Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Coinbase and Bitunix are two popular platforms that offer different features for crypto enthusiasts. Coinbase is an established exchange known for its user-friendly interface and regulatory compliance, while Bitunix is a newer exchange that offers a wider selection of cryptocurrencies and focuses on both spot and derivatives trading.

When comparing these exchanges, you’ll want to consider factors that matter most to you. Coinbase supports fewer cryptocurrencies but has built a reputation for security and ease of use, making it popular among beginners. Bitunix, on the other hand, supports over 270 cryptocurrencies and may appeal to more experienced traders looking for variety.

Your priorities around fees, security, available coins, and trading options will ultimately determine which exchange better suits your needs. Some users prefer to pay higher fees on established platforms like Coinbase for peace of mind, while others might choose Bitunix for its broader selection of trading pairs.

Coinbase Vs Bitunix: At A Glance Comparison

Coinbase and Bitunix are popular cryptocurrency exchanges that offer different features and benefits. Here’s how they compare at a glance:

| Feature | Coinbase | Bitunix |

|---|---|---|

| Cryptocurrencies | 100+ | 270+ |

| Trading Options | Primarily spot trading | Spot and derivatives trading |

| Security | Strong security measures | Includes proof of reserves |

| User Interface | Beginner-friendly | Trading-focused |

| Fees | Generally higher | Competitive rates |

Coinbase is known for its user-friendly platform, making it ideal if you’re new to cryptocurrency trading. It offers fewer cryptocurrencies than Bitunix but provides a more straightforward experience.

Bitunix supports over 270 cryptocurrencies and focuses on both spot and derivatives trading. This makes it a good choice if you want more advanced trading options.

One notable advantage of Bitunix is its proof of reserves system. This adds an extra layer of security by verifying that the exchange actually holds the assets it claims to have.

When choosing between these exchanges, consider your experience level and trading needs. Coinbase might be better if you’re looking for simplicity, while Bitunix could be more suitable if you need a wider range of trading options and cryptocurrencies.

Both exchanges have established themselves in the cryptocurrency market, but they serve slightly different user needs.

Coinbase Vs Bitunix: Trading Markets, Products & Leverage Offered

Coinbase and Bitunix offer different trading options to meet various investor needs. Let’s examine what each platform provides.

Trading Markets

| Feature | Coinbase | Bitunix |

|---|---|---|

| Spot Trading | Extensive selection | Available |

| Derivatives | Limited options | Strong focus |

| Supported Coins | 200+ cryptocurrencies | Fewer options but focused |

Coinbase excels in spot trading with a wide variety of cryptocurrencies. You can buy and sell tokens directly on their user-friendly platform.

Bitunix specializes in derivatives trading, including futures contracts. This makes it appealing if you’re interested in more advanced trading strategies.

Products Offered

- Coinbase: Spot trading, limited futures, Coinbase Earn (interest-bearing product), staking, NFT marketplace

- Bitunix: Futures contracts, spot trading, advanced trading tools

Leverage Options

Bitunix provides higher leverage options for derivatives trading, allowing you to amplify potential returns (and risks).

Coinbase offers more conservative leverage limits, which might be safer for beginners but less appealing to experienced traders seeking higher potential returns.

If you’re new to crypto, Coinbase’s simpler product lineup might be more comfortable. For advanced trading with futures and higher leverage, Bitunix offers more specialized tools.

Both exchanges continue to expand their offerings as the market evolves, so checking their current products before making your decision is recommended.

Coinbase Vs Bitunix: Supported Cryptocurrencies

When choosing between Coinbase and Bitunix, the range of supported cryptocurrencies is a crucial factor to consider.

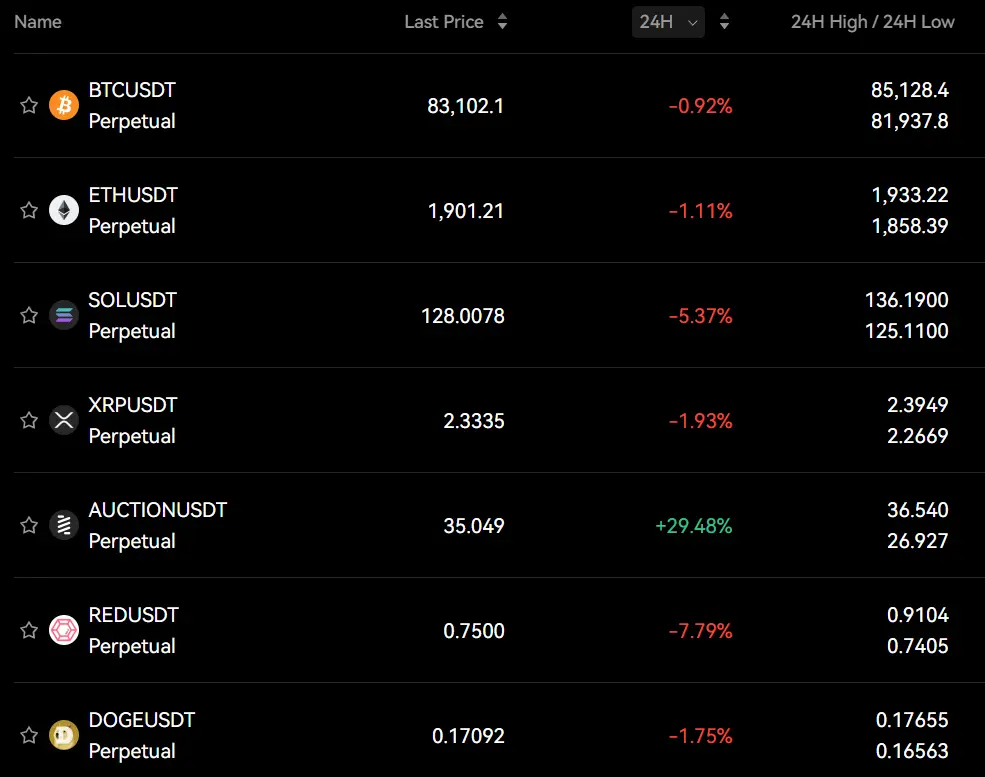

Bitunix offers a more extensive selection with support for over 270 cryptocurrencies. This gives you access to both established coins and emerging altcoins for diverse trading opportunities.

Coinbase, while historically known for a more conservative approach, has expanded its offerings in recent years. However, it typically supports fewer cryptocurrencies than Bitunix, focusing on well-established coins with proven track records.

Here’s a quick comparison:

| Exchange | Number of Cryptocurrencies | Selection Type |

|---|---|---|

| Bitunix | 270+ | Wide variety including established and emerging coins |

| Coinbase | Fewer than Bitunix | Focus on established cryptocurrencies |

If you’re looking to trade popular cryptocurrencies like Bitcoin, Ethereum, or Solana, both platforms will meet your needs. However, if you want access to newer or more niche tokens, Bitunix offers more options.

Remember that cryptocurrency availability can change as exchanges regularly add new coins. It’s worth checking each platform’s current listings if you’re interested in specific cryptocurrencies.

Both exchanges verify cryptocurrencies before listing them, but Bitunix’s larger selection gives you more flexibility for diversifying your crypto portfolio.

Coinbase Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and Bitunix, understanding their fee structures can help you make a better decision for your crypto trading needs.

Trading Fees

Coinbase typically uses a tiered fee structure that can be higher for casual traders. Regular Coinbase trading fees range from 0.5% to 4.5% depending on your payment method and transaction size.

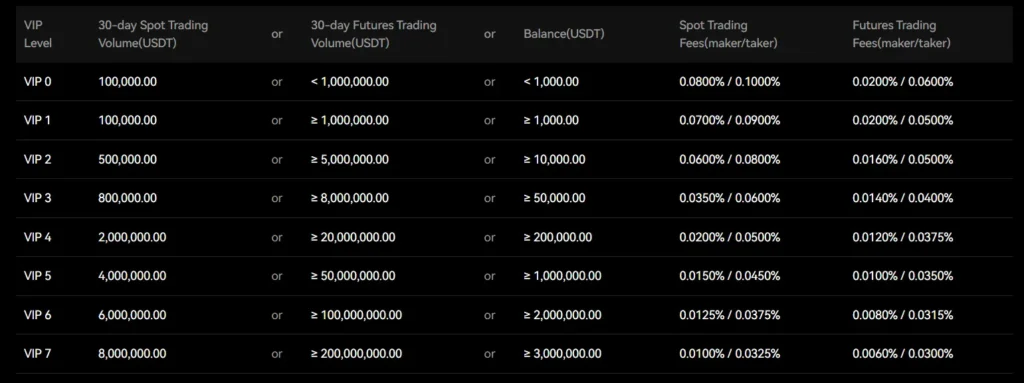

Bitunix also employs a tiered fee structure based on 30-day trading volume. According to search results, Bitunix generally offers more competitive trading fees compared to top-tier exchanges like Coinbase.

Subscription Options

Coinbase offers a premium subscription called Coinbase One that provides zero-fee trading for subscribers. This might be cost-effective if you trade frequently.

Bitunix doesn’t appear to have a similar subscription model based on available information.

Deposit and Withdrawal Fees

For both platforms, deposit fees are typically lower than withdrawal fees. Coinbase charges varying fees based on the payment method and cryptocurrency.

Bitunix maintains competitive withdrawal fees, which contributes to its appeal as an alternative to more established exchanges.

Security Features

While considering fees, it’s worth noting that Bitunix offers proof of reserves, which adds to its security credentials. Coinbase is known for its solid security infrastructure.

Your trading volume and preferred cryptocurrencies will largely determine which platform offers you the best value in terms of fees.

Coinbase Vs Bitunix: Order Types

When you’re choosing between Coinbase and Bitunix, understanding the order types each platform offers is essential for your trading strategy.

Coinbase provides several order types to help you control your trades. These include market orders that execute immediately at current prices, limit orders that execute at your specified price, and stop-limit orders for risk management.

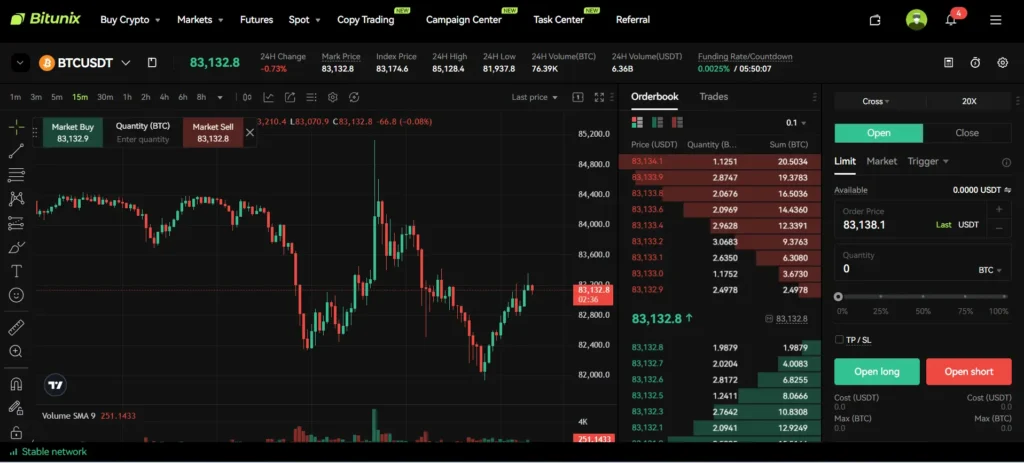

Bitunix, while less well-known than Coinbase, also offers competitive trading options. Based on available information, Bitunix provides standard order types similar to top exchanges.

Coinbase Order Types:

- Market orders (instant execution)

- Limit orders (set your price)

- Stop-limit orders (protection against market drops)

- Bracket orders (advanced exit strategies)

Coinbase’s advanced trading tools give you greater control over your portfolio. Their platform is designed to be accessible for beginners while offering enough depth for experienced traders.

The search results don’t provide specific details about Bitunix’s order types. However, user feedback suggests Bitunix offers competitive features compared to top-tier exchanges.

Both platforms aim to give you flexibility in how you execute trades. Coinbase has more documented features and a reputation for beginner-friendly tools with advanced capabilities.

Your trading style should determine which platform better suits your needs. If you prefer well-documented order types with educational resources, Coinbase might be your better option.

Coinbase Vs Bitunix: KYC Requirements & KYC Limits

Coinbase and Bitunix have different approaches to KYC (Know Your Customer) requirements, which directly impact how you can use these platforms.

Coinbase requires comprehensive KYC verification for all users. You must provide personal information, government ID, and complete verification before trading or withdrawing funds. There’s no option to use Coinbase without completing KYC.

Bitunix offers more flexibility with a tiered KYC system. You can use Bitunix with limited functionality without completing KYC verification.

Bitunix KYC Tiers:

- No KYC: Daily withdrawals limited to ≤500,000 USDT

- Basic KYC: Requires personal information, ID, and selfie

- Advanced KYC: Higher withdrawal limits with additional verification

Without KYC on Bitunix, you’ll face some trading limitations, but you can still access the platform. This offers more privacy than Coinbase’s all-or-nothing approach.

Bitunix uses KYC primarily to prevent money laundering and illegal activities while still providing options for users seeking more discretion.

When choosing between these platforms, consider your privacy needs against functionality requirements. Coinbase offers full features but requires complete identity verification. Bitunix provides more flexible options if KYC requirements are a concern for you.

Remember that even when using no-KYC options, your transactions are still recorded on the blockchain.

Coinbase Vs Bitunix: Deposits & Withdrawal Options

When choosing between Coinbase and Bitunix, understanding your deposit and withdrawal options is crucial for a smooth trading experience.

Coinbase offers more payment methods for depositing funds. You can use bank transfers, credit/debit cards, and PayPal in many regions. This makes it accessible for beginners just starting with crypto.

Bitunix supports cryptocurrency deposits and some fiat options, though these are more limited than Coinbase’s offerings.

For withdrawals, both platforms allow you to move your crypto to external wallets or convert to fiat.

Fee comparison:

| Platform | Withdrawal Fees | Deposit Methods |

|---|---|---|

| Coinbase | Higher (varies by crypto) | Bank transfers, cards, PayPal |

| Bitunix | Lower (approximately 0.0005 BTC for Bitcoin) | Mainly crypto, limited fiat |

Coinbase charges significantly higher fees, with trading fees between 0.5% and 1.5%, which affects your overall costs when moving money in and out.

Processing times differ between the platforms. Coinbase may take 3-5 business days for bank transfers, while crypto deposits are faster on both exchanges.

Security features for deposits and withdrawals include two-factor authentication on both platforms, though Bitunix specifically mentions their proof of reserves system for added security.

For beginners, Coinbase’s user-friendly interface makes deposits and withdrawals more straightforward, while experienced traders might prefer Bitunix’s lower fee structure.

Coinbase Vs Bitunix: Trading & Platform Experience Comparison

When choosing between Coinbase and Bitunix, the trading experience differs significantly. Coinbase offers a user-friendly interface that’s perfect for beginners, while Bitunix provides more advanced trading options.

Bitunix supports over 270 cryptocurrencies, giving you more variety than Coinbase. This makes Bitunix attractive if you’re looking to trade beyond the most popular coins.

Both platforms offer spot trading, but Bitunix adds derivatives trading to its offerings. This gives experienced traders more options for complex strategies.

Security Features:

- Coinbase: Industry-leading security protocols, regulated in many countries

- Bitunix: Features proof of reserves for added security verification

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | Higher | Varies by coin |

| Bitunix | Lower | Varies by coin |

The mobile experience is solid on both platforms, but Coinbase’s app is more intuitive for newcomers. Bitunix’s app packs more features that experienced traders might prefer.

Coinbase provides educational resources that help you learn as you trade. Bitunix focuses more on providing advanced trading tools rather than educational content.

You’ll find that Coinbase has stronger regulatory compliance in many countries, which may matter depending on where you live. Bitunix appears to be gaining popularity as an alternative to top-tier exchanges.

Coinbase Vs Bitunix: Liquidation Mechanism

When trading on cryptocurrency exchanges with leverage, understanding the liquidation mechanism is crucial. This system protects the platform when your position moves against you.

Coinbase Liquidation Process

Coinbase uses a progressive liquidation system for its perpetual futures. Your position faces liquidation when your margin ratio drops below the maintenance threshold.

Coinbase sends warnings as your position approaches liquidation levels. This gives you time to add funds or reduce your position size.

Bitunix Liquidation Approach

Bitunix employs a tiered liquidation process based on your account’s leverage level. Higher leverage trades face stricter liquidation parameters.

One advantage of Bitunix is its partial liquidation feature. Rather than closing your entire position, the system may liquidate only a portion to bring your margin levels back to safety.

Key Differences

| Feature | Coinbase | Bitunix |

|---|---|---|

| Warning System | Advanced notifications | Basic alerts |

| Liquidation Type | Full position | Partial available |

| Recovery Options | Add funds or reduce size | Add funds or adjust leverage |

| Liquidation Fee | Higher fee structure | Tiered based on volume |

Both platforms impose restrictions on withdrawing funds during volatile market conditions, which adds to liquidity risk.

You should consider these liquidation mechanisms carefully when choosing between Coinbase and Bitunix, especially if you plan to trade with leverage.

Coinbase Vs Bitunix: Insurance

When choosing a crypto exchange, insurance coverage is a key factor to consider for your asset protection. Both Coinbase and Bitunix offer different approaches to safeguarding your investments.

Coinbase provides FDIC insurance for USD balances up to $250,000 per customer. This applies only to fiat currency, not cryptocurrency holdings. For crypto assets, Coinbase maintains a separate insurance policy against security breaches and theft.

Bitunix focuses on security through its proof of reserves system, which allows you to verify that your assets are fully backed. This transparency serves as a form of protection, though it differs from traditional insurance.

Neither exchange offers complete protection against market volatility or personal account compromises due to phishing.

Here’s a quick comparison of their insurance features:

| Feature | Coinbase | Bitunix |

|---|---|---|

| FDIC Insurance | Yes (USD only) | No |

| Crypto Insurance | Limited coverage | Not specified |

| Proof of Reserves | No | Yes |

| Cold Storage | 98% of assets | Percentage unknown |

You should consider maintaining your own security practices regardless of exchange choice. Using strong passwords, enabling two-factor authentication, and keeping large holdings in personal wallets adds extra protection.

The best insurance ultimately comes from combining exchange protections with your own security measures.

Coinbase Vs Bitunix: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your experience. Both Coinbase and Bitunix offer customer support, but they differ in key ways.

Coinbase provides 24/7 email support and phone support for urgent issues. You can also use their help center to find answers to common questions. Many users report varying response times depending on how busy the platform is.

Bitunix offers customer support through multiple channels including live chat, email, and a ticket system. Their team typically responds within 24 hours for most inquiries.

Response Time Comparison:

| Platform | Email Response | Live Chat | Phone Support |

|---|---|---|---|

| Coinbase | 24-72 hours | Limited | Yes (urgent issues) |

| Bitunix | Within 24 hours | Available | Not available |

Both platforms have comprehensive knowledge bases where you can find tutorials and guides for self-help options.

Coinbase tends to experience longer wait times during market volatility or when the user base surges. Bitunix, being a smaller exchange, sometimes offers more personalized support.

Remember that your experience may vary based on the complexity of your issue and current platform traffic. It’s always good practice to try the self-help resources first before contacting support.

For serious account issues, both exchanges recommend using official channels only and being cautious of scammers pretending to offer support through unofficial means.

Coinbase Vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and Bitunix offer strong security features, but they differ in several important ways.

Coinbase is known for its highly regulated approach to security. They store 98% of customer funds in offline cold storage, protecting your assets from online threats. Coinbase also offers two-factor authentication and biometric login options for your account.

Bitunix stands out with its proof of reserves system. This transparency feature allows you to verify that your assets are actually held by the exchange. According to recent reviews, many users consider Bitunix’s security measures stronger than some top-tier exchanges.

Key Security Features Comparison:

| Feature | Coinbase | Bitunix |

|---|---|---|

| Cold Storage | 98% of funds | Yes (percentage not specified) |

| Two-Factor Authentication | Yes | Yes |

| Proof of Reserves | No | Yes |

| Insurance | FDIC insurance up to $250,000 (USD only) | Not specified |

| Regulatory Compliance | Very high | Moderate |

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling two-factor authentication, and being cautious of phishing attempts.

Remember that your personal security practices matter just as much as the exchange’s security features. Never share your private keys or seed phrases with anyone.

Is Coinbase Safe & Legal To Use?

Coinbase operates as a legal cryptocurrency exchange in the United States and many other countries. It follows regulatory requirements and has proper licensing to offer its services.

Security is a priority for Coinbase. The platform uses strong measures to protect user accounts, including two-factor authentication and encryption for sensitive data.

Important security features:

- Cold storage for 98% of customer funds

- Biometric authentication options

- Account monitoring systems

Despite these protections, Coinbase is not FDIC-insured like traditional banks. This means your cryptocurrency is not backed by government guarantees.

The SEC filed a lawsuit against Coinbase in 2023, claiming it operated as an unregistered securities exchange. This case is still ongoing and creates some legal uncertainty.

Coinbase maintains insurance against theft from their hot wallets, but this coverage has limitations. Your funds could be at risk if there’s a major security breach.

When using Coinbase, you should take personal security steps too. Use strong passwords, enable all security features, and consider moving large holdings to private wallets.

The platform’s long history since 2012 and public company status provide some reassurance about its legitimacy compared to newer exchanges like Bitunix.

Is Bitunix Safe & Legal To Use?

Bitunix implements several security measures to protect user funds and data. According to search results, they maintain proof of reserves, which adds an extra layer of security by verifying that the exchange holds the assets it claims.

The platform offers a user-friendly interface while prioritizing robust security protocols. This makes it accessible for both beginners and experienced traders.

For Canadians specifically, Bitunix offers a no-KYC option. This means you can trade without completing a full identity verification process, which some users prefer for privacy reasons.

Security features at Bitunix include:

- Proof of reserves verification

- Data protection measures

- Safe trading environment

You can access Bitunix from anywhere, making it convenient for trading cryptocurrencies on the go. The platform allows you to buy, sell, and trade various blockchain cryptocurrencies.

When compared to top-tier exchanges, some users consider Bitunix to be better in terms of security and features. However, as with any crypto platform, you should always use strong passwords and enable available security features.

Always remember that cryptocurrency trading involves risks, regardless of the platform you choose. While Bitunix appears to implement good security practices, it’s wise to only invest what you can afford to lose.

Frequently Asked Questions

Choosing between cryptocurrency exchanges involves understanding key differences in fees, security, and user experience. These common questions address the most important factors when comparing Coinbase and Bitunix.

What are the differences in fees between Coinbase and Bitunix?

Coinbase typically charges higher fees than Bitunix. You’ll pay between 0.5% to 4.5% per transaction on Coinbase, depending on your payment method and transaction size.

Bitunix offers more competitive fee structures, with trading fees generally ranging from 0.1% to 0.25%. This difference can significantly impact your returns when trading frequently or in large volumes.

Both platforms may charge additional fees for deposits or withdrawals, but Bitunix tends to have lower overall fee structures across most transaction types.

Which platform offers better security, Coinbase or Bitunix?

Coinbase has established a strong security reputation with insurance coverage for digital assets, two-factor authentication, and cold storage for 98% of customer funds.

Bitunix provides proof of reserves, which adds transparency to its security measures. This feature allows you to verify that your assets are backed by actual holdings.

Both platforms implement industry-standard security protocols, but Coinbase’s longer market presence and regulated status in more regions might give some users additional confidence.

How do user experiences compare when using Coinbase versus Bitunix?

Coinbase offers a streamlined, beginner-friendly interface that prioritizes simplicity over advanced features. The platform is known for its accessibility to newcomers.

Bitunix also provides a user-friendly experience while offering more trading options and tools that appeal to both beginners and more experienced traders.

You might find Bitunix more suitable if you’re looking for a balance between usability and trading functionality, while Coinbase excels at providing the most straightforward experience.

Are there any advantages to using Bitunix over Coinbase for cryptocurrency trading?

Bitunix offers lower trading fees, which can save you significant money over time, especially with frequent transactions.

The platform provides more diverse trading options and tools that advanced traders might find beneficial compared to Coinbase’s more limited offerings.

Bitunix’s proof of reserves system gives you additional transparency about the exchange’s financial backing, which some users consider an important advantage when choosing where to trade.

What are the customer service differences between Coinbase and Bitunix?

Coinbase has faced criticism for slow customer support response times, particularly during high-volume periods. You might experience delays when needing assistance with account issues.

Bitunix appears to offer more responsive customer service, though as a newer platform, the volume of support requests may be lower than what Coinbase handles.

Both platforms provide support through email tickets, but Bitunix may offer more direct communication channels for resolving issues quickly.

How do the transaction speeds of Coinbase compare to those of Bitunix?

Coinbase processing times vary by payment method, with bank transfers taking 3-5 business days and card purchases processing almost instantly but at higher fees.

Bitunix generally offers faster transaction processing across most payment methods, with many transfers completing within minutes to hours.

Network congestion affects both platforms during high-volume periods, but Bitunix’s infrastructure appears designed to maintain faster processing speeds even during busy market conditions.

Coinbase Vs Bitunix Conclusion: Why Not Use Both?

Both Coinbase and Bitunix offer unique advantages that can benefit different aspects of your crypto journey. Rather than choosing one over the other, using both platforms might be the smartest approach.

Coinbase provides a well-established reputation and excellent security features. It’s backed by strong regulatory compliance in many countries, making it a trusted choice for beginners.

Bitunix stands out with its faster verification process and proof of reserves system, which adds an extra layer of security for your funds. Many users also report that Bitunix offers a more user-friendly experience for newcomers.

Consider this strategy: Use Coinbase for your long-term investments and larger transactions where reputation matters most. Its insurance policies and strong security make it ideal for holding significant amounts.

Use Bitunix for your day-to-day trading activities and exploring newer cryptocurrencies. Its simpler interface and faster verification can make your trading experience smoother.

By leveraging both platforms, you get the best of both worlds – Coinbase’s established security and Bitunix’s user-friendly approach. This dual-platform strategy also helps spread your risk across different exchanges.

Remember to keep track of your assets across both platforms and maintain separate secure login credentials for each. Using a portfolio tracking app can help you monitor your complete crypto holdings in one place.