Choosing the right cryptocurrency exchange for trading can make a big difference in your investment strategy. BYDFi and PrimeXBT are two popular platforms that offer crypto derivatives trading with leverage options, but they have key differences worth exploring.

BYDFi scores higher overall with a 9.0 rating compared to PrimeXBT, and offers up to 200x leverage with no KYC requirements for U.S. traders. This makes BYDFi particularly attractive if you want to start trading quickly without identity verification processes, while still accessing high leverage options.

Both platforms provide tools for cryptocurrency derivatives trading, but they differ in fee structures, user interfaces, and additional features. PrimeXBT offers up to 100x leverage with advanced trading features and a user-friendly interface, while BYDFi has become known for its higher leverage limits and accessibility. Understanding these differences will help you select the platform that best fits your trading style and requirements.

BYDFi vs PrimeXBT: At A Glance Comparison

When choosing between BYDFi and PrimeXBT for your crypto trading needs, several key differences stand out.

BYDFi holds a higher overall score of 9.0 compared to PrimeXBT, according to recent comparisons. This suggests BYDFi may offer better overall value for most traders.

BYDFi is known for its high leverage trading options, allowing you to trade with up to 200x leverage. This feature is particularly attractive if you’re looking to maximize your position sizes.

| Feature | BYDFi | PrimeXBT |

|---|---|---|

| Overall Score | 9.0 | Lower than BYDFi |

| Max Leverage | Up to 200x | Competitive but lower |

| KYC Requirements | No KYC for U.S. traders | More stringent |

| User Interface | User-friendly | Complex but powerful |

A notable advantage of BYDFi is that U.S. traders can use the platform without completing KYC verification processes. This adds a layer of privacy many traders value.

Both platforms offer crypto derivatives trading, but BYDFi appears to be more popular among traders seeking high leverage options.

Trading fees vary between the platforms, with BYDFi potentially offering more competitive rates for certain trading activities.

Your trading experience and goals should guide your choice between these platforms. BYDFi might better serve beginners or those seeking simplicity, while PrimeXBT could appeal to more experienced traders.

BYDFi vs PrimeXBT: Trading Markets, Products & Leverage Offered

BYDFi and PrimeXBT offer different trading options and leverage limits that cater to various trader needs.

BYDFi stands out with impressive leverage options of up to 200x on cryptocurrency trading. This makes it particularly attractive for traders looking to maximize their position sizes with minimal capital.

PrimeXBT provides leverage trading on popular cryptocurrencies including Bitcoin, Ethereum, and Litecoin with flexible margin options. The platform focuses on creating a comprehensive trading environment.

Leverage Comparison:

| Platform | Maximum Leverage |

|---|---|

| BYDFi | Up to 200x |

| PrimeXBT | Varies by asset |

BYDFi is notably U.S.-regulation compliant, making it accessible to American traders. This is a significant advantage for U.S.-based users looking for high-leverage options.

Both platforms offer cryptocurrency derivatives trading, allowing you to speculate on price movements without owning the underlying assets.

PrimeXBT includes additional trading products beyond basic spot trading, expanding your potential trading strategies.

BYDFi provides advanced trading tools alongside its high leverage options, giving you more analytical capabilities when making trading decisions.

The fee structures differ between platforms, with MEXC noted for having particularly low derivatives trading fees (0%) compared to both BYDFi and PrimeXBT.

When choosing between these platforms, consider your location, leverage needs, and trading preferences to select the option that best aligns with your strategy.

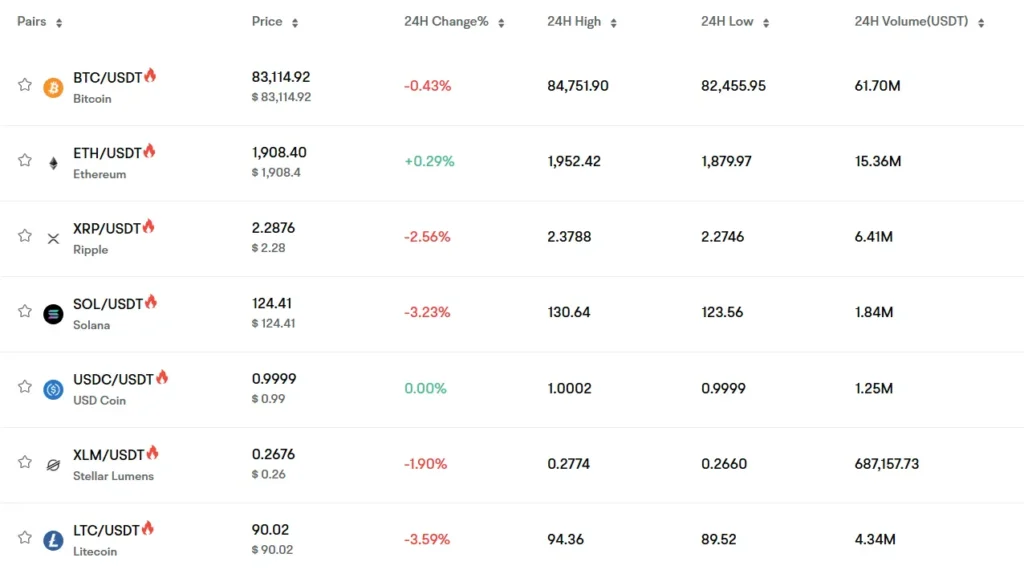

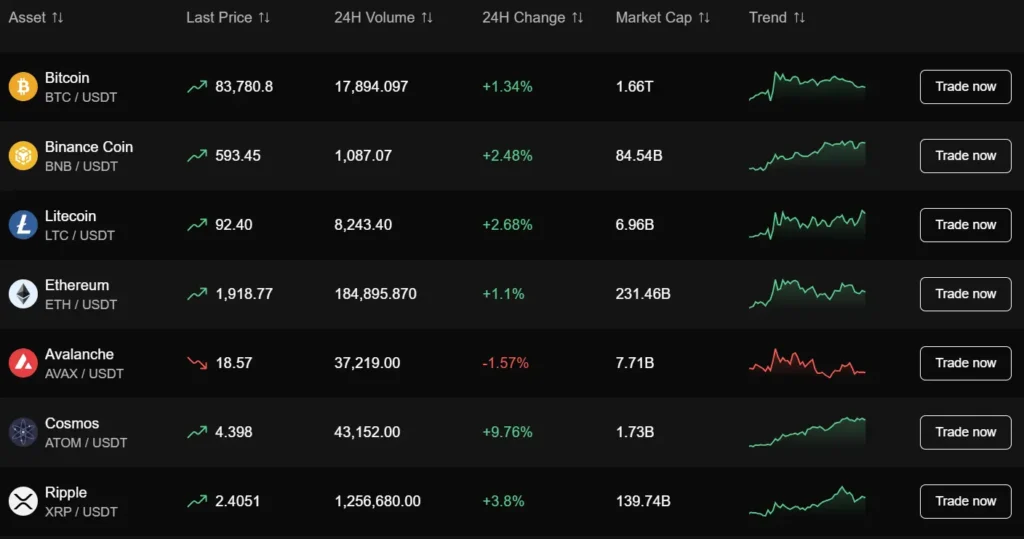

BYDFi vs PrimeXBT: Supported Cryptocurrencies

When choosing between BYDFi and PrimeXBT, the range of supported cryptocurrencies is an important factor to consider for your trading strategy.

BYDFi offers a more extensive selection of cryptocurrencies compared to PrimeXBT. This gives you more options to diversify your trading portfolio across different digital assets.

PrimeXBT focuses on major cryptocurrencies including Bitcoin, Ethereum, and Litecoin. While the selection is smaller, these are some of the most traded assets in the crypto market.

BYDFi Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Multiple altcoins

- More token options for traders interested in emerging assets

PrimeXBT Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Select other major cryptocurrencies

If you’re looking to trade a wide variety of cryptocurrencies, BYDFi would be the better choice for your needs. The platform’s broader selection allows you to explore more trading opportunities.

For traders who prefer to focus only on established cryptocurrencies with higher market caps, PrimeXBT’s offerings may be sufficient. Their focused approach might be simpler for beginners.

Both platforms allow you to trade with leverage on their supported cryptocurrencies, though the specific leverage limits may vary for different assets.

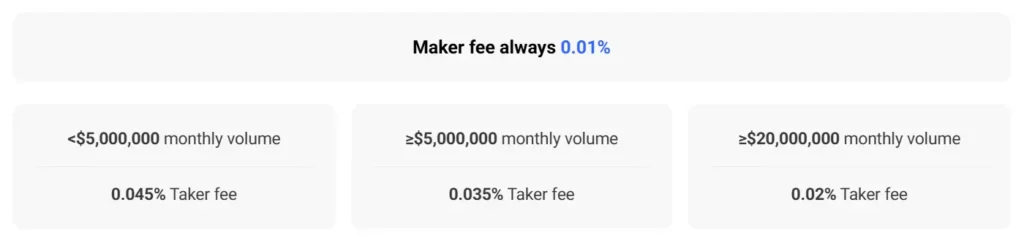

BYDFi vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and PrimeXBT, understanding the fee structure can help you make a more informed decision for your trading needs.

BYDFi offers competitive trading fees with a maximum of 0.3% per trade. For leverage trading specifically, the fee drops to 0.050% when you’re opening a position.

PrimeXBT, meanwhile, charges around 0.05% for crypto trades, making it one of the most economical options for active traders.

Trading Fee Comparison:

| Exchange | Standard Trading Fee | Leverage Trading Fee |

|---|---|---|

| BYDFi | Up to 0.3% | 0.050% (opening) |

| PrimeXBT | 0.05% | 0.05% |

Regarding deposit fees, PrimeXBT stands out by charging no deposit fees at all. This can be advantageous if you frequently add funds to your account.

Both exchanges keep withdrawal fees relatively minimal, though exact rates vary depending on the cryptocurrency being withdrawn.

It’s worth noting that BYDFi consistently ranks as having lower overall trading fees when compared directly to PrimeXBT in comparison studies.

Your trading volume and frequency should guide your choice between these platforms. High-volume traders might benefit more from PrimeXBT’s flat 0.05% fee structure, while occasional traders might find BYDFi’s fee schedule more suitable.

BYDFi vs PrimeXBT: Order Types

When trading on cryptocurrency platforms, the available order types can significantly impact your trading strategy. Both BYDFi and PrimeXBT offer several order options to help you execute trades effectively.

BYDFi Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

- OCO (One-Cancels-Other) orders

BYDFi provides these standard order types to help you manage risk while trading with leverage up to 200x. Their order execution is generally quick due to their high liquidity order book.

PrimeXBT Order Types:

- Market orders

- Limit orders

- Stop orders

- OCO orders

- Trailing stop orders

PrimeXBT stands out by offering trailing stop orders, which automatically adjust your stop price as the market moves in your favor. This feature can be particularly useful for capturing profits in volatile markets.

Both platforms support conditional orders that help you automate your trading strategy. You can set specific price triggers that execute trades without requiring you to monitor the market constantly.

For day traders and scalpers, the order execution speed is crucial. PrimeXBT tends to have slightly better execution times due to its larger user base of approximately 1 million active users compared to BYDFi’s 500,000.

The interfaces for placing orders differ between the platforms. PrimeXBT offers a more traditional trading terminal, while BYDFi has a simpler, more beginner-friendly order placement system.

BYDFi vs PrimeXBT: KYC Requirements & KYC Limits

PrimeXBT operates with a no-KYC policy that allows users to trade without sharing personal information. This makes it attractive for traders who value privacy and want to begin trading immediately without verification delays.

BYDFi has a more flexible approach to KYC. You can trade crypto-to-crypto without completing KYC verification. However, KYC becomes necessary when you want to make fiat deposits or exceed certain withdrawal limits.

Here’s a comparison of their KYC policies:

| Feature | BYDFi | PrimeXBT |

|---|---|---|

| Crypto trading without KYC | Yes | Yes |

| Fiat transactions | Requires KYC | Limited options |

| Withdrawal limits without KYC | Available with limits | Available |

| Account verification speed | 1-2 business days | Not applicable |

For BYDFi, completing KYC allows you to access higher withdrawal limits and use fiat payment methods. The basic verification typically includes submitting ID documents and proof of address.

If you prioritize privacy and want to avoid identity verification entirely, PrimeXBT might be more suitable for your needs. You can trade with full platform functionality without completing any verification steps.

Remember that regulatory requirements can change based on your location. Some regions may have stricter rules that override the exchange’s standard KYC policies.

Both platforms offer ways to start trading quickly, but they differ in how they handle identity verification requirements as you scale up your trading activities.

BYDFi vs PrimeXBT: Deposits & Withdrawal Options

When choosing between BYDFi and PrimeXBT, understanding their deposit and withdrawal options is crucial for your trading experience.

BYDFi offers several deposit methods including cryptocurrency transfers, bank transfers, and some credit/debit card options. Their withdrawal process typically completes within 24 hours for crypto transactions.

PrimeXBT focuses primarily on cryptocurrency deposits and withdrawals. They don’t typically support fiat currency directly, requiring you to use crypto for platform funding.

Deposit Methods Comparison:

| Method | BYDFi | PrimeXBT |

|---|---|---|

| Cryptocurrency | Yes | Yes |

| Bank Transfer | Yes | No |

| Credit/Debit Cards | Limited | No |

Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and USDT for deposits and withdrawals. BYDFi has slightly lower withdrawal fees at approximately 0.0005 BTC compared to PrimeXBT’s 0.0007 BTC for Bitcoin withdrawals.

Processing times vary between the exchanges. BYDFi typically processes withdrawals within 24 hours, while PrimeXBT advertises faster processing times of 1-2 hours for most crypto withdrawals.

Security measures for withdrawals are robust on both platforms, with two-factor authentication and email confirmations required to process transactions.

BYDFi offers more flexibility with its fiat options, making it potentially more accessible for beginners. PrimeXBT’s crypto-focused approach might appeal more to experienced traders who already hold digital assets.

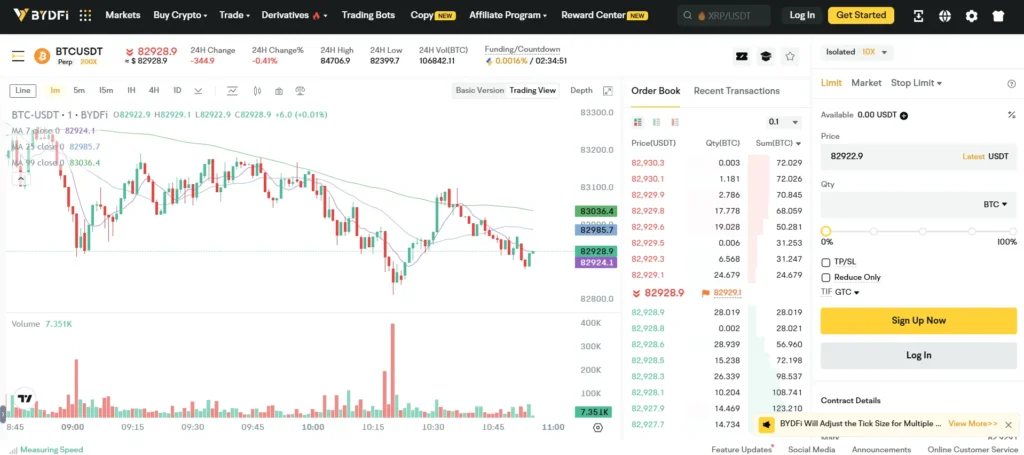

BYDFi vs PrimeXBT: Trading & Platform Experience Comparison

BYDFi offers a user-friendly platform with leverage trading up to 200x, making it attractive for traders seeking high-leverage opportunities. The interface is designed to be accessible even for beginners while still providing advanced tools for experienced traders.

PrimeXBT features a professional trading interface with extensive charting capabilities and analytical tools. It supports cross-asset trading, allowing you to trade cryptocurrencies alongside traditional markets like forex and commodities.

Trading Tools Comparison:

| Feature | BYDFi | PrimeXBT |

|---|---|---|

| Max Leverage | Up to 200x | Up to 100x |

| Mobile App | Yes | Yes |

| Demo Account | Yes | Yes |

| Trading Bots | Available | Limited |

BYDFi stands out with its no-KYC option for US traders, which is a significant advantage for those seeking privacy or faster onboarding. The platform also provides competitive fees and a variety of trading pairs.

PrimeXBT excels in its advanced charting tools and multi-asset trading capabilities. You can access traditional markets alongside crypto, which is ideal if you want to diversify your trading activities without switching platforms.

Both exchanges offer demo accounts so you can practice trading strategies without risking real money. This feature is particularly valuable for beginners or when testing new approaches.

Mobile trading is supported on both platforms, allowing you to monitor positions and execute trades on the go. The mobile apps include most features available on desktop versions.

BYDFi vs PrimeXBT: Liquidation Mechanism

When trading with leverage on either BYDFi or PrimeXBT, understanding the liquidation mechanism is crucial for your risk management strategy.

BYDFi uses a graduated liquidation system that triggers when your margin ratio falls below maintenance requirements. This typically happens when your position loses value to the point where it approaches your initial margin.

PrimeXBT employs a similar liquidation protocol but offers a bit more flexibility with its tiered margin system. Your positions on PrimeXBT will face liquidation when equity drops below maintenance margin levels.

Both platforms send warnings before liquidation occurs. BYDFi sends notifications at 80% and 90% of margin usage, while PrimeXBT alerts you when approaching critical levels.

Key Differences:

| Feature | BYDFi | PrimeXBT |

|---|---|---|

| Liquidation Threshold | Varies by asset (typically 80-120% of initial margin) | Tiered system based on leverage used |

| Warning System | Two-stage alerts | Progressive notifications |

| Partial Liquidation | Available for larger positions | Limited availability |

BYDFi offers partial liquidation options for positions above certain sizes. This means the system might only close part of your trade to bring your margin ratio back to safer levels.

PrimeXBT tends to liquidate positions fully once thresholds are crossed. However, their slightly higher maintenance margin requirements can provide a small buffer against market volatility.

Both platforms calculate liquidation prices in real-time, which you can view on your open position details.

BYDFi vs PrimeXBT: Insurance

When trading on cryptocurrency exchanges, insurance is a crucial factor to consider for your asset protection. Both BYDFi and PrimeXBT take different approaches to securing user funds.

BYDFi maintains an insurance fund to cover potential losses from liquidations that occur during volatile market conditions. This fund helps protect traders from negative balance scenarios when using leverage up to 200x.

PrimeXBT also operates an insurance fund designed to protect users against counterparty risk. Their system is structured to prevent socialized losses, ensuring that successful traders don’t bear the burden of others’ losses.

Neither platform offers comprehensive insurance coverage like some traditional financial institutions. Your funds are not protected against hacks or security breaches in the same way bank deposits might be.

It’s worth noting that both exchanges implement additional security measures beyond insurance. These include cold storage of funds, two-factor authentication, and regular security audits.

For users trading with significant amounts, the limited insurance coverage on both platforms is an important consideration. You should only deposit funds you can afford to lose and consider spreading investments across multiple platforms.

Both exchanges are relatively transparent about their insurance policies, though specific details about fund sizes and exact coverage limitations may require further research on their official websites.

BYDFi vs PrimeXBT: Customer Support

When choosing a crypto exchange, reliable customer support can make a big difference in your trading experience. Both BYDFi and PrimeXBT offer support options, but they differ in availability and methods.

BYDFi provides 24/7 live chat support, which means you can get help at any time of day or night. This is especially valuable if you trade across different time zones or encounter urgent issues.

In addition to live chat, BYDFi offers email support and maintains a detailed FAQ section to help you find answers quickly. They’re also active on social media platforms and have dedicated Telegram groups where you can connect with other users.

PrimeXBT’s customer support system includes ticket-based support and a knowledge base. Their response times may vary depending on request volume and complexity of your issue.

Both platforms provide documentation and guides to help you navigate their features and trading tools. This self-service approach can be helpful for solving common problems without waiting for support.

When comparing the two, BYDFi appears to offer more immediate support options with their 24/7 live chat. This might be important if you prefer real-time assistance rather than waiting for email responses.

Your trading style and when you typically need help should influence which platform’s support system works better for you.

BYDFi vs PrimeXBT: Security Features

When trading crypto, security should be your top priority. Both BYDFi and PrimeXBT offer essential security features, but with some notable differences.

BYDFi, established in 2020, has built a reputation for being secure and reliable. The platform implements two-factor authentication (2FA) to protect your account from unauthorized access.

PrimeXBT also offers 2FA but adds cold storage solutions for most crypto assets, keeping your funds offline and away from potential hackers.

Key Security Features Comparison:

| Feature | BYDFi | PrimeXBT |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Partial | Majority of funds |

| Insurance Fund | Limited | Yes |

| Withdrawal Confirmation | Email and SMS | |

| Regulation | Basic compliance | Multiple jurisdictions |

BYDFi’s security approach focuses on user-friendly protection while maintaining accessibility for traders who want quick access to their funds.

PrimeXBT employs a multi-signature system that requires multiple approvals for withdrawals of large amounts, adding an extra layer of security.

You should note that PrimeXBT has faced fewer security incidents historically, which might give you more confidence in their security practices.

Both platforms use SSL encryption to protect your data during transmission. This helps prevent man-in-the-middle attacks when you’re accessing your trading account.

Neither platform has experienced major hacks, which speaks to their security infrastructure quality. However, you should always use strong passwords and enable all available security features regardless of which platform you choose.

Is BYDFi Safe & Legal To Use?

BYDFi operates as a regulated Money Services Business (MSB) in the United States and Canada, which adds significant credibility to the platform. This regulatory compliance means you can trade with more confidence compared to unregulated exchanges.

Security is a priority for BYDFi. The exchange implements offline cold storage for cryptocurrencies and uses multi-signature technology to protect user funds. These security measures help keep your assets safe from potential cyber threats.

BYDFi requires Know Your Customer (KYC) verification for all users. While this might seem inconvenient, it’s actually an important security and legal measure that legitimate exchanges implement to prevent fraud and comply with regulations.

The platform has been operating since April 2020, which gives it a reasonable track record in the cryptocurrency industry. While not as established as some older exchanges, BYDFi has built a reputation for providing a secure trading environment.

For US traders specifically, BYDFi is one of the few reputable exchanges that offers high-leverage trading (up to 200x) while maintaining regulatory compliance. This makes it a legal option if you’re looking for leverage trading opportunities from within the United States.

When comparing safety features with PrimeXBT, BYDFi’s regulatory status in the US gives it an advantage for American users who want to ensure they’re trading on a compliant platform.

Is PrimeXBT Safe & Legal To Use?

PrimeXBT has strong security features to protect users’ assets. The platform employs bank-grade encryption to safeguard data and funds. According to search results, PrimeXBT has never experienced a security breach or hack.

However, PrimeXBT operates without regulatory oversight. This lack of regulation raises some concerns about user protection and accountability. When trading on unregulated platforms, you face additional risks compared to regulated alternatives.

For US-based traders, PrimeXBT’s legal status is questionable. The platform doesn’t have proper licensing to operate in the United States. This means if you’re in the US, using PrimeXBT may violate local regulations.

In contrast, BYDFi is regulated by FinCEN in the United States. This regulatory approval makes BYDFi a more legally sound option for US traders seeking leverage trading.

When considering safety, you should evaluate:

- Security measures: PrimeXBT has strong technical security

- Regulatory status: PrimeXBT lacks formal regulation

- Geographic restrictions: Not legally available in all jurisdictions

Your location plays a crucial role in determining if PrimeXBT is legal for you to use. Always check your local laws before creating an account on any crypto trading platform.

Frequently Asked Questions

Traders considering BYDFi and PrimeXBT often have specific concerns about features, accessibility, and costs. These platforms differ in significant ways that impact trading experience and potential returns.

What are the main differences between BYDFi and PrimeXBT trading platforms?

BYDFi (formerly BitYard) focuses on providing a user-friendly cryptocurrency exchange experience with a range of trading options. The platform emphasizes accessibility for newer traders while still offering advanced features.

PrimeXBT positions itself as a professional-grade trading platform with more complex trading tools and charting capabilities. It offers a wider variety of asset classes beyond just cryptocurrencies, including traditional markets.

The user interface differs significantly between the two, with BYDFi generally considered more approachable for beginners.

Which platform between BYDFi and PrimeXBT offers better leverage options?

PrimeXBT typically offers higher maximum leverage than BYDFi, with options reaching up to 100x on certain cryptocurrency pairs. This appeals to experienced traders looking for amplified position sizes.

BYDFi provides more moderate leverage options that many consider safer, especially for newer traders. The platform’s approach helps reduce the risk of significant losses during volatile market periods.

Your risk tolerance and trading experience should guide your choice between these leverage options.

How do BYDFi and PrimeXBT compare in terms of fees and commissions?

BYDFi generally maintains competitive trading fees compared to many exchanges, with straightforward fee structures. Their fee system is designed to be transparent and easy to understand.

PrimeXBT typically charges fees based on the specific markets you trade, with different rates for cryptocurrencies versus traditional assets. The platform occasionally offers lower fees than BYDFi for high-volume traders.

Both platforms implement withdrawal fees that vary by cryptocurrency network and congestion levels.

What security features are distinct for BYDFi compared to PrimeXBT?

BYDFi implements multi-factor authentication, cold storage for majority of assets, and regular security audits. The platform also provides anti-phishing codes to protect user accounts from common social engineering attacks.

PrimeXBT utilizes advanced encryption protocols and maintains an insurance fund to protect against unexpected market conditions. Their security system includes withdrawal address whitelisting to prevent unauthorized fund transfers.

Both platforms require KYC verification, though the specific requirements and verification speed differ.

Can users from the United States trade on BYDFi or PrimeXBT?

Neither BYDFi nor PrimeXBT currently accepts users from the United States due to regulatory considerations. BYDFi explicitly lists the US among restricted countries in their terms of service.

Both platforms implement IP detection and verification procedures to enforce these geographic restrictions. Attempting to circumvent these restrictions may result in account termination and potential fund freezes.

You should always check the most current country restrictions before attempting to register, as these policies can change based on evolving regulations.

What variety of trading instruments do BYDFi and PrimeXBT provide to their users?

BYDFi focuses primarily on cryptocurrency spot trading and derivatives, including futures contracts. The platform offers access to major cryptocurrencies and an expanding selection of altcoins and tokens.

PrimeXBT provides a broader range of instruments beyond cryptocurrencies, including forex pairs, commodities, and stock indices. This diversity allows for cross-market trading strategies and portfolio diversification.

The availability of different trading instruments may affect your platform choice depending on whether you want to focus solely on crypto or trade multiple asset classes.

BYDFi vs PrimeXBT Conclusion: Why Not Use Both?

After examining both platforms, it’s clear that BYDFi and PrimeXBT each have unique strengths for crypto traders.

BYDFi stands out with its low trading fees (0.050% for leverage trading) and is often cited as the best crypto exchange for day trading. It offers user-friendly features that make it accessible for traders at various experience levels.

PrimeXBT, on the other hand, provides some of the highest leverage options in the market, making it ideal for traders with higher risk tolerance. Its advanced features cater well to experienced traders looking for more complex trading strategies.

You don’t necessarily need to choose just one platform. Many successful traders use multiple exchanges to take advantage of different features and opportunities.

Using both platforms could give you the best of both worlds – BYDFi’s competitive fees for regular trading and PrimeXBT’s high leverage options for specific high-risk strategies.

Your trading needs may vary depending on market conditions and personal goals. Having accounts on both platforms provides flexibility to adapt to changing circumstances.

Consider starting with the platform that best matches your current trading style, then explore the other as you expand your trading strategies.

Remember to practice proper risk management regardless of which platform you choose, especially when using leverage trading features.