Choosing the right cryptocurrency exchange can impact your trading experience and financial outcomes. Coinbase and Deepcoin represent two different options in the crypto marketplace, each with unique features and limitations to consider. While Coinbase is widely recognized for its user-friendly interface and regulatory compliance, Deepcoin offers alternative trading options that might appeal to different types of investors.

These exchanges differ in several key areas including fee structures, available cryptocurrencies, and trading capabilities. Coinbase, established longer in the market, provides access to mainstream cryptocurrencies with straightforward buying and selling options. Deepcoin, by comparison, may offer different trading pairs and features not found on Coinbase.

Understanding these differences can help you make better decisions about where to conduct your cryptocurrency transactions. The right choice depends on your specific needs, trading volume, and comfort level with various platform features.

Coinbase Vs Deepcoin: At A Glance Comparison

When comparing Coinbase and Deepcoin exchanges, several key differences stand out. This quick comparison will help you decide which platform might better suit your cryptocurrency trading needs.

Coinbase has earned a higher overall trust score (6.0) compared to Deepcoin, according to the search results. This reflects Coinbase’s established reputation in the market.

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | Higher | Varies by crypto |

| Deepcoin | Lower | Varies by crypto |

Coinbase is widely recognized as beginner-friendly with an intuitive interface. The platform offers robust security features and is regulated in several countries.

Deepcoin supports more cryptocurrencies than Coinbase, giving you access to a wider range of digital assets. This might be important if you’re looking to trade less common tokens.

Key Features:

- Coinbase: Strong regulatory compliance, insurance on USD deposits, extensive educational resources

- Deepcoin: More trading pairs, generally lower fees, advanced trading tools

Coinbase provides better customer support options and more deposit methods, including bank transfers, credit cards, and PayPal in many regions.

Deepcoin offers more advanced trading types and tools that might appeal to experienced traders looking for sophisticated options.

Your choice between these exchanges should depend on your trading experience, which cryptocurrencies you want to access, and your preference for either lower fees or a more established reputation.

Coinbase Vs Deepcoin: Trading Markets, Products & Leverage Offered

Coinbase and Deepcoin offer different trading options for crypto investors. Let’s compare what each platform provides.

Coinbase features over 200 cryptocurrencies for spot trading, making it one of the most comprehensive exchanges for buying and selling digital assets directly. You can access major coins like Bitcoin, Ethereum, and hundreds of altcoins.

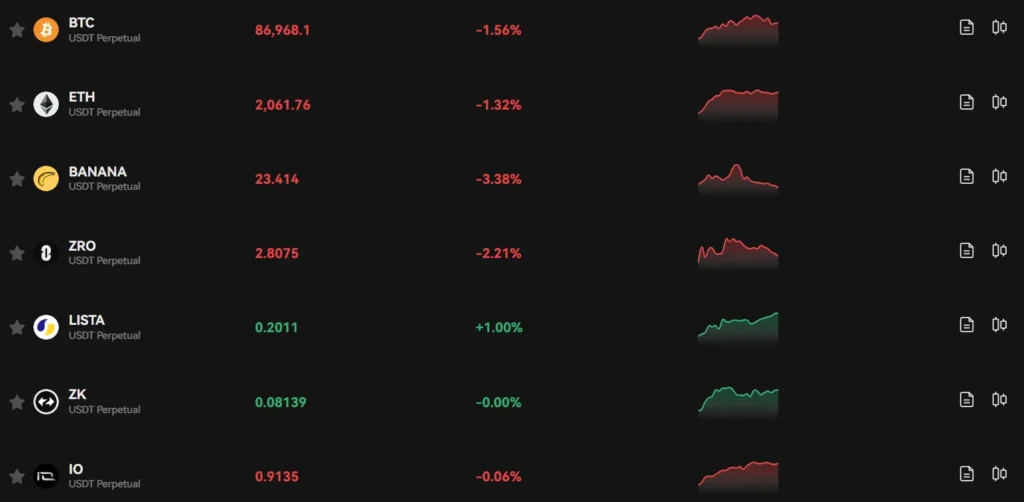

Deepcoin specializes in derivatives trading with a focus on futures contracts and perpetual swaps. The platform supports around 100+ trading pairs for derivatives.

Leverage Options:

- Coinbase: Limited leverage (up to 5x) on select products

- Deepcoin: High leverage options (up to 125x) on futures trading

Product Comparison:

| Feature | Coinbase | Deepcoin |

|---|---|---|

| Spot Trading | ✓ (200+ coins) | ✓ (Limited selection) |

| Futures | Limited offerings | ✓ (100+ pairs) |

| Perpetual Swaps | Limited | ✓ |

| Options | ✓ | Limited |

| Max Leverage | 5x | Up to 125x |

Coinbase provides a more regulated environment with fewer high-risk products. This makes it better suited for beginners and conservative traders.

Deepcoin targets advanced traders looking for higher leverage and more sophisticated derivatives tools. You’ll find more trading pairs specifically designed for futures trading.

Both platforms offer mobile apps and desktop interfaces, but you’ll notice Coinbase has a more user-friendly design while Deepcoin focuses on technical tools for active traders.

Coinbase Vs Deepcoin: Supported Cryptocurrencies

When choosing between Coinbase and Deepcoin, the range of supported cryptocurrencies is an important factor to consider.

Coinbase offers a wider selection of cryptocurrencies compared to Deepcoin. Based on current information, Coinbase supports more digital assets for trading and investing.

This difference matters if you’re looking to diversify your crypto portfolio or access specific tokens. With more options available, Coinbase may be the better choice for traders who want variety.

Here’s a simple comparison of their cryptocurrency support:

| Exchange | Cryptocurrency Support |

|---|---|

| Coinbase | Larger selection |

| Deepcoin | Fewer options |

It’s worth noting that DeepCoin (DC) is not currently available for trading on Coinbase. If you’re specifically interested in this token, you’ll need to look elsewhere.

Both exchanges continue to add new cryptocurrencies over time. However, Coinbase typically leads in listing mainstream and established tokens first.

Before choosing your platform, check if the specific cryptocurrencies you want to trade are available. This ensures you won’t need to create accounts on multiple exchanges to access all your preferred tokens.

The cryptocurrency options may influence your choice depending on your trading goals and investment strategy.

Coinbase Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and Deepcoin, understanding the fee structure is essential for your trading strategy.

According to recent 2025 data, Coinbase offers competitive trading fees of up to 0.60%, which appears to be lower than Deepcoin’s rates. This difference can significantly impact your profits, especially if you trade frequently.

For deposits and withdrawals, Coinbase stands out by charging no fees for ACH transfers from U.S. banks. This makes it cost-effective if you regularly move funds between your bank account and trading platform.

Here’s a quick comparison of the fees:

| Fee Type | Coinbase | Deepcoin |

|---|---|---|

| Trading Fees | Up to 0.60% | Higher than Coinbase |

| ACH Deposits | Free | Varies |

| ACH Withdrawals | Free | Varies |

The fee structure can vary based on your trading volume and account level. Higher-volume traders might qualify for lower fees on both platforms.

Be aware that both exchanges may charge different rates for various cryptocurrencies. Some tokens might have higher withdrawal fees depending on network congestion.

Consider your trading habits when deciding between these platforms. If you make frequent trades or multiple deposits/withdrawals, even small fee differences can add up quickly.

Coinbase Vs Deepcoin: Order Types

When trading cryptocurrencies, the types of orders available can make a big difference in your trading strategy. Both Coinbase and Deepcoin offer various order types, but they differ in some important ways.

Coinbase provides several order types through its Advanced Trading platform. You can place market orders that execute immediately at the current market price. These orders cannot be canceled since they fill right away.

Limit orders are also available on Coinbase. These let you set a specific price at which you want to buy or sell. Your order will only execute if the market reaches your set price.

Coinbase also offers stop-limit orders, which combine features of stop and limit orders. These are useful for setting automatic buys or sells when prices reach certain levels.

Deepcoin offers similar basic order types including market and limit orders. However, some users report that Deepcoin provides additional advanced order types that might appeal to experienced traders.

The user interface for placing orders differs between the platforms. Coinbase is known for its clean, beginner-friendly design that makes placing orders straightforward.

Order Type Comparison

| Order Type | Coinbase | Deepcoin |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| Bracket Orders | ✓ | Limited |

Remember that Coinbase scores higher overall (9.6) compared to Deepcoin, which may reflect better execution and reliability of their order system.

Coinbase Vs Deepcoin: KYC Requirements & KYC Limits

Coinbase and Deepcoin differ significantly in their KYC (Know Your Customer) approaches. These differences might influence which platform you choose.

Coinbase follows strict KYC requirements in compliance with local regulations. You must verify your identity to use their platform, even for basic trading. This typically involves submitting government-issued ID and proof of address.

Your account limits on Coinbase vary based on your verification level, location, and payment method. These limits act as financial safeguards to protect your account.

In contrast, Deepcoin operates with more flexible KYC policies. According to search results, Deepcoin has no mandatory KYC checks in place. This means you can trade on the exchange without revealing your identity.

This lack of mandatory verification makes Deepcoin appealing if you value privacy. However, it’s important to understand the potential implications.

KYC Comparison Table:

| Feature | Coinbase | Deepcoin |

|---|---|---|

| KYC Required | Yes (mandatory) | No (optional) |

| ID Verification | Government ID needed | Not required for basic trading |

| Trading Without Verification | Not possible | Possible |

| Account Limits | Vary by verification level | Fewer restrictions |

Remember that while less KYC might seem convenient, regulated exchanges like Coinbase offer additional security and consumer protections. Your choice should balance privacy preferences with security needs.

Coinbase Vs Deepcoin: Deposits & Withdrawal Options

Coinbase and Deepcoin offer different options when it comes to depositing and withdrawing funds. Understanding these differences can help you choose the exchange that best fits your needs.

Coinbase Deposit Methods:

- Bank transfers (ACH)

- Wire transfers

- Credit/debit cards

- PayPal (in some regions)

- Cryptocurrency deposits

Coinbase supports fiat currency deposits in USD, EUR, GBP and several other currencies. This makes it accessible for users who want to convert traditional money to crypto.

Deepcoin Deposit Methods:

- Cryptocurrency deposits

- Limited fiat options

- Third-party payment processors

Deepcoin primarily focuses on crypto-to-crypto transactions. Its fiat options are more limited compared to Coinbase, which might be inconvenient if you’re looking to use traditional currency.

Withdrawal Speeds:

Coinbase typically processes crypto withdrawals within minutes, while fiat withdrawals can take 1-5 business days depending on your region and withdrawal method.

Deepcoin handles crypto withdrawals within 24 hours in most cases. The platform has fewer fiat withdrawal options than Coinbase.

Fees Comparison:

| Coinbase | Deepcoin | |

|---|---|---|

| Deposit Fees | Varies by method (0-3.99%) | Lower for crypto deposits |

| Withdrawal Fees | Flat network fee + variable fee | Competitive crypto withdrawal fees |

Deepcoin generally offers lower withdrawal fees for cryptocurrencies, while Coinbase provides more options for fiat transactions but at potentially higher costs.

Coinbase Vs Deepcoin: Trading & Platform Experience Comparison

Coinbase offers a user-friendly platform designed specifically for beginners entering the crypto world. You’ll find a clean interface with basic trading options that make it easy to buy, sell, and hold cryptocurrencies.

Deepcoin, in contrast, caters more to experienced traders with advanced trading features. The platform supports more complex trading types without requiring significant documentation from users.

User Interface

- Coinbase: Simple, intuitive design with guided processes

- Deepcoin: More complex layout with advanced trading tools

Coinbase is highly regulated and emphasizes security, making it a trusted choice for new investors. You’ll have access to educational resources that help you understand crypto basics.

Deepcoin provides a global trading experience with fewer restrictions. This means you can access more trading options but with potentially less regulatory protection.

Trading Features Comparison:

| Feature | Coinbase | Deepcoin |

|---|---|---|

| Beginner-friendly | ✓✓✓ | ✓ |

| Advanced trading tools | ✓ | ✓✓✓ |

| Fiat currency support | Yes | Limited |

| Documentation requirements | Stricter | Minimal |

| Mobile experience | Excellent | Good |

You’ll find Coinbase charges higher fees than Deepcoin, which is often the trade-off for its beginner-friendly approach and regulatory compliance.

Both platforms offer mobile apps, but Coinbase’s app maintains the simplicity of its desktop version while Deepcoin’s mobile experience preserves most advanced trading capabilities.

Coinbase Vs Deepcoin: Liquidation Mechanism

Liquidation mechanisms play a vital role in crypto trading platforms, especially when using leverage. These systems protect both users and the platform when trades go against expectations.

Deepcoin offers a Dual-price liquidation protection mechanism specifically designed to safeguard traders using high leverage. This system helps prevent major losses that often happen during volatile market movements.

Coinbase, while not emphasizing a specific named liquidation system like Deepcoin, still maintains robust liquidation processes within its DeFi offerings. Coinbase’s liquidation triggers when collateral value drops below established thresholds.

Key Differences in Liquidation Approaches:

| Feature | Deepcoin | Coinbase |

|---|---|---|

| Protection Type | Dual-price mechanism | Threshold-based system |

| Target Users | High-leverage traders | Broader DeFi users |

| Support | 24/7 multi-lingual | Standard support channels |

When choosing between these platforms, consider your trading style. If you frequently use high leverage, Deepcoin’s specialized protection might appeal to you more.

Both platforms aim to minimize unexpected losses, but they approach this goal differently. Deepcoin focuses on preventing liquidation shocks for leveraged positions, while Coinbase implements more traditional collateral monitoring.

Your risk tolerance and trading frequency should guide your choice between these platforms’ liquidation systems.

Coinbase Vs Deepcoin: Insurance

When choosing a crypto exchange, insurance protection is a key factor to consider for your security. Let’s look at how Coinbase and Deepcoin compare in this important area.

Coinbase offers crime insurance that protects a portion of digital currencies held in their storage systems against theft losses. This provides a safety net if their platform gets hacked.

It’s important to note that Coinbase is not an FDIC-insured bank. This means cryptocurrency on Coinbase doesn’t receive the same government protections as traditional bank deposits.

For specific assets in hot storage (online wallets), Coinbase maintains insurance against certain types of breaches. However, this insurance doesn’t cover individual account compromises resulting from personal security failures.

Deepcoin’s insurance details aren’t as clearly documented as Coinbase’s. Based on the available search results, Deepcoin scores lower overall compared to Coinbase’s 9.6 rating, which may reflect differences in security features.

When comparing the two platforms:

| Feature | Coinbase | Deepcoin |

|---|---|---|

| Insurance Type | Crime insurance | Limited information available |

| Coverage | Portion of digital assets against theft | Unclear |

| Transparency | Detailed information provided | Limited public details |

| FDIC Status | Not FDIC-insured | Not FDIC-insured |

You should contact Deepcoin directly for specific information about their current insurance policies before making your decision.

Coinbase Vs Deepcoin: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Let’s see how Coinbase and Deepcoin compare in this area.

Coinbase Support Options:

- Email support

- Phone support (limited hours)

- Help center with FAQs

- Social media channels

Coinbase has built a reputation for reliable but sometimes slow customer service. Response times can range from a few hours to several days depending on your issue and support volume.

Deepcoin Support Options:

- 24/7 multilingual support

- One-minute response time (as advertised)

- Live chat

- Email support

According to search results, Deepcoin emphasizes its quick response times and round-the-clock availability. They claim to offer solutions to users with a one-minute response time.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| Coinbase | Hours to days | No |

| Deepcoin | Minutes (claimed) | Yes |

Your experience may vary based on the complexity of your issue. Simple questions on both platforms typically receive faster responses than complicated account issues.

Language support is another factor to consider. Deepcoin promotes multilingual support, which can be valuable if English isn’t your primary language.

For new crypto users, Coinbase’s extensive help center provides educational resources that might solve your problem without contacting support directly.

Coinbase Vs Deepcoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and Deepcoin offer various security measures to protect your assets, but they differ in their approaches.

Coinbase Security Features:

- 98% of assets stored in cold wallets (offline storage)

- Two-factor authentication (2FA)

- AES-256 encryption for digital wallets

- FDIC insurance on USD balances (up to $250,000)

- Regular security audits and bug bounty programs

Coinbase has built a strong reputation for security over the years. They’ve implemented strict measures that follow regulatory requirements in various countries where they operate.

Deepcoin Security Features:

- Hot and cold wallet structure for asset isolation

- Multi-signature technology for transactions

- Advanced encryption standards

- Regular security assessments

Deepcoin uses a combined hot and cold wallet structure to secure assets through isolated methods. This helps protect your funds from potential online threats.

You’ll find that both platforms employ industry-standard security protocols. However, Coinbase has a longer track record and more transparency regarding its security practices.

For additional protection, both exchanges allow you to set up 2FA, withdrawal limits, and IP address verification. These features give you more control over your account security.

Remember to always use strong passwords and enable all available security features regardless of which platform you choose.

Is Coinbase Safe & Legal To Use?

Coinbase is generally considered a safe platform for buying, selling, and storing cryptocurrency. It is a U.S.-based company that follows strict security protocols to protect user assets and data.

The platform uses several security measures to keep your funds safe. These include two-factor authentication (2FA), biometric fingerprint logins, and insurance against certain types of losses.

Coinbase’s digital wallets are non-custodial, which means the company cannot access them. This adds an extra layer of security for your crypto assets.

From a legal standpoint, Coinbase operates as a regulated financial institution in the United States. It is licensed in most U.S. states and many countries worldwide.

Important security note: The SEC filed a lawsuit against Coinbase in 2023, claiming it operated as an illegal securities exchange. This case is still ongoing and may affect how Coinbase operates in the future.

When using Coinbase, you should take these safety precautions:

- Enable two-factor authentication

- Use a strong, unique password

- Be wary of phishing attempts

- Consider moving large amounts to a hardware wallet

Remember that while Coinbase itself is secure, your account could still be compromised if you don’t follow good security practices.

Compared to Deepcoin, Coinbase offers a smoother user experience and has a stronger reputation for security in the cryptocurrency market.

Is Deepcoin Safe & Legal To Use?

Deepcoin offers several security features to protect user funds. The exchange uses a hot and cold wallet structure that keeps assets secure through isolated methods. It also has a self-developed third-generation trading system for added protection.

While Deepcoin allows US investors to use its platform, there are important considerations regarding legal protection. US traders can access Deepcoin, but they will have no fund protection if issues arise.

Regarding regulation, Deepcoin appears to operate with less regulatory oversight than Coinbase. Remember that regulation isn’t strictly required for a cryptocurrency exchange to be reliable, but it does provide additional user protection that Deepcoin may lack.

When considering safety, keep these points in mind:

- Deepcoin uses dual-price liquidation for additional security

- The platform employs hot and cold wallet separation

- US users have access but limited legal protections

- The exchange has fewer regulatory safeguards than Coinbase

Your risk tolerance should guide your decision. If strong regulatory oversight and guaranteed fund protection are important to you, Deepcoin might present more risks than alternatives like Coinbase, which operates under stricter regulatory frameworks.

Frequently Asked Questions

When comparing Coinbase and Deepcoin, several key differences emerge in their features, fees, security measures, and available cryptocurrencies. Users often have specific questions about which platform might better suit their trading needs.

What are the key differences between trading fees on Coinbase and Deepcoin?

Coinbase generally charges higher fees than Deepcoin. You’ll typically pay between 0.5% to 4.5% per transaction on Coinbase, depending on your payment method and transaction size.

Deepcoin offers more competitive fee structures with trading fees starting around 0.1% for makers and 0.2% for takers. This significant difference can impact your profitability, especially if you’re an active trader.

Coinbase Pro (now Advanced Trade) provides slightly lower fees than the standard Coinbase platform but still tends to be more expensive than Deepcoin’s fee schedule.

How does the security of Coinbase compare to that of Deepcoin?

Coinbase is widely recognized for its robust security measures. You benefit from 98% of assets stored in cold storage, FDIC insurance on USD balances (up to $250,000), and advanced encryption protocols.

Coinbase also offers multiple 2FA options and has a strong track record of security with no major breaches since its founding in 2012.

Deepcoin employs security measures like cold storage and encryption, but lacks the same level of regulatory oversight as Coinbase. You should note that Deepcoin doesn’t offer FDIC insurance protection for your fiat deposits.

What range of cryptocurrencies is available on Coinbase versus Deepcoin?

Coinbase supports over 200 cryptocurrencies for trading. You can access major coins like Bitcoin, Ethereum, and Solana, along with many altcoins and tokens.

Deepcoin offers a wider selection with support for over 400 cryptocurrencies. This includes many newer and smaller market cap tokens that might not be available on Coinbase.

The broader selection on Deepcoin can be advantageous if you’re looking to trade emerging cryptocurrencies or want access to more niche tokens.

Which platform between Coinbase and Deepcoin offers better tools for advanced traders?

Deepcoin provides more advanced trading features. You’ll find futures trading, options, leveraged tokens, and margin trading with up to 125x leverage in some markets.

The platform also offers more detailed charting tools and technical analysis indicators that experienced traders often require.

Coinbase Advanced Trade (formerly Coinbase Pro) provides professional charts and limit orders, but lacks the derivatives and high-leverage options that Deepcoin offers. For beginners, Coinbase’s simpler interface may be preferred.

How do user experiences differ when using Coinbase versus Deepcoin?

Coinbase offers a more intuitive, user-friendly experience designed with beginners in mind. You’ll find educational resources, a clean interface, and simplified trading options.

The mobile app for Coinbase is highly rated and provides nearly all the functionality of the desktop version.

Deepcoin’s interface is more complex and geared toward experienced traders. You might find the learning curve steeper, but the platform offers more advanced features and trading options that experienced users value.

What are the customer support options for Coinbase and Deepcoin?

Coinbase provides email support, an extensive help center, and phone support for certain account issues. You can access their support through the website or mobile app.

Response times on Coinbase can vary, with some users reporting delays during high-volume periods.

Deepcoin offers 24/7 customer service primarily through chat and email. Support is available in multiple languages, but some users report inconsistent response quality.

Neither platform offers extensive person-to-person support, which is typical for crypto exchanges that handle high volumes of users.

Coinbase vs Deepcoin Conclusion: Why Not Use Both?

When comparing Coinbase and Deepcoin, each platform offers unique benefits that might appeal to different types of crypto users. Based on the search results, Coinbase provides a smoother user experience, making it ideal for beginners.

Deepcoin, while perhaps not as user-friendly, likely offers its own advantages such as different fee structures or trading options.

You don’t always have to choose just one platform. Many crypto traders use multiple exchanges to take advantage of different features, fee structures, and available cryptocurrencies.

Benefits of using both platforms:

- Access to more cryptocurrencies and trading pairs

- Ability to compare fees and get the best rates

- Reduced risk by not keeping all assets on one exchange

- Take advantage of specific features unique to each platform

If you’re new to cryptocurrency, you might start with Coinbase for its ease of use. As you gain experience, you could add Deepcoin to your toolkit for its specific offerings.

Remember to consider security practices when using multiple exchanges. Use strong, unique passwords and enable two-factor authentication on all your accounts.

By diversifying your exchange usage, you can create a more flexible trading strategy that adapts to market conditions and your evolving needs as a crypto user.