Choosing the right cryptocurrency exchange can be a challenge with so many options available. If you’re comparing BYDFi and Bitunix, you need to understand their key differences to make an informed decision.

BYDFi has earned a strong overall score of 9.0 according to recent evaluations, making it a top contender among cryptocurrency exchanges in 2025. This score reflects its performance across important factors like security features, available cryptocurrencies, and fee structures.

When selecting between these platforms, you’ll want to consider aspects like trading volume, supported coins, user interface, and customer support quality. Each exchange offers unique benefits that might align differently with your trading goals and experience level.

BYDFi Vs Bitunix: At A Glance Comparison

When choosing between BYDFi and Bitunix, it’s important to understand their key differences. BYDFi stands out with a high trust score of 9.1 according to recent evaluations.

BYDFi offers high leverage trading of up to 200x, making it attractive for traders looking to maximize potential returns. The platform doesn’t require KYC verification for US traders, which can be a significant advantage if you value privacy.

Regulatory compliance is another area where BYDFi excels. The exchange holds licenses in multiple jurisdictions including Australia, Singapore, and the United States.

Key Features Comparison:

| Feature | BYDFi | Bitunix |

|---|---|---|

| Trust Score | 9.1 | Not specified in search results |

| Max Leverage | Up to 200x | Not specified in search results |

| KYC for US Traders | Not required | Not specified in search results |

| Regulatory Status | Licensed in Australia, Singapore, US | Not specified in search results |

| Trading Fees | Competitive | Not specified in search results |

BYDFi appears to be positioned as a derivatives trading platform with strong regulatory backing. This makes it a potentially safer option if you’re concerned about exchange legitimacy.

The available search results don’t provide specific information about Bitunix, suggesting it may be a newer or less-documented exchange. You should conduct additional research before making your decision.

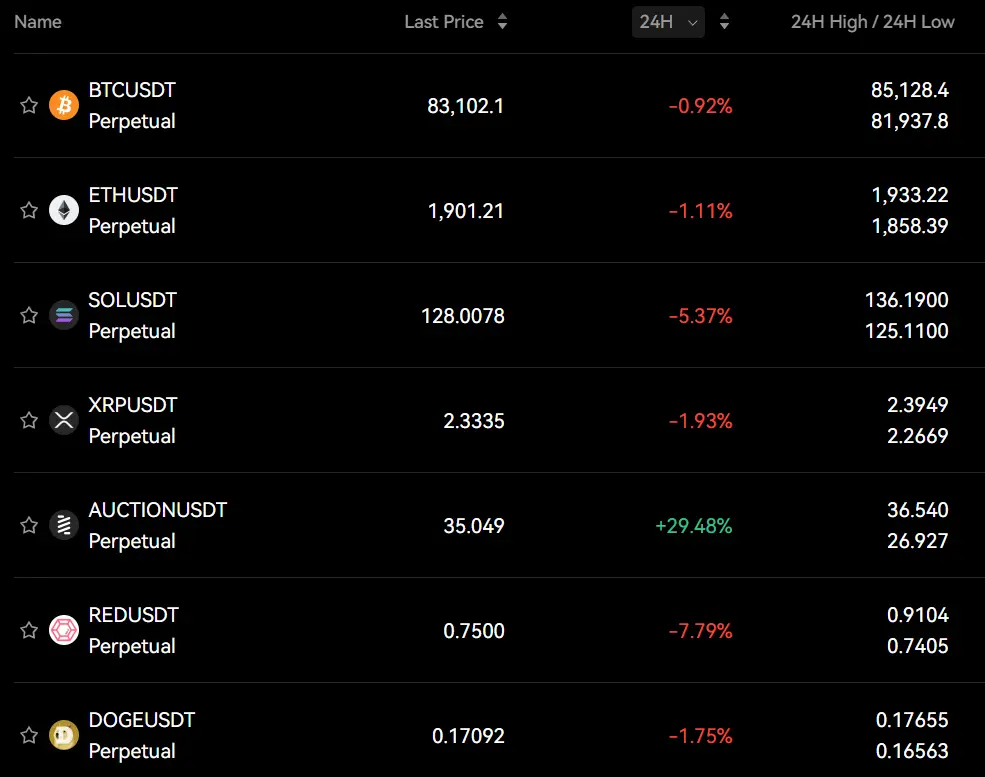

BYDFi Vs Bitunix: Trading Markets, Products & Leverage Offered

BYDFi and Bitunix both offer crypto futures trading, but they differ in what they provide to traders.

BYDFi features a user-friendly platform with a variety of trading markets. You can access spot trading, futures contracts, and leverage options. Their interface is designed to accommodate both beginners and experienced traders.

Bitunix focuses more on advanced trading features with competitive leverage offerings. The platform has gained popularity among traders looking for specialized futures options.

Leverage Options:

| Platform | Maximum Leverage | Available Markets |

|---|---|---|

| BYDFi | Up to 100x | Diverse selection |

| Bitunix | Up to 125x | More specialized |

BYDFi provides important risk management tools like stop-loss orders to help protect your investments. These features are particularly valuable when using higher leverage.

Both platforms offer cryptocurrency derivatives, but BYDFi tends to have more trading pairs available. You’ll find major cryptocurrencies like BTC and ETH on both exchanges.

The fee structures differ slightly between the platforms. BYDFi maintains competitive fees that appeal to regular traders.

When choosing between these platforms, consider your trading experience level. BYDFi might be better if you value ease of use, while Bitunix could be preferable if you need specialized futures options with higher leverage capabilities.

Neither platform is available in all regions, so check their geographic restrictions before creating an account.

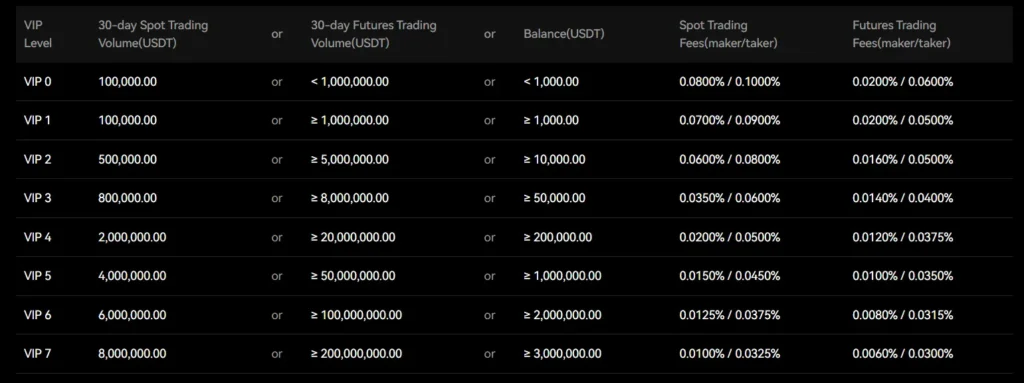

BYDFi Vs Bitunix: Supported Cryptocurrencies

When choosing between BYDFi and Bitunix for your trading needs, the variety of cryptocurrencies available on each platform is an important factor to consider.

BYDFi offers an impressive selection of over 600 altcoins for spot trading and supports approximately 150 cryptocurrency pairs for futures trading. This wide range gives you plenty of options to diversify your portfolio.

Bitunix, while newer to the market, focuses on providing a curated selection of the most popular cryptocurrencies and trading pairs.

BYDFi Cryptocurrency Support:

- 600+ altcoins for spot trading

- 150+ futures trading pairs

- Up to 200X leverage on futures

- Established since 2020

Bitunix Cryptocurrency Support:

- Major cryptocurrencies (Bitcoin, Ethereum, etc.)

- Focus on high-liquidity trading pairs

- Emerging altcoins with growth potential

Both exchanges support the most popular cryptocurrencies like Bitcoin and Ethereum. However, if you’re looking to trade more obscure altcoins, BYDFi likely offers better coverage with its extensive selection.

For futures traders, BYDFi provides more options with its 150+ pairs and leverage up to 200X. This makes it particularly attractive if you’re interested in derivatives trading.

Your choice between these platforms may depend on whether you prioritize having access to a wide range of cryptocurrencies (BYDFi) or prefer trading a more focused selection of established tokens (Bitunix).

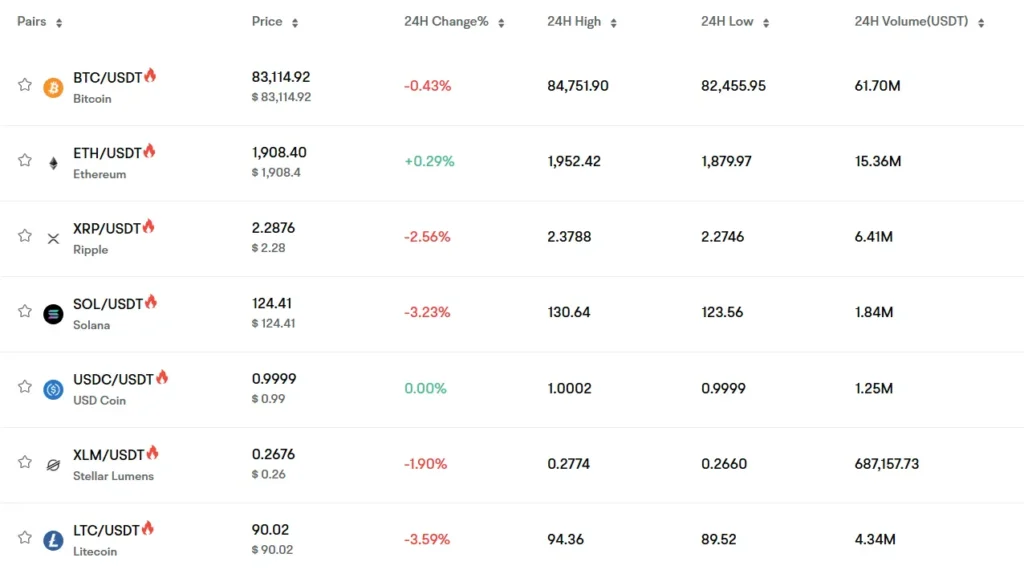

BYDFi Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and Bitunix, understanding their fee structures can help you make a better decision for your trading needs.

BYDFi offers competitive trading fees of up to 0.3%, making it one of the more affordable options in the cryptocurrency exchange market. A standout feature is that BYDFi charges no deposit fees, which is ideal if you frequently move assets onto the platform.

Bitunix, while also competitive, typically has slightly higher trading fees than BYDFi. Their fee structure is tiered based on your trading volume.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Volume Discounts |

|---|---|---|---|

| BYDFi | Up to 0.3% | Up to 0.3% | Yes |

| Bitunix | Higher than BYDFi | Higher than BYDFi | Yes |

For withdrawal fees, BYDFi maintains relatively low rates compared to industry standards. The exact fee varies depending on the cryptocurrency you’re withdrawing.

Bitunix’s withdrawal fees tend to be standard for the industry but are generally higher than what BYDFi charges for most popular cryptocurrencies.

If you’re making frequent trades or regular deposits, BYDFi’s fee structure could result in significant savings over time. Their no-deposit-fee policy is particularly advantageous for traders who regularly move funds onto the exchange.

For occasional traders, the difference in fees might be less impactful on your overall trading experience and profitability.

BYDFi Vs Bitunix: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly affect your trading strategy. Both BYDFi and Bitunix offer several order types to meet different trading needs.

BYDFi Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take profit orders

- OCO (One-Cancels-the-Other)

BYDFi provides these standard order types for both spot trading and perpetual swap trading. Their platform supports traders who need flexible order execution options.

Bitunix Order Types:

- Market orders

- Limit orders

- Stop orders

- Trailing stop orders

- Post-only orders

Bitunix focuses on offering sophisticated trading tools with their order types. The platform is designed to accommodate both beginners and more advanced traders.

The main difference lies in the specialized orders. BYDFi offers OCO orders which allow you to place two orders simultaneously, while Bitunix provides trailing stop orders that adjust automatically as the market price changes.

Both exchanges allow you to set up basic market and limit orders quickly. This makes them suitable for traders who prefer straightforward trading options.

Your trading style should guide your choice between these platforms. If you prefer OCO orders for risk management, BYDFi might be more suitable. If trailing stops are important for your strategy, Bitunix could be the better option.

BYDFi Vs Bitunix: KYC Requirements & KYC Limits

When choosing between BYDFi and Bitunix, understanding their KYC (Know Your Customer) requirements can help you make an informed decision.

BYDFi offers trading without KYC verification, making it a privacy-focused option. This means you can start trading immediately without submitting personal documents.

However, BYDFi may impose certain limitations based on your location. While the exchange prioritizes privacy, it still implements security measures to prevent fraudulent activities.

Bitunix operates with a tiered KYC system that affects your daily withdrawal limits. To access higher withdrawal amounts, you need to complete more extensive verification.

Bitunix KYC Levels:

- Basic KYC: Requires personal information, ID, and a selfie

- Higher levels: Offer increased withdrawal limits with additional verification

Both exchanges employ security measures to protect users. BYDFi uses both KYC and Anti-Money Laundering (AML) protocols to counter fraudulent transactions.

Your choice between these exchanges may depend on how much you value privacy versus withdrawal flexibility. If minimal verification is your priority, BYDFi might be the better option.

For traders needing higher withdrawal limits and willing to complete verification, Bitunix’s tiered system provides a structured approach.

BYDFi Vs Bitunix: Deposits & Withdrawal Options

When choosing between BYDFi and Bitunix, deposit and withdrawal options are important factors to consider.

BYDFi offers an extensive range of deposit methods. You can deposit cryptocurrencies directly or use fiat currencies through credit cards and debit cards.

The platform makes the deposit process straightforward. You simply log in to your account and navigate to the deposit section to begin adding funds.

Bitunix provides fewer deposit and withdrawal options compared to BYDFi. However, users report that the available methods work well and transaction fees are reasonable.

Both exchanges support crypto deposits, but BYDFi gives you more flexibility with fiat options.

Here’s a quick comparison:

| Feature | BYDFi | Bitunix |

|---|---|---|

| Crypto deposits | ✓ | ✓ |

| Fiat deposits | Credit/debit cards | Limited options |

| Withdrawal methods | Multiple options | Fewer choices |

| User experience | Seamless process | Simple interface |

| Fees | Competitive | Reasonable |

BYDFi stands out with its user-friendly deposit and withdrawal process. The platform guides you through each step, making it accessible even if you’re new to crypto trading.

If you prioritize having multiple funding options, BYDFi will likely better meet your needs. Bitunix works well for basic transactions but doesn’t offer the same variety of methods.

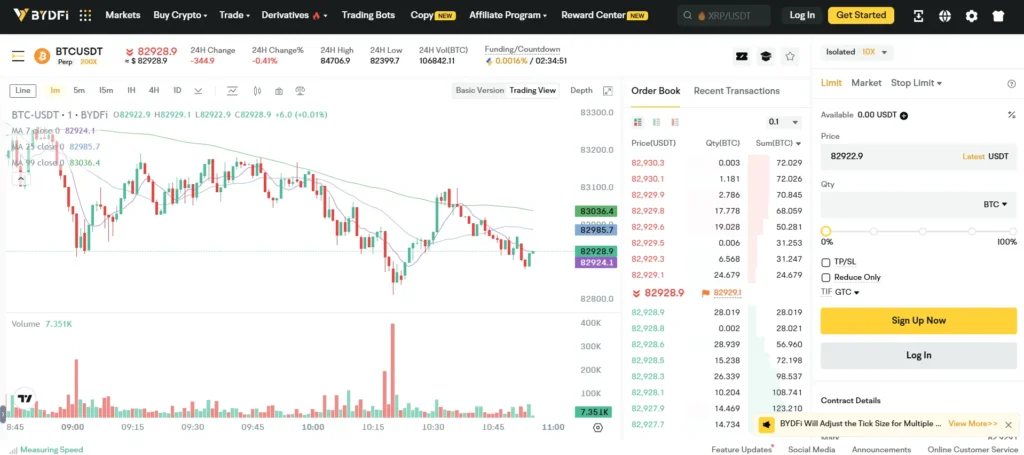

BYDFi Vs Bitunix: Trading & Platform Experience Comparison

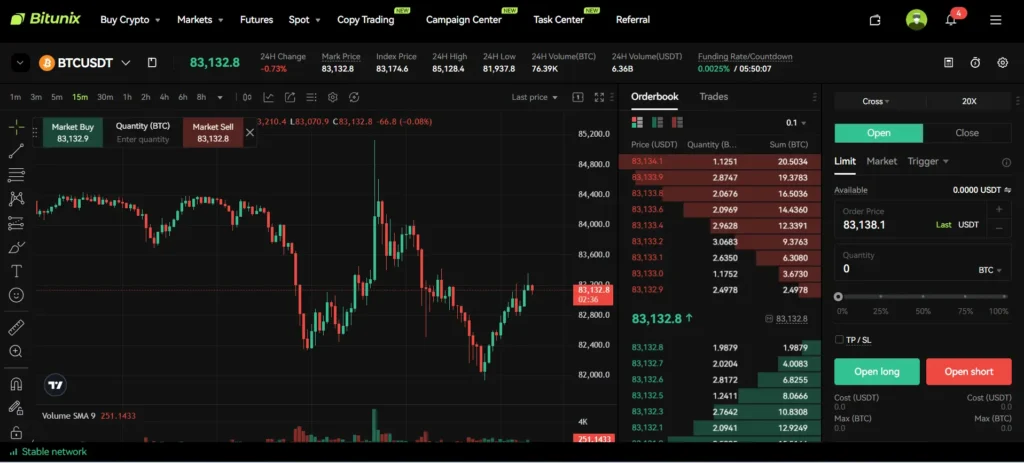

When comparing BYDFi and Bitunix, both platforms offer crypto futures trading with some key differences in their trading experience.

BYDFi provides a more established platform with up to 200x leverage on futures trading. This high leverage option gives you more trading power with less capital.

Bitunix is a newer contender in the futures trading space. While less known than BYDFi, it’s gaining attention among US-based traders looking for alternatives.

User Interface:

- BYDFi: Clean, intuitive dashboard with advanced charting tools

- Bitunix: Modern interface focused on simplicity for newer traders

Trading Features Comparison:

| Feature | BYDFi | Bitunix |

|---|---|---|

| Max Leverage | Up to 200x | Up to 125x |

| KYC Requirements | No KYC for US traders | Basic KYC |

| Mobile App | Yes, fully featured | Yes, limited functions |

| Trading Pairs | 100+ | 50+ |

BYDFi’s platform offers more advanced trading tools and indicators for technical analysis. You’ll find a wider range of order types to execute complex strategies.

Bitunix focuses on a more streamlined experience with fewer but more carefully selected trading pairs. This makes it less overwhelming if you’re newer to futures trading.

Both platforms support spot and futures trading, but BYDFi edges ahead with its higher overall rating (9.1) according to independent reviews.

BYDFi Vs Bitunix: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. Both BYDFi and Bitunix have systems in place to manage risk when positions approach dangerous territory.

BYDFi’s liquidation process occurs when a trader’s position can no longer be maintained due to insufficient margin. The platform automatically closes the position to prevent further losses and protect the exchange.

Bitunix features an Estimated Liquidation Price indicator that shows you exactly at what price your position would be closed due to insufficient margin. This transparency helps you manage risk more effectively.

Key Differences in Liquidation Processes:

| Feature | BYDFi | Bitunix |

|---|---|---|

| Liquidation Warning | Provides notifications | Displays estimated liquidation price |

| Margin Call | Partial liquidation option | Full position liquidation |

| Liquidation Fee | Variable based on asset | Fixed structure |

Both exchanges define liquidation as the forced exchange of cryptocurrency for cash or stablecoins like USDT when margin requirements aren’t met.

You can avoid liquidation on either platform by:

- Monitoring your positions closely

- Adding more funds to increase your margin

- Setting stop-loss orders

- Using lower leverage ratios

BYDFi scores higher in overall exchange ratings (9.1) compared to other platforms, which may reflect user satisfaction with their risk management systems.

BYDFi Vs Bitunix: Insurance

When trading on crypto exchanges, insurance protection is a key factor to consider for your funds’ safety. Both BYDFi and Bitunix offer some form of insurance protection, but they differ in important ways.

BYDFi maintains an insurance fund to protect users from liquidation losses during volatile market conditions. This fund acts as a safety net when traders face negative balances due to market gaps or extreme volatility.

Bitunix also provides an insurance fund, primarily designed to prevent socialized losses during extreme market movements. Their system aims to maintain stability even when markets experience unexpected swings.

The coverage amounts differ between the platforms. BYDFi typically allocates a larger percentage of trading fees to their insurance fund, potentially offering more robust protection.

Neither exchange provides FDIC-like insurance that covers hacks or exchange insolvency. This is common in the crypto industry, so you should always practice proper security measures.

Both platforms publish regular updates about their insurance fund sizes. You can check these reports on their respective websites to assess the current protection levels.

When choosing between these exchanges, consider your trading style and risk tolerance. If you frequently use high leverage, an exchange with a well-funded insurance pool might be more suitable for your needs.

BYDFi Vs Bitunix: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both BYDFi and Bitunix offer support services, but they differ in several ways.

BYDFi provides 24/7 customer support, which is clearly mentioned in multiple search results. This round-the-clock availability means you can get help at any time, regardless of your time zone.

Bitunix also offers customer support that users have described as “good” in feedback. Based on user comments, Bitunix appears to prioritize fast responses to customer inquiries.

BYDFi Support Features:

- 24/7 availability

- Multiple support channels

- Part of their core service offerings

Bitunix Support Features:

- Reportedly fast response times

- Positive user feedback

- Support for trading-related issues

If immediate assistance is important to you, both exchanges seem to deliver. BYDFi explicitly advertises their constant availability as a key feature, while Bitunix has earned positive mentions for their support quality.

For new users especially, having reliable support can help navigate the sometimes complex world of crypto trading. You might want to consider how important quick responses are to your trading style when choosing between these platforms.

BYDFi Vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both BYDFi and Bitunix offer robust security features, but with some key differences.

BYDFi implements multi-layered security protocols including advanced encryption algorithms to create a secure trading environment. A standout feature is their multi-layered cold storage system that keeps most user funds offline and safe from online threats.

BYDFi also stands out for its regulatory compliance. It’s one of the few exchanges that follows financial industry regulations, which adds an extra layer of protection for your assets.

Bitunix, like BYDFi, features strong security measures to protect user funds and data. Their system includes encryption technology and secure storage solutions.

Key Security Features Comparison:

| Feature | BYDFi | Bitunix |

|---|---|---|

| Cold Storage | Multi-layered system | Yes |

| Encryption | Advanced algorithms | Standard encryption |

| Regulatory Compliance | Strong compliance record | Limited information |

| Multi-factor Authentication | Available | Available |

Both exchanges offer multi-factor authentication to secure your account. This adds an essential extra step when logging in or making transactions.

You should consider choosing BYDFi if regulatory compliance is important to you. Its strong user reviews related to security also speak to its reliability in protecting assets.

Bitunix may be suitable if you’re looking for basic security features with a user-friendly interface. However, there’s less public information about their specific security protocols.

Is BYDFi A Safe & Legal To Use?

BYDFi operates with strong regulatory credentials that help ensure your safety when trading. The exchange is registered with FinCEN in the United States and FINTRAC in Canada, giving it legitimate status in highly regulated markets.

Beyond North America, BYDFi also functions under regulatory oversight in Singapore, Australia, and Estonia. This wide regulatory coverage shows their commitment to following rules across different regions.

Security measures include:

- Advanced security protocols

- Strict compliance procedures

- Prioritization of user safety

For traders concerned about legal compliance, BYDFi’s approach goes beyond just meeting minimum requirements. The exchange views compliance as a fundamental part of providing a secure trading environment.

When comparing user experience, BYDFi generally offers a smoother interface than some competitors like Bybit. This makes it particularly suitable for new traders who need clear navigation and straightforward tools.

BYDFi adheres to all relevant regulations in the areas where it operates. This is especially important in strictly regulated locations like New York, where not all crypto exchanges can legally operate.

Your funds and personal information receive protection through BYDFi’s security framework, which follows industry standards for crypto exchanges. This comprehensive approach to regulation and security helps make BYDFi both a safe and legal option for crypto trading.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange with a focus on security. According to search results, the platform has not experienced any hacks so far, which is a positive sign for users concerned about safety.

The exchange emphasizes security measures to protect user data and assets. They also comply with anti-money laundering (AML) regulations, which helps ensure legitimate trading activities on the platform.

Bitunix offers over 300 trading pairs and positions itself as a global crypto derivatives exchange. This variety gives you multiple options for diversifying your crypto investments.

One interesting aspect of Bitunix is that it doesn’t require mandatory KYC (Know Your Customer) verification. This makes the platform more flexible for users who prefer privacy, though this policy may vary depending on your location and trading volume.

For US residents, you should check the current availability as cryptocurrency regulations vary by country and change frequently. The search results mention availability in the US, but you should verify this information directly from Bitunix’s official website.

Users have generally reported positive experiences with Bitunix, describing it as “legit” and “safe” for trading cryptocurrencies. The platform seems to balance security features while maintaining user-friendly trading options.

Frequently Asked Questions

Traders comparing BYDFi and Bitunix often have specific questions about their features and differences. The following answers address the most common inquiries based on current platform capabilities and user experiences.

What are the key differences in user experience between BYDFi and Bitunix?

BYDFi offers a more established interface with a focus on versatility. The platform includes detailed charts and technical analysis tools that active traders appreciate.

Bitunix provides a simpler, more streamlined experience that new users find less overwhelming. Their dashboard prioritizes essential functions with fewer clicks to execute trades.

Both platforms support mobile trading, but Bitunix’s app receives better reviews for responsiveness and stability when trading on the go.

How do Bitunix’s security measures compare to those of BYDFi?

Bitunix implements industry-standard security protocols including two-factor authentication, cold storage for most funds, and regular security audits. They also offer IP whitelisting for account access.

BYDFi provides similar core security features but adds risk management tools like position limits and stop-loss guarantees that protect traders during volatile market conditions.

Neither platform has reported major security breaches, though BYDFi has been operating longer, providing a more established security track record.

What is the range of derivative trading options available on BYDFi versus Bitunix?

BYDFi offers a comprehensive suite of derivative products including perpetual futures contracts with up to 100x leverage on major cryptocurrencies. They also support options trading and coin-margined futures.

Bitunix provides fewer derivative options but focuses on quality execution. Their perpetual contracts offer up to 125x leverage on select pairs with guaranteed liquidity.

Both platforms support USDT-margined futures, but BYDFi additionally offers multi-collateral margin options that let you use different cryptocurrencies as collateral.

How do the fees for trading and withdrawals on BYDFi compare with Bitunix?

BYDFi implements a maker-taker fee structure starting at 0.1% for makers and 0.15% for takers, with discounts available based on trading volume and token holdings.

Bitunix offers slightly lower base fees at 0.08% for makers and 0.12% for takers. Their VIP program provides more significant fee reductions for high-volume traders.

Withdrawal fees vary by cryptocurrency on both platforms, but Bitunix generally maintains lower withdrawal minimums, making it more accessible for smaller traders.

Which platform between BYDFi and Bitunix offers better support for beginners in cryptocurrency trading?

Bitunix clearly prioritizes newcomers with an intuitive interface, comprehensive tutorials, and a demo trading environment. Their customer support typically responds within minutes via live chat.

BYDFi offers learning resources but assumes more prior knowledge. Their platform includes more advanced features that can overwhelm beginners, though their knowledge base is extensive.

Both platforms offer copy trading features, but Bitunix’s version is more accessible to beginners with clearer performance metrics and lower minimum investment requirements.

Can users expect a higher liquidity on BYDFi or on Bitunix for major cryptocurrency pairs?

BYDFi generally maintains higher liquidity for major cryptocurrency pairs like BTC/USDT and ETH/USDT, with tighter spreads and less slippage during normal market conditions.

Bitunix has competitive liquidity for top-10 cryptocurrencies but shows more significant gaps with less popular trading pairs. Their market maker program is actively improving this situation.

During high volatility events, BYDFi demonstrates more stable liquidity, while Bitunix occasionally experiences wider spreads. This difference matters most for large-volume traders.

Bitunix Vs BYDFi Conclusion: Why Not Use Both?

When comparing Bitunix and BYDFi, both exchanges offer unique advantages that could benefit your trading strategy.

BYDFi stands out with its user-friendly platform that many beginners find easier to navigate. Based on search results, BYDFi provides a smoother user experience compared to some competitors, making it ideal if you’re new to crypto trading.

Bitunix, meanwhile, has gained positive user feedback for its simple interface and reasonable transaction fees. Many users report satisfaction with its overall service quality.

Key benefits of using both platforms:

| Feature | Bitunix | BYDFi |

|---|---|---|

| User Experience | Simple interface | Smoother navigation |

| Fee Structure | Reasonable fees | Competitive rates |

| Target Users | General traders | Perfect for new traders |

| Security | Robust measures | Strong protection |

You don’t need to limit yourself to just one exchange. Using both platforms allows you to take advantage of different fee structures, trading pairs, and liquidity pools.

This dual approach can help you minimize risk through diversification while maximizing opportunities across both platforms.

Consider your specific trading needs when deciding how to split your activities between these exchanges. You might use one for certain types of trades and the other for different investment strategies.

Remember that market conditions change frequently, so having accounts on multiple platforms gives you more flexibility to respond to opportunities as they arise.