When choosing a cryptocurrency exchange, comparing options like BYDFi and Deepcoin can help you make a better decision for your trading needs. Based on recent comparisons, BYDFi has earned a higher overall score of 9.0 compared to Deepcoin. Understanding the key differences between these exchanges in terms of features, fees, and available trading pairs can significantly impact your trading experience and potential profits.

Both exchanges offer cryptocurrency derivatives trading, though they compete in a market dominated by larger platforms like Binance, Huobi Global, and Bybit. You’ll want to examine their specific fee structures, supported cryptocurrencies, and security measures before committing your funds to either platform.

BYDFi Vs Deepcoin: At A Glance Comparison

When comparing BYDFi and Deepcoin, several key differences stand out. BYDFi has earned a higher overall score of 9.0 compared to Deepcoin’s lower rating, according to recent evaluations.

BYDFi launched in April 2020 (originally as BitYard) and aims to provide users with an enhanced trading experience. The platform includes unique features like copy trading, which lets you follow successful traders’ strategies.

Deepcoin offers various trading options but doesn’t match BYDFi’s overall performance in most comparative metrics.

| Feature | BYDFi | Deepcoin |

|---|---|---|

| Overall Score | 9.0 | Lower than BYDFi |

| Launch Date | April 2020 | Not specified in search results |

| Special Features | Copy trading | Standard trading options |

| User Experience | Focused on better trading experience | Less information available |

Security is an important factor to consider when choosing between these exchanges. While specific security details aren’t mentioned in the search results, you should research this aspect before making a decision.

Trading fees will affect your bottom line. Unfortunately, the exact fee structures aren’t detailed in the search results, so you’ll want to check the current rates on both platforms.

Both exchanges offer cryptocurrency trading pairs, though BYDFi appears to have a more established reputation based on the comparative scores.

BYDFi Vs Deepcoin: Trading Markets, Products & Leverage Offered

When comparing BYDFi and Deepcoin, both exchanges offer cryptocurrency derivatives trading with some key differences in their offerings.

BYDFi provides higher leverage options for traders looking to maximize their positions. The platform allows you to borrow funds to increase your trading power significantly.

For example, with just 1 BTC and 10x leverage on BYDFi, you can trade as if you had 10 BTC at your disposal.

BYDFi stands out with its copy trading feature, allowing beginners to mirror successful traders’ strategies. The platform also offers crypto perpetuals and a demo trading option for practice.

Deepcoin has a solid offering but received a lower overall score (compared to BYDFi’s 9.0) in comprehensive evaluations.

Trading Products Comparison:

| Feature | BYDFi | Deepcoin |

|---|---|---|

| Leverage Trading | Higher options | Standard options |

| Copy Trading | Yes | Limited |

| Demo Trading | Yes | No |

| Perpetuals | Yes | Yes |

Both exchanges support a wide range of cryptocurrencies, but BYDFi gives you access to more trading pairs and markets.

Security is prioritized on both platforms, but BYDFi has implemented additional measures to protect your funds during high-leverage trading scenarios.

You’ll find the user interface on BYDFi more suitable for both beginners and advanced traders with its intuitive design and comprehensive tools.

BYDFi Vs Deepcoin: Supported Cryptocurrencies

When choosing between BYDFi and Deepcoin, the variety of cryptocurrencies available for trading is an important factor to consider. BYDFi stands out by supporting over 400 cryptocurrencies and trading pairs, giving you a wide range of options for your investment portfolio.

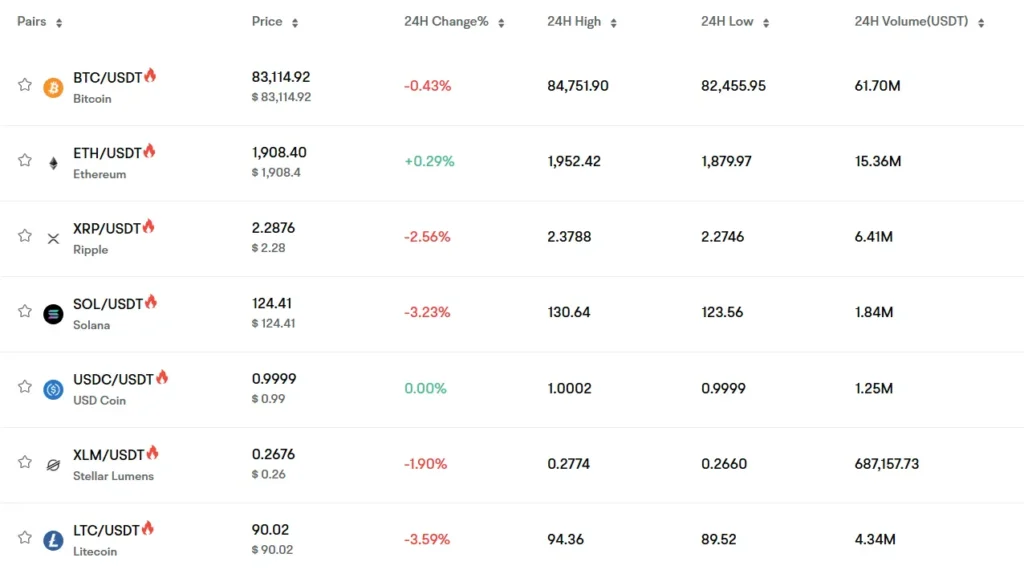

Deepcoin also offers a substantial selection of cryptocurrencies, though specific numbers aren’t available in the search results. Both exchanges provide access to major cryptocurrencies like Bitcoin, Ethereum, and other popular altcoins.

BYDFi has an advantage in fiat currency support, accepting more than 60 fiat currencies through payment processors including BANXA, Xanpool, Transak, Mercuryo, and Ramp. This makes it easier for you to fund your account using your local currency.

Cryptocurrency Support Comparison:

| Feature | BYDFi | Deepcoin |

|---|---|---|

| Cryptocurrencies | 400+ | Multiple (exact number not specified) |

| Fiat Currencies | 60+ | Limited information available |

| Payment Processors | BANXA, Xanpool, Transak, Mercuryo, Ramp | Limited information available |

The extensive cryptocurrency selection on BYDFi might be beneficial if you’re looking to trade less common altcoins or want to diversify your portfolio beyond the major tokens.

Both platforms cater to cryptocurrency derivative traders, with each appearing in rankings of top derivative exchanges. Your choice might depend on which specific tokens you plan to trade regularly.

BYDFi Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing BYDFi and Deepcoin, fees play a major role in your decision-making process. Both exchanges offer competitive fee structures, but there are some notable differences.

BYDFi charges trading fees of up to 0.40% per transaction. This is slightly higher than Deepcoin, which offers trading fees of up to 0.12%.

Deepcoin attracts more users partly due to its lower fee structure. With approximately 1 million active users compared to BYDFi’s 500,000, Deepcoin has a larger community.

Trading Fees Comparison:

| Exchange | Trading Fees |

|---|---|

| BYDFi | Up to 0.40% |

| Deepcoin | Up to 0.12% |

BYDFi stands out by offering no deposit fees across most cryptocurrencies. This is a significant advantage if you frequently move assets onto the exchange.

Withdrawal fees on both platforms vary depending on the cryptocurrency and network used. BYDFi’s withdrawal fees change based on the specific crypto and blockchain network you select.

You should consider your trading volume when choosing between these exchanges. If you trade frequently in large amounts, Deepcoin’s lower trading fees might save you more money over time.

Both exchanges offer competitive fee structures compared to the broader market, making them reasonable choices for cost-conscious traders.

BYDFi Vs Deepcoin: Order Types

When trading cryptocurrencies, the types of orders available can greatly impact your trading strategy. Both BYDFi and Deepcoin offer various order types to suit different trading needs.

BYDFi provides a comprehensive range of order options. These include standard market orders for immediate execution at current market prices and limit orders that execute only at your specified price or better.

Deepcoin matches these basic order types while both platforms also support stop-loss orders to help manage risk by automatically selling when prices fall to a certain level.

For more advanced traders, BYDFi offers copy trading functionality. This feature allows you to automatically mirror the trades of successful traders.

Deepcoin counters with its own set of advanced order types including trailing stops, which adjust automatically as the market moves in your favor.

BYDFi Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

- Copy trading

Deepcoin Order Types:

- Market orders

- Limit orders

- Stop-loss orders

- Trailing stops

- OCO (One-Cancels-Other)

Both exchanges support futures trading with specialized order types for derivatives. These include leverage settings and liquidation protection mechanisms.

The platforms differ slightly in their execution speed and available time-in-force options. BYDFi offers good-till-canceled orders, while Deepcoin provides additional fill-or-kill options for traders who need immediate complete execution.

BYDFi Vs Deepcoin: KYC Requirements & KYC Limits

BYDFi offers flexibility with its KYC policies. You can trade on BYDFi without completing KYC verification, making it attractive if privacy is important to you.

Without KYC on BYDFi, you’ll face some limitations. Unverified accounts can withdraw up to 0.2 BTC daily, while verified users enjoy a much higher limit of 5 BTC per day.

Deepcoin, in contrast, is known for being regulation-compliant globally. This suggests they likely have stricter KYC requirements than BYDFi.

BYDFi KYC Features:

- No mandatory KYC verification

- Trading available without identity verification

- Withdrawal limits apply based on verification status

While trading without KYC is possible on BYDFi, be aware that certain restrictions might apply based on your location. This is common with exchanges that offer no-KYC options.

For those concerned about privacy, BYDFi’s approach makes it a popular choice among exchanges that don’t require immediate identity verification.

If you need higher withdrawal limits, completing KYC on BYDFi will significantly increase your daily withdrawal capacity from 0.2 BTC to 5 BTC.

BYDFi Vs Deepcoin: Deposits & Withdrawal Options

When choosing between BYDFi and Deepcoin, understanding your deposit and withdrawal options is essential for smooth transactions.

BYDFi offers a wide range of deposit methods. You can deposit cryptocurrencies directly or use fiat currencies through credit cards and debit cards. This flexibility makes it easier for you to fund your account using your preferred method.

For withdrawals, BYDFi charges fixed fees to cover transfer costs. While no deposit fees are charged, you should be aware of these withdrawal costs when planning your trading strategy.

Deepcoin also supports cryptocurrency deposits, but has a more limited range of fiat options compared to BYDFi.

Fee Comparison:

| Fee Type | BYDFi | Deepcoin |

|---|---|---|

| Deposit Fees | None | Varies |

| Withdrawal Fees | Fixed fees | From $10 |

Deepcoin’s withdrawal fees start from $10, which may be lower than BYDFi’s in some cases where BYDFi’s fees can reach up to $60 depending on the cryptocurrency.

Processing times for both exchanges are comparable, though they vary based on network congestion and the specific cryptocurrency being transferred.

Both platforms implement security measures for your deposits and withdrawals, including two-factor authentication and withdrawal address whitelisting to protect your funds.

BYDFi Vs Deepcoin: Trading & Platform Experience Comparison

When comparing BYDFi and Deepcoin’s trading platforms, BYDFi stands out with a higher overall score of 9.0. This suggests a more comprehensive and user-friendly experience for traders of all levels.

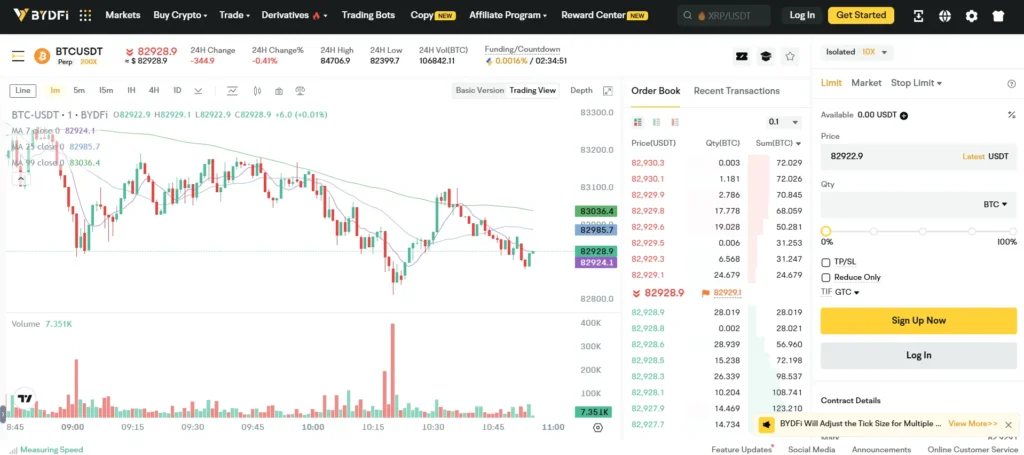

BYDFi offers a web-based trading platform with intuitive navigation and detailed market information. This helps you make better investment decisions without feeling overwhelmed by complex interfaces.

One of BYDFi’s advantages is its special features that Deepcoin doesn’t match:

- Copy trading (follow successful traders)

- Crypto perpetuals trading

- Demo trading accounts for practice

The user experience on BYDFi is designed to be smoother and more accessible, especially for newer traders. You’ll find the interface easier to navigate compared to Deepcoin.

Both platforms offer cryptocurrency trading, but BYDFi provides more comprehensive market information and trading tools. This gives you an edge when making trading decisions.

For beginners, BYDFi’s platform is particularly helpful. The intuitive design reduces the learning curve you might experience with other exchanges.

If you value security alongside user experience, BYDFi has implemented robust measures to protect your assets. This creates a more confident trading environment compared to many competitors.

The mobile experience on BYDFi also deserves mention, giving you trading flexibility whether you’re at home or on the go.

BYDFi Vs Deepcoin: Liquidation Mechanism

Liquidation is a critical process in cryptocurrency trading that affects your funds when positions reach certain risk levels. Both BYDFi and Deepcoin have distinct approaches to handling liquidations.

BYDFi offers up to 200x leverage with flexible margin options. You can choose between cross margin and isolated margin to manage your liquidation risks effectively. This flexibility helps you optimize capital efficiency while trading volatile assets.

When liquidation occurs on BYDFi, the process is quick and seamless. Your funds are automatically transferred to your account, minimizing delays and complications.

Deepcoin, while scoring lower than BYDFi’s overall score of 9.0, also provides liquidation mechanisms for traders. However, specific details about Deepcoin’s liquidation process are more limited in comparison.

Key Differences:

| Feature | BYDFi | Deepcoin |

|---|---|---|

| Leverage | Up to 200x | Varies by asset |

| Margin Options | Cross and Isolated | Limited flexibility |

| Liquidation Speed | Quick and automatic | Standard process |

| Risk Management Tools | More comprehensive | Basic options |

Understanding these liquidation mechanisms helps you make informed decisions about which platform better suits your trading style and risk tolerance.

BYDFi’s approach to liquidation appears more trader-friendly with its focus on reducing liquidation risks through flexible margin options and efficient capital management.

BYDFi Vs Deepcoin: Insurance

When comparing cryptocurrency exchanges, insurance protection is a critical factor to consider for your investments. Both BYDFi and Deepcoin offer some form of insurance, but they differ in their approaches.

BYDFi maintains an insurance fund to protect user assets in case of unexpected market movements or system failures. This fund helps cover potential losses from liquidations and other trading risks.

Deepcoin, with its larger user base of approximately 1 million active users, also operates an insurance fund. Their fund is designed to protect traders engaging in futures and other derivative products.

Neither exchange offers FDIC-like insurance that you might find with traditional financial institutions. This is common in the cryptocurrency space.

Insurance Coverage Comparison:

| Feature | BYDFi | Deepcoin |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Type | Trading losses, liquidations | Primarily derivatives trading |

| External Insurance | No | No |

| Self-custody Options | Available | Available |

The exact amount allocated to these insurance funds isn’t publicly disclosed by either exchange, which is something to keep in mind.

For maximum security, you should consider keeping only trading amounts on these platforms and storing larger holdings in personal wallets when not actively trading.

Both exchanges also implement standard security measures like cold storage for the majority of funds and two-factor authentication to complement their insurance protections.

BYDFi Vs Deepcoin: Customer Support

When choosing between cryptocurrency exchanges, customer support can make or break your experience. Both BYDFi and Deepcoin offer support options, but there are important differences to consider.

BYDFi provides excellent customer support through email and live chat channels. Users report positive experiences with their responsiveness and helpfulness when resolving issues.

One limitation of BYDFi is the lack of phone-based customer support. However, many users find that the quality of their email and chat support compensates for this gap.

Deepcoin also offers customer support options, though specific details about their support channels are more limited in available information. They serve a larger user base of approximately 1 million active users compared to BYDFi’s 500,000.

Response times can vary for both platforms during high-volume periods. It’s worth noting that larger exchanges like Deepcoin sometimes face challenges in maintaining consistent support quality due to their bigger user base.

For English-speaking users, BYDFi might provide more accessible support based on user reviews. If you’re new to crypto trading, responsive customer service should be a priority in your decision.

Remember to test each platform’s support responsiveness before committing significant funds. You can send a simple inquiry to gauge their reply time and helpfulness.

BYDFi Vs Deepcoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both BYDFi and Deepcoin offer security features to protect your investments, but there are some key differences.

BYDFi implements two-factor authentication (2FA), giving your account an extra layer of protection. They also use cold storage for most assets, keeping your crypto offline and away from potential hackers.

Deepcoin also offers 2FA, but based on available information, BYDFi has a higher overall security score of 9.0 compared to Deepcoin’s lower rating.

BYDFi Security Highlights:

- Two-factor authentication (2FA)

- Cold storage for asset protection

- Know Your Customer (KYC) verification

- Higher overall security score (9.0)

Deepcoin Security Highlights:

- Two-factor authentication

- Standard encryption protocols

- Lower overall security rating than BYDFi

You should also check each platform’s history with security breaches. Neither exchange has had major security incidents reported, which is a positive sign.

Remember to enable all available security features no matter which platform you choose. This includes using a strong, unique password and activating 2FA on your account.

The security edge appears to go to BYDFi based on their higher overall score and more comprehensive security approach with cold storage implementation.

Is BYDFi A Safe & Legal To Use?

BYDFi takes security seriously, implementing measures to protect your funds and personal information. The platform uses security features to guard against unauthorized access and potential cyber threats.

When it comes to legitimacy, BYDFi has taken important regulatory steps. It’s registered with FinCEN in the United States and FINTRAC in Canada, which gives it legal standing in these highly regulated markets.

User experiences generally suggest reliability. During testing processes, users report no significant issues with basic functions like:

- Deposits and withdrawals

- Purchasing cryptocurrency

- Trading on the platform

BYDFi currently serves about 500,000 active users, which is smaller than Deepcoin’s user base of approximately 1 million. While not the largest exchange, this substantial user community indicates a level of trust in the platform.

For US traders specifically, BYDFi’s FinCEN registration provides a layer of regulatory compliance that many crypto exchanges lack. This registration means the platform meets certain financial oversight requirements.

The platform appears to function smoothly for most users. No major security incidents have been widely reported, which is a positive sign for an exchange operating in the volatile crypto space.

Remember that all cryptocurrency platforms carry inherent risks. While BYDFi has taken steps toward security and legitimacy, you should always use caution and follow security best practices when trading crypto.

Is Deepcoin A Safe & Legal To Use?

Deepcoin operates in a gray area when it comes to safety and legality, especially for US traders. According to search results, Deepcoin does allow US investors to use its platform, but this comes with significant risks.

US investors on Deepcoin have no fund protection. This means your money could be at risk if something goes wrong.

The platform has gathered around 1 million active users, which is larger than some competitors like BYDFi. A substantial user base often indicates some level of trust in the platform.

Safety features on Deepcoin include:

- Standard encryption protocols

- Two-factor authentication options

- Cold wallet storage for most funds

Legal considerations vary by location. While Deepcoin allows US users to register, you should be aware that using the platform might put you in a legally uncertain position.

The California Department of Financial Protection and Innovation (DFPI) maintains a Crypto Scam Tracker that allows you to check if exchanges have received complaints. It’s worth checking this resource before using any exchange.

When considering Deepcoin, you should weigh the lack of regulatory protections against the features it offers. Many US traders prefer to use exchanges that are fully compliant with US regulations to ensure their funds are protected.

Remember to always do your own research and consider consulting with a financial advisor before using any crypto exchange, especially ones with questionable legal status in your jurisdiction.

Frequently Asked Questions

Traders often have specific questions when comparing crypto exchanges. These FAQs address the most common queries about BYDFi and Deepcoin’s offerings, security measures, and user experiences.

What features differentiate BYDFi and Deepcoin in terms of crypto derivatives trading?

BYDFi offers a more simplified derivatives trading interface with copy trading features that allow beginners to mirror experienced traders’ positions. The platform supports both standard futures contracts and perpetual swaps.

Deepcoin provides more advanced trading tools including a robust API for algorithmic trading and detailed technical analysis indicators. It also offers higher leverage options, with up to 125x leverage compared to BYDFi’s 100x maximum.

Both platforms support cross and isolated margin modes, but Deepcoin has a more comprehensive risk management system with adjustable take-profit and stop-loss settings.

How do BYDFi and Deepcoin compare in terms of liquidity and trading volume for cryptocurrency futures?

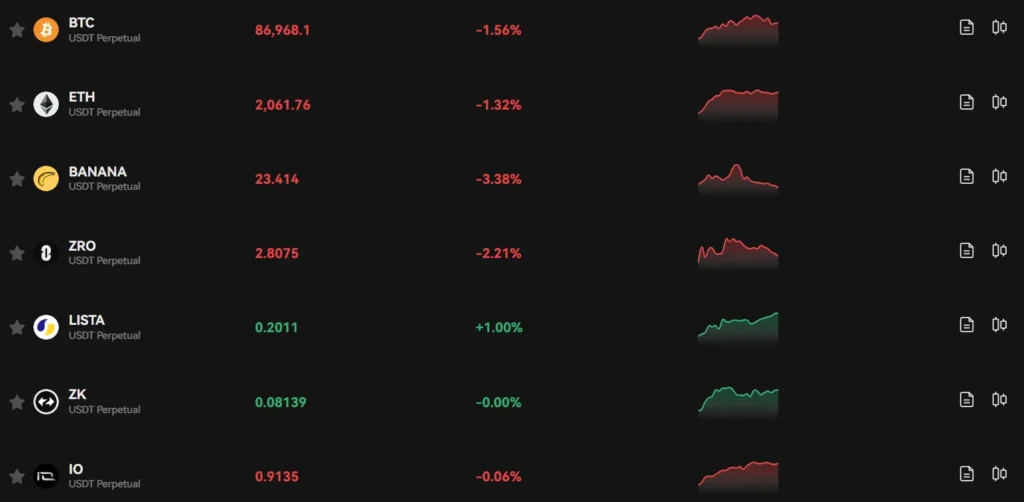

Deepcoin generally maintains higher liquidity across major trading pairs, especially for BTC and ETH perpetual contracts. Its 24-hour trading volumes consistently surpass those of BYDFi for most derivatives products.

BYDFi has improved its liquidity pools significantly since rebranding from BitYard, but still lags behind Deepcoin in terms of market depth. This means larger trades on BYDFi may experience more slippage.

For altcoin futures, the liquidity gap narrows, with both platforms offering comparable market depth for mid-cap cryptocurrency derivatives.

Are BYDFi and Deepcoin both compliant with regulatory requirements in the US for crypto exchanges?

Neither BYDFi nor Deepcoin currently holds licenses to operate fully in the United States. Both exchanges restrict access to US traders due to regulatory considerations.

BYDFi is based in Singapore and complies with regulations in multiple Asian and European jurisdictions. Deepcoin is also headquartered in Singapore and follows similar compliance protocols.

Traders from the US should be aware that accessing either platform may require VPN usage, which could violate the platforms’ terms of service and potentially lead to account restrictions.

Which platform between BYDFi and Deepcoin offers a wider range of crypto derivatives products?

Deepcoin offers a more extensive selection of derivatives products with over 150 cryptocurrency pairs available for futures trading. Their offering includes quarterly futures, perpetual swaps, and options contracts.

BYDFi provides approximately 100 trading pairs for derivatives, focusing primarily on perpetual contracts. The platform lacks options trading, which gives Deepcoin an advantage for traders seeking diverse derivative instruments.

Both platforms regularly add new pairs based on market demand, but Deepcoin typically introduces emerging cryptocurrencies to its derivatives lineup more quickly than BYDFi.

What are the security measures implemented by BYDFi and Deepcoin to protect traders’ assets?

BYDFi employs multi-signature cold wallets to store the majority of user funds offline. They also use two-factor authentication, anti-phishing codes, and maintain a dedicated security team for monitoring suspicious activities.

Deepcoin implements a comprehensive security framework including SSL encryption, regular security audits, and a Secure Asset Fund for Users (SAFU) to compensate traders in case of security breaches.

Both platforms offer insurance funds to protect against auto-deleveraging and liquidation cascades, but Deepcoin’s fund is reportedly larger as a percentage of trading volume.

How do user reviews rate BYDFi and Deepcoin in terms of customer support and user experience?

BYDFi receives positive reviews for its intuitive interface and responsive live chat support. Users particularly appreciate the platform’s straightforward layout and 24/7 customer service in multiple languages.

Deepcoin gets mixed reviews regarding customer support, with some users reporting slower response times for complex issues. However, it scores highly for its professional trading interface and mobile app functionality.

Both exchanges have active community forums and educational resources, but BYDFi is often rated higher for beginner-friendly documentation and tutorials that help new traders navigate derivatives markets.

Deepcoin Vs BYDFi Conclusion: Why Not Use Both?

Deepcoin and BYDFi each offer unique advantages for crypto traders. Deepcoin has a larger user base of approximately 1 million active users, while BYDFi serves around 500,000 users.

BYDFi stands out with its user-friendly platform that’s especially good for beginners. Their feature-rich dashboards and copy trading options make it easier for new traders to get started.

Deepcoin, meanwhile, competes well on fees and features, though specific details weren’t provided in the search results.

Why choose just one? You can actually benefit from using both platforms:

- Use BYDFi for its copy trading and beginner-friendly interface

- Try Deepcoin for its larger community and potentially different trading pairs

- Compare fees between both to maximize your trading efficiency

Both exchanges operate in over 150 countries and work to comply with financial regulations, giving you reasonable security options.

Your trading style and needs should guide your choice. If you’re new to crypto trading, BYDFi’s user-friendly approach might be best. If you value a larger community, Deepcoin could be your preference.

Remember that diversifying across platforms can reduce your risk if one exchange faces technical issues or other problems.