When choosing a cryptocurrency exchange, understanding the key differences between platforms like Coinbase and BitMEX can help you make better trading decisions. These two exchanges serve different purposes and cater to different types of crypto users.

Coinbase is more suitable for beginners and those looking for a regulated platform with simple buying options, while BitMEX targets experienced traders seeking advanced derivatives trading with high leverage.

Both exchanges have strong security measures, but they differ significantly in their features, fee structures, and available cryptocurrencies. Coinbase operates as a regulated public company with most assets held in cold storage, offering a straightforward experience for buying, selling, and storing crypto. BitMEX, on the other hand, specializes in derivatives trading with products like futures contracts, making it better suited for trading strategies that involve leverage.

Coinbase vs BitMEX: At A Glance Comparison

Coinbase and BitMEX are two different types of cryptocurrency platforms that serve distinct trader needs.

Coinbase is a beginner-friendly exchange focused on spot trading. It offers a simple interface with support for buying, selling, and storing various cryptocurrencies directly.

BitMEX specializes in cryptocurrency derivatives trading, particularly futures and perpetual contracts. It caters to more advanced traders looking for leverage opportunities.

Target Users:

- Coinbase: Beginners, casual investors, those who want to own actual crypto

- BitMEX: Experienced traders, those interested in derivatives and margin trading

Key Features Comparison:

| Feature | Coinbase | BitMEX |

|---|---|---|

| Primary Focus | Spot trading | Derivatives trading |

| Leverage Options | Limited | Up to 100x on some contracts |

| User Interface | Simple, beginner-friendly | Complex, advanced tools |

| Supported Coins | 100+ cryptocurrencies | Limited selection, focused on trading pairs |

| Fiat Support | Yes (USD, EUR, GBP, etc.) | No direct fiat support |

| Security | High (majority in cold storage) | High (multi-signature wallets) |

| Fees | Higher than industry average | Lower trading fees, especially with volume |

BitMEX requires more trading knowledge and experience. You’ll need to understand concepts like futures, perpetual swaps, and leverage.

Coinbase offers easier entry for newcomers with direct bank connections and simpler buying options. However, you’ll pay higher fees for this convenience.

Coinbase vs BitMEX: Trading Markets, Products & Leverage Offered

Coinbase and BitMEX offer different trading experiences based on their available markets, products, and leverage options.

Coinbase provides a wider range of cryptocurrencies for spot trading. You can access over 200 cryptocurrencies on their platform, making it ideal if you’re looking for variety in your investments.

BitMEX focuses primarily on derivatives trading. The platform specializes in Bitcoin and crypto futures contracts and perpetual swaps rather than direct coin purchases.

Leverage Options:

- Coinbase: Limited leverage up to 5x on select products

- BitMEX: Up to 100x leverage on certain contracts

This difference in leverage makes BitMEX attractive to experienced traders looking for higher risk/reward opportunities.

Products Comparison:

| Feature | Coinbase | BitMEX |

|---|---|---|

| Spot Trading | Yes (200+ coins) | Limited |

| Futures | Yes (limited) | Yes (extensive) |

| Perpetual Swaps | Limited | Extensive |

| Options | Limited | Yes |

| Max Leverage | 5x | 100x |

BitMEX excels in derivatives trading tools and appeals to traders who want advanced trading features and high leverage capabilities.

Coinbase offers a more beginner-friendly approach with its diverse coin selection but fewer complex trading products.

Your trading style and risk tolerance should guide your choice between these platforms. BitMEX suits active traders seeking leverage, while Coinbase works better for those wanting diverse coin exposure.

Coinbase vs BitMEX: Supported Cryptocurrencies

When choosing between Coinbase and BitMEX, the range of supported cryptocurrencies is a key factor to consider for your trading strategy.

Coinbase offers a significantly larger selection of cryptocurrencies compared to BitMEX. You can trade popular coins like Bitcoin, Ethereum, and Solana, plus many smaller altcoins on Coinbase.

BitMEX supports over 100 cryptocurrencies according to recent data. The platform specializes in derivatives trading, offering perpetual swaps, futures, options, and pre-launch futures markets for these coins.

Coinbase Cryptocurrency Support:

- Large selection of cryptocurrencies

- Regular addition of new coins

- Support for most major cryptocurrencies

- More altcoin options for diversification

BitMEX Cryptocurrency Support:

- Over 100 supported coins

- Focus on derivative products for these currencies

- Trading pairs primarily denominated in Bitcoin

- Specialized contracts like perpetual swaps

The difference in supported cryptocurrencies reflects each platform’s target audience. Coinbase caters to both beginners and experienced traders seeking a wide variety of direct crypto purchases.

BitMEX targets more advanced traders looking for leverage and derivative trading options on a still substantial but more focused selection of cryptocurrencies.

Your choice between these platforms may depend on whether you want access to more cryptocurrency options (Coinbase) or more sophisticated trading products for a still decent range of coins (BitMEX).

Coinbase vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and BitMEX, understanding their fee structure is crucial for your trading decisions.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| Coinbase | 0.4% – 0.6% | 0.4% – 0.6% | Higher than industry average |

| BitMEX | 0.025% | 0.075% | Among the lowest for futures trading |

Coinbase charges relatively high trading fees compared to most exchanges. Your fees decrease slightly if you have higher trading volumes.

BitMEX offers significantly lower trading fees, making it more attractive for frequent traders and those dealing with larger amounts.

Deposit Fees

Both platforms don’t charge fees for cryptocurrency deposits. Coinbase allows fiat deposits through bank transfers and credit cards, with varying fees depending on your payment method.

BitMEX only accepts cryptocurrency deposits with no deposit fees.

Withdrawal Fees

Coinbase charges network fees for crypto withdrawals, which vary by asset. For Bitcoin, this typically ranges from $1-3 per transaction.

BitMEX charges a flat fee for Bitcoin withdrawals (0.0005 BTC) but doesn’t support direct fiat withdrawals.

The fee difference between these exchanges is substantial. If you’re an active trader focusing on cost efficiency, BitMEX’s lower trading fees could save you money over time.

Remember that BitMEX is primarily a derivatives platform, while Coinbase offers a more beginner-friendly experience with direct fiat support but at higher costs.

Coinbase vs BitMEX: Order Types

When trading on cryptocurrency exchanges, the types of orders available can make a big difference in your trading strategy. Coinbase and BitMEX offer different order options to help you buy and sell crypto.

Coinbase Order Types:

- Market orders (buy/sell immediately at current price)

- Limit orders (set your desired price)

- Stop-limit orders (trigger a limit order when a specific price is reached)

- Bracket orders (set both stop loss and take profit levels)

Coinbase’s order system is designed to be straightforward, making it accessible for beginners while still offering enough tools for more experienced traders.

BitMEX Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

- Post-only orders (ensures you’re always the maker, not the taker)

- Trailing stop orders (follows the market price by a set percentage)

BitMEX provides more advanced order types that are particularly useful for margin trading and futures contracts.

The order matching engine on BitMEX is built for high-frequency trading, which can be important if you’re looking to execute complex trading strategies.

If you’re new to crypto trading, Coinbase’s simpler order system might be more appropriate. For experienced traders who need specialized tools, BitMEX offers more sophisticated options for precise position management.

Remember that understanding how these order types work is crucial before using leverage or trading futures on either platform.

Coinbase vs BitMEX: KYC Requirements & KYC Limits

Coinbase has strict KYC (Know Your Customer) requirements that all users must complete before trading. You’ll need to provide your full name, address, date of birth, and upload a government-issued ID.

BitMEX has more flexible KYC policies. While they do require email verification, their full KYC requirements may vary based on your trading volume and location. Some basic trading can be done with minimal verification.

Coinbase KYC Process:

- ID verification required before any trading

- Photo ID upload (passport, driver’s license)

- Proof of address may be required

- Face verification in some cases

BitMEX KYC Process:

- Email verification for basic access

- Full KYC may be required for larger withdrawals

- Trading possible with minimal verification

Coinbase implements KYC to comply with US regulations, as it’s a US-based company. This affects withdrawal limits, which increase as you complete more verification steps.

BitMEX operates with fewer restrictions, making it appealing if you prefer privacy. However, this comes with limitations for US traders, as BitMEX restricts access to US residents due to regulatory concerns.

Your withdrawal limits on Coinbase depend on your verification level and account age. New accounts start with lower limits that increase over time.

BitMEX withdrawal limits are typically based on your trading volume and verification status rather than strict KYC tiers.

Coinbase vs BitMEX: Deposits & Withdrawal Options

When choosing between Coinbase and BitMEX, deposit and withdrawal options are important factors to consider.

Coinbase offers more flexibility for funding your account. You can deposit funds using bank transfers, credit/debit cards, and even PayPal in some regions. This makes it easier for beginners to start trading.

For withdrawals, Coinbase allows you to transfer funds directly to your bank account or PayPal. These options make it convenient to access your money when needed.

BitMEX, in contrast, only accepts cryptocurrency deposits. You cannot fund your account with fiat currency directly. This means you need to already own crypto or buy it elsewhere first.

The withdrawal process on BitMEX is also crypto-only. To convert your crypto to fiat money, you’ll need to:

- Withdraw crypto from BitMEX to an external wallet

- Use another exchange to convert it to fiat

- Withdraw the fiat to your bank account

Comparison Table:

| Feature | Coinbase | BitMEX |

|---|---|---|

| Fiat Deposits | ✓ (Bank, Card, PayPal) | ✗ |

| Crypto Deposits | ✓ | ✓ |

| Fiat Withdrawals | ✓ (Bank, PayPal) | ✗ |

| Crypto Withdrawals | ✓ | ✓ |

If you’re new to crypto or prefer easy access to your funds, Coinbase’s variety of deposit and withdrawal methods might be more suitable for your needs.

Coinbase vs BitMEX: Trading & Platform Experience Comparison

Coinbase offers a user-friendly platform designed primarily for beginners and intermediate traders. Its clean interface makes buying, selling, and managing cryptocurrencies straightforward for newcomers.

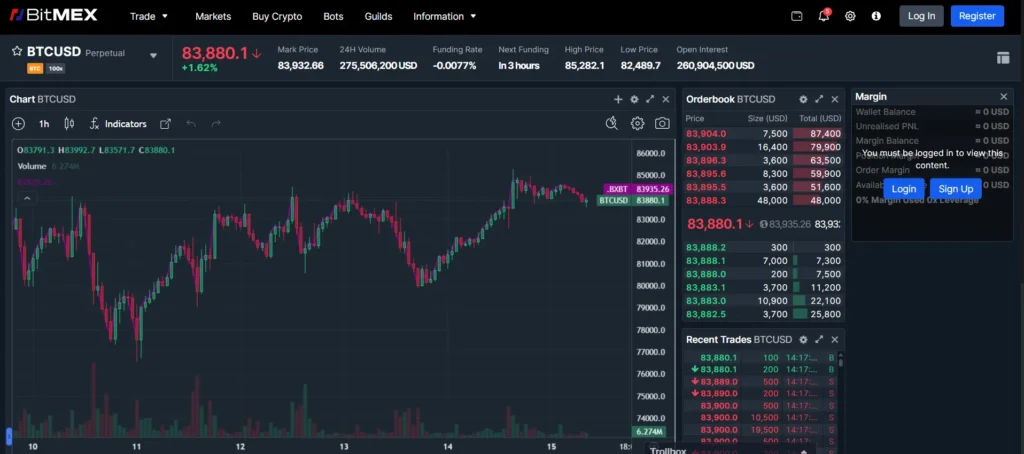

BitMEX, in contrast, caters to advanced traders with more complex trading options, particularly futures and derivatives trading. The platform includes advanced charting tools and order types not available on Coinbase.

User Interface Comparison:

- Coinbase: Clean, intuitive, mobile-friendly

- BitMEX: Technical, data-rich, trading-focused

When you use Coinbase, you’ll find the learning curve quite gentle. The platform guides you through purchases with simple buy/sell options. This simplicity comes at the cost of fewer advanced trading features.

BitMEX provides you with more sophisticated trading tools, including leverage options up to 100x on some contracts. However, you’ll need to understand trading terminology and concepts to use it effectively.

Trading Options:

| Feature | Coinbase | BitMEX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | Limited | Extensive |

| Leverage | Limited | Up to 100x |

| Derivatives | Basic | Advanced |

Coinbase’s mobile app delivers nearly all the functionality of its desktop version. BitMEX’s mobile experience, while improved recently, still works best on desktop for serious trading sessions.

For beginners, Coinbase offers educational resources to help you learn as you trade. BitMEX assumes you already understand trading concepts and focuses instead on providing professional-grade tools.

Coinbase vs BitMEX: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for your risk management. Both Coinbase and BitMEX have different approaches to this important process.

BitMEX uses a unique liquidation system based on index prices rather than market prices. This means your position won’t be liquidated unless the actual index price moves against you, which offers some protection against market manipulation.

However, BitMEX has faced criticism for its liquidation practices. Some traders report having profitable positions liquidated when one of BitMEX’s two reference indexes experienced issues, even when their positions were technically in profit.

Coinbase takes a more straightforward approach to liquidations. When your margin ratio falls below the required maintenance margin, Coinbase will begin liquidating your position to prevent further losses.

BitMEX is known for its highly leveraged products, which can lead to cascading liquidations during market volatility. This was notably observed during previous market crashes, where a chain reaction of liquidations amplified price movements.

For new traders, Coinbase’s liquidation mechanism may be more transparent and easier to understand. BitMEX offers more sophisticated features but requires a deeper understanding of how their system works.

Here’s a quick comparison:

| Feature | Coinbase | BitMEX |

|---|---|---|

| Liquidation Trigger | Maintenance margin ratio | Index price movements |

| Transparency | More straightforward | More complex dual-index system |

| Protection Features | Standard | Spike protection (with limitations) |

| Max Leverage | Lower | Higher (increased liquidation risk) |

Coinbase vs BitMEX: Insurance

When you’re trading cryptocurrencies, insurance can provide peace of mind in case something goes wrong. Coinbase and BitMEX have different approaches to protecting your funds.

Coinbase Insurance Coverage:

- All USD balances are FDIC-insured up to $250,000 per customer

- Digital assets held in their online storage are covered by a commercial insurance policy

- About 98% of customer crypto is stored in offline cold storage for added security

Coinbase takes insurance seriously, which helps protect you against potential breaches or theft. Their insurance doesn’t cover losses from unauthorized access to your personal account, so strong passwords and two-factor authentication remain essential.

BitMEX Insurance Approach:

- Uses an Insurance Fund to prevent auto-deleveraging positions

- The fund has grown substantially over time

- Does not offer FDIC insurance since it focuses primarily on derivatives trading

BitMEX’s Insurance Fund works differently than traditional insurance. It’s designed to maintain the platform’s operations rather than directly protecting your individual deposits against theft or hacking.

For security-focused traders, Coinbase provides more comprehensive coverage for your holdings. BitMEX offers more specialized protection related to trading positions and leverage.

Remember to consider insurance coverage as just one factor when choosing between these exchanges. Your trading needs, fee structure preferences, and available cryptocurrencies should also influence your decision.

Coinbase vs BitMEX: Customer Support

When choosing between crypto exchanges, customer support can make a big difference in your experience, especially when issues arise with your funds or trades.

Coinbase offers 24/7 customer support, which is a significant advantage for users. This means you can get help at any time, regardless of your time zone.

However, despite having round-the-clock support, Coinbase’s response times can be slow. Some users report waiting up to 4 days for responses to their inquiries, which can be frustrating when dealing with urgent matters.

BitMEX provides customer support through email and a ticketing system. This structured approach helps track your issues, but lacks the immediacy of live chat or phone support.

Here’s a quick comparison of their support options:

| Feature | Coinbase | BitMEX |

|---|---|---|

| 24/7 Support | Yes | Not specified |

| Contact Methods | Multiple channels | Email and ticketing |

| Response Time | Can be slow (up to 4 days) | Varies |

Both platforms could improve their customer service experience. If you value having multiple ways to reach support and don’t mind potential delays, Coinbase might be your preference.

If you prefer a more structured approach with clear ticket tracking, BitMEX’s system might work better for you, though response times may vary.

Coinbase vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and BitMEX have implemented various security measures to protect your assets, but they differ in their approaches.

Coinbase is known for its state-of-the-art security protocols. They store 98% of customer funds in offline cold storage, protecting them from online threats. Coinbase also offers two-factor authentication (2FA) and biometric login options for account access.

BitMEX also provides robust security features but takes a different approach. They use a multi-signature wallet system for fund management and require 2FA for all account activities.

Insurance coverage is another important security aspect. Coinbase maintains insurance for cryptocurrency held in their online storage, giving you an extra layer of protection. BitMEX, however, doesn’t offer the same level of insurance coverage.

Both platforms conduct regular security audits and compliance checks. Coinbase is regulated in multiple countries and follows strict KYC (Know Your Customer) protocols. BitMEX has strengthened its compliance measures in recent years but has faced regulatory challenges.

Here’s a quick comparison of key security features:

| Security Feature | Coinbase | BitMEX |

|---|---|---|

| Cold Storage | 98% of funds | Partial |

| 2FA | Yes | Yes |

| Insurance | Yes | Limited |

| Biometric Login | Yes | No |

| Regulatory Compliance | Strong | Improving |

You should consider enabling all available security features regardless of which platform you choose.

Is Coinbase Safe & Legal To Use?

Coinbase is generally considered safe and operates legally in most countries where it has a presence. The platform implements strong security measures to protect user funds and information.

However, it’s worth noting that the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase in 2023. The SEC claimed Coinbase operated as an illegal securities exchange, broker, and clearing agency.

Despite this legal challenge, Coinbase continues to operate and serve millions of customers worldwide. The company is publicly traded on NASDAQ, which requires certain standards of transparency and accountability.

Security Features:

- Two-factor authentication (2FA)

- Insurance protection for digital assets

- Cold storage for majority of customer funds

- Regular security audits

When comparing Coinbase to BitMEX, Coinbase often ranks higher in terms of regulatory compliance and security. This can give you peace of mind when storing your cryptocurrencies.

Remember that no exchange is 100% immune to risks. Even with Coinbase’s security measures, you should consider:

- Using unique, strong passwords

- Enabling all security features

- Not keeping large amounts on the exchange long-term

- Being cautious of phishing attempts

For most users, Coinbase provides a reasonable balance of security, legality, and usability. Its intuitive interface and strong security make it a popular choice for both beginners and experienced traders.

Is BitMEX Safe & Legal To Use?

BitMEX has implemented strong security measures to protect user funds and data. The platform uses cold storage for most customer assets and offers two-factor authentication to secure accounts.

However, BitMEX has faced legal issues in the past. In 2021, a federal court ordered BitMEX to pay $100 million for illegally operating a cryptocurrency derivatives trading platform and anti-money laundering violations.

The exchange has since worked to improve its compliance. They’ve enhanced their KYC (Know Your Customer) procedures and regulatory frameworks to meet international standards.

Be aware that BitMEX charges inactivity fees. Some users have reported having their accounts charged 0.1 BTC for being inactive over extended periods.

When comparing safety with other exchanges like Coinbase, BitMEX generally offers good security but may not match the regulatory compliance level of US-based exchanges.

Important safety considerations:

- Enable two-factor authentication

- Use strong, unique passwords

- Be aware of inactivity fees

- Understand that regulations vary by country

Your ability to legally use BitMEX depends on your location. The platform restricts access from certain countries including the United States. Always check if BitMEX operates legally in your country before signing up.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges. These answers address the most common concerns about Coinbase and BitMEX platforms, including fees, security features, and available trading options.

What are the key differences in fees between Coinbase and BitMEX?

Coinbase charges higher fees than BitMEX overall. Coinbase’s fee structure includes transaction fees ranging from 0.5% to 4.5% depending on payment method and trade size.

BitMEX uses a maker-taker fee model where makers can receive rebates of 0.01% while takers pay around 0.075% per trade. This fee structure makes BitMEX more cost-effective for high-volume traders.

Coinbase also charges deposit and withdrawal fees that vary by payment method, while BitMEX primarily charges Bitcoin network fees for withdrawals.

How do Coinbase and BitMEX compare in terms of security measures?

Coinbase stores 98% of customer funds in offline cold storage and offers two-factor authentication (2FA), biometric login options, and FDIC insurance on USD balances up to $250,000.

BitMEX employs a multi-signature wallet system for its cold storage and requires 2FA for all accounts. The platform performs regular security audits but doesn’t offer FDIC insurance.

Coinbase has a stronger security track record with no major security breaches, while BitMEX has faced some security concerns in the past.

What are the available cryptocurrencies for trading on Coinbase versus BitMEX?

Coinbase supports over 200 cryptocurrencies for direct purchase, including Bitcoin, Ethereum, Solana, and many altcoins. You can buy these assets directly with fiat currency.

BitMEX focuses primarily on cryptocurrency derivatives rather than spot trading. It offers perpetual contracts and futures mainly for Bitcoin and a select few other cryptocurrencies like Ethereum and Litecoin.

The limited selection on BitMEX makes Coinbase the better choice if you want to trade a diverse range of cryptocurrencies directly.

Can beginners use BitMEX or Coinbase with ease, and which is more user-friendly?

Coinbase is designed with beginners in mind, featuring a clean interface, educational resources, and a simple buying process. The mobile app is intuitive and allows quick purchases.

BitMEX caters to experienced traders with a complex interface focused on derivatives trading. New users often find its features overwhelming and the learning curve steep.

If you’re new to crypto trading, Coinbase offers a much more accessible entry point with better educational support and simpler trading options.

How do the leverage options offered by Coinbase differ from those provided by BitMEX?

BitMEX offers high leverage trading up to 100x on some contracts, allowing you to control large positions with relatively small capital. This creates potential for higher profits but also increases risk substantially.

Coinbase provides limited leverage options primarily through Coinbase Advanced (formerly Coinbase Pro) with much lower maximums, typically up to 3x leverage on certain trading pairs.

The difference in leverage makes BitMEX more suitable for experienced traders looking for higher risk-reward opportunities.

What are the fiat currency support differences between BitMEX and Coinbase?

Coinbase provides extensive fiat currency support, allowing deposits and withdrawals in USD, EUR, GBP and many other currencies. You can connect bank accounts, credit cards, and other payment methods directly.

BitMEX operates primarily as a crypto-to-crypto exchange with limited fiat on-ramps. The platform mainly uses Bitcoin as its base currency for trading and deposits.

This difference means Coinbase offers much easier access for users wanting to enter the crypto market directly from traditional banking systems.

Coinbase vs BitMEX Conclusion: Why Not Use Both?

You don’t need to choose just one exchange. Using both Coinbase and BitMEX might be your best strategy in 2025.

Coinbase offers a user-friendly interface with a higher overall score of 9.6 compared to BitMEX. It’s regulated and ideal for beginners who want straightforward crypto purchases with fiat currency.

BitMEX provides advanced trading features and high liquidity that experienced traders appreciate. Its derivatives platform allows for more complex trading strategies with leverage options.

Security on Both Platforms:

- Coinbase: Strong regulatory compliance

- BitMEX: Robust security protocols including verification systems

- Both: Prioritize user security with different approaches

Your trading needs might vary day to day. Some days you’ll want Coinbase’s simplicity for basic transactions. Other days you might need BitMEX’s advanced features for complex trades.

Consider using Coinbase for:

- Direct fiat purchases

- User-friendly experience

- Regulated environment

Consider using BitMEX for:

- Derivatives trading

- Higher liquidity for large trades

- Advanced trading features

Many experienced crypto traders maintain accounts on multiple exchanges to take advantage of different features and opportunities. This approach gives you flexibility and helps you avoid missing out on platform-specific benefits.