When choosing a crypto exchange, comparing Coinbase and FameEX helps you make an informed decision for your trading needs. Both platforms offer distinct features that cater to different types of crypto traders in 2025.

Coinbase stands out with its user-friendly interface and strong security measures, making it ideal for beginners, while FameEX offers competitive features that may appeal to more experienced traders. The differences between these exchanges extend to their fee structures, supported cryptocurrencies, and trading options.

You’ll find that Coinbase provides excellent educational resources and has a strong reputation in the market, while FameEX might offer advantages in other areas like trading fees or specialized features. Understanding these differences will help you select the platform that best aligns with your trading goals and experience level.

Coinbase Vs FameEX: At A Glance Comparison

When choosing between Coinbase and FameEX, understanding their key differences helps you make an informed decision. Here’s how these cryptocurrency exchanges compare side by side.

User Experience:

Coinbase offers a beginner-friendly interface with simple navigation. FameEX provides a functional platform but may require more crypto knowledge to use effectively.

Available Cryptocurrencies:

Coinbase supports 150+ cryptocurrencies for trading. FameEX typically offers fewer options but includes most major coins and some altcoins.

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | 0.4% – 0.6% | Varies by coin |

| FameEX | 0.1% – 0.2% | Varies by coin |

FameEX generally offers lower trading fees compared to Coinbase, which can save you money on frequent trades.

Security Features:

- Coinbase: Two-factor authentication, insurance on USD deposits, cold storage for 98% of assets

- FameEX: Two-factor authentication, cold wallet storage

Coinbase has a stronger security reputation and regulatory compliance in the US and other regions.

Customer Support:

Coinbase provides email support, a help center, and phone support for some issues. FameEX typically offers email and chat support but may have slower response times.

Mobile Experience:

Both exchanges offer mobile apps, but Coinbase’s app is more polished and feature-rich with better ratings on app stores.

Coinbase Vs FameEX: Trading Markets, Products & Leverage Offered

Coinbase offers a diverse range of cryptocurrencies for trading, with over 200 tokens available on its main platform. Their Derivatives Exchange provides futures contracts with modest leverage options, typically up to 5x for retail traders.

FameEX provides access to approximately 150+ cryptocurrencies through spot trading markets. They also offer futures trading with significantly higher leverage options – up to 125x on select pairs.

Available Markets:

| Feature | Coinbase | FameEX |

|---|---|---|

| Spot Trading | 200+ cryptocurrencies | 150+ cryptocurrencies |

| Futures | Yes (via Derivatives Exchange) | Yes |

| Options | Limited offerings | Limited offerings |

| Margin Trading | Available for eligible users | Available |

Coinbase focuses more on accessibility and regulatory compliance, making it suitable for beginners and institutional traders. Their product lineup includes staking options, NFT marketplace access, and educational resources.

FameEX appeals to more experienced traders seeking higher leverage and trading flexibility. They offer copy trading features and more aggressive trading tools for risk-tolerant users.

You’ll find Coinbase’s interface more straightforward but with higher fees. FameEX provides more advanced charting tools and technical analysis features built into their platform.

Both exchanges continue expanding their offerings in 2025, with Coinbase focusing on regulated innovative products while FameEX emphasizes competitive fees and higher leverage options.

Coinbase Vs FameEX: Supported Cryptocurrencies

Coinbase offers a significantly larger selection of cryptocurrencies compared to FameEX. Based on recent data, Coinbase supports hundreds of different cryptocurrencies for trading.

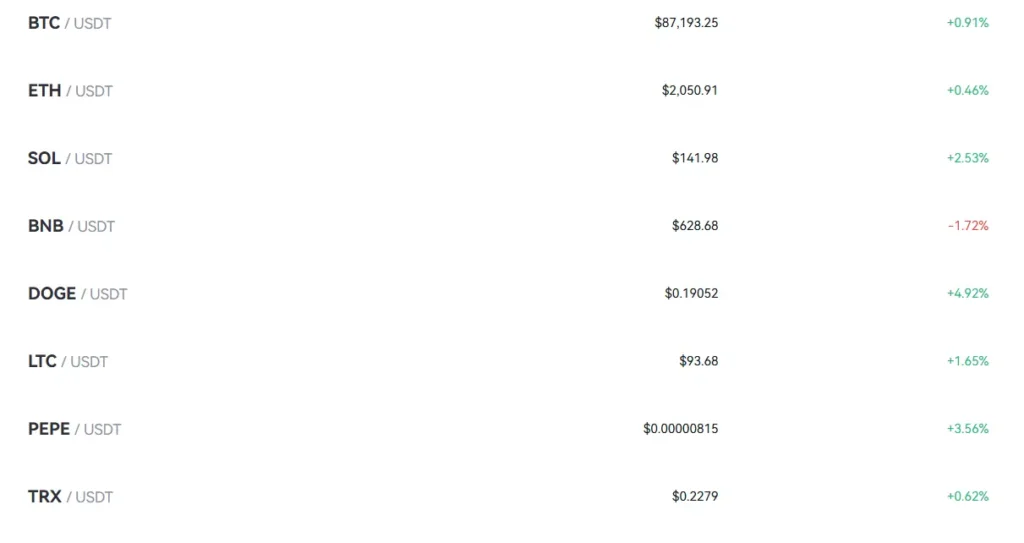

FameEX has a more limited selection but is gaining recognition specifically for meme coin trading in 2025. While it doesn’t match Coinbase’s extensive library, FameEX focuses on providing access to popular meme coins.

Coinbase Cryptocurrency Support:

- Hundreds of cryptocurrencies available

- All major coins (Bitcoin, Ethereum, etc.)

- Wide range of altcoins and tokens

- Regular additions of new projects

- Strong support for established cryptocurrencies

FameEX Cryptocurrency Support:

- Smaller selection of cryptocurrencies

- Strong focus on meme coins

- Popular mainstream cryptocurrencies

- Growing list of supported assets

When choosing between these platforms, consider which specific cryptocurrencies you want to trade. If you need access to a wide variety of options, Coinbase is likely your better choice.

For meme coin enthusiasts, FameEX offers specialized support that might better suit your trading needs. You’ll find popular meme coins readily available on their platform.

Both exchanges continue to add new cryptocurrencies to their offerings as the market evolves. Always check their current listings before deciding which platform best suits your investment strategy.

Coinbase Vs FameEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and FameEX, understanding their fee structures is crucial for your trading strategy.

Trading Fees

Coinbase charges taker fees between 0.05% and 0.60% when you place market orders. These rates vary based on your trading volume and membership level.

FameEX generally offers lower trading fees compared to Coinbase’s standard rates. While specific FameEX rates vary, they tend to be more competitive for regular traders.

Subscription Options

Coinbase offers Coinbase One, a subscription service that provides zero trading fees on up to $10,000 of monthly trades. This can be cost-effective if you trade frequently.

FameEX also has tiered membership levels that can reduce your trading costs as your volume increases.

Withdrawal Fees

Coinbase withdrawal fees can reach up to $60 depending on the cryptocurrency and network. Some users report fees up to 3% for certain transactions.

FameEX typically maintains lower withdrawal fees, which can save you money when moving assets off the platform.

Daily Limits

Coinbase imposes a daily trading limit of approximately $25,000 for standard accounts. Your limits may increase based on your account verification level and trading history.

FameEX also implements daily limits, but these are often more flexible for active traders.

The fee difference becomes more significant with larger trade volumes, making FameEX potentially more economical for high-volume traders.

Coinbase Vs FameEX: Order Types

When trading cryptocurrencies, the available order types can significantly impact your trading experience. Both Coinbase and FameEX offer different options to execute your trades.

Coinbase Order Types:

- Market Orders: Execute immediately at the current market price

- Limit Orders: Set your desired buy or sell price

- Stop-Limit Orders: Combine stop price triggers with limit order execution

- Bracket Orders: Advanced tool for setting both take-profit and stop-loss targets

Coinbase provides a straightforward trading experience with these essential order types. Their platform is designed to be user-friendly while still offering enough tools for strategic trading.

FameEX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Advanced conditional orders

FameEX may offer better order depth for certain transactions. This can create more arbitrage opportunities for traders looking to profit from price differences.

Your trading style should influence which platform you choose. If you’re a beginner, Coinbase’s intuitive interface might be preferable. Their order execution is reliable and straightforward.

For more experienced traders, FameEX’s additional order flexibility could be advantageous. You might find their order book depth beneficial for larger trades or specialized strategies.

Both platforms continue to evolve their offerings. As of March 2025, they regularly update their trading features to remain competitive in the fast-changing crypto market.

Coinbase Vs FameEX: KYC Requirements & KYC Limits

When choosing between Coinbase and FameEX, understanding their KYC (Know Your Customer) requirements is crucial for your trading experience.

Coinbase KYC Requirements:

- Full verification required before trading

- Government-issued ID needed

- Proof of address documentation

- Facial verification process

- Phone number verification

Coinbase follows strict regulatory compliance as a US-based exchange. You must complete their KYC process before accessing any trading features or depositing significant funds.

FameEX KYC Requirements:

- Basic trading available with minimal verification

- Tiered KYC system with increasing requirements

- Higher withdrawal limits require more documentation

- Government ID required for advanced tiers

- Proof of residence for highest tier access

FameEX offers more flexibility with their verification requirements. You can begin basic trading with minimal information, unlike Coinbase’s all-or-nothing approach.

Withdrawal Limits Comparison:

| Exchange | No KYC | Basic KYC | Full KYC |

|---|---|---|---|

| Coinbase | Not available | $7,500 daily | $25,000+ daily |

| FameEX | 2 BTC daily | 50 BTC daily | 100+ BTC daily |

The verification process on Coinbase typically takes 1-3 business days. FameEX verification can be completed in as little as a few hours for basic tiers.

Your choice between these platforms should consider how quickly you need to start trading and your comfort level with providing personal information.

Coinbase Vs FameEX: Deposits & Withdrawal Options

Coinbase offers multiple deposit methods for users in the US and internationally. You can fund your account using bank transfers (ACH), wire transfers, and debit cards. Credit card deposits are not supported.

FameEX provides fewer deposit options compared to Coinbase. It primarily supports cryptocurrency deposits and some bank transfer options, but availability varies by region.

For withdrawals, Coinbase allows you to cash out to your bank account, PayPal (in some regions), or transfer crypto to external wallets. Processing times range from instant to 3-5 business days depending on the method chosen.

FameEX withdrawals are mainly focused on cryptocurrency transfers to external wallets. Fiat withdrawals are more limited than Coinbase and may have higher minimum requirements.

Coinbase Deposit Methods:

- ACH transfers (US)

- Wire transfers

- Debit cards

- PayPal (select regions)

- Cryptocurrency deposits

FameEX Deposit Methods:

- Cryptocurrency deposits

- Limited bank transfer options

- Third-party payment processors (varies by region)

Both platforms implement security measures for withdrawals, including confirmation emails and two-factor authentication. Coinbase may place temporary holds on withdrawals for new accounts as a security measure.

Withdrawal fees vary between platforms. Coinbase charges network fees for crypto withdrawals, while FameEX’s fee structure depends on the cryptocurrency being withdrawn.

Coinbase Vs FameEX: Trading & Platform Experience Comparison

Coinbase offers a user-friendly interface that’s perfect for beginners while also providing advanced features for experienced traders. The platform scores high in overall user experience with a 9.6 rating according to recent comparisons.

FameEX has been gaining attention in 2025 as a platform specializing in meme coins and other cryptocurrency trading options. While not as well-known as Coinbase, it provides competitive services for specific trading needs.

User Interface Comparison:

- Coinbase: Clean, intuitive design with mobile app support

- FameEX: Functional interface with focus on trading efficiency

Coinbase’s beta NFT trading platform now operates with zero transaction fees for both creators and collectors, giving you additional trading options beyond traditional cryptocurrencies.

Security Features:

| Feature | Coinbase | FameEX |

|---|---|---|

| Two-factor authentication | Yes | Yes |

| Cold storage | 98% of assets | Partial |

| Insurance protection | Available | Limited |

You’ll find Coinbase supports over 150 cryptocurrencies, making it versatile for diverse trading strategies. FameEX specializes more in trending coins, particularly meme coins.

Trading fees vary between the platforms. Coinbase’s fee structure is transparent but can be higher than some alternatives. FameEX typically offers more competitive rates, especially for frequent traders.

Both platforms provide adequate educational resources, though Coinbase generally offers more comprehensive learning materials for newcomers to cryptocurrency trading.

Coinbase Vs FameEX: Liquidation Mechanism

Liquidation is what happens when your trading position can’t meet the margin requirements. Both Coinbase and FameEX have systems to handle this, but they work differently.

Coinbase Liquidation Process:

- Uses a graduated liquidation approach

- Sends multiple warnings before liquidation occurs

- Typically maintains a liquidation threshold of around 80% of collateral

- Offers some grace period for users to add funds

FameEX (similar to Phemex based on available information) uses a more aggressive liquidation system. Their process is designed for faster markets with higher leverage options.

FameEX Liquidation Process:

- Implements automatic liquidations when margins fall below requirements

- Uses an insurance fund to manage liquidation risks

- Offers partial liquidation in some cases rather than closing entire positions

- Generally has tighter liquidation thresholds

You’ll find Coinbase’s system more forgiving for beginners. It gives you more time to react when positions move against you.

FameEX appeals more to experienced traders who understand liquidation risks. Their system is optimized for efficiency in volatile markets.

Neither platform guarantees protection against liquidation in extreme market conditions. Always use stop-loss orders and proper risk management when trading with leverage on either platform.

Coinbase Vs FameEX: Insurance

When choosing a crypto exchange, insurance coverage is a crucial factor to consider for your asset protection. Both Coinbase and FameEX offer different insurance options to protect your investments.

Coinbase Insurance Coverage:

- FDIC insurance for USD balances up to $250,000 per customer

- Commercial crime insurance for digital assets held in hot wallets

- 98% of customer crypto stored in offline cold storage

Coinbase’s insurance policy is quite comprehensive, giving you peace of mind that your funds have some protection against theft and security breaches.

FameEX Insurance Coverage:

- Security fund to protect user assets

- Insurance protection against potential security breaches

- Less extensive documentation about specific coverage amounts

FameEX offers insurance, but their policy details aren’t as transparent or well-documented as Coinbase’s coverage.

You should note that neither exchange offers complete protection against market volatility or losses from your trading decisions. Their insurance primarily covers security incidents and theft.

For maximum security, you might consider keeping only trading amounts on either platform and transferring larger holdings to personal wallets when not actively trading.

Always verify the current insurance policies directly on each platform as coverage terms can change.

Coinbase Vs FameEX: Customer Support

When choosing a crypto exchange, customer support quality can make a big difference in your trading experience. Both Coinbase and FameEX offer support options, but they differ in availability and quality.

Coinbase provides customer support through email tickets and has a comprehensive help center with guides and FAQs. They’ve improved their response times over the years, but during high-volume periods, you might experience delays.

FameEX, according to the search results, offers 24/7 customer support across all channels. This around-the-clock availability is beneficial if you encounter issues outside regular business hours.

Support Options Comparison:

| Feature | Coinbase | FameEX |

|---|---|---|

| 24/7 Support | Limited | Yes |

| Email Support | Yes | Yes |

| Live Chat | Limited | Yes |

| Phone Support | Limited | Unknown |

| Help Center | Comprehensive | Available |

FameEX appears to have a more active community and forums where you can get peer assistance. Community support can be valuable for troubleshooting common issues or learning platform tips.

Coinbase, with its larger user base of around 8.8 million active users, may have more standardized support processes, but this can sometimes mean less personalized assistance.

Your support needs may vary based on your trading experience. If you’re new to crypto, both platforms offer resources, but FameEX’s 24/7 support might provide more immediate help when you need it.

Coinbase Vs FameEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and FameEX offer various security measures, but they differ in important ways.

Coinbase provides robust security features including auto-enrolled two-factor authentication (2FA) with security key support. Your account is also protected with strong password requirements and multi-signature options for added protection.

FameEX, while newer to the market, also employs security protocols but isn’t as widely recognized for its security framework as Coinbase.

Key Security Features Comparison:

| Feature | Coinbase | FameEX |

|---|---|---|

| Two-Factor Authentication | Yes (auto-enrolled) | Yes |

| Security Key Support | Yes | Limited |

| Cold Storage | 98% of assets | Partial |

| Insurance | Yes | Limited |

| Regulatory Compliance | High (US-based) | Moderate |

Coinbase is regulated in multiple countries and keeps 98% of customer funds in offline cold storage to prevent hacking attempts. This approach has helped them maintain a strong security record.

FameEX operates as a centralized exchange requiring account creation like Coinbase. However, its security infrastructure isn’t as extensively documented or tested.

You should enable all available security features regardless of which platform you choose. This includes using strong, unique passwords and activating 2FA immediately after creating your account.

Remember that even with strong platform security, your personal security practices play a crucial role in keeping your crypto assets safe.

Is Coinbase A Safe & Legal To Use?

Coinbase is generally considered a safe and legal platform for cryptocurrency trading in most countries. It has built a reputation as one of the most trustworthy exchanges in the crypto space.

In terms of security, Coinbase employs robust measures to protect user funds. The platform stores approximately 98% of customer assets in offline cold storage, keeping them safe from online threats.

Coinbase is a regulated entity in the United States and complies with financial regulations. It operates with licenses in many jurisdictions, making it a legal choice for most users.

For your peace of mind, Coinbase provides some insurance coverage. However, it’s important to note that Coinbase is not FDIC-insured like traditional banks, as cryptocurrency itself isn’t covered by such protections.

Some users have reported issues with unauthorized account access. Using strong passwords and enabling two-factor authentication can help protect your account.

Coinbase maintains compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This means you’ll need to verify your identity when creating an account.

Key Security Features:

- Two-factor authentication

- Biometric logins

- Address whitelisting

- Cold storage for most assets

- Regular security audits

While no platform is 100% risk-free, Coinbase’s security track record and regulatory compliance make it one of the safer options for buying, selling, and storing cryptocurrency.

Is FameEX A Safe & Legal To Use?

FameEX presents mixed signals regarding safety and legitimacy. The platform lacks regulation from recognized financial authorities, which means you won’t have protection from financial oversight organizations.

Some sources indicate that FameEX’s official platform operates legally with secure and efficient transactions. Users report fast fund transfers on the legitimate site.

However, there are concerning reports. The Washington State Department of Financial Institutions has received complaints about FameEX potentially being involved in “pig butchering” scams.

Security measures claimed by FameEX:

- Segregation of user funds

- Robust security protocols

- Efficient transaction processing

Warning signs to consider:

- No recognized regulatory oversight

- Existence of phishing websites mimicking FameEX

- Complaints filed with financial authorities

You should exercise caution when considering FameEX. Multiple phishing websites attempt to impersonate the platform, making it crucial to verify you’re using the official site.

Before investing, research thoroughly and start with small amounts if you decide to proceed. Consider using more established exchanges with clear regulatory compliance if security is your primary concern.

The lack of regulation means your funds won’t have the same protections offered by platforms that comply with financial authorities’ requirements.

Frequently Asked Questions

Investors often have specific concerns when choosing between Coinbase and FameEX for their cryptocurrency needs. These questions address the key differences, advantages, and potential drawbacks of each platform.

What are the prominent differences between Coinbase and other crypto exchanges?

Coinbase stands out with its user-friendly interface and strong regulatory compliance. Unlike many competitors, Coinbase is publicly traded and offers FDIC insurance on USD deposits up to $250,000.

Coinbase typically charges higher fees than most exchanges. Its basic platform provides fewer advanced trading features compared to specialized exchanges.

The exchange offers excellent educational resources for beginners. This makes it particularly suitable for those new to cryptocurrency investing.

What are the key factors to consider when choosing the best crypto exchange for US citizens?

Regulatory compliance should be your top priority. Ensure the exchange is properly registered with FinCEN and follows US financial laws.

Security measures like two-factor authentication, cold storage of assets, and insurance policies protect your investments. These features vary significantly between platforms.

Fee structures can impact your returns. Compare trading fees, withdrawal costs, and deposit methods before deciding.

Available cryptocurrencies matter if you want to trade specific coins. Coinbase offers fewer altcoins than FameEX but includes all major cryptocurrencies.

How does FameEX compare in terms of trustworthiness to leading crypto exchanges?

FameEX is a newer platform compared to established exchanges like Coinbase. It doesn’t have the same long-term track record of security and reliability.

The platform offers competitive features and lower fees than Coinbase. However, it has less regulatory oversight in some jurisdictions.

FameEX uses security protocols like cold storage and two-factor authentication. But it lacks the public company transparency and FDIC insurance that Coinbase provides.

What should users know about any potential downsides of using Coinbase for trading?

Coinbase charges higher fees than most competitors, including FameEX. These can significantly impact your investment returns, especially for frequent traders.

Customer service issues have been reported by some users. During high-volume periods, response times can be delayed.

The basic Coinbase platform has limited advanced trading tools. More experienced traders may find the interface too simplistic for their needs.

Which crypto exchange is recognized as the foremost competitor to Coinbase among experts?

Binance is widely considered Coinbase’s main competitor globally. It offers more cryptocurrencies, lower fees, and advanced trading features.

For US traders specifically, Kraken and Gemini compete most directly with Coinbase. They balance regulatory compliance with competitive features.

FameEX has emerged as an alternative with lower fees, but it doesn’t yet have the market share or reputation to be considered Coinbase’s primary competitor.

Are there any crypto exchanges that are rated higher than Coinbase by financial authorities or publications?

For security features, Gemini and Kraken often receive higher ratings than Coinbase from cybersecurity experts. Both exchanges have never experienced major security breaches.

In terms of trading features and fees, Binance is frequently rated above Coinbase by trading publications. Its advanced trading platform offers more tools at lower costs.

For regulatory compliance in the US, Coinbase shares top ratings with Gemini. Both exchanges maintain strict adherence to US regulations and reporting requirements.

Coinbase Vs FameEX Conclusion: Why Not Use Both?

When choosing between Coinbase and FameEX, you don’t necessarily have to pick just one. Many crypto investors use multiple exchanges to take advantage of different benefits.

Coinbase offers strong security and a user-friendly interface that’s perfect for beginners. It’s regulated in the US and has a solid reputation, making it a trustworthy choice for new investors.

FameEX provides lower fees and more trading options for users looking to expand their crypto activities. It’s gaining popularity as a user-friendly alternative to other exchanges.

Benefits of using both platforms:

- Risk diversification – Spreading your assets across multiple exchanges reduces your exposure if one platform has issues

- Fee optimization – Use each platform when its fee structure benefits you most

- Feature access – Take advantage of unique tools and coins available on each platform

You might consider using Coinbase for your basic crypto needs and long-term holdings, while using FameEX for more active trading or accessing coins not available on Coinbase.

The crypto world changes quickly. By familiarizing yourself with both platforms, you’ll be more adaptable as the market evolves and your investment strategy develops.

Remember to maintain proper security practices on all platforms, including strong passwords and two-factor authentication.