Choosing the right cryptocurrency exchange for your trading needs is important. BYDFi and Poloniex are two popular platforms that traders often compare when looking for a place to buy and sell digital assets. BYDFi has an overall higher score of 9.0 compared to Poloniex, suggesting it might offer better features for some users.

Both exchanges have their own strengths and serve different types of crypto traders. BYDFi, founded in 2020, aims to provide a fair trading environment, while Poloniex has been around longer and was once one of the largest crypto exchanges. When deciding between these platforms, you’ll want to consider factors like fees, available cryptocurrencies, security measures, and user experience.

BYDFi vs Poloniex: At A Glance Comparison

When choosing between BYDFi and Poloniex for your cryptocurrency trading needs, understanding key differences can help you make an informed decision.

BYDFi currently holds a higher overall score of 9.0 compared to Poloniex, according to recent comparison data. This suggests BYDFi may offer better overall value and features for many users.

Both exchanges allow you to trade various cryptocurrencies, but they differ in several important areas:

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| BYDFi | Competitive | Varies by coin |

| Poloniex | Standard | Varies by coin |

Security Features:

- BYDFi offers strong security protocols to protect your assets

- Poloniex has been operating longer but has experienced security incidents in the past

- Both provide two-factor authentication and other security measures

User interface is another important consideration. BYDFi typically provides a more modern trading experience, while Poloniex offers a familiar platform that many experienced traders appreciate.

Trading volume differs between the exchanges, which affects liquidity. Higher liquidity generally means better prices and easier execution of larger trades.

Available cryptocurrencies vary between platforms. You should check if your preferred coins are supported before choosing an exchange.

Customer support quality can significantly impact your experience, especially during high-volume trading periods or when issues arise.

Mobile app functionality is essential if you plan to trade on the go. Both exchanges offer mobile options with varying features and usability.

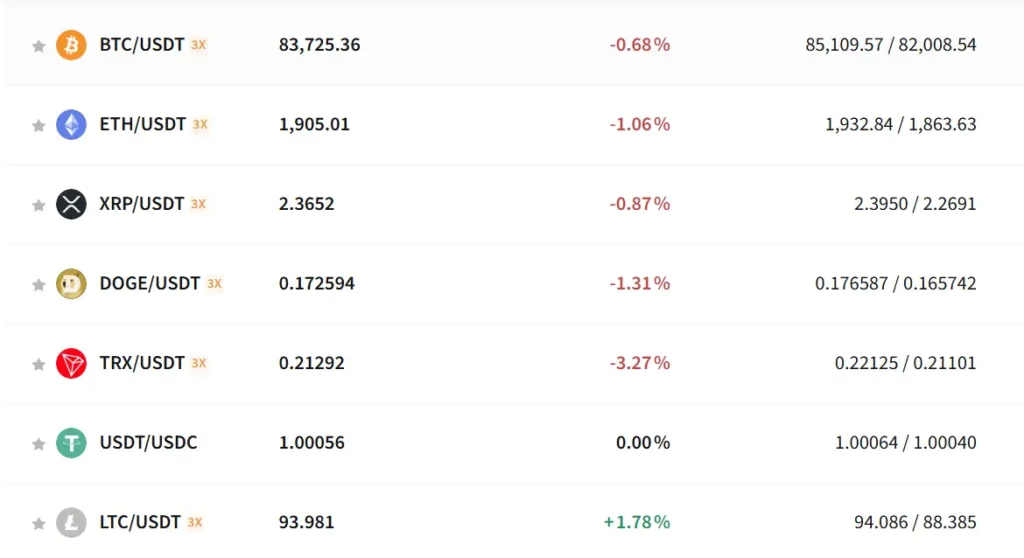

BYDFi vs Poloniex: Trading Markets, Products & Leverage Offered

Both BYDFi and Poloniex offer various crypto trading options, but they differ significantly in what they provide to traders.

BYDFi stands out with its impressive leverage options, offering very high leverage for trading. This makes it attractive for traders looking to amplify their positions with less capital.

Poloniex provides leverage of up to 100x on certain trading pairs. This platform has been around longer and has established a solid reputation in the crypto trading space.

When comparing the overall trading experience, BYDFi scores higher with a 9.0 overall rating compared to Poloniex. This rating likely reflects user satisfaction with BYDFi’s trading interface and features.

Leverage Comparison:

- BYDFi: Very high leverage options

- Poloniex: Up to 100x leverage

Both exchanges support a range of cryptocurrency trading pairs, allowing you to diversify your trading portfolio. They offer spot trading for direct crypto purchases and futures trading for more advanced strategies.

For margin trading, both platforms let you borrow funds to increase your position size. This can amplify both potential profits and losses, so you should approach with caution.

Your trading style and risk tolerance should guide your choice between these platforms. If maximum leverage is your priority, BYDFi might be more suitable, while Poloniex offers a well-established trading environment.

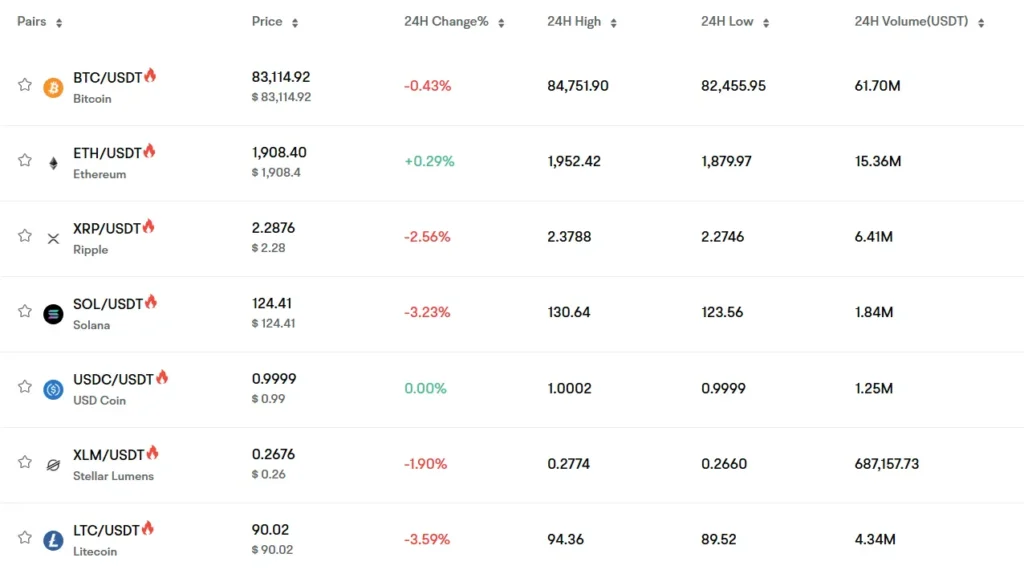

BYDFi vs Poloniex: Supported Cryptocurrencies

Both BYDFi and Poloniex offer a wide range of cryptocurrencies for trading, but there are some differences worth noting.

BYDFi supports a comprehensive selection of digital assets, earning it a high overall score of 9.0 according to comparison data. The platform allows you to trade major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Poloniex also offers an extensive cryptocurrency selection. While it received a slightly lower overall score in comparisons, it remains a popular choice for traders looking for variety.

Trading Pairs Comparison:

| Exchange | Major Coins | Altcoins | Stablecoins |

|---|---|---|---|

| BYDFi | Bitcoin, Ethereum, Ripple, Litecoin | Many altcoins | USDT, USDC |

| Poloniex | Bitcoin, Ethereum, Ripple, Litecoin | Wide selection | Multiple options |

You can access both platforms through their respective bots, which make trading easier. The BYDFi Poloniex bot specifically allows you to trade Bitcoin, Ethereum, Ripple, Litecoin, and numerous other coins.

If you’re interested in newer or more niche cryptocurrencies, it’s worth checking each platform’s current listings as they regularly update their supported assets.

Both exchanges continue to add new cryptocurrencies to their platforms, keeping up with market demands and emerging digital assets.

BYDFi vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and Poloniex, understanding the fee structure is crucial for your trading strategy.

Trading Fees:

- BYDFi: Up to 0.40% per trade, with a flat maker/taker rate of 0.1% on spot trading

- Poloniex: Up to 0.3% per trade, with fees ranging from 0.10% to 0.20% depending on your 30-day trading volume

BYDFi offers competitive rates especially for spot trading, while Poloniex uses a tiered system that rewards higher volume traders.

Withdrawal Fees:

- BYDFi: Can be up to $60

- Poloniex: Approximately 0.00025 BTC (varies by cryptocurrency)

Withdrawal costs on both platforms depend on the specific cryptocurrency you’re transferring. BYDFi’s fees can be higher for certain assets.

Deposit Fees:

- BYDFi: Charges apply when depositing funds

- Poloniex: Similar structure with varying rates by payment method

You should consider your trading frequency and volume when comparing these platforms. High-volume traders might benefit from Poloniex’s tiered fee structure.

For US-based traders, it’s worth noting that BYDFi is available in the United States, which might be a deciding factor alongside fee considerations.

Always check the current fee schedules on both platforms before trading, as these rates may change over time.

BYDFi vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both BYDFi and Poloniex offer several order options, but with some notable differences.

Poloniex supports three main order types for spot trading: limit, market, and stop-limit orders (which include stop-market). These basic order types cover essential trading needs for most users.

BYDFi typically offers a more extensive range of order types, including limit, market, stop-limit, and additional advanced order options that cater to experienced traders.

Common Order Types on Both Platforms:

- Limit Orders: Allow you to set a specific price for buying or selling.

- Market Orders: Execute immediately at the best available price.

- Stop-Limit Orders: Trigger a limit order when the market reaches a specified price.

The main difference lies in the advanced order options. BYDFi generally provides more sophisticated trading tools compared to Poloniex’s more straightforward approach.

Your trading style should influence which platform you choose. If you prefer simple, straightforward trading with basic order types, Poloniex’s three options might be sufficient. For more complex trading strategies requiring advanced order types, BYDFi likely offers more flexibility.

Before selecting either platform, consider practicing with their order systems through demo accounts if available. This hands-on experience will help you determine which platform’s order types better suit your trading needs.

BYDFi vs Poloniex: KYC Requirements & KYC Limits

BYDFi offers a more flexible approach to Know Your Customer (KYC) verification. You can access most features without completing KYC, including all trading types and cryptocurrency pairs.

For those who want to use fiat currencies on BYDFi, KYC verification becomes necessary. This requirement mainly affects users looking to make fiat deposits before trading.

Poloniex takes a tiered approach to verification. Lower verification levels come with certain restrictions and limitations on trading capabilities. To access the full range of features and higher limits, you need to reach the highest verification level.

KYC Requirements Comparison:

| Exchange | KYC Optional? | Features Without KYC | Fiat Transactions |

|---|---|---|---|

| BYDFi | Yes | Most trading features | Requires KYC |

| Poloniex | Yes (for small accounts) | Limited features | Requires KYC |

Poloniex offers increased limits and enhanced features for verified users. The platform stores most user funds offline in cold storage for security purposes.

Both exchanges balance accessibility with regulatory compliance. Your choice may depend on how important KYC-free trading is to your strategy and whether you need fiat on/off ramps.

If privacy is your priority, BYDFi might be more suitable with its broader KYC-free options. For higher trading limits and full platform access, completing verification on either platform is recommended.

BYDFi vs Poloniex: Deposits & Withdrawal Options

Both BYDFi and Poloniex offer various methods for depositing and withdrawing funds, though they differ in several important ways.

Deposit Options

BYDFi provides multiple fiat deposit options including bank transfers, credit/debit cards, and some third-party payment processors. These options make it easier for beginners to start trading.

Poloniex has more limited fiat deposit options. Based on recent information, users looking to deposit USD into Poloniex have several methods available, though these may be more restricted compared to some competitors.

Cryptocurrency Deposits

Both exchanges support deposits in major cryptocurrencies like Bitcoin, Ethereum, and many altcoins. The process is similar on both platforms – you generate a deposit address and send funds to it.

Withdrawal Methods

| Feature | BYDFi | Poloniex |

|---|---|---|

| Crypto withdrawals | Wide range | Wide range |

| Fiat withdrawals | Multiple options | Limited options |

| Processing time | 1-3 business days | 1-5 business days |

| Verification required | Yes | Yes |

Poloniex withdrawal fees vary by cryptocurrency. To transfer funds from Poloniex to another exchange like Binance, you can use the withdrawal features directly from your Poloniex account.

Both exchanges require identity verification before allowing certain deposit or withdrawal limits. This KYC process helps prevent fraud but may take 1-3 days to complete.

Network congestion can affect withdrawal times on both platforms, especially during high-traffic periods.

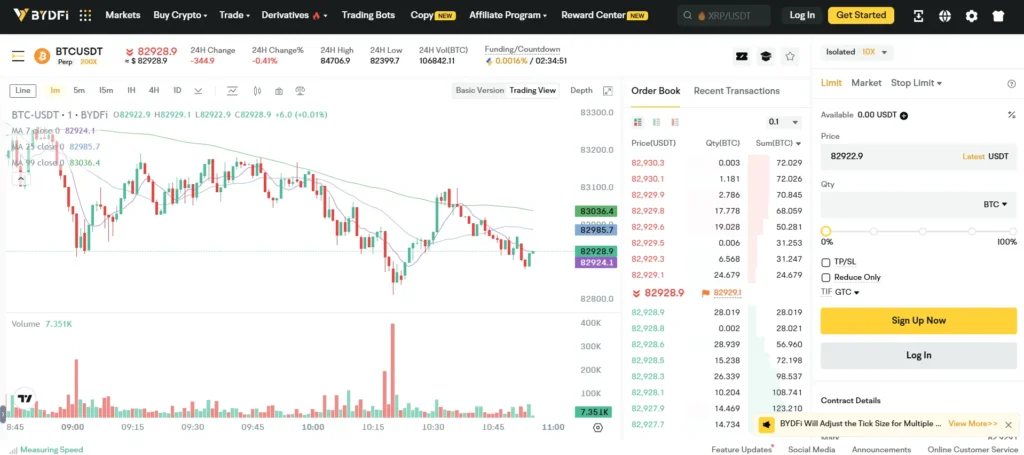

BYDFi vs Poloniex: Trading & Platform Experience Comparison

When comparing the trading platforms of BYDFi and Poloniex, several key differences stand out that might influence your choice between them.

BYDFi offers a more intuitive user interface with a higher overall score of 9.0 compared to Poloniex. This makes it potentially easier for beginners to navigate and execute trades quickly.

Poloniex has been around longer in the crypto space, which has allowed it to develop more refined trading features for experienced traders. However, this doesn’t necessarily make it more user-friendly.

Trading Features Comparison:

| Feature | BYDFi | Poloniex |

|---|---|---|

| User Interface | Modern, intuitive | Traditional, feature-rich |

| Mobile Experience | Streamlined app | Functional but less polished |

| Trading Tools | Growing selection | Comprehensive set |

| Chart Options | Basic to intermediate | Advanced options |

Both exchanges offer spot trading, but their fee structures differ. BYDFi tends to have more competitive fees in general, which can save you money on frequent trades.

The platform responsiveness can affect your trading experience significantly. BYDFi typically shows faster load times during high-volume trading periods compared to occasional lag reported with Poloniex.

For newer crypto traders, BYDFi’s platform design makes the learning curve less steep. Poloniex offers more advanced tools but requires more time to master.

Security features are integrated into both platforms, with two-factor authentication and withdrawal confirmations being standard on each.

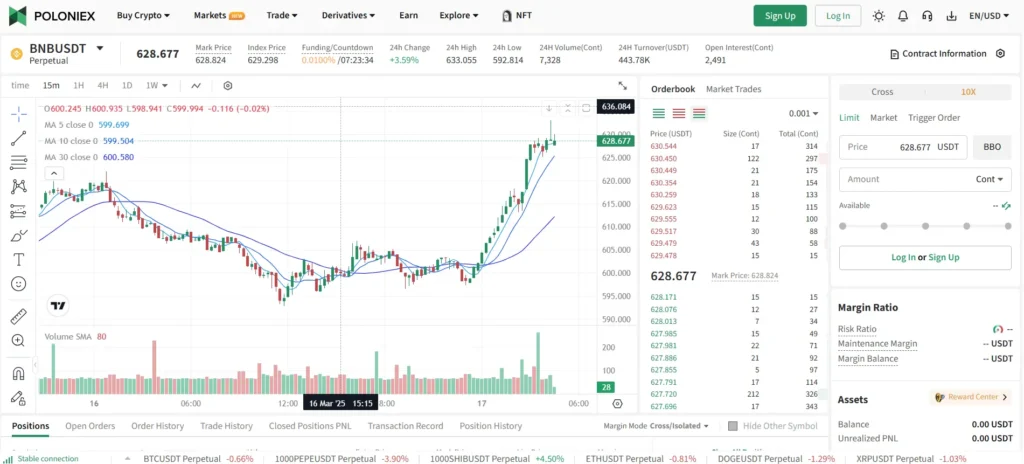

BYDFi vs Poloniex: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management. Both BYDFi and Poloniex have different approaches to handling liquidations.

BYDFi uses an isolated margin system for liquidations. This means your potential losses are limited to the amount you’ve allocated to a specific position. If your position reaches the liquidation price, only that specific trade is affected.

Poloniex, on the other hand, employs a cross-margin approach in many of its trading pairs. Under this system, all your available balance in the account can be used to prevent liquidation across positions.

BYDFi provides clear warnings when your position approaches the liquidation threshold. You’ll receive notifications at different risk levels, giving you time to add margin or reduce position size.

Poloniex’s liquidation system tends to be less transparent in its warning stages. The platform will liquidate positions when maintenance margin requirements aren’t met.

Liquidation Comparison

| Feature | BYDFi | Poloniex |

|---|---|---|

| Margin Type | Isolated | Mostly Cross |

| Warning System | Multi-stage alerts | Limited alerts |

| Liquidation Speed | Gradual | Potentially faster |

| Partial Liquidation | Yes | Limited options |

BYDFi allows partial liquidations in some cases, helping you maintain portions of your position during market volatility. This can be especially helpful during unexpected price movements.

You’ll find BYDFi’s liquidation mechanism more forgiving for beginners due to its isolated approach and clear warning system.

BYDFi vs Poloniex: Insurance

When trading cryptocurrencies, insurance protection is a crucial factor to consider. Both BYDFi and Poloniex offer some form of insurance coverage, but they differ in their approaches.

BYDFi maintains a dedicated insurance fund to protect users against unexpected losses during high-volatility periods. This fund helps cover negative balances that might occur during liquidations in margin trading.

Poloniex also provides an insurance fund, primarily focused on covering losses from security incidents. Their coverage extends to certain situations where users might face losses due to platform technical issues.

Insurance Coverage Comparison:

| Feature | BYDFi | Poloniex |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Focus | Trading losses, liquidation protection | Security incidents, technical issues |

| SAFU-style Fund | Limited | Yes |

| Regular Audits | Yes | Yes |

Neither exchange offers complete insurance comparable to traditional financial institutions. Your funds are still subject to market risks and potential security breaches.

You should note that neither platform provides explicit FDIC-like insurance that covers all user deposits. This is typical across most cryptocurrency exchanges currently operating.

For maximum protection, consider limiting the amount you keep on either exchange long-term. Using hardware wallets for storing significant holdings remains the safest approach for crypto assets.

BYDFi vs Poloniex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both BYDFi and Poloniex offer support options, but there are notable differences.

BYDFi provides multiple support channels including email, live chat, and social media assistance. Their response times are generally quick, with most users receiving help within 24 hours.

Poloniex has faced criticism for their customer support. According to the search results, they’ve experienced “issues with customer support” that users have noted as a drawback.

Support Options Comparison:

| Platform | Live Chat | Social Media | Ticket System | |

|---|---|---|---|---|

| BYDFi | ✓ | ✓ | ✓ | ✓ |

| Poloniex | ✓ | Limited | ✓ | ✓ |

BYDFi has invested in building a responsive support team, making it easier for you to resolve issues quickly. Their focus on customer service aligns with their commitment to providing a fair trading environment.

Poloniex has improved their support in recent years, but still struggles with occasional delays during high-volume periods. They’ve also experienced “technical glitches” that can impact the support experience.

If customer support is a priority for you, BYDFi currently offers a more reliable experience. Their higher “value for money” score mentioned in the search results may reflect this stronger customer service focus.

BYDFi vs Poloniex: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both BYDFi and Poloniex offer various security measures to protect your assets.

BYDFi implements two-factor authentication (2FA) to add an extra layer of protection to your account. They also use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

Poloniex similarly offers 2FA but has faced security challenges in the past. In 2014, they experienced a hack that resulted in a loss of about 12.3% of their Bitcoin holdings at that time.

BYDFi appears to have a stronger value for money score compared to Poloniex, according to recent comparisons. This might indicate better overall service quality relative to fees charged.

Key Security Features Comparison:

| Feature | BYDFi | Poloniex |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | Limited | Available |

| Security History | No major breaches | Experienced a hack in 2014 |

Both platforms require identity verification to comply with KYC (Know Your Customer) regulations, helping prevent fraud and money laundering activities.

You should consider enabling all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious of phishing attempts.

Is BYDFi A Safe & Legal To Use?

BYDFi takes security seriously, implementing strong measures to protect your assets. The platform enforces Anti-Money Laundering (AML) regulations as part of its compliance framework.

Security features include Two-Factor Authentication (2FA) to add an extra layer of protection to your account. Your funds are also kept in cold storage, which means they’re held offline and less vulnerable to hacking attempts.

BYDFi operates legally in supported jurisdictions, though specific regulations may vary by country. The platform appears to balance security with accessibility.

According to search results, BYDFi actively defends its reputation and warns against defamatory actions. This suggests the company maintains professional standards and is concerned about its public image.

For those concerned about safety during transfers, BYDFi offers a Q&A hub with guidance on secure investing and trading practices. This resource can help you navigate the platform safely.

When comparing BYDFi to Poloniex, search results indicate BYDFi scored higher overall (9.0) in a comprehensive comparison. This suggests positive performance in various evaluation categories.

Key Security Features:

- Two-Factor Authentication (2FA)

- Cold storage for cryptocurrencies

- AML compliance

- Expert Q&A hub for security questions

Remember to verify the platform’s legal status in your specific location before trading, as cryptocurrency regulations differ worldwide.

Is Poloniex A Safe & Legal To Use?

Poloniex has made significant improvements to its security features, making it one of the safer cryptocurrency exchanges available today. The platform uses various security measures similar to other top exchanges like Binance.

Despite experiencing a security breach in the past, Poloniex has strengthened its defenses. However, you should still exercise caution when using any cryptocurrency exchange.

When comparing security features between platforms like BYDFi and Poloniex, Poloniex shows solid security protocols. BYDFi has a slightly higher overall score (9.0) in recent comparisons.

If you’re planning to transfer coins from other platforms like Coinbase to Poloniex, follow proper security steps to ensure safe transfers:

- Enable two-factor authentication

- Verify wallet addresses carefully

- Start with small test transactions

- Use secure internet connections

Regarding legality, Poloniex operates as a legitimate cryptocurrency exchange in many jurisdictions. However, availability varies by country due to different regulatory requirements.

You should check if Poloniex is authorized to operate in your location before creating an account. Cryptocurrency regulations continue to evolve, so staying informed about your local laws is important.

For maximum safety while using Poloniex, consider these practices:

- Use strong, unique passwords

- Never share your private keys

- Enable all available security features

- Keep most of your crypto in cold storage when not actively trading

Frequently Asked Questions

Many users have specific concerns when choosing between BYDFi and Poloniex for their cryptocurrency trading needs. Both platforms have distinct features that might make one more suitable than the other depending on your priorities.

How do BYDFi and Poloniex compare in terms of user experience?

BYDFi offers a more modern interface that many beginners find easier to navigate. The platform uses a clean design with helpful tooltips and guides for new users.

Poloniex has been around longer but has a slightly steeper learning curve. Its interface packs more information on each screen, which experienced traders often prefer but newcomers might find overwhelming.

Both platforms offer mobile apps, but BYDFi’s app receives higher ratings for stability and ease of use.

What are the differences in transaction fees between BYDFi and Poloniex?

BYDFi typically charges trading fees ranging from 0.1% to 0.2% per transaction, with lower fees available for high-volume traders.

Poloniex uses a maker-taker fee structure with fees starting at 0.125% for makers and 0.25% for takers. These fees decrease as your 30-day trading volume increases.

Withdrawal fees vary by cryptocurrency on both platforms, with BYDFi often having slightly lower withdrawal fees for popular coins.

Which platform offers a wider range of cryptocurrencies, BYDFi or Poloniex?

Poloniex historically supports more cryptocurrencies, with over 100 different tokens and coins available for trading. The platform is known for listing newer, more speculative assets.

BYDFi offers fewer cryptocurrencies overall but ensures each listing meets strict security and legitimacy standards. The platform focuses on established coins with higher market caps.

Both exchanges regularly add new cryptocurrencies, but Poloniex typically adds them more quickly after they launch.

How do security measures between BYDFi and Poloniex differ?

BYDFi emphasizes security with mandatory two-factor authentication, regular security audits, and cold storage for most user funds. The platform has not reported any major security breaches.

Poloniex also uses two-factor authentication and cold storage, but the exchange experienced a hack in 2014. Since then, they’ve significantly upgraded their security protocols.

Both platforms offer IP address monitoring and email notifications for account activity, but BYDFi provides more granular security settings for users.

Can users earn interest on their holdings with BYDFi and Poloniex, and how do the conditions vary?

BYDFi offers staking options for several proof-of-stake cryptocurrencies with annual yields ranging from 2% to 15% depending on the asset and staking period.

Poloniex provides lending features where you can lend your crypto to margin traders and earn interest. Rates fluctuate based on market demand but typically range from 0.01% to 0.2% daily.

The minimum amounts required for earning interest are generally lower on BYDFi, making it more accessible to small investors.

What are the customer support options provided by BYDFi and Poloniex, and which is considered more responsive?

BYDFi provides 24/7 customer support through live chat, email tickets, and an extensive knowledge base. Response times typically range from a few minutes for chat to 24 hours for complex email inquiries.

Poloniex offers support through email tickets and a help center, but lacks live chat options. Users report longer wait times, sometimes 2-3 days during busy periods.

Both platforms maintain active social media accounts, but BYDFi staff are generally more responsive to queries posted on Twitter and Telegram.

BYDFi vs Poloniex Conclusion: Why Not Use Both?

After comparing these two crypto exchanges, you might wonder which one to choose. The answer might surprise you—consider using both platforms to maximize your trading opportunities.

BYDFi offers better value for money according to the search results. It has strong security measures including AML regulations, two-factor authentication, and cold storage for your crypto assets.

Poloniex brings its own strengths to the table. It’s backed by Goldman Sachs and provides high liquidity for traders. This makes it easier to execute trades quickly at fair prices.

Each platform serves different needs. BYDFi might be better for cost-conscious traders, while Poloniex could work well for those who prioritize liquidity and institutional backing.

Important security note: Poloniex experienced a hack in 2014 that resulted in a loss of about 12% of user assets. Both exchanges have likely improved security since then, but this history is worth knowing.

Your trading volume and preferences matter in this decision. If you trade frequently, test both platforms with small amounts first to see which interface and fee structure works better for you.

Having accounts on multiple exchanges gives you flexibility. When one platform has maintenance issues or better rates for specific coins, you can simply switch to the other.

Remember to enable all available security features on whichever platform(s) you choose to keep your investments safe.