Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bybit and MEXC are two popular platforms that offer different advantages for crypto traders in 2025. Bybit stands out with more advanced trading features, while MEXC focuses on providing a different set of options for cryptocurrency enthusiasts.

Both exchanges allow you to buy, sell, and trade various digital assets, but they differ in their approach. You’ll find that Bybit tends to cater to traders looking for sophisticated tools and trading options. MEXC, on the other hand, may appeal to you if you’re looking for certain specific features or cryptocurrencies not available elsewhere.

When deciding between these two exchanges, you should consider factors like trading fees, available cryptocurrencies, security features, and user interface. Your trading goals and experience level will also play a key role in determining which platform better suits your needs.

Bybit Vs MEXC: At A Glance Comparison

When choosing between Bybit and MEXC in 2025, several key differences stand out. Both exchanges offer crypto trading services, but they cater to different user needs.

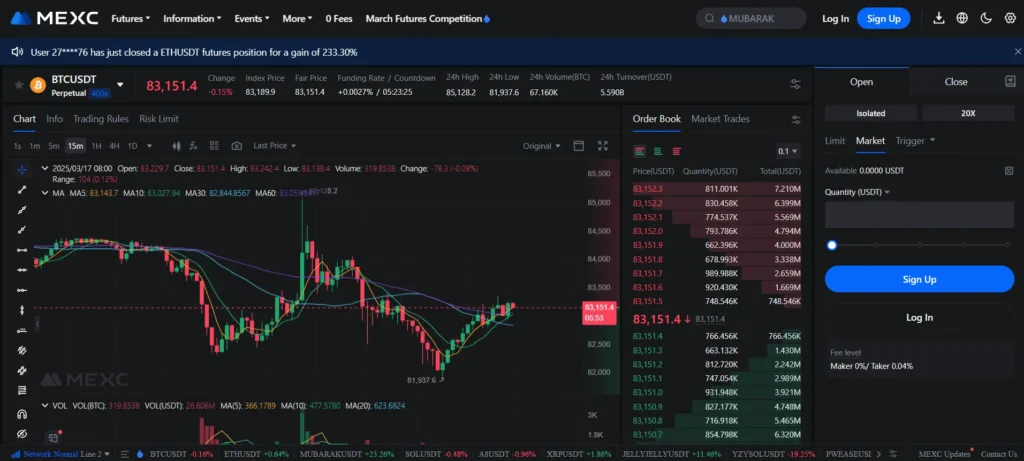

Bybit shines with higher trading volume and liquidity, making it easier to execute large trades without price slippage. Its derivatives trading platform is better optimized for traders who use leverage.

MEXC offers competitive features too, though the search results suggest Bybit has more advanced options, particularly in the options trading area.

| Feature | Bybit | MEXC |

|---|---|---|

| Trading Volume | Higher | Lower |

| Liquidity | Better | Good |

| Derivatives Trading | Highly optimized | Standard |

| Options Trading | Advanced features | Basic features |

Fees vary between the platforms, though specific numbers aren’t provided in the search results. Both exchanges appear in lists of platforms with competitive fee structures.

Security is crucial for any crypto exchange. While the search results don’t provide specific security comparisons, both platforms are mentioned among reputable exchanges in 2025.

You might find Bybit more suitable if you’re an active trader who values liquidity and advanced trading features. MEXC could be a good alternative depending on your specific trading needs.

For new traders, the interface and ease of use might be worth considering alongside these technical differences.

Bybit Vs MEXC: Trading Markets, Products & Leverage Offered

Both Bybit and MEXC offer extensive trading options for crypto enthusiasts, but they differ in key areas.

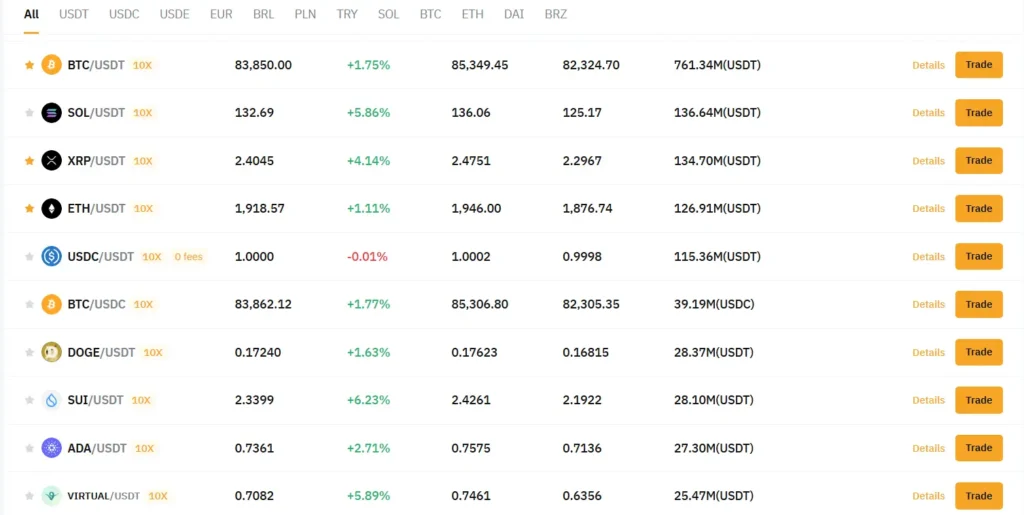

MEXC supports over 600 futures trading pairs, making it a standout for traders seeking variety. You’ll find all major cryptocurrencies like BTC and ETH along with numerous altcoins.

Bybit offers fewer trading pairs but compensates with a user-friendly interface that beginners appreciate. Their spot and futures markets are well-organized and easy to navigate.

Leverage Options:

- MEXC: Up to 400x leverage

- Bybit: Up to 100x leverage

For leverage traders, MEXC’s 400x maximum gives you significantly more power, though this comes with increased risk.

Trading Products Comparison:

| Feature | MEXC | Bybit |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | ✓ |

| Copy Trading | ✓ | ✓ |

| Staking | Up to 300% APR | Available |

MEXC stands out with its impressive 300% staking APR on 22 coins, while Bybit offers more modest but still competitive staking options.

Trading fees on MEXC (0.05% for spot and 0.01%/0.04% for futures) are comparable to Bybit’s fee structure. You’ll find both platforms offer fee discounts for higher trading volumes.

Both exchanges provide copy trading features, allowing you to follow successful traders’ strategies automatically.

Bybit Vs MEXC: Supported Cryptocurrencies

When choosing between Bybit and MEXC, the range of available cryptocurrencies is a key factor to consider. Both exchanges offer a wide selection, but there are some notable differences.

MEXC stands out with support for over 600 trading pairs, including major cryptocurrencies and many smaller altcoins. This makes it an attractive option if you’re looking to trade less common tokens.

Bybit offers a more curated selection but covers all major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). While it has fewer total coins than MEXC, Bybit focuses on quality over quantity.

For futures trading, MEXC provides more options with its 600+ futures trading pairs. Bybit also offers futures markets but with a somewhat smaller selection.

Cryptocurrency Support Comparison:

| Feature | Bybit | MEXC |

|---|---|---|

| Major cryptocurrencies | ✓ | ✓ |

| Number of trading pairs | Moderate | 600+ |

| Futures trading pairs | Good selection | 600+ |

| Small-cap altcoins | Limited | Extensive |

If you want access to the widest possible range of cryptocurrencies, especially smaller altcoins, MEXC might be your better choice. However, if you primarily trade mainstream cryptocurrencies, both platforms will meet your needs effectively.

Remember that larger exchanges typically offer better liquidity for major coins, which can result in better pricing and easier trading.

Bybit Vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and MEXC, understanding their fee structures is crucial for your trading strategy.

Deposit Fees

Both Bybit and MEXC don’t charge fees for deposits. This is good news if you’re frequently adding funds to your account.

Trading Fees

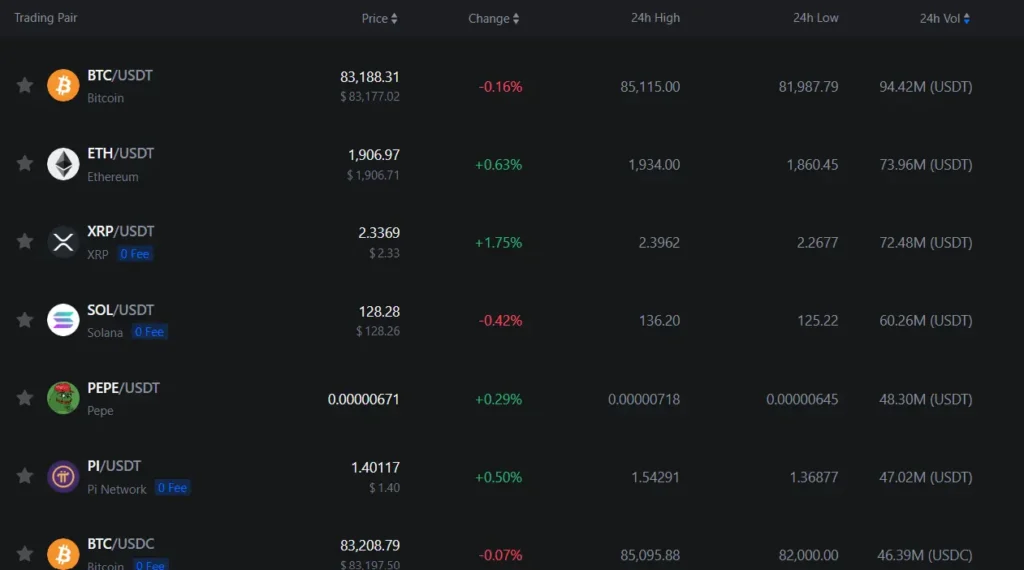

MEXC offers a flat trading fee of 0.05% for both makers and takers in the spot market. This rate applies regardless of your trading volume.

Bybit, however, charges fees for spot trading that are higher than MEXC. For futures trading, Bybit’s fees are also more expensive compared to MEXC.

Withdrawal Fees

Withdrawal fees vary between the two platforms. These fees typically depend on the cryptocurrency you’re withdrawing and network congestion.

You should check the current fee schedules on both platforms before making large withdrawals, as these can affect your overall profits.

Fee Comparison Table

| Fee Type | MEXC | Bybit |

|---|---|---|

| Deposits | Free | Free |

| Spot Trading | 0.05% (makers & takers) | Higher than MEXC |

| Futures Trading | Lower than Bybit | Higher than MEXC |

| Withdrawals | Varies by crypto | Varies by crypto |

If you’re fee-conscious, MEXC generally offers more competitive rates, especially for regular trading activities.

Bybit Vs MEXC: Order Types

Both Bybit and MEXC offer a variety of order types to help you execute trades according to your strategy.

Bybit Order Types:

- Market Orders (instant execution at current market price)

- Limit Orders (set your desired price)

- Stop-Limit Orders (triggers a limit order when market hits a certain price)

- Take Profit and Stop Loss Orders (automatic exit positions)

- Conditional Orders (execute when specific conditions are met)

Bybit also offers advanced order features like Post-Only and Reduce-Only options for futures trading. These help you maintain position without increasing exposure.

MEXC Order Types:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- Take Profit and Stop Loss Orders

- OCO (One-Cancels-the-Other) Orders

MEXC provides simpler order types but handles most common trading needs effectively. Their interface makes it easy to set up basic orders even if you’re new to trading.

The main difference is that Bybit offers more specialized order types for futures and margin trading. This makes Bybit better suited if you want advanced trading features.

MEXC focuses more on spot trading with straightforward order types. If you prefer simplicity and primarily trade spot markets, MEXC’s order options will likely meet your needs.

Your choice between these exchanges should consider which order types match your trading style and experience level.

Bybit Vs MEXC: KYC Requirements & KYC Limits

When choosing between Bybit and MEXC, understanding their KYC (Know Your Customer) policies can be a deciding factor for many traders.

Bybit KYC Requirements:

- Requires all users to complete KYC verification before trading

- Mandatory verification regardless of account level

- Typically requires government ID, proof of address, and facial verification

MEXC KYC Requirements:

- Offers KYC-free trading options

- Features three different account tiers:

- Unverified (no KYC)

- Primary KYC

- Verified Plus

If privacy is important to you, MEXC has a clear advantage with its KYC-free trading option. You can start trading immediately without submitting personal identification documents.

Bybit’s mandatory verification might cause delays when you first sign up, but provides better regulatory compliance in many jurisdictions.

Both exchanges set transaction limits based on verification status. With MEXC, unverified accounts can still trade but have lower withdrawal limits compared to verified accounts.

Your trading volume and location may affect which platform’s KYC policy works better for your needs. Some countries have stricter regulations that both platforms must follow.

Remember that while KYC-free options offer more privacy, verified accounts generally provide higher withdrawal limits and access to more features on both platforms.

Bybit Vs MEXC: Deposits & Withdrawal Options

When choosing between Bybit and MEXC for your crypto trading, understanding their deposit and withdrawal options is crucial.

MEXC supports crypto deposits and withdrawals but doesn’t offer direct fiat withdrawals. This means you can easily move your cryptocurrencies in and out of the platform, but might need extra steps to convert to traditional currency.

Bybit offers a more comprehensive approach with support for both crypto and fiat options. This gives you more flexibility when funding your account or cashing out your profits.

Deposit Methods Comparison:

| Feature | MEXC | Bybit |

|---|---|---|

| Crypto Deposits | ✅ | ✅ |

| Fiat Deposits | Limited | ✅ |

| Credit/Debit Card | ✅ | ✅ |

Withdrawal Options:

- MEXC: Primarily crypto withdrawals

- Bybit: Both crypto and fiat withdrawal options

Both exchanges implement security measures for withdrawals, including two-factor authentication and email confirmations to protect your funds.

Processing times vary between the platforms, with most crypto withdrawals completing within minutes to hours depending on network congestion.

Fee structures differ between the exchanges, so you should check their current rates before making large transactions. Withdrawal fees typically depend on the cryptocurrency network you’re using.

Bybit Vs MEXC: Trading & Platform Experience Comparison

When you trade on Bybit and MEXC, you’ll notice differences in their platforms that affect your experience. Both exchanges offer user-friendly interfaces, but they cater to different types of traders.

Bybit provides a more advanced trading platform with sophisticated tools for experienced traders. You’ll find detailed charting capabilities and a variety of order types that help you execute complex strategies.

MEXC offers a simpler interface that’s easier for beginners to navigate. Though less feature-rich than Bybit, it still provides the essential tools you need for trading.

Trading Features Comparison:

| Feature | Bybit | MEXC |

|---|---|---|

| User Interface | Advanced, feature-rich | Simple, beginner-friendly |

| Mobile App | Highly rated, full-featured | Functional but less polished |

| Trading Pairs | 350+ | 1,400+ |

| Order Types | Advanced variety | Basic selection |

| Chart Tools | Comprehensive | Adequate |

Bybit excels in futures and leverage trading with more advanced features. You’ll appreciate its stable platform that rarely experiences downtime during high market volatility.

MEXC stands out with its extensive selection of trading pairs, especially for newer altcoins. You can access many tokens on MEXC that aren’t available on Bybit.

Both platforms offer copy trading features, allowing you to follow successful traders’ strategies. However, Bybit’s copy trading system tends to be more robust and user-friendly.

Bybit Vs MEXC: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. This feature helps manage risk by closing positions when they reach certain loss thresholds.

Bybit’s Liquidation Process

- Uses a tiered liquidation system

- Sends early warnings when approaching liquidation price

- Offers partial liquidation to help save portions of your position

- Implements a fair price marking system to prevent flash liquidations

Bybit’s liquidation mechanism is designed to be trader-friendly. You receive notifications before liquidation occurs, giving you time to add more margin or reduce position size.

MEXC’s Liquidation Approach

- Uses a direct liquidation system at predetermined price levels

- Offers liquidation protection for some trading pairs

- Has a less transparent warning system compared to Bybit

- Maintains a insurance fund to handle liquidation losses

MEXC tends to have a more straightforward liquidation process. Your position gets closed when it hits the liquidation price without as many intermediate steps.

Key Differences

| Feature | Bybit | MEXC |

|---|---|---|

| Warning System | Advanced multi-level | Basic |

| Partial Liquidation | Yes | Limited |

| Liquidation Fee | 0.5%-2% | 0.5%-3% |

| Insurance Fund | Large | Moderate |

You’ll find Bybit’s liquidation process more forgiving for new traders. The early warning system gives you more time to react before losing your position.

Bybit Vs MEXC: Insurance

When choosing between Bybit and MEXC, understanding their insurance policies is crucial for your protection against potential losses.

Bybit offers a more robust insurance fund compared to MEXC. As of March 2025, Bybit maintains an insurance fund worth over $300 million to protect traders against auto-deleveraging during volatile market conditions.

MEXC’s insurance fund is smaller but still provides basic protection for users. Their approach focuses on risk management rather than maintaining a massive insurance fund.

Insurance Features Comparison:

| Feature | Bybit | MEXC |

|---|---|---|

| Insurance Fund Size | $300+ million | $75+ million |

| Coverage Scope | Trading losses, system failures | Mainly trading losses |

| Auto-deleveraging Protection | Strong | Basic |

| User Fund Protection | SAFU-like protection | Standard protection |

Both exchanges keep user funds in cold storage to minimize security risks. Bybit stores approximately 95% of assets offline, while MEXC claims to keep about 98% in cold wallets.

Neither exchange offers direct FDIC-like insurance for crypto assets, which is common across the industry. This means you should still practice caution with the amount you keep on either platform.

If insurance and fund protection are your top priorities, Bybit generally offers more comprehensive coverage due to its larger insurance fund and more established risk management systems.

Bybit Vs MEXC: Customer Support

When choosing between Bybit and MEXC, customer support can be a deciding factor. Both exchanges offer 24/7 support, but there are some differences worth noting.

Bybit provides multiple support channels including live chat, email, and an extensive help center. Their team typically responds within minutes for urgent issues. Many users report positive experiences with their responsive and knowledgeable support agents.

MEXC also offers round-the-clock support through similar channels. Their multilingual support team can assist you in several languages, which is helpful if English isn’t your first language.

Response times may vary between the two platforms. Bybit often has faster initial response times, especially during peak trading hours. MEXC can sometimes take longer to resolve complex issues.

Both exchanges provide comprehensive FAQs and guides to help you solve common problems without contacting support. These self-help resources are particularly useful for beginners.

Support Comparison

| Feature | Bybit | MEXC |

|---|---|---|

| 24/7 Support | ✓ | ✓ |

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Multilingual | Limited | Extensive |

| Response Time | Generally faster | Can vary |

If you value quick response times, Bybit might be your preferred choice. If you need support in multiple languages, MEXC could better serve your needs.

Bybit Vs MEXC: Security Features

When comparing Bybit and MEXC exchanges, security is a top concern for all crypto traders. Both platforms have implemented various measures to protect your assets.

Bybit requires all users to complete KYC (Know Your Customer) verification before trading. This helps prevent fraud and ensures compliance with regulations. Your personal information is needed, but this adds a layer of security.

MEXC, on the other hand, offers KYC-free trading options. This gives you more privacy but might come with some limitations.

Two-Factor Authentication (2FA)

- Both exchanges support 2FA

- Adds an extra security layer to your account

- Highly recommended for all users

Bybit employs multi-signature cold wallets to store most user funds offline. This significantly reduces the risk of hacking attempts since assets aren’t accessible through internet connections.

MEXC also uses cold storage technology for the majority of user assets. They implement real-time monitoring systems to detect unusual activities on their platform.

Both exchanges offer fund passwords as an additional security measure for withdrawals. This helps protect your assets even if someone gains access to your account.

Neither exchange has reported major security breaches as of March 2025, which speaks to their security infrastructure. However, you should always use strong passwords and enable all security features available on either platform.

Is Bybit A Safe & Legal To Use?

Bybit has maintained a perfect safety record with no security breaches or loss of customer funds. This strong security history demonstrates their commitment to protecting user assets.

However, legality depends on your location. Bybit does not serve US residents due to regulatory requirements. Using a VPN to bypass these restrictions is not recommended and could lead to account issues.

For non-US users, Bybit requires KYC (Know Your Customer) verification before trading. This differs from MEXC, which offers KYC-free trading options.

Security Features:

- Advanced encryption protocols

- Cold storage for majority of funds

- Two-factor authentication (2FA)

- Regular security audits

Bybit’s emphasis on security has helped it build trust in the crypto community. Many users consider it a reliable exchange for trading digital assets.

Before using Bybit, check if it’s legal in your country of residence. Regulations change frequently, so staying informed about your local laws is important.

If you’ve had negative experiences with other exchanges like MEXC or Tradeorge, Bybit might offer a more secure alternative. Their focus on security has helped them avoid the problems that have affected some competitors.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or loss of user funds. This track record suggests the exchange has established reliable security measures.

The platform is legal to use in many countries, though availability depends on your location. Always check if MEXC operates legally in your jurisdiction before signing up.

Security Features:

- Multi-factor authentication (MFA)

- Cold storage for most crypto assets

- Regular security audits

One advantage of MEXC is its KYC-free trading option. Unlike Bybit, which requires all users to complete KYC verification, MEXC allows you to trade without providing identification documents.

However, KYC-free accounts typically have lower withdrawal limits. You might need to complete verification eventually if you plan to trade larger amounts.

Important Considerations:

- Some users have reported issues with account restrictions

- There are allegations about banning profitable traders

- Customer support quality can vary

The exchange ranks in the top 15 crypto platforms globally, offering access to over 1,600 cryptocurrencies. This extensive selection provides you with numerous trading opportunities.

Always use strong, unique passwords and enable all available security features when using any crypto exchange. Transfer large holdings to private wallets rather than keeping them on the exchange for maximum safety.

Frequently Asked Questions

Trading cryptocurrency can be complex, and choosing between Bybit and MEXC involves understanding several key differences. Here are answers to common questions traders ask when comparing these two popular exchanges.

Which exchange offers better leverage options, Bybit or MEXC?

Bybit offers leverage up to 100x on major cryptocurrency pairs, making it a strong choice for experienced traders who want significant position sizing options. The platform also provides adjustable leverage settings.

MEXC provides even higher leverage options, with up to 200x leverage on selected trading pairs. This higher ceiling may appeal to traders looking for maximum position amplification.

Both platforms offer leverage on spot and futures markets, but always remember that higher leverage comes with increased liquidation risks.

How do Bybit and MEXC compare in terms of trading fees?

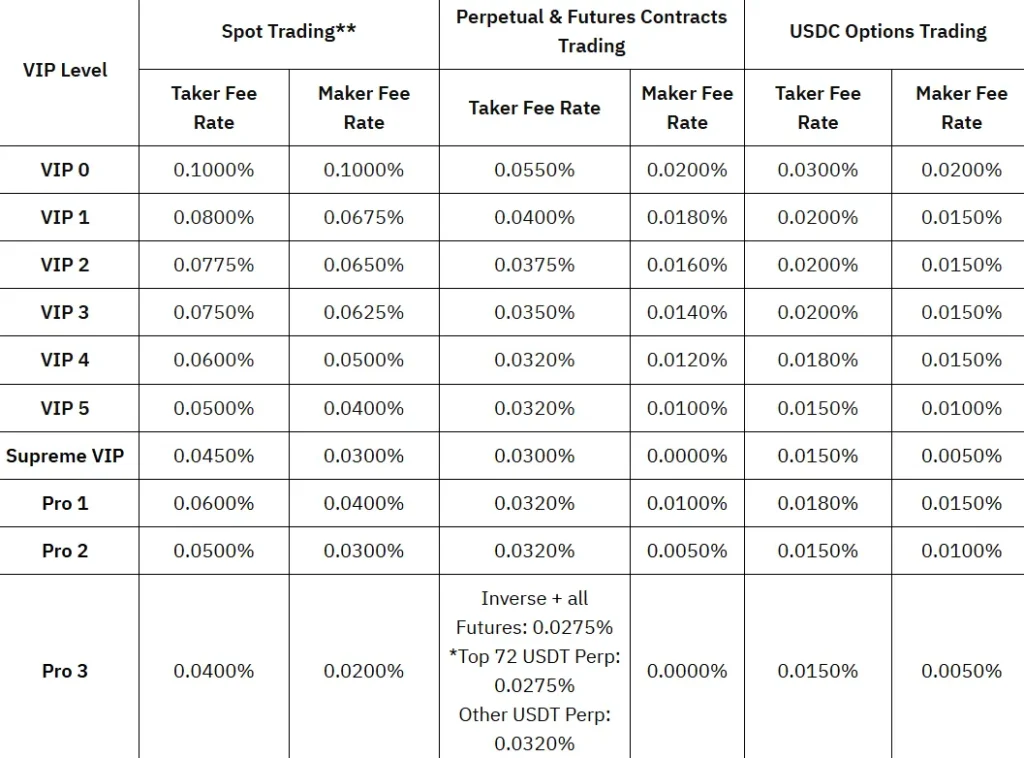

Bybit operates on a maker-taker fee structure with futures trading fees starting at 0.06% for takers and 0.01% for makers. Fees decrease as your trading volume increases or as you hold more assets on the platform.

MEXC also uses a maker-taker model with competitive fees starting at around 0.02% for makers and 0.06% for takers. Like Bybit, MEXC rewards higher volume traders with lower fees.

For traders who frequently move between positions, MEXC’s fee structure might be slightly more favorable depending on your trading volume and patterns.

Which platform provides a wider range of cryptocurrencies, Bybit or MEXC?

MEXC clearly wins in terms of cryptocurrency selection, offering over 1,500 different coins and tokens. This includes many smaller market cap projects and newly launched tokens.

Bybit supports fewer cryptocurrencies, but still maintains a solid selection of approximately 500+ coins. Bybit tends to focus on more established projects with higher market capitalizations.

If you’re interested in trading newer or more obscure altcoins, MEXC will likely provide more options for your trading strategy.

How do the security measures of Bybit differ from those of MEXC?

Bybit employs multi-signature cold wallets to store the majority of user funds offline. They also offer two-factor authentication (2FA), advanced encryption, and regular security audits.

MEXC implements similar security features including cold wallet storage, 2FA, and anti-phishing measures. They also have a dedicated security team that monitors the platform 24/7.

Both exchanges have strong security track records, but Bybit is sometimes perceived as having a slight edge due to its more transparent security protocols and insurance funds.

What are the differences in user interface and ease of use between Bybit and MEXC?

Bybit features a clean, intuitive interface that works well for both beginners and experienced traders. The platform offers useful educational resources and a demo trading account for practice.

MEXC’s interface is functional but can feel slightly more complex for beginners. The platform packs more features and information on each screen, which experienced traders might prefer.

Both platforms offer mobile apps, but Bybit’s app receives higher ratings for responsiveness and ease of navigation.

Can users from the USA legally trade on Bybit or MEXC, and what are the restrictions?

Neither Bybit nor MEXC currently holds licenses to operate fully in the United States. US residents are officially restricted from creating accounts on both platforms.

Some US traders use VPNs to access these platforms, but this violates the terms of service and carries significant risks including potential account freezes and loss of funds.

If you’re a US-based trader, consider regulated alternatives like Kraken or Coinbase to avoid legal complications and ensure account security.

MEXC Vs Bybit Conclusion: Why Not Use Both?

After comparing MEXC and Bybit, it’s clear that each exchange has its own strengths. You don’t necessarily need to choose just one.

Bybit offers better liquidity, higher trading volumes, and more advanced derivatives trading features. Its platform is well-optimized for serious traders who need reliable execution.

MEXC, on the other hand, provides lower fees across the board. They charge 0.050% for both makers and takers, with potential discounts when using their MX token. For cost-conscious traders, this is a significant advantage.

Fee Comparison:

| Exchange | Spot Trading | Futures Trading | Deposits |

|---|---|---|---|

| MEXC | Lower | Lower | Free |

| Bybit | Higher | Higher | Free |

Security features are strong on both platforms. MEXC employs anti-phishing codes in communications, similar to those used by larger exchanges like Binance.

You might consider using Bybit for:

- Advanced derivatives trading

- Trading during high market volatility

- Accessing better liquidity

And MEXC for:

- Lower-cost transactions

- Special zero-fee promotions

- Wider selection of altcoins

Many experienced crypto traders maintain accounts on multiple exchanges to leverage different fee structures and features. This strategy lets you optimize your trading experience based on your specific needs at different times.