

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Warning System | Margin calls before liquidation | Limited warnings |

| Liquidation Speed | Gradual when possible | Generally faster |

| Prevention Tools | Position monitoring tools | Auto-investment mode |

Both platforms calculate liquidation prices based on your leverage level, position size, and market volatility. Higher leverage means liquidation can happen with smaller price movements.

Coinbase Vs WhiteBIT: Insurance

When choosing a crypto exchange, insurance coverage is a crucial factor to consider for your financial security. Coinbase and WhiteBIT differ significantly in their approach to insurance protection.

Coinbase offers robust insurance coverage for your digital assets. They maintain a commercial crime policy that covers losses from theft, including cybersecurity breaches. For US customers, USD balances are FDIC-insured up to $250,000 per individual.

WhiteBIT’s insurance approach is different. They maintain a dedicated Asset Protection Fund designed to safeguard user assets. This fund acts as a self-insurance mechanism against potential security breaches.

Coinbase Insurance Highlights:

- FDIC insurance for USD balances (US customers only)

- Commercial crime insurance policy

- Coverage for hot wallet storage (online storage)

- 98% of customer crypto stored in cold wallets for added security

WhiteBIT Insurance Highlights:

- Asset Protection Fund for emergency situations

- Cold storage for majority of funds

- Regular security audits to prevent breaches

- No FDIC insurance equivalent for fiat currencies

You should note that neither exchange offers complete coverage for all potential loss scenarios. Market volatility losses are not covered by either platform’s insurance policies.

Always consider enabling additional security features like two-factor authentication to add extra protection for your crypto assets regardless of which platform you choose.

Coinbase Vs WhiteBIT: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Coinbase and WhiteBIT offer support, but there are key differences.

Coinbase has a reputation for slower response times. Many users report waiting days for email responses, which can be frustrating during urgent situations. The platform offers email support and a help center, but lacks live chat options for most users.

Coinbase Support Options:

- Email support

- Help center with FAQs

- Phone support (limited to specific account issues)

- Twitter support account

WhiteBIT tends to provide more responsive customer service. Their support team typically responds within 24 hours, and they offer more communication channels.

WhiteBIT Support Options:

- 24/7 live chat

- Email support

- Telegram community

- Extensive knowledge base

- Multi-language support

For beginners, WhiteBIT’s quick response times can be valuable when you’re learning to navigate cryptocurrency trading. Their live chat feature lets you get answers without waiting days.

Response quality matters too. WhiteBIT support agents generally provide detailed, helpful answers. Coinbase responses can sometimes feel automated or generic.

Both platforms offer support in multiple languages, but WhiteBIT covers more languages, making it accessible to a wider global audience.

Coinbase Vs WhiteBIT: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both Coinbase and WhiteBIT offer robust security features, but they differ in several ways.

Coinbase provides industry-leading security protections. They store 98% of customer funds in offline cold storage to protect against hacking attempts. Your account can be secured with two-factor authentication (2FA) via SMS or authenticator apps.

WhiteBIT also employs cold storage for most user funds. They maintain a 96% cold storage policy, which is slightly lower than Coinbase but still excellent by industry standards.

Key Security Features Comparison:

| Feature | Coinbase | WhiteBIT |

|---|---|---|

| Cold Storage | 98% of funds | 96% of funds |

| 2FA Options | SMS, Authenticator apps | SMS, Email, Authenticator apps |

| Insurance | FDIC insurance up to $250,000 (USD only) | Protection fund for users |

| Account Verification | ID verification required | Multi-level KYC process |

| Security Certifications | SOC 1 Type 2 & SOC 2 Type 2 | ISO 27001 certification |

WhiteBIT offers a Protection Fund designed to compensate users in case of security breaches. This provides additional peace of mind when trading on their platform.

Coinbase has never experienced a significant security breach that resulted in lost customer funds. They also offer FDIC insurance for USD holdings, protecting your cash deposits up to $250,000.

Both exchanges require identity verification to comply with regulations and prevent fraud. However, WhiteBIT’s verification process has multiple levels that unlock different withdrawal limits.

Is Coinbase Safe & Legal To Use?

Coinbase is generally considered a safe platform for cryptocurrency trading and investing. It employs strong security measures to protect user funds and information.

The exchange is regulated in the United States and complies with financial regulations in many countries. Based on the search results, Coinbase has regulatory approval in Spain, though it lacks regulation in some other jurisdictions.

Security Features:

- Two-factor authentication (2FA)

- Biometric login options

- 98% of customer funds stored in offline cold storage

- USD balances insured up to $250,000 by FDIC

Many users report positive experiences with Coinbase’s security. According to search results, connecting your card with Coinbase is considered as safe as with other financial institutions.

Coinbase ranks higher (#2) in Digital Asset Custody Services compared to WhiteBIT (#21), suggesting stronger overall security infrastructure.

Legal Status:

- Fully licensed in the US

- Compliant with AML and KYC requirements

- Registered as a Money Services Business with FinCEN

When using Coinbase, you should still follow best practices like using unique passwords and enabling all security features. No exchange is completely immune to risks.

The platform’s regulatory compliance provides you with additional protection compared to some other exchanges that operate with less oversight.

Is WhiteBIT Safe & Legal To Use?

WhiteBIT is generally considered a safe cryptocurrency exchange with strong security measures in place. The platform has earned an AAA security rating and is ranked among the top 3 safest trading platforms according to search results.

Security on WhiteBIT includes several key features. The exchange utilizes two-factor authentication (2FA), cold wallet storage for user funds, and anti-phishing measures to protect your assets.

WhiteBIT complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which adds an extra layer of legitimacy and security to the platform.

Regarding regulation, WhiteBIT has some legal presence in certain regions. Search results indicate it is regulated in Spain, though it lacks regulation in France, UAE, and Singapore. This partial regulation status is important to consider when evaluating its legal standing.

The exchange provides secure storage options and appears to be well-established in the cryptocurrency market.

Key Security Features:

- Two-factor authentication (2FA)

- Cold wallet storage for funds

- Anti-phishing protection

- Routine security measures

- KYC and AML compliance

Before using WhiteBIT, you should verify if it’s legally available in your region, as cryptocurrency regulations vary widely by country.

Frequently Asked Questions

Here are the answers to common questions about Coinbase and WhiteBIT crypto exchanges. These platforms have different features, fees, and security measures that might influence your trading decisions.

What are the key differences between Coinbase and WhiteBIT trading platforms?

Coinbase focuses on simplicity and regulatory compliance, making it popular in the US and many Western countries. It offers a straightforward interface with educational resources for newcomers.

WhiteBIT has a more advanced trading interface with more technical features. It supports futures trading and margin trading options that Coinbase doesn’t offer.

The exchanges also differ in geographic availability. Coinbase operates in over 100 countries while WhiteBIT has a stronger presence in Eastern Europe.

Which exchange offers better security, Coinbase or WhiteBIT?

Coinbase has a strong security record with 98% of assets stored in cold storage. It offers two-factor authentication, biometric login options, and is a publicly traded company subject to regular audits.

WhiteBIT also emphasizes security with 96% of funds in cold storage. It uses DDOS protection and offers address whitelisting features.

Both platforms provide insurance for certain assets, but Coinbase’s insurance covers a broader range of scenarios. Neither exchange has experienced major hacks, which speaks to their security measures.

How do the fees compare between Coinbase and WhiteBIT?

Coinbase typically charges higher fees than WhiteBIT. Standard Coinbase transactions may include fees between 0.5% to 4.5% depending on payment method and transaction size.

WhiteBIT offers a more competitive fee structure with trading fees ranging from 0.1% to 0.2%. Its maker-taker model rewards high-volume traders with lower fees.

You can reduce fees on both platforms through membership tiers or by using their advanced trading platforms (Coinbase Pro or WhiteBIT’s professional interface).

Can users trade a variety of cryptocurrencies on both Coinbase and WhiteBIT?

Coinbase supports over 200 cryptocurrencies for trading, including all major coins and many established altcoins. It tends to be selective about which tokens it lists.

WhiteBIT offers a wider selection with support for over 400 cryptocurrency trading pairs. It often lists newer projects and tokens earlier than Coinbase.

Both platforms allow conversion between cryptocurrencies and trading with fiat currencies, though available pairs differ by region.

Which platform between Coinbase and WhiteBIT is more user-friendly for beginners?

Coinbase is widely recognized as more beginner-friendly with its simple interface and educational resources. Its mobile app is intuitive and designed for newcomers to cryptocurrency.

WhiteBIT’s interface contains more features and technical indicators that can overwhelm beginners. However, it does offer basic views and simplified trading options.

Coinbase Earn program allows you to learn about crypto while earning tokens, which isn’t available on WhiteBIT. This feature makes Coinbase particularly attractive for cryptocurrency newcomers.

How do the customer support services of Coinbase and WhiteBIT differ?

Coinbase offers email support and a help center with extensive documentation. Premium customers get access to 24/7 phone support, though response times can vary during high demand periods.

WhiteBIT provides live chat support, email tickets, and an active Telegram community. Their support team typically responds within 24 hours for standard issues.

Both platforms have faced criticism during peak market periods when support systems become overwhelmed. WhiteBIT tends to have faster response times but Coinbase offers more support channels for premium users.

Coinbase Vs WhiteBIT Conclusion: Why Not Use Both?

Both Coinbase and WhiteBIT offer unique advantages that can benefit different types of crypto traders. You don’t necessarily have to choose just one platform.

Coinbase shines with its user-friendly interface, strong security measures, and 1:1 customer asset ratio. This means your assets aren’t used for lending or other corporate purposes, providing peace of mind for beginners and security-conscious users.

WhiteBIT, while having fewer coin options than Coinbase, serves as a decent option for beginners. It offers staking services similar to Coinbase Earn, where you can gain interest on supported assets.

Key differences to consider:

- Coinbase has a wider selection of cryptocurrencies compared to WhiteBIT

- WhiteBIT may have higher trading and non-trading fees

- Coinbase ranks higher in trustworthiness, especially among Gen Z users

You might use Coinbase as your primary exchange for its reputation and extensive coin selection, while using WhiteBIT for specific trading pairs or features not available on Coinbase.

Your trading needs, security preferences, and fee tolerance should guide your decision. Many experienced traders maintain accounts on multiple exchanges to take advantage of different fee structures, coin availability, and special features.

Remember to consider your own trading volume, preferred cryptocurrencies, and security needs when deciding which platform works best for your situation.