Choosing the right crypto futures trading platform can greatly impact your trading success. BYDFi and BitMEX are two popular options that offer different features for traders in 2025. Both platforms provide crypto futures trading with leverage, but they differ in their fee structures, security measures, and available trading pairs.

When comparing these exchanges, you’ll want to consider several key factors. BitMEX is known for its advanced trading features and high liquidity, making it attractive for experienced traders. BYDFi, on the other hand, offers leverage options up to 50x, allowing you to potentially amplify your profits.

Understanding the differences between these platforms will help you make a more informed decision based on your specific trading needs. Each platform has unique strengths in areas like user interface, supported cryptocurrencies, and regulatory compliance that might make one more suitable for your trading style than the other.

BYDFi vs BitMEX: At A Glance Comparison

When choosing between BYDFi and BitMEX for your cryptocurrency trading needs, understanding their key differences is essential.

BYDFi scores higher overall with a 9.0 rating compared to BitMEX’s slightly lower score. This difference reflects several factors that might impact your trading experience.

Fee Structure

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| BYDFi | Lower | Competitive |

| BitMEX | Higher | Standard |

Platform Features

- BYDFi offers a more intuitive interface suitable for beginners

- BitMEX provides advanced tools but has a steeper learning curve

- Both platforms support futures trading with leverage options

The liquidity on BitMEX tends to be higher, which can be important if you’re planning to execute large trades. However, BYDFi has been gaining popularity for its user-friendly platform.

Security Considerations

- Both exchanges implement strong security measures

- BitMEX has been operating longer but has faced regulatory challenges

- BYDFi is newer to the market but emphasizes security protocols

You’ll find that BitMEX offers more advanced trading options, which experienced traders might prefer. Meanwhile, BYDFi’s simpler approach makes it more accessible if you’re newer to cryptocurrency trading.

The exchanges differ in available cryptocurrencies, with BYDFi potentially offering a wider selection for diversifying your portfolio.

BYDFi vs BitMEX: Trading Markets, Products & Leverage Offered

BYDFi and BitMEX offer different trading options for cryptocurrency enthusiasts. Both platforms focus on derivatives trading but have some key differences.

BYDFi provides a wider range of trading products including spot trading, futures contracts, and options trading. You can access various cryptocurrency pairs with leverage options that vary by asset.

BitMEX specializes in cryptocurrency derivatives and is known for its advanced trading features. The platform offers perpetual contracts and futures with high liquidity for traders.

Leverage Options:

| Platform | Maximum Leverage | Notable Feature |

|---|---|---|

| BYDFi | Up to 100x | Varied leverage by asset |

| BitMEX | Up to 100x | Known for BTC perpetuals |

When comparing trading markets, BitMEX has historically focused more on Bitcoin-based contracts while BYDFi offers a broader selection of altcoin trading pairs.

Both exchanges provide futures trading, but they differ in user experience. BitMEX targets more experienced traders with its advanced interface, whereas BYDFi aims to be accessible to traders of different skill levels.

You should consider trading volume and liquidity when choosing between these platforms. BitMEX traditionally maintains high liquidity for its main products, which can mean tighter spreads for your trades.

For leverage trading specifically, both platforms allow you to amplify your positions substantially, but remember that higher leverage also means increased risk.

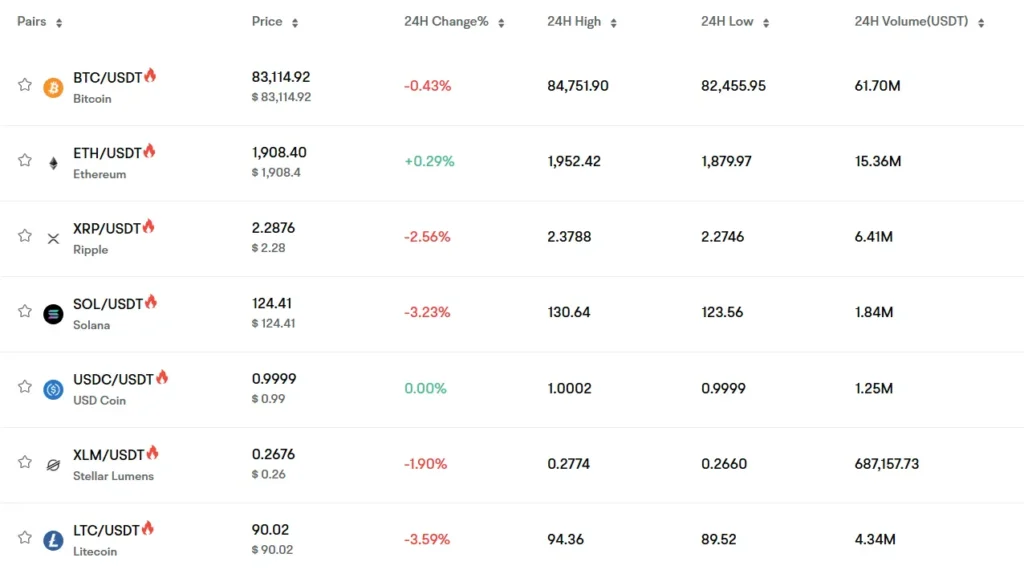

BYDFi vs BitMEX: Supported Cryptocurrencies

When choosing between BYDFi and BitMEX for crypto trading, the variety of supported cryptocurrencies is an important factor to consider.

BitMEX offers a more limited selection of cryptocurrencies. It primarily focuses on Bitcoin (BTC) trading pairs, with some additional major altcoins. BitMEX is known for its Bitcoin futures and perpetual contracts with leverage up to 100x.

BYDFi provides a wider range of cryptocurrencies for trading. Based on current information, BYDFi supports more digital assets than BitMEX, making it potentially more suitable if you’re looking to diversify your trading portfolio.

Here’s a simple comparison of their cryptocurrency offerings:

| Exchange | Primary Focus | Variety of Assets |

|---|---|---|

| BitMEX | Bitcoin-centric | Limited selection |

| BYDFi | Multi-crypto | Broader selection |

If you’re mainly interested in trading Bitcoin with high leverage, BitMEX might meet your needs. Its specialized focus on BTC has made it popular among Bitcoin traders.

For traders wanting access to more cryptocurrencies beyond the major ones, BYDFi offers greater flexibility. This broader selection allows you to explore trading opportunities across different crypto assets.

Before making your decision, check both platforms’ current listings as supported cryptocurrencies can change over time as exchanges update their offerings.

BYDFi vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and BitMEX, understanding their fee structures is essential for your trading strategy.

BitMEX charges a 0.075% trading fee for takers while offering a 0.025% rebate for makers. This maker-taker model rewards users who add liquidity to the exchange.

BYDFi’s trading fees appear to be competitive in the market, though based on the search results, Kraken scores better on features and evaluation metrics than both BYDFi and BitMEX.

For deposit and withdrawal fees, BitMEX bases its charges on dynamic Bitcoin prices. This means the actual cost can fluctuate with market conditions.

Fee Comparison Table:

| Exchange | Taker Fee | Maker Fee | Deposit Fee | Withdrawal Fee |

|---|---|---|---|---|

| BitMEX | 0.075% | -0.025% (rebate) | Based on BTC prices | Based on BTC prices |

| BYDFi | Up to 0.1%* | Varies | Not specified | Not specified |

*Full fee details for BYDFi aren’t fully specified in the search results

Both exchanges offer competitive fee structures compared to other platforms in the cryptocurrency market.

You should consider these fees alongside other factors like available trading pairs, platform security, and user interface when deciding which exchange better suits your trading needs.

BYDFi vs BitMEX: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both BYDFi and BitMEX offer various order options to meet different trading needs.

BitMEX Order Types:

- Market Orders (execute immediately at current market price)

- Limit Orders (set your desired price)

- Stop Limit Orders (triggers a limit order when price hits a certain level)

- Take Profit Orders (automatically sells at profit target)

- Trailing Stop Orders (adjusts stop price as market moves)

BitMEX is known for its advanced order functionality. They also provide maker rebates for traders who place limit orders that add liquidity to the market.

BYDFi Order Types:

- Market Orders

- Limit Orders

- Stop-Loss Orders

- Take Profit Orders

- OCO (One Cancels Other) Orders

BYDFi offers a user-friendly interface that makes placing these orders straightforward, even for newer traders. Their system allows you to set stop-loss orders to protect your positions from significant losses.

Both platforms support leveraged trading, allowing you to open larger positions than your account balance would typically allow. However, BitMEX generally provides more sophisticated order execution options for algorithmic traders.

For day traders, BitMEX offers more complex order routing options and API capabilities. BYDFi focuses on making common order types accessible with a clean interface and straightforward execution.

BYDFi vs BitMEX: KYC Requirements & KYC Limits

When trading on cryptocurrency exchanges, understanding KYC (Know Your Customer) requirements is essential. Both BYDFi and BitMEX have different approaches to identity verification.

BitMEX mandates KYC verification for all traders. You must provide government-approved identification before you can start trading on their platform. This requirement is non-negotiable and applies to users from all eligible countries.

For US citizens, BitMEX has specific restrictions. You may not be able to trade certain products like the XBTUSD perpetual swap due to regulatory constraints.

BYDFi offers more flexibility with its tiered KYC system. You can start trading with basic verification, which requires minimal personal information.

BitMEX KYC Levels:

- Basic verification: Required for all users

- Full verification: Required for all trading activities

BYDFi KYC Levels:

- Level 1: Basic information, limited withdrawal amounts

- Level 2: ID verification, increased limits

- Level 3: Advanced verification, highest withdrawal limits

The verification process on BitMEX typically takes 24-48 hours to complete. BYDFi’s basic verification is often faster, allowing you to begin trading more quickly.

Both platforms implement these measures to comply with global regulations and prevent financial crimes. Your choice between the two may depend on how quickly you need to start trading and your comfort level with sharing personal information.

BYDFi vs BitMEX: Deposits & Withdrawal Options

When using cryptocurrency exchanges, deposit and withdrawal methods matter a lot. Both BYDFi and BitMEX offer different options that might affect your trading experience.

BYDFi keeps things simple with its deposit process. You can fund your account using various cryptocurrencies. Their straightforward approach makes it easier for beginners who might feel overwhelmed by complex deposit procedures.

BitMEX, on the other hand, bases its deposit and withdrawal fees on dynamic Bitcoin prices. This means the fees can change depending on current market conditions. BitMEX charges a 0.075% trading fee while offering a 0.025% rebate for makers.

Deposit Options Comparison:

| Exchange | Cryptocurrency Support | Fee Structure |

|---|---|---|

| BYDFi | Multiple cryptocurrencies | Simpler fee structure |

| BitMEX | Bitcoin-based | Dynamic fees based on BTC price |

BYDFi aims to be more user-friendly than competitors like BitMEX or PrimeXBT. This shows in their deposit and withdrawal system design.

For withdrawals, both platforms have verification processes to ensure security. You should always check the current fee rates before making transactions, as they can change frequently.

If you’re new to crypto trading, BYDFi’s simpler approach might be more appealing. Experienced traders might appreciate BitMEX’s more sophisticated options despite the variable fee structure.

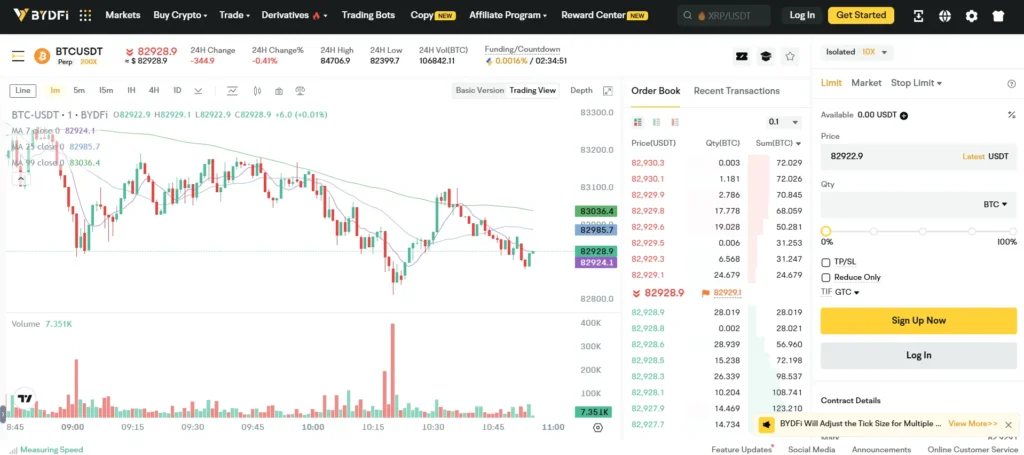

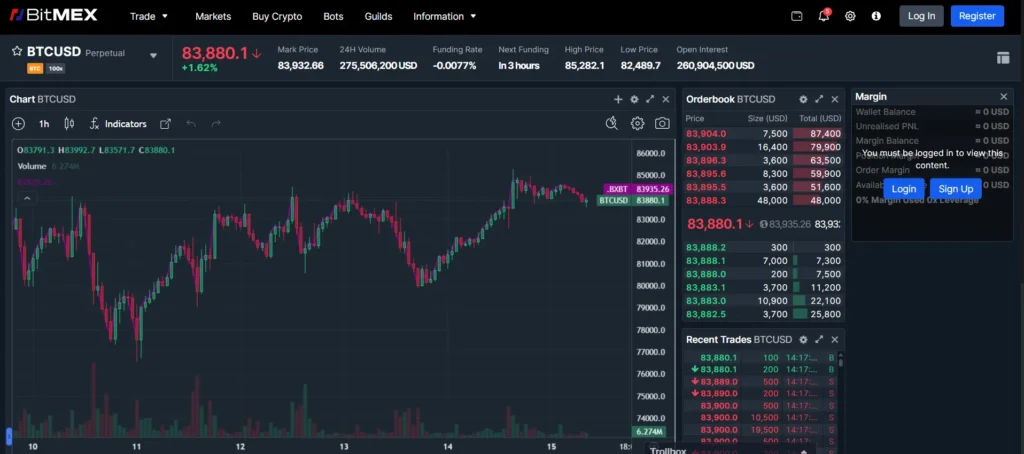

BYDFi vs BitMEX: Trading & Platform Experience Comparison

When comparing BYDFi and BitMEX platforms, you’ll notice significant differences in user experience and trading features.

BYDFi offers a more intuitive interface that appeals to beginners while still providing advanced tools. The platform scores higher overall with a 9.0 rating compared to BitMEX, according to recent comparisons.

BitMEX caters more to experienced traders with its robust trading engine. It’s known for high leverage options and a wide range of cryptocurrency futures trading opportunities.

User Interface Comparison:

- BYDFi: Clean, modern design with straightforward navigation

- BitMEX: More technical interface with comprehensive charting tools

Both exchanges offer mobile trading capabilities, but BYDFi’s app receives better usability ratings from new traders.

For trading tools, BitMEX provides more advanced order types and analytical features. However, BYDFi has made significant improvements to its platform in 2025, closing this gap.

Trading Experience Highlights:

- BYDFi: Lower entry barriers, simplified processes

- BitMEX: Greater depth of trading options, better for experienced users

- BYDFi: Faster learning curve for newcomers

- BitMEX: More sophisticated risk management tools

The trading fees structure also impacts platform experience. BYDFi typically offers more competitive fees for regular traders, while BitMEX may have advantages for high-volume traders.

You’ll find that platform stability remains crucial during high market volatility. Both exchanges have improved their infrastructure, but BitMEX has a longer track record of handling extreme market conditions.

BYDFi vs BitMEX: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is critical. Both BYDFi and BitMEX have established systems to handle positions that reach their liquidation price.

BitMEX’s liquidation mechanism is quite strict. Once your position is liquidated on BitMEX, there is no recovery possible according to their platform policy. BitMEX maintains an insurance fund that serves as a financial buffer to cover losses from liquidations.

This insurance fund works as a safety net for the platform, not individual traders. When your position reaches the liquidation price, BitMEX’s system automatically closes it to prevent further losses.

BYDFi offers a somewhat different approach, though both platforms prioritize market stability and risk management. Both exchanges use auto-deleveraging systems that kick in when positions become too risky.

Your liquidation price depends on several factors:

- Initial margin: The amount you put up

- Leverage used: Higher leverage means closer liquidation price

- Market volatility: Can trigger sudden price movements

To avoid liquidation on either platform:

- Monitor your positions regularly

- Use stop-loss orders

- Consider lower leverage

- Maintain adequate margin

Both exchanges send notifications when your position approaches liquidation levels, giving you an opportunity to add funds or reduce exposure before the automatic closure occurs.

BYDFi vs BitMEX: Insurance

When trading on cryptocurrency exchanges, insurance funds provide crucial protection against unexpected losses. Both BYDFi and BitMEX offer insurance mechanisms, but they differ in important ways.

BitMEX maintains a substantial insurance fund that works as a safety net during liquidations. This fund covers losses that might occur when a trader’s position is liquidated at a price worse than the bankruptcy price.

As of 2025, BitMEX’s insurance fund has grown significantly over the years, showing the exchange’s commitment to trader protection. The fund helps ensure that winning traders always receive their profits in full.

BYDFi also offers an insurance mechanism, though it’s structured differently than BitMEX’s. BYDFi’s system aims to protect users from potential losses during extreme market volatility.

Both exchanges use their insurance funds to manage risk during market fluctuations. However, BitMEX’s fund is generally considered more established due to its longer history in the market.

You should consider the strength of these insurance protections when choosing between these platforms. A robust insurance fund can be particularly important if you engage in high-leverage trading.

Neither exchange guarantees complete protection against all potential losses. Insurance funds have limitations and specific conditions under which they operate.

BYDFi vs BitMEX: Customer Support

When trading cryptocurrencies, reliable customer support can make a significant difference in your experience. Both BYDFi and BitMEX offer support options, but they differ in accessibility and methods.

BYDFi provides multiple support channels for your trading needs. You can reach their team via email at [email protected] or through their live chat feature. This dual approach gives you flexibility when seeking assistance with urgent or complex issues.

BitMEX also offers customer support in various languages, making it accessible to a global audience. This multilingual support helps you navigate trading challenges regardless of your primary language.

Response times can vary between the two platforms. While specific response time data isn’t available in the search results, both exchanges aim to address user concerns promptly.

The quality of support is another important factor to consider. BYDFi mentions having a “responsive customer support team,” suggesting they prioritize timely assistance.

BitMEX, as a more established platform, has had longer to develop its support infrastructure. However, this doesn’t necessarily guarantee better service quality than the newer BYDFi.

For new traders, the availability of educational resources and support documentation may also influence your choice between these exchanges. Both platforms offer resources to help you understand their trading features.

BYDFi vs BitMEX: Security Features

When trading cryptocurrencies, security should be your top priority. Both BYDFi and BitMEX offer solid security measures, but they differ in several key areas.

BYDFi emphasizes user protection through multi-factor authentication and cold storage solutions for your assets. Their security system keeps most funds in offline storage, reducing the risk of online attacks.

BitMEX has built a strong reputation for security over its longer time in the market. They use a comprehensive security framework that includes insurance funds to protect traders against losses during extreme market conditions.

Both platforms implement KYC (Know Your Customer) procedures, though the strictness varies. These checks help prevent fraud and unauthorized account access.

Security Feature Comparison:

| Feature | BYDFi | BitMEX |

|---|---|---|

| Multi-factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | Limited | Extensive |

| API Security | Standard | Advanced |

| Security History | Newer track record | Established history |

BitMEX has faced and overcome security challenges in the past, giving them valuable experience in threat management. This experience has helped them develop robust protection systems.

BYDFi, while newer, has been quick to implement modern security standards. Their user-friendly interface doesn’t compromise on protection measures.

You should always use strong passwords and enable all available security features regardless of which platform you choose.

Is BYDFi A Safe & Legal To Use?

BYDFi operates as a regulated cryptocurrency exchange serving more than 150 countries worldwide. The platform complies with financial industry regulations, which adds a layer of security for its users.

If you’re concerned about legality, it’s important to check if your country appears on BYDFi’s restricted list. Unlike BitMEX, which prohibits users from the United States, Cuba, Crimea and several other regions, BYDFi has fewer geographical restrictions.

Security features on BYDFi include:

- Two-factor authentication (2FA)

- Cold wallet storage for most funds

- Regular security audits

The exchange has maintained a clean reputation with no major security breaches reported. User reviews generally indicate satisfaction with the platform’s reliability and security measures.

For legal compliance, BYDFi implements KYC (Know Your Customer) procedures. You’ll need to verify your identity when trading above certain limits, which helps prevent fraud and money laundering.

Before using BYDFi, check your local laws regarding cryptocurrency trading. Even if the platform allows access from your country, your local regulations may have specific requirements or restrictions.

Trading on BYDFi carries the standard risks associated with cryptocurrency exchanges. While the platform appears secure, always use strong passwords and enable all available security features to protect your investments.

Is BitMEX A Safe & Legal To Use?

BitMEX has worked hard to rebuild its reputation after facing legal challenges in the past. The exchange has improved its compliance and security features to better protect users.

When it comes to safety, BitMEX takes security seriously. They implement wallet security, system protections, and trading safeguards to keep your funds and information safe.

BitMEX is legal to use in many countries, but not all. The platform has had regulatory issues in the past, particularly with US authorities. You should check if BitMEX is permitted in your country before signing up.

The exchange offers:

- Strong security measures

- Improved compliance protocols

- Trading protections

Many users consider BitMEX trustworthy for trading, but follow this simple advice: only keep what you need for active trading on the platform. Don’t use it as a long-term storage solution for your crypto.

BitMEX continues to operate as a legitimate exchange in the cryptocurrency market. Their efforts to enhance security and meet regulatory requirements have helped restore user confidence.

Remember that all crypto exchanges carry some risk. You should always use two-factor authentication, strong passwords, and be cautious about the amount of funds you keep on any exchange.

Frequently Asked Questions

Trading cryptocurrency involves many technical details that can be confusing for beginners and experienced traders alike. Here are answers to common questions about BYDFi and BitMEX platforms.

How do I get started with margin trading on BYDFi?

To begin margin trading on BYDFi, first create and verify your account. This requires providing basic personal information and completing identity verification.

Next, deposit funds into your account using one of the supported cryptocurrencies. BYDFi accepts Bitcoin, Ethereum, and several other popular coins.

Once your account is funded, navigate to the trading section and select the margin trading option. Choose your desired trading pair, set your leverage amount, and place your first order.

BYDFi offers an intuitive interface with built-in tutorials for new users. Practice with a small amount until you feel comfortable with the platform’s features.

What security measures does BitMEX employ to protect user assets?

BitMEX implements multi-signature wallets that require multiple approvals for withdrawals, significantly reducing the risk of unauthorized access. All user funds are stored in cold wallets, keeping them offline and away from potential hackers.

The platform uses two-factor authentication (2FA) to secure user accounts. This adds an extra verification step when logging in or making important account changes.

BitMEX also employs a dedicated security team that continuously monitors the platform for suspicious activities. They conduct regular security audits and penetration testing to identify and address potential vulnerabilities.

Can users from all countries trade on BYDFi?

BYDFi is available in many countries worldwide, but it does have restrictions in certain regions. Users from the United States, Canada, and some sanctioned countries cannot access the platform due to regulatory constraints.

Before signing up, check BYDFi’s terms of service for the most current list of restricted countries. These restrictions may change as cryptocurrency regulations evolve globally.

Some features might be limited in certain countries even where BYDFi is accessible. These limitations typically relate to specific trading pairs or leverage options.

What are the differences in leverage options between BYDFi and BitMEX?

BYDFi offers leverage up to 100x on major cryptocurrency pairs, allowing traders to control larger positions with less capital. Different assets have different maximum leverage limits based on their volatility and liquidity.

BitMEX also provides up to 100x leverage on its Bitcoin perpetual contracts. For other cryptocurrencies, the leverage options typically range from 20x to 50x depending on the asset.

Both platforms implement dynamic leverage limits that may decrease during periods of high market volatility. This helps protect traders from sudden liquidations when markets become unpredictable.

How does the liquidation process differ on BYDFi compared to BitMEX?

BYDFi uses a tiered liquidation system that gradually reduces position size rather than closing the entire position at once. This approach gives traders a chance to add funds and save their positions.

BitMEX employs an auto-deleveraging system that liquidates positions when they reach their maintenance margin level. The platform uses a fair price marking system to prevent liquidations from temporary price spikes.

Both platforms have liquidation fees, but they differ in structure. BYDFi charges a percentage of the position value, while BitMEX uses a flat fee approach for liquidations.

What kind of customer support can traders expect from BYDFi and BitMEX?

BYDFi offers 24/7 customer support through live chat, email, and ticket systems. Response times are typically under 24 hours, with priority given to account security issues.

The platform maintains a comprehensive help center with guides and tutorials for common questions. BYDFi also provides community support through Telegram and Discord channels.

BitMEX customer support operates through a ticket-based system with email support. Their response times can range from a few hours to 1-2 days depending on the complexity of the issue and current support volume.

BitMEX vs BYDFi Conclusion: Why Not Use Both?

BitMEX and BYDFi each have distinct advantages worth considering. BYDFi scores higher overall with a 9.0 rating compared to BitMEX’s lower score, according to the comparison data.

BYDFi offers services in over 150 countries and maintains compliance with financial industry regulations. This makes it a solid choice for users seeking a secure and widely accessible platform.

BitMEX, however, excels with higher leverage options for traders looking to maximize their positions. This feature particularly appeals to experienced traders who understand the risks involved.

Key Differences:

- Overall Rating: BYDFi (9.0) vs BitMEX (lower score)

- Geographic Reach: BYDFi (150+ countries) vs BitMEX (more limited)

- Leverage Options: BitMEX (higher) vs BYDFi (standard)

You don’t need to choose just one platform. Many crypto traders maintain accounts on multiple exchanges to take advantage of different features, fee structures, and trading opportunities.

Using both exchanges allows you to leverage BYDFi’s stronger regulatory compliance while accessing BitMEX’s advanced trading options when needed. This strategy helps you adapt to changing market conditions.

Consider your specific trading needs when deciding how to allocate your resources between these platforms. Your trading volume, preferred cryptocurrencies, and risk tolerance should guide your decision.