Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Bybit and Kraken are two popular options that many traders consider in 2025, each with their own strengths and trade-offs.

When comparing Bybit vs Kraken, Kraken typically charges higher fees (up to 0.4% maximum) but offers more reliability and convenience, while Bybit generally maintains lower fee structures for traders. Kraken is known for its strong security measures and user-friendly platform, though it does require KYC (Know Your Customer) verification which might not be ideal for all users.

Both exchanges support a variety of cryptocurrencies, but they differ in their available features, trading tools, and regional availability. Your choice between these platforms will likely depend on your specific trading needs, fee sensitivity, and whether you prioritize ease of use or advanced trading options.

Bybit Vs Kraken: At A Glance Comparison

When choosing between Bybit and Kraken, several key differences stand out. Here’s a quick comparison to help you decide which platform might work better for your trading needs.

Trading Fees:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bybit | Lower | Lower |

| Kraken | 0.16% | 0.26% |

Bybit generally offers lower trading fees compared to Kraken. This can make a significant difference if you’re an active trader.

- User Interface: Bybit provides a streamlined interface that many beginners find approachable. Kraken offers a professional setup with Kraken Pro available for more advanced traders.

- Available Cryptocurrencies: Both exchanges support major cryptocurrencies, but Kraken typically has a wider selection of altcoins available for trading.

- Security Features: Kraken has built a strong reputation for security over its longer history in the market. Bybit also maintains solid security protocols, but Kraken is often considered the more established option for security-focused users.

- Payment Methods: Kraken supports more fiat currency options and payment methods than Bybit. This makes it easier to deposit funds directly from your bank account.

- Trading Tools: Bybit excels in futures trading and offers advanced tools for derivatives. Kraken provides a more comprehensive spot trading environment with additional features through Kraken Pro.

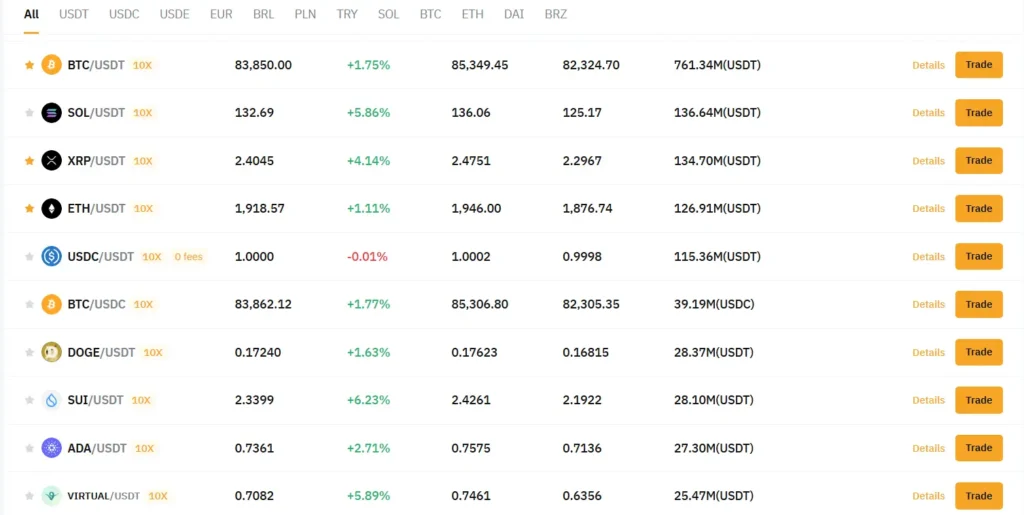

Bybit Vs Kraken: Trading Markets, Products & Leverage Offered

Bybit and Kraken offer different trading options for cryptocurrency investors. Your choice between them may depend on what you want to trade and how much risk you’re comfortable with.

Available Markets

- Bybit: Offers spot trading, futures, options, and copy trading

- Kraken: Provides spot trading, futures, margin trading, and staking services

Kraken has been around longer and is known for security and regulation compliance. Bybit has grown quickly by offering more advanced trading features.

Leverage Differences

| Exchange | Maximum Leverage |

|---|---|

| Bybit | Up to 100x |

| Kraken | Up to 5x |

Bybit clearly offers higher leverage options if you’re looking for potentially bigger returns. However, this comes with significantly higher risk.

The search results indicate Bybit is popular for its margin trading, with spot margin options allowing up to 5x leverage. Kraken scores better in feature evaluations according to comparison tools.

You’ll find more cryptocurrencies available on Bybit, especially newer altcoins. Kraken focuses on established cryptocurrencies and has stricter listing requirements.

If you’re new to trading, Kraken’s lower leverage limits might protect you from excessive risk. For experienced traders seeking aggressive positions, Bybit’s higher leverage capabilities could be appealing.

Bybit Vs Kraken: Supported Cryptocurrencies

When choosing between Bybit and Kraken, the range of available cryptocurrencies is a key factor to consider. Both exchanges offer different selections that might influence your decision.

Kraken provides access to over 100 cryptocurrencies. The platform is known for its careful selection process, focusing on established coins and tokens with strong reputations.

Bybit offers a somewhat similar selection, though the exact number can vary as they regularly update their listings. Both exchanges support major cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

Kraken stands out with its support for privacy coins like Monero, which isn’t available on many exchanges. This makes Kraken a preferred choice if privacy coins are important to you.

Bybit typically focuses more on trading pairs for futures and derivatives. You’ll find they excel in offering various contract types for the cryptocurrencies they support.

The two platforms differ in how quickly they list new tokens. Bybit tends to add emerging cryptocurrencies faster, while Kraken takes a more conservative approach, prioritizing security and regulatory compliance.

Before choosing either exchange, check their current listings to ensure they support the specific cryptocurrencies you want to trade. Both platforms regularly update their offerings to meet user demands and market trends.

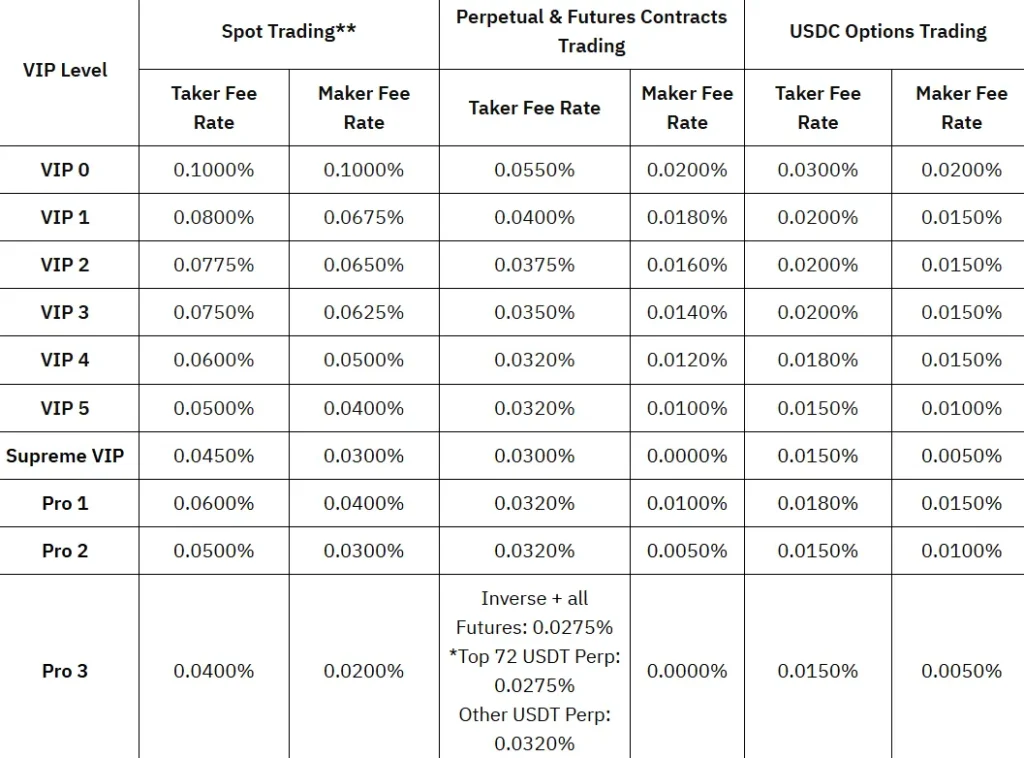

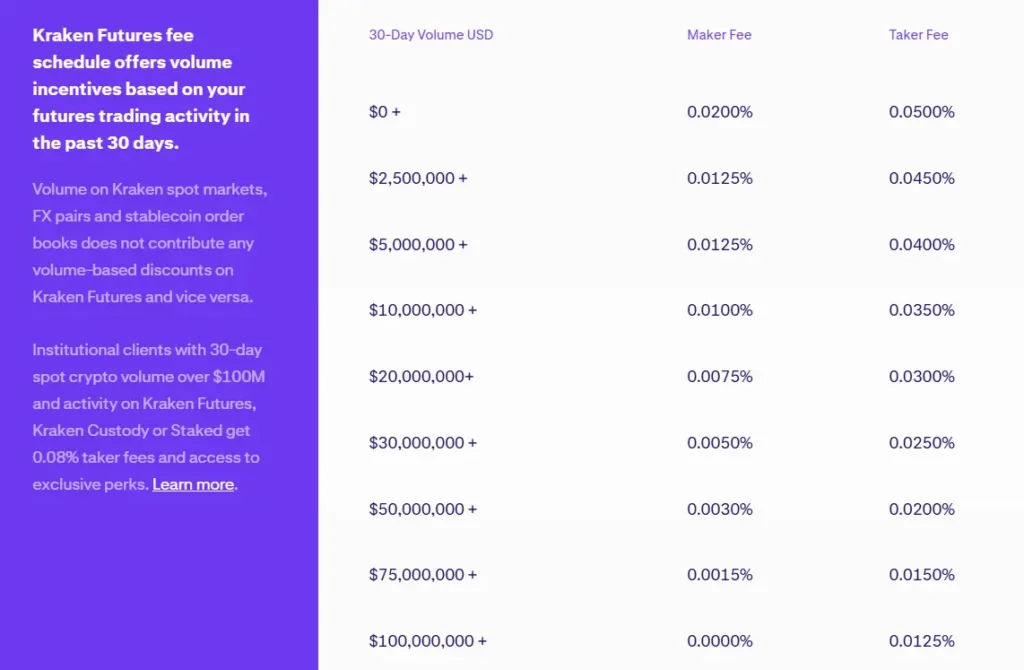

Bybit Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and Kraken, fees play a key role in your decision. Both platforms have different fee structures that can impact your trading costs.

Trading Fees:

| Fee Type | Bybit | Kraken |

|---|---|---|

| Futures Maker fee | 0.02% | 0.02% |

| Futures Taker fee | 0.055% | 0.05% |

| Spot Maker fee | – | 0.16% |

| Spot Taker fee | – | 0.26% |

For futures trading, Bybit and Kraken have identical maker fees at 0.02%. However, Kraken offers a slightly lower taker fee (0.05%) compared to Bybit (0.055%).

If you prefer spot trading, Kraken charges 0.16% for makers and 0.26% for takers. These rates are higher than many other exchanges.

Deposit and Withdrawal Fees:

- Deposit Fees: Both platforms don’t charge deposit fees

- Withdrawal Fees: Kraken charges 0.0002 BTC for Bitcoin withdrawals, while Bybit charges 0.0005 BTC

You’ll find that Kraken’s withdrawal fees are more competitive than Bybit’s. This difference becomes significant if you make frequent withdrawals.

Fee structures may change based on your trading volume or VIP status. Higher trading volumes typically qualify you for lower fees on both platforms.

Check the current fee schedules on both platforms before making your final decision, as fees may have updated since March 2025.

Bybit Vs Kraken: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your trading strategy. Both Bybit and Kraken offer various order options to help you execute trades according to your preferences.

Bybit provides a comprehensive range of order types that cater to different trading styles. You can place market orders, limit orders, and conditional orders on the platform.

Kraken also offers these basic order types but adds some advanced options like stop-loss and take-profit orders to help manage your risk.

For derivative trading, Bybit shines with its trailing stop orders and post-only orders that are particularly useful for futures trading. These features give you more control over your positions in volatile markets.

Kraken’s scaled orders allow you to set up multiple limit orders at once, which is helpful for dollar-cost averaging strategies. You can also use settle position orders to close positions at market price.

Here’s a quick comparison of the order types:

| Order Type | Bybit | Kraken |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Trailing Stop | ✓ | Limited |

| Post-Only | ✓ | ✓ |

| Scaled Orders | ✗ | ✓ |

If you’re into leverage trading, Bybit offers more specialized order types designed for futures and perpetuals trading. This gives you an edge when executing complex trading strategies.

Bybit Vs Kraken: KYC Requirements & KYC Limits

When choosing between Bybit and Kraken, understanding their KYC (Know Your Customer) requirements is essential for your trading experience.

Bybit KYC Requirements:

- Offers a tiered verification system

- Allows withdrawals up to 20,000 USDT daily without KYC verification

- Uses KYC to identify customers and analyze risk profiles

- KYC helps prevent money laundering and illegal activities

Bybit’s no-KYC withdrawal option makes it attractive if you value privacy and quick access to your funds.

Kraken KYC Requirements:

- Implements stricter KYC procedures

- Requires verification for most account functions

- Has a more thorough identification process

- Focuses on regulatory compliance

Kraken’s approach to KYC reflects its position as a more regulated exchange, often preferred by users who prioritize security.

Verification Tiers Comparison:

| Feature | Bybit | Kraken |

|---|---|---|

| No-KYC withdrawal limit | Up to 20,000 USDT daily | Limited to none |

| Basic verification | Simple process | More extensive |

| Advanced verification | Available for higher limits | Required for most features |

| Verification time | Generally faster | Can take longer |

The right exchange for you depends on your priorities. If you value minimal verification for basic trading, Bybit might be your choice. If you prefer an exchange with robust security measures, Kraken’s comprehensive KYC approach might better suit your needs.

Bybit Vs Kraken: Deposits & Withdrawal Options

When choosing between Bybit and Kraken, you need to consider how you’ll move your money in and out of these platforms. Both exchanges offer several options, but they differ in some key ways.

Deposit Methods

- Bybit: Supports crypto deposits and limited fiat options (wire transfers, credit cards)

- Kraken: Offers more robust fiat deposit methods including ACH, SEPA, wire transfers, and credit/debit cards

Withdrawal Methods

- Bybit: Primarily crypto withdrawals, limited fiat withdrawal options

- Kraken: Supports both crypto and multiple fiat withdrawal methods

Fees

| Method | Bybit | Kraken |

|---|---|---|

| Crypto Deposits | Free | Free |

| Crypto Withdrawals | Varies by coin | Varies by coin |

| Fiat Deposits | 1-3% for cards | 0-1.7% depending on method |

| Fiat Withdrawals | Limited options | $4-35 for wire transfers |

Kraken generally provides more comprehensive fiat options, making it easier for beginners to use traditional banking methods. This can be important if you regularly need to convert between crypto and your local currency.

Processing times also differ between the platforms. Kraken typically processes withdrawals faster, especially for verified accounts. Bybit may have slightly longer processing times for certain withdrawal methods.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication requirements to protect your funds.

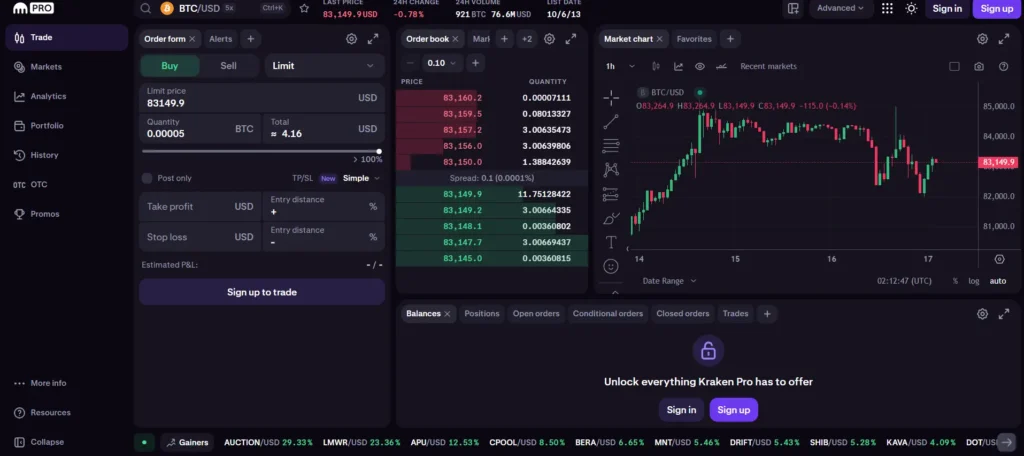

Bybit Vs Kraken: Trading & Platform Experience Comparison

Bybit and Kraken offer different trading experiences that cater to various types of crypto traders. When using these platforms, you’ll notice distinct differences in their interfaces and features.

Kraken provides a more traditional exchange experience with a clean, user-friendly interface. You can access spot trading with zero fees, making it attractive for basic buy-and-sell transactions.

Bybit focuses more on derivatives trading and offers NFT capabilities. The platform has a low minimum deposit requirement, making it accessible for beginners.

Trading Features Comparison:

| Feature | Bybit | Kraken |

|---|---|---|

| Derivatives | ✓ | ✓ |

| NFT Trading | ✓ | Limited |

| Minimum Deposit | Low | Moderate |

| Interface | Modern, feature-rich | Clean, traditional |

| Mobile Experience | Strong | Strong |

When trading on Kraken, you’ll benefit from their reputation for reliability and security. The platform is known for stable performance even during high market volatility.

Bybit offers a more diverse range of trading options with futures and other derivatives prominently featured. You might find its interface slightly more complex but with more advanced trading tools.

Both platforms provide mobile apps, but your experience will depend on your trading style. Frequent traders might prefer Bybit’s feature-rich environment, while those seeking simplicity may lean toward Kraken’s straightforward approach.

Bybit Vs Kraken: Liquidation Mechanism

Liquidation is a critical aspect to understand when trading with leverage on cryptocurrency exchanges. Bybit and Kraken handle this process differently, which can impact your trading experience.

Bybit’s Dual Price Mechanism

Bybit uses a dual price mechanism that helps prevent unfair liquidations. This system relies on two different price references:

- Mark Price (for position valuation)

- Last Traded Price (for execution)

This approach protects you from price manipulation and flash crashes that might otherwise trigger unnecessary liquidations. Bybit can process up to 100,000 transactions per second, ensuring smooth operation during high volatility.

Kraken’s Liquidation Warning System

Unlike Bybit, Kraken doesn’t use a dual-price mechanism. Instead, Kraken implements a liquidation warning system that notifies you when your positions are approaching liquidation levels.

This gives you an opportunity to add more collateral or close positions before liquidation occurs. The system is straightforward but may offer less protection against market manipulation.

Key Differences

| Feature | Bybit | Kraken |

|---|---|---|

| Price Mechanism | Dual price | Single price |

| Liquidation Protection | Built into pricing | Warning notifications |

| Processing Speed | Up to 100,000 TPS | Not specified in results |

Understanding these differences can help you choose the exchange that better suits your trading style and risk tolerance. If you’re concerned about unfair liquidations, Bybit’s approach might offer more protection.

Bybit Vs Kraken: Insurance

When choosing a crypto exchange, insurance coverage is a crucial factor to consider for your asset protection. Both Bybit and Kraken offer different approaches to safeguarding your investments.

Kraken maintains a comprehensive insurance policy to protect user funds. They store the majority of assets (95%) in cold storage, which adds an extra layer of security against potential hacks.

In contrast, Bybit operates an Insurance Fund designed to prevent auto-liquidations from negatively impacting traders. This fund acts as a buffer during volatile market conditions.

Neither exchange offers FDIC insurance since cryptocurrency is not considered legal tender in most jurisdictions. This differs from traditional banking protections you might be familiar with.

Kraken’s security track record is notable, with no major security breaches since its founding in 2011. This strong history might give you additional confidence beyond formal insurance protections.

Bybit has also maintained a relatively secure platform, though it’s newer to the market (founded in 2018). Their insurance fund specifically targets futures and derivatives trading protection rather than comprehensive coverage.

Insurance Comparison:

| Feature | Kraken | Bybit |

|---|---|---|

| Cold Storage | 95% of assets | Partial storage |

| Insurance Fund | Yes | Yes (focus on derivatives) |

| FDIC Insurance | No | No |

| Security History | Strong (since 2011) | Good (since 2018) |

You should evaluate which insurance approach better aligns with your trading style and risk tolerance before choosing between these platforms.

Bybit Vs Kraken: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both Bybit and Kraken offer support options, but they differ in important ways.

Bybit provides 24/7 customer support in multiple languages. Their team is known for being responsive and helpful. You can reach them through live chat, email, or their help center.

Kraken also offers reliable customer support with options including live chat and email support. Their team is known for being knowledgeable about crypto trading issues.

Response times vary between the platforms. Bybit typically responds within minutes on live chat. Kraken might take longer during peak times, but their answers are often detailed and helpful.

Support Options Comparison:

| Feature | Bybit | Kraken |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | No | No |

| Multiple Languages | Yes | Yes |

| Help Center/FAQ | Comprehensive | Extensive |

If you’re new to crypto trading, Bybit’s friendly support team might be more approachable. Their staff is trained to help beginners navigate the platform.

Kraken’s support team excels at handling technical questions and security concerns. Their representatives often have deeper knowledge about complex trading features.

Both exchanges offer educational resources alongside their direct support options to help you solve common problems on your own.

Bybit Vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and Kraken offer robust security measures, but they differ in some key aspects.

Kraken is widely regarded as having some of the strongest security in the industry. It offers advanced features including two-factor authentication (2FA), SSL encryption, and global settings lock.

Bybit also implements strong security measures with 2FA, SSL encryption, and a cold wallet storage system to protect your assets from online threats.

Kraken’s Security Highlights:

- Proof of reserves audits

- 95% of assets stored in cold wallets

- 24/7 global security team

- Never been successfully hacked

Bybit’s Security Highlights:

- Multi-signature cold wallet storage

- Real-time monitoring systems

- Regular security audits

- Insurance fund for derivatives trading

Kraken has built a reputation for security excellence over many years in the market. Their focus on regulatory compliance adds an extra layer of protection for your investments.

Bybit, while newer to the market, has invested heavily in security infrastructure. Their platform includes risk management tools to help you protect your account.

Both exchanges require identity verification to comply with regulations and prevent fraud. You’ll need to complete KYC (Know Your Customer) procedures on either platform.

For maximum security on either exchange, always enable 2FA, use strong unique passwords, and consider a hardware wallet for long-term storage.

Is Bybit Safe & Legal To Use?

Bybit offers solid security features to protect your crypto. They use two-factor authentication (2FA), SSL encryption, and cold wallet storage systems to keep funds safe from hackers.

However, legality varies by location. Bybit faces restrictions in several countries, with the United States being a notable example where access is limited.

Unlike Kraken, Bybit operates with fewer regulatory approvals. Based on the search results, Bybit lacks regulation from major financial authorities, including:

- AMF (France)

- DFSA (UAE)

- Singapore regulatory bodies

Some users consider Bybit less trustworthy than more established exchanges like Coinbase and Kraken. This perception exists despite Bybit being the second-largest crypto exchange globally.

When deciding to use Bybit, you should:

- Check your country’s restrictions before creating an account

- Verify current regulations as crypto laws change frequently

- Consider your risk tolerance for using less regulated platforms

For maximum security on Bybit, always enable all available security features and keep the majority of your long-term holdings in private wallets rather than on the exchange.

Is Kraken Safe & Legal To Use?

Kraken is widely regarded as one of the safest cryptocurrency exchanges available today. According to recent search results, independent auditors often rank Kraken #1 in terms of both security and customer service.

Kraken implements robust security measures to protect your funds and personal information. These include two-factor authentication (2FA) and an account lock feature that allows you to immediately secure your account if you suspect unauthorized access.

The exchange has maintained a strong security record since its founding in 2011. Unlike many competitors, Kraken has never experienced a major security breach resulting in customer fund losses.

From a legal standpoint, Kraken operates as a legitimate business that complies with regulations in jurisdictions where it offers services. The company is registered as a Money Services Business with FinCEN in the United States.

You should know that Kraken follows Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This means you’ll need to verify your identity before using their full range of services.

Key Security Features:

- Two-factor authentication (2FA)

- Account lock functionality

- Cold storage for majority of assets

- Regular security audits

- Global Compliance team

While no exchange can guarantee 100% safety, Kraken’s long-standing reputation and security-first approach make it one of the more trustworthy options for cryptocurrency trading in 2025.

Frequently Asked Questions

Traders often have specific questions when choosing between Bybit and Kraken. Here are answers to the most common questions about these platforms to help you make an informed decision.

What are the key differences in fees between Bybit and Kraken?

Bybit offers competitive trading fees, especially for high-volume traders. Their fee structure is particularly favorable for derivatives trading.

Kraken provides lower withdrawal fees compared to Bybit. They also offer zero-fee spot trading for certain pairs, which can be advantageous for frequent traders.

Trading fees on both platforms decrease as your trading volume increases, but the tier structures differ. Bybit typically appeals to active traders, while Kraken might be more cost-effective for occasional traders.

How do the security features of Bybit compare to those of Kraken?

Kraken has built a strong reputation for security with its long history in the crypto space. They offer two-factor authentication, SSL encryption, and maintain most assets in cold storage.

Bybit implements similar security measures including 2FA and multi-signature wallets. Their platform includes risk management tools that help protect traders from significant losses.

Both exchanges have solid security protocols, but Kraken’s longer track record gives some users more confidence in their security systems.

Which platform offers a better user experience, Bybit or Kraken, based on user reviews?

Bybit’s interface is designed with traders in mind, featuring an intuitive layout that appeals to both beginners and experienced traders. Users praise its responsive design and trading tools.

Kraken’s platform receives positive feedback for reliability and stability. However, some users find its interface less intuitive for beginners compared to Bybit.

User experience preferences often depend on trading style. Active traders tend to favor Bybit’s interface, while those focused on long-term investing might prefer Kraken’s approach.

Are there any notable differences in the variety of cryptocurrencies offered by Bybit and Kraken?

Kraken offers a wide selection of cryptocurrencies, including many altcoins and smaller projects. They typically have strict listing requirements which can mean fewer but higher-quality tokens.

Bybit focuses more on popular cryptocurrencies and trading pairs. They excel in derivatives offerings, including futures and options contracts for major cryptocurrencies.

Both platforms regularly add new tokens, but they follow different approaches to listings. Your preference will depend on whether you prioritize variety or focus on trading major cryptocurrencies.

How do both exchanges handle customer support and user concerns?

Kraken provides 24/7 customer support through live chat, email, and an extensive knowledge base. They’re known for responsive service and detailed responses to inquiries.

Bybit also offers around-the-clock support through multiple channels. Their support team is available via chat, email, and social media platforms.

Response times can vary for both exchanges during high-volume periods. Both platforms maintain active community forums where users can find solutions to common issues.

What are the advantages and disadvantages of using leverage on Bybit vs Kraken?

Bybit offers higher leverage options than Kraken, allowing traders to open larger positions with less capital. This can amplify potential profits but also increases risk.

Kraken takes a more conservative approach to leverage, offering lower maximum limits. This can be safer for beginners or risk-averse traders.

Both platforms provide liquidation protection measures, but they work differently. Bybit uses a dual-price mechanism to prevent unnecessary liquidations, while Kraken employs strict risk management systems.

Bybit Vs Kraken Conclusion: Why Not Use Both?

When comparing Bybit and Kraken, each exchange offers distinct advantages that might benefit your trading strategy.

Kraken stands out with better overall features and higher evaluation scores according to recent comparisons. Its platform is transparent about fees and trading costs, making it easier for you to plan your trades.

Bybit excels in derivatives trading but charges lower fees (compared to Kraken’s 0.16% maker and 0.26% taker fees). This makes it appealing if you’re focused on keeping costs down.

Consider using both platforms for different purposes:

- Kraken: Better for spot trading, beginners, and those who value transparency

- Bybit: Ideal for derivatives trading and lower fee structures

Many traders actually maintain accounts on multiple exchanges to:

- Take advantage of different fee structures

- Access various trading pairs not available on a single platform

- Diversify exchange risk

- Utilize the unique features each platform offers

You might find that Kraken serves your spot trading needs while Bybit handles your derivatives trading. This combination could provide you with a more complete trading toolkit.

Remember that neither exchange is perfect for everyone. Your trading volume, preferred assets, and comfort with various interfaces should guide your decision.