Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bybit and WhiteBIT are two popular platforms that offer various services for crypto traders in 2025. Each has its own strengths and weaknesses that might matter to you.

When comparing Bybit vs WhiteBIT, the key differences include fee structures, available cryptocurrencies, trading types, and earning opportunities. Bybit offers diverse earn programs including flexible and fixed-term savings options, while WhiteBIT provides consistent interest rates starting at 1.01% per month across more than 20 coins.

Both exchanges have their own unique features that might appeal to different types of traders. WhiteBIT offers longer investment terms with higher percentages, which might interest long-term holders. Bybit, on the other hand, focuses on providing a variety of earning methods to help users maximize their crypto holdings.

Bybit vs WhiteBIT: At A Glance Comparison

When choosing between Bybit and WhiteBIT, several key differences can help you make the right decision for your trading needs.

Fees Structure

| Feature | Bybit | WhiteBIT |

|---|---|---|

| Deposit Fee | 0% | 0% |

| Trading Fees | Varies by asset | Varies by asset |

| Withdrawal Fees | Asset-dependent | Asset-dependent |

Both exchanges offer competitive fee structures, but they differ in specific rates for certain cryptocurrencies and transaction types.

Payment Methods

WhiteBIT offers more options for depositing and withdrawing funds, including e-wallets, bank cards, and transfers. This gives you greater flexibility in managing your crypto assets.

Trading Features

Bybit is known for its futures trading platform and advanced tools for experienced traders. WhiteBIT focuses on providing a wider range of cryptocurrencies and payment options.

User Experience

The platforms have different interfaces that cater to various trading styles. Your preference will depend on whether you value simplicity or advanced trading features.

Security Measures

Both exchanges implement standard security protocols, but specific features may vary. It’s important to review their current security measures as these are frequently updated.

Supported Cryptocurrencies

The number and types of cryptocurrencies available differ between the platforms, with each offering unique selections that might influence your choice.

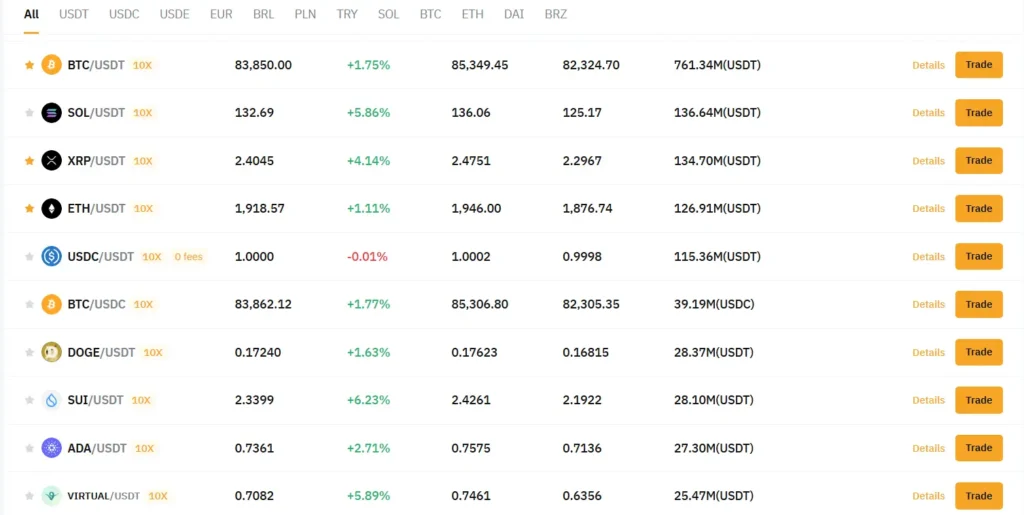

Bybit vs WhiteBIT: Trading Markets, Products & Leverage Offered

Both Bybit and WhiteBIT offer a range of trading options, but they differ in several key areas that might influence your choice.

Trading Markets

| Exchange | Spot Trading | Futures | Options | Margin |

|---|---|---|---|---|

| Bybit | Yes | Yes | Yes | Yes |

| WhiteBIT | Yes | Yes | Limited | Yes |

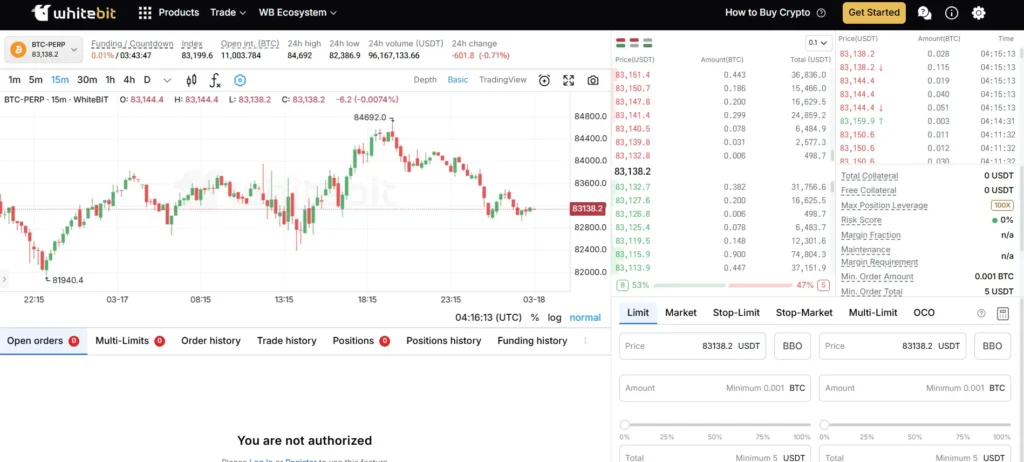

Bybit provides a comprehensive futures trading platform with USDT and coin-margined contracts. You can access perpetual contracts and quarterly futures with up to 100x leverage on major cryptocurrencies.

WhiteBIT focuses more on spot trading but has expanded its futures offerings. The platform supports futures trading with competitive leverage options, though not as extensive as Bybit’s range.

Leverage Options

- Bybit: Offers up to 100x leverage on major pairs

- WhiteBIT: Provides up to 50x leverage on select trading pairs

Bybit stands out with its advanced trading products, including options trading and USDC perpetual contracts. These features make it appealing if you’re an experienced trader looking for sophisticated instruments.

WhiteBIT excels in providing a broad range of spot trading pairs with over 400 cryptocurrencies available. This makes it a solid choice if you value variety in your trading options.

Both platforms offer demo accounts where you can practice trading strategies without risking real funds. This is especially helpful if you’re new to leveraged trading.

Bybit vs WhiteBIT: Supported Cryptocurrencies

When choosing between Bybit and WhiteBIT, the variety of cryptocurrencies each platform supports is a crucial factor to consider. Both exchanges offer a wide range of digital assets, but there are some differences worth noting.

Bybit provides access to over 150 cryptocurrencies. You’ll find all major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) available on their platform. Their selection includes both established cryptocurrencies and newer altcoins.

WhiteBIT, on the other hand, supports more than 400 cryptocurrencies. This gives you a significantly larger selection of trading options, especially if you’re interested in lesser-known altcoins or newer tokens.

Key cryptocurrency categories available on both platforms:

- Large-cap coins (Bitcoin, Ethereum, Cardano)

- DeFi tokens (Uniswap, Aave)

- Stablecoins (USDT, USDC)

- Meme coins (Dogecoin, Shiba Inu)

WhiteBIT has an edge when it comes to supporting regional cryptocurrencies and smaller market cap tokens. If you’re looking to diversify into more niche crypto assets, WhiteBIT might be the better choice.

Both exchanges regularly add new cryptocurrencies to their platforms. You should check their official websites for the most up-to-date listings, as supported assets can change based on market conditions and regulatory requirements.

Trading pairs are also more numerous on WhiteBIT, giving you more flexibility in how you trade between different cryptocurrencies without converting to a stablecoin first.

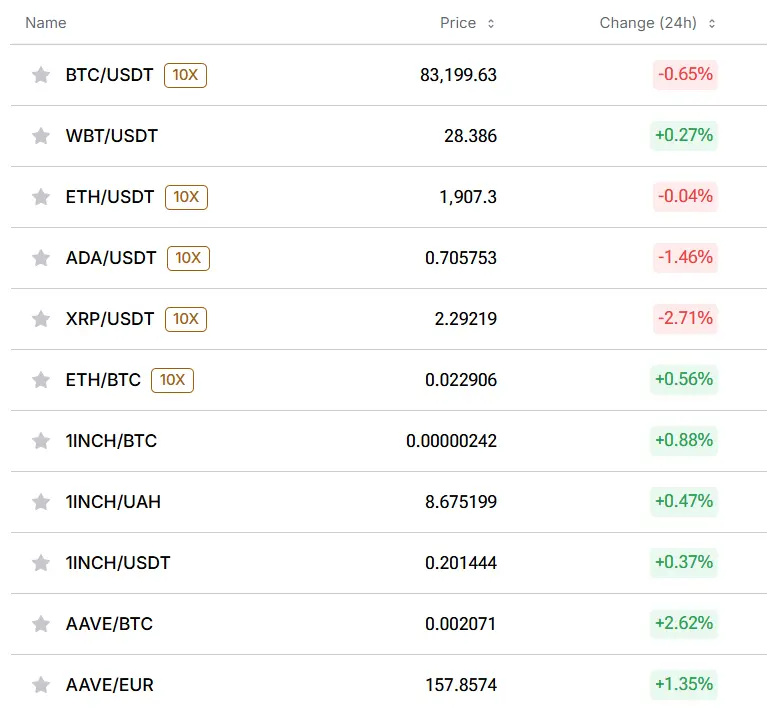

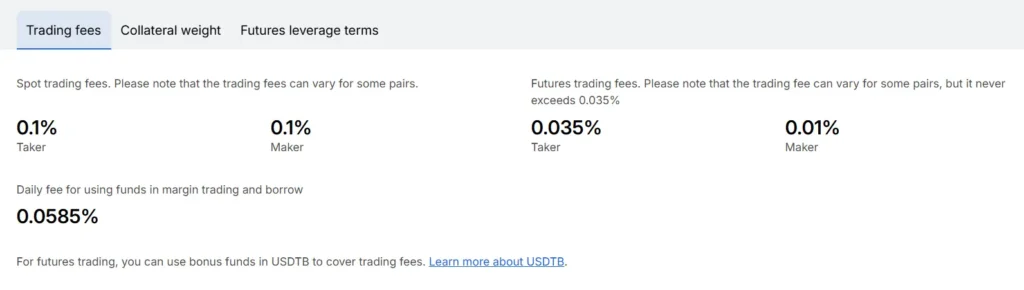

Bybit vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and WhiteBIT, fees play a crucial role in your decision. Let’s look at how these exchanges compare in terms of costs.

WhiteBIT offers a standard trading fee of 0.1%, which is quite competitive in the crypto exchange market. This flat rate makes it easy to calculate your costs when trading.

Bybit’s fee structure is similar, though they offer potential discounts based on trading volume and token holdings. This can be beneficial if you’re a high-volume trader.

For deposits, both platforms shine with 0% deposit fees across most payment methods. You can use e-wallets, bank cards, and transfers without extra costs on either platform.

Fee Comparison Table:

| Fee Type | Bybit | WhiteBIT |

|---|---|---|

| Trading Fee | 0.1% (with possible discounts) | 0.1% |

| Deposit Fee | 0% | 0% |

| Withdrawal Fee | Varies by cryptocurrency | Varies by cryptocurrency |

Withdrawal fees differ based on the cryptocurrency you’re withdrawing. Both exchanges charge network fees that fluctuate with blockchain congestion.

WhiteBIT offers more payment options for deposits and withdrawals, including various e-wallets and banking methods. This gives you more flexibility in managing your funds.

If you’re looking for the lowest fees possible, both exchanges are competitive. Your choice might depend more on which coins you trade and what payment methods you prefer.

Bybit vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, understanding available order types can help you execute your strategy effectively. Both Bybit and WhiteBIT offer various order options, though they differ in some respects.

Bybit provides a comprehensive range of order types, categorized into basic and advanced options. Basic orders include Market, Limit, and Conditional orders, allowing you to buy or sell at current market prices or set specific price points.

WhiteBIT’s order selection is also robust but structured differently. The platform supports Market and Limit orders as standard offerings, providing essential trading functionality for most users.

Bybit’s Advanced Order Types:

- Stop Loss and Take Profit orders

- Trailing Stop orders

- Post-Only orders

- Reduce-Only orders

- Time in Force options (GTC, IOC, FOK)

WhiteBIT’s Additional Features:

- Stop Limit orders

- OCO (One Cancels Other) orders

- Iceberg orders for large trades

Bybit excels with its trading interface that makes complex order types more accessible to intermediate traders. Its conditional orders let you set triggers based on last traded price or mark price.

WhiteBIT offers solid functionality but may have fewer advanced order variations compared to Bybit. However, its interface is often praised for being straightforward and user-friendly.

Your trading style and needs should guide your choice between these platforms. More sophisticated strategies might benefit from Bybit’s expanded order options, while newer traders might appreciate WhiteBIT’s simpler approach.

Bybit vs WhiteBIT: KYC Requirements & KYC Limits

Both Bybit and WhiteBIT implement Know Your Customer (KYC) procedures, but they differ in their approaches and limitations.

Bybit uses KYC to identify customers and assess risk profiles. This verification helps prevent money laundering and other illegal activities. KYC completion on Bybit unlocks several benefits for users.

When you complete Bybit’s verification, you gain access to higher withdrawal limits, additional services like crypto loans, and staking opportunities.

WhiteBIT’s KYC policy has an interesting distinction. Mandatory KYC only applies to users who registered after September 21, 2022. If you created your account before this date, verification remains optional.

Both exchanges comply with Anti-Money Laundering (AML) regulations, but their verification levels work differently.

Bybit KYC Benefits:

- Enhanced account security

- Higher withdrawal limits

- Access to advanced trading features

- Crypto loans and staking options

WhiteBIT KYC Features:

- Strong security and account protection

- Compliance with regulatory requirements

- Optional verification for pre-September 2022 accounts

When choosing between these platforms, consider how their KYC requirements might affect your trading habits. If you prefer minimal verification, WhiteBIT might be preferable if you have an older account.

For maximum platform features and higher trading limits, completing KYC on either exchange is recommended.

Bybit vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Bybit and WhiteBIT, understanding their deposit and withdrawal options is crucial for your trading experience.

Bybit offers a variety of ways to fund your account. You can use cryptocurrencies, bank transfers, and even credit/debit cards in many regions. Their deposit fees are typically 0%, making it cost-effective to get started.

WhiteBIT also provides multiple options for deposits and withdrawals. They support e-wallets, bank cards, and transfers, which gives you flexibility in managing your funds.

Both exchanges support cryptocurrency deposits, which remain the most popular method among traders. This includes major coins like Bitcoin, Ethereum, and various altcoins.

| Feature | Bybit | WhiteBIT |

|---|---|---|

| Deposit Fee | 0% for most methods | 0% for most methods |

| Crypto Deposits | Yes | Yes |

| Bank Transfers | Yes | Yes |

| Card Payments | Yes | Yes |

| E-Wallets | Limited | Yes |

Withdrawal times vary between the platforms. Crypto withdrawals typically process faster than fiat withdrawals on both exchanges. Fiat withdrawals may take 1-5 business days depending on your banking network.

Remember that verification requirements might affect your deposit and withdrawal limits. Both platforms require KYC verification for higher transaction limits and fiat currency operations.

Each exchange may have different minimum deposit amounts depending on the payment method you choose, so check their current requirements before funding your account.

Bybit vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between Bybit and WhiteBIT, the trading experience is a key factor to consider. Both platforms offer unique features that can impact your trading journey.

Bybit provides a more intuitive interface that many beginners find easier to navigate. The platform is known for its stability during high market volatility, which is crucial when executing time-sensitive trades.

WhiteBIT offers a clean design with straightforward navigation, though some users report a steeper learning curve initially. The platform supports more trading pairs than Bybit, giving you access to a wider range of cryptocurrencies.

Trading Tools Comparison:

| Feature | Bybit | WhiteBIT |

|---|---|---|

| Charts | Advanced TradingView | Basic charting |

| Order Types | Market, Limit, Stop, Take Profit | Market, Limit, Stop |

| Mobile App | Highly rated, full-featured | Functional but less intuitive |

| API Access | Comprehensive | Limited |

Bybit excels in derivatives trading with up to 100x leverage options on futures contracts. WhiteBIT offers more modest leverage but provides a broader selection of spot trading pairs.

Both platforms support demo accounts where you can practice trading strategies without risking real money. This feature is especially valuable if you’re new to cryptocurrency trading.

The mobile experience differs significantly between the two. Bybit’s app maintains most desktop functionality, while WhiteBIT’s mobile version has some limitations that might affect your trading on the go.

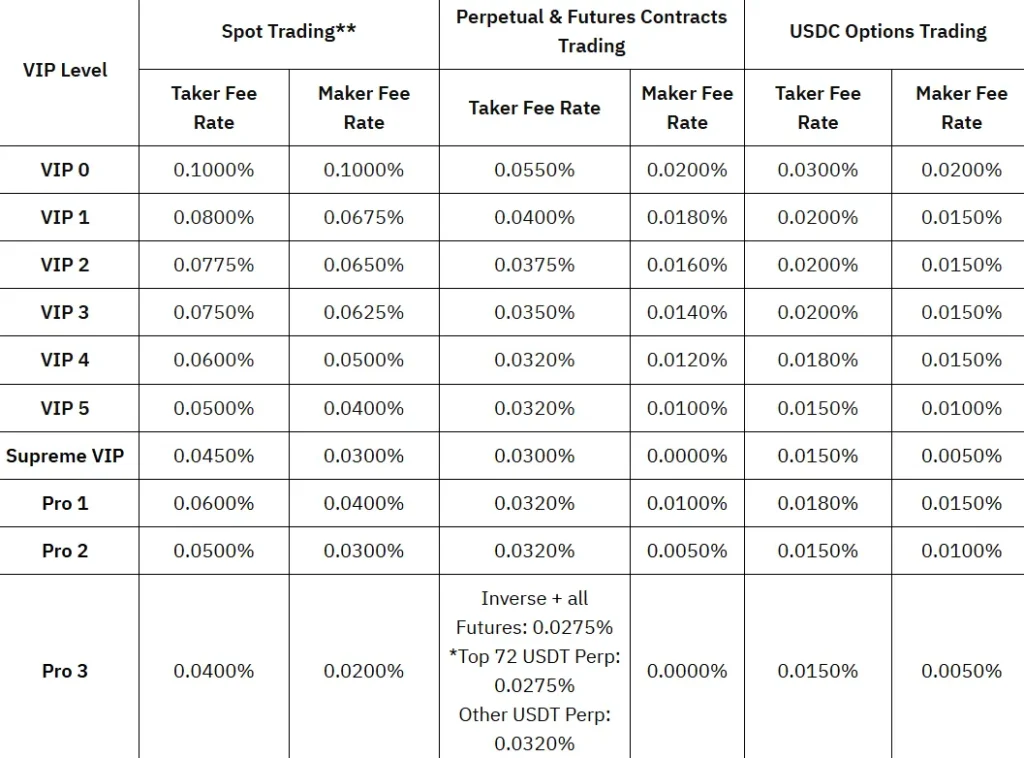

Bybit vs WhiteBIT: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. Both Bybit and WhiteBIT have systems in place to protect themselves when your position approaches a point where losses might exceed your margin.

Bybit uses a progressive liquidation system that attempts to close your position gradually. This approach gives you a better chance to recover if the market moves back in your favor. Bybit also provides a clear liquidation price calculator to help you manage risk.

WhiteBIT employs a more traditional liquidation mechanism. When your position reaches the liquidation threshold, the entire position may be closed at once. This can sometimes feel more abrupt to traders.

Both platforms send notifications as your position approaches liquidation levels. Bybit tends to offer more advanced warning features and risk management tools compared to WhiteBIT.

Key differences:

| Feature | Bybit | WhiteBIT |

|---|---|---|

| Liquidation style | Progressive | Traditional |

| Warning system | Multiple alerts | Basic notifications |

| Stop loss options | Advanced | Standard |

Some Bybit users have reported confusion about liquidations despite having stop losses in place. This highlights the importance of understanding how each platform’s liquidation works with other order types.

You should practice with small positions when first using either platform to become familiar with their liquidation mechanisms before committing larger amounts.

Bybit vs WhiteBIT: Insurance

When trading on cryptocurrency exchanges, insurance funds are crucial for protecting your investments. These funds help manage risk and cover losses during extreme market conditions.

Bybit’s Insurance Approach

Bybit maintains a substantial insurance fund to protect traders against auto-deleveraging (ADL). As of March 2025, their fund exceeds $150 million. This fund steps in when liquidated positions cannot be closed at the bankruptcy price.

WhiteBIT’s Protection Measures

WhiteBIT takes a different approach to security. They implement a multi-level security system and keep most funds in cold storage. However, their insurance coverage is not as prominently advertised as Bybit’s.

Both exchanges prioritize user protection, but they do so through different mechanisms:

| Feature | Bybit | WhiteBIT |

|---|---|---|

| Insurance Fund | Large dedicated fund | Less transparent |

| Cold Storage | Yes (majority) | Yes (majority) |

| Protection Focus | Trading losses | Account security |

You should note that neither exchange offers full insurance for all assets or scenarios. Most coverage is limited to specific situations like system failures or security breaches.

For maximum protection, you might consider spreading your assets across exchanges and using additional security measures like two-factor authentication and hardware wallets.

Bybit vs WhiteBIT: Customer Support

When choosing between Bybit and WhiteBIT, customer support can make a big difference in your trading experience. Both exchanges offer multiple ways to get help, but there are some key differences to consider.

Bybit provides 24/7 customer support through live chat, email, and an extensive help center. Their response times are typically quick, with most live chat inquiries answered within minutes. Many users report positive experiences with Bybit’s support team.

WhiteBIT also offers round-the-clock support via live chat and email. Their help center includes detailed guides and FAQs to help solve common issues. WhiteBIT’s support is available in more languages compared to Bybit, which is helpful if English isn’t your first language.

Response Time Comparison:

| Exchange | Live Chat | Social Media | |

|---|---|---|---|

| Bybit | 5-10 minutes | 24 hours | 24-48 hours |

| WhiteBIT | 10-15 minutes | 24-48 hours | 24-48 hours |

Both platforms have active communities on Telegram and Discord where you can get peer support. These channels are often faster than official support for simple questions.

The quality of support agents varies between the two exchanges. Bybit agents tend to have more technical knowledge about trading features, while WhiteBIT excels in helping beginners navigate their platform.

Neither exchange offers phone support, which might be disappointing if you prefer speaking to a representative directly.

Bybit vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and WhiteBIT offer strong security measures, but with some key differences.

WhiteBIT claims to store 96% of user funds in cold wallets, keeping them offline and away from potential hackers. The platform follows KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements strictly.

Bybit also uses cold storage for most assets but doesn’t specify the exact percentage. Both exchanges offer two-factor authentication (2FA) to add an extra layer of protection to your account.

WhiteBIT Security Features:

- 96% cold wallet storage

- Strict KYC/AML compliance

- Two-factor authentication

- Anti-phishing codes

Bybit Security Features:

- Cold wallet storage (percentage unspecified)

- Two-factor authentication

- Advanced encryption

- Withdrawal address whitelisting

WhiteBIT stands out with its anti-phishing security measures, helping you avoid fake websites. Bybit offers withdrawal address whitelisting, allowing you to restrict withdrawals to pre-approved addresses only.

Neither exchange has reported major security breaches as of March 2025, which speaks to their security infrastructure’s effectiveness.

You should enable all available security features regardless of which platform you choose. Setting up 2FA, using strong passwords, and being vigilant about phishing attempts will enhance your security on either exchange.

Is Bybit a Safe & Legal To Use?

Bybit has gained a reputation as a secure platform for crypto trading. It employs multiple security measures to protect your assets and account information.

These security features include two-factor authentication (2FA) and anti-phishing code to prevent unauthorized access. Bybit also stores 100% of client funds offline in cold storage, making them less vulnerable to hacking attempts.

In terms of regulation, Bybit does have some government oversight, though it’s not as extensively regulated as some traditional financial institutions. According to the search results, Bybit is:

| Regulation Type | Status |

|---|---|

| Government-regulated | Yes |

| U.S. Regulated | No |

| FCA U.K. Regulated | No |

| Germany Regulated | No |

This means you can’t legally use Bybit if you’re located in the United States. The platform implements Know Your Customer (KYC) procedures, which helps prevent fraud and ensures compliance with anti-money laundering regulations.

Bybit is considered the second-largest crypto exchange globally. However, some Bitcoin enthusiasts don’t recommend it as frequently as other exchanges like Coinbase or Kraken.

Before using Bybit, check if it’s legal in your country of residence. Always enable all security features and follow good security practices when trading on any exchange.

Is WhiteBIT a Safe & Legal To Use?

WhiteBIT is generally considered a safe cryptocurrency exchange. According to CER.live, it ranks among the top five most secure crypto exchanges. The platform employs robust security strategies to protect users’ assets.

The exchange uses secure encryption technology and various protocols to ensure your cryptocurrencies remain protected. This focus on security helps minimize risks associated with trading and holding digital assets.

Regarding legality, WhiteBIT operates with some regulatory oversight. It is government-regulated, though specific jurisdictions may vary. However, it’s important to note that WhiteBIT is not regulated in the United States, United Kingdom, or Germany.

If you’re a resident of these countries, you may face restrictions when trying to use the platform. Always check the current regulations in your location before signing up.

Like all crypto exchanges, WhiteBIT carries some platform risks. Your funds could potentially be vulnerable to:

- Hacking attempts

- Fraud

- Platform mismanagement

- Exchange insolvency

No cryptocurrency exchange can guarantee 100% security. Some users have reported that WhiteBIT occasionally uses alarming messages to encourage withdrawals, which might cause unnecessary concern.

Before choosing WhiteBIT, compare its security features with other exchanges like Bybit to determine which best meets your needs and risk tolerance.

Frequently Asked Questions

Choosing between Bybit and WhiteBIT involves understanding key differences in their features, fees, security measures, and available cryptocurrencies. These exchanges have distinct advantages that might influence your trading decisions.

What features set Bybit and WhiteBIT apart from each other?

Bybit focuses on derivatives trading with advanced features for futures contracts. It offers high leverage options and a user-friendly interface designed for both beginners and experienced traders.

WhiteBIT stands out with its strong regulatory compliance and varied trading products. The platform requires lockup periods for most coins, with minimums of 10 days for many cryptocurrencies and 30 days for others.

Both exchanges provide mobile apps, but Bybit typically offers more advanced charting tools and trading features.

Can users from the United States trade on WhiteBIT?

No, WhiteBIT does not currently support users from the United States. This restriction is due to regulatory requirements and compliance measures.

Bybit also has restrictions for US traders. If you’re based in the US, you’ll need to consider other exchanges that specifically allow US customers.

How do Bybit and WhiteBIT compare in terms of trading fees?

Bybit typically charges maker fees ranging from 0.01% to 0.06% and taker fees between 0.06% and 0.1% depending on your trading volume and user level.

WhiteBIT’s fee structure varies more frequently, making it important to check their current rates. Their rates are competitive but change based on market conditions and trading pairs.

Both exchanges offer fee discounts for users who hold their native tokens or maintain high trading volumes.

What are the security measures implemented by Bybit and WhiteBIT?

WhiteBIT complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. They provide secure storage solutions for user funds and implement multi-factor authentication.

Bybit uses cold storage for most user funds, offers two-factor authentication, and has implemented address whitelisting for withdrawals.

Neither exchange has reported major security breaches, though both recommend using all available security features to protect your account.

How does customer support differ between Bybit and WhiteBIT?

Bybit offers 24/7 customer support through live chat, email, and an extensive knowledge base. Their response times are generally quick, especially for urgent issues.

WhiteBIT provides support through multiple channels including email and social media. Their support team handles queries in several languages, which is helpful for international users.

Both exchanges offer community forums where users can discuss issues and find solutions from other traders.

Which platform offers a wider range of cryptocurrencies, Bybit or WhiteBIT?

WhiteBIT supports a substantial number of cryptocurrencies and trading pairs. They regularly add new tokens to their platform based on market demand and compliance requirements.

Bybit has been expanding its offerings but traditionally focused more on major cryptocurrencies with high liquidity. They’ve recently added more altcoins to appeal to diverse traders.

When selecting between these exchanges, check if they support the specific cryptocurrencies you want to trade, as their listings continue to evolve.

Bybit vs WhiteBIT Conclusion: Why Not Use Both?

Choosing between Bybit and WhiteBIT doesn’t have to be an either/or decision. Each platform offers unique strengths that might benefit your trading strategy in different ways.

Bybit excels in futures trading and has a user-friendly interface that many traders appreciate. However, it’s important to note that Bybit faces restrictions in the United States due to regulatory issues.

WhiteBIT provides a wide range of trading options beyond just futures. Its comprehensive product offerings might appeal to traders looking for variety in their cryptocurrency trading experience.

Key considerations for using both platforms:

- Different fee structures: Use the platform with lower fees for specific types of trades

- Varying coin selections: Access more cryptocurrencies by having accounts on both exchanges

- Risk management: Spread your assets across multiple platforms for added security

- Feature comparison: Take advantage of the best tools each platform offers

You might find that using Bybit for certain types of trades and WhiteBIT for others gives you the most comprehensive trading experience.

Remember to consider your specific needs, location restrictions, and trading goals when deciding how to allocate your activities between these platforms.

By maintaining accounts on both exchanges, you can capitalize on promotional offers, different liquidity pools, and unique features while minimizing the limitations of relying on just one platform.