Choosing the right cryptocurrency trading platform can make a big difference in your trading experience. Today, we’re comparing two popular options: BYDFi and Bitget. These platforms offer similar services but have key differences that might matter to you.

BYDFi offers up to 125x leverage and serves about 1 million users, while Bitget provides up to 100x leverage and has a larger user base of over 8 million traders. This difference in leverage and community size might affect your trading strategy and experience.

Both platforms specialize in perpetual contract trading, allowing you to trade cryptocurrency with leverage. Your choice between them should depend on your specific needs, such as preferred trading pairs, fee structures, and platform interface. In this comparison, we’ll help you understand which platform might work better for your trading style.

BYDFi Vs Bitget: At A Glance Comparison

When choosing between BYDFi and Bitget for your crypto trading needs, understanding their key differences is essential.

User Base & Market Position:

- Bitget: Approximately 8 million users worldwide

- BYDFi: Around 1 million users globally

Leverage Options:

- Bitget: Offers up to 100x leverage

- BYDFi: Provides up to 125x leverage (higher than Bitget)

Platform Features Comparison:

| Feature | BYDFi | Bitget |

|---|---|---|

| Max Leverage | 125x | 100x |

| User Base | 1M | 8M |

| Trading Focus | Perpetual contracts | Diverse trading options |

| Overall Score* | 9.0 | Not specified |

*Based on BitDegree comparison

Both exchanges specialize in perpetual contract trading but differ in their approach to user experience and available features.

You’ll find that Bitget has a larger user community, which often translates to better liquidity for popular trading pairs.

BYDFi offers slightly higher leverage options, which might appeal to experienced traders looking for potentially higher returns (with corresponding higher risks).

The platform you choose should align with your trading style, risk tolerance, and feature preferences. Consider factors like user interface, supported cryptocurrencies, and fee structures before making your decision.

Security measures and customer support quality are also crucial factors to evaluate when selecting between these two crypto exchanges.

BYDFi Vs Bitget: Trading Markets, Products & Leverage Offered

When comparing the trading offerings of BYDFi and Bitget, several key differences stand out. Both platforms provide cryptocurrency perpetual contract trading, but with varying features.

Bitget serves a larger user base of over 8 million users, while BYDFi has approximately 1 million users. This difference in size may affect liquidity and trading experience.

Leverage Options:

- BYDFi: Up to 125x leverage

- Bitget: Up to 100x leverage

BYDFi offers slightly higher leverage, which can be attractive if you’re looking for greater potential returns. However, higher leverage also means increased risk.

Both platforms provide copy trading services, allowing you to mirror the trades of successful traders. This feature is especially helpful if you’re new to crypto trading or don’t have time to develop your own strategies.

User Base Comparison:

| Platform | User Base | Max Leverage |

|---|---|---|

| BYDFi | 1 million | 125x |

| Bitget | 8 million | 100x |

The larger user base on Bitget might translate to better liquidity and potentially more stable prices during volatile market conditions.

You’ll find similar functionalities between the platforms, though Bitget’s larger ecosystem may offer more diverse trading pairs and products.

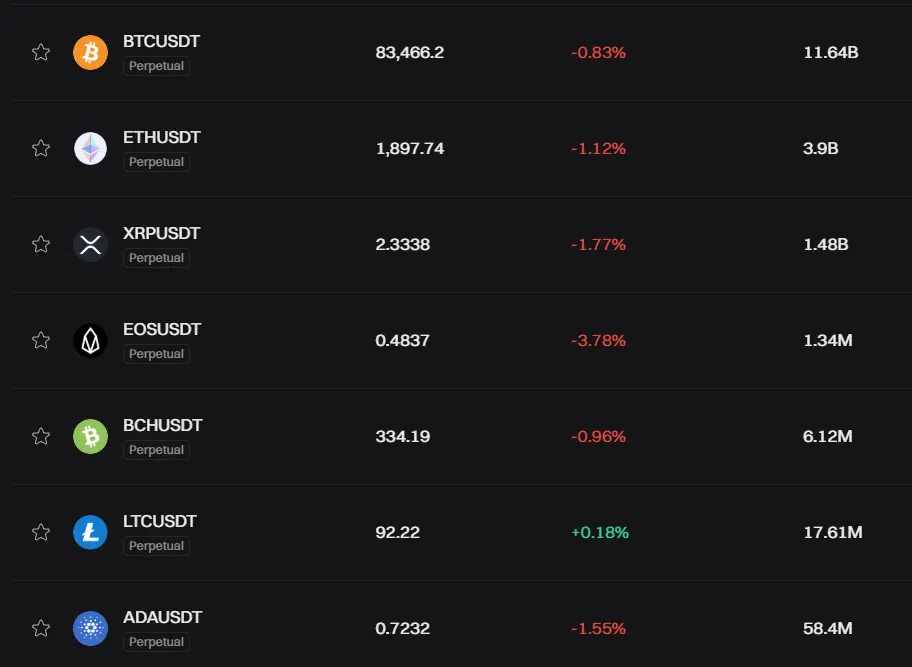

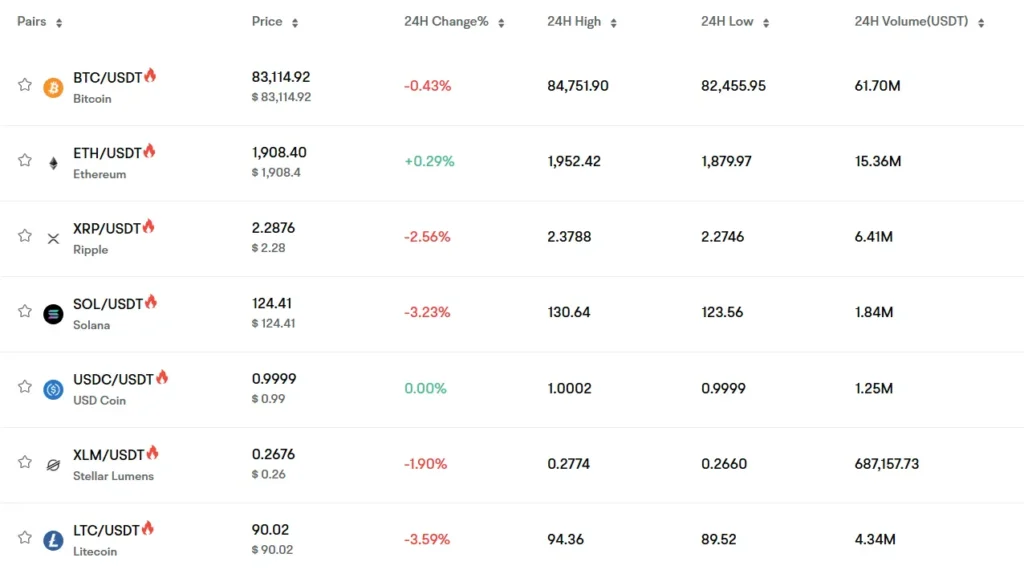

BYDFi Vs Bitget: Supported Cryptocurrencies

Both BYDFi and Bitget offer a variety of cryptocurrencies for trading, but there are some differences in their selections.

Bitget provides access to Bitcoin and numerous other popular cryptocurrencies. The platform serves over 8 million users worldwide, making it a larger exchange compared to BYDFi.

BYDFi supports around 1 million users and offers many major cryptocurrencies as well. While smaller in user base, BYDFi compensates by offering slightly higher leverage options up to 125x for crypto trading, compared to Bitget’s 100x maximum leverage.

When choosing between these platforms, you should consider which specific cryptocurrencies you want to trade. Both exchanges cover major coins like Bitcoin and Ethereum, but their offerings for altcoins and newer tokens may differ.

Each platform has its own listing policies that determine which cryptocurrencies make it onto their exchange. Bitget generally offers a wider selection due to its larger user base and market presence.

If you’re looking to trade specific altcoins, it’s worth checking both platforms’ current listings before making your decision. Remember that available cryptocurrencies can change as exchanges regularly add new tokens and occasionally delist others.

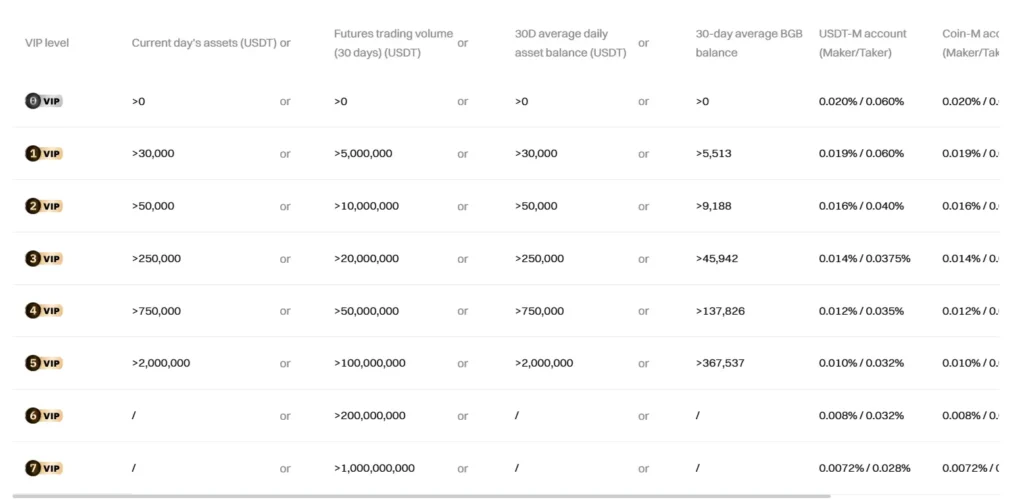

BYDFi Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BYDFi and Bitget, understanding fee structures can help you make an informed decision. Let’s examine how these platforms differ in terms of trading and transaction costs.

For trading fees, there’s a notable difference between the platforms. BYDFi charges 0.1% for both maker and taker trades. Bitget, on the other hand, offers varying rates with 0.02% for maker fees and 0.06% for taker fees in regular trading.

For spot trading specifically, Bitget charges a standard 0.2% fee. You can reduce this to 0.14% if you pay using BFT tokens, Bitget’s native cryptocurrency.

Fee Comparison Table:

| Platform | Maker Fee | Taker Fee | Spot Trading Fee | Fee Discount Option |

|---|---|---|---|---|

| BYDFi | 0.1% | 0.1% | 0.1% | N/A |

| Bitget | 0.02% | 0.06% | 0.2% | 0.14% with BFT |

For perpetual contract trading, BYDFi maintains its fee structure at 0.1% for both maker and taker trades. This consistency can make cost calculations simpler for frequent traders.

Regarding withdrawal fees, both platforms have varying rates depending on the cryptocurrency being withdrawn. These fees are subject to change based on network conditions and cryptocurrency values.

Deposit methods are another important consideration. Both exchanges offer multiple options for funding your account, though the specific methods available may vary by region.

BYDFi Vs Bitget: Order Types

When trading on cryptocurrency platforms, order types can make a big difference in your experience. Let’s compare what BYDFi and Bitget offer in this area.

Bitget provides a comprehensive set of order types for its 8+ million users. You can place market orders for immediate execution at current prices, and limit orders to buy or sell at specific price points.

BYDFi, though serving a smaller user base of around 1 million, matches these basic offerings and includes additional flexibility in some areas.

Bitget Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

- Trailing stop orders

- OCO (One-Cancels-Other)

BYDFi Order Types:

- Market orders

- Limit orders

- Stop orders

- Post-only orders

- Reduce-only orders

Both platforms support conditional orders that trigger based on market conditions. This is particularly useful when you’re trading with leverage, which goes up to 100x on Bitget and 125x on BYDFi.

Bitget stands out with its advanced charting tools that integrate well with its order system. This helps you place more strategic trades based on technical analysis.

BYDFi offers post-only orders that ensure you’re always a market maker rather than taker, potentially saving on fees. This feature is particularly valuable for high-frequency traders.

Your trading style will determine which platform’s order types better suit your needs.

BYDFi Vs Bitget: KYC Requirements & KYC Limits

Both BYDFi and Bitget implement Know Your Customer (KYC) procedures to comply with regulations and enhance platform security. These requirements directly affect your trading experience and access to features.

Bitget requires KYC verification for users to access full platform functionality. The process typically involves submitting personal identification documents. Successful verification allows you to access higher withdrawal limits and all trading features.

BYDFi also implements KYC measures, though specific requirements may vary. Both platforms collect and verify user information to prevent fraud and comply with anti-money laundering regulations.

KYC Levels and Limits Comparison:

| Feature | Bitget | BYDFi |

|---|---|---|

| Basic Access | Limited without KYC | Limited without KYC |

| Withdrawal Limits | Higher with KYC completion | Increased with KYC verification |

| Required Documents | Government ID, proof of address | Similar documentation requirements |

| Security Measures | Secure storage of KYC information | Protected verification process |

For both platforms, completing KYC verification is essential if you plan to trade regularly or work with larger amounts. Unverified accounts face significant limitations on withdrawals and trading capabilities.

The verification process on both platforms is relatively straightforward. You’ll need to submit clear photos of your identification documents and possibly complete a facial recognition step to verify your identity.

Remember that certain countries may be restricted from accessing these platforms entirely, regardless of KYC status.

BYDFi Vs Bitget: Deposits & Withdrawal Options

Both BYDFi and Bitget offer multiple ways to deposit and withdraw funds for your cryptocurrency trading needs.

Bitget provides support for both crypto and fiat deposits. You can fund your account using bank transfers, credit/debit cards, and various payment providers. Bitget serves over 8 million users globally, making it a larger platform with potentially more payment options.

BYDFi also supports crypto deposits and withdrawals. While serving a smaller user base of around 1 million traders, BYDFi still offers essential payment methods for account funding.

Here’s a quick comparison of their deposit and withdrawal features:

| Feature | Bitget | BYDFi |

|---|---|---|

| Crypto deposits | Yes | Yes |

| Fiat deposits | Yes | Limited |

| Bank transfers | Yes | Available |

| Card payments | Yes | Available |

| Withdrawal speed | Fast | Standard |

| User base | 8+ million | 1+ million |

Processing times for withdrawals vary between platforms. Both exchanges implement security measures like two-factor authentication and withdrawal confirmations to protect your funds.

Fee structures differ between the platforms. Bitget may offer more competitive rates for certain withdrawal methods due to its larger user base and trading volume.

Before choosing either platform, check their current deposit and withdrawal options as these features are regularly updated based on regulatory requirements and platform improvements.

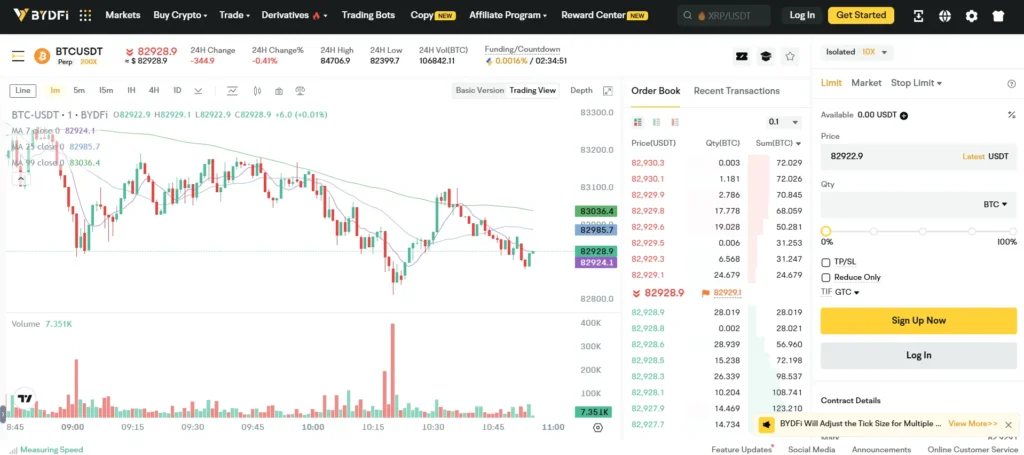

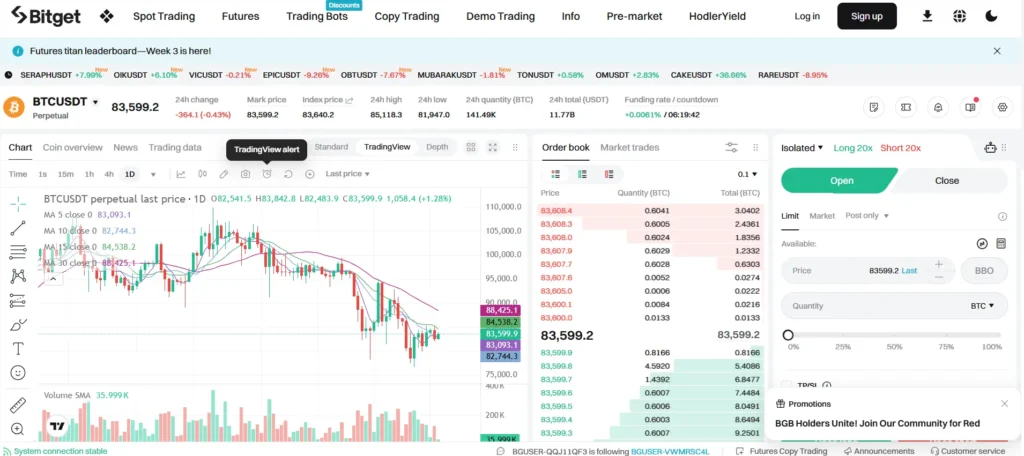

BYDFi Vs Bitget: Trading & Platform Experience Comparison

When comparing BYDFi and Bitget’s trading experiences, both platforms offer distinct advantages for crypto traders.

BYDFi provides up to 125x leverage for perpetual contracts, slightly higher than Bitget’s 100x leverage. This gives you more trading power if you’re comfortable with higher risk.

Bitget serves a larger user base of over 8 million users compared to BYDFi’s 1 million. A larger user base often means better liquidity for your trades.

User Interface Comparison:

- BYDFi: Clean interface focused on “Build Your Dream Finance” concept

- Bitget: Feature-rich dashboard with more trading tools

Both platforms support perpetual contract trading, but they differ in execution speed. Bitget often processes orders slightly faster, which matters if you’re an active day trader.

The trading fees structure varies between the platforms. You’ll need to check current rates as they frequently update their fee schedules to stay competitive.

Mobile experience is important for on-the-go trading. Both offer mobile apps, but Bitget’s app generally receives higher ratings in app stores.

For newcomers, Bitget provides more educational resources to help you understand trading concepts. BYDFi’s interface might be less overwhelming if you’re just starting out.

Trading pairs availability differs slightly between platforms, with Bitget typically offering more options for diverse portfolio building.

BYDFi Vs Bitget: Liquidation Mechanism

Liquidation occurs when your position can’t maintain the required margin level. Both BYDFi and Bitget have specific mechanisms to handle this situation.

BYDFi implements a partial liquidation system. When your margin ratio falls below the maintenance level, the platform will gradually reduce your position size instead of closing it entirely. This approach helps you stay in the market even during volatile conditions.

Bitget uses a similar step-by-step liquidation process but offers an insurance fund as an additional safety net. This fund helps protect traders from losses beyond their collateral during extreme market movements.

Liquidation Thresholds Comparison:

| Platform | Initial Margin | Maintenance Margin | Liquidation Process |

|---|---|---|---|

| BYDFi | 1% (at 100x) | 0.5% | Partial liquidation |

| Bitget | 1% (at 100x) | 0.5% | Insurance-backed |

Both platforms send liquidation warnings before taking action. You’ll receive notifications when your position approaches the danger zone, giving you time to add funds or reduce exposure.

BYDFi offers up to 125x leverage compared to Bitget’s 100x, which means BYDFi positions can be more prone to liquidation during sudden price movements.

To avoid liquidation on either platform, you should:

- Monitor your positions regularly

- Use stop-loss orders

- Maintain adequate margin

- Consider lower leverage for volatile assets

The liquidation prevention tools are more extensive on Bitget, with its risk management dashboard showing real-time position health.

BYDFi Vs Bitget: Insurance

When trading cryptocurrencies, protecting your assets is crucial. Both BYDFi and Bitget offer insurance funds to safeguard users against unexpected losses.

Bitget maintains a robust insurance fund worth over $300 million as of 2025. This substantial reserve helps protect traders from auto-deleveraging during volatile market conditions.

BYDFi’s insurance fund is smaller at approximately $50 million. While this offers protection, it provides less coverage compared to Bitget’s larger fund.

Insurance Coverage Comparison:

| Exchange | Insurance Fund Size | Coverage Details |

|---|---|---|

| Bitget | $300+ million | Covers liquidation losses, system failures |

| BYDFi | ~$50 million | Basic protection against negative balances |

Bitget also implements a “Proof of Reserves” system that allows you to verify your funds are properly backed. This transparency feature gives traders additional confidence.

Both platforms use multi-signature wallets and cold storage for the majority of user funds. This security practice helps protect your assets from potential hacking attempts.

You should note that neither exchange offers FDIC-like insurance that covers all potential losses. The insurance funds primarily protect against system failures and abnormal market conditions.

When choosing between these platforms, consider your trading volume and risk tolerance. Larger traders might prefer Bitget’s more substantial insurance coverage for additional peace of mind.

BYDFi Vs Bitget: Customer Support

When choosing between BYDFi and Bitget, customer support quality can be a deciding factor for your trading experience.

Bitget offers 24/7 customer service through multiple channels. You can access help via live chat, email, and ticket systems. Their team typically responds within minutes for urgent issues.

BYDFi also provides round-the-clock support with similar contact options. However, their smaller user base (1 million compared to Bitget’s 8 million) sometimes means faster response times.

Both platforms offer comprehensive knowledge bases and FAQs to help you solve common problems independently. These resources cover account setup, trading features, and troubleshooting.

Bitget’s larger size gives them an advantage with more support staff and language options. They support over 15 languages, making them accessible to a global audience.

BYDFi currently supports fewer languages but focuses on quality service in their core markets. Their support team is known for detailed, personalized responses.

Response time comparison:

| Platform | Live Chat | Ticket System | |

|---|---|---|---|

| Bitget | 1-5 mins | 1-24 hrs | 1-12 hrs |

| BYDFi | 2-10 mins | 1-48 hrs | 1-24 hrs |

Both platforms maintain active community forums where you can get peer support. These forums can be valuable resources for platform-specific trading strategies and tips.

BYDFi Vs Bitget: Security Features

When choosing a crypto trading platform, security should be your top priority. Both BYDFi and Bitget offer robust security measures to protect your investments.

Bitget implements multi-factor authentication (MFA) to secure your account from unauthorized access. The platform also uses cold storage for the majority of user funds, keeping them offline and safe from potential hacks.

BYDFi matches these security basics with its own MFA system and cold wallet storage. However, BYDFi offers up to 125x leverage compared to Bitget’s 100x, which may appeal to experienced traders.

Key Security Features Comparison:

| Feature | BYDFi | Bitget |

|---|---|---|

| Multi-factor authentication | ✓ | ✓ |

| Cold wallet storage | ✓ | ✓ |

| Insurance fund | Limited | Comprehensive |

| KYC verification | Required | Required |

| Security audits | Regular | Regular |

Bitget has gained popularity with over 8 million users and maintains a strong focus on security protocols. The platform includes comprehensive insurance funds to protect user assets in case of extreme market volatility.

BYDFi serves approximately 1 million users and employs similar security standards. Both platforms require KYC verification to comply with regulations and prevent fraudulent activities.

You should regularly update your passwords and enable all available security features regardless of which platform you choose. Security in crypto isn’t just the platform’s responsibility—your practices matter too.

Is BYDFi A Safe & Legal To Use?

BYDFi prioritizes safety through both technical and legal measures. The platform requires KYC (Know Your Customer) verification, which is a standard security practice among reputable cryptocurrency exchanges.

With approximately 1 million users, BYDFi has established itself as a notable player in the crypto exchange market. The platform offers up to 125x leverage for cryptocurrency trading, which is slightly higher than Bitget’s 100x maximum.

For U.S. users, it’s important to understand the legal landscape. Cryptocurrency exchanges operating in the United States must comply with regulations like the Bank Secrecy Act (BSA) and follow guidelines from the Financial Crimes Enforcement Network (FinCEN).

Key safety features of BYDFi include:

- Mandatory KYC verification

- Compliance with relevant financial regulations

- Technical security measures to protect user funds

When comparing exchanges like BYDFi, Bitget, and Binance, you should consider both security measures and legal compliance in your jurisdiction. Each platform has different approaches to regulatory compliance.

It’s worth noting that crypto regulations vary by country and state. You should verify that BYDFi is properly licensed to operate in your location before creating an account or depositing funds.

Always conduct your own research about any platform where you plan to trade cryptocurrencies to ensure it meets your personal standards for safety and legality.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered safe for crypto trading, as there have been no major security breaches or significant losses of user funds reported. The platform serves over 8 million users worldwide, indicating a substantial level of trust within the crypto community.

From a legal standpoint, Bitget must comply with important regulations in the USA. These include the Bank Secrecy Act (BSA) and requirements set by the Financial Crimes Enforcement Network (FinCEN).

Safety Measures:

- Implementation of fund backing reassurances

- Security protocols to protect user assets

- No history of major attacks

However, you should be aware that some users have expressed concerns about certain aspects of the platform. Like all centralized exchanges, Bitget carries inherent risks that come with entrusting your assets to a third party.

When comparing safety features with competitors like BYDFi and Binance, Bitget maintains competitive security standards while offering features such as up to 100x leverage for trading.

Remember that all crypto trading involves risk. You should only invest what you can afford to lose and consider using additional security measures like two-factor authentication and cold storage for long-term holdings.

Frequently Asked Questions

Users often have key questions when comparing BYDFi and Bitget trading platforms. These platforms differ in several important aspects including leverage options, user base size, security features, and fee structures.

What are the major differences between BYDFi and Bitget trading platforms?

BYDFi and Bitget differ in user base size and leverage options. Bitget serves over 8 million users while BYDFi has approximately 1 million users.

For leverage trading, BYDFi offers slightly higher maximum leverage at 125x compared to Bitget’s 100x. This difference might matter to traders looking for higher risk-reward ratios.

Bitget provides a more seamless user experience with fast processing times, which can be important for frequent traders. BYDFi offers a dedicated FAQ section and help center for quick answers to common queries.

How do the security features of BYDFi compare to those of Bitget?

Both platforms implement industry-standard security measures including two-factor authentication and cold storage solutions for crypto assets.

Bitget generally receives positive feedback regarding its security infrastructure and has invested significantly in security technology to protect user funds.

BYDFi also maintains security protocols, though with a smaller user base, it may have different security scaling considerations than Bitget.

What range of cryptocurrencies can be traded on BYDFi versus Bitget?

Both platforms support major cryptocurrencies like Bitcoin and Ethereum, but Bitget typically offers a wider range of trading pairs.

Bitget frequently adds new tokens and trading pairs to stay competitive in the market. This can be advantageous if you’re looking to trade newer or less common cryptocurrencies.

BYDFi provides a more focused selection of cryptocurrencies but ensures good liquidity for the pairs it does offer.

How do the fee structures of BYDFi and Bitget differ?

Bitget offers low trading fees, making it cost-effective for frequent traders. Their fee structure often includes discounts for high-volume traders.

BYDFi’s fee structure is competitive but may have different tier systems and incentives compared to Bitget. Exact fee percentages vary based on trading volume and account types.

Both platforms may offer fee reductions when using their native tokens for fee payment, though specific details and rates differ between them.

What customer support options are available for users of BYDFi and Bitget?

BYDFi provides a separate FAQ section and a comprehensive help center for users to find quick answers. They also offer direct support channels for more complex issues.

Bitget offers multiple support channels including live chat, email support, and an extensive knowledge base. Response times and quality of support may vary between the two platforms.

Both platforms provide educational resources, though they may differ in depth and presentation style.

Are BYDFi and Bitget both compliant with international regulatory standards?

Both platforms work to maintain compliance with applicable regulations, though their approaches and jurisdictional focuses may differ.

Bitget has expanded its regulatory compliance efforts to serve US customers legally and safely. This includes following KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

BYDFi also implements compliance measures, but you should verify their current regulatory status in your specific region before trading, as this can change over time.

Bitget Vs BYDFi Conclusion: Why Not Use Both?

After comparing Bitget and BYDFi, it’s clear both platforms have unique strengths for crypto traders. Instead of limiting yourself to one option, consider using both exchanges to maximize your trading potential.

Bitget serves over 8 million users and offers up to 100x leverage on perpetual contracts. Its established user base provides reliability and liquidity that many traders value.

BYDFi, while smaller with around 1 million users, offers higher leverage options of up to 125x. This could be advantageous for experienced traders looking for greater position flexibility.

Benefits of using both platforms:

- Risk diversification – Spread your assets across multiple exchanges

- Access to different trading pairs and opportunities

- Compare fees to maximize profitability on different trades

- Backup access if one platform experiences downtime

You can use Bitget for its robust ecosystem and established reputation, while turning to BYDFi when you need higher leverage options or different trading pairs.

Both platforms offer copy trading features, allowing you to follow successful traders’ strategies. This is especially helpful if you’re new to crypto trading.

Remember to consider your specific trading needs, risk tolerance, and experience level when deciding how to distribute your activities between these platforms.