Choosing the right crypto exchange can make a big difference in your trading experience. Coinbase and OKX are two popular options in 2025, each with distinct features that might fit different types of traders.

Coinbase excels in user-friendly design and security features for beginners, while OKX offers more advanced trading tools, higher leverage options, and a wider range of cryptocurrencies. The platforms also differ in their fee structures, with OKX generally charging lower trading fees than Coinbase, though Coinbase might be cheaper for direct fiat purchases.

Your trading style and needs will determine which platform works best for you. If you’re new to crypto and value simplicity, Coinbase’s straightforward approach might be ideal. If you’re looking for more advanced features and lower fees, OKX could be the better choice. Let’s compare these exchanges in detail to help you make an informed decision.

Coinbase Vs OKX: At A Glance Comparison

Coinbase and OKX offer different experiences for crypto traders in 2025. Here’s how they stack up against each other in key areas:

Fee Structure:

- Coinbase: Higher trading fees but potentially cheaper for buying crypto with cash

- OKX: Generally lower trading fees, especially for active traders

User Experience:

- Coinbase: Beginner-friendly interface, simplified trading process

- OKX: More complex platform with advanced tools for experienced traders

Target Users:

| Exchange | Best For |

|---|---|

| Coinbase | Beginners, casual investors, those who value security |

| OKX | Advanced traders, those seeking low fees, derivatives traders |

Features Comparison:

- Coinbase excels in security and regulatory compliance

- OKX offers high leverage options and more trading pairs

Business Focus:

Coinbase serves around 83% of small businesses while OKX reaches over 92% of this market segment.

Product Range:

- Coinbase: Basic cryptocurrency trading with strong fiat support

- OKX: Expanded offerings including DeFi products, NFTs, and derivatives

You’ll find Coinbase more suitable if you’re new to crypto and value simplicity. OKX might be your better choice if you’re an experienced trader looking for advanced tools and lower fees.

Coinbase Vs OKX: Trading Markets, Products & Leverage Offered

Coinbase and OKX offer different trading options that might suit various investor needs. Let’s examine what each platform provides.

Available Cryptocurrencies:

- Coinbase: 250+ cryptocurrencies

- OKX: 350+ cryptocurrencies

OKX gives you access to more tokens compared to Coinbase, which may be important if you’re looking for more exotic or newer cryptocurrencies.

Trading Products:

| Feature | Coinbase | OKX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | Limited | Extensive |

| Options | Limited | ✓ |

| Margin Trading | Limited | ✓ |

| Derivatives | Basic | Advanced |

OKX significantly outperforms Coinbase when it comes to advanced trading features. If you’re an experienced trader looking for diverse instruments, OKX provides more options.

Leverage Options:

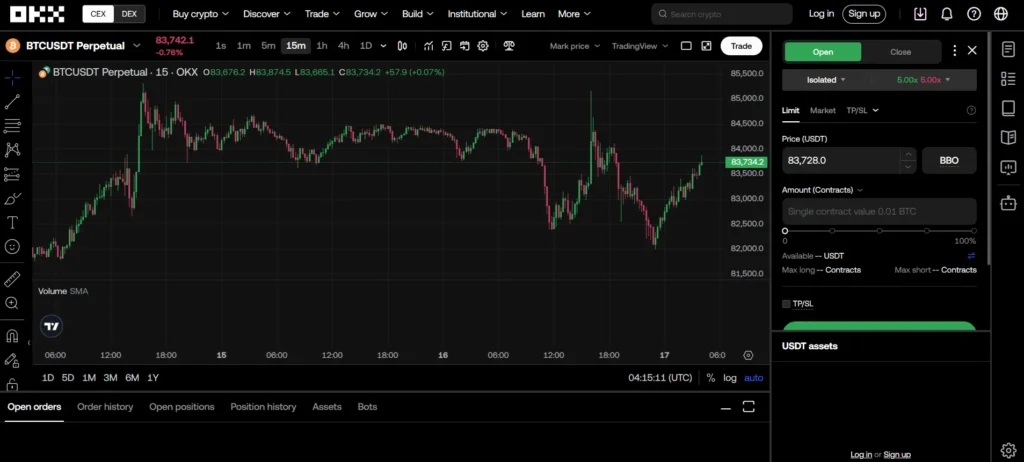

Coinbase offers limited leverage (up to 5x) on certain products. OKX, however, provides much higher leverage options—up to 100x on some futures contracts.

Trading Tools:

Both platforms offer charting tools, but OKX provides more advanced technical analysis features. You’ll find better order types and trading bots on OKX compared to Coinbase’s more straightforward interface.

For Beginners vs Advanced Traders:

Coinbase is more suitable if you’re new to crypto trading and want a simple experience. OKX caters to experienced traders who need advanced products, higher leverage, and more sophisticated trading tools.

The trading volume on both platforms is substantial, ensuring good liquidity for most major cryptocurrencies.

Coinbase Vs OKX: Supported Cryptocurrencies

When choosing between Coinbase and OKX, the range of available cryptocurrencies is an important factor to consider.

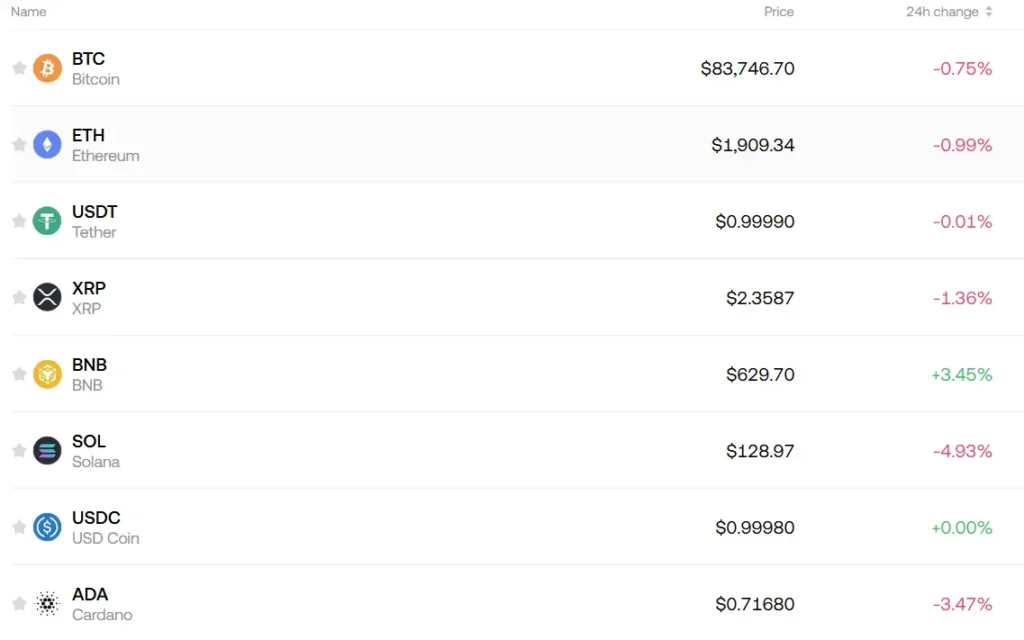

Coinbase offers a solid selection of cryptocurrencies, though it’s more limited than some competitors. You’ll find all major coins like Bitcoin, Ethereum, and Solana, plus many established altcoins. As of 2025, Coinbase supports approximately 200+ cryptocurrencies.

OKX significantly outperforms Coinbase in this category with support for over 350 cryptocurrencies. This includes major coins, emerging tokens, and a wide variety of altcoins that aren’t available on Coinbase.

Here’s a quick comparison:

| Feature | Coinbase | OKX |

|---|---|---|

| Total cryptocurrencies | 200+ | 350+ |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Niche altcoins | Limited | Extensive |

| New token listings | Selective | Frequent |

If you’re looking to trade only major cryptocurrencies, both platforms will meet your needs. However, if you want access to newer or more obscure tokens, OKX offers significantly more options.

Keep in mind that the specific selection changes regularly as both platforms add new tokens. Coinbase tends to be more selective about which cryptocurrencies it lists, focusing on established projects. OKX typically adds new tokens more quickly.

For traders interested in maximum variety and access to emerging projects, OKX has a clear advantage in cryptocurrency selection.

Coinbase Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and OKX, understanding their fee structures can help you make the right decision for your trading needs.

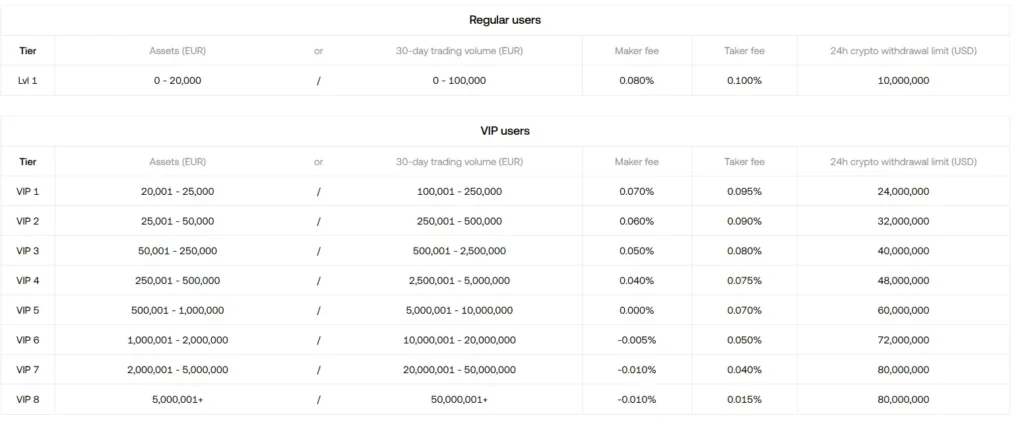

Trading Fees Comparison:

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| Coinbase | 0.40% | 0.60% |

| OKX | 0.08% | 0.10% |

As you can see, OKX offers significantly lower trading fees compared to Coinbase. This difference can have a major impact on your profits, especially if you trade frequently or with larger amounts.

For regular traders, OKX’s maker fee of 0.08% is five times lower than Coinbase’s 0.40%. This makes OKX more cost-effective for high-volume trading.

Deposit and Withdrawal Considerations:

Coinbase may have advantages when it comes to buying crypto with cash. Their built-in fiat services sometimes make the process cheaper and more straightforward than OKX.

OKX charges fees for withdrawing crypto to private wallets. The exact amount varies by cryptocurrency network and current blockchain conditions.

Both platforms may offer fee discounts for high-volume traders or users who hold their native tokens. These incentives can further reduce your costs if you’re an active trader.

Your choice between these platforms should consider your trading frequency, preferred payment methods, and the cryptocurrencies you plan to trade.

Coinbase Vs OKX: Order Types

When trading on cryptocurrency exchanges, the types of orders available can impact your strategy. Both Coinbase and OKX offer several order types, but they differ in variety and complexity.

Coinbase keeps things simple with a focus on basic order types. You can place market orders that execute immediately at current prices. Limit orders are also available, allowing you to set a specific price for buying or selling.

OKX provides more advanced trading options. Besides the standard market and limit orders, you can use stop orders, trailing stops, and post-only orders. These additional tools give you more control over your trading strategy.

Coinbase Order Types:

- Market orders

- Limit orders

- Stop orders (on Coinbase Advanced)

OKX Order Types:

- Market orders

- Limit orders

- Stop orders

- Trailing stop orders

- Post-only orders

- One-cancels-the-other (OCO)

- Time-weighted average price (TWAP)

The difference in order types reflects each platform’s overall approach. Coinbase aims for simplicity and ease of use, making it better for beginners. OKX targets more experienced traders who need advanced tools.

You should consider your trading style when choosing between these platforms. If you need sophisticated order types for complex strategies, OKX offers more options. For straightforward buying and selling, Coinbase’s simpler approach might be sufficient.

Coinbase Vs OKX: KYC Requirements & KYC Limits

Both Coinbase and OKX require Know Your Customer (KYC) verification, but they differ in their approaches and limits.

Coinbase KYC Requirements:

- Mandatory KYC for all users

- Requires personal information, ID verification, and sometimes a selfie

- Complete verification needed before trading or depositing funds

OKX KYC Requirements:

- KYC required at all account levels

- Recently strengthened requirements for withdrawals

- Previously allowed some usage via VPN without full verification, but this has changed

Withdrawal Limits:

| Exchange | Without KYC | Basic KYC | Full KYC |

|---|---|---|---|

| Coinbase | Not allowed | Limited | High |

| OKX | Very limited | Moderate | High |

OKX supports purchases with over 90 different fiat currencies once you complete verification. This gives you flexibility when funding your account from different regions.

Legal concerns may have influenced these stricter policies. OKX was named in a class action lawsuit in January 2024 related to alleged money laundering issues.

If privacy is your main concern, you might want to explore alternative exchanges. Some platforms offer services with minimal KYC requirements, though they typically impose lower withdrawal limits.

Your identity verification experience will generally be smoother on Coinbase, which has a more streamlined process. However, OKX offers more fiat currency options for deposits and withdrawals.

Coinbase Vs OKX: Deposits & Withdrawal Options

When choosing between Coinbase and OKX, understanding their deposit and withdrawal options is crucial for your trading experience.

Coinbase offers straightforward fiat currency options for US users. You can deposit funds using bank transfers (ACH), wire transfers, debit cards, and PayPal in some regions. Withdrawal methods include bank transfers, PayPal, and wire transfers.

OKX provides more crypto-to-crypto trading pairs but has more limited fiat options in the US. They support bank transfers, credit/debit cards, and third-party payment processors like Simplex.

Here’s a comparison of their options:

| Feature | Coinbase | OKX |

|---|---|---|

| Fiat deposit methods | Bank transfers, wire transfers, debit cards, PayPal | Bank transfers, credit/debit cards, third-party processors |

| Crypto deposits | Wide range of cryptocurrencies | Extensive cryptocurrency options |

| Withdrawal fees | Variable (higher than OKX) | Generally lower fees |

| Processing time | 1-5 business days for fiat | 1-5 business days for fiat |

Coinbase typically charges higher fees for deposits and withdrawals but offers more user-friendly options for beginners and US-based traders.

OKX may be more cost-effective for frequent traders due to lower withdrawal fees, especially for crypto-to-crypto transactions.

Both platforms implement security measures like two-factor authentication and withdrawal address whitelisting to protect your funds.

Coinbase Vs OKX: Trading & Platform Experience Comparison

Coinbase offers a user-friendly interface that’s perfect for beginners. You’ll find its clean design and simplified tools make buying and selling crypto straightforward.

OKX delivers a more advanced trading environment with powerful tools for experienced traders. Its platform includes advanced charting, multiple order types, and extensive trading pairs.

Fee Comparison:

| Exchange | Spot Trading Fees | Features |

|---|---|---|

| Coinbase | Higher | Beginner-friendly |

| OKX | Lower | Advanced trading tools |

When it comes to available features, OKX significantly outmatches Coinbase for advanced trading. You get access to derivatives, margin trading, and more complex instruments on OKX.

Coinbase shines with its educational resources and intuitive mobile app. The platform prioritizes simplicity, making it accessible for new crypto users.

Trading volume differs between the platforms. Coinbase reports approximately $5.3 billion in daily trading volume, showing its strong market position.

OKX stands out with its wider selection of trading pairs and advanced order types. You can use features like stop-limit orders, OCO (One-Cancels-the-Other), and advanced charting tools.

Both platforms offer mobile apps, but their focus differs. Coinbase aims for simplicity while OKX packs more features into its mobile experience.

For beginners, Coinbase provides a gentler learning curve. If you’re an advanced trader seeking lower fees and more tools, OKX might better suit your needs.

Coinbase Vs OKX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management. Both Coinbase and OKX have systems to protect themselves when your positions move against you.

OKX uses a tiered liquidation system that begins with warnings as your position approaches dangerous territory. The platform calculates a liquidation price based on your collateral and leverage level. When your margin ratio falls below maintenance requirements, OKX starts partial liquidation to reduce risk.

Coinbase takes a more straightforward approach to liquidation. Their system automatically closes positions when they reach predetermined liquidation thresholds. You’ll receive notifications, but the process is generally less flexible than OKX’s tiered approach.

Key differences to note:

| Feature | OKX | Coinbase |

|---|---|---|

| Warning system | Multi-tier warnings | Basic notifications |

| Liquidation process | Gradual/partial possible | Complete position closure |

| User control | More options to add margin | Limited intervention options |

| Transparency | Detailed liquidation metrics | Simpler threshold display |

OKX offers more sophisticated tools for managing liquidation risk, including insurance funds and ADL (Auto-Deleveraging) mechanisms. These features give experienced traders more control during volatile market conditions.

For beginners, Coinbase’s simpler liquidation system might be easier to understand, though it offers fewer options to save positions that are moving against you.

Coinbase Vs OKX: Insurance

Both Coinbase and OKX offer insurance protection for your digital assets, but they have different approaches to keeping your funds safe.

Coinbase Insurance Coverage:

- USD balances are FDIC-insured up to $250,000 per customer

- Digital assets held in their online storage are covered by a commercial crime insurance policy

- Approximately 98% of customer crypto is stored in cold storage, away from potential online threats

Coinbase’s insurance primarily protects against security breaches and employee theft, not from individual account compromises due to personal security failures.

OKX Insurance Coverage:

- Maintains a Investor Protection Fund to safeguard user assets

- Uses a mix of cold storage and other security measures

- Does not offer FDIC insurance for fiat deposits like Coinbase does

When comparing the two exchanges, Coinbase generally provides more transparent information about their insurance policies. You can easily find details about their coverage on their website.

It’s worth noting that neither exchange offers complete protection against all possible risks. Market volatility, personal account security issues, and certain types of hacks may not be covered.

You should always use strong security practices regardless of which exchange you choose. Enable two-factor authentication, use unique passwords, and consider moving large holdings to personal wallets for additional security.

Coinbase Vs OKX: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your experience. Based on user reviews, OKX appears to have an edge in this area.

Coinbase has faced criticism for its slow response times. Users often report waiting days or even weeks to get help with account issues. This has been one of the biggest complaints about the platform in recent years.

OKX, on the other hand, has received higher ratings for customer support quality. With a support rating of 6.9 compared to Coinbase’s lower score, many users find OKX more responsive to their needs.

Both exchanges offer multiple ways to get help:

| Support Feature | Coinbase | OKX |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | ✓ | ✓ |

| Phone Support | Limited | ✓ |

| Knowledge Base | Extensive | Good |

If you’re new to crypto trading, responsive customer service becomes even more important. You might need help with verifying your account, recovering access, or understanding trading features.

Remember that support quality can vary depending on your region and the complexity of your issue. During high-volume trading periods or market volatility, response times for both exchanges may increase.

Coinbase Vs OKX: Security Features

When choosing between Coinbase and OKX, security should be a top priority for your crypto assets. Both exchanges offer strong protection, but with different approaches.

Coinbase emphasizes regulatory compliance and user safety. It stores 98% of customer funds in cold storage, making them inaccessible to hackers. You’ll also benefit from FDIC insurance on USD balances up to $250,000.

OKX provides advanced security features for active traders. Their multi-signature wallet technology requires multiple approvals for withdrawals, adding an extra layer of protection.

Key Security Features Comparison:

| Feature | Coinbase | OKX |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | 98% of funds | 95% of funds |

| Insurance | FDIC for USD balances | Private insurance fund |

| Regulatory Status | Publicly traded, US-based | Hong Kong-based |

| KYC Requirements | Strict | Moderate |

Both platforms require identity verification (KYC) but Coinbase has stricter requirements due to US regulations. This means you’ll need to provide more personal information on Coinbase.

OKX offers a dedicated security center where you can manage all your security settings in one place. You can set up anti-phishing codes and withdrawal address whitelisting for added protection.

Coinbase provides a more beginner-friendly security setup with clear instructions and regular security prompts. Your account can be further secured with biometric login options on mobile devices.

Is Coinbase A Safe & Legal To Use?

Coinbase is a legal and licensed cryptocurrency exchange that operates in over 100 countries. It complies with regulations in each jurisdiction where it provides services, making it a legitimate platform for trading crypto.

When it comes to safety, Coinbase has built a strong reputation for security. The platform stores 98% of customer funds in offline cold storage to protect against hacking attempts. This approach significantly reduces vulnerability to online attacks.

Coinbase also offers several security features to protect your account:

- Two-factor authentication (2FA)

- Biometric login options

- Device verification

- Insurance coverage for digital assets held on the platform

The search results mention that Coinbase is backed by “industry-leading security measures,” and many users trust the Coinbase wallet for its high security standards.

However, it’s important to understand potential risks. If someone gains access to your device with your credentials (like if you lose your phone), your funds could be compromised.

Coinbase is considered one of the most durable crypto exchanges due to its liquidity and wise token allocation. This contributes to its overall safety profile in the volatile crypto market.

For U.S. customers, Coinbase offers FDIC insurance on USD balances up to $250,000, adding an extra layer of protection for your fiat currency holdings.

Is OKX A Safe & Legal To Use?

OKX is considered safe for cryptocurrency trading. Founded in 2017 and based in Seychelles, the platform has maintained a strong security record with an A security rating and an 81.80% security score.

As a regulated cryptocurrency exchange, OKX operates legally in most countries where crypto trading is permitted. However, it’s important to note that OKX is not available in the United States due to regulatory restrictions.

The platform employs industry-standard security measures to protect user funds and data. These include:

- Two-factor authentication (2FA)

- Cold storage for majority of customer funds

- Regular security audits

- Advanced encryption for data protection

When compared to other major exchanges like Coinbase, OKX offers similar security features. Both are considered reputable and trusted platforms in the cryptocurrency space.

If you’re concerned about wallet security, OKX offers its own hot wallet solution. Some users prefer using independent wallets like MyEtherWallet for additional security, but exchange-provided wallets are generally safe for most users.

Millions of users worldwide trust OKX for their cryptocurrency trading needs. The platform’s commitment to regulatory compliance and security has helped establish it as one of the leading cryptocurrency exchanges globally.

Before using OKX, check if it’s legal in your country and review their terms of service to ensure compliance with local regulations.

Frequently Asked Questions

Choosing between Coinbase and OKX involves understanding several key differences that impact your trading experience. Both platforms have distinct approaches to fees, security, and available features.

What are the main differences in fees between OKX and Coinbase?

OKX generally offers lower trading fees compared to Coinbase. Their maker-taker fee structure starts at 0.08% for makers and 0.10% for takers, which decreases with higher trading volume.

Coinbase’s standard trading fees are higher, starting at 0.6% for transactions under $10,000. However, Coinbase Pro offers more competitive rates for active traders.

For fiat transactions, Coinbase might be more cost-effective due to its built-in fiat services, while OKX often charges additional fees for fiat deposits and withdrawals.

How do user reviews compare for OKX and Coinbase?

Coinbase receives positive reviews for its user-friendly interface and beginner accessibility. Users frequently praise its straightforward approach and educational resources.

OKX garners favorable reviews from experienced traders who appreciate its advanced trading options and lower fee structure. However, some users note its interface has a steeper learning curve.

Security and reliability are mentioned in reviews for both platforms, with Coinbase often cited as feeling more trustworthy for US-based users due to its regulatory compliance.

What are the key security features of OKX and Coinbase?

Coinbase implements bank-level encryption, two-factor authentication, and keeps 98% of customer funds in cold storage. They also offer FDIC insurance on USD balances up to $250,000 for US customers.

OKX uses multi-signature technology, cold storage solutions, and real-time monitoring systems. Their platform includes anti-phishing codes and withdrawal safeguards.

Both exchanges conduct regular security audits and maintain emergency funds to protect against potential breaches, though Coinbase’s regulatory compliance in the US provides additional security assurances.

How do OKX and Coinbase differ in terms of supported cryptocurrencies and trading pairs?

OKX supports over 350 cryptocurrencies and offers more than 600 trading pairs. The platform provides access to a wider range of altcoins and emerging tokens.

Coinbase offers around 200 cryptocurrencies but is more selective about which tokens it lists, focusing on established projects that meet their compliance standards.

Trading pairs on OKX include more variety in derivatives, futures, and margin options, while Coinbase presents a more curated selection with emphasis on spot trading for mainstream investors.

Which platform, OKX or Coinbase, offers better customer support?

Coinbase provides 24/7 email support, a comprehensive help center, and phone support for specific issues. Response times can vary based on inquiry volume and complexity.

OKX offers live chat support, email tickets, and an extensive knowledge base. They also maintain active community channels for peer assistance.

For US-based users, Coinbase often provides better localized support with US-based representatives, while OKX’s support may have longer response times for North American customers.

What are the unique features that set OKX apart from Coinbase?

OKX offers advanced trading options including futures, options, perpetual swaps, and margin trading with leverage up to 125x. Their platform also includes a DeFi wallet and NFT marketplace.

The OKX Earn platform provides staking opportunities with competitive APY rates across more assets than Coinbase’s staking options.

OKX’s trading bot marketplace allows algorithmic trading strategies without coding knowledge, giving experienced traders automated tools that aren’t available on Coinbase’s more straightforward platform.

Coinbase Vs OKX Conclusion: Why Not Use Both?

After comparing these two major crypto exchanges, you might wonder which one to choose. The answer might surprise you – using both platforms could be your best strategy.

Coinbase shines with its user-friendly interface and excellent security features. It’s perfect if you’re new to crypto trading or prefer a straightforward experience. The platform offers over 150 assets and ranks 3rd by trading volume.

OKX, however, excels in advanced trading features and derivatives options. It generally has lower trading fees than Coinbase for most transactions. For traders looking for sophisticated tools, OKX delivers what you need.

Your choice depends on your specific needs. If you’re a beginner, Coinbase’s intuitive design makes it easier to start. If you’re an experienced trader seeking advanced features, OKX might be better suited.

But why limit yourself? You can use Coinbase for simple purchases and user-friendly services while leveraging OKX for more complex trading strategies and lower fees.

Many experienced crypto users maintain accounts on multiple exchanges to take advantage of different strengths. This approach gives you flexibility and access to more features and coins.

Remember to consider factors like:

- Security measures

- Fee structures

- Available cryptocurrencies

- Trading tools

- Customer support quality

By understanding what each platform offers, you can make informed decisions about where to conduct your crypto activities.