Choosing between Coinbase and Bitget in 2025 can be tricky if you’re looking to buy or trade cryptocurrency. Each exchange offers different benefits that might suit your specific needs.

Coinbase stands out with its beginner-friendly interface and easy setup process, while Bitget offers lower trading fees and access to more altcoins. This key difference often guides most users’ decisions when selecting between these popular platforms.

Your experience level matters when picking an exchange. If you’re new to crypto, Coinbase’s simple design might be worth the higher fees. But if you’re more experienced and want to trade a wider variety of coins at lower costs, Bitget could be the better choice for your trading activities.

Coinbase Vs Bitget: At A Glance Comparison

When choosing between Coinbase and Bitget in 2025, several key differences stand out. Both platforms offer cryptocurrency trading but cater to different types of users.

Fees Structure

| Platform | Maker Fees | Taker Fees | Notable |

|---|---|---|---|

| Coinbase | Higher | Higher | Premium pricing |

| Bitget | 0.02% | 0.06% | Can pay with bonus funds |

Bitget offers significantly lower trading fees compared to Coinbase, making it more attractive for frequent traders. You’ll save money on transactions if you trade often.

User Experience

Coinbase is known for its user-friendly interface, perfect if you’re new to crypto trading. The platform prioritizes simplicity and ease of use.

Bitget tends to focus more on advanced features and trading options. You’ll find more complex trading tools here, which might appeal if you have trading experience.

Security Features

Both exchanges emphasize security, but implement different approaches. You should consider factors like insurance coverage, two-factor authentication, and cold storage policies.

Available Cryptocurrencies

Your trading options vary between platforms. Coinbase typically offers carefully vetted coins, while Bitget may provide access to a wider range of altcoins and trading pairs.

Mobile Experience

Both offer wallet apps for managing your crypto on the go. The functionality and ease of use differ, so consider how much mobile trading you plan to do.

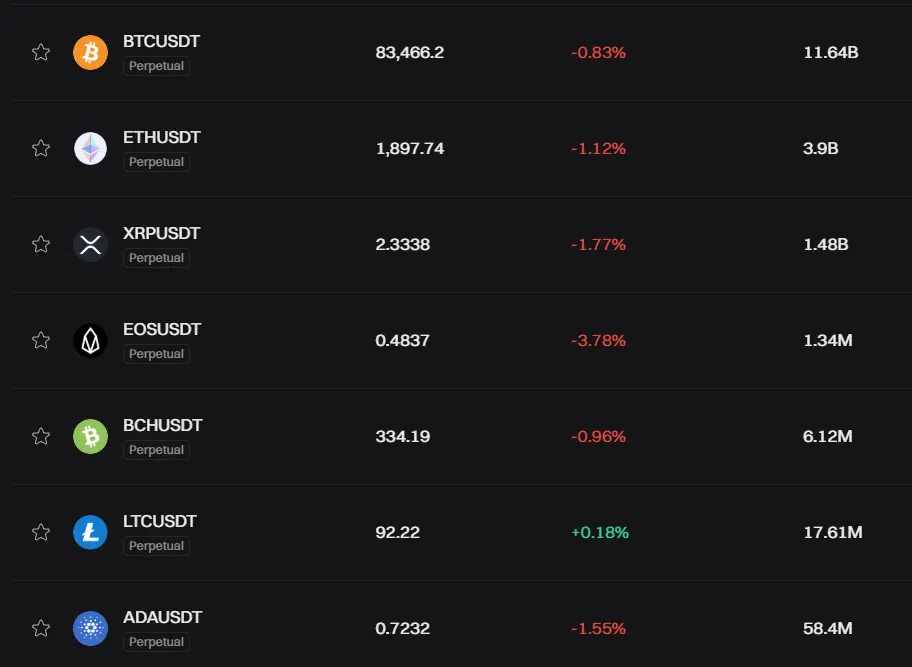

Coinbase Vs Bitget: Trading Markets, Products & Leverage Offered

Coinbase and Bitget offer different trading options that might influence your choice between platforms.

Available Markets:

- Coinbase: Supports 250+ cryptocurrencies

- Bitget: Offers 400+ cryptocurrencies

Bitget provides more cryptocurrency options, giving you greater selection variety.

Trading Products:

| Feature | Coinbase | Bitget |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Copy Trading | Limited | ✓ |

| Staking | ✓ | ✓ |

Bitget stands out with its copy trading feature, allowing you to automatically mirror experienced traders’ strategies.

Leverage Options:

Coinbase offers a modest 10x leverage on select cryptocurrencies for futures trading. This conservative approach prioritizes safety.

Bitget provides more aggressive leverage options, making it popular among traders seeking higher potential returns. However, higher leverage also means greater risk.

Trading Interface:

You’ll find Coinbase’s interface more beginner-friendly with intuitive navigation. The platform emphasizes security and compliance.

Bitget offers more advanced trading tools and charts that experienced traders might prefer. Its interface packs more features but has a steeper learning curve.

The platform you choose should align with your trading experience, risk tolerance, and preferred cryptocurrencies.

Coinbase Vs Bitget: Supported Cryptocurrencies

When choosing between Coinbase and Bitget, the range of available cryptocurrencies is an important factor to consider.

Coinbase offers access to over 200 cryptocurrencies for trading. The platform includes major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), as well as many altcoins and tokens.

Bitget provides a more extensive selection with support for over 600 cryptocurrencies. This gives you significantly more options if you’re interested in trading lesser-known or emerging tokens.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Cryptocurrencies | Popular Options |

|---|---|---|

| Coinbase | 200+ | Bitcoin, Ethereum, Solana, Cardano, Polygon |

| Bitget | 600+ | Bitcoin, Ethereum, Solana, plus many altcoins and tokens |

Both platforms support the most popular cryptocurrencies that most traders look for. However, if you want to explore more niche or emerging projects, Bitget offers you considerably more choices.

Remember that the exact number of supported cryptocurrencies can change as both exchanges regularly add new tokens. You should check their current listings if you’re looking for specific cryptocurrencies to trade.

The quality of supported coins also matters. Coinbase is known for its careful vetting process before listing new tokens, while Bitget offers more variety but includes some higher-risk tokens.

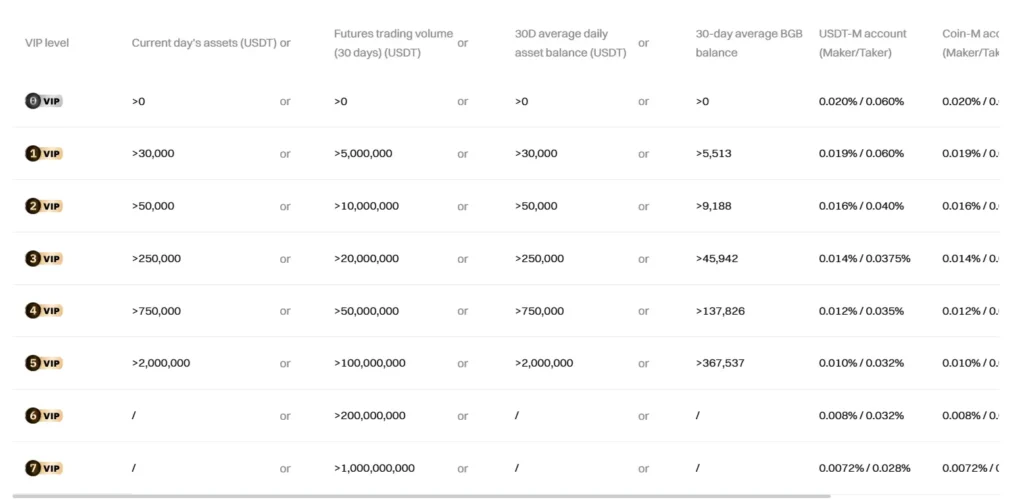

Coinbase Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Coinbase and Bitget, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| Coinbase | 0.5% + variable fee | 0.5% + variable fee |

Bitget offers significantly lower trading fees compared to Coinbase. This difference can have a major impact on your profits, especially if you trade frequently or in large volumes.

Deposit Fees

Coinbase charges no fees for ACH deposits from U.S. banks, making it convenient for American users. This is helpful if you’re transferring money directly from your bank account.

Bitget also offers competitive deposit options, though specific rates may vary based on your payment method and location.

Withdrawal Fees

Both platforms charge network fees for crypto withdrawals, which vary by cryptocurrency. These fees fluctuate based on network congestion.

Coinbase tends to have higher withdrawal fees overall, while Bitget aims to keep these costs lower for users.

Fee Reduction Options

Bitget allows you to pay commissions with bonus funds, potentially reducing your trading costs further. This feature isn’t available on Coinbase.

You should consider your trading volume and frequency when comparing these platforms. If you’re an active trader, Bitget’s lower fees might save you considerable money over time.

Coinbase Vs Bitget: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is essential for executing your strategy effectively. Both Coinbase and Bitget offer various order options, but they differ in some important ways.

Coinbase provides basic order types for most users. Their main platform offers market orders that execute immediately at the current price. This is ideal when you want to buy or sell quickly without waiting.

From the search results, we know that Coinbase market orders “cannot be cancelled because they are filled immediately.” This makes them simple but less flexible for price-sensitive traders.

Coinbase also offers limit orders through their Advanced Trading platform. These let you set a specific price at which you want to buy or sell.

Bitget generally offers more advanced trading options. Their platform includes:

- Market Orders: Execute immediately at market price

- Limit Orders: Set your desired price

- Stop Orders: Trigger at a certain price point

- OCO (One-Cancels-Other): Place two orders where filling one cancels the other

- Trailing Stop Orders: Adjust automatically as the market moves

Bitget’s wider range of order types gives experienced traders more tools to manage risk and execute complex strategies.

If you’re a beginner, Coinbase’s simpler approach might be easier to understand. For advanced traders, Bitget’s comprehensive order options provide more flexibility to implement sophisticated trading strategies.

Coinbase Vs Bitget: KYC Requirements & KYC Limits

Both Coinbase and Bitget implement Know Your Customer (KYC) protocols to comply with regulatory requirements and enhance platform security.

Coinbase KYC Requirements:

- Basic verification requires your name, email, and phone number

- Full verification asks for government ID, address proof, and facial recognition

- Complete KYC unlocks higher trading limits and all platform features

Coinbase uses a tiered verification system where higher levels of verification grant you increased trading limits and access to more advanced features.

Bitget KYC Requirements:

- Basic account setup needs email or phone verification

- Full verification requires personal information and ID documents

- Bitget has implemented anti-money laundering (AML) security alongside KYC systems

Bitget offers different verification tiers similar to Coinbase, with progressively higher limits as you complete more verification steps.

Trading Limits Comparison:

| Exchange | No KYC Limit | Basic KYC | Full KYC |

|---|---|---|---|

| Coinbase | Very limited | Moderate | High |

| Bitget | Basic trading | Enhanced | Full access |

Without completing KYC, your trading abilities will be severely restricted on both platforms. Full verification is highly recommended if you plan to trade regularly.

The verification process on both platforms typically takes 1-3 business days, though it may be quicker during non-peak periods.

Coinbase Vs Bitget: Deposits & Withdrawal Options

When choosing between Coinbase and Bitget, understanding their deposit and withdrawal options is essential for managing your crypto efficiently.

Coinbase offers free ACH deposits and withdrawals for U.S. bank transfers, making it cost-effective for American users. You can also use credit/debit cards and wire transfers, though these methods typically include higher fees.

Bitget provides competitive options with generally lower fees across their platform. Their deposit methods include bank transfers and credit cards, similar to Coinbase.

Withdrawal fees vary between the platforms:

| Platform | Crypto Withdrawal Fees | Fiat Withdrawal Options |

|---|---|---|

| Coinbase | Varies by cryptocurrency | Bank transfer, PayPal (select regions) |

| Bitget | Lower than industry average | Bank transfer |

Processing times differ between the exchanges. Coinbase crypto withdrawals often process within minutes, while fiat withdrawals may take 1-3 business days depending on your payment method.

Bitget typically processes withdrawals quickly, but exact timeframes depend on network congestion and the specific cryptocurrency you’re withdrawing.

Both platforms support a wide range of cryptocurrencies for deposits and withdrawals, though Coinbase tends to be more selective about which coins it lists.

Security measures for transactions are robust on both exchanges, with two-factor authentication and withdrawal address whitelisting available to protect your funds.

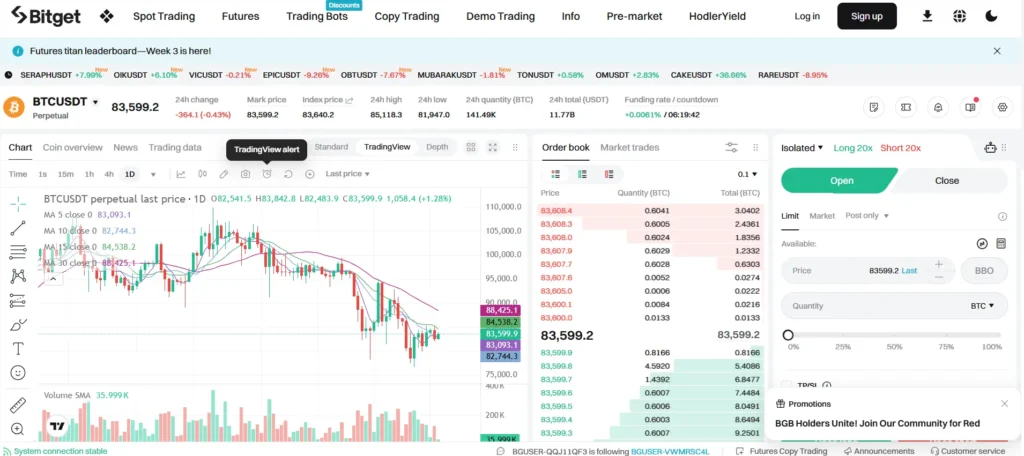

Coinbase Vs Bitget: Trading & Platform Experience Comparison

When choosing between Coinbase and Bitget, the trading experience differs significantly. Coinbase offers a cleaner, more beginner-friendly interface that many new traders find approachable.

Bitget, on the other hand, caters more to experienced traders with advanced features and tools. Its platform includes more complex trading options like futures trading.

Fee Structure:

| Exchange | Maker Fee | Taker Fee | Notable |

|---|---|---|---|

| Bitget | 0.02% | 0.06% | Can use bonus funds for fees |

| Coinbase | Higher | Higher | Premium for user-friendly design |

You’ll notice Bitget offers more competitive trading fees compared to Coinbase. This difference can be significant if you’re an active trader making frequent transactions.

The trading interface on Coinbase prioritizes simplicity while Bitget provides more detailed market data and technical analysis tools. Your choice depends on your trading style and experience level.

Mobile accessibility is strong with both platforms, letting you trade on the go. Coinbase’s app maintains its simplicity advantage, while Bitget’s mobile version keeps most advanced features intact.

For beginners, Coinbase’s intuitive design might be worth the higher fees. For experienced traders focused on cost efficiency and advanced features, Bitget offers more value.

Both platforms offer strong security measures, but they target different user experiences – Coinbase for simplicity and Bitget for trading flexibility.

Coinbase Vs Bitget: Liquidation Mechanism

When trading on margin or futures platforms, understanding how exchanges handle liquidations is crucial for your risk management. Both Coinbase and Bitget have specific liquidation mechanisms that trigger when your positions fall below certain thresholds.

Coinbase Liquidation Process:

- Uses a gradual liquidation system rather than immediate full liquidation

- Typically starts liquidation when margin ratio falls below 3%

- Sends notifications before liquidation begins

- Offers a chance to add more funds to avoid complete position closure

Coinbase provides a small time buffer for traders to respond to margin calls. This gives you a brief opportunity to deposit additional funds and maintain your position.

Bitget Liquidation Process:

- Employs an insurance fund to protect traders from negative balances

- Triggers liquidation when maintenance margin requirements aren’t met

- Uses a tiered system based on position size and leverage

- Offers copy trading with specific liquidation rules for followers

Bitget’s copy trading feature includes special liquidation rules that may differ from standard trading. This can affect how quickly positions are closed when following another trader’s strategy.

Both platforms calculate liquidation prices based on your leverage, position size, and market volatility. Higher leverage means liquidation will occur closer to your entry price, giving you less room for price fluctuation.

Neither exchange guarantees execution at the exact liquidation price during extreme market volatility. Slippage can occur, potentially leading to larger losses than anticipated.

Coinbase Vs Bitget: Insurance

When choosing a crypto exchange, understanding insurance protection is essential for your security. Both Coinbase and Bitget offer different approaches to keeping your assets safe.

Coinbase provides FDIC insurance for USD balances up to $250,000 per customer. This applies only to your fiat currency, not cryptocurrencies. For crypto assets, Coinbase maintains a separate insurance policy that covers certain losses from security breaches.

Coinbase stores approximately 98% of customer crypto in cold storage, which adds an extra layer of protection against online attacks.

Bitget also prioritizes security through its Protection Fund, which reached $300 million in 2023. This fund is designed to protect users against potential exchange security incidents.

Unlike Coinbase, Bitget doesn’t offer FDIC insurance for fiat deposits. However, they maintain a comprehensive security framework that includes multi-signature wallets and regular security audits.

Both exchanges implement two-factor authentication (2FA) and advanced encryption to protect your account. These measures work alongside their insurance policies to create multiple security layers.

When deciding between these platforms, you should consider:

- Coinbase: Better for users seeking traditional insurance backing for USD funds

- Bitget: Strong protection fund specifically for crypto assets

Your trading volume and the types of assets you hold might influence which insurance approach better suits your needs.

Coinbase Vs Bitget: Customer Support

When choosing between Coinbase and Bitget, customer support can make a big difference in your trading experience. Both platforms offer support options, but they differ in availability and quality.

Coinbase provides 24/7 email support and has a comprehensive help center with guides and FAQs. You can also reach them through live chat, though response times may vary depending on the time of day and current demand.

Bitget also offers 24/7 support through multiple channels including email, live chat, and social media platforms. Many users report faster response times with Bitget compared to Coinbase.

Here’s a quick comparison of their customer support features:

| Feature | Coinbase | Bitget |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Email Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Phone Support | Limited | No |

| Social Media Support | Yes | Yes |

| Help Center/FAQ | Extensive | Good |

Coinbase tends to have longer wait times during peak periods or market volatility. You might wait several hours or even days for complex issues.

Bitget typically responds faster, often within minutes for chat support and within 24 hours for email inquiries.

For beginners, Coinbase’s help resources are more detailed and easier to understand. Bitget’s support materials are improving but may require more technical knowledge.

Language support is another consideration. Coinbase offers support in more languages, while Bitget has been expanding its language options recently.

Coinbase Vs Bitget: Security Features

When choosing a crypto exchange, security should be your top priority. Both Coinbase and Bitget offer strong security measures, but with some key differences.

Coinbase is widely recognized for its robust security infrastructure. It stores 98% of customer funds in offline cold storage, protecting them from online attacks. You also get two-factor authentication (2FA) and biometric login options.

Bitget provides similar cold storage solutions but stands out with its Protection Fund. This fund, worth over $300 million, serves as insurance for users if any security issues arise.

Key Security Features Comparison:

| Feature | Coinbase | Bitget |

|---|---|---|

| Cold Storage | 98% of funds | Yes (percentage not specified) |

| 2FA | Yes | Yes |

| Insurance | FDIC insurance (USD only) | $300M+ Protection Fund |

| Biometric Login | Yes | Yes |

| Security History | Strong track record | Good, but less established |

Coinbase has a longer history in the market with fewer security incidents. This established track record gives many users peace of mind.

Bitget’s approach to security focuses on rapid recovery if issues occur. Their Protection Fund is designed to compensate users quickly if any security breach happens.

You should enable all available security features regardless of which platform you choose. This includes using unique passwords, enabling 2FA, and keeping your recovery phrases in secure offline locations.

Is Coinbase A Safe & Legal To Use?

Coinbase is widely regarded as one of the safer cryptocurrency exchanges in the market. Based on available information, it operates legally in the United States and other jurisdictions where it has received proper authorization.

The platform implements strong security measures to protect user funds and data. These include two-factor authentication, cold storage for most cryptocurrencies, and insurance coverage for digital assets held online.

Coinbase is known for its regulatory compliance, which adds an extra layer of security for users. Unlike some exchanges, Coinbase works within established financial frameworks and follows KYC (Know Your Customer) protocols.

When major market movements happen, some users report outages or access issues with Coinbase. This could potentially affect your ability to trade during volatile periods.

For enhanced safety, consider these practices:

- Enable all security features offered

- Use a unique, strong password

- Consider a hardware wallet for long-term storage

- Maintain accounts on multiple exchanges

Coinbase’s user-friendly interface makes it particularly suitable for beginners concerned about security. The exchange offers a standard platform for new users and a more advanced interface (Coinbase Pro) for experienced traders.

Overall, Coinbase provides reliable security features and operates legally in its authorized markets, making it a generally safe option for cryptocurrency trading and investment.

Is Bitget A Safe & Legal To Use?

Bitget appears to be a legitimate cryptocurrency exchange that has not experienced major security breaches. According to search results, the platform has not recorded significant losses of user funds.

The exchange employs standard security measures like two-factor authentication (2FA) to protect users’ accounts. Forbes has reportedly listed Bitget among the world’s most trustworthy crypto exchanges, noting its strong BTC-ETH holding score and focus on transparency.

However, user opinions about Bitget’s safety are mixed. While some sources indicate it’s safe to use, others mention concerns. There are reports of some users expressing dissatisfaction, with at least one Reddit post calling it “shady” and claiming it scams both users and project developers.

Regarding regulation, Bitget’s status varies by location. The search results indicate it has some level of regulation in the United States, but it doesn’t appear to be regulated by financial authorities in the UK, Germany, or France.

Before using Bitget, you should:

- Research the platform’s current regulatory status in your country

- Start with small amounts to test the platform

- Enable all available security features

- Keep most crypto in a personal wallet rather than on the exchange

As with any crypto exchange, you should exercise caution and be aware that regulations in this space change frequently.

Frequently Asked Questions

Many crypto traders have questions when choosing between Coinbase and BitGet. These platforms differ in several key areas including security features, fee structures, and available cryptocurrencies.

What are the key differences in security measures between BitGet and Coinbase?

Coinbase implements bank-level encryption, 2FA authentication, and keeps 98% of assets in cold storage. The platform is also FDIC-insured for USD balances up to $250,000.

BitGet offers similar security features including 2FA and cold storage solutions. However, it lacks the FDIC insurance that Coinbase provides for USD deposits.

Both exchanges use anti-phishing measures, but Coinbase has a longer track record of maintaining security during market volatility and hacking attempts.

Can users expect lower transaction fees on BitGet compared to Coinbase?

BitGet typically offers lower trading fees than Coinbase, with standard fees ranging from 0.1% to 0.2% per transaction. Volume-based discounts can reduce these fees further.

Coinbase charges higher fees, especially on its main platform where transaction fees can reach 1.49% to 3.99%. Coinbase Pro offers lower fees but still generally exceeds BitGet’s fee structure.

For high-volume traders, BitGet presents a more cost-effective option, potentially saving hundreds of dollars monthly compared to Coinbase.

How do BitGet’s supported cryptocurrencies compare to those of Coinbase?

Coinbase supports over 200 cryptocurrencies for trading, focusing on established tokens that have passed its rigorous security and compliance standards.

BitGet offers a wider selection of cryptocurrencies, including many emerging altcoins and tokens not available on Coinbase. This makes BitGet attractive for traders seeking exposure to newer projects.

Regional restrictions may affect which coins are available to you on either platform, as regulatory compliance differs by country.

Which exchange offers more advanced trading features, BitGet or Coinbase?

BitGet provides more advanced trading features including futures trading, copy trading, and leverage options up to 125x. Its interface caters to experienced traders seeking sophisticated tools.

Coinbase offers a more straightforward interface designed for beginners, with limited advanced features on its main platform. Coinbase Pro adds more tools but still lacks the derivative options found on BitGet.

Technical traders generally prefer BitGet’s charting tools and order types, while new investors find Coinbase’s simplified approach more accessible.

How do customer support experiences differ between BitGet and Coinbase users?

Coinbase offers email support, a comprehensive help center, and phone support for specific issues. Response times can vary from hours to days depending on inquiry complexity and market conditions.

BitGet provides 24/7 live chat support in multiple languages, which users generally report as more responsive than Coinbase’s support system.

Both platforms struggle during high-volume periods, but BitGet’s live chat feature gives it an advantage for urgent issues requiring immediate assistance.

What are the main geographical restrictions affecting BitGet and Coinbase?

Coinbase operates in over 100 countries with full regulatory compliance, making it widely accessible in North America, Europe, and many parts of Asia and Oceania.

BitGet faces more restrictions in certain regions, particularly in the United States where regulatory hurdles limit its full service availability.

Before signing up, check each platform’s current country restrictions, as regulatory environments for crypto exchanges continue to evolve rapidly across different jurisdictions.

Bitget Vs Coinbase Conclusion: Why Not Use Both?

Coinbase and Bitget each offer unique advantages that might appeal to different aspects of your crypto journey. Coinbase shines with its user-friendly interface and is often recommended for beginners just starting in crypto.

Bitget, on the other hand, provides advanced features like futures trading, copy trading, and more extensive earn options that experienced traders value.

You don’t necessarily have to choose just one platform. Many crypto users maintain accounts on multiple exchanges to take advantage of different features and opportunities.

For example, you could use Coinbase for simple buying, selling, and storing of mainstream cryptocurrencies while utilizing Bitget for copy trading or futures when you’re ready for more advanced strategies.

This dual approach lets you enjoy Coinbase’s simplicity and strong security alongside Bitget’s advanced trading features and potentially lower fees.

Key benefits of using both:

- Access to a wider range of coins and trading pairs

- Ability to compare fees for specific transactions

- Reduced risk through platform diversification

- Different user experiences for different needs

Remember that maintaining accounts on multiple platforms requires keeping track of more login credentials and potentially managing wallets across different systems. Start with one that matches your current needs, then expand as your crypto experience grows.