Choosing the right cryptocurrency exchange can make a big difference in your trading experience. As we move through 2025, Coinbase and MEXC remain popular options for crypto enthusiasts, each with distinct features and benefits. Based on current reviews, MEXC slightly edges out Coinbase with a score of 4.5/5 compared to Coinbase’s 4.35/5, but your ideal choice depends on your specific needs.

These exchanges differ in several key areas including fees, available cryptocurrencies, and trading options. Coinbase is known for its user-friendly interface and strong security measures, making it appealing for beginners. MEXC, on the other hand, offers a wider range of cryptocurrencies and trading types that might appeal to more experienced traders.

Understanding these differences can help you select the platform that best suits your trading style and goals. Both exchanges have continued to evolve their offerings in 2025, adding new features and improving user experience to stay competitive in the rapidly changing crypto market.

Coinbase Vs MEXC: At A Glance Comparison

Coinbase and MEXC are popular cryptocurrency exchanges with distinct features that might appeal to different types of traders.

Trading Fees:

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| Coinbase | 0.40%-0.60% | 0.40%-0.60% |

| MEXC | 0.10%-0.20% | 0.10%-0.20% |

MEXC generally offers lower trading fees than Coinbase, making it potentially more attractive for frequent traders.

Available Cryptocurrencies:

- Coinbase: 200+ cryptocurrencies

- MEXC: 1,500+ cryptocurrencies

If you’re looking for variety and access to newer or smaller cap tokens, MEXC provides significantly more options.

User Interface:

Coinbase features a more beginner-friendly interface with intuitive navigation and educational resources. MEXC offers a comprehensive trading platform that might feel more complex for newcomers.

Security Features:

Both exchanges implement strong security measures including two-factor authentication and cold storage. Coinbase is regulated in the US and offers FDIC insurance on USD deposits up to $250,000.

Payment Methods:

Coinbase supports bank transfers, credit/debit cards, and PayPal in many regions. MEXC has fewer fiat options but supports P2P trading for fiat transactions.

Mobile Experience:

You can access both exchanges via mobile apps. Coinbase’s app is highly rated for its simplicity, while MEXC’s app contains more advanced trading features.

Customer Support:

Coinbase provides email and chat support with faster response times. MEXC offers support through multiple channels including Telegram and Discord communities.

Coinbase Vs MEXC: Trading Markets, Products & Leverage Offered

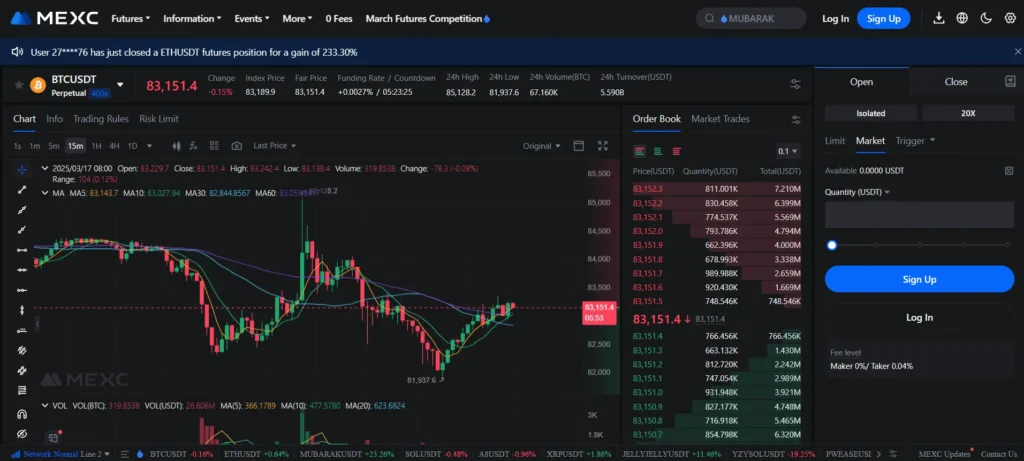

Coinbase and MEXC offer different options for crypto traders in 2025. Your choice between these platforms may depend on what trading features you need.

Coinbase provides a more limited selection of cryptocurrencies compared to MEXC. You can access major coins like Bitcoin and Ethereum, plus a carefully vetted selection of altcoins on Coinbase.

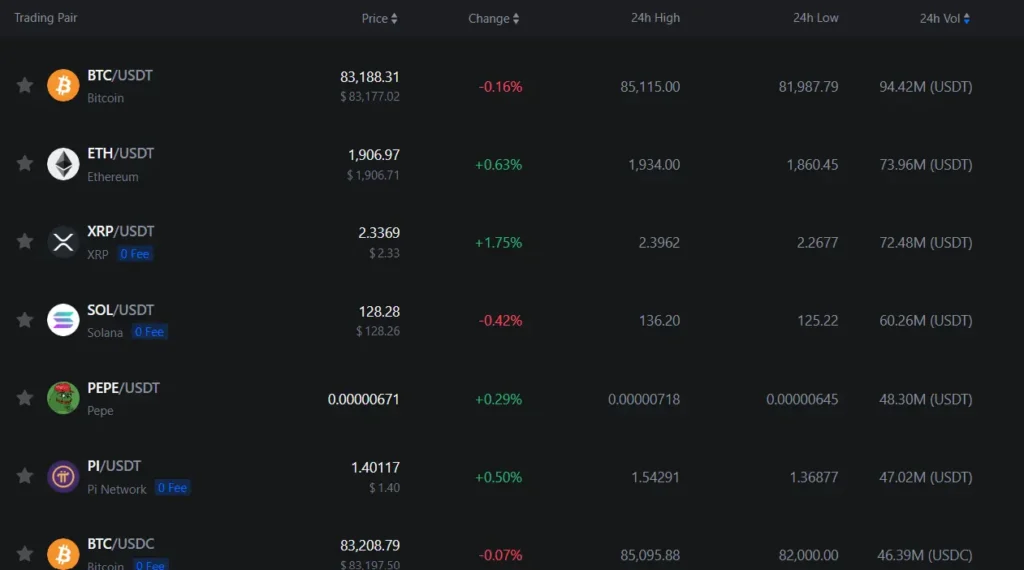

MEXC stands out with its extensive coin offerings, including many smaller altcoins and new tokens that aren’t available on Coinbase. This makes MEXC attractive if you’re looking to trade emerging projects.

Leverage Trading:

- MEXC: Up to 200x leverage for BTC and ETH

- Coinbase: Much lower leverage options

MEXC clearly takes the lead in leverage trading, offering some of the highest leverage ratios in the crypto exchange market. This appeals to experienced traders who want to maximize potential returns.

Coinbase focuses more on spot trading and offers fewer derivative products. You’ll find their platform prioritizes security and compliance over high-risk trading options.

Trading Products Comparison:

| Feature | Coinbase | MEXC |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | Limited | Extensive |

| Margin Trading | Limited | Advanced |

| New Token Listings | Conservative | Frequent |

MEXC is generally better suited for active day traders and those seeking advanced trading options. Coinbase works well if you prefer a more straightforward trading experience with established cryptocurrencies.

Coinbase Vs MEXC: Supported Cryptocurrencies

When choosing between Coinbase and MEXC, the variety of cryptocurrencies available is a key factor to consider. As of March 2025, these exchanges offer significantly different options.

Coinbase supports approximately 250+ cryptocurrencies for trading. This includes major coins like Bitcoin, Ethereum, and Solana, along with many established altcoins and some newer tokens.

MEXC stands out with support for over 1,600 cryptocurrencies. This makes it one of the most extensive exchanges for crypto variety in 2025. You’ll find not just mainstream tokens but also many small-cap altcoins and newly launched projects.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | Coinbase | MEXC |

|---|---|---|

| Total cryptocurrencies | 250+ | 1,600+ |

| New token listings | Selective | Frequent |

| DeFi tokens | Moderate selection | Extensive |

| NFT-related tokens | Limited | Comprehensive |

| Staking options | 15+ coins | 50+ coins |

Coinbase follows strict listing requirements, which means fewer but potentially more secure options. Their review process is thorough before adding new tokens.

MEXC prioritizes variety and quick listings of emerging projects. This gives you early access to new tokens, though with potentially higher risk.

Your choice depends on your trading goals. If you want established cryptocurrencies with higher security standards, Coinbase may be preferable. For access to a wider range of tokens and emerging projects, MEXC offers more options.

Coinbase Vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Coinbase and MEXC’s fee structures, there are notable differences that might affect your choice between these platforms.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| Coinbase | 0.4-0.6% | 0.4-0.6% | Higher than industry average |

| MEXC | 0.1-0.2% | 0.1-0.2% | More competitive rates |

Coinbase uses a straightforward but generally higher fee structure. You’ll pay more per trade, which can add up if you trade frequently.

MEXC offers more competitive trading fees, making it potentially better for active traders who want to maximize their profits.

Deposit Fees

Coinbase charges no fees for ACH deposits from U.S. banks, which is convenient if you’re transferring money from your bank account.

MEXC also offers various free deposit methods, though specific options may vary by country and payment method.

Withdrawal Fees

Withdrawal costs vary by cryptocurrency on both platforms. Coinbase typically charges network fees plus their service fee.

MEXC’s withdrawal fees are often lower than Coinbase, especially for popular cryptocurrencies.

If you’re making frequent withdrawals, these differences can significantly impact your overall costs.

Both exchanges adjust their fee structures periodically, so it’s worth checking their current rates before making your decision.

Coinbase Vs MEXC: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is crucial for your success. Both Coinbase and MEXC offer several order types, but there are some differences worth noting.

Coinbase Order Types:

- Market orders: Execute immediately at current market price

- Limit orders: Set your own price for buying or selling

- Stop orders: Trigger market orders when price hits a certain level

Coinbase keeps things relatively simple with these basic order types. This makes it ideal for beginners who don’t need complex trading options.

MEXC Order Types:

- Market orders: Similar to Coinbase

- Limit orders: Set your own price

- Stop-limit orders: Combines features of stop and limit orders

- OCO (One-Cancels-the-Other): Place two orders at once

- Trailing stop orders: Dynamic stops that follow price movements

MEXC clearly offers more advanced order types than Coinbase. This gives you greater flexibility in setting up complex trading strategies.

The extra order types on MEXC can help you manage risk better and create more sophisticated trading approaches. However, they also require more knowledge to use effectively.

For beginners, Coinbase’s simpler order selection might be easier to understand. Advanced traders will likely prefer MEXC’s broader range of options.

Consider your trading style and experience level when choosing between these exchanges based on order types.

Coinbase Vs MEXC: KYC Requirements & KYC Limits

Coinbase and MEXC have different approaches to Know Your Customer (KYC) requirements. These differences might affect your choice depending on your privacy preferences and trading needs.

Coinbase requires KYC verification for all users. You must provide personal information and identity documents before you can start trading. This strict approach aligns with Coinbase’s focus on regulatory compliance.

MEXC, in contrast, offers more flexibility with KYC. As of March 2025, MEXC allows you to trade without mandatory KYC verification. You can deposit, trade on spot markets, use futures contracts, and withdraw crypto assets without completing identity verification.

MEXC KYC Levels and Limits:

- No KYC: Basic trading functionality with limited withdrawal amounts

- KYC Level 1: Increased daily withdrawal limits

- Higher KYC Levels: Further increased limits and trading capabilities

It’s important to note that MEXC may require KYC in certain situations. Some users report being asked for verification when withdrawing larger amounts or during account reviews.

Coinbase KYC Limits:

- All accounts require basic verification

- Higher transaction limits require additional verification steps

- No option to trade anonymously

If privacy and trading without identity verification are priorities for you, MEXC offers more flexibility. However, Coinbase’s strict KYC policies provide greater regulatory certainty and potentially better protection in regulated markets.

Coinbase Vs MEXC: Deposits & Withdrawal Options

When choosing between Coinbase and MEXC, deposit and withdrawal options are important factors to consider.

Coinbase offers more traditional payment methods for users in the United States and other supported countries. You can fund your account using:

- ACH transfers (free for US customers)

- Bank transfers

- Debit cards

- Wire transfers

- PayPal (in some regions)

Coinbase is known for its user-friendly interface, making the deposit process straightforward for beginners. For withdrawals, you can transfer funds back to your bank or to external crypto wallets.

MEXC offers fewer fiat deposit options compared to Coinbase. However, MEXC provides:

- Bank transfers

- Credit/debit cards

- Third-party payment processors

- P2P trading options

MEXC typically has lower withdrawal fees for cryptocurrencies than Coinbase. This makes MEXC potentially more cost-effective if you plan to move crypto frequently.

Both exchanges have different geographic restrictions. Coinbase serves more countries for fiat transfers, while MEXC might be more accessible in regions where Coinbase isn’t available.

Processing times vary between the platforms. Coinbase deposits via ACH can take 3-5 business days to clear, though funds are often available for trading immediately. MEXC’s processing times depend on your chosen payment method.

Each platform has different minimum and maximum deposit/withdrawal limits based on your verification level and account standing.

Coinbase Vs MEXC: Trading & Platform Experience Comparison

Coinbase offers a user-friendly interface designed for beginners with a clean layout and straightforward navigation. You’ll find the platform easy to understand, even if you’re new to crypto trading.

MEXC provides a more advanced trading experience with more features and tools for experienced traders. The platform supports more cryptocurrencies than Coinbase, giving you access to a wider range of trading options.

Both platforms offer mobile apps, but Coinbase’s app is often praised for its simplicity and ease of use. MEXC’s app includes more advanced trading features but may feel overwhelming if you’re just starting out.

Fee Comparison:

- Coinbase: Higher fees (varies by transaction type)

- MEXC: Lower fees (0% for makers, 0.02% for takers in spot trading)

When it comes to trading types, MEXC offers more options including futures trading and margin trading. Coinbase focuses primarily on spot trading for the average investor.

Security is strong on both platforms, but Coinbase has a longer track record in the industry. You might feel more comfortable with Coinbase if security is your top priority.

The dashboard experience differs significantly between the two. Coinbase prioritizes simplicity with clear buy/sell options, while MEXC displays more technical charts and trading pairs for active traders.

For day trading specifically, MEXC offers more tools and lower fees that can make a significant difference in your profits over time.

Coinbase Vs MEXC: Liquidation Mechanism

When trading futures or leveraged positions, understanding the liquidation mechanism is crucial. Both Coinbase and MEXC have systems in place to manage risk, but they operate differently.

Coinbase uses a tiered liquidation process. Your position gets partially liquidated in stages as it approaches the liquidation price. This gives you a chance to add more collateral before losing your entire position.

MEXC employs a more direct approach. Their system will liquidate your position completely when it reaches the liquidation price. This can be faster but offers less opportunity to recover.

Here’s a comparison of key liquidation features:

| Feature | Coinbase | MEXC |

|---|---|---|

| Liquidation Type | Partial/Tiered | Complete |

| Warning Notifications | Yes | Yes |

| Auto-Deleveraging | Yes | Yes |

| Insurance Fund | Available | Available |

| Liquidation Fee | 0.5% | 0.05-0.2% |

MEXC typically has lower liquidation fees, ranging from 0.05% to 0.2% depending on the asset. Coinbase charges a flat 0.5% liquidation fee on most assets.

Both platforms send notifications when your position approaches liquidation. However, MEXC offers more detailed risk indicators in their trading interface.

You should consider setting stop-loss orders on both platforms to prevent liquidations entirely. This strategy helps protect your capital during volatile market conditions.

Coinbase Vs MEXC: Insurance

When comparing Coinbase and MEXC, insurance is an important factor to consider for your assets’ safety.

Coinbase Insurance Coverage:

- FDIC insurance covers USD balances up to $250,000 per customer

- Private insurance policy for crypto assets held in hot wallets

- 98% of customer funds stored in cold storage with additional security measures

Coinbase takes security seriously and has never experienced a system-wide hack that resulted in stolen customer funds.

MEXC Insurance Coverage:

- Limited public information about specific insurance policies

- Has an “Investor Protection Fund” to cover potential losses

- Less transparent about exact coverage amounts compared to Coinbase

You should note that MEXC, while growing in popularity, doesn’t offer the same clear insurance guarantees that Coinbase provides.

For U.S. users, Coinbase’s FDIC insurance on fiat deposits offers significant peace of mind that MEXC doesn’t match.

Both exchanges use cold storage for most crypto assets, but Coinbase’s insurance policy for hot wallets gives additional protection for the small percentage of funds that need to remain accessible.

If insurance coverage is a priority for your trading activities, Coinbase currently offers more comprehensive and transparent protection for your assets in 2025.

Coinbase Vs MEXC: Customer Support

Customer support is a key factor when choosing a crypto exchange. Both Coinbase and MEXC offer different options for users who need help.

Coinbase provides 24/7 email support and has a comprehensive help center with tutorials and FAQs. You can also use their chat support, though response times may vary depending on your account tier.

Premium Coinbase users (Coinbase One subscribers) get access to priority support with faster response times. This can be valuable during high-traffic periods when regular support channels may be slower.

MEXC also offers 24/7 support through multiple channels including email, live chat, and social media. Many users report quick response times from their support team, which is a plus for those who need immediate assistance.

One difference is language support. Coinbase focuses primarily on English, while MEXC offers support in multiple languages, making it more accessible to global users.

Both platforms maintain active community forums where you can find answers to common questions. These peer support resources can often resolve issues faster than waiting for official support.

Response quality can vary between the platforms. Coinbase support tends to be more structured but sometimes feels scripted. MEXC support agents are typically flexible but may occasionally face language barriers with English-speaking users.

Neither platform offers phone support as of March 2025, which remains a limitation compared to traditional financial institutions.

Coinbase Vs MEXC: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and MEXC offer security features, but there are important differences to consider.

Coinbase has a strong reputation for security. It stores 98% of customer funds in offline cold storage to protect against hacking attempts. Coinbase also offers two-factor authentication (2FA), biometric login options, and insurance coverage for digital assets held on the platform.

MEXC provides standard security measures like 2FA and anti-phishing codes. However, it doesn’t match Coinbase’s security rating based on industry reviews. MEXC does implement multi-signature wallets and regular security audits.

Key Security Differences:

| Feature | Coinbase | MEXC |

|---|---|---|

| Cold Storage | 98% of funds | Partial implementation |

| Insurance | Yes | Limited |

| Regulatory Compliance | High (US-based) | Moderate |

| User Verification | Strict KYC | Standard KYC |

Coinbase has never experienced a major security breach affecting customer funds. This track record has helped establish it as one of the most trusted exchanges in the crypto space.

MEXC has improved its security protocols in 2025, but still doesn’t have the same level of regulatory oversight as Coinbase. This is something to consider if security is your main concern.

Remember to enable all available security features regardless of which platform you choose. Use strong passwords, activate 2FA, and consider a hardware wallet for long-term storage of significant crypto assets.

Is Coinbase Safe & Legal To Use?

Coinbase is widely considered a safe platform for cryptocurrency trading and storage in 2025. The exchange implements strong security measures including two-factor authentication, biometric verification, and cold storage for assets.

About 98% of user funds are kept in offline cold storage, significantly reducing the risk of hacking. This approach helps protect your investments from online threats.

Coinbase is fully regulated and complies with legal requirements in the jurisdictions where it operates. The platform is registered as a Money Services Business with FinCEN in the United States.

Your funds on Coinbase are protected by insurance coverage, adding an extra layer of security. This means if the exchange experiences security breaches, your investments have some protection.

Key Security Features:

- Two-factor authentication

- Biometric verification

- Cold storage for most assets

- Insurance coverage

- Regulatory compliance

Despite market fluctuations, Coinbase maintains a strong reputation for security. User funds remain safe at Coinbase, with no significant security incidents in recent history.

When comparing to other exchanges, Coinbase stands out for its commitment to regulatory compliance and security, making it a trustworthy option for both new and experienced crypto investors.

Is MEXC Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a clean security record with no reported hacks or loss of user funds. This track record helps establish its reliability as a cryptocurrency exchange.

The platform is considered legitimate and implements security measures including proof of reserves to protect users’ assets. However, it’s worth noting that MEXC now requires KYC (Know Your Customer) verification as of 2024, which was not mandatory before.

When using MEXC, you should follow these safety practices:

- Withdraw your crypto to a personal wallet after purchasing

- Enable two-factor authentication

- Use strong, unique passwords

- Be cautious with phishing attempts

MEXC is available in most countries worldwide, including regions with stricter cryptocurrency regulations. The exchange primarily offers crypto-to-crypto trading pairs.

While MEXC appears safe based on its operating history, you should exercise the same caution you would with any cryptocurrency platform. No exchange is completely risk-free in the volatile crypto market.

For your protection, never keep large amounts of cryptocurrency on any exchange long-term. Always transfer significant holdings to a secure personal wallet where you control the private keys.

Frequently Asked Questions

Many traders struggle to decide between Coinbase and MEXC exchanges. These platforms differ in fees, security measures, earning potential, trading features, interface design, and where they operate worldwide.

What are the key differences in trading fees between Coinbase and MEXC?

Coinbase charges higher fees than MEXC for most transactions. You’ll pay between 0.5% to 4.5% per trade on Coinbase, depending on your payment method and transaction size.

MEXC offers more competitive rates with spot trading fees starting at 0.2% for makers and takers. Their fee structure rewards higher trading volumes with discounts.

You can further reduce MEXC fees by holding their native token, while Coinbase offers fee discounts through their Coinbase One subscription service.

How does the security of Coinbase compare with that of MEXC?

Coinbase is regulated in the United States and holds insurance on USD deposits. They store 98% of customer funds in cold storage and offer advanced security features like two-factor authentication and biometric login.

MEXC implements standard security measures including two-factor authentication and SSL encryption. They maintain an emergency insurance fund to protect user assets.

Coinbase has a longer track record for security, while MEXC has grown quickly but with fewer years of proven security history.

Can users earn interest on their crypto assets through Coinbase and MEXC platforms?

Coinbase allows you to earn rewards through staking on select cryptocurrencies like Ethereum, Solana, and Algorand. Rates typically range from 2-5% APY depending on the asset.

MEXC offers more earning options including Savings, Staking, ETH 2.0 Staking, and Launchpad events. Their rates are often more competitive than Coinbase’s offerings.

Both platforms make it easy to start earning, but MEXC typically provides more flexible terms and a wider variety of earning products.

What advanced trading features are available on MEXC and not on Coinbase?

MEXC supports futures trading with up to 200x leverage, which Coinbase doesn’t offer. You can access grid trading, bots, and other algorithmic tools on MEXC.

MEXC lists many more altcoins and new project tokens than Coinbase. They often add new coins shortly after launch, while Coinbase has stricter listing requirements.

MEXC’s copy trading feature lets you follow successful traders, a social trading option not available on Coinbase’s main platform.

How does the user experience and interface differ between Coinbase and MEXC?

Coinbase offers a simpler, more intuitive interface designed for beginners. Their mobile app is clean, easy to navigate, and focuses on basic trading functions.

MEXC’s interface is more complex with advanced charting tools and technical analysis features. This makes it better for experienced traders but potentially overwhelming for newcomers.

You’ll find Coinbase’s educational resources more comprehensive, while MEXC focuses more on providing trading tools than educational content.

What are the regional availability differences between Coinbase and MEXC for cryptocurrency trading?

Coinbase operates in over 100 countries but has stronger presence in North America and Europe. Certain features are limited based on your region due to regulatory requirements.

MEXC serves over 200 countries and regions with fewer restrictions. They have stronger market penetration in Asia and emerging markets where Coinbase may have limited services.

You might find MEXC more accessible if you live outside major Western markets, as they have fewer geoblocking restrictions than Coinbase.

MEXC Vs Coinbase Conclusion: Why Not Use Both?

Both MEXC and Coinbase offer valuable services for crypto traders in 2025, but they excel in different areas.

Coinbase stands out for its user-friendly interface, strong regulatory compliance, and excellent security features. It’s ideal if you’re new to crypto or prefer a platform backed by strong consumer protections.

MEXC offers a wider range of cryptocurrencies and both spot and futures trading options. The platform typically lists new tokens faster and charges lower fees than Coinbase.

Why choose just one? Many experienced traders maintain accounts on both platforms to take advantage of their complementary strengths.

You might use Coinbase for:

- Secure storage of major cryptocurrencies

- Simple buying and selling with fiat currency

- Educational resources to learn about crypto

And MEXC for:

- Access to newer, less established tokens

- Lower trading fees for frequent transactions

- Futures trading and other advanced features

Be aware that MEXC has received some criticism for withdrawal issues and customer support quality. Always start with small amounts when trying a new exchange.

By using both platforms strategically, you can enjoy the security and simplicity of Coinbase alongside the variety and lower costs of MEXC. This combined approach gives you the best of both worlds in your crypto journey.