When it comes to cryptocurrency exchanges, Coinbase and DigiFinex represent two distinct options for traders and investors. These platforms differ in several key areas including fees, available cryptocurrencies, trading features, and user experience. Comparing Coinbase and DigiFinex helps you determine which exchange better meets your specific crypto trading needs in 2025.

Both exchanges offer cryptocurrency trading services, but they target different user segments. Coinbase is known for its user-friendly interface that appeals to beginners, while DigiFinex offers more advanced trading options and a wider range of cryptocurrencies. Understanding these differences is essential before deciding where to put your money.

You’ll find variations in fee structures, deposit methods, and available trading types between these platforms. Coinbase typically charges higher fees but provides enhanced security and regulatory compliance, while DigiFinex often offers more competitive rates and additional services like wealth management features.

Coinbase Vs DigiFinex: At A Glance Comparison

When choosing between Coinbase and DigiFinex, understanding their key differences can help you make the right choice for your crypto needs.

Fees: DigiFinex typically offers lower fees than Coinbase. This can make a big difference if you trade often or in large amounts.

KYC Requirements: DigiFinex provides options to trade without completing KYC verification, while Coinbase strictly requires identity verification for all users.

User Experience: Coinbase stands out for its user-friendly interface. It’s designed with beginners in mind, making it easier to navigate for newcomers to crypto.

Trust and Reputation: Coinbase is widely recognized as one of the most trusted exchanges. It’s publicly traded in the US and follows strict regulations.

| Feature | Coinbase | DigiFinex |

|---|---|---|

| Founded | 2012 | 2018 |

| Trading Fees | Higher | Lower |

| KYC Required | Yes (always) | Optional for basic trading |

| Beginner-Friendly | Very high | Moderate |

| Supported Cryptocurrencies | 200+ | 300+ |

| Mobile App | Highly rated | Available but less refined |

| Regulation | Heavily regulated (US-based) | Less regulated |

DigiFinex offers more cryptocurrencies to trade, giving you access to a wider range of digital assets.

Coinbase provides better customer support and educational resources, which can be valuable if you’re new to cryptocurrency trading.

Coinbase Vs DigiFinex: Trading Markets, Products & Leverage Offered

Coinbase offers a more simplified trading environment compared to DigiFinex. You’ll find spot trading for over 200 cryptocurrencies on Coinbase, but with limited advanced trading options.

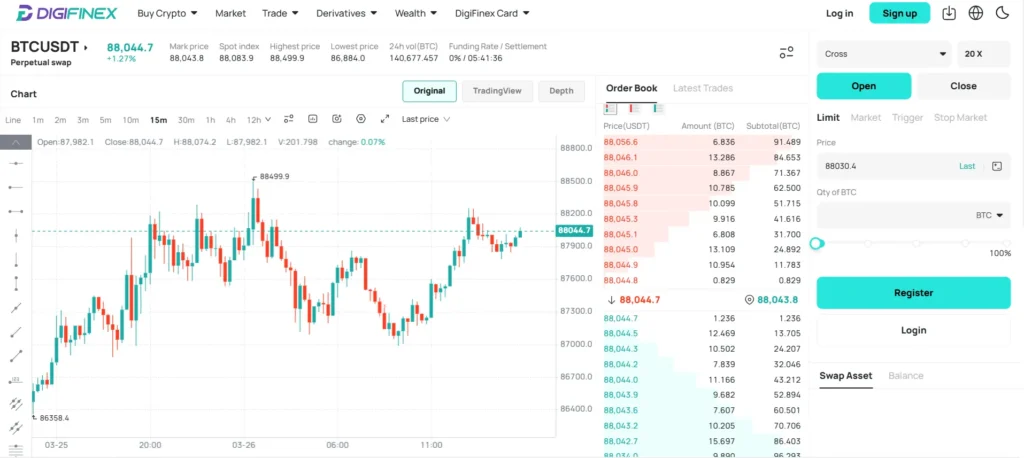

DigiFinex provides a wider range of trading products. The exchange supports spot trading, margin trading, derivatives, and even ETF products. This gives you more flexibility in how you approach the crypto market.

Available Trading Products:

| Feature | Coinbase | DigiFinex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Margin Trading | Limited | ✓ |

| Futures/Derivatives | Limited | ✓ |

| ETF Products | Limited | ✓ |

| Trading Pairs | 200+ | 300+ |

When it comes to leverage, DigiFinex has the clear advantage. You can access up to 100x leverage on some trading pairs, allowing for potentially higher returns (with higher risk).

Coinbase keeps leverage options more restricted, focusing on accessibility and security rather than high-risk trading strategies. This makes Coinbase better for beginners but potentially limiting for advanced traders.

DigiFinex’s wealth management options also provide additional ways to earn passive income on your crypto holdings. These include staking, savings products, and other investment vehicles not as readily available on Coinbase.

The trading interface on DigiFinex might feel more complex but offers more tools for technical analysis and trading strategies.

Coinbase Vs DigiFinex: Supported Cryptocurrencies

When choosing between Coinbase and DigiFinex, the range of available cryptocurrencies is a key factor to consider.

Coinbase supports a more curated selection of cryptocurrencies. You’ll find major coins like Bitcoin, Ethereum, and Litecoin, plus a growing number of altcoins. Coinbase carefully reviews tokens before listing them, which can mean fewer options but higher quality selections.

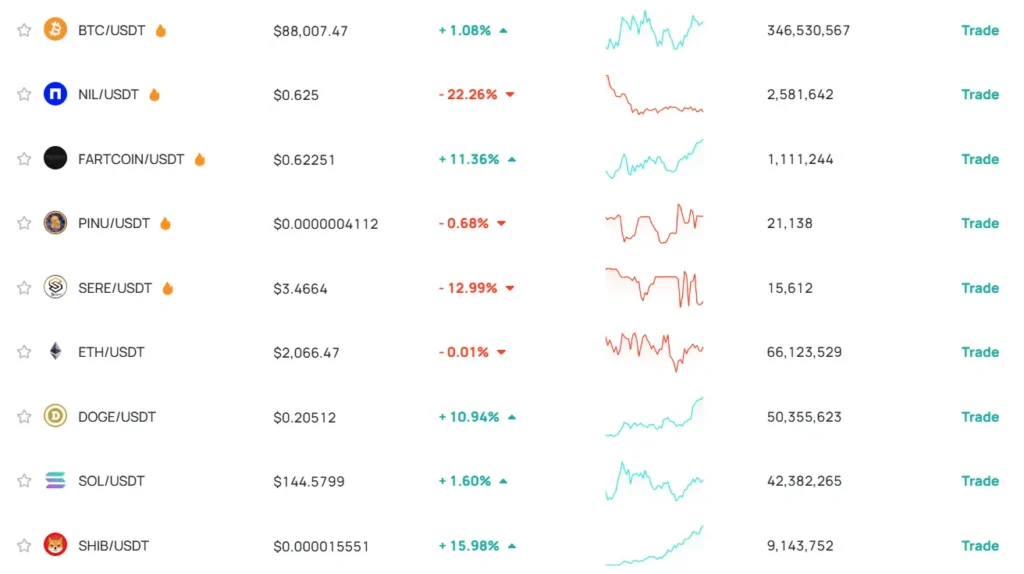

DigiFinex generally offers a wider variety of cryptocurrencies. The platform supports numerous altcoins and tokens that might not be available on Coinbase. This can be beneficial if you’re looking to trade less-established or newer digital assets.

Here’s a quick comparison:

| Feature | Coinbase | DigiFinex |

|---|---|---|

| Total cryptocurrencies | Moderate selection | Larger selection |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoins | Selected varieties | Extensive options |

| New token listings | Cautious approach | More frequent additions |

Coinbase tends to prioritize security and regulatory compliance when adding new cryptocurrencies. This means you might wait longer for trending coins to appear.

DigiFinex typically adds new tokens more quickly, giving you access to emerging cryptocurrencies sooner. This can be advantageous for traders looking to capitalize on new market opportunities.

Your choice between these exchanges may depend on whether you prefer a platform with carefully vetted options or one offering a broader range of trading possibilities.

Coinbase Vs DigiFinex: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Coinbase and DigiFinex, fees are a crucial factor to consider for your trading decisions. Based on current information as of March 2025, DigiFinex generally offers lower trading fees than Coinbase.

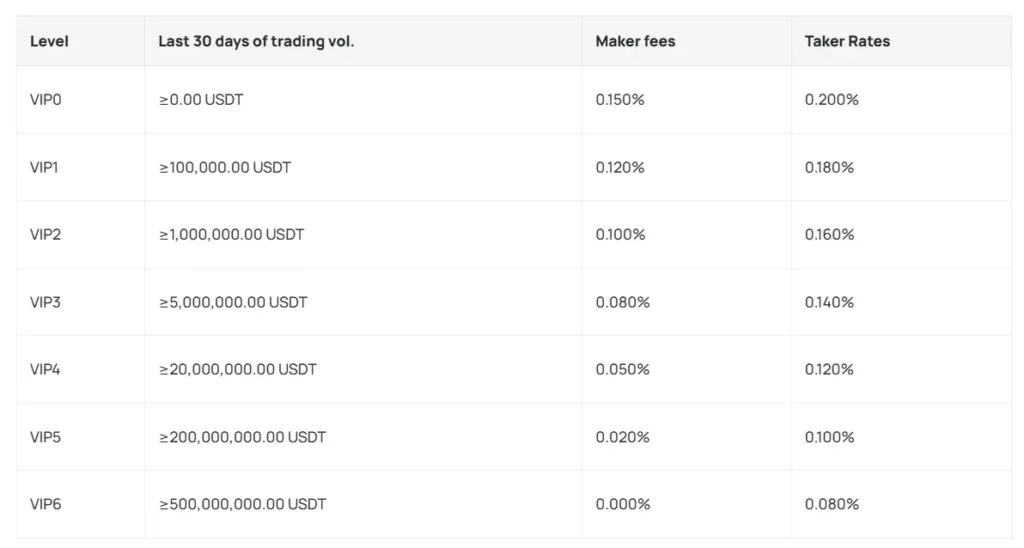

DigiFinex’s standard trading fees start at 0.20% for makers and takers. If you trade in higher volumes, these fees can decrease significantly. DigiFinex also offers fee discounts when you use their native DFT token.

Coinbase, on the other hand, charges higher standard fees. Their regular platform charges can range from 0.50% to 1.49% per trade depending on your payment method and transaction size. Coinbase Pro offers more competitive rates but still typically higher than DigiFinex.

Fee Comparison Table:

| Fee Type | Coinbase | DigiFinex |

|---|---|---|

| Standard Trading | 0.50%-1.49% | 0.20% |

| Professional Platform | 0.00%-0.60% | 0.04%-0.20% |

| Withdrawal Fees | Varies by crypto | Varies by crypto |

For deposits, Coinbase offers more free options for fiat currency, including ACH transfers in the US. DigiFinex charges for some fiat deposits but provides more KYC-free options.

Withdrawal fees vary by cryptocurrency on both platforms. Coinbase typically includes network fees in their withdrawal charges, while DigiFinex sets fixed rates for each crypto.

You should consider your trading volume and preferred currencies when choosing between these exchanges. If fee minimization is your priority, DigiFinex typically provides the better option for most traders.

Coinbase Vs DigiFinex: Order Types

When trading cryptocurrency, the types of orders available can significantly impact your trading strategy. Both Coinbase and DigiFinex offer various order types, but with notable differences.

Coinbase Order Types:

- Market orders: Execute immediately at current market price

- Limit orders: Set a specific price for your trade

- Stop-limit orders: Combines stop price triggers with limit order execution

- Bracket orders: Advanced tool for managing risk with multiple connected orders

DigiFinex Order Types:

- Market orders: Instant execution at best available price

- Limit orders: Trade at your specified price

- Stop-limit orders: Similar to Coinbase’s offering

- OCO (One-Cancels-Other): Special order type not available on Coinbase

DigiFinex tends to offer more advanced trading options compared to Coinbase. This makes it potentially better suited for experienced traders who need complex order types.

Coinbase’s interface is generally more beginner-friendly, with clear explanations of each order type. Their help documentation thoroughly explains how each order functions.

Your trading style should determine which platform is right for you. If you’re new to crypto trading, Coinbase’s simpler approach might be better. For active traders requiring advanced order execution, DigiFinex offers more flexibility.

Both platforms allow you to take control of your portfolio through various order types, but they cater to different user experience levels.

Coinbase Vs DigiFinex: KYC Requirements & KYC Limits

Both Coinbase and DigiFinex require KYC (Know Your Customer) verification, but their approaches differ significantly.

Coinbase KYC Requirements:

- Mandatory for all users

- Requires one proof of ID (passport preferred)

- Requires one proof of address (bank statement recommended)

- Verification must be completed before any trading

Coinbase follows strict regulatory standards as a US-based exchange. You cannot deposit funds or make trades without completing their verification process.

DigiFinex KYC Requirements:

- Hong Kong-based exchange with over 4 million users

- KYC verification required before deposits or trading

- Less stringent in some regions compared to Coinbase

DigiFinex verification levels may vary by region, affecting your withdrawal limits and trading capabilities.

Verification Benefits:

| Feature | Coinbase | DigiFinex |

|---|---|---|

| Trading without KYC | Not possible | Not possible |

| Withdrawal limits | Higher with full KYC | Increases with verification level |

| Account security | Enhanced | Enhanced |

Completing KYC on either platform helps protect your account and provides access to more features. The verification process typically takes 1-3 business days but might be longer during high-volume periods.

When choosing between these platforms, consider your comfort level with sharing personal information and the regulatory environment in your location.

Coinbase Vs DigiFinex: Deposits & Withdrawal Options

When choosing between Coinbase and DigiFinex, understanding their deposit and withdrawal options is essential for your trading experience.

Coinbase offers more traditional banking options. You can deposit funds using bank transfers, credit/debit cards, and PayPal in many regions. This makes it particularly accessible for beginners in the crypto space.

DigiFinex focuses more on crypto-to-crypto transactions. While it does offer some fiat options, these are more limited compared to Coinbase.

Withdrawal Methods Comparison:

| Method | Coinbase | DigiFinex |

|---|---|---|

| Bank Transfer | ✅ | ⚠️ (Limited) |

| Credit/Debit Cards | ✅ | ⚠️ (Limited) |

| PayPal | ✅ | ❌ |

| Crypto | ✅ | ✅ |

Processing times also differ between the platforms. Coinbase typically processes fiat withdrawals within 1-5 business days, while DigiFinex crypto withdrawals are generally faster than Coinbase.

Fee structures vary too. Coinbase charges higher fees for convenience, especially when using credit cards. DigiFinex typically has lower withdrawal fees for crypto transactions.

Security measures for withdrawals are robust on both platforms. Coinbase implements mandatory waiting periods for new accounts, while DigiFinex uses various verification steps to protect your funds.

Your choice should depend on whether you prioritize fiat accessibility (Coinbase) or prefer primarily crypto-based transactions (DigiFinex).

Coinbase Vs DigiFinex: Trading & Platform Experience Comparison

Coinbase offers a clean, beginner-friendly interface that makes it easy to buy, sell, and manage your crypto. The platform is known for its simplicity and intuitive design, which helps new users navigate without confusion.

DigiFinex provides a more advanced trading experience with additional features that might appeal to experienced traders. Its interface includes more technical analysis tools and trading options.

User Interface Comparison:

- Coinbase: Streamlined, minimal, focus on simplicity

- DigiFinex: Feature-rich, trading-focused, more complex

When it comes to available trading types, DigiFinex offers more options. You can access spot trading, futures, and margin trading on DigiFinex, while Coinbase primarily focuses on spot trading for its regular users.

Mobile Experience:

Both exchanges offer mobile apps, but Coinbase’s app is generally rated higher for reliability and ease of use. DigiFinex’s app provides more trading features but might feel overwhelming to newcomers.

Trading fees differ significantly between the platforms. Coinbase charges higher fees, especially for smaller transactions. DigiFinex typically offers lower trading fees, making it more attractive if you trade frequently or in larger volumes.

Platform Security:

Coinbase has built a strong reputation for security with insurance on USD deposits and strict regulatory compliance. DigiFinex also emphasizes security but doesn’t have the same level of regulatory oversight in Western markets.

The learning curve is steeper with DigiFinex, while Coinbase prioritizes accessibility for crypto beginners at the expense of advanced trading features.

Coinbase Vs DigiFinex: Liquidation Mechanism

When trading on cryptocurrency exchanges, understanding the liquidation process is crucial for your financial safety. Both Coinbase and DigiFinex have mechanisms to handle liquidations, but they work differently.

Coinbase’s liquidation process is more transparent and user-friendly. When your collateral value in DeFi activities falls below a predetermined threshold, Coinbase initiates the liquidation process. You’ll receive notifications before this happens, giving you time to add more funds.

DigiFinex takes a different approach to liquidations. Their system monitors collateral ratios continuously and may liquidate positions more quickly when market conditions change rapidly.

Key Differences in Liquidation Approaches:

| Feature | Coinbase | DigiFinex |

|---|---|---|

| Warning notifications | Multiple alerts | Limited warnings |

| Liquidation threshold | More conservative | Often more aggressive |

| Time to respond | Longer window | Shorter window |

| User controls | More options to prevent | Fewer prevention options |

DigiFinex offers fee-less spot trading, which might appeal to frequent traders, but their liquidation process can be more stringent.

You should consider how each platform handles market volatility. Coinbase generally provides more protection during market downturns, with clearer DeFi liquidation processes as noted in their educational materials.

The liquidation speed matters too. DigiFinex typically executes liquidations faster, which can be beneficial in rapidly declining markets but might give you less time to react.

Coinbase Vs DigiFinex: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. This aspect provides safety for your assets in case of security breaches or platform insolvency.

Coinbase Insurance Coverage:

- FDIC insurance for USD deposits up to $250,000

- Commercial crime insurance that covers digital assets held in hot wallets

- 98% of customer funds stored in cold storage for additional security

Coinbase maintains a strong insurance position compared to many exchanges in the market. Your USD balances enjoy standard banking protections, while your crypto has additional layers of security.

DigiFinex Insurance Coverage:

- Limited publicly available information about specific insurance policies

- Claims to utilize a security fund for potential compensation in case of breaches

- Employs cold storage security systems for the majority of user assets

DigiFinex appears to offer less transparent insurance protections compared to Coinbase. While they maintain security measures, they don’t provide the same clear insurance guarantees.

When evaluating these platforms, you should consider how important insurance protection is for your investment strategy. If insurance is a top priority, Coinbase offers more clearly defined protections for your assets.

Remember that insurance policies change over time, so it’s wise to verify current coverage details directly with each platform before making your decision.

Coinbase Vs DigiFinex: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your experience. Both Coinbase and DigiFinex offer support options, but they differ in quality and responsiveness.

Coinbase provides multiple support channels including email, phone support, and an extensive help center. Many users find their documentation helpful for solving common issues without waiting for agent assistance.

However, Coinbase has faced criticism for slow response times during high-volume periods. Search results indicate that some users report “poor customer service” experiences, especially when dealing with account issues or transaction problems.

DigiFinex also offers customer support options, but according to search results, their support team may be “less responsive than Coinbase’s.” This could be important if you need quick help with trading problems or account access.

Both platforms provide community forums where users can find answers to common questions. These peer-to-peer resources often provide faster solutions than waiting for official support.

Response time is especially critical during market volatility when you might need immediate assistance. In these situations, Coinbase typically has more resources but can still be overwhelmed by high ticket volumes.

For new cryptocurrency users, Coinbase’s more established support infrastructure may feel more reassuring. DigiFinex might require you to be more self-sufficient when troubleshooting issues.

Coinbase Vs DigiFinex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and DigiFinex offer strong security features, but with notable differences.

Coinbase is known for its industry-leading security measures. They store 98% of customer funds in offline cold storage, protecting your assets from online threats.

Coinbase also offers two-factor authentication (2FA), biometric fingerprint logins, and insurance against breaches. Your USD deposits are FDIC-insured up to $250,000, giving you extra peace of mind.

DigiFinex also emphasizes security with its own robust features. The platform uses multi-signature technology and cold storage solutions to protect user funds.

DigiFinex implements strict KYC (Know Your Customer) procedures and offers 2FA. Their security system includes real-time monitoring and risk control mechanisms.

Here’s a quick comparison of key security features:

| Security Feature | Coinbase | DigiFinex |

|---|---|---|

| Cold Storage | 98% of funds | Yes (percentage unspecified) |

| Two-Factor Authentication | Yes | Yes |

| Biometric Login | Yes | Limited |

| Insurance | Yes | Not clearly specified |

| FDIC Insurance | Yes (USD only) | No |

| Multi-signature | Yes | Yes |

Coinbase has a stronger reputation for security and more transparent policies. Their regulatory compliance in major markets like the US adds an extra layer of security assurance.

DigiFinex offers solid security features but with less transparency about specific protective measures compared to Coinbase.

Is Coinbase A Safe & Legal To Use?

Coinbase is considered one of the safest cryptocurrency exchanges available today. It operates legally in over 100 countries and complies with financial regulations in the regions it serves.

The platform implements extensive security measures to protect your investments. These include:

- 98% of customer funds stored offline in cold storage

- AES-256 encryption for digital wallets

- Two-factor authentication (2FA)

- Biometric fingerprint logins

- FDIC insurance for USD balances (up to $250,000)

Despite these protections, some customers have reported unauthorized access issues. To maximize your security on Coinbase, always enable all available security features and use strong, unique passwords.

Coinbase is a publicly-traded company on the NASDAQ (COIN), which means it faces strict oversight and transparency requirements. This adds an extra layer of legitimacy compared to many other exchanges.

When using Coinbase, you benefit from their intuitive interface designed for beginners. The platform makes it easy to buy, sell, and store cryptocurrencies without technical knowledge.

Remember that while Coinbase itself is secure, cryptocurrency investments carry inherent risks. Never invest more than you can afford to lose, and consider using a hardware wallet for long-term storage of large amounts.

Is DigiFinex A Safe & Legal To Use?

DigiFinex has been operating since 2017 and has built a mixed reputation in the crypto space. Some users consider it safe and legitimate based on its longevity and range of services.

The exchange offers all-in-one crypto services for buying popular assets. However, safety opinions vary significantly across different sources.

Some reports indicate DigiFinex handles its proof of reserves in-house rather than using third-party auditors. This self-monitoring approach might raise questions about transparency compared to exchanges with external verification.

Security considerations:

- No major hacks reported since its founding

- In-house management of reserve verification

- Mixed user feedback regarding safety

When considering legality, DigiFinex operates in various jurisdictions, but you should verify if it’s permitted in your specific location before using it.

For maximum security, many experts recommend not keeping large amounts of cryptocurrency on any exchange. While some users choose to leave small amounts on DigiFinex for convenience, larger holdings are typically safer in personal wallets.

Remember that even legitimate exchanges carry risks. If you decide to use DigiFinex, enable all available security features like two-factor authentication and use strong, unique passwords to protect your account.

Frequently Asked Questions

Choosing between Coinbase and DigiFinex involves understanding key differences in their features, fees, and available cryptocurrencies. These platforms each offer unique advantages for different types of traders and investors.

What features distinguish Coinbase from DigiFinex as a cryptocurrency exchange platform?

Coinbase offers a more beginner-friendly interface with educational resources and a simple design. You’ll find staking options, a robust mobile app, and integration with various payment methods.

DigiFinex provides more advanced trading tools, including margin trading and futures contracts. The platform focuses on offering all-in-one services with more complex trading options for experienced users.

Coinbase includes a built-in wallet service and regulated status in many countries, making it appealing to institutional investors. DigiFinex emphasizes its wealth management services and variety of trading pairs.

Are there any geographic restrictions affecting who can trade on Coinbase and DigiFinex?

Coinbase operates in over 100 countries but has notable restrictions in certain regions. You cannot use Coinbase in countries under U.S. sanctions or where cryptocurrency trading faces heavy regulation.

DigiFinex has fewer geographic restrictions and serves more international markets. However, it still blocks users from some countries with strict crypto regulations.

U.S. traders have full access to Coinbase but may face limitations on DigiFinex due to regulatory compliance issues. Always check the current country availability before creating an account on either platform.

How do Coinbase and DigiFinex compare in terms of security measures and user privacy?

Coinbase maintains industry-leading security with 98% of assets stored in cold wallets, two-factor authentication, and insurance coverage for digital assets. Your funds benefit from regular security audits and compliance with financial regulations.

DigiFinex implements multi-signature wallets, cold storage systems, and real-time monitoring. The platform offers similar authentication options but has less transparent insurance policies.

Both exchanges require KYC (Know Your Customer) verification, but Coinbase follows stricter compliance standards due to its U.S. base. DigiFinex offers slightly more privacy but still adheres to standard verification requirements.

What are the transaction fees associated with Coinbase and DigiFinex, and how do they compare?

Coinbase charges higher fees than many competitors, with transaction fees ranging from 0.5% to 4.5% depending on payment method and transaction size. You’ll also pay spread fees when converting between cryptocurrencies.

DigiFinex offers more competitive trading fees, typically around 0.2% for makers and takers. Volume-based discounts benefit active traders with progressively lower costs.

Coinbase Pro (now Advanced Trade) provides lower fees for active traders, but DigiFinex generally offers better fee structures overall. Both platforms charge network fees for withdrawals that vary by cryptocurrency.

Which platform between Coinbase and DigiFinex offers a wider range of cryptocurrencies for trading?

DigiFinex supports a significantly larger selection of cryptocurrencies and trading pairs than Coinbase. You can access hundreds of altcoins and tokens on DigiFinex, including many smaller market cap options.

Coinbase takes a more selective approach, listing fewer cryptocurrencies but ensuring each meets strict security and regulatory standards. You’ll find most major cryptocurrencies but fewer speculative tokens.

The difference in cryptocurrency selection reflects each platform’s focus: Coinbase emphasizes regulatory compliance while DigiFinex prioritizes variety and trading options for experienced traders.

How do the customer support services of Coinbase and DigiFinex compare in terms of efficiency and reliability?

Coinbase offers email support, a comprehensive help center, and phone support for specific issues. Response times have improved recently, but you may still experience delays during high volume periods.

DigiFinex provides 24/7 customer service through multiple channels including live chat, which often delivers faster response times than Coinbase. Support is available in several languages.

Both platforms struggle during market volatility periods with increased support tickets. Coinbase has more resources but serves more customers, while DigiFinex typically provides more personalized assistance for technical issues.

DigiFinex Vs Coinbase Conclusion: Why Not Use Both?

Both DigiFinex and Coinbase offer valuable services for crypto traders and investors, each with their own strengths.

DigiFinex stands out with high liquidity, low trading fees, and a full ecosystem of trading options. It also offers wealth management tools and even a crypto card for users who want more from their exchange.

Coinbase excels in user-friendly design, strong security measures, and regulatory compliance. It’s often the go-to choice for beginners entering the crypto space.

You might consider using both platforms to maximize benefits. Use Coinbase for its ease of use and security when you’re starting out or making simple trades.

Turn to DigiFinex when you need access to more trading options or want to take advantage of their lower fees for larger trades.

Remember that regardless of which platform you choose, it’s generally best not to leave large amounts of crypto on any exchange long-term. While both platforms have security measures, keeping significant holdings in personal wallets adds an extra layer of protection.

Consider your trading needs, security concerns, and comfort level when deciding which platform works best for you—or whether using both makes the most sense for your crypto strategy.