When choosing a cryptocurrency exchange, Coinbase and KuCoin often make the shortlist for many traders. Both platforms offer ways to buy, sell, and trade digital assets, but they differ in significant ways that might affect your decision.

KuCoin offers a wider selection of cryptocurrencies and generally lower fees than Coinbase, making it attractive for experienced traders looking for variety and cost efficiency. While Coinbase is known for its user-friendly interface and strong security features, KuCoin provides more advanced trading options and services not available to US-based exchanges.

Your trading needs, experience level, and location will heavily influence which exchange works better for you. If you’re just starting out, Coinbase’s simplicity might be appealing, but if you’re seeking access to a broader range of tokens or lower transaction costs, KuCoin might be the better choice.

Coinbase Vs KuCoin: At A Glance Comparison

When choosing between Coinbase and KuCoin, several key differences can help you make the right decision for your crypto trading needs.

Available Cryptocurrencies: KuCoin offers a wider selection of tokens compared to Coinbase. This is mainly because KuCoin isn’t based in the US and faces fewer regulatory restrictions.

Fees: KuCoin generally charges lower fees, with maker and taker fees starting around 0.1%. Coinbase’s fee structure is typically higher, which can impact your trading profits over time.

User Ratings: According to the search results, Coinbase Wallet has a higher overall score (8.4) compared to KuCoin. This suggests better user satisfaction with Coinbase’s wallet functionality.

Regulatory Compliance: Coinbase operates with strict regulatory compliance, especially in the US. KuCoin provides more flexibility but with potentially less regulatory protection.

| Feature | Coinbase | KuCoin |

|---|---|---|

| Cryptocurrencies | Fewer options | More token variety |

| Fee Structure | Higher | Lower (starts at ~0.1%) |

| User Rating | 8.4 | Lower than Coinbase |

| Best For | Beginners, US users | Experienced traders, access to more tokens |

Remember that regardless of which exchange you choose, it’s recommended not to store your coins on any exchange long-term. Both platforms offer similar core services with differences mainly in their fee structures and available tokens.

Coinbase Vs KuCoin: Trading Markets, Products & Leverage Offered

Coinbase and KuCoin offer different trading options to match various investor needs. Your choice between them may depend on your trading experience and goals.

Available Cryptocurrencies:

- Coinbase: Supports 200+ cryptocurrencies

- KuCoin: Offers 700+ cryptocurrencies

KuCoin clearly provides more variety for traders looking to diversify into altcoins and newer tokens.

Trading Products:

| Feature | Coinbase | KuCoin |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Limited | Extensive |

| Margin Trading | Limited | Yes |

| Staking | Yes | Yes |

| Trading Bots | No | Yes |

KuCoin stands out with its trading bots that help automate your investment strategies.

Leverage Options:

Coinbase offers modest leverage of up to 10x on select cryptocurrencies through futures trading. This conservative approach helps balance profit potential with risk management.

KuCoin provides more aggressive leverage options, making it popular among experienced traders. You can access up to 100x leverage on certain trading pairs.

Target Audience:

Coinbase is designed to be user-friendly for beginners and casual investors. The platform focuses on simplicity and regulatory compliance.

KuCoin caters to more experienced traders with its advanced features, higher leverage, and wider selection of trading products. You’ll find more specialized tools if you’re comfortable with complex trading strategies.

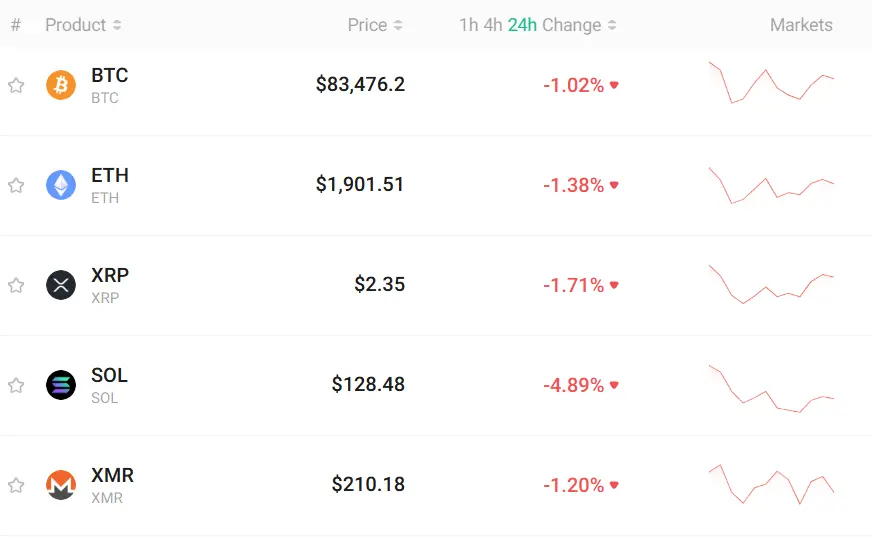

Coinbase Vs KuCoin: Supported Cryptocurrencies

When choosing between Coinbase and KuCoin, the variety of available cryptocurrencies is an important factor to consider. Based on recent data, Coinbase offers a larger selection of cryptocurrencies compared to KuCoin.

Coinbase supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), as well as many altcoins and tokens. The platform regularly adds new cryptocurrencies as they gain popularity and meet Coinbase’s listing requirements.

KuCoin, while offering fewer total cryptocurrencies than Coinbase, still provides access to over 20 different digital assets. This includes many of the same major coins found on Coinbase.

Cryptocurrency Support Comparison:

| Feature | Coinbase | KuCoin |

|---|---|---|

| Total cryptocurrencies | Higher number | Lower number (20+) |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Altcoin variety | Extensive | Good |

| New coin listings | Regular additions | Less frequent |

One advantage of Coinbase is its careful selection process for cryptocurrencies, which may provide you with more established and vetted options. However, KuCoin sometimes lists newer, emerging cryptocurrencies that aren’t yet available on Coinbase.

Your choice between these platforms might depend on whether you want access to a wide range of established cryptocurrencies (Coinbase) or if you’re looking for specific coins that might only be available on KuCoin.

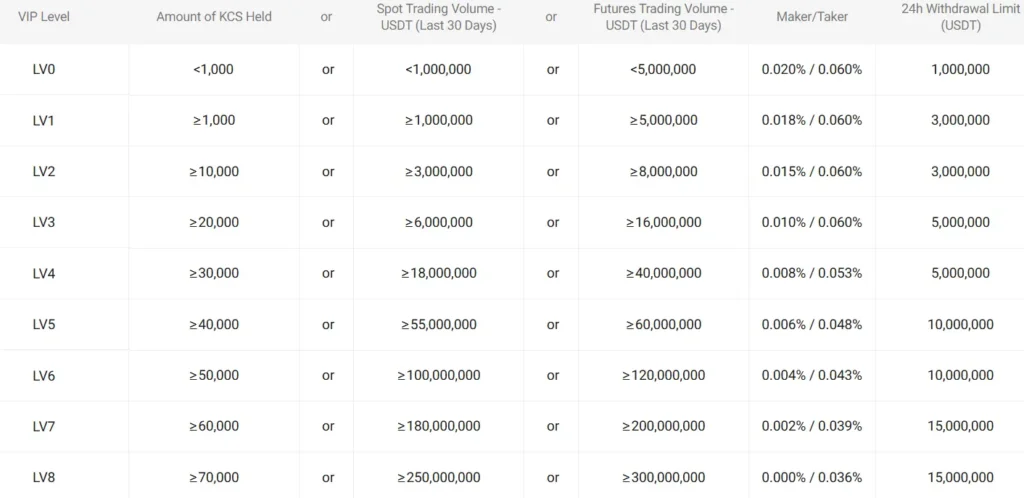

Coinbase Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and KuCoin, understanding their fee structures is crucial for your trading success.

Trading Fees

KuCoin offers significantly lower trading fees compared to Coinbase. At similar tier levels, KuCoin charges around 0.09% to 0.1% per trade.

Coinbase, on the other hand, has a more complex fee structure that varies frequently. You’ll typically pay higher fees on Coinbase for standard trades, making KuCoin more cost-effective for regular traders.

Deposit Fees

KuCoin generally offers free crypto deposits. Coinbase also provides free crypto deposits, but has more deposit options overall.

For fiat deposits, Coinbase offers more methods but charges varying fees depending on your payment method. KuCoin has fewer fiat deposit options.

Withdrawal Fees

Crypto withdrawal fees at KuCoin depend on the specific cryptocurrency you’re withdrawing. The fees vary by token.

Coinbase withdrawal fees also vary by cryptocurrency, but they tend to be higher than KuCoin in many cases.

Purchase Fees

If you want to buy crypto directly with fiat currency, Coinbase typically has lower direct purchase fees than KuCoin.

Fee Reduction Options

Both exchanges offer ways to reduce fees. KuCoin users can get discounts by holding the platform’s native KCS token.

Coinbase provides fee reductions through their Coinbase Advanced platform for higher-volume traders.

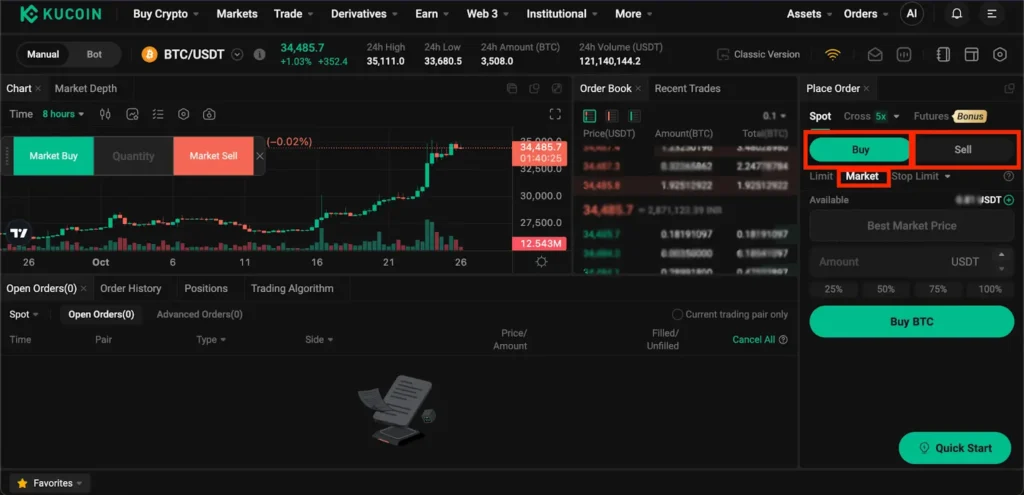

Coinbase Vs KuCoin: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both Coinbase and KuCoin offer various order options, but they differ in complexity and variety.

Coinbase Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

Coinbase keeps things relatively simple with these basic order types. This makes the platform more approachable if you’re new to cryptocurrency trading.

KuCoin Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

- Post-only orders

- Iceberg orders

- Time-weighted average price (TWAP) orders

- Advanced conditional orders

KuCoin clearly offers more advanced trading options. These sophisticated order types give you greater control over your trading strategy and can help minimize risk.

If you’re an experienced trader, KuCoin’s diverse order options might better suit your needs. The platform’s iceberg orders let you place large trades without revealing the full amount to the market.

Beginner traders might prefer Coinbase’s straightforward approach. The limited but essential order types make it easier to start trading without feeling overwhelmed.

Both platforms allow you to set basic buy and sell parameters. However, KuCoin gives you more tools to execute complex trading strategies and manage market volatility.

Coinbase Vs KuCoin: KYC Requirements & KYC Limits

Coinbase and KuCoin have different approaches to Know Your Customer (KYC) requirements, which may affect your choice between these platforms.

Coinbase KYC Policy:

- Requires KYC verification for all customers

- No exceptions or non-KYC options available

- Collects full identification including government ID, address proof, and personal information

Coinbase implements strict KYC procedures to comply with U.S. regulations. You must complete identity verification before trading on their platform.

KuCoin KYC Policy:

- Offers basic trading without mandatory KYC verification

- Higher withdrawal limits require KYC completion

- Caters more to international users with flexible verification requirements

On KuCoin, you can trade with limited functionality without completing KYC. However, your daily withdrawal limits will be restricted until verification is complete.

Withdrawal Limits Comparison:

| Exchange | Without KYC | With Basic KYC | With Full KYC |

|---|---|---|---|

| Coinbase | Not allowed | $7,500-$25,000/day | $50,000+/day |

| KuCoin | 1-5 BTC/day | 100-200 BTC/day | 500+ BTC/day |

KuCoin offers more flexibility for users who prefer privacy or cannot complete full KYC due to their location.

If regulatory compliance is important for you, Coinbase’s thorough KYC process provides greater security and legal protection. However, if you value privacy or need quick access to trading, KuCoin’s less stringent requirements might be preferable.

Coinbase Vs KuCoin: Deposits & Withdrawal Options

When choosing between Coinbase and KuCoin, understanding your deposit and withdrawal options is crucial for managing your crypto assets effectively.

Coinbase Deposit Options:

- Bank transfers (ACH)

- Wire transfers

- Credit/debit cards

- PayPal (in some regions)

- Crypto transfers from external wallets

KuCoin offers fewer fiat deposit methods but provides extensive crypto deposit options. Most users transfer cryptocurrency from other wallets or exchanges.

Withdrawal Options Comparison:

| Feature | Coinbase | KuCoin |

|---|---|---|

| Fiat Withdrawals | Direct to bank accounts | Limited options (third-party) |

| Crypto Withdrawals | To any compatible wallet | To any compatible wallet |

| Withdrawal Fees | Up to $60 or 3% | Typically around 0.1% |

Coinbase makes it easier to move between fiat currencies and crypto. This is helpful if you’re new to crypto or need to regularly convert back to traditional currency.

KuCoin’s withdrawal fees are generally lower at around 0.1%, while Coinbase can charge up to 3% or $60 depending on the method and amount.

Processing times vary for both platforms. Crypto withdrawals typically process within minutes, while fiat withdrawals may take 1-5 business days depending on your location and banking system.

You’ll need to complete identity verification on both platforms before making withdrawals, though KuCoin allows limited functionality with basic verification.

Coinbase Vs KuCoin: Trading & Platform Experience Comparison

Coinbase offers a straightforward, user-friendly platform designed for beginners. You’ll find a clean interface that makes buying and selling crypto simple.

KuCoin provides a more advanced trading experience with additional features that experienced traders might prefer. The platform includes more detailed charts and trading options.

Available Cryptocurrencies:

- Coinbase: Fewer options, focusing on established tokens

- KuCoin: Significantly more tokens available (not being US-based allows for this advantage)

Trading Tools:

| Feature | Coinbase | KuCoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | Limited | Extensive |

| Margin Trading | Limited | Advanced |

| Trading Bots | No | Yes |

KuCoin runs more smoothly for complex trading activities. You’ll notice faster execution times and more options for advanced orders.

Fee structures differ significantly between the two platforms. KuCoin starts at 0.1% for both Makers and Takers, while Coinbase charges notably higher fees.

The mobile experience varies too. Coinbase keeps things simple but functional. KuCoin’s app contains more features but might feel overwhelming if you’re new to crypto trading.

For beginners, Coinbase’s platform is adequate and easy to navigate. If you’re an experienced trader looking for more tools and cryptocurrency options, KuCoin offers the depth you need.

Coinbase Vs KuCoin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding liquidation mechanisms is crucial for your risk management. The process of liquidation occurs when your position’s value falls below maintenance margin requirements.

Coinbase takes a more conservative approach to liquidation. Their system will typically give you warnings as your position approaches the liquidation threshold. This gives you time to add more funds or reduce your position.

KuCoin offers leveraged tokens that provide amplified exposure without the risk of liquidation, which is a unique advantage compared to Coinbase. This feature allows you to gain increased market exposure without worrying about being liquidated.

Both exchanges use different liquidation methods for margin trading:

| Feature | Coinbase | KuCoin |

|---|---|---|

| Warning System | Multiple notifications | Limited warnings |

| Liquidation Speed | Gradual process | Can be faster |

| Prevention Tools | Position reduction options | Insurance fund protection |

| Leveraged Products | Standard options | Includes non-liquidatable tokens |

KuCoin’s insurance fund helps protect traders from extreme market volatility, potentially reducing the severity of liquidations during market crashes.

Coinbase offers better liquidity in many trading pairs, which can result in less slippage during the liquidation process. This means you might lose less money if your position gets liquidated on Coinbase.

Your trading style and risk tolerance should guide which platform’s liquidation mechanism better suits your needs.

Coinbase Vs KuCoin: Insurance

When comparing Coinbase and KuCoin, insurance coverage is a crucial factor to consider for your crypto assets.

Coinbase Insurance Protection:

- FDIC insurance for USD balances up to $250,000

- Commercial crime insurance policy that covers digital assets held in hot wallets

- Approximately 98% of customer funds stored in cold storage for added protection

Coinbase’s insurance coverage makes it a standout option if security is your top priority. Your USD deposits enjoy the same protection as traditional bank accounts.

KuCoin Insurance Protection:

- Created the “Safeguard Fund” after a 2020 hack to protect user assets

- Allocates a portion of trading fees to their insurance fund

- Less comprehensive insurance compared to Coinbase

KuCoin has improved its security measures since experiencing a major hack, but its insurance coverage isn’t as robust as Coinbase’s offerings.

For U.S. users, Coinbase provides more peace of mind with its regulatory compliance and insurance coverage. KuCoin offers fewer guarantees but has worked to strengthen its security framework.

Your choice depends on your risk tolerance. If maximum protection for your crypto assets is essential, Coinbase’s comprehensive insurance makes it the safer option.

Coinbase Vs KuCoin: Customer Support

Customer support quality can make or break your crypto trading experience. Both Coinbase and KuCoin offer several support channels, but they differ in responsiveness and effectiveness.

Coinbase provides email support, a help center, and phone support for urgent matters. Their response times typically range from 24-48 hours for email inquiries, though this can vary during high-volume periods.

KuCoin offers email support, live chat, and an extensive knowledge base. According to user feedback, KuCoin’s response times can be somewhat slower than Coinbase, often taking 48-72 hours for email responses.

Both platforms receive mixed reviews from users. Some report quick and helpful responses, while others complain about delayed assistance during critical trading moments.

Coinbase Support Channels:

- Email support

- Phone support (for urgent issues)

- Help center/FAQ

- Twitter support

KuCoin Support Channels:

- Email support

- Live chat

- Knowledge base

- Community forums

For English speakers, Coinbase might offer a slight advantage with more native English-speaking support staff. KuCoin serves a global audience but sometimes experiences language barriers in communication.

Remember that during market volatility or platform updates, both exchanges typically experience longer support wait times. It’s advisable to test each platform’s customer service with a simple inquiry before committing to large trades.

Coinbase Vs KuCoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and KuCoin offer strong security measures, but there are some key differences.

Coinbase has built a solid reputation for security over the years. It stores 98% of customer funds in cold storage, keeping them offline and safe from hackers.

KuCoin also uses cold storage for most user assets. They implement a multi-layered security system to protect your funds.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection to your account.

Coinbase has a slight edge with additional security features:

- FDIC insurance for USD balances (up to $250,000)

- Biometric login options

- Address whitelisting for withdrawals

- Regular security audits

KuCoin offers:

- Trading password (separate from login password)

- Regular security audits

- Anti-phishing code feature

Coinbase is regulated in multiple countries and complies with strict financial regulations. This gives many users more confidence in its security.

KuCoin has improved its security since a 2020 hack where some funds were stolen. They’ve since recovered most assets and strengthened their systems.

For maximum security on either platform, you should:

- Enable all available security features

- Use a strong, unique password

- Consider a hardware wallet for long-term storage

Is Coinbase A Safe & Legal To Use?

Coinbase operates as a legal cryptocurrency exchange in many countries, including the United States. It complies with financial regulations and is registered with FinCEN as a Money Services Business.

The platform prioritizes security with several robust measures. Coinbase stores 98% of customer funds in offline cold storage to protect them from online threats. This significantly reduces the risk of hacking attempts.

Coinbase offers additional security features for your account:

- Two-factor authentication (2FA)

- Biometric login options

- Address whitelisting

- Insurance coverage for digital assets

Your USD balances on Coinbase are FDIC-insured up to $250,000, providing an extra layer of protection. This insurance only applies to cash holdings, not cryptocurrency investments.

The exchange has a strong track record for security compared to many competitors. While no platform is completely immune to threats, Coinbase has maintained a relatively clean security history without major breaches.

Coinbase verifies your identity through KYC (Know Your Customer) procedures. This includes submitting identification documents and personal information to comply with regulations and prevent fraud.

You can enhance your security on Coinbase by:

- Using a strong, unique password

- Enabling all security features

- Being cautious of phishing attempts

- Regularly monitoring your account

For extra protection, consider using Coinbase Vault for long-term holdings, which requires multiple approvals for withdrawals.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered a safe cryptocurrency exchange with strong security measures. The platform uses two-factor authentication (2FA), encryption, and cold storage for most assets to protect user funds.

However, KuCoin operates in a gray area for US users. While many Americans use the platform, KuCoin isn’t registered with US regulatory bodies like FinCEN or the SEC. This creates potential legal risks for US-based traders.

In 2020, KuCoin experienced a major security breach where approximately $280 million in crypto assets was stolen. The platform did recover most funds and reimbursed affected users, demonstrating their commitment to customer protection.

Safety Features:

- Two-factor authentication

- Anti-phishing safety phrases

- Trading password protection

- Majority of assets stored in cold wallets

KuCoin’s reputation in the crypto community remains fairly positive. The exchange has been operating since 2017 and serves millions of users worldwide.

If you’re considering using KuCoin, remember that unregulated exchanges carry additional risks. You should:

- Only deposit funds you can afford to lose

- Enable all security features

- Consider withdrawing large holdings to a personal wallet

- Stay informed about regulatory changes in your country

For US users specifically, using a fully regulated exchange like Coinbase might offer more legal protection, even though KuCoin provides a wider range of trading options and features.

Frequently Asked Questions

Investors considering cryptocurrency exchanges often have specific concerns about fees, features, and security. These key differences between Coinbase and KuCoin can significantly impact your trading experience and profitability.

What are the differences in fees between Coinbase and KuCoin for cryptocurrency transactions?

KuCoin offers substantially lower trading fees compared to Coinbase. The base trading fee at KuCoin starts at 0.1% for both makers and takers, which is significantly lower than Coinbase’s higher fee structure.

Coinbase’s fees are generally higher across all transaction types. They implement a tiered fee structure that depends on your trading volume, but even their lowest tiers charge more than KuCoin’s standard rates.

You can reduce fees on both platforms by maintaining higher trading volumes or using their respective tokens (KCS for KuCoin and holding larger balances for Coinbase).

How do trading features on Coinbase compare to those available on KuCoin?

KuCoin provides more advanced trading features than Coinbase. You’ll find margin trading, futures trading, and trading bots on KuCoin that aren’t available on Coinbase’s main platform.

Coinbase offers a simpler, more intuitive interface that’s better for beginners. Their platform focuses on ease of use rather than advanced features, making it more accessible for newcomers to cryptocurrency.

KuCoin supports more chart tools and technical analysis features. If you’re an experienced trader, you’ll appreciate KuCoin’s advanced order types and analytical capabilities.

What options do users have for crypto-to-crypto trading between Coinbase and KuCoin?

KuCoin offers a wider selection of cryptocurrencies for trading. You can access over 700 trading pairs on KuCoin, giving you many more options for direct crypto-to-crypto exchanges.

Coinbase has fewer trading pairs but focuses on well-established cryptocurrencies. Their selection is more limited but includes thoroughly vetted coins, which some users prefer for security reasons.

Trading on KuCoin gives you access to many smaller altcoins that aren’t available on Coinbase. This can be valuable if you’re looking to invest in emerging projects or lesser-known tokens.

How does the security of Coinbase stand in comparison to KuCoin?

Coinbase has a stronger security record with no major hacks to date. As a publicly traded US company, they face stricter regulatory oversight and compliance requirements.

KuCoin experienced a significant security breach in 2020 but managed to recover most of the stolen funds. They’ve since strengthened their security measures, but this history represents a potential concern.

Both exchanges offer two-factor authentication and cold storage for most funds. Coinbase insures USD balances through FDIC insurance (up to $250,000), providing an additional layer of protection not found on KuCoin.

Can users transfer cryptocurrency assets directly between Coinbase and KuCoin?

Yes, you can transfer cryptocurrencies directly between Coinbase and KuCoin. The process involves sending from one exchange’s wallet to the other using the appropriate deposit address.

You should only transfer coins that both exchanges support. Common cryptocurrencies like Bitcoin, Ethereum, and major stablecoins work well for transfers between these platforms.

Transfer fees and processing times depend on the specific cryptocurrency network you’re using. Bitcoin transfers might take longer and cost more than transfers using networks like Solana or XRP.

What are the customer service experiences like between Coinbase and KuCoin?

Coinbase offers phone support, email tickets, and chat support. Their customer service has improved in recent years, though response times can still vary during periods of high market activity.

KuCoin primarily relies on ticket-based support and live chat. They generally have faster response times than Coinbase but lack direct phone support options.

English-speaking users may find Coinbase’s support more accessible. KuCoin sometimes has language barriers in their customer service, which can create challenges for users who only speak English.

KuCoin Vs Coinbase Conclusion: Why Not Use Both?

After comparing these two popular exchanges, you might be wondering which one to choose. The answer could be both, depending on your trading needs.

Coinbase offers more deposit options and has stronger regulatory compliance. It’s also more user-friendly for beginners and provides better security features with established certifications.

KuCoin stands out with lower trading fees (around 0.1%) and a much wider selection of cryptocurrencies. Not being US-based allows KuCoin to offer many tokens unavailable on Coinbase.

Consider using Coinbase for:

- Simpler trading experiences

- Direct crypto purchases with lower fees

- Higher security standards

- Regulatory peace of mind

Use KuCoin when you need:

- Access to a broader range of altcoins

- Lower trading fees for frequent transactions

- More advanced trading features

- Trading bot compatibility (like 3commas)

You might start with Coinbase as you learn cryptocurrency basics, then expand to KuCoin as you become more experienced and want to explore additional tokens.

Many experienced traders maintain accounts on both platforms. This strategy lets you enjoy Coinbase’s security and simplicity while accessing KuCoin’s variety and lower fees when needed.

Your choice ultimately depends on your trading experience, the cryptocurrencies you want to access, and your comfort level with each platform’s regulatory approach.