Choosing the right cryptocurrency exchange can make a big difference in your trading experience. BYDFi and KuCoin are two popular platforms that offer various features for crypto traders. While KuCoin boasts a larger user base with around 20 million users, BYDFi has been growing steadily with over 500,000 active users.

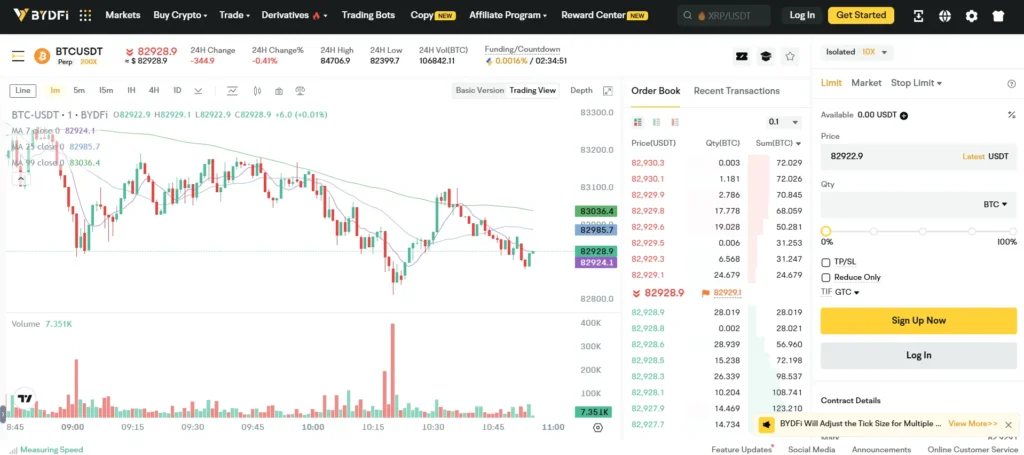

BYDFi offers higher leverage options at up to 200x compared to KuCoin’s 100x maximum, giving traders more flexibility for margin trading. This key difference might matter to you if you’re looking for greater potential returns, though it comes with increased risk. Both exchanges provide a range of trading options, but they differ in their fee structures and available features.

The overall comparison scores suggest BYDFi has a slight edge with a 9.0 rating compared to KuCoin’s score. However, your ideal choice depends on what you value most – whether that’s the extensive user base and established reputation of KuCoin or the potentially better leverage options and features of BYDFi.

BYDFi vs KuCoin: At A Glance Comparison

When choosing between BYDFi and KuCoin, understanding their key differences helps you make the right decision for your crypto trading needs.

User Base:

- KuCoin: Approximately 20 million users worldwide

- BYDFi: Over 500,000 active users

Overall Rating:

- BYDFi: 9.0/10

- KuCoin: Lower overall score than BYDFi

Availability:

Both exchanges operate in hundreds of countries, making them accessible to traders globally.

Key Features Comparison:

| Feature | BYDFi | KuCoin |

|---|---|---|

| Founded | Newer platform | Established longer |

| Trading Tools | Comprehensive trading tools | Extensive trading features |

| User Interface | User-friendly | Slightly more complex |

| Market Reach | Growing | Larger established market |

BYDFi stands out with its higher overall score, suggesting strong performance in key areas that matter to crypto traders.

KuCoin has the advantage of a much larger user base, which typically translates to higher trading volumes and liquidity.

Both exchanges offer similar services but may differ in trading fees, security measures, and available cryptocurrencies. These factors will influence which platform better suits your specific trading style and requirements.

Your decision may depend on whether you prefer an established exchange with more users (KuCoin) or a newer platform with potentially better overall performance metrics (BYDFi).

BYDFi vs KuCoin: Trading Markets, Products & Leverage Offered

BYDFi and KuCoin both offer a variety of trading options, but they differ in important ways.

KuCoin provides access to over 700 cryptocurrencies, making it one of the larger exchanges by asset selection. You can trade spot, futures, and margin on KuCoin with leverage up to 100x on certain trading pairs.

BYDFi offers fewer cryptocurrencies overall but still covers major coins and tokens. Their platform supports spot trading, futures contracts, and margin trading with leverage options up to 125x on some trading pairs.

Trading Products Comparison:

| Feature | BYDFi | KuCoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Max Leverage | Up to 125x | Up to 100x |

| Number of Assets | 200+ | 700+ |

Both platforms offer trading bots and advanced order types to help you automate your trading strategies. KuCoin has more trading pairs and market depth, which can be beneficial for traders looking for obscure altcoins.

BYDFi stands out with its slightly higher leverage options, which might appeal to experienced traders looking for greater potential returns. However, higher leverage also means higher risk.

You’ll find that both exchanges support fiat deposits, but neither allows fiat withdrawals, requiring conversion to crypto before transferring funds out.

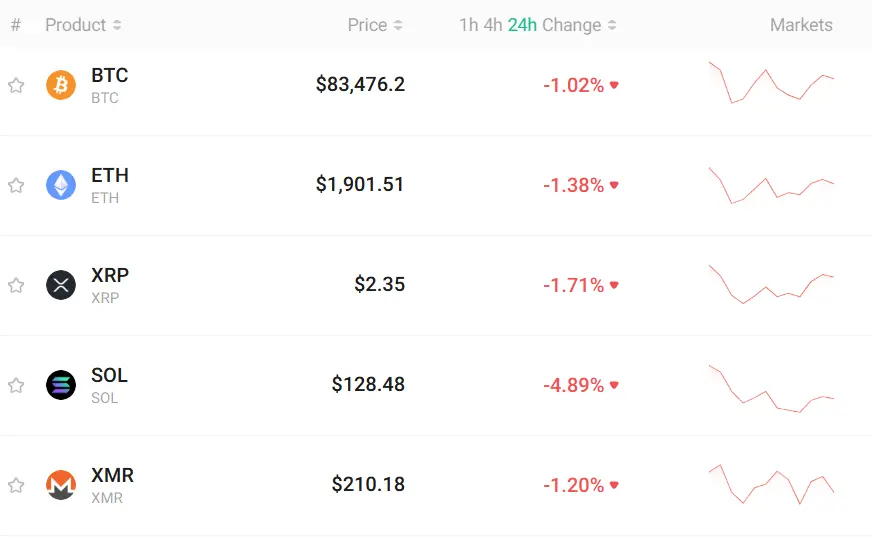

BYDFi vs KuCoin: Supported Cryptocurrencies

Both BYDFi and KuCoin offer a wide range of cryptocurrencies for trading, but there are some differences in their selections.

KuCoin has a larger variety of cryptocurrencies available. It supports over 700 different digital assets and more than 1,200 trading pairs. This makes KuCoin an excellent choice if you’re looking to trade less common or newer tokens.

BYDFi offers fewer cryptocurrencies compared to KuCoin. While it supports major cryptocurrencies like Bitcoin, Ethereum, and many popular altcoins, its selection is more limited.

Major cryptocurrencies supported by both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Cardano (ADA)

- Solana (SOL)

KuCoin is known for listing new cryptocurrencies earlier than many other exchanges. This gives you the opportunity to invest in promising projects at an early stage, though this comes with higher risk.

Both exchanges allow crypto-to-crypto trading pairs. However, KuCoin offers more trading pair combinations due to its larger selection of supported cryptocurrencies.

Neither exchange allows direct fiat withdrawals, according to the search results. This means you’ll need to convert your funds to cryptocurrency before transferring them off the platform.

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade. If you’re mainly interested in major coins, either platform will likely meet your needs.

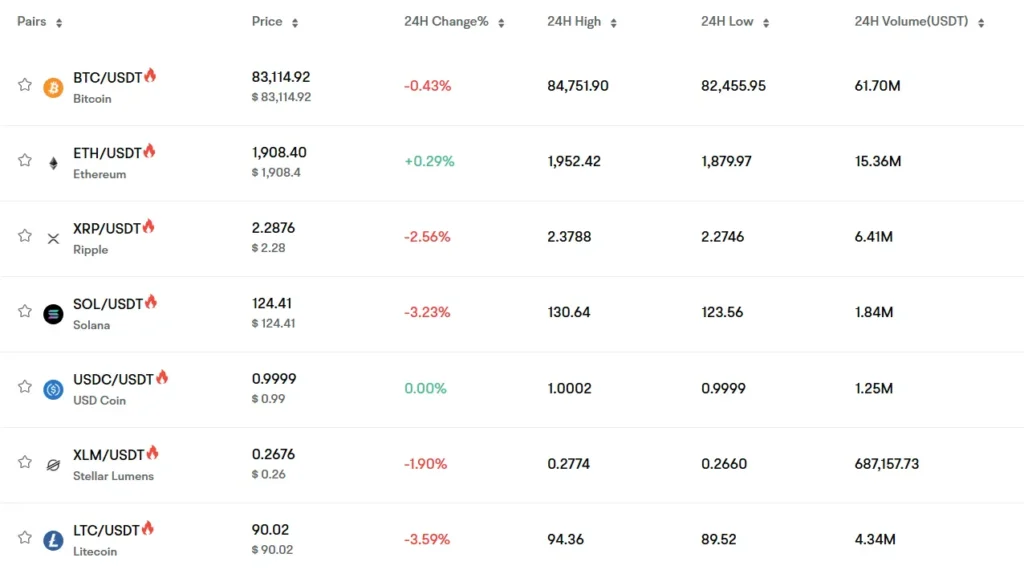

BYDFi vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing BYDFi and KuCoin, fees play a crucial role in your decision-making process. Both exchanges offer competitive fee structures, but there are notable differences.

BYDFi offers trading fees of up to 0.3%, making it one of the more affordable options in the market. This lower fee structure can be particularly beneficial if you’re an active trader.

KuCoin’s trading fees range from 0.005% to 0.1%, depending on your tier level. Your trading volume and KCS (KuCoin’s native token) holdings can qualify you for discounts on these fees.

Trading Fee Comparison:

| Exchange | Standard Trading Fee | Potential Discounts |

|---|---|---|

| BYDFi | Up to 0.3% | Varies |

| KuCoin | 0.005% – 0.1% | Based on tier levels and KCS holdings |

KuCoin regularly offers promotions and special discounts on trading fees. You might find temporary fee reductions during certain promotional periods.

For deposit fees, both exchanges generally don’t charge for most cryptocurrencies. However, withdrawal fees vary by cryptocurrency and are subject to change based on network conditions.

When choosing between these exchanges, consider your trading volume and frequency. High-volume traders might benefit more from KuCoin’s tier-based discounts, while occasional traders might find BYDFi’s straightforward fee structure more appealing.

Always check the current fee schedules on both platforms before trading, as cryptocurrency exchanges may update their fee structures periodically.

BYDFi vs KuCoin: Order Types

When trading cryptocurrency, the types of orders available can significantly impact your trading strategy. Both BYDFi and KuCoin offer a variety of order types to help you execute trades effectively.

KuCoin provides standard order types including market orders, limit orders, and stop orders. These basic options allow you to buy or sell assets at current prices or set specific price points for execution.

BYDFi matches these basic order types and also offers limit close orders, which help you set predetermined exit points for your trades. This feature is particularly useful for managing risk and locking in profits.

For advanced traders, KuCoin has additional options like post-only orders and iceberg orders that help with large volume trading without significantly impacting market prices.

BYDFi shines with its leverage trading options that come with tiered margin levels. This feature allows you to amplify potential returns, though it also increases risk.

Both platforms support stop-loss and take-profit orders to help you manage positions automatically. These tools are essential for traders who can’t monitor markets constantly.

KuCoin offers OCO (One-Cancels-the-Other) orders, letting you place two orders simultaneously with the execution of one automatically canceling the other.

BYDFi’s interface makes setting up complex orders more intuitive for beginners, while KuCoin’s extensive order options might appeal more to experienced traders who need greater flexibility.

BYDFi vs KuCoin: KYC Requirements & KYC Limits

KuCoin offers three different levels of KYC verification. Each level provides different withdrawal limits and access to features.

KuCoin’s Level 1 verification is basic, requiring minimal personal information. Level 2 requires more documentation, while Level 3 offers the highest withdrawal limits for users who complete full verification.

Without KYC verification, KuCoin still allows withdrawals below certain limits. This makes it a viable option if you prefer maintaining privacy for smaller trading activities.

BYDFi also implements KYC procedures, but with a different structure than KuCoin. Their verification process is designed to balance security requirements with user convenience.

KuCoin KYC Features:

- Three-tiered verification system

- Higher daily withdrawal limits with each level

- Basic trading possible without KYC

BYDFi KYC Features:

- Structured verification process

- Withdrawal limits tied to verification status

- Security measures to protect user data

When choosing between these exchanges, consider your trading volume and privacy preferences. If you plan to withdraw large amounts regularly, completing higher KYC levels on either platform will be necessary.

Both exchanges comply with regulatory requirements while trying to maintain user-friendly experiences. Your choice may depend on which platform offers withdrawal limits that better match your trading needs.

BYDFi vs KuCoin: Deposits & Withdrawal Options

Both BYDFi and KuCoin offer various options for funding your accounts, but they differ in some key aspects.

When it comes to deposits, both exchanges allow you to add fiat currency to your account. This makes it easier for beginners to start trading without already owning cryptocurrency.

However, there’s an important limitation to note. According to the search results, neither BYDFi nor KuCoin currently supports fiat withdrawals. This means you can’t directly withdraw your funds as traditional currency.

For cryptocurrency transactions, both platforms offer standard deposit and withdrawal options for a range of digital assets. The specific cryptocurrencies supported may vary between the platforms.

Deposit Methods:

- Fiat currency deposits ✓

- Cryptocurrency deposits ✓

- Bank transfers (availability varies)

- Credit/debit cards (availability varies)

Withdrawal Methods:

- Fiat currency withdrawals ✗

- Cryptocurrency withdrawals ✓

Processing times and fees for deposits and withdrawals can vary based on the method you choose and the cryptocurrency involved. It’s worth checking the current fee structures on both platforms before making transactions.

Remember to verify the minimum deposit and withdrawal amounts for your preferred methods, as these can change and may impact your trading strategy.

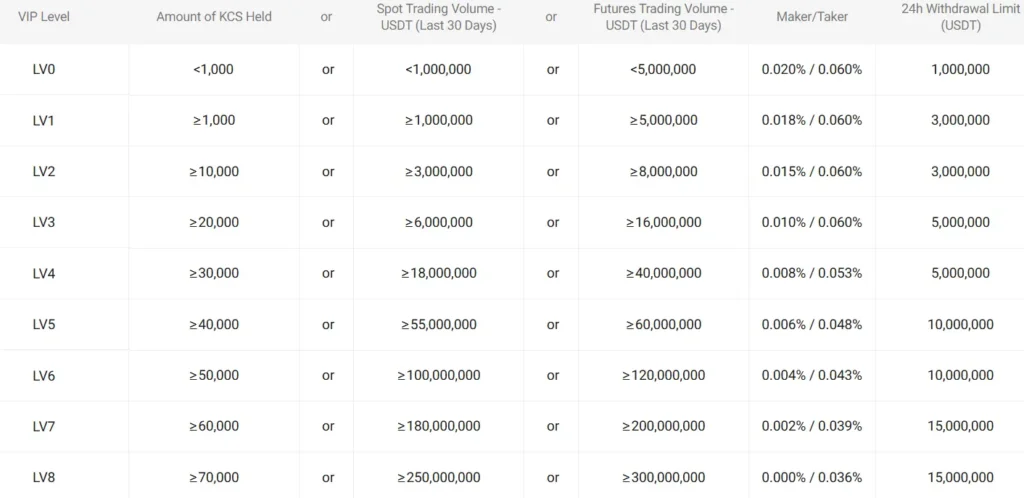

BYDFi vs KuCoin: Trading & Platform Experience Comparison

When choosing between BYDFi and KuCoin, the trading experience is a key factor to consider. Both platforms offer user-friendly interfaces, but with notable differences.

KuCoin serves approximately 20 million users worldwide, providing a robust trading environment with advanced tools. The platform supports spot trading, futures, and margin options that experienced traders appreciate.

BYDFi, with its smaller user base of around 500,000 active users, offers a more streamlined experience that might be less overwhelming for beginners.

Trading Features Comparison:

| Feature | BYDFi | KuCoin |

|---|---|---|

| User Interface | Clean, straightforward | Feature-rich, more complex |

| Mobile App | Available, user-friendly | Comprehensive, advanced features |

| Trading Types | Spot, futures, margin | Spot, futures, margin, lending |

| Trading Bots | Limited options | Multiple automated trading tools |

Both platforms allow you to trade hundreds of cryptocurrencies, but KuCoin typically offers a wider selection of altcoins and trading pairs.

The order execution speed on both exchanges is reliable, with KuCoin having a slight edge during high-volume trading periods.

You’ll find that BYDFi’s overall score of 9.0 slightly edges out KuCoin in some comparison metrics, suggesting a quality platform experience despite its smaller size.

For newer traders, BYDFi’s less cluttered interface might be preferable, while experienced traders often gravitate toward KuCoin’s extensive toolset and deeper liquidity pools.

BYDFi vs KuCoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. Both BYDFi and KuCoin employ liquidation processes to protect themselves from losses when markets move against traders’ positions.

BYDFi uses a tiered liquidation system that starts with margin calls when your margin ratio approaches dangerous levels. This gives you time to add funds before full liquidation occurs. Their system typically liquidates positions gradually rather than all at once.

KuCoin’s KuCoin Futures platform uses a risk management system that issues warnings at specific margin ratios. When your margin ratio falls below the maintenance margin requirement, the liquidation process begins automatically.

Both platforms calculate liquidation prices based on your position size, leverage used, and maintenance margin requirements. However, BYDFi tends to offer slightly more flexible liquidation parameters with options to adjust risk settings.

KuCoin implements an insurance fund to help prevent negative balances during extreme market volatility. This adds a layer of protection for both the exchange and traders.

On BYDFi, you’ll find partial liquidation features that can help preserve portions of your position rather than losing everything at once. This can be beneficial during volatile trading conditions.

Liquidation fees differ between the platforms. KuCoin typically charges 0.5-1% on liquidated positions, while BYDFi’s fees range from 0.5-0.8% depending on the trading pair.

BYDFi vs KuCoin: Insurance

When investing in cryptocurrency, protecting your assets should be a top priority. Both BYDFi and KuCoin understand this concern and have implemented security measures.

KuCoin offers a Safeguard Program that functions as an insurance fund. This program aims to protect users’ assets in case of security breaches or hacks. They allocate a portion of their operational revenue to maintain this fund.

BYDFi also prioritizes asset protection through security systems. However, specific information about their dedicated insurance fund is less prominent in available resources.

Security Features Comparison:

| Feature | BYDFi | KuCoin |

|---|---|---|

| Insurance Fund | Limited information | Safeguard Program |

| Cold Storage | Yes | Yes |

| Two-Factor Authentication | Yes | Yes |

| Regular Security Audits | Yes | Yes |

Both exchanges store most user assets in cold storage wallets, keeping them offline and away from potential online threats.

You should always enable two-factor authentication (2FA) regardless of which platform you choose. This adds an extra layer of protection to your account.

Neither exchange offers FDIC insurance, which is common among cryptocurrency platforms. This differs from traditional banks where deposits are typically insured by government programs.

Remember to research the latest security measures on both platforms before making your decision, as crypto exchanges regularly update their security protocols.

BYDFi vs KuCoin: Customer Support

When choosing a crypto exchange, customer support quality can make a big difference in your trading experience. Both BYDFi and KuCoin offer customer support services, but there are some notable differences between them.

BYDFi provides what many users describe as responsive and helpful customer support. According to search results, BYDFi delivers slightly better and faster customer service compared to KuCoin. This can be particularly valuable if you’re new to crypto trading or encounter issues that need quick resolution.

KuCoin, with its larger user base of around 20 million users, offers reliable and efficient customer support. While it may not be quite as fast as BYDFi’s support, it’s still considered reasonably good by most standards.

Support Comparison:

| Feature | BYDFi | KuCoin |

|---|---|---|

| Response Time | Faster | Good |

| Quality | Very helpful | Reliable |

| User Base | 500,000+ active users | 20 million+ users |

Both exchanges offer multiple support channels including email tickets, live chat, and help centers with FAQs and guides. Your specific needs may determine which support system works better for you.

If immediate assistance is your priority, BYDFi might be the better choice. However, KuCoin’s established support system serves its much larger user base effectively.

BYDFi vs KuCoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both BYDFi and KuCoin offer robust security features to protect your assets.

KuCoin implements multi-layer security protocols including two-factor authentication (2FA) and advanced encryption. Their platform also features a “Basic” and “Advanced” verification level, giving you options based on your privacy needs.

BYDFi utilizes smart contracts for secure transactions, which adds an extra layer of protection. They focus on providing anonymous transactions while maintaining security standards.

Both exchanges store most user funds in cold wallets, keeping them offline and safe from potential online threats. This is a crucial security practice in the crypto world.

KuCoin Security Highlights:

- Multi-factor authentication

- Tiered verification levels

- Advanced encryption protocols

- Cold wallet storage

BYDFi Security Highlights:

- Smart contract security

- Anonymous transaction options

- Secure storage solutions

- Regular security audits

Both platforms continually update their security measures to adapt to new threats. They invest in keeping user assets safe and providing a secure trading environment.

Your choice may depend on whether you value KuCoin’s established security reputation or BYDFi’s focus on privacy and smart contract implementation. Both exchanges prioritize keeping your investments protected from unauthorized access.

Is BYDFi A Safe & Legal To Use?

BYDFi prioritizes security through several protection measures. The platform employs cold storage for most user funds, keeping them offline and away from potential hackers.

BYDFi implements standard security features including two-factor authentication (2FA) and advanced encryption to protect your account. These safety measures are similar to what you’ll find on KuCoin.

Regarding legality, BYDFi operates with basic regulatory compliance. The exchange follows Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, requiring identity verification for higher-tier accounts.

Safety Features on BYDFi:

- Cold storage for majority of assets

- Two-factor authentication

- Advanced encryption protocols

- Regular security audits

However, it’s important to note that BYDFi isn’t as established as larger exchanges like KuCoin. This newer status means it has less time to prove its security track record.

For US users, you should exercise caution. While not explicitly banned, many international exchanges operate in regulatory gray areas for US customers. Always check current regulations before using any exchange.

The safest approach when using BYDFi is to only keep trading funds on the platform. Store your long-term holdings in a personal wallet where you control the private keys.

Remember that no exchange is completely risk-free. Even with security measures in place, exchanges can face technical issues or targeted attacks.

Is KuCoin A Safe & Legal To Use?

KuCoin faces significant legal challenges in 2024. The exchange received a Department of Justice indictment for violating U.S. regulations, raising serious concerns about its legal status.

Despite these issues, some users consider KuCoin the “least shady” among similar exchanges like Binance, HTX, OKX, and Poloniex. However, this doesn’t mean it’s completely trustworthy.

If you’re based in the United States, you should be particularly cautious. The recent legal troubles suggest U.S. regulators are taking action against the platform for operating without proper compliance.

Safety Concerns:

- Legal troubles with U.S. authorities

- Regulatory compliance issues

- Questions about user fund security

KuCoin’s uncertain legal status makes it a risky choice for your crypto investments. You should consider alternatives with clearer regulatory standing.

When comparing KuCoin to BYDFi, the search results suggest BYDFi offers a better and smoother user experience. BYDFi positions itself as a social trading platform focused on providing a glitch-free experience for individual investors.

Your crypto assets deserve protection through properly regulated platforms. Before using KuCoin, research its current legal status in your country and consider whether the risks outweigh the benefits.

Frequently Asked Questions

Traders comparing BYDFi and KuCoin often have specific questions about features, fees, and usability. These exchanges differ in several key aspects that impact trading experience and outcomes.

What are the main differences between BYDFi and KuCoin platforms?

BYDFi and KuCoin differ primarily in their overall scores, with BYDFi scoring 9.0 compared to KuCoin’s slightly lower rating. Both platforms allow fiat deposits, but neither supports fiat withdrawals.

BYDFi tends to be more streamlined, focusing on core trading functions. KuCoin offers a wider range of features and cryptocurrencies, making it more comprehensive but potentially more complex.

Trading interfaces also differ, with BYDFi designed for simplicity while KuCoin provides more advanced charting and analysis tools.

Which exchange offers better security features, BYDFi or KuCoin?

Both exchanges implement standard security measures like two-factor authentication and cold storage for funds. KuCoin has experienced a major hack previously but compensated affected users.

BYDFi emphasizes its security protocols but has less time in the market to demonstrate long-term security resilience. KuCoin’s longer history provides more evidence of security handling under pressure.

You should enable all available security features regardless of which platform you choose.

Can users expect lower fees on BYDFi compared to KuCoin?

BYDFi generally offers competitive fee structures that may be lower than KuCoin in certain trading scenarios. Trading fees vary based on your trading volume and token holdings on both platforms.

KuCoin’s fee structure is tiered and can be reduced by holding their native KCS token. BYDFi similarly offers incentives that can lower overall trading costs.

The actual cost advantage depends on your specific trading patterns and volume.

How do the trading options differ on BYDFi versus KuCoin?

KuCoin provides a broader range of trading options, including spot trading, margin trading, futures, and staking. Their selection of cryptocurrencies is extensive with hundreds of trading pairs.

BYDFi offers core trading functions with fewer cryptocurrency options but maintains essential trading types that most traders need. Their platform focuses on making these core functions accessible.

For specialized trading strategies, KuCoin typically offers more tools and options.

Is one platform more user-friendly for new traders: BYDFi or KuCoin?

BYDFi is generally considered more user-friendly for beginners due to its straightforward interface and simpler navigation. New traders can quickly learn the platform without feeling overwhelmed.

KuCoin offers more features but comes with a steeper learning curve. The platform provides extensive educational resources to help newcomers, but the interface contains more elements to understand.

Your preference may depend on whether you value simplicity or feature richness when starting your trading journey.

What advantages does BYDFi hold over KuCoin in terms of customer support?

BYDFi focuses on responsive customer support as a competitive advantage, with typically faster response times compared to KuCoin. Support is available through multiple channels including live chat.

KuCoin handles a larger user base, which can sometimes result in longer wait times for support inquiries. Their support system is comprehensive but may experience delays during high-volume periods.

Both platforms offer knowledge bases and FAQs, but BYDFi tends to prioritize direct customer interaction more prominently.

BYDFi vs KuCoin Conclusion: Why Not Use Both?

Both BYDFi and KuCoin offer valuable features for crypto traders. BYDFi stands out with its user-friendly interface, making it easier for beginners to navigate the platform.

KuCoin, on the other hand, provides a wider range of cryptocurrencies and trading options. This makes it attractive for experienced traders looking for variety.

You don’t have to choose just one platform. Many crypto investors use multiple exchanges to maximize their trading opportunities.

Benefits of using both platforms:

- Access to more trading pairs and cryptocurrencies

- Spread your risk across different exchanges

- Take advantage of different fee structures

- Benefit from unique features on each platform

Using both platforms allows you to experience BYDFi’s smoother user experience while also accessing KuCoin’s extensive trading options.

Consider your trading needs when deciding how to use these platforms. You might prefer BYDFi for daily trading and KuCoin for accessing rarer altcoins.

Remember to keep track of your assets across both platforms. Using portfolio tracking tools can help you maintain a clear overview of your investments.

As the crypto market continues to evolve through 2025, having accounts on multiple reputable exchanges gives you flexibility and trading advantages.