Choosing the right cryptocurrency exchange can greatly impact your trading success. Today, we’re comparing two popular platforms: BYDFi and OKX. These exchanges offer different features that may suit various trading styles and needs.

BYDFi has a higher overall score of 9.0 compared to OKX’s 7.3, suggesting it might be the better option for some traders. However, scores don’t tell the whole story. OKX offers a wider variety of trading options, including spot trading and futures, which might appeal to more advanced traders looking for diverse investment opportunities.

When selecting between these exchanges, you should consider factors beyond just ratings. Security measures, fee structures, available cryptocurrencies, and user interface all play important roles in your trading experience. Both platforms have their strengths, and your specific needs will determine which is the better fit for you.

BYDFi Vs OKX: At A Glance Comparison

When choosing between BYDFi and OKX, understanding their key differences can help you make the right decision for your trading needs.

BYDFi scores higher overall with a 9.0 rating compared to OKX’s 7.3, according to comparison data. This suggests better overall user satisfaction with BYDFi’s services.

Security Features:

Both exchanges prioritize security, but implement different measures to protect your assets. You should check their specific security protocols before deciding.

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| BYDFi | Competitive | Varies by asset |

| OKX | Tiered system | Network-based |

Trading Options:

OKX offers a wide variety of trading options and has established a solid reputation in the cryptocurrency industry. You’ll find numerous trading pairs available.

BYDFi provides a user-friendly platform that may appeal to you if you’re looking for a streamlined trading experience.

Cryptocurrency Support:

Both exchanges support major cryptocurrencies, but their selection of altcoins differs. You should verify that your preferred coins are available on either platform.

The best choice depends on your specific trading goals, experience level, and which features matter most to you. Consider factors like interface usability, customer support, and available educational resources when making your decision.

BYDFi Vs OKX: Trading Markets, Products & Leverage Offered

When comparing BYDFi and OKX, you’ll find distinct differences in their trading offerings that can impact your experience.

BYDFi provides high leverage trading options of up to 200x, making it attractive for traders seeking amplified positions. The platform emphasizes security while supporting numerous fiat currencies, giving you flexibility with deposits.

OKX offers leverage of up to 100x, slightly lower than BYDFi but still substantial for most trading strategies. It has established itself as a popular choice for spot trading markets alongside its leveraged options.

Leverage Comparison:

| Platform | Maximum Leverage |

|---|---|

| BYDFi | Up to 200x |

| OKX | Up to 100x |

Both exchanges offer cryptocurrency spot and futures trading, but they differ in their specialized products. BYDFi focuses on leverage trading tools with advanced features for experienced traders.

OKX has a more diversified product lineup including options trading, perpetual swaps, and other derivatives beyond standard futures contracts. This gives you more variety in how you approach the market.

For U.S. traders specifically, BYDFi stands out with its regulatory compliance. This makes it accessible if you’re trading from the United States, whereas OKX has more restrictions for U.S. customers.

Your trading style and needs will determine which platform serves you better – BYDFi for higher leverage and U.S. access, or OKX for product diversity and established spot markets.

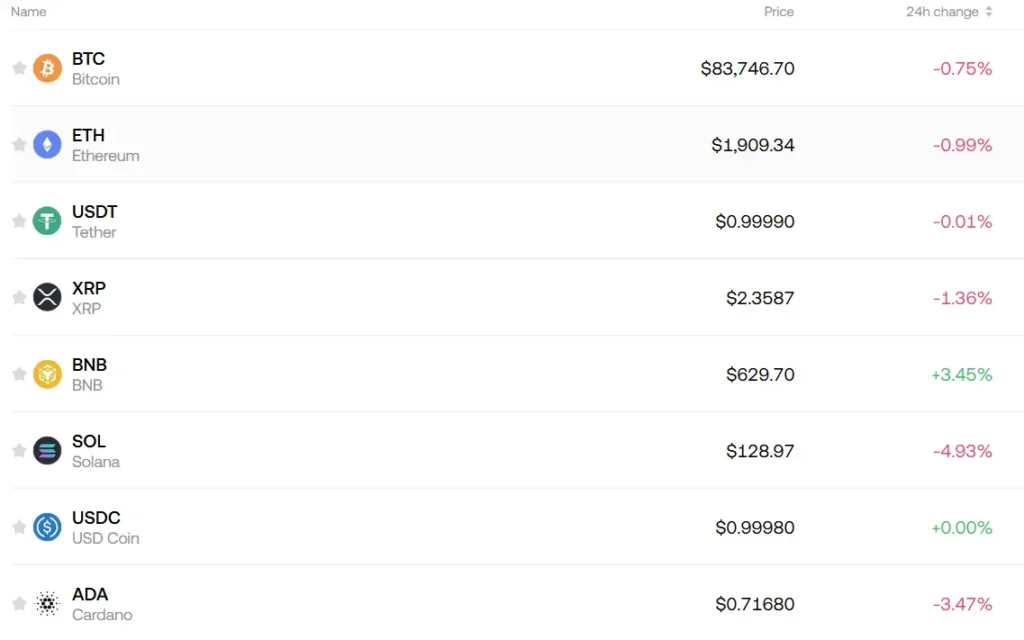

BYDFi Vs OKX: Supported Cryptocurrencies

When choosing between BYDFi and OKX, the range of supported cryptocurrencies is a key factor to consider. Both exchanges offer a variety of digital assets, but there are some important differences.

OKX stands out with its extensive selection of cryptocurrencies. The platform supports over 350 different digital assets, giving you access to both established coins and emerging tokens.

BYDFi, while offering fewer total cryptocurrencies than OKX, still provides a solid selection of the most popular coins and tokens. You’ll find all major cryptocurrencies available on this platform.

Key Cryptocurrency Support Comparison:

| Feature | BYDFi | OKX |

|---|---|---|

| Total cryptocurrencies | 150+ | 350+ |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| DeFi tokens | Limited selection | Comprehensive |

| New/emerging tokens | Occasional additions | Frequent additions |

Both exchanges regularly add new cryptocurrencies to their platforms. OKX typically introduces new tokens more frequently, which might be important if you’re interested in trading newer projects.

If you’re focused mainly on trading established cryptocurrencies like Bitcoin and Ethereum, either exchange will meet your needs. However, if you want access to a wider range of altcoins and newer tokens, OKX offers more options.

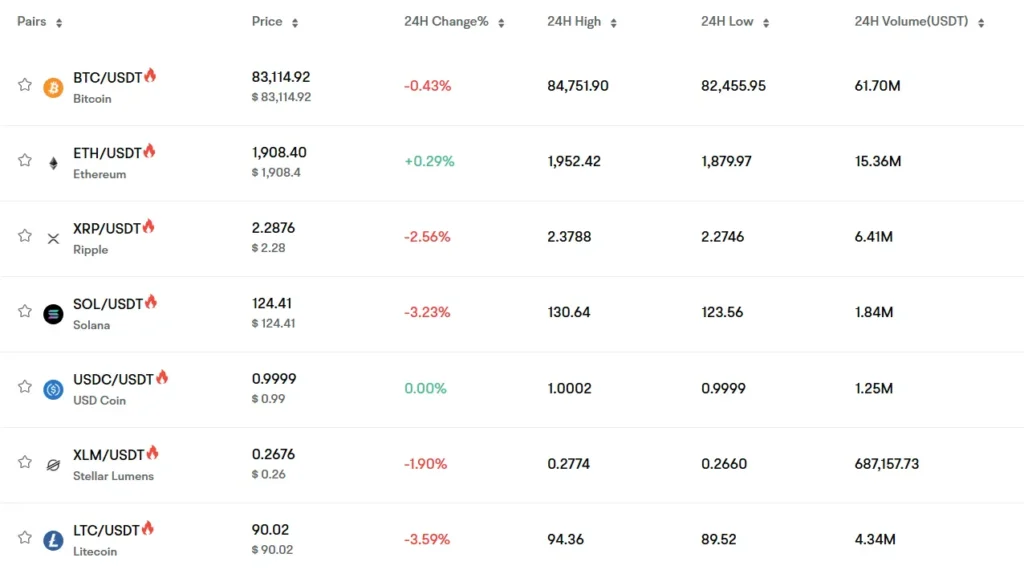

BYDFi Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing BYDFi and OKX, understanding their fee structures is crucial for your trading strategy. BYDFi offers more competitive trading fees overall, with a score of 9.0 compared to OKX’s 7.3 based on current data.

Trading Fees:

| Exchange | Maker Fee | Taker Fee | VIP/Discount Programs |

|---|---|---|---|

| BYDFi | 0.06% | 0.08% | Yes – volume-based |

| OKX | 0.08% | 0.10% | Yes – OKB token holders get discounts |

BYDFi’s lower base fees can save you money on frequent trades. Both exchanges offer tiered fee structures that reward higher trading volumes with lower rates.

Deposit Fees:

Both exchanges offer free crypto deposits, which is standard across the industry. However, fiat deposit methods and fees vary by region and payment method.

Withdrawal Fees:

OKX typically charges network fees for crypto withdrawals, which vary by blockchain congestion. BYDFi also charges withdrawal fees, but they’re often slightly lower for many popular cryptocurrencies.

Your withdrawal costs will depend on which cryptocurrencies you’re using. ETH and ERC-20 token withdrawals are generally more expensive on both platforms due to network fees.

Both exchanges implement withdrawal limits based on your verification level. Higher verification tiers allow for larger daily and monthly withdrawal amounts.

Remember that fee structures may change, so always check the exchanges’ official fee pages before making your decision.

BYDFi Vs OKX: Order Types

When trading cryptocurrencies, order types play a crucial role in your trading strategy. Both BYDFi and OKX offer various order types to meet different trading needs.

OKX provides a more comprehensive range of advanced order types. You can use market orders, limit orders, and stop orders on their platform. They also offer trailing stop orders and stop-limit orders, giving you more control over your trades.

These advanced features on OKX help you manage risk better and execute complex trading strategies with ease.

BYDFi also offers basic order types like market and limit orders. However, based on available information, their selection appears less extensive than OKX’s offerings.

The variety of order types matters because they let you customize how you enter and exit positions. For example, stop orders help protect your investments from significant losses, while limit orders ensure you only buy or sell at your desired price.

When choosing between these exchanges, consider how the available order types align with your trading style. If you need more sophisticated tools, OKX’s advanced order types might be more suitable for your needs.

Remember that understanding how to use different order types effectively can significantly impact your trading performance regardless of which platform you choose.

BYDFi Vs OKX: KYC Requirements & KYC Limits

BYDFi and OKX have different approaches to KYC (Know Your Customer) verification, which may influence your choice between these exchanges.

BYDFi does not require KYC verification for basic trading. You can create an account, deposit funds, and start trading without submitting any personal identification documents. This makes BYDFi appealing if you value privacy or want to start trading immediately.

OKX, while not making KYC mandatory for all users, offers additional benefits for those who complete verification. Completing KYC on OKX can increase your withdrawal limits and give you access to more platform features.

Withdrawal Limits:

- BYDFi: Allows no-KYC withdrawals up to certain limits

- OKX: Higher withdrawal limits available after KYC verification

For security, OKX has implemented stricter KYC procedures and follows anti-money laundering regulations. This creates a safer trading environment but requires more personal information.

Your decision might depend on your priorities. If easy access without ID verification is important, BYDFi offers more flexibility. If you prefer a platform with stronger regulatory compliance, OKX might be more suitable.

Remember that regulations change frequently in the crypto space. The KYC requirements for both exchanges may update as new laws are introduced in different countries.

BYDFi Vs OKX: Deposits & Withdrawal Options

When choosing between BYDFi and OKX, understanding their deposit and withdrawal options can help you make a better decision for your trading needs.

BYDFi supports several deposit methods including cryptocurrency transfers and some fiat options. You can deposit major cryptocurrencies like Bitcoin, Ethereum, and various altcoins directly to your BYDFi wallet.

OKX offers a wider range of deposit options. Beyond cryptocurrency deposits, OKX supports bank transfers, credit/debit cards, and third-party payment processors in many regions.

For withdrawals, both exchanges allow you to transfer your cryptocurrencies to external wallets. OKX generally provides more fiat withdrawal options compared to BYDFi.

Fee comparison:

| Exchange | Crypto Withdrawal Fees | Processing Time |

|---|---|---|

| BYDFi | Varies by cryptocurrency | 1-24 hours |

| OKX | Generally competitive | 1-24 hours |

Both platforms implement security measures for withdrawals, including email confirmations and two-factor authentication to protect your funds.

OKX typically has higher daily withdrawal limits, making it potentially better for high-volume traders. BYDFi offers decent limits that work well for most regular traders.

The minimum deposit and withdrawal amounts differ by cryptocurrency on both platforms, so check their current requirements before moving funds.

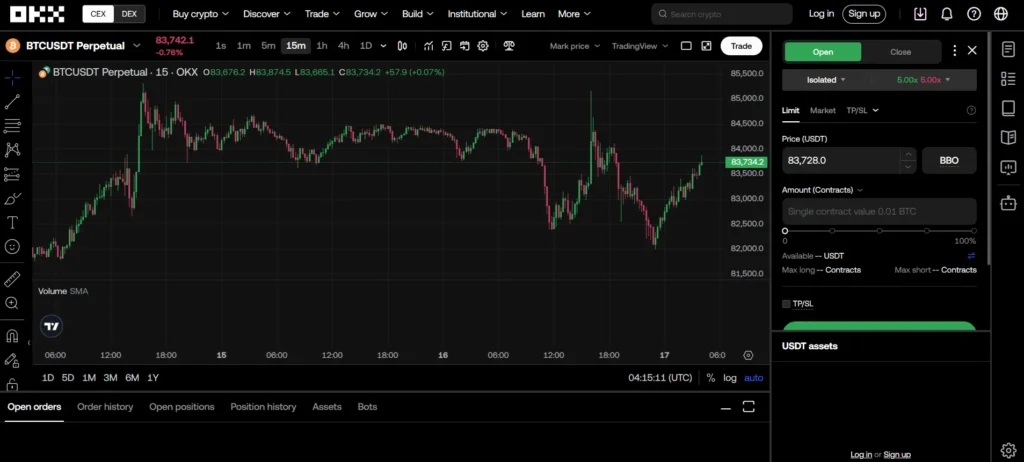

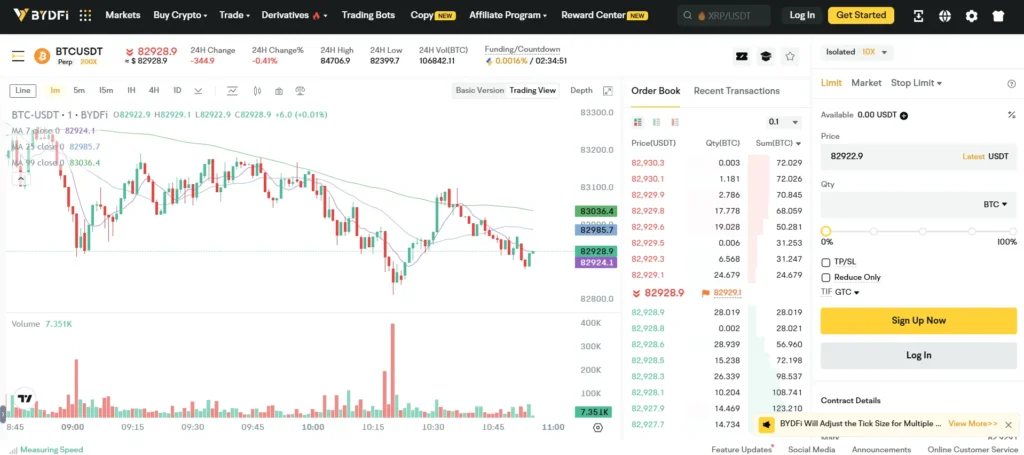

BYDFi Vs OKX: Trading & Platform Experience Comparison

Both BYDFi and OKX offer cryptocurrency trading platforms with distinct features that may appeal to different types of traders.

OKX stands out with its variety of trading options including spot trading and futures contracts. Its high trading volume and liquidity make it a popular choice among active traders who need to execute large orders quickly.

BYDFi received a higher overall score of 9.0 compared to OKX’s 7.3 in some comparisons, suggesting potential advantages in its platform experience.

User Interface

- BYDFi: Clean design, more beginner-friendly

- OKX: Feature-rich but potentially more complex for newcomers

Trading Tools

- BYDFi: Basic trading tools with straightforward execution

- OKX: Advanced charting, multiple order types, and trading bots

When you use OKX, you’ll find more advanced trading options but might face a steeper learning curve. BYDFi offers a more streamlined experience that you might find easier to navigate if you’re newer to crypto trading.

Both platforms offer mobile apps so you can trade on the go, but they differ in responsiveness and feature availability.

The trading fees structure varies between the platforms, with different maker/taker fees and discount programs. You should compare their current fee schedules based on your typical trading volume to determine which offers better value.

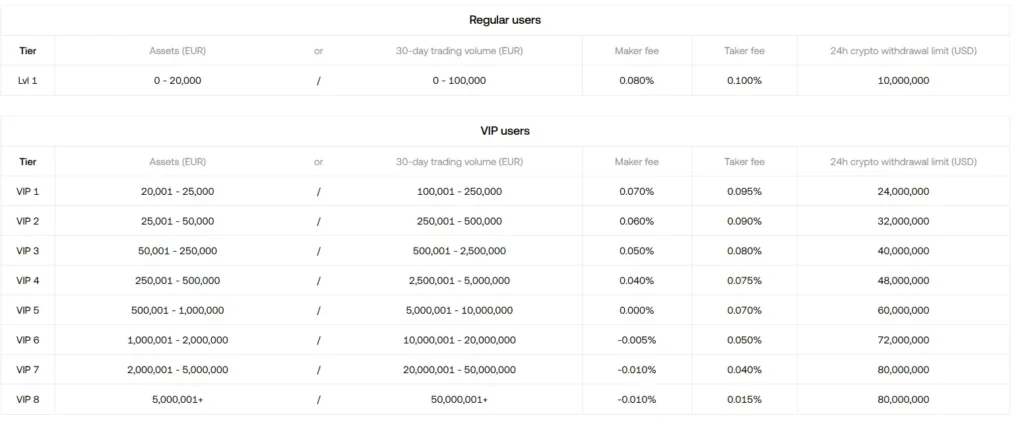

BYDFi Vs OKX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for managing risk. Both BYDFi and OKX have systems in place to protect themselves when your positions approach dangerous territory.

BYDFi’s liquidation process begins with a margin call when your margin ratio falls below the maintenance margin requirement. If you don’t add funds quickly, the system will start liquidating your positions to prevent further losses.

OKX operates similarly but offers tiered liquidation that happens gradually rather than all at once. This gives you a chance to adjust your position before complete liquidation occurs.

A key difference is BYDFi’s implementation of unrealized profit margins in their upgraded Perpetual Trading System. This feature provides additional flexibility when calculating liquidation thresholds.

Liquidation Fee Comparison:

| Exchange | Liquidation Fee | Partial Liquidation |

|---|---|---|

| BYDFi | 0.5% | Yes |

| OKX | 0.5-2% (varies) | Yes (tiered) |

Both platforms offer cross-margin mode to help you avoid liquidation by sharing margin across multiple positions. This can be particularly helpful during volatile market conditions.

You should regularly monitor your positions on either platform and set stop-loss orders to prevent unexpected liquidations. Remember that high leverage significantly increases liquidation risk.

BYDFi Vs OKX: Insurance

When comparing BYDFi and OKX exchanges, insurance protection is an important factor to consider for your investments.

OKX provides comprehensive insurance coverage for its users. The exchange maintains a dedicated fund to protect user assets in case of security breaches or hacks. This coverage helps ensure your financial security while trading on their platform.

OKX also offers employee benefits that include health insurance and retirement plans, demonstrating their commitment to security at all levels of the organization.

BYDFi’s insurance details are less prominently featured in comparison. While BYDFi scores higher in some overall exchange comparisons (9.0 vs OKX’s 7.3), specific information about their insurance policies is not as readily available in the search results.

For both exchanges, it’s worth noting that insurance typically covers only certain scenarios and may have limitations. You should check the current terms on each platform’s security pages for the most up-to-date information.

When choosing between these exchanges, consider how important insurance coverage is for your trading strategy. If protection against potential security incidents is a top priority, you’ll want to examine each platform’s specific insurance offerings and fund reserves.

Remember that insurance policies can change, so verify the current coverage before making your decision.

BYDFi Vs OKX: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both BYDFi and OKX offer support options, but they differ in a few key ways.

BYDFi provides customer support through email at [email protected]. They also offer live chat support for quick responses to your questions or issues you might encounter while using their platform.

OKX is known for efficient customer service across multiple channels. Their support system is designed to handle user queries promptly, which can be important when you’re dealing with time-sensitive trading matters.

Response times can vary between the two platforms. During high-volume trading periods, you might experience longer wait times with both exchanges.

Both platforms offer help centers with FAQs and guides to help you solve common problems without needing to contact support directly.

For new traders, the quality of customer support can be especially important as you learn to navigate these platforms. Consider which support method works best for your needs—email support if you prefer detailed explanations, or live chat if you need quick answers.

Remember that support availability may vary depending on your location and the time of day you need assistance.

BYDFi Vs OKX: Security Features

When choosing a crypto exchange, security should be your top priority. Both BYDFi and OKX have implemented various security measures to protect user assets.

BYDFi emphasizes security as one of its core strengths. The platform uses multi-signature wallets to secure user funds and maintains strict KYC procedures to prevent fraud.

OKX offers strong security features including two-factor authentication (2FA), anti-phishing codes, and cold storage for the majority of user assets. Their security system also includes real-time monitoring for suspicious activities.

Key Security Features Comparison:

| Feature | BYDFi | OKX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Multi-signature Wallets | ✓ | ✓ |

| Anti-phishing Protection | Limited | Advanced |

| Insurance Fund | Available | Comprehensive |

OKX has built a strong reputation for security over the years with no major security breaches reported. Their security team actively monitors the platform for potential threats.

BYDFi, while emphasizing security, has less publicly available information about their specific security protocols compared to OKX.

Both exchanges require identity verification for higher transaction limits, helping to prevent money laundering and other illegal activities.

You should enable all available security features on whichever platform you choose, including 2FA and strong, unique passwords to maximize your protection.

Is BYDFi A Safe & Legal To Use?

BYDFi operates as a licensed cryptocurrency exchange based in Singapore. According to recent data, the platform holds multiple licenses that require adherence to specific security standards.

The exchange implements important security measures including Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. These features help protect users and ensure compliance with financial regulations.

BYDFi emphasizes security in its trading platform. The exchange received a high overall score of 9.0 in comparison reviews, suggesting strong performance across various metrics.

Users can trade with confidence as BYDFi maintains transparent operations. The platform supports numerous fiat currencies, making it accessible for traders from different regions.

When using BYDFi, you’ll benefit from their focus on secure and transparent trading. Their user-friendly interface makes navigation straightforward, even for newer crypto traders.

Reviews indicate no significant issues with essential functions like deposits and withdrawals. Trading and purchasing operations also appear to function smoothly on the platform.

The exchange’s legal status and security features make it a legitimate option for cryptocurrency trading. However, as with any financial platform, you should always conduct your own research before committing significant funds.

Is OKX A Safe & Legal To Use?

OKX is considered a safe and legitimate cryptocurrency exchange. It ranks among the top platforms for trading Bitcoin and other cryptocurrencies.

The exchange is registered in Malta and Hong Kong, complying with the Virtual Financial Asset Act (VFAA). This regulation is overseen by the Malta Financial Services Authority, adding a layer of legitimacy to OKX’s operations.

In the Bahamas, OKX must obtain a license from the Securities Commission of the Bahamas (SCB) to operate legally. This requirement shows that OKX operates within legal frameworks across different jurisdictions.

Safety Measures:

- Strong platform security

- Regulatory compliance in multiple countries

- Established reputation in the crypto market

When comparing security aspects with other exchanges like BYDFi and BitMEX, OKX demonstrates competitive safety standards. This makes it a reliable choice for your cryptocurrency trading needs.

You should always do your own research before using any exchange. While OKX is generally considered safe, crypto markets involve risks regardless of the platform you choose.

The exchange offers trading services for a wide range of cryptocurrencies, making it versatile for different trading strategies you might want to employ.

Frequently Asked Questions

Traders often have specific questions about cryptocurrency exchanges before choosing the right platform. Here are answers to common questions about BYDFi and OKX to help you make an informed decision.

What are some advantages of using BYDFi over other exchanges?

BYDFi offers lower trading fees compared to many competitors, making it cost-effective for frequent traders. The platform provides a simple, intuitive interface that helps new users navigate the cryptocurrency trading world.

BYDFi also features a robust mobile app that allows trading on the go. Their customer support is available 24/7, responding to inquiries quickly.

The exchange regularly adds new cryptocurrencies, giving users access to emerging tokens before they appear on larger platforms.

How does OKX ensure the security of my investments?

OKX implements multi-layer security protocols including two-factor authentication and cold storage for most user funds. The platform conducts regular security audits to identify and address potential vulnerabilities.

OKX maintains an insurance fund to protect users against exceptional market conditions. They also offer customizable account security settings, allowing you to set specific withdrawal limits and restrictions.

Their security team monitors trading activities 24/7 for suspicious transactions to prevent fraud.

Are there any geographical restrictions for using BYDFi?

BYDFi is available in most countries worldwide, though some restrictions apply. Users from the United States, Iran, North Korea, and several other sanctioned countries cannot access the platform due to regulatory constraints.

Always check the latest terms of service before signing up, as geographical restrictions may change based on evolving regulations. BYDFi may require identity verification depending on your location.

What trading pairs does OKX offer to its users?

OKX provides an extensive range of trading pairs, including major cryptocurrencies like Bitcoin, Ethereum, and hundreds of altcoins. The platform supports spot trading, margin trading, and futures contracts.

OKX regularly adds new trading pairs based on market demand and token quality. They offer both crypto-to-crypto pairs and several fiat-to-crypto options through partnerships with payment processors.

Their tokenized stocks and commodities trading expands investment options beyond traditional cryptocurrencies.

How does BYDFi accommodate beginner traders in the cryptocurrency market?

BYDFi offers a demo trading account where beginners can practice without risking real money. Their knowledge base includes detailed guides, video tutorials, and market analysis for educational purposes.

The user interface features simplified trading options alongside advanced tools. Beginners can start with basic spot trading before exploring more complex products.

BYDFi’s customer support team is trained to assist new traders with technical questions and trading basics.

What fee structure does OKX implement for transactions and withdrawals?

OKX uses a tiered fee structure based on trading volume, with maker fees ranging from 0.08% to 0.03% and taker fees from 0.10% to 0.05%. Higher trading volumes qualify for lower fees, benefiting active traders.

Withdrawal fees vary by cryptocurrency, reflecting network transaction costs. OKX occasionally runs promotions with reduced or zero trading fees for new users.

VIP users receive additional fee discounts based on their OKX token holdings and monthly trading volume.

OKX Vs BYDFi Conclusion: Why Not Use Both?

When comparing OKX and BYDFi, both exchanges offer unique advantages that might benefit different aspects of your trading strategy.

BYDFi scores higher overall (9.0 compared to OKX’s 7.3) and provides some distinct features like copy trading, crypto perpetuals, and demo trading options. These tools can be particularly helpful if you’re looking to learn from experienced traders or practice strategies.

OKX, while scoring lower, still maintains a solid reputation in the crypto exchange space and might offer different trading pairs or liquidity options that complement your portfolio.

BYDFi emphasizes security and supports numerous fiat currencies, which could be valuable if you frequently move between crypto and traditional money. However, information about their withdrawal options appears limited based on available data.

Why consider using both platforms:

- Risk diversification: Spreading assets across multiple exchanges reduces your exposure to any single platform’s security issues

- Feature utilization: Access BYDFi’s copy trading while leveraging OKX’s unique offerings

- Trading opportunities: Different exchanges sometimes offer varying prices during volatile markets

You could use BYDFi for its higher-rated features like demo trading to practice strategies, then implement successful approaches on both platforms to maximize opportunities.

Remember to consider fees, security measures, and available trading pairs when deciding how to allocate your trading activities between these exchanges.