Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Today, we’re comparing two popular platforms: Coinbase and BingX. Each offers unique features that might better suit your specific needs.

When deciding between Coinbase and BingX, you should consider differences in their fee structures, available cryptocurrencies, trading options, and user interfaces. Coinbase is known for its user-friendly design and strong security, while BingX offers more advanced trading features including derivatives.

The two exchanges also differ in their deposit methods, supported countries, and customer service options. Understanding these key differences will help you pick the platform that best matches your trading style, whether you’re a beginner looking for simplicity or an experienced trader seeking more complex tools.

Coinbase vs BingX: At A Glance Comparison

When choosing between Coinbase and BingX in 2025, understanding their key differences can help you make the right choice for your crypto needs.

Exchange Type:

- Coinbase: Beginner-friendly exchange with strong regulation and security

- BingX: Trading platform focused on derivatives and social trading features

Supported Cryptocurrencies:

| Exchange | Number of Coins | Notable Exclusives |

|---|---|---|

| Coinbase | 200+ | Many new token listings |

| BingX | 300+ | More altcoins and trading pairs |

Fee Structure:

Coinbase charges higher fees for basic users (0.5-3.99% per transaction) but offers reduced rates through Coinbase Pro. BingX typically maintains lower trading fees (0.1-0.2%) across its platform.

User Experience:

Coinbase provides a simple, clean interface ideal for beginners. BingX offers a more complex trading environment with advanced charting tools and copy trading features.

Security Features:

Both exchanges offer two-factor authentication and cold storage solutions. Coinbase holds stronger regulatory compliance in the US market, while BingX has expanded its security measures significantly in 2025.

Unique Features:

- Coinbase: Earn program, educational resources, Coinbase Card

- BingX: Copy trading, futures contracts, social trading community

Your choice depends on your trading experience and goals. Coinbase works better for beginners and those prioritizing security, while BingX suits more experienced traders looking for advanced features and lower fees.

Coinbase vs BingX: Trading Markets, Products & Leverage Offered

Coinbase and BingX offer different trading options to meet various investor needs. Your choice between these platforms may depend on what you want to trade and how much risk you’re willing to take.

Markets & Products:

| Feature | Coinbase | BingX |

|---|---|---|

| Cryptocurrencies | Wide selection | Wide selection |

| Spot Trading | Yes | Yes |

| Futures Trading | Yes | Yes |

| Copy Trading | Limited | Extensive |

Coinbase provides a straightforward approach to cryptocurrency trading. You can buy, sell, and trade popular coins directly. The platform focuses on security and ease of use for beginners.

BingX offers similar spot trading options but adds more advanced features for experienced traders. Their copy trading system lets you automatically follow successful traders’ strategies.

Leverage Options:

Coinbase takes a conservative approach to leverage. They offer up to 3x leverage on certain cryptocurrencies and about 10x leverage for select futures trading.

BingX provides much higher leverage options. This means you can potentially make bigger profits, but it also comes with greater risk of losses.

Your trading style should guide your platform choice. If you prefer lower-risk trading with strong security, Coinbase might be better. For more advanced trading with higher leverage options, BingX offers more flexibility.

Remember that higher leverage means higher risk. Only use leverage if you understand how it works and can manage potential losses.

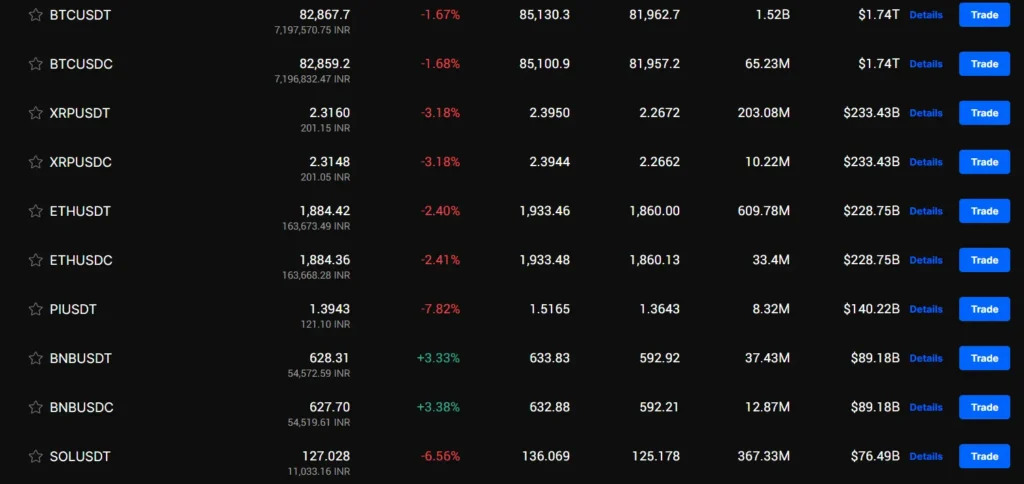

Coinbase vs BingX: Supported Cryptocurrencies

When choosing a cryptocurrency exchange, the variety of available coins can significantly impact your trading options. Both Coinbase and BingX offer a range of cryptocurrencies, but with notable differences.

Coinbase supports over 200 cryptocurrencies as of March 2025. This includes major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), along with many altcoins and tokens. Coinbase typically adds new cryptocurrencies after careful review processes.

BingX offers access to more than 300 cryptocurrencies. Their selection includes mainstream options and a wider variety of smaller, emerging tokens. This broader selection gives you more opportunities to diversify your portfolio with newer projects.

Key differences in cryptocurrency support:

| Feature | Coinbase | BingX |

|---|---|---|

| Total cryptocurrencies | 200+ | 300+ |

| New coin listing speed | Moderate | Faster |

| Staking options | Limited selection | More extensive |

| Token types | Focus on established coins | More emerging tokens |

BingX tends to list new cryptocurrencies more quickly than Coinbase. This can be beneficial if you want early access to emerging projects, though it may come with additional risk.

Both platforms support the most popular cryptocurrencies that make up the majority of market volume. Your choice may depend on whether you prefer Coinbase’s more curated approach or BingX’s wider selection.

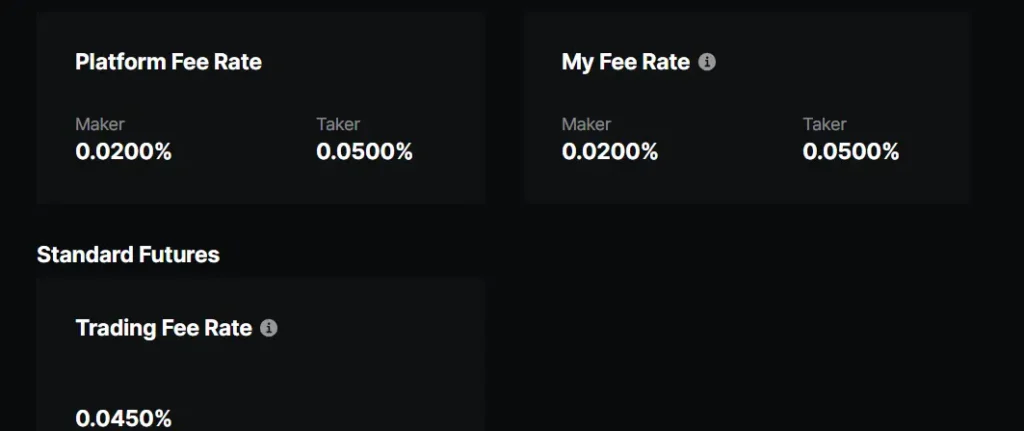

Coinbase vs BingX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Coinbase and BingX, fees are a key factor to consider. These costs can significantly impact your trading profits.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Coinbase | 0.40-0.60% | 0.40-0.60% |

| BingX | 0.08-0.20% | 0.08-0.20% |

BingX offers lower trading fees, making it more cost-effective for frequent traders. Your costs with BingX can be about 2-5 times less than with Coinbase.

Deposit Methods & Fees

Coinbase supports bank transfers, credit cards, and PayPal. Most deposit methods incur a fee of 1.49-3.99%, depending on your payment method.

BingX primarily focuses on crypto deposits, which are usually free. It offers fewer fiat deposit options compared to Coinbase.

Withdrawal Fees

Coinbase charges network fees for crypto withdrawals. These vary by cryptocurrency but tend to be higher than industry averages.

BingX also charges network fees for withdrawals, but they are generally more competitive than Coinbase.

For high-volume traders, BingX’s lower fee structure provides significant savings. However, if you value more fiat deposit options and a user-friendly interface, Coinbase might be worth the higher fees.

Your specific trading habits should guide your choice. Consider how often you trade and what deposit methods you prefer to determine which platform will be more cost-effective.

Coinbase vs BingX: Order Types

When trading on crypto exchanges, the types of orders available can significantly impact your trading strategy. Coinbase and BingX offer different options to meet various trading needs.

Coinbase provides several basic order types for traders. You can use market orders to buy or sell immediately at the current price. Limit orders let you set specific prices for your trades.

Coinbase also offers stop orders to help manage risk. However, Coinbase focuses more on simplicity rather than advanced trading features.

BingX offers a wider range of order types designed for more active traders. Beyond the basic market and limit orders, you’ll find:

- Stop-loss and take-profit orders

- OCO (One-Cancels-Other) orders

- Trailing stop orders

- Grid trading options

BingX’s platform is built with more sophisticated traders in mind. You can create complex strategies using these various order types.

For beginners, Coinbase’s simpler approach might be preferable. The streamlined order types make it easier to get started without feeling overwhelmed.

Advanced traders may prefer BingX’s robust options. The variety of order types gives you more control over your trading strategy and risk management.

Your trading style will determine which platform’s order types better suit your needs. Consider how frequently you trade and how much control you want over your positions.

Coinbase vs BingX: KYC Requirements & KYC Limits

Coinbase and BingX differ significantly in their approach to Know Your Customer (KYC) requirements, which affects how quickly you can start trading.

Coinbase has mandatory KYC verification for all users. You must provide personal information, including your full name, address, date of birth, and government-issued ID before you can begin trading.

BingX offers more flexibility with KYC. Based on current information, BingX makes KYC verification optional for users. You can trade on the platform with minimal or no KYC requirements for certain transactions.

Here’s how they compare:

| Feature | Coinbase | BingX |

|---|---|---|

| KYC Required | Yes, for all users | Optional |

| Verification Speed | Can take 1-3 business days | Faster access without verification |

| Trading Without KYC | Not possible | Possible with limitations |

| Withdrawal Limits | Higher with full verification | Limited without KYC |

Without KYC verification on BingX, you can start trading immediately, but you’ll face lower withdrawal limits. This makes BingX potentially more appealing if you value privacy or want to begin trading quickly.

For users concerned about regulatory compliance and security, Coinbase’s strict KYC policies provide additional protection and legitimacy. However, the verification process takes longer.

Your choice between these platforms may depend on how you prioritize trading access speed versus security and withdrawal flexibility.

Coinbase vs BingX: Deposits & Withdrawal Options

Coinbase and BingX offer different options for moving your money in and out of their platforms. Each has unique advantages depending on your needs.

Coinbase Deposit Methods:

- Bank transfers (ACH)

- Wire transfers

- Credit/debit cards

- PayPal (in some regions)

- Cryptocurrency deposits

Coinbase is known for its user-friendly approach to fiat deposits, making it accessible for beginners. You can easily connect your bank account or use a credit card to buy crypto directly.

BingX Deposit Methods:

- Cryptocurrency deposits

- Bank transfers (limited regions)

- Third-party payment processors

- P2P trading options

BingX focuses more on crypto-to-crypto transactions and offers fewer fiat options than Coinbase. This makes it better suited for users who already hold cryptocurrency.

Withdrawal Comparison:

| Feature | Coinbase | BingX |

|---|---|---|

| Fiat withdrawals | Widely supported | Limited |

| Crypto withdrawals | All listed coins | All listed coins |

| Processing time | 1-5 business days (fiat) | 1-3 business days (fiat) |

| Withdrawal fees | Higher than average | Competitive rates |

Coinbase typically charges higher fees for withdrawals but provides more options for getting your money back to your bank account. You’ll find its process straightforward but potentially costly.

BingX offers lower withdrawal fees in most cases but has fewer options for converting back to traditional currency. This makes it more appealing if you’re primarily trading between different cryptocurrencies.

Both platforms implement security measures like withdrawal confirmation emails and two-factor authentication to protect your funds.

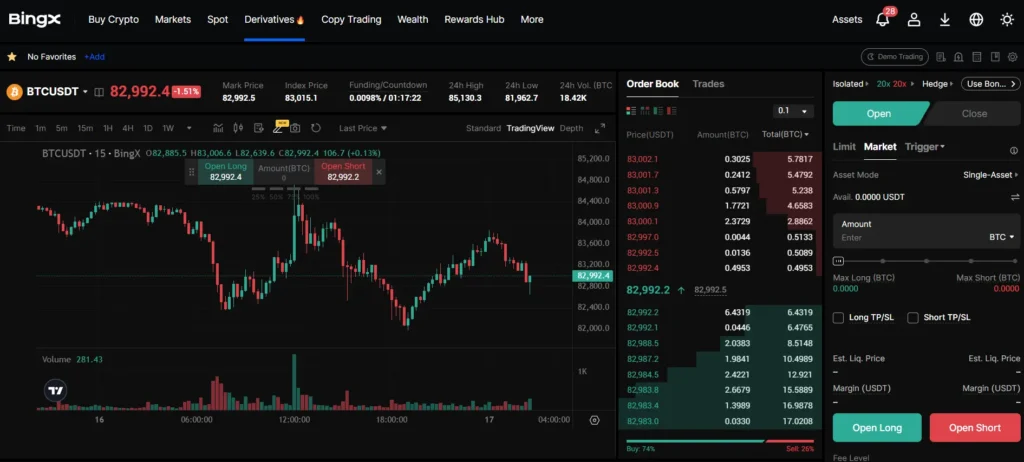

Coinbase vs BingX: Trading & Platform Experience Comparison

When choosing between Coinbase and BingX, the trading experience differs significantly. Coinbase offers a clean, beginner-friendly interface that makes it easy for new traders to buy and sell cryptocurrencies.

BingX, on the other hand, caters more to experienced traders with advanced features like copy trading and more complex trading options. This platform might feel overwhelming if you’re just starting out.

User Interface Comparison:

- Coinbase: Simple, intuitive design with basic functions prominently displayed

- BingX: Feature-rich interface with more technical tools and analytics

Coinbase charges higher fees but provides a more straightforward experience. You can quickly purchase crypto with fiat currency using bank transfers or credit cards.

BingX typically offers lower trading fees and more trading pairs. The platform includes social trading features that let you follow and copy successful traders’ strategies.

Mobile Experience: Both platforms offer mobile apps, but Coinbase’s app maintains its simplicity advantage. BingX’s mobile version keeps most advanced features intact but may require more learning time.

For beginners, Coinbase’s educational resources stand out. You’ll find helpful guides and earn-while-you-learn programs that BingX doesn’t match.

Trading tools on BingX include more advanced charting capabilities and technical analysis features. This makes it better suited if you’re looking to implement complex trading strategies.

Coinbase vs BingX: Liquidation Mechanism

When trading with leverage on crypto platforms, understanding the liquidation mechanism is crucial for risk management. Both Coinbase and BingX have systems in place to protect themselves when your positions reach critical levels.

BingX uses a tiered liquidation system that gradually reduces your position size as you approach the liquidation price. This gives you a chance to add more collateral before complete liquidation occurs.

Coinbase, on the other hand, employs a more straightforward approach. When your position reaches the liquidation threshold, the platform automatically closes your position to prevent further losses.

Liquidation Thresholds Comparison:

| Platform | Initial Warning | Partial Liquidation | Full Liquidation |

|---|---|---|---|

| BingX | 80% of margin | 90% of margin | 97% of margin |

| Coinbase | None | None | 80% of margin |

BingX offers a liquidation protection fund that may absorb some losses during volatile market conditions. This can potentially save your position during short-term price spikes.

Both platforms send notifications when your positions approach liquidation levels. BingX typically provides more frequent alerts at different threshold levels.

Your liquidation price is calculated differently on each platform. BingX factors in trading fees when determining this price, while Coinbase uses a more straightforward calculation based solely on your position size and margin.

For new traders, BingX’s graduated liquidation approach might be more forgiving when learning to manage leveraged positions.

Coinbase vs BingX: Insurance

When choosing a cryptocurrency exchange, insurance is a crucial factor to consider. It provides protection for your assets in case of security breaches or platform failures.

Coinbase Insurance Coverage:

- FDIC insurance for USD balances up to $250,000 per customer

- Commercial crime insurance for digital assets held in hot wallets

- Most customer assets (98%) stored in cold storage for enhanced security

Coinbase maintains a strong insurance policy to protect users from potential hacks or theft. This gives you an added layer of security for your investments, especially important for beginners and high-volume traders.

BingX Insurance Coverage:

- Maintains a dedicated Asset Protection Fund

- Insurance primarily covers assets in hot wallets

- Less comprehensive coverage compared to Coinbase

BingX offers some protection through its Asset Protection Fund, but the coverage is not as extensive as Coinbase’s insurance policy. This difference might be significant if security is your primary concern.

For large investments, Coinbase provides more robust insurance protection. However, both platforms implement strong security measures like two-factor authentication and cold storage solutions.

Before making your decision, you should assess how much value you place on comprehensive insurance coverage. Your risk tolerance and investment size will help determine which platform’s insurance policy better suits your needs.

Coinbase vs BingX: Customer Support

Customer support can make or break your crypto trading experience. Both Coinbase and BingX offer several support channels, but they differ in response times and availability.

Coinbase provides 24/7 email support and has a comprehensive help center with articles and guides. You can also access phone support for account issues, though wait times can be lengthy during peak hours.

BingX offers live chat support that’s generally responsive, with most users getting help within minutes. They also provide email support and maintain an extensive knowledge base.

Response Times:

- Coinbase: Typically 24-48 hours for email; 10-30 minutes for phone

- BingX: Usually under 10 minutes for live chat; 24 hours for email

Coinbase has stronger verification procedures when handling account issues. This adds security but can sometimes slow down the resolution process.

BingX’s support team is particularly helpful with trading-related questions. Their agents are trained to assist with the platform’s copy trading and derivatives features.

Language support is another consideration. Coinbase excels with support in multiple languages, while BingX’s strongest support is in English and Chinese.

Support Channels Comparison:

| Feature | Coinbase | BingX |

|---|---|---|

| Live Chat | Limited | Yes |

| Yes | Yes | |

| Phone | Yes | No |

| Help Center | Extensive | Good |

| Social Media | Active | Active |

Coinbase vs BingX: Security Features

When it comes to keeping your crypto safe, both Coinbase and BingX offer strong security features, but with different approaches.

Coinbase is known for its robust security infrastructure. You get two-factor authentication (2FA), biometric login options, and insurance coverage for digital assets held in their online storage. About 98% of customer funds are stored in cold wallets, keeping them offline and away from potential hackers.

BingX also provides standard security protections including 2FA and encryption. They focus on risk management systems to protect traders, especially those using their copy trading feature.

Key Security Features Comparison:

| Feature | Coinbase | BingX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | 98% of funds | Partial |

| Insurance Coverage | ✓ | Limited |

| Regulatory Compliance | High (Multiple regions) | Growing |

| Account Monitoring | 24/7 | Available |

Coinbase has earned a reputation for regulatory compliance across multiple jurisdictions. This gives you added protection and legitimacy when using their platform.

BingX is working to strengthen its regulatory position but doesn’t yet match Coinbase’s extensive compliance framework.

You should enable all available security features regardless of which platform you choose. This includes using unique passwords, enabling 2FA, and being cautious about phishing attempts.

Both platforms employ encryption techniques to protect your data during transactions, though Coinbase’s longer history has allowed them to develop more sophisticated security protocols.

Is Coinbase Safe & Legal To Use?

Coinbase is legal to use in the United States. It follows US regulations and is fully licensed to operate as a cryptocurrency exchange. The company has stated they are “100% committed” to staying in the US despite regulatory challenges.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for 98% of customer funds

- Insurance coverage

- State-of-the-art security measures

Coinbase enforces Know Your Customer (KYC) requirements, which means you’ll need to verify your identity to use the platform. This is standard for legitimate exchanges operating in the US.

Many consider Coinbase one of the safest crypto exchanges available in 2025. Its strong security practices help protect your investments from potential threats.

If you’re concerned about safety, Coinbase’s reputation as a publicly-traded company provides additional accountability. They must follow strict regulations and reporting requirements.

For US-based users looking for a secure and legal way to buy cryptocurrency, Coinbase is a reliable option. The platform balances regulatory compliance with user security.

Remember that while Coinbase is secure, you should always use strong passwords and enable all available security features to protect your account.

Is BingX Safe & Legal To Use?

BingX is considered a legitimate cryptocurrency exchange with several security features in place. These include two-factor authentication (2FA), proof of reserve systems, and fund passwords for withdrawals.

For added security, BingX offers address whitelisting and encrypted communication. These measures help protect your assets from unauthorized access.

The platform is regulated and operates legally in many jurisdictions. This regulation provides an additional layer of oversight compared to unregulated exchanges.

Users praise BingX for its reliability in the cryptocurrency trading space. The platform has established itself as a secure option for both beginner and experienced traders.

While no exchange is completely risk-free, BingX has demonstrated a commitment to security. Their robust safety measures align with industry standards.

BingX is particularly known for its copy trading features. This allows you to follow successful traders while benefiting from the platform’s security infrastructure.

The exchange may not be available in all countries, so you should check if it operates legally in your location before signing up. Always verify the current regulatory status in your region.

Frequently Asked Questions

Traders often have specific questions when comparing Coinbase and BingX. These platforms differ in several key areas including fees, security features, user experience, cryptocurrency offerings, withdrawal processes, and customer support options.

What are the key differences in fees between Coinbase and BingX?

Coinbase typically charges higher fees than BingX. Coinbase’s standard trading fees range from 0.5% to 4.5% per transaction, plus additional fees for certain payment methods.

BingX offers more competitive fee structures with spot trading fees starting at 0.1%. BingX also provides fee discounts for high-volume traders and those who hold the platform’s native token.

The fee difference becomes especially noticeable for frequent traders. Coinbase Pro offers slightly lower fees than regular Coinbase but still generally remains higher than BingX’s fee structure.

What are the security measures implemented by Coinbase as compared to BingX?

Coinbase is known for robust security with 98% of customer funds stored in offline cold storage. They offer two-factor authentication (2FA), biometric logins, and FDIC insurance for USD balances up to $250,000.

Coinbase complies with strict regulatory requirements in multiple countries and has a strong track record for security since its founding in 2012.

BingX implements multi-signature technology and cold storage solutions. They offer 2FA and API key management for additional security layers.

BingX also provides risk management tools like stop-loss orders and has established a Protection Fund to safeguard user assets in emergencies.

How do the user interfaces and ease of use compare between Coinbase and BingX?

Coinbase offers an intuitive, beginner-friendly interface designed for simplicity. The platform features a clean dashboard, straightforward buy/sell processes, and educational resources for newcomers.

BingX provides a more feature-rich interface geared toward experienced traders. Their platform includes advanced charting tools, multiple order types, and copy trading functionality.

Coinbase’s mobile app is highly rated for its ease of use, while BingX’s app delivers more technical trading features. Your choice depends on your trading experience and specific needs.

Which platform offers a greater variety of cryptocurrencies, Coinbase or BingX?

BingX generally offers a wider selection of cryptocurrencies than Coinbase. BingX supports hundreds of cryptocurrencies including many newer and smaller altcoins.

Coinbase has a more selective approach, listing around 200+ cryptocurrencies. They typically add new tokens after thorough vetting processes, focusing on established projects.

Both platforms regularly add new cryptocurrencies, but BingX tends to list emerging tokens faster. Coinbase prioritizes regulatory compliance when adding new assets to their exchange.

How do withdrawal processes and limits differ between Coinbase and BingX?

Coinbase withdrawal limits vary based on your verification level and account history. New users typically start with lower limits that increase over time with account activity and additional verification.

Withdrawal processing on Coinbase usually takes 1-5 business days for bank transfers, while crypto withdrawals are processed more quickly depending on network congestion.

BingX generally offers higher withdrawal limits for verified users. Their processing times for crypto withdrawals are comparable to industry standards, typically completing within minutes to hours.

Both platforms require identity verification for withdrawals, though BingX may have less stringent requirements for certain withdrawal methods compared to Coinbase.

What customer support services do Coinbase and BingX offer to their users?

Coinbase provides email support, an extensive help center, and phone support for certain issues. Response times can vary based on inquiry complexity and platform traffic.

They’ve expanded their customer service team in recent years following previous criticism about slow response times during high-volume periods.

BingX offers 24/7 customer support through live chat, email, and social media channels. They also maintain a knowledge base with tutorials and guides.

BingX typically provides faster response times for basic inquiries, particularly through their live chat feature. Both platforms offer more personalized support for higher-tier accounts.

Coinbase vs BingX Conclusion: Why Not Use Both?

When comparing Coinbase and BingX in 2025, both platforms offer unique advantages that might benefit your crypto journey.

Coinbase provides a user-friendly interface ideal for beginners and strong regulatory compliance that many investors find reassuring. Its reputation for security and straightforward buying and selling options make it a solid choice for new traders.

BingX, meanwhile, focuses on creating a seamless trading experience with advanced trading features. The platform offers competitive fees and diverse trading options that experienced traders often appreciate.

Instead of choosing just one platform, consider using both to maximize your crypto experience. You can use Coinbase for simple purchases and secure storage, while leveraging BingX for more complex trading strategies.

This dual approach allows you to:

- Diversify your risk across multiple platforms

- Access more trading pairs and opportunities

- Take advantage of different fee structures in various situations

- Utilize the strongest features of each platform

The crypto world changes rapidly, and having accounts on multiple reputable exchanges gives you flexibility and options.

Remember to verify the security measures and regulatory compliance of any exchange you use. Both Coinbase and BingX have implemented robust security measures to protect your assets.

Your trading style and goals should ultimately guide which platform you use more frequently, but maintaining access to both can be a smart strategy.