Choosing between Coinbase and eToro can be challenging when you’re looking to invest in cryptocurrencies. These two popular platforms offer different features that might align with your specific needs as an investor.

Coinbase focuses more exclusively on cryptocurrency trading while eToro provides a wider range of investment options including stocks, ETFs, and commodities. If you’re a beginner in the crypto world, Coinbase offers a user-friendly experience with opportunities to earn crypto rewards through staking, interest, and Learn and Earn programs. eToro, on the other hand, stands out with its social trading features and availability in more countries.

When comparing costs, platform capabilities, and cryptocurrency selection, you’ll find notable differences between these exchanges. Coinbase has earned a higher overall score in some comparisons, but eToro might be the better choice if you’re looking for a platform that allows you to diversify beyond just cryptocurrencies.

Coinbase vs eToro: At A Glance Comparison

When choosing between Coinbase and eToro, several key differences can help you make the right decision for your investment needs.

Platform Focus

- Coinbase: Primarily focused on cryptocurrency trading

- eToro: Multi-asset platform offering crypto, stocks, ETFs, and commodities

User Experience

| Feature | Coinbase | eToro |

|---|---|---|

| Beginner-friendly | ✓ | ✓ |

| Social trading | ✗ | ✓ |

| Educational resources | ✓ | ✓ |

eToro’s social trading feature lets you copy successful traders’ moves automatically. This makes it popular for those who want to learn while investing.

Cryptocurrency Selection

Coinbase offers a wider range of cryptocurrencies than eToro, making it better if you want to explore more crypto options.

Availability

eToro is available in more countries worldwide compared to Coinbase, which might affect your choice depending on your location.

Fee Structure

Both platforms build fees into their services, but the structure differs. eToro often includes fees in the spread, while Coinbase has more transparent but sometimes higher transaction fees.

Ideal For

- Coinbase: Best for crypto-focused beginners and those wanting access to more cryptocurrencies

- eToro: Better for traders wanting a social experience and access to multiple asset classes beyond just crypto

Coinbase vs eToro: Trading Markets, Products & Leverage Offered

When choosing between Coinbase and eToro, understanding what you can trade on each platform is essential for meeting your investment goals.

eToro offers a more diverse range of investment options. You can trade cryptocurrencies, stocks, ETFs, and commodities all in one place. This variety makes eToro suitable if you want to diversify beyond just crypto.

Coinbase focuses primarily on cryptocurrency trading. While its selection is more limited in terms of asset classes, Coinbase supports around 70 different cryptocurrencies compared to eToro’s 37.

Here’s a comparison of what each platform offers:

| Feature | Coinbase | eToro |

|---|---|---|

| Cryptocurrencies | ~70 coins | ~37 coins |

| Stocks | No | Yes |

| ETFs | No | Yes |

| Commodities | No | Yes |

| Forex | No | Yes |

Regarding leverage, eToro provides leverage options for certain products, allowing you to amplify your potential returns (and risks).

Coinbase doesn’t offer leverage trading on its main platform. This makes Coinbase potentially safer for beginners who might not understand the risks associated with leverage.

Your trading style and investment goals should guide your choice. If you want to focus solely on crypto with more coin options, Coinbase might be better. If you prefer a one-stop platform for different asset classes, eToro offers more versatility.

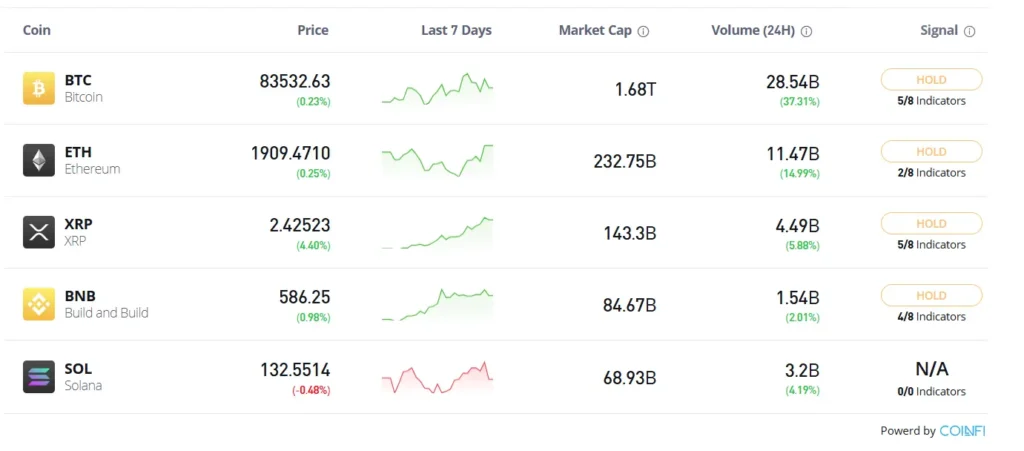

Coinbase vs eToro: Supported Cryptocurrencies

When choosing between Coinbase and eToro, the variety of cryptocurrencies available is an important factor to consider.

Coinbase offers a more extensive selection with over 360 cryptocurrencies available for trading. This gives you more options if you’re interested in exploring beyond the major tokens.

eToro, while offering fewer cryptocurrencies, provides access to other investment assets that Coinbase doesn’t have, including stocks, ETFs, and options.

Here’s a simple comparison of their cryptocurrency offerings:

| Platform | Number of Cryptocurrencies | Other Assets |

|---|---|---|

| Coinbase | 360+ | Crypto only |

| eToro | Fewer than Coinbase | Stocks, ETFs, Options |

If you’re focused primarily on cryptocurrency variety, Coinbase has the advantage. Their larger selection gives you more opportunities to diversify your crypto portfolio.

However, if you want a platform where you can trade both cryptocurrencies and traditional financial assets, eToro might be more suitable for your needs.

It’s worth noting that both platforms support the major cryptocurrencies like Bitcoin, Ethereum, and other popular tokens. The difference becomes apparent when you’re looking for lesser-known or newer cryptocurrencies.

Both platforms regularly add new cryptocurrencies, so these numbers may increase over time.

Coinbase vs eToro: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Coinbase and eToro, understanding their fee structures is crucial for making an informed decision about which platform suits your needs better.

Trading Fees

- Coinbase: Up to 0.40% per trade

- eToro: Starts at 1% spread fee for cryptocurrencies

- eToro’s trading fees are generally higher than Coinbase’s

Coinbase uses a straightforward fee structure, while eToro incorporates fees into the spread. This means you’ll pay the difference between buying and selling prices.

Withdrawal Fees

- Coinbase: Can be up to $60 depending on the withdrawal method

- eToro: Up to 3% and $5 flat fee for some withdrawals

- Both platforms charge network fees for crypto transfers

eToro also charges an inactivity fee if you don’t log into your account for 12 months. Coinbase doesn’t have inactivity fees.

Deposit Fees

- Coinbase offers free ACH transfers but charges for credit card deposits

- eToro has various deposit methods with different fees depending on your region

You should consider both the immediate trading costs and potential withdrawal fees. These can significantly impact your overall returns, especially if you trade frequently.

For beginners making smaller transactions, these fees can eat into profits. More active traders should pay special attention to the trading fee percentages.

Remember that fees may change, so it’s worth checking both platforms’ current fee schedules before making your final decision.

Coinbase vs eToro: Order Types

When trading crypto, the types of orders you can place affect your strategy and potential profits. Both Coinbase and eToro offer different order options that cater to various trading styles.

Coinbase Order Types:

- Market orders (buy/sell at current price)

- Limit orders (set your desired price)

- Stop orders (triggers when price reaches a certain level)

Coinbase Pro provides more advanced options, including stop-limit orders that combine features of both stop and limit orders. This gives you more control over entry and exit points.

eToro Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

eToro also features a unique “Copy Trading” option that lets you automatically mimic the trades of successful investors. This is especially helpful if you’re new to trading.

The platforms differ in how they execute orders. Coinbase tends to process orders more quickly, which is important during volatile market conditions.

eToro provides trailing stop orders, which adjust automatically as the market price moves in your favor. This feature helps protect your profits if the market suddenly reverses.

Both platforms allow you to set up recurring buy orders, making it easy to dollar-cost average your investments over time.

Coinbase vs eToro: KYC Requirements & KYC Limits

Both Coinbase and eToro require Know Your Customer (KYC) verification to comply with financial regulations. These procedures help prevent fraud and money laundering while keeping your assets secure.

Coinbase implements a robust KYC process with multiple verification layers. You’ll need to provide personal information, a valid ID, and sometimes a selfie for verification.

Coinbase offers two-factor authentication (2FA) through both SMS and Google Authenticator app, giving you an extra security layer when accessing your account.

eToro similarly requires identity verification before you can fully use their platform. You must submit personal details and identification documents.

eToro provides 2FA through SMS, though it lacks the additional Google Authenticator option that Coinbase offers.

KYC Limits Comparison:

| Platform | Basic Verification | Full Verification |

|---|---|---|

| Coinbase | Limited trading, deposit & withdrawal caps | Higher limits, access to all features |

| eToro | Basic trading with restrictions | Increased limits, full trading capabilities |

Your trading limits on both platforms will increase as you complete higher levels of verification. This tiered approach allows you to start with basic access while gradually gaining more privileges.

Neither platform allows you to trade anonymously. Verification is mandatory for using their services, which helps protect both you and the platform.

Coinbase vs eToro: Deposits & Withdrawal Options

Both Coinbase and eToro offer multiple ways to fund your account, but they differ in fees and processing times.

Coinbase supports bank transfers, debit cards, and wire transfers for deposits. Bank transfers are free but can take 3-5 business days to process. Debit card deposits are instant but come with a 3.99% fee.

eToro accepts bank transfers, credit/debit cards, PayPal, Skrill, and Neteller. Most deposit methods are free, but some may incur a small fee depending on your location.

When it comes to withdrawal fees, Coinbase charges vary by method and can go up to $60 for certain options. eToro charges a flat $5 withdrawal fee regardless of the amount or method.

Minimum deposit requirements also differ between platforms:

| Platform | Minimum Deposit |

|---|---|

| Coinbase | $2 |

| eToro | $10-$1000 (varies by region) |

For cryptocurrencies, both platforms allow you to send and receive directly to external wallets. Coinbase charges network fees for crypto withdrawals, while eToro’s fees vary by cryptocurrency.

Processing times for withdrawals on Coinbase typically take 1-5 business days. eToro withdrawals can take up to 2 business days to process plus 1-3 days for the funds to reach your account.

Both platforms require identity verification before allowing withdrawals, which enhances security but may slow down your first withdrawal request.

Coinbase vs eToro: Trading & Platform Experience Comparison

Coinbase offers a simple, user-friendly platform that’s perfect for beginners. The interface is clean and straightforward, making it easy to buy, sell, and manage your cryptocurrencies.

eToro provides a more social trading experience. You can follow and copy successful traders, which is helpful if you’re looking to learn from others. This feature isn’t available on Coinbase.

Both platforms allow you to trade on mobile apps, but they differ in what you can trade. Coinbase focuses mainly on cryptocurrencies and fiat currencies. eToro offers a wider range of products including stocks, ETFs, and commodities.

Platform Features Comparison:

| Feature | Coinbase | eToro |

|---|---|---|

| User Interface | Simple, beginner-friendly | Social, feature-rich |

| Copy Trading | No | Yes |

| Asset Types | Mainly crypto | Crypto, stocks, ETFs, commodities |

| Mobile App | Yes | Yes |

Coinbase’s platform is more specialized for cryptocurrency trading. If you’re just getting started with crypto, their straightforward approach might be less overwhelming.

eToro’s social elements make it stand out. You can interact with other traders, see what they’re investing in, and even automatically copy their trades. This can be valuable if you want to learn as you go.

Your trading style will determine which platform feels better to use. Coinbase suits those who want simplicity, while eToro works well if you value social features and diverse trading options.

Coinbase vs eToro: Liquidation Mechanism

When trading on margin or with leveraged positions, both Coinbase and eToro have mechanisms to protect themselves from excessive losses. These are called liquidation mechanisms.

Coinbase’s Liquidation Process:

- Triggers when your margin ratio falls below maintenance requirements

- Sends email and in-app notifications as warnings

- Automatically closes positions if funds aren’t added

- Typically gives a short window to add more funds before liquidation

Coinbase uses a fairly standard liquidation process that monitors your account continuously. You’ll receive alerts when you approach dangerous levels.

eToro’s Liquidation Process:

- Uses a tiered system based on equity percentage

- Implements automatic stop-loss on leveraged positions

- Provides “margin call” warnings at 50% of required margin

- Features a unique “zero risk” policy for some copy trading options

eToro’s system is designed to be more user-friendly for beginners. Their platform closes positions gradually rather than all at once in many cases.

Both platforms charge liquidation fees, but eToro’s fees are typically higher. Coinbase charges a flat fee, while eToro’s fees vary based on position size and asset type.

Understanding these liquidation mechanisms is crucial when trading with leverage on either platform. They directly impact your risk management strategy and potential losses.

Coinbase vs eToro: Insurance

When you invest in crypto, safety is a top concern. Both Coinbase and eToro offer insurance protections, but there are key differences to understand.

Coinbase insures USD balances up to $250,000 through FDIC protection (for US customers). This means your dollars are protected if something happens to Coinbase.

For crypto assets, Coinbase maintains a commercial crime insurance policy. This covers digital assets held in their hot wallets (online storage) against theft and cybersecurity breaches.

eToro offers similar protections. For cash deposits, eToro provides protection through various financial regulatory bodies depending on your region. In the US, cash deposits are FDIC-insured up to $250,000.

Important note: Neither platform fully insures crypto assets against market losses or all types of hacks. The insurance mainly covers security breaches of their systems, not individual account compromises.

eToro adds an extra layer of protection with its eToro Money crypto wallet, which includes insurance for certain situations. This can be valuable if you’re storing significant crypto assets.

Both platforms store most customer crypto (over 95%) in cold storage – offline systems that are much harder to hack. This practice is one of the most effective security measures against theft.

When choosing between these platforms, consider your specific insurance needs alongside other features like fees, available cryptocurrencies, and user experience.

Coinbase vs eToro: Customer Support

When choosing between Coinbase and eToro, customer support is a key factor to consider. Both platforms have similarities and differences in how they handle user issues.

Both Coinbase and eToro offer 24/7 customer support, but users have criticized the quality of support on both platforms. This is a common issue in the crypto exchange industry.

Coinbase Support Options:

- Email support

- Help center with FAQs

- Phone support: +1 (888) 908-7930

- Response time: Can vary from hours to days

eToro Support Options:

- Ticketing system

- Limited live chat

- Help center with guides

- Response time: Usually within 24 hours

Coinbase has improved its support by adding phone options, giving you direct access to representatives. This can be helpful when you need immediate assistance with account issues.

eToro relies more heavily on its ticketing system, which means you’ll need to wait for a response. The platform does offer some live chat support, but it’s limited compared to other services.

For beginners, Coinbase’s phone support might be more reassuring when you encounter problems. However, both platforms could improve their customer service to meet user expectations.

Neither platform stands out significantly in this category, making it essentially a tie when comparing their customer support offerings.

Coinbase vs eToro: Security Features

Both Coinbase and eToro offer strong security features to protect your cryptocurrency investments. Let’s compare what each platform provides to keep your funds safe.

Coinbase Security:

- Industry-leading security measures

- Two-factor authentication (2FA)

- Holds all assets in reserves at a 1:1 ratio

- Advanced encryption technology

- More resources dedicated to security due to larger company size

eToro Security:

- Two-factor authentication (2FA)

- SMS verification options

- Standard encryption protocols

When it comes to account protection, both platforms support two-factor authentication through SMS. This adds an extra layer of security beyond just your password.

Coinbase seems to have an edge in the security department. As a larger company, Coinbase can invest more resources into their security infrastructure compared to eToro.

For your crypto assets, Coinbase maintains a 1:1 reserve policy. This means they hold the full value of customer assets at all times, reducing risks if the company faces financial troubles.

eToro provides solid security basics but doesn’t advertise as many advanced security features as Coinbase does.

Your choice between these platforms might depend on how much you prioritize security features. If maximum protection is your top concern, Coinbase’s more robust security measures might be the better option for you.

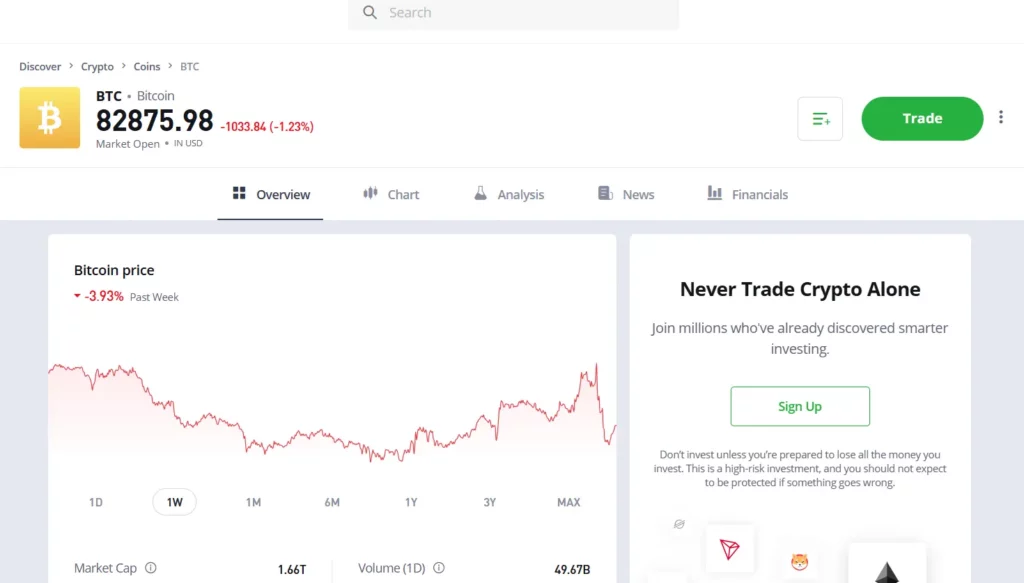

Is Coinbase Safe & Legal To Use?

Coinbase is legal to use in the United States and many other countries around the world. According to search results, Coinbase is regulated in the United States and also by the United Kingdom’s Financial Conduct Authority (FCA).

Safety is a priority at Coinbase, with multiple layers of protection for users. The platform implements two-factor authentication (2FA), allowing you to secure your account through SMS. Coinbase goes a step further by supporting Google Authenticator for 2FA, giving you an extra security option.

Your funds are kept secure at Coinbase. All client funds are stored in United States banks, providing an additional layer of protection compared to some other crypto platforms.

Coinbase is widely recognized as one of the most secure and reputable cryptocurrency exchanges available today. This reputation has helped it become a popular choice for both beginners and experienced crypto traders.

Key security features include:

- Two-factor authentication options

- Regulated in the US and UK

- Bank-level protection for your funds

- Industry reputation for security

When you create an account, you’ll need to verify your identity, which helps maintain the platform’s compliance with financial regulations and protects users.

Is eToro Safe & Legal To Use?

eToro is a legitimate and regulated platform that operates legally in many countries. It holds licenses from top financial authorities including the FCA in the UK, CySEC in Europe, and ASIC in Australia.

For security, eToro uses several measures to protect user assets. They implement DDoS protection and standardization protocols to prevent unauthorized access. Your funds are also segregated from company operational funds.

Security Features:

- Multi-signature security

- Two-factor authentication (2FA)

- SSL encryption

- Anti-money laundering procedures

However, compared to Coinbase, eToro may offer slightly less robust security. Coinbase has obtained crime insurance to protect users if their security is breached, giving it an edge in this area.

When you use eToro, your cryptocurrency investments aren’t FDIC or SIPC insured. This is important to remember as it affects how your assets are protected.

eToro supports fewer cryptocurrencies than Coinbase. While Coinbase offers over 250 cryptocurrencies, eToro only supports about 8 cryptocurrencies. This might limit your trading options.

Before signing up, check if eToro is available in your location. Some states and countries have restrictions on cryptocurrency trading platforms. You should also review their terms of service and privacy policy to understand how your data is handled.

Frequently Asked Questions

Investors comparing Coinbase and eToro often have specific questions about how these platforms differ. These questions touch on costs, features, user experience, security protocols, and available cryptocurrencies.

What are the key differences in trading fees between Coinbase and eToro?

Coinbase typically charges higher fees than eToro for most transactions. Coinbase’s fee structure includes spread markups of about 0.5% plus additional transaction fees that vary by payment method.

eToro uses a spread-based fee model, charging around 1% for cryptocurrency trades without the additional transaction fees that Coinbase imposes. For frequent traders, these fee differences can significantly impact overall investment returns.

When withdrawing funds, Coinbase charges network fees that fluctuate with blockchain congestion, while eToro has fixed withdrawal fees.

How does eToro’s platform compare to Coinbase in terms of crypto trading features?

eToro offers social trading features that Coinbase doesn’t have, allowing you to copy successful traders’ portfolios automatically. This can be valuable if you’re new to crypto investing.

Coinbase provides more advanced trading tools through Coinbase Pro, including detailed charts, market depth information, and limit orders. eToro offers similar professional tools but integrates them within a single platform.

eToro also supports trading across multiple asset classes including stocks and ETFs, while Coinbase focuses exclusively on cryptocurrencies.

What are the differences in user experience when trading on Coinbase versus eToro?

Coinbase offers a straightforward, beginner-friendly interface that makes buying and selling crypto simple. The platform emphasizes ease of use with a clean design and intuitive navigation.

eToro’s interface combines social media elements with trading functions, creating a more interactive experience. You can follow other traders’ activities, comment on market moves, and engage with the community.

Both platforms offer mobile apps, but Coinbase’s app is often praised for its simplicity while eToro’s app provides more social functionality.

How do Coinbase and eToro’s security measures for cryptocurrency holdings compare?

Coinbase stores approximately 98% of customer funds in offline cold storage, protecting assets from online threats. They also offer $250,000 FDIC insurance on USD balances and maintain a crime insurance policy.

eToro implements similar cold storage security but hasn’t been as transparent about specific percentages. They maintain regulatory compliance in multiple jurisdictions and use two-factor authentication.

Both platforms verify user identities through KYC procedures, but Coinbase has a longer track record in the crypto security space since 2012.

What are the advantages and disadvantages of using eToro over Coinbase for crypto investments?

eToro’s main advantages include lower trading fees, social trading capabilities, and the ability to trade multiple asset classes in one account. The platform makes diversification easier across crypto and traditional investments.

The disadvantages of eToro include fewer available cryptocurrencies than Coinbase and potentially slower customer support response times based on user reviews.

eToro’s minimum deposit of $50 is higher than Coinbase, which allows you to start with smaller amounts.

How does the selection of tradable cryptocurrencies on Coinbase compare to those available on eToro?

Coinbase offers a significantly larger selection of cryptocurrencies than eToro, with access to over 200 different tokens and coins. This includes both major cryptocurrencies and smaller altcoins.

eToro supports fewer cryptocurrencies, typically around 30-40 of the most popular options. The platform focuses on established coins rather than newer or more speculative tokens.

If you’re interested in investing in niche or emerging cryptocurrencies, Coinbase provides more options. For traders focused on mainstream cryptocurrencies like Bitcoin and Ethereum, both platforms offer sufficient choices.

Coinbase vs eToro Conclusion: Why Not Use Both?

Both Coinbase and eToro offer unique advantages that might make using both platforms a smart strategy.

Coinbase excels with its user-friendly interface and strong security measures. It’s particularly good for beginners just starting their crypto journey. The platform focuses primarily on cryptocurrency trading and has established itself as a trusted name in the industry.

eToro, meanwhile, offers a wider range of investment options. Beyond crypto, you can trade stocks, ETFs, and commodities. Its social trading feature allows you to copy successful traders, which can be helpful if you’re learning.

Consider using Coinbase for:

- Straightforward crypto purchases

- Enhanced security features

- Simple user experience

Consider using eToro for:

- Diversifying beyond just crypto

- Social trading benefits

- Trading in more countries (as it’s available in more regions)

Your trading style and goals should determine which platform works best. Beginners might prefer Coinbase’s simplicity, while more experienced traders could benefit from eToro’s diverse offerings.

Many investors use multiple platforms to take advantage of different features and spreads. This strategy helps you access the best of both worlds while minimizing the limitations of either platform.

Remember to consider the fee structures of both platforms as they differ significantly and will impact your returns over time.