When it comes to cryptocurrency platforms, choosing between Coinbase and Bybit can significantly impact your trading experience and investment returns. These two popular exchanges offer different features, fee structures, and user experiences that cater to various types of investors.

Bybit has recently surpassed Coinbase to become the second-largest cryptocurrency exchange by trading volume worldwide. This shift in the market highlights the changing landscape of crypto exchanges and raises important questions for investors about which platform might better serve their needs.

You’ll want to consider several factors before deciding which exchange to use, including trading fees, available cryptocurrencies, security features, and user interface. While Coinbase has built a reputation as a beginner-friendly platform with strong regulatory compliance, Bybit offers competitive fees and more advanced trading options that might appeal to experienced traders.

Coinbase Vs Aibit: At A Glance Comparison

Coinbase and Aibit offer different experiences for cryptocurrency traders. Let’s compare their key features to help you decide which platform might work better for your needs.

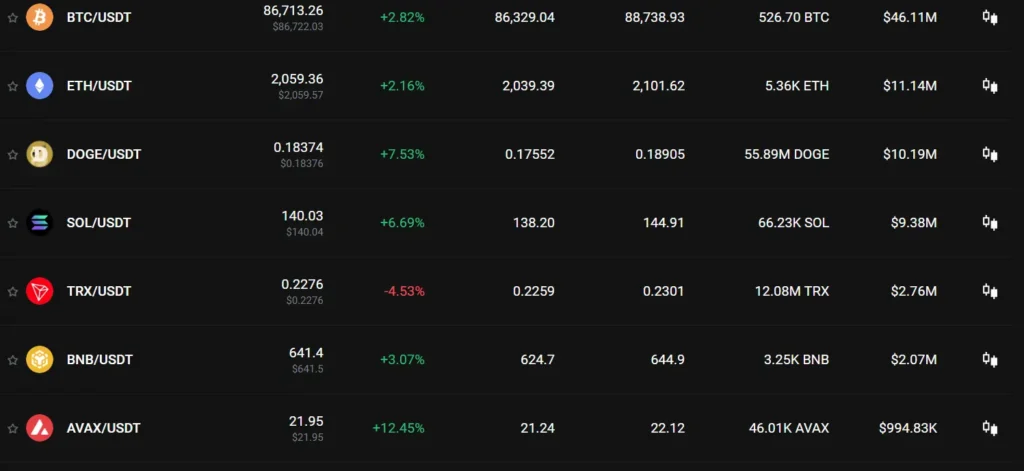

Trading Volume and Market Position

Coinbase has historically been one of the top cryptocurrency exchanges. However, recent data suggests Bybit (similar to Aibit) has surpassed Coinbase in trading volume to become the second-largest exchange in the market.

Fee Structure

Coinbase is known for higher fees compared to alternatives. Their fee structure can impact your profits, especially for smaller trades.

Aibit offers more competitive fees, with some sources indicating no fees for certain transactions, making it potentially more cost-effective for frequent traders.

Platform Focus

Coinbase provides a user-friendly interface geared toward beginners and mainstream adoption. It emphasizes security and regulatory compliance.

Aibit tends to focus more on active traders with additional trading options and features.

Overall Ratings

According to comparison data, Coinbase scores highly on overall metrics with a 9.6 rating in some reviews. This reflects its strong reputation for security and ease of use.

Long-term Holding

For investors planning to buy and hold cryptocurrency for 5+ years without frequent trading, Coinbase might offer advantages through its established security practices and insurance protections.

Available Cryptocurrencies

Both platforms support the major cryptocurrencies, but their selection of altcoins varies. You should check each platform for specific coins you’re interested in trading.

Coinbase Vs Aibit: Trading Markets, Products & Leverage Offered

Coinbase provides a diverse range of trading markets with support for numerous cryptocurrencies. You can access spot trading, futures contracts, and margin trading options on their platform.

For leverage trading, Coinbase offers up to 3x leverage for eligible customers on certain cryptocurrencies. They also provide a retail-friendly futures trading option with up to 10x leverage on select cryptocurrencies.

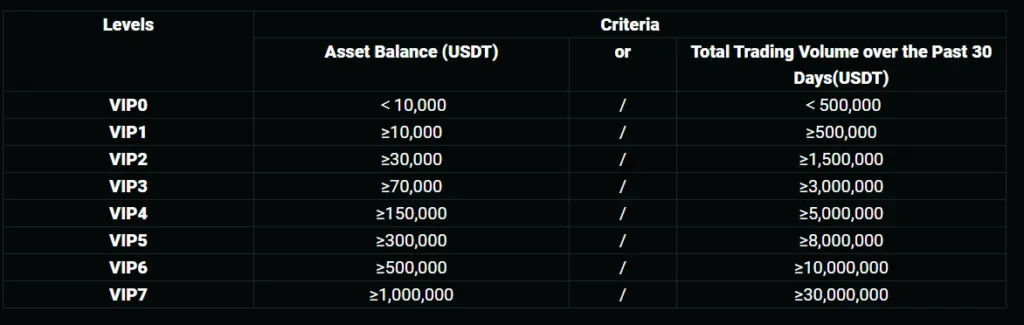

Aibit, in comparison, focuses on providing higher leverage options for traders looking to maximize their potential returns. Their platform specializes in derivatives trading with competitive leverage offerings.

Trading Products Comparison:

| Feature | Coinbase | Aibit |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ (up to 3x) | ✓ (higher leverage) |

| Derivatives | Limited options | Extensive options |

When choosing between these platforms, consider your trading experience and risk tolerance. Coinbase takes a more conservative approach to leverage, which may be better for beginners or those seeking lower risk.

Aibit tends to appeal to more experienced traders looking for advanced trading products and higher leverage options. Their platform specializes in derivatives and leverage trading tools.

Both platforms offer mobile apps and web interfaces for trading on the go. You can access real-time market data and execute trades from anywhere.

Coinbase Vs Aibit: Supported Cryptocurrencies

Coinbase offers an impressive range of cryptocurrency options for traders. According to recent data, Coinbase Prime supports more than 240 digital assets and 300 different trading pairs. For custody services, they handle over 425 digital assets.

Coinbase Wallet supports multiple networks including Ethereum, Solana, and all EVM-compatible networks. These are available in both their mobile app and browser extension.

Aibit (often stylized as ibit) offers fewer cryptocurrency options compared to Coinbase. While specific numbers aren’t available in the search results, Aibit appears to focus primarily on Bitcoin trading.

When choosing between these platforms, consider which cryptocurrencies you plan to trade. If you need access to a wide variety of altcoins and trading pairs, Coinbase provides more options.

For Bitcoin-focused traders, Aibit might be sufficient. Some Reddit users have suggested Aibit offers better value for Bitcoin purchases specifically, noting that Coinbase’s spread and fees can be disadvantageous.

Your decision should factor in:

- Number of cryptocurrencies needed

- Trading pairs required

- Fee structures

- Specific networks you plan to use

Coinbase’s extensive support for different networks means you’ll have more flexibility in how you interact with various blockchain ecosystems. This can be valuable if you plan to use DeFi applications or other blockchain services beyond simple trading.

Coinbase Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

Coinbase and Aibit have different fee structures that can impact your crypto trading costs. Let’s compare them to help you make a better choice.

Coinbase Trading Fees:

- Taker fees: 0.6% for new users (under $10,000 monthly volume)

- Maker fees: 0.4% for new users

- Fees decrease as your trading volume increases

- Can be significantly high for large transactions

Aibit Trading Fees:

- Much lower than Coinbase

- Example: A Bitcoin purchase that would cost over $2,000 in fees on Coinbase might cost less than $6 on Aibit (IBIT)

Deposit Fees:

- Coinbase: Varies by payment method

- Aibit: Generally lower deposit fees

Withdrawal Fees:

- Both platforms charge network fees for crypto withdrawals

- Coinbase often has higher withdrawal fees

You can save substantial money by choosing the platform with lower fees. For large trades especially, the difference between paying $6 versus $2,000 in fees is enormous.

Coinbase does offer enhanced security and a user-friendly interface that some traders value. However, if minimizing costs is your priority, Aibit appears to be the more economical choice for 2025.

Coinbase Vs Aibit: Order Types

When trading on cryptocurrency exchanges, order types give you control over how your trades execute. Let’s compare what Coinbase and Aibit offer in this area.

Coinbase Order Types:

- Market Orders: Execute immediately at the current market price

- Limit Orders: Set a specific price at which you want to buy or sell

- Stop-Limit Orders: Combine stop price triggers with limit orders

- Bracket Orders: Advanced orders that help manage risk with multiple conditions

Coinbase’s market orders are straightforward – they fill instantly at the best available price. This makes them quick but gives you less control over the exact price.

Their limit orders let you specify the exact price you’re willing to accept. This gives you better price control but may not execute if the market doesn’t reach your price.

Aibit Order Types:

- Basic Order Types: Similar standard offerings

- Advanced Trading Options: May vary from Coinbase

Aibit generally provides standard order types similar to most exchanges. However, their specific features might differ slightly from Coinbase.

When choosing between the platforms, consider which order types you’ll use most. If you’re a beginner, both platforms offer the essential order types you need to start trading.

For advanced traders, Coinbase’s well-documented order system with bracket orders might offer more sophisticated trading options.

Coinbase Vs Aibit: KYC Requirements & KYC Limits

Coinbase follows strict Know Your Customer (KYC) protocols as a regulated financial institution. When you sign up for a Coinbase account, you’ll immediately encounter KYC verification processes.

Coinbase requires identity verification for both deposits and withdrawals. This includes providing personal information and submitting identification documents.

For US customers, Coinbase offers a daily deposit limit of $25,000. Your specific limits may vary based on your verification level and account history.

Aibit’s KYC requirements tend to be less stringent compared to Coinbase. However, this doesn’t mean you can avoid identity verification entirely.

Coinbase KYC Levels:

- Basic: Email verification, personal information

- Full: Government ID, proof of address, facial verification

Aibit KYC Levels:

- Basic: Email and phone verification

- Advanced: ID verification for higher transaction limits

The KYC process on Coinbase might feel more thorough and time-consuming. This reflects their compliance with regulations in major markets like the US.

Some users report that Coinbase’s KYC requirements have become more extensive over time. This trend follows broader regulatory developments in the cryptocurrency industry.

Your choice between these platforms may depend on how quickly you need to start trading and your comfort with providing personal information.

Coinbase Vs Aibit: Deposits & Withdrawal Options

When using crypto exchanges, how quickly you can access your money matters. Let’s compare how Coinbase and Aibit handle deposits and withdrawals.

Coinbase Withdrawal Speed:

- Bank transfers: 1-3 days

- Instant withdrawals to debit cards (with fees)

- Completion times vary by location and payment method

Coinbase offers various deposit methods including bank transfers, debit cards, and wire transfers. Your “available balance” shows exactly how much you can transfer or cash out, which helps with planning.

Aibit Withdrawal Options:

- Generally offers standard withdrawal methods

- Competitive processing times

- May have different fee structures than Coinbase

Both platforms support cryptocurrency deposits directly to your wallet. Coinbase’s interface is designed for beginners, making it easier to understand the deposit process.

For those needing quick access to funds, Coinbase has instant withdrawal options, but they come with higher fees. Aibit might offer different timeframes for withdrawals depending on your verification level.

When choosing between these platforms, consider:

- How fast you need your funds

- Withdrawal fees

- Supported payment methods in your region

- Minimum and maximum withdrawal limits

Your banking provider also affects withdrawal speed, as some banks process crypto exchange transfers faster than others.

Coinbase Vs Aibit: Trading & Platform Experience Comparison

Coinbase offers a user-friendly platform designed for beginners with a clean interface and simple navigation. You’ll find the basic trading features easy to understand, making your first crypto purchases straightforward.

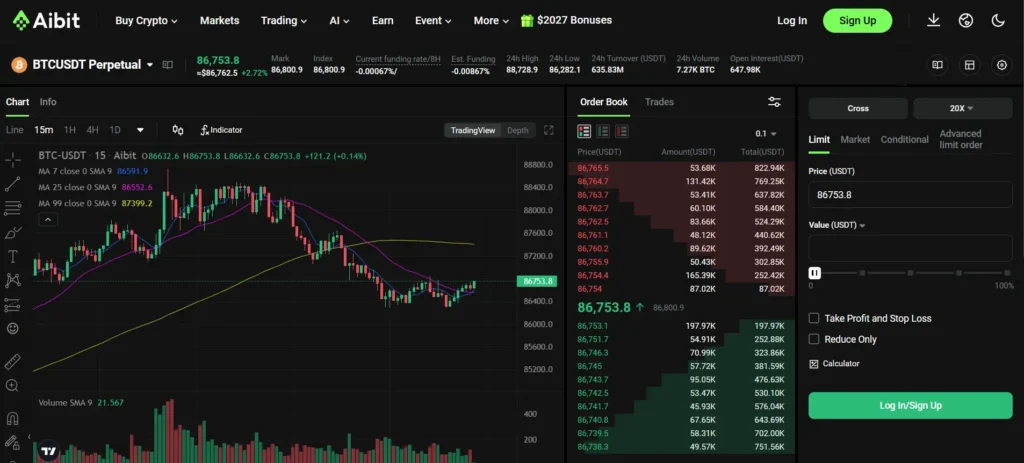

Aibit (often confused with Bybit) provides a more advanced trading experience with robust charting tools and technical analysis features. You get access to more complex order types and trading options than on Coinbase.

Trading Fees Comparison:

| Exchange | Spot Trading Fees | Maker/Taker Fees |

|---|---|---|

| Coinbase | 0.4% – 0.6% | 0.4%/0.6% |

| Aibit | 0.1% – 0.2% | 0.1%/0.2% |

Coinbase’s platform prioritizes security and compliance, which appeals to institutional investors and those new to crypto. Your assets are insured, providing peace of mind for long-term holders.

Aibit excels in trading variety, offering futures, options, and margin trading that Coinbase doesn’t provide. You can leverage your positions on Aibit, but this comes with higher risk.

Mobile experience differs significantly between the platforms. Coinbase’s app mirrors its web simplicity, while Aibit offers more advanced features that may feel overwhelming to beginners.

Key Platform Differences:

- Coinbase focuses on ease-of-use and security

- Aibit provides more trading tools and options

- Coinbase has higher fees but better support

- Aibit offers more advanced trading features with lower fees

Coinbase Vs Aibit: Liquidation Mechanism

When trading with leverage on cryptocurrency platforms, understanding the liquidation process is crucial. Liquidation happens when your collateral value falls below a certain threshold, triggering the platform to close your position.

Coinbase’s liquidation system includes a “liquidation buffer,” which provides extra funds beyond the minimum threshold. This buffer is expressed as a percentage of the difference between your current margin and the liquidation threshold.

For Coinbase Futures, your position gets liquidated to prevent negative balances. This protective measure helps you avoid catastrophic losses when trading with leverage, which can amplify both profits and losses.

Aibit’s liquidation mechanism differs in several key aspects. Their system typically offers tiered liquidation levels that gradually close portions of your position rather than liquidating everything at once.

Key Differences:

| Feature | Coinbase | Aibit |

|---|---|---|

| Liquidation Type | Complete position closure | Partial/tiered liquidation |

| Warning System | Limited notifications | Multiple price alerts |

| Buffer Mechanism | Fixed percentage buffer | Adjustable buffer options |

| Recovery Options | Few post-liquidation options | Position recovery features |

You should monitor your positions carefully on both platforms. Set price alerts to avoid unexpected liquidations, especially during volatile market conditions.

Remember that liquidation thresholds vary based on the asset you’re trading and current market volatility. Always check the specific requirements for each position you open.

Coinbase Vs Aibit: Insurance

When comparing Coinbase and ibit (BlackRock’s iShares Bitcoin Trust), insurance coverage is an important factor to consider.

Coinbase offers crime insurance that protects a portion of digital currencies held in their storage systems against theft. This provides some protection for your assets stored on the platform.

However, it’s crucial to understand that Coinbase is not an FDIC-insured bank. This means cryptocurrency held on Coinbase doesn’t have the same protections as money in a traditional bank account.

The insurance Coinbase provides covers only specific scenarios like theft. It doesn’t protect against market volatility or if you lose access to your account through your own actions.

ibit, as an Exchange Traded Product (ETP), operates differently. It doesn’t hold actual bitcoin for you but instead offers exposure to bitcoin’s price movements through a financial instrument.

BlackRock’s ibit provides a regulated investment vehicle that may offer different protections than a crypto exchange like Coinbase. These protections come from securities regulations rather than direct insurance on digital assets.

When choosing between these options, consider how important insurance coverage is for your investment strategy. Coinbase offers direct cryptocurrency ownership with some insurance against theft, while ibit provides regulated market exposure without direct cryptocurrency custody.

Your risk tolerance and investment goals should guide which option best suits your needs.

Coinbase Vs Aibit: Customer Support

When choosing between cryptocurrency platforms, customer support can make a big difference in your experience. Both Coinbase and Aibit offer support options, but they differ in quality and accessibility.

Coinbase provides multiple support channels including email, a help center, and a support ticket system. Based on search results, Coinbase has established support articles covering common issues like payments and recovery of unsupported cryptocurrencies.

However, some users report frustration with Coinbase’s support response times. Customer experiences suggest that during high-volume periods, you might wait longer than expected for assistance.

Aibit, being a newer platform, has less documented customer support history. The platform appears to focus on self-service options rather than direct support channels that Coinbase offers.

Key Support Differences:

- Coinbase: Established help center, documented support processes

- Aibit: Newer support system, less public information available

When you need help recovering funds or solving account issues, Coinbase has clear processes in place. The search results mention that Coinbase customers can recover lost funds for certain assets.

Your personal preferences matter here. If you value having documented support articles and established processes, Coinbase might feel more secure. If you prefer newer platforms with potentially less bureaucracy, Aibit might appeal to you.

Coinbase Vs Aibit: Security Features

When comparing Coinbase and Aibit, security is a top concern for your investments.

Coinbase offers robust account protection measures including auto-enrolled two-factor authentication (2FA) with security key support. Your account is also safeguarded with password protection and multi-signature capabilities.

Aibit, provides a different security approach. You don’t directly own cryptocurrency when investing in Aibit, which means you aren’t responsible for securing private keys or digital wallets.

Coinbase gives you the option of self-custody through Coinbase Wallet, where you control your private keys. This offers more control but requires your active participation in security measures.

With Aibit, BlackRock handles the security of the underlying bitcoin assets. Your investment is protected through traditional securities infrastructure rather than cryptocurrency-specific security protocols.

Coinbase has invested heavily in AI-blockchain integration to enhance security, with their CISO leading initiatives to protect user assets and improve threat detection.

Key Security Differences:

- Coinbase: Direct crypto ownership with multiple security layers (2FA, security keys)

- Aibit: No direct crypto ownership; institutional security through BlackRock

Self-custody options:

- Coinbase: Available through Coinbase Wallet

- Aibit: Not applicable (institutional custody only)

Your choice between these platforms should consider whether you prefer direct control over your crypto assets with personal security responsibility or institutional management with traditional investment protections.

Is Coinbase A Safe & Legal To Use?

Coinbase is generally considered a safe platform for cryptocurrency trading. As one of the largest U.S.-based exchanges, it employs robust security measures to protect user assets and data.

The platform uses industry-standard security protocols including:

- Two-factor authentication (2FA)

- AES-256 encryption for data storage

- 98% of customer funds stored in offline cold storage

- Regular security audits

Coinbase is a fully regulated and legal company in the United States. It’s registered as a Money Services Business with FinCEN and holds appropriate licenses to operate in different states.

However, no platform is 100% secure. There have been some security incidents reported by users, though these often involve individual account compromises rather than platform-wide breaches.

To maximize your security on Coinbase, you should:

- Use a strong, unique password

- Enable all security features

- Be cautious of phishing attempts

- Consider using Coinbase Vault for long-term storage

Coinbase also carries insurance against certain types of losses, providing an extra layer of protection for your assets.

For most users, Coinbase represents a reasonable balance between accessibility and security in the cryptocurrency space. Its legal status and compliance with regulations make it a legitimate option for those entering crypto markets.

Is Aibit A Safe & Legal To Use?

Based on the search results and available information, Aibit appears to be confused with IBIT (iShares Bitcoin Trust), which is BlackRock’s spot Bitcoin ETF approved by the SEC on January 11, 2024.

IBIT is a legal investment vehicle that offers regulatory advantages to investors. It provides a way to gain exposure to Bitcoin through traditional brokerage accounts without directly holding the cryptocurrency.

Many investors consider ETFs like IBIT safer than directly purchasing Bitcoin on exchanges. This is because exchanges have been targets of hacking attempts in the past.

When comparing safety options for Bitcoin investment, consider these factors:

| Investment Option | Safety Features | Regulatory Status |

|---|---|---|

| IBIT (BlackRock ETF) | Institutional security | SEC approved |

| Direct Bitcoin | Depends on storage method | Legal but less regulated |

| Exchange-held Bitcoin | Varies by exchange | Legal but risks vary |

If you’re concerned about security, ETFs like IBIT offer protection through established financial institutions with robust security measures.

Remember that all investments carry risk. The safety of your Bitcoin investment depends on the platform you choose and how you manage your assets.

Frequently Asked Questions

Investors often need clear information when comparing cryptocurrency investment options. These questions address common concerns about fees, features, security, and the fundamental differences between direct Bitcoin ownership and Bitcoin ETFs.

What are the differences in fees between IBIT and Coinbase?

IBIT charges an expense ratio of approximately 0.25% annually on assets under management. This fee is deducted from the fund’s assets rather than charged directly to investors.

Coinbase uses a different fee structure with trading fees ranging from 0.5% to 4.5% per transaction depending on payment method and transaction size. They also charge spread fees of about 0.5% for cryptocurrency conversions.

For larger investors, Coinbase Pro offers lower fees starting at 0.6% and decreasing with higher trading volume, potentially making it more cost-effective for frequent traders.

How does Coinbase Pro compare to IBIT in terms of trading features?

Coinbase Pro provides advanced trading tools including real-time order books, charting tools, and multiple order types like limit, market, and stop orders. These features give traders more control over their entry and exit points.

IBIT, as an ETF, trades like a stock with standard market, limit, and stop orders available through your brokerage account. It follows standard market hours rather than 24/7 cryptocurrency trading.

Coinbase Pro offers more cryptocurrency pairs and trading options, while IBIT focuses exclusively on Bitcoin exposure through a regulated ETF structure.

What are the benefits of holding IBIT compared to actual Bitcoin?

IBIT provides Bitcoin exposure through traditional brokerage accounts without requiring cryptocurrency wallets or keys. This eliminates the technical complexity of managing cryptocurrency directly.

IBIT offers potential tax advantages since it’s treated as a standard security rather than cryptocurrency. This can simplify tax reporting compared to direct Bitcoin ownership.

The fund’s Bitcoin holdings are stored in cold storage by Coinbase Custody, providing institutional-grade security without requiring personal security management. This reduces the risk of theft or loss from hacking.

Which platform offers a better user experience, IBIT or Coinbase?

Coinbase provides a user-friendly mobile app and website designed specifically for cryptocurrency transactions. Its interface includes educational resources and simplified buying processes ideal for beginners.

IBIT is accessed through your existing brokerage platform, making it familiar to traditional investors. You don’t need to learn new systems or create additional accounts to gain Bitcoin exposure.

For newcomers to investing, Coinbase offers a more guided experience for cryptocurrency specifically. IBIT integrates with existing investment workflows through standard brokerages.

How do Bitcoin ETFs differ from direct Bitcoin investments on platforms like IBIT and Coinbase?

Bitcoin ETFs like IBIT represent Bitcoin ownership without requiring direct cryptocurrency custody. The fund holds Bitcoin while you own shares of the fund through regular brokerage accounts.

Direct Bitcoin investments through Coinbase give you actual ownership of cryptocurrency assets. You can transfer these assets to external wallets or use them for transactions outside the platform.

ETFs trade only during market hours (9:30 AM to 4:00 PM Eastern, Monday-Friday), while direct Bitcoin trading on Coinbase is available 24/7. This timing difference can affect your ability to react to market movements.

What are the security measures employed by Coinbase and IBIT to protect user assets?

Coinbase secures customer assets with measures including 98% cold storage of cryptocurrency, AES-256 encryption for digital information, and FDIC insurance for USD balances up to $250,000. They also offer two-factor authentication and biometric login options.

IBIT’s underlying Bitcoin is secured by Coinbase Custody, which uses institutional-grade offline storage systems with geographic distribution of private keys. The custody solution implements strict physical security and multi-signature approval processes.

Both platforms conduct regular security audits and comply with regulatory requirements, though IBIT benefits from additional oversight as an SEC-regulated investment vehicle.

Aibit Vs Coinbase Conclusion: Why Not Use Both?

When deciding between Aibit and Coinbase, you don’t necessarily have to choose just one. Both platforms offer distinct advantages that can complement each other in your crypto strategy.

Coinbase provides a user-friendly interface with strong security features and regulatory compliance. It’s ideal for beginners and those who value simplicity and peace of mind.

Aibit appears to offer more competitive spreads and significantly lower fees according to user reports. This can make a substantial difference in your trading costs over time.

You might consider using Coinbase for its educational resources and ease of use when first entering the crypto space. Its intuitive interface helps newcomers navigate the complex world of digital assets.

For larger transactions or more frequent trading, Aibit could save you money through lower fees. This becomes especially important as your trading volume increases.

A practical approach is to:

- Start with Coinbase for smaller purchases and learning

- Transition to Aibit for larger trades and regular investing

- Use Coinbase Pro if you need advanced trading features

Remember to compare current fee structures before making transactions, as these can change over time. What works best for your strategy today might need adjustment as your experience grows.

Ultimately, having accounts on multiple platforms gives you flexibility and options as market conditions change.