Choosing the right crypto exchange can make a big difference in your trading success. BYDFi and BloFin are two popular platforms that traders often compare when looking for a place to trade cryptocurrency futures and derivatives.

Both exchanges offer features for serious crypto traders, but they differ in terms of fees, trading tools, and security measures. BYDFi has been gaining attention for its competitive cost structure, while BloFin is known for its deep liquidity and advanced security protocols that appeal to more experienced traders.

You’ll want to consider factors like user interface, available cryptocurrencies, and customer support when making your choice. By the end of this article, you’ll understand the key differences between these platforms to help you decide which one better fits your trading style and needs in 2025.

BYDFi Vs BloFin: At A Glance Comparison

When choosing between BYDFi and BloFin for your crypto trading needs, understanding their key differences can help you make the right decision. Both platforms offer cryptocurrency exchange services but have distinct features that set them apart.

BYDFi and BloFin both provide futures trading capabilities, allowing you to leverage your positions for potentially higher returns. However, BloFin stands out with over 300 perpetual swap contracts, giving you more trading options.

Trading Features Comparison:

| Feature | BYDFi | BloFin |

|---|---|---|

| Perpetual Contracts | Available | 300+ contracts |

| Copy Trading | Limited | Advanced system |

| User Interface | Standard | Advanced |

| Trading Tools | Basic toolset | Comprehensive |

BloFin offers a copy trading feature that lets you automatically mirror successful traders’ strategies. This can be helpful if you’re new to cryptocurrency trading or want to save time on market analysis.

Both exchanges are centralized platforms, meaning they act as intermediaries for your trades. This provides better liquidity and faster transaction speeds compared to decentralized exchanges.

Fees vary between the platforms, with different structures for spot trading, futures, and withdrawals. You should check their current fee schedules before making your decision.

Security measures are essential when choosing a crypto exchange. Both platforms implement standard security protocols, but you should research their specific security features and history.

BYDFi Vs BloFin: Trading Markets, Products & Leverage Offered

When choosing between BYDFi and BloFin for crypto trading, understanding their available markets and leverage options is crucial for your trading strategy.

BloFin stands out with coverage of over 400 cryptocurrency pairs, giving you extensive options for diversifying your trading portfolio. The platform offers up to 150x leverage, making it attractive if you’re looking to amplify potential returns on your trades.

BYDFi also provides leverage trading features, though the exact multipliers may differ from BloFin. Both platforms support cryptocurrency derivatives trading, allowing you to speculate on price movements without owning the underlying assets.

Key Comparison Points:

| Feature | BYDFi | BloFin |

|---|---|---|

| Crypto Pairs | Multiple options | 400+ pairs |

| Max Leverage | Competitive | Up to 150x |

| Products | Derivatives, spot | Contract trading, derivatives |

| Target Users | Mixed experience levels | Trading-focused users |

Both exchanges offer futures trading capabilities, letting you take both long and short positions based on your market outlook.

Your choice between these platforms might depend on specific cryptocurrencies you want to trade. BloFin’s wider selection gives you more niche options, while BYDFi might offer a more streamlined experience.

Consider your leverage needs carefully. Higher leverage like BloFin’s 150x multiplier increases potential profits but also significantly raises your risk exposure.

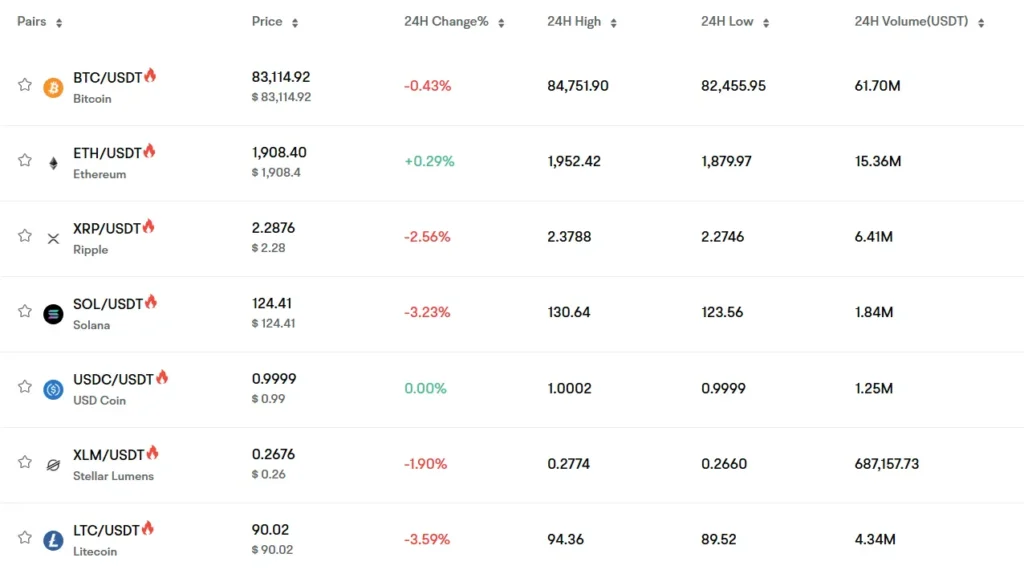

BYDFi Vs BloFin: Supported Cryptocurrencies

When choosing between BYDFi and BloFin, the range of supported cryptocurrencies is an important factor to consider.

BYDFi offers access to over 600 altcoins for spot trading. The platform also supports around 150 futures markets with leverage options up to 200x. This wide selection gives you plenty of options for diversifying your crypto portfolio.

BloFin, while slightly more limited, still provides a robust selection with over 400 cryptocurrencies available for trading. Their lineup includes all the major cryptocurrencies like Bitcoin (BTC) and other popular tokens.

Both exchanges support the most commonly traded cryptocurrencies, but BYDFi has the edge in terms of sheer quantity and variety of available assets.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | BYDFi | BloFin |

|---|---|---|

| Total cryptocurrencies | 600+ | 400+ |

| Futures markets | 150+ | Not specified |

| Maximum leverage | 200x | Not specified |

| Major cryptos (BTC, ETH, etc.) | ✓ | ✓ |

If you’re looking for more obscure altcoins or want access to a wider range of futures markets, BYDFi might be the better option for you. However, BloFin’s 400+ cryptocurrencies should be sufficient for most traders’ needs.

Both platforms regularly add new cryptocurrencies as they gain popularity in the market.

BYDFi Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and BloFin, understanding their fee structures can help you make a better decision for your trading needs.

BYDFi offers competitive trading fees in the cryptocurrency market. They maintain low trading fees and don’t charge deposit fees, making them attractive for frequent traders.

BloFin’s fee structure is tiered based on VIP levels. Their maker fees range from 0.0060% for VIP 1 members and can go down to zero for VIP 5 members. Taker fees start at 0.0500% and can decrease to 0.0350% at higher VIP levels.

For futures trading on BloFin, fees depend more on trading volume. When combined with VIP status, traders can achieve rates as low as 0.02% for maker fees and 0.06% for taker fees.

Trading Fee Comparison:

| Exchange | Maker Fees | Taker Fees | VIP Structure |

|---|---|---|---|

| BYDFi | Low (exact % varies) | Low (exact % varies) | Yes |

| BloFin | 0-0.0060% | 0.0350-0.0500% | 5 VIP levels |

Both exchanges offer competitive fee structures that improve with higher trading volumes. BloFin provides more detailed information about their tiered fee system across VIP levels.

You should check each platform’s current fee schedule before trading, as cryptocurrency exchanges occasionally update their fee structures.

BYDFi Vs BloFin: Order Types

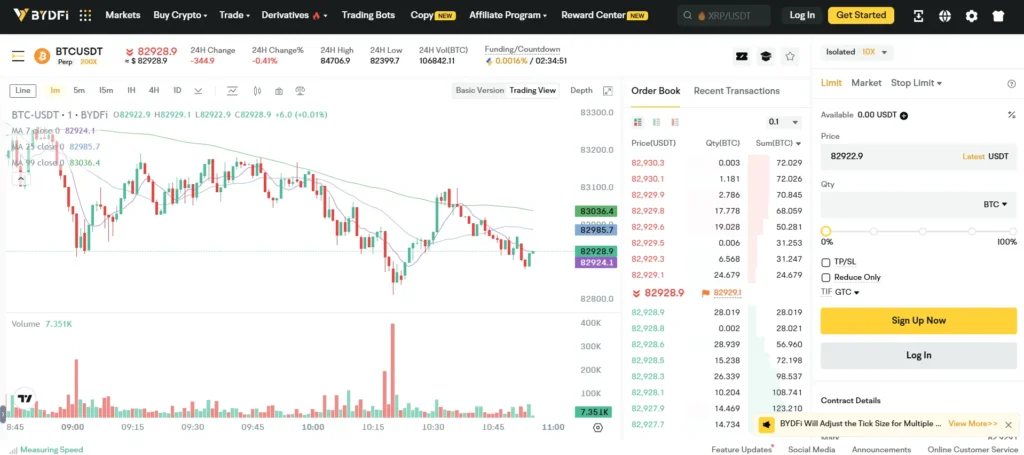

When trading on cryptocurrency platforms, the available order types can significantly impact your trading strategy. Both BYDFi and BloFin offer essential order types to help you execute trades effectively.

BloFin provides several common order types including market orders and limit orders. With market orders, you can immediately execute trades at the current market price. Limit orders allow you to set specific price points for your trades to execute automatically.

BloFin also supports position management features. You can close positions directly on the K-line chart or use reverse orders to switch your position direction quickly.

BYDFi similarly offers market and limit orders, providing the basic functionality most traders need. The platform has been serving US traders for years, as noted by some users who have traded crypto futures on BYDFi without requiring VPN services.

Both platforms provide real-time charts and technical indicators to help you make informed decisions about when to execute your orders. These tools can help you determine optimal entry and exit points for your trades.

The order execution speed and reliability are important factors to consider when comparing these platforms. Your trading style and preferences will ultimately determine which platform’s order system works better for you.

BYDFi Vs BloFin: KYC Requirements & KYC Limits

BYDFi and BloFin differ significantly in their Know Your Customer (KYC) policies, which may affect your trading experience.

BYDFi does not require KYC verification for trading. This means you can trade on the platform with up to 200x leverage on over 500+ cryptocurrencies without submitting personal information. This feature makes BYDFi attractive if you value privacy or live in regions with complex regulations.

BloFin, on the other hand, has a tiered KYC system. While basic functions are available without verification, withdrawal limits exist for non-verified accounts.

If you want to withdraw more than 20,000 USDT from BloFin, you must complete their KYC process. This involves providing a government-issued ID, a selfie, and proof of address.

KYC Requirements Comparison:

| Feature | BYDFi | BloFin |

|---|---|---|

| KYC Required | No | Yes, for higher withdrawal limits |

| Withdrawal Limit Without KYC | No stated limit | Up to 20,000 USDT |

| Verification Process | None | Government ID, selfie, proof of address |

Your choice between these platforms may depend on your privacy preferences and withdrawal needs. If you prefer anonymous trading with no withdrawal restrictions, BYDFi might be more suitable.

Remember that KYC policies can change as regulations evolve, so it’s wise to check the latest requirements directly from both platforms.

BYDFi Vs BloFin: Deposits & Withdrawal Options

Both BYDFi and BloFin offer various methods for depositing and withdrawing funds, though they differ in some key aspects.

BYDFi supports cryptocurrency deposits with no minimum deposit requirements. You can fund your account using popular cryptocurrencies like Bitcoin, Ethereum, and many altcoins.

For withdrawals on BYDFi, processing times typically range from 10 minutes to 24 hours depending on network congestion. The platform charges variable withdrawal fees based on the specific cryptocurrency.

BloFin provides similar cryptocurrency deposit options with support for over 300 cryptocurrencies. Their deposit process is straightforward with no minimum requirements for most tokens.

BloFin’s withdrawal system processes most requests within 24 hours. They implement a tiered fee structure that offers lower rates for users with higher trading volumes.

Both platforms use blockchain confirmations for deposits, meaning your funds become available after a certain number of network confirmations. This can take anywhere from a few minutes to an hour.

Neither exchange currently supports direct fiat deposits through bank transfers or credit cards in the US market, requiring users to deposit cryptocurrency first.

Security features for withdrawals include:

- Two-factor authentication (2FA)

- Email confirmations

- Withdrawal address whitelisting

- Anti-phishing codes

Processing times and fees can vary based on network conditions, so checking each platform’s current fee schedule before making transactions is recommended.

BYDFi Vs BloFin: Trading & Platform Experience Comparison

Both BYDFi and BloFin offer crypto futures trading with distinct platform experiences. Let’s examine how they compare in key areas.

Interface Design

BYDFi features a straightforward interface that beginners can navigate easily. BloFin offers a more sophisticated design with advanced charting tools that experienced traders might prefer.

Trading Tools

BloFin provides more comprehensive analysis tools and indicators for technical traders. BYDFi offers simpler but effective tools that cover essential trading needs.

Mobile Experience

Both platforms have mobile apps, but BYDFi’s app tends to be more responsive on various devices. BloFin’s mobile version includes more features but may feel crowded on smaller screens.

Order Types

| Feature | BYDFi | BloFin |

|---|---|---|

| Limit Orders | Yes | Yes |

| Market Orders | Yes | Yes |

| Stop-Loss | Yes | Yes |

| Take-Profit | Yes | Yes |

| Trailing Stops | Limited | Advanced |

Platform Stability

BloFin generally experiences fewer outages during high market volatility. BYDFi has improved its stability but may still face occasional delays during peak trading times.

Trading Fees

BYDFi typically offers lower trading fees for beginners. BloFin has a more complex fee structure that can be more favorable for high-volume traders.

Learning Resources

BloFin provides more educational content including tutorials and market analysis. BYDFi offers basic guides but lacks the depth of educational materials found on BloFin.

BYDFi Vs BloFin: Liquidation Mechanism

When trading with leverage, understanding the liquidation process is crucial for protecting your investments. Both BYDFi and BloFin have systems in place to manage risk, but they operate differently.

BloFin’s forced liquidation process begins when your position approaches dangerous territory. The system automatically takes control of your position to prevent your account from going negative. This protective measure ensures that you don’t lose more than your initial investment.

BloFin uses a price and time priority matching mechanism for USDT-Margined perpetual contracts. This means orders are matched based on price first, then by when they were placed.

Some users have reported issues with BloFin’s liquidation practices. There have been complaints about sudden changes to margin requirements and liquidation thresholds without proper notice, resulting in unexpected liquidations.

BYDFi, on the other hand, offers more transparent liquidation terms. Their system provides clearer warnings before liquidation occurs, giving you more time to add funds or adjust positions.

The main differences between these platforms’ liquidation mechanisms:

| Feature | BYDFi | BloFin |

|---|---|---|

| Warning system | More advance notices | Less predictable |

| Transparency | Clearer terms | Some reports of sudden changes |

| User control | More time to react | System takes over quickly |

You should regularly monitor your positions on either platform to avoid liquidation. Setting stop-loss orders can help protect your investments from market volatility.

BYDFi Vs BloFin: Insurance

When comparing crypto exchanges, insurance protection is a critical factor for your security. Both BYDFi and BloFin offer insurance options, but they differ in coverage specifics.

BYDFi maintains an insurance fund to protect users against unexpected market events. This fund acts as a safety net in case of system failures or liquidation errors. The exact coverage amount isn’t publicly specified, but it provides basic protection.

BloFin offers a more comprehensive insurance approach. Their platform includes protection against hacks and security breaches through a dedicated reserve fund. This additional layer of security can give traders more confidence when handling larger portfolios.

Neither platform provides FDIC-style insurance that you might expect from traditional financial institutions. This is common in the crypto industry, where regulation is still developing.

Both exchanges implement cold storage solutions for most user assets, which serves as a preventative security measure rather than insurance.

For high-volume traders, BloFin’s insurance model may offer more complete coverage against potential risks. However, you should verify current insurance details directly with each platform as policies can change.

Remember to consider insurance as just one factor in your overall exchange selection process. Security practices, trading fees, and available features should also influence your decision.

BYDFi Vs BloFin: Customer Support

When choosing between crypto exchanges, customer support can make or break your experience. Both BYDFi and BloFin offer support systems, but they differ in key ways.

BYDFi prioritizes customer satisfaction with a comprehensive support system. Their standout feature is live chat support, giving you quick access to help when you need it. This real-time assistance can be crucial when dealing with urgent trading issues.

BloFin also provides customer support options, though specific details about their support channels are less prominent in reviews. They appear to offer standard support options found on most crypto platforms.

Response times can vary between the platforms. BYDFi seems to emphasize efficiency in their support system, suggesting potentially faster response times.

Both exchanges provide knowledge bases and FAQs to help you solve common problems without contacting support directly. These self-service options can save you time for straightforward questions.

Support quality often depends on the complexity of your issue. Simple account questions might be handled quickly, while technical problems could take longer on either platform.

Language support is another consideration. Check if your preferred language is supported before choosing either exchange, as this can significantly impact your support experience.

Customer reviews suggest BYDFi may have a slight edge in customer satisfaction regarding support responsiveness, but experiences can vary widely between users.

BYDFi Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both BYDFi and BloFin have implemented various security measures to protect your assets.

BloFin uses two-factor authorization (2FA) to add an extra layer of protection to your account. This means you’ll need more than just a password to access your funds.

The platform also employs SSL encryption to protect your data during transmission. This helps prevent hackers from intercepting your information when you’re using the exchange.

One notable security feature of BloFin is its cold storage system for assets. This means most of your crypto is kept offline, making it much harder for hackers to access.

BloFin maintains a 1:1 reserve ratio for assets, ensuring your funds are fully backed and available for withdrawal at any time.

BYDFi also implements security measures, though specific details are less prominent in the search results. When comparing the two exchanges, you should consider factors like their history of security incidents and regulatory compliance.

Both platforms offer standard security features you’d expect from modern crypto exchanges. However, BloFin appears to highlight its security measures more prominently in marketing materials.

Before choosing either exchange, you should verify their current security certifications and check recent reviews about their security performance.

Is BYDFi A Safe & Legal To Use?

BYDFi maintains strong security protocols that protect user funds. According to search results, over 95% of assets are stored in secure locations, making it a highly trustworthy exchange.

The platform is considered both safe and legitimate as a crypto exchange. This is crucial information for you as a trader who needs to trust where you place your funds.

BYDFi does have KYC (Know Your Customer) verification requirements, with limitations of 1.5 BTC for non-verified accounts. This shows their commitment to regulatory compliance.

For US-based traders, BYDFi presents an interesting option. Some sources indicate it allows US traders to trade with up to 200x leverage on over 500+ coins without KYC verification. However, you should verify this information as regulations change frequently.

Key Security Features:

- Advanced security protocols

- Majority of assets in secure storage

- KYC verification options

The platform aims to be technically and legally safe, balancing security with accessibility. This focus on both technical security and legal compliance helps protect you and your investments.

Before trading, you should check the latest regulations in your region, as crypto laws evolve rapidly.

Is BloFin A Safe & Legal To Use?

BloFin has established itself as a secure platform for cryptocurrency trading. The platform focuses on providing reliable services for managing crypto investments with strong security measures in place.

For U.S. residents, the legal status requires careful consideration. According to search results, some users report successfully using BloFin from the United States. However, you should verify current regulations as cryptocurrency exchange accessibility can change.

When evaluating BloFin’s safety, consider these factors:

- Security protocols: Check their encryption standards and fund protection measures

- Regulatory compliance: Verify if they follow Anti-Money Laundering (AML) requirements

- User verification: BloFin requires additional documentation for users representing legal entities

You should read reviews from multiple sources to form a balanced opinion about BloFin’s reliability. Look for information about any pending legal issues that might affect the platform’s standing.

Before creating an account, review their terms of service carefully. This will help you understand your rights and the platform’s obligations toward users.

Trading cryptocurrency always carries inherent risks, regardless of the platform you choose. Never invest more than you can afford to lose, and consider starting with small amounts to test the platform’s performance.

Frequently Asked Questions

These questions address key differences between BYDFi and BloFin exchanges, their legitimacy in various regions, and how they compare to other platforms in the crypto trading space.

What are the main differences between BYDFi and BloFin in trading crypto derivatives?

BYDFi offers futures trading with up to 200x leverage across approximately 150 futures contracts. The platform has been operating since 2020 and serves users in over 150 countries.

BloFin provides futures and perpetual contracts with up to 125x leverage. It offers more than 300 perpetual swap contracts and features copy trading functionality as one of its standout features.

The user interfaces differ significantly, with BloFin often praised for its advanced trading tools compared to BYDFi’s more straightforward approach.

Which platforms are considered the best for trading crypto futures in the United States?

Most major international exchanges with strong regulatory compliance are preferred for trading crypto futures in the United States. However, availability is limited due to strict regulations.

Neither BloFin nor BYDFi are widely recommended as primary platforms for U.S. traders due to regulatory concerns and geographic restrictions.

Regulated exchanges with proper licenses and compliance measures are typically better options for U.S.-based traders looking to engage in futures trading.

How does BloFin’s trustworthiness compare to other crypto exchanges?

BloFin is a centralized crypto exchange that has gained recognition for its advanced trading features. However, it’s still relatively new compared to more established players in the market.

The platform implements security measures, but lacks the long track record of older exchanges. Users should exercise caution and conduct thorough research before committing significant funds.

Trust ratings for BloFin vary across review platforms, with mixed feedback about customer support and withdrawal processes.

What are the restrictions for trading on BloFin in various countries?

BloFin imposes restrictions on users from certain jurisdictions due to regulatory requirements. The exact list of restricted countries isn’t fully disclosed in the search results.

Users should verify their country’s status directly with BloFin before creating an account. Restrictions typically apply to countries with strict cryptocurrency regulations or sanctions.

Using VPNs to circumvent geographic restrictions violates most exchange terms of service and can result in account freezes or permanent bans.

Is BYDFi recognized as a legitimate platform for crypto exchanges in the USA?

BYDFi operates in over 150 countries and claims to comply with financial industry regulations. However, its regulatory status specifically in the United States remains unclear.

U.S. traders should exercise caution as many international exchanges face regulatory challenges in the American market. BYDFi isn’t prominently mentioned among recommended exchanges for U.S. users.

Before using BYDFi in the USA, you should verify its current regulatory status and compliance with local laws.

Which crypto exchanges are currently the largest in the global market in terms of trading volume?

Neither BYDFi nor BloFin rank among the top global exchanges by trading volume. The cryptocurrency market is dominated by larger, more established platforms.

Major exchanges with the highest trading volumes typically include Binance, Coinbase, OKX, and others with strong market presence and liquidity.

Trading volume can fluctuate significantly based on market conditions, with larger exchanges generally providing better liquidity for traders executing substantial orders.

BloFin Vs BYDFi Conclusion: Why Not Use Both?

Both BloFin and BYDFi offer valuable features for crypto traders in 2025. Instead of choosing one over the other, you might benefit from using both platforms strategically.

BloFin stands out with its deep liquidity and over 300 perpetual swap contracts. Its advanced trading features and copy trading functionality make it appealing for traders looking for sophisticated options.

BYDFi has its own strengths, though the search results don’t specify them in detail. Comparing costs, features, and integrations between the two platforms can help you leverage their respective advantages.

Using multiple exchanges gives you access to more trading pairs and opportunities. You can take advantage of price differences between platforms and enjoy a wider range of features.

Key benefits of using both:

- Broader access to different cryptocurrencies

- Ability to compare fees and choose the lower-cost option for each trade

- Reduced risk through platform diversification

Remember to consider security measures on both platforms. Managing accounts on multiple exchanges requires good organization but can enhance your trading flexibility.

You might use one platform for certain types of trades and the other for different strategies. This approach allows you to benefit from the best each exchange has to offer.