Choosing the right crypto exchange can make a big difference in your trading experience. Coinbase and BYDFi are two popular options with different features that might suit different types of traders.

While Coinbase operates as a centralized exchange focusing on user-friendly features and regulatory compliance, BYDFi functions on a more decentralized model where it doesn’t hold users’ funds directly. This fundamental difference shapes how each platform handles security, fees, and available trading options.

You’ll want to consider several factors when deciding between these exchanges. Coinbase is well-known for its simple interface and strong security measures, making it ideal for beginners. BYDFi offers more advanced trading options and potentially lower fees, which might appeal to experienced traders looking for specific features beyond the basics.

Coinbase Vs BYDFi: At A Glance Comparison

Coinbase and BYDFi are popular cryptocurrency exchanges that offer different features and services. Here’s a quick comparison to help you decide which platform might better suit your needs.

User Experience: Coinbase offers a user-friendly interface designed for beginners. BYDFi provides a trading platform that balances simplicity with advanced tools.

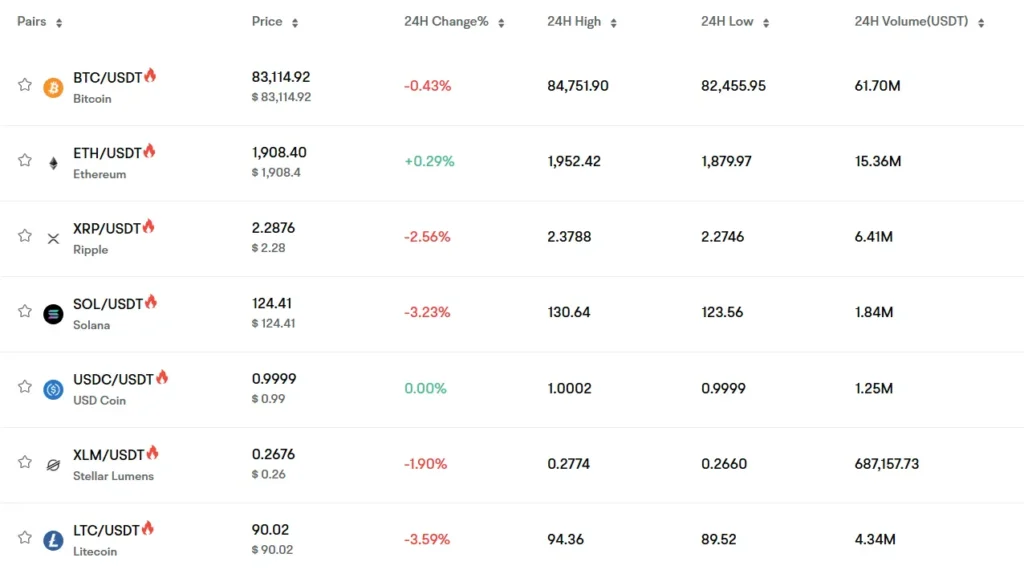

Available Cryptocurrencies: Coinbase supports a wide range of established cryptocurrencies. BYDFi offers many trading pairs but may include more emerging tokens.

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | Higher (0.5% – 4.5%) | Varies by cryptocurrency |

| BYDFi | Lower (typically 0.1% – 0.2%) | Varies by cryptocurrency |

Security Features: Both exchanges prioritize security but implement different measures. Coinbase is known for its strong regulatory compliance and insurance policies. BYDFi focuses on technical security protocols.

Additional Services: Coinbase offers educational resources, staking options, and a Visa debit card. BYDFi provides futures trading, copy trading, and often higher interest rates on crypto deposits.

Mobile Experience: You can access both platforms via mobile apps. Coinbase has a more established app with higher ratings. BYDFi’s app offers more advanced trading features.

Customer Support: Response times and support quality vary between the platforms. Coinbase has more extensive support resources but can be slower to respond during high-volume periods.

Coinbase Vs BYDFi: Trading Markets, Products & Leverage Offered

Coinbase and BYDFi offer different trading options that may affect your choice between them.

Markets Available:

- Coinbase: Offers 200+ cryptocurrencies with fiat pairs (USD, EUR, GBP)

- BYDFi: Provides 100+ crypto assets with spot and derivatives markets

Product Differences:

| Feature | Coinbase | BYDFi |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | Limited | Extensive |

| Leverage | Up to 5x | Up to 200x |

| Staking | ✓ | ✓ |

| NFT Marketplace | ✓ | ✗ |

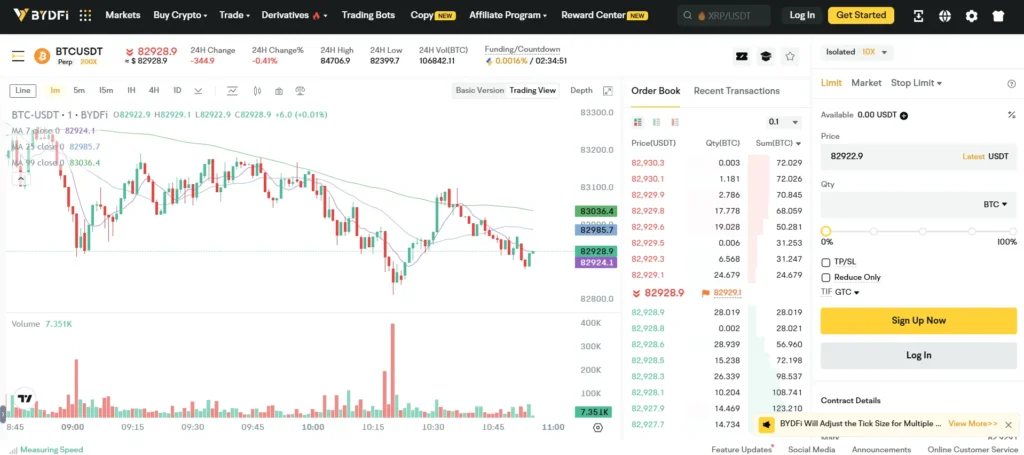

BYDFi stands out with its leverage options. You can trade with up to 200x leverage on certain pairs, making it attractive if you’re looking for higher-risk, higher-reward opportunities.

Coinbase focuses more on being beginner-friendly with a simpler product lineup. Their platform emphasizes spot trading and basic investment options.

Trading Tools:

Coinbase provides educational resources and a clean interface suitable for newcomers. Charts and analysis tools are basic but functional.

BYDFi offers more advanced trading tools with detailed charts, technical indicators, and customizable interfaces. These features cater to experienced traders who need deeper market analysis.

Your trading style should guide your choice. Choose Coinbase if you prefer simplicity and mainstream cryptocurrencies. Pick BYDFi if you need high leverage and advanced trading options.

Coinbase Vs BYDFi: Supported Cryptocurrencies

When choosing a cryptocurrency exchange, the variety of available digital assets is a key factor to consider. Coinbase and BYDFi offer different selections that may influence your decision.

Coinbase supports a larger number of cryptocurrencies compared to BYDFi. This gives you more options when diversifying your crypto portfolio. Coinbase regularly adds new tokens and coins to its platform.

BYDFi, while offering fewer cryptocurrencies, focuses on providing strong support for its listed assets. The exchange emphasizes quality over quantity in its selection.

Here’s a quick comparison of supported assets:

| Feature | Coinbase | BYDFi |

|---|---|---|

| Number of cryptocurrencies | Higher | Lower |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | Extensive | Limited |

| New token additions | Frequent | Occasional |

If you’re looking to trade popular cryptocurrencies like Bitcoin and Ethereum, both platforms will meet your needs. However, for more obscure altcoins or newer tokens, Coinbase likely offers better coverage.

BYDFi operates on a decentralized model, which affects how it lists and supports various cryptocurrencies. This approach focuses on security but may limit the range of available assets.

Your choice between these platforms might depend on whether you value having access to a wide variety of cryptocurrencies or prefer focusing on a more select group of digital assets.

Coinbase Vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and BYDFi, fees play a crucial role in your decision. These costs can significantly impact your trading profits over time.

Trading Fees:

- Coinbase: 1.49% to 3.99% per transaction

- BYDFi: More competitive fee structure (specific rates vary by trading volume)

BYDFi generally offers lower trading fees than Coinbase, making it potentially more cost-effective for frequent traders.

Withdrawal Fees:

- Coinbase: Up to $60 per withdrawal

- BYDFi: Up to 3% per withdrawal

Daily Trading Limits:

- Coinbase: Varies by account level

- BYDFi: Up to $25,000 daily

For deposits, BYDFi provides multiple options similar to Coinbase, but specific fees depend on your payment method and location.

BYDFi tends to appeal to more advanced traders with its competitive fee structure. However, Coinbase’s higher fees come with a more user-friendly interface that beginners might find valuable.

Your trading volume should influence your choice. If you’re a high-volume trader, BYDFi’s lower fee percentages could save you significant money over time.

Remember that fee structures can change, so always check the exchanges’ current rates before making your decision. Both platforms update their fee policies regularly to stay competitive in the market.

Coinbase Vs BYDFi: Order Types

When trading cryptocurrencies, the types of orders available can greatly impact your strategy. Both Coinbase and BYDFi offer several order options, but they differ in some important ways.

Coinbase provides basic order types through its simple interface. On Coinbase Advanced Trading, you can access:

- Market orders

- Limit orders

- Stop-limit orders

- Bracket orders

These options give you decent control over your trades. Market orders execute immediately at current prices, while limit orders let you set specific buy or sell prices.

BYDFi offers a more extensive range of order types, which includes:

- Market orders

- Limit orders

- Stop-limit orders

- Trailing stop orders

- OCO (One-Cancels-the-Other) orders

- Advanced customizable trading strategies

The trailing stop feature on BYDFi is particularly useful. It automatically adjusts your stop price as the market moves in your favor, helping protect your profits.

For advanced traders, BYDFi’s customizable trading strategies provide more flexibility. You can create complex order combinations that execute based on specific market conditions.

If you’re new to crypto trading, Coinbase’s simpler order selection might be easier to understand. However, experienced traders may prefer BYDFi’s more comprehensive options.

Both platforms have improved their trading features over time, with BYDFi focusing more on catering to active traders who need specialized order types.

Coinbase Vs BYDFi: KYC Requirements & KYC Limits

Both Coinbase and BYDFi require KYC (Know Your Customer) verification, but they differ in their approach and restrictions.

Coinbase KYC Requirements:

- Must be at least 18 years old

- Must live in a country where Coinbase operates

- Must complete identity verification

- Full legal name, address, and date of birth required

- Photo ID verification mandatory

Without completing Coinbase’s KYC process, you cannot make transactions. Their verification process is typically more rigorous, reflecting their status as a regulated U.S.-based exchange.

BYDFi KYC Requirements:

- Basic account creation with email only

- Tiered verification system with different limits

- Less stringent initial verification

- Full verification similar to Coinbase requirements

BYDFi offers more flexibility with their tiered approach to KYC. You can perform basic trading with minimal information, but higher withdrawal limits require more verification.

Trading Limits Comparison:

| Feature | Coinbase | BYDFi |

|---|---|---|

| No KYC | No trading allowed | Limited trading possible |

| Basic KYC | Lower limits | Moderate limits |

| Full KYC | High limits | High limits |

| Withdrawal without KYC | Not possible | Small amounts possible |

BYDFi generally offers more flexibility for users wanting minimal KYC requirements. Coinbase, with its 8.8 million active users compared to BYDFi’s 500,000, maintains stricter compliance with regulations.

Remember that KYC requirements may change based on your location and current regulations.

Coinbase Vs BYDFi: Deposits & Withdrawal Options

When comparing Coinbase and BYDFi, their deposit and withdrawal options are important factors to consider for your trading experience.

Coinbase offers a variety of deposit methods for US users including ACH transfers, wire transfers, and debit/credit cards. You can also deposit cryptocurrencies directly from external wallets.

BYDFi provides fewer fiat deposit options compared to Coinbase. It focuses more on crypto deposits, making it potentially less convenient if you’re new to cryptocurrency.

Withdrawal methods also differ between the two platforms. Coinbase allows withdrawals to bank accounts, PayPal (in supported regions), and external crypto wallets.

BYDFi mainly supports crypto withdrawals to external wallets, with more limited fiat withdrawal options.

Fee comparison:

| Method | Coinbase | BYDFi |

|---|---|---|

| Crypto deposits | Free | Free |

| ACH deposits | Free or small fee | Limited availability |

| Card deposits | Higher fees (up to 3.99%) | Limited availability |

| Crypto withdrawals | Network fee + small platform fee | Network fee |

Processing times vary between the platforms. Coinbase typically processes ACH deposits within 3-5 business days, while crypto transactions depend on network conditions.

BYDFi processing times for crypto movements are comparable, though fiat transactions may take longer due to fewer direct banking relationships.

Before choosing either platform, verify the current deposit and withdrawal options available in your region, as these can change based on regulations.

Coinbase Vs BYDFi: Trading & Platform Experience Comparison

Coinbase offers a simple, user-friendly interface that’s perfect for beginners. You can easily buy, sell, and trade popular cryptocurrencies with just a few clicks. The platform prioritizes simplicity over advanced features.

BYDFi provides a more comprehensive trading experience with advanced charting tools and order types. You get access to more trading pairs and features like futures trading that Coinbase doesn’t offer.

Interface Comparison:

- Coinbase: Clean, intuitive design focused on simplicity

- BYDFi: Feature-rich dashboard with more technical indicators

Coinbase charges higher fees but offers a more polished experience. Trading fees typically range from 0.5% to 1.49% per transaction, which is higher than many competitors.

BYDFi keeps fees lower, with most trading fees under 0.2%. This makes it more appealing if you plan to trade frequently or in larger volumes.

Mobile Experience:

| Feature | Coinbase | BYDFi |

|---|---|---|

| App Design | Very polished | Functional but less refined |

| Features | Basic trading only | Advanced trading options |

| Speed | Fast and responsive | Sometimes slower to load |

You’ll find more educational resources on Coinbase, making it easier to learn as you trade. BYDFi focuses more on providing advanced tools for experienced traders.

Both platforms offer decent security measures, but Coinbase has a longer track record of protecting user funds and complying with regulations.

Coinbase Vs BYDFi: Liquidation Mechanism

When trading on crypto exchanges, understanding liquidation processes is crucial. Liquidation happens when your collateral value drops below required levels for borrowed funds.

Coinbase follows a centralized liquidation model. When your position reaches the liquidation threshold, Coinbase automatically closes it to prevent further losses. You’ll receive notifications before this happens, giving you time to add funds.

BYDFi uses a decentralized liquidation approach. Since BYDFi doesn’t hold your funds directly, the liquidation process works differently from Coinbase’s model.

In DeFi platforms like BYDFi, smart contracts automatically trigger liquidations. These happen when your collateral-to-loan ratio falls below preset thresholds. No human intervention occurs in this process.

Liquidation Thresholds Comparison:

| Exchange | Typical Liquidation Threshold | Warning System | Liquidation Speed |

|---|---|---|---|

| Coinbase | 80-85% of collateral value | Multiple alerts | Gradual |

| BYDFi | Varies by asset pair | Limited alerts | Immediate |

You’ll find BYDFi’s liquidation happens faster due to its decentralized nature. Smart contracts execute without delay when conditions are met.

Coinbase offers more buffer time and communication before liquidation. This gives you more opportunity to add funds or close positions voluntarily.

Your trading style and risk tolerance should guide which liquidation mechanism works better for your needs.

Coinbase Vs BYDFi: Insurance

When choosing a cryptocurrency platform, understanding the insurance coverage is essential for protecting your investments. Let’s compare how Coinbase and BYDFi approach insurance protection.

Coinbase does not have FDIC insurance coverage, which is designed for traditional banks. However, Coinbase maintains a separate insurance policy for digital assets held in their hot wallets.

For USD balances, Coinbase offers some protection. If you’re a US customer, your USD balances may be eligible for FDIC insurance up to $250,000, but only in the specific case of Coinbase’s failure as a company.

BYDFi takes a different approach to security. While specific insurance details are limited, BYDFi focuses on prevention through robust security protocols rather than traditional insurance models.

Neither platform offers comprehensive insurance for crypto assets against market volatility, personal account breaches, or phishing attacks. Your cryptocurrencies are generally not insured against hacking events that aren’t directly related to the platform’s security failure.

When considering your options, remember that security features may be more important than insurance alone. Coinbase offers more comprehensive security measures overall, including two-factor authentication, biometric login options, and cold storage for the majority of user assets.

You should always use strong passwords, enable all available security features, and consider using hardware wallets for long-term storage regardless of which platform you choose.

Coinbase Vs BYDFi: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both Coinbase and BYDFi offer support options, but they differ in several ways.

Coinbase provides support through email, a help center, and a phone line for urgent issues. Their response times typically range from 24-72 hours for email inquiries. Coinbase also offers a comprehensive knowledge base with guides and FAQs.

BYDFi, being a smaller exchange with around 500K users, offers support primarily through email and live chat. Their support team generally responds within 24 hours. They also provide a ticket system for tracking your issues.

Support Channels Comparison:

| Feature | Coinbase | BYDFi |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | Limited | ✓ |

| Phone Support | ✓ | ✗ |

| Help Center | Extensive | Basic |

| Social Media Support | ✓ | ✓ |

Coinbase’s larger size comes with more resources for customer service, but also higher volume of requests. You might wait longer during peak times or market volatility.

BYDFi tends to offer more personalized support due to its smaller user base. However, they have fewer support channels available compared to Coinbase.

Both platforms support English, but Coinbase offers support in more languages, which might be important if English isn’t your first language.

Coinbase Vs BYDFi: Security Features

When choosing between Coinbase and BYDFi, security should be a top priority for your crypto investments. Both platforms offer various security measures to protect your assets.

Coinbase Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Strong emphasis on regular security audits

- Insurance coverage for digital assets

- Complete control over private keys when using Coinbase Wallet

Coinbase serves about 8.8 million active users and has built a reputation for its robust security practices. Their custody solution keeps most crypto assets in offline storage, reducing hack risks.

BYDFi Security Features:

- Two-factor authentication

- Cold storage protection

- Standard encryption protocols

- Smaller user base (approximately 500,000 active users)

BYDFi, while newer to the market, implements standard security measures similar to other exchanges. Their smaller size might mean less attention from potential hackers, but also potentially fewer resources for security development.

You should consider enabling all available security features on whichever platform you choose. This includes using strong passwords, activating 2FA, and being cautious about phishing attempts.

For maximum security with Coinbase, you might want to use Coinbase Wallet since it gives you full control of your private keys. This ownership means you have complete control over your assets rather than trusting the exchange to manage them.

Is Coinbase A Safe & Legal To Use?

Coinbase is one of the most trusted cryptocurrency exchanges in the market. It’s fully regulated and complies with financial laws in the regions where it operates. This includes important regulations like anti-money laundering (AML) and know your customer (KYC) requirements.

When it comes to security, Coinbase stores 98% of customer funds in cold storage. This approach significantly reduces the risk of hacking since most assets are kept offline.

The remaining 2% of funds that stay online for trading are protected by comprehensive security measures. Coinbase also offers additional security features that you can enable:

- Two-factor authentication (2FA)

- Biometric login options

- Email alerts for suspicious activity

- Insurance for digital assets held on the platform

For New York residents wondering about legal compliance, Coinbase is fully licensed to operate in the state. It has obtained the necessary permits to offer cryptocurrency trading services legally.

Your personal and financial information is protected through encryption and secure data handling practices. Many users report positive experiences regarding the safety of connecting payment methods to Coinbase.

Remember that while Coinbase provides strong security, you should still follow good security practices. This includes using strong passwords and enabling all available security features to protect your account.

Is BYDFi A Safe & Legal To Use?

BYDFi takes security seriously with most customer funds held in cold storage, away from potential online threats. This approach helps protect your investments from hackers.

The exchange follows strict compliance procedures and adheres to relevant regulations. This commitment to regulatory compliance helps ensure you’re trading on a legitimate platform.

For US traders, BYDFi is available as a legal alternative to platforms like Bybit, which cannot operate in the United States. This makes BYDFi a viable option if you’re located in the US and looking for a compliant exchange.

BYDFi has implemented advanced security measures to protect user accounts and funds. These security features help safeguard your assets while trading on the platform.

When compared to established exchanges like Coinbase, BYDFi offers competitive security standards. Coinbase keeps 98% of funds in cold storage, and BYDFi follows similar best practices.

Key Security Features:

- Cold storage for majority of user funds

- Compliance with financial regulations

- Advanced security protocols

- Legal availability in the United States

The platform prioritizes user security alongside its trading features, making it both a safe and legal choice for most cryptocurrency traders.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges. These questions focus on fees, security, available coins, ease of use, earning options, and customer support quality.

What are the main differences in fees between Coinbase and BYDFi for cryptocurrency trading?

Coinbase typically charges higher fees than BYDFi for regular trading activities. Standard Coinbase fees range from 0.5% to 4.5% depending on payment method and transaction size.

BYDFi offers more competitive fee structures with maker-taker models that can be significantly lower than Coinbase’s rates. Their fees generally start around 0.1% for makers and 0.15% for takers.

For high-volume traders, BYDFi’s fee schedule becomes even more advantageous as rates decrease with higher trading volumes. Coinbase does offer reduced fees through their Coinbase One subscription service.

How does the security of assets compare between Coinbase and BYDFi?

Coinbase is known for industry-leading security practices. They store 98% of customer funds in offline cold storage and maintain insurance policies against certain types of breaches.

Coinbase is a publicly traded company in the US, which means they face strict regulatory oversight and transparency requirements. This adds an extra layer of security assurance for users.

BYDFi implements strong security measures including two-factor authentication, cold wallet storage, and regular security audits. However, they don’t have the same level of regulatory oversight or insurance coverage as Coinbase.

What variety of cryptocurrencies can be traded on BYDFi versus Coinbase?

Coinbase offers around 200+ cryptocurrencies for trading on their platform. They carefully vet new additions and gradually expand their selection with established tokens.

BYDFi typically provides access to a wider range of cryptocurrencies, including more newly launched and smaller-cap tokens. This gives traders more options for diversification and exposure to emerging projects.

Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. BYDFi tends to list new tokens faster than Coinbase, which follows a more conservative approach.

Which platform, Coinbase or BYDFi, offers more user-friendly trading tools for beginners?

Coinbase is widely recognized for its beginner-friendly interface. Their main platform is intentionally simplified with a clean design that makes buying and selling straightforward for newcomers.

BYDFi offers more advanced trading features and charts that can be overwhelming for complete beginners. However, their platform does include helpful educational resources to help new users learn.

For more experienced traders, BYDFi provides advanced order types, detailed charting tools, and trading bots that Coinbase’s standard platform lacks. Coinbase does offer Coinbase Pro for more advanced trading needs.

Can users earn interest on their holdings with Coinbase or BYDFi, and how do the rates differ?

Both platforms allow users to earn passive income on cryptocurrency holdings. Coinbase offers staking rewards for certain proof-of-stake coins like Ethereum, Tezos, and Cosmos.

BYDFi typically provides more earning options including staking, savings products, and liquidity mining. Their interest rates are often higher than Coinbase’s rates for comparable assets.

Interest rates vary by cryptocurrency and market conditions. BYDFi generally offers more competitive rates, sometimes 1-3% higher than Coinbase for the same assets, making it attractive for yield-seeking investors.

Which exchange provides better customer service and support: Coinbase or BYDFi?

Coinbase has a larger customer support team and offers multiple contact methods including email support, phone support for certain issues, and an extensive help center with guides.

Response times can be slow during high-volume periods on Coinbase. Users sometimes report waiting days for responses to support tickets during market volatility.

BYDFi offers customer support primarily through ticket systems and live chat. Their smaller size sometimes means more personalized attention, but they have fewer support resources overall compared to Coinbase.

BYDFi Vs Coinbase Conclusion: Why Not Use Both?

After comparing BYDFi and Coinbase, it’s clear that each platform has unique strengths. Coinbase scores higher overall with a 9.6 rating compared to BYDFi, but that doesn’t tell the whole story.

Coinbase shines with its user-friendly interface, strong security features, and regulatory compliance. It’s an excellent choice for beginners and those who prioritize a trusted, established platform in the cryptocurrency space.

BYDFi offers access to over 400 cryptocurrencies, giving you more trading options than Coinbase. It also typically features lower fees and more advanced trading tools that experienced traders might prefer.

Why choose just one?

Many crypto enthusiasts maintain accounts on multiple exchanges to:

- Take advantage of different fee structures

- Access a wider range of cryptocurrencies

- Utilize specific features unique to each platform

- Spread risk across different platforms

You might use Coinbase for its simplicity when buying major cryptocurrencies and BYDFi when you want to trade lesser-known tokens or use more advanced trading features.

The crypto world changes quickly. Having accounts on both platforms gives you flexibility as market conditions shift and as your trading needs evolve.

Remember to prioritize security on all platforms by using strong passwords, enabling two-factor authentication, and keeping only what you need for trading in exchange wallets.