Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Both Bybit and DigiFinex are popular platforms, but they have key differences that might affect which one works best for you.

When comparing Bybit and DigiFinex, you’ll find variations in their fee structures, supported cryptocurrencies, available trading types, and additional features like interest accounts. Bybit offers compounding on cryptocurrency interest accounts, maintaining a rate of about 0.6% for Bitcoin, while DigiFinex provides its own set of competitive features.

You should consider factors like user experience, deposit methods, and platform security before making your choice. These exchanges serve different types of traders with varying needs, so understanding the specific differences can help you select the platform that aligns with your trading goals and preferences.

Bybit Vs DigiFinex: At A Glance Comparison

When choosing between Bybit and DigiFinex, understanding their key differences can help you make the right choice for your crypto trading needs.

Trading Volume & Reputation

| Feature | Bybit | DigiFinex |

|---|---|---|

| Trust Score | Higher | Lower |

| Trading Volume | Larger | Smaller |

| Market Legitimacy | Strong confidence | Moderate confidence |

Bybit offers compound interest at a rate of 0.6% for Bitcoin, which can help your investments grow faster over time. DigiFinex does not appear to offer the same compounding benefits.

Platform Features

Both exchanges support multiple cryptocurrencies and trading pairs, but they differ in their user experience. Bybit is often praised for its intuitive interface and trading tools.

Fee Structure

The fee structures between these platforms vary. You should check current rates before deciding, as these can impact your trading profits significantly.

Security & Reliability

Bybit generally receives higher user scores compared to DigiFinex, suggesting better customer satisfaction and potentially stronger security measures.

When comparing the two platforms, consider your trading needs. If you’re looking for higher liquidity and stronger market confidence, Bybit might be the better option. However, DigiFinex may offer different cryptocurrency options that could suit your specific investment strategy.

Remember to check the most current information before making your decision, as exchange features and rates change frequently in the crypto market.

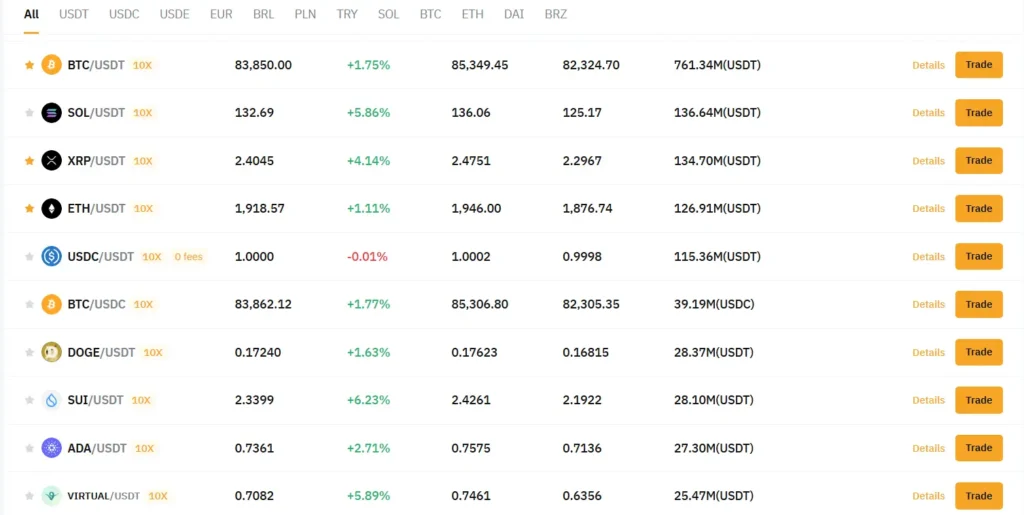

Bybit Vs DigiFinex: Trading Markets, Products & Leverage Offered

Bybit and DigiFinex offer different trading options for crypto investors. Both platforms serve traders with various needs, but they have distinct features worth comparing.

Bybit specializes in derivatives trading, particularly futures and margin trading. You can access spot trading, perpetual contracts, and options on this platform. Bybit’s leverage goes up to 100x on certain trading pairs, making it attractive for experienced traders.

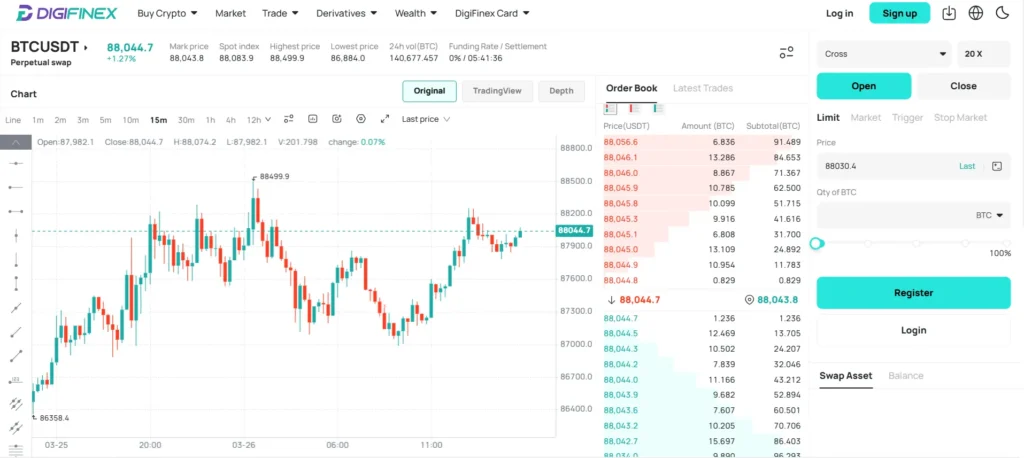

DigiFinex provides spot trading as its primary service but also offers futures trading with more limited leverage options. The platform typically offers leverage up to 20x, which is significantly lower than Bybit’s maximum.

Here’s a comparison of their key trading features:

| Feature | Bybit | DigiFinex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Perpetuals | ✓ | ✓ |

| Options | ✓ | ✗ |

| Max Leverage | Up to 100x | Up to 20x |

| Earn Programs | Flexible & fixed savings, staking | Basic interest accounts |

Bybit offers more advanced trading tools and products, making it better suited for traders looking for sophisticated options. Their earn programs are also more diverse, including flexible and fixed-term savings options.

DigiFinex has a simpler approach with fewer complex products. This might be more approachable if you’re new to crypto trading or prefer straightforward options without overwhelming features.

Both exchanges support a wide range of cryptocurrencies, but Bybit generally has more trading pairs available for derivatives trading.

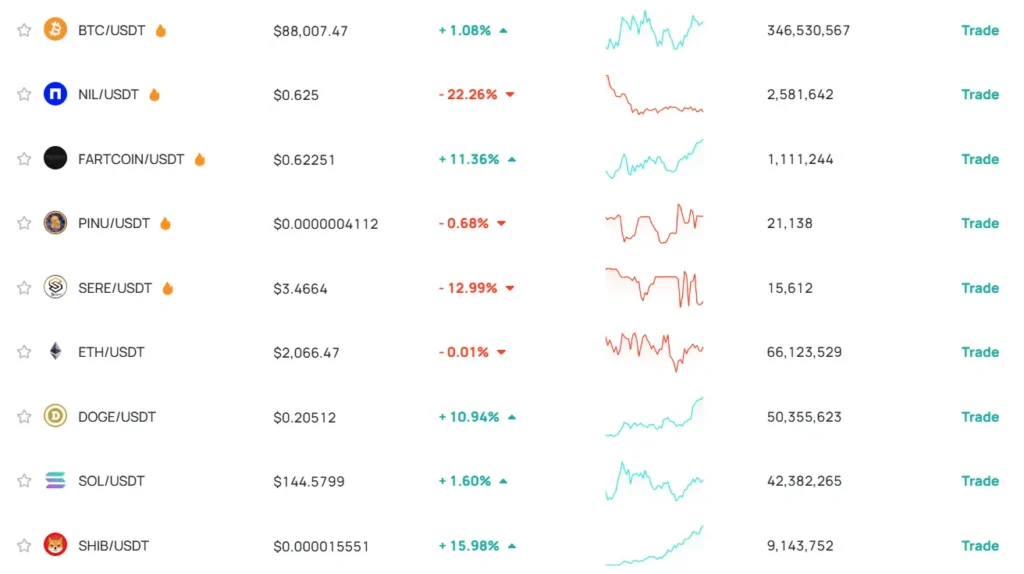

Bybit Vs DigiFinex: Supported Cryptocurrencies

When choosing between Bybit and DigiFinex, the range of available cryptocurrencies is a key factor to consider. Both exchanges offer a variety of digital assets, but there are some differences worth noting.

Bybit supports a solid selection of cryptocurrencies, focusing on major coins and popular altcoins. You’ll find Bitcoin (BTC), Ethereum (ETH), and other established cryptocurrencies available for trading. Bybit tends to be more selective about which tokens it lists.

DigiFinex typically offers a wider range of cryptocurrencies, including many smaller altcoins and newer tokens. This makes it potentially more appealing if you’re looking to trade less mainstream digital assets.

Cryptocurrency Support Comparison:

| Feature | Bybit | DigiFinex |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Major Altcoins | ✓ | ✓ |

| Smaller Altcoins | Limited | Extensive |

| New Token Listings | Selective | Frequent |

Both platforms regularly update their available cryptocurrencies, adding new options as the market evolves. You should check their current listings if you’re looking to trade specific tokens.

Remember that while DigiFinex may offer more options, Bybit’s more curated approach might provide additional confidence in the quality of listed assets.

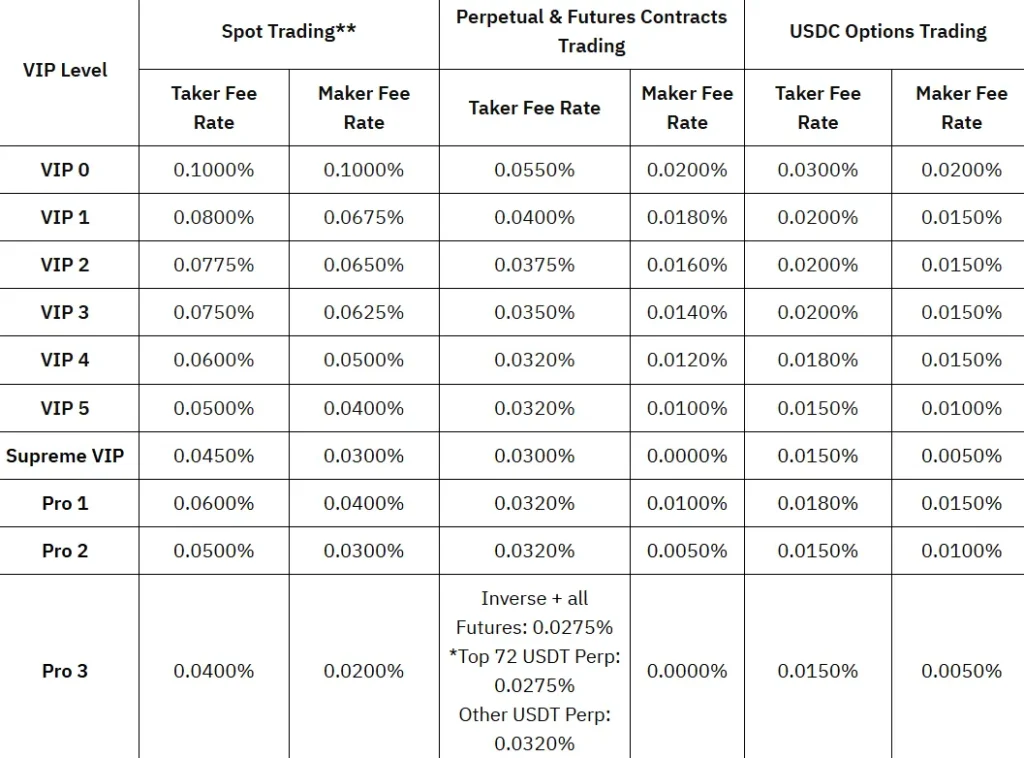

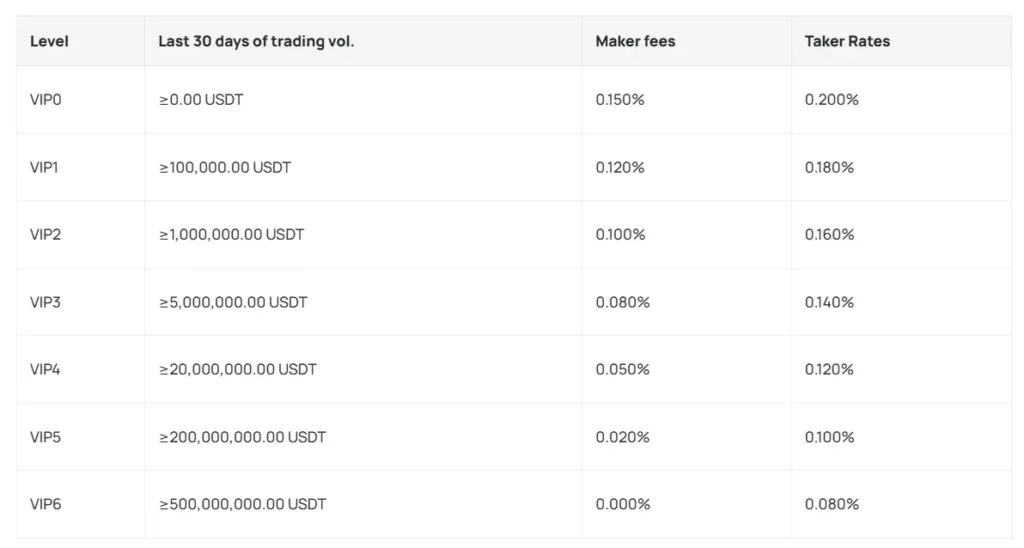

Bybit Vs DigiFinex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and DigiFinex, understanding their fee structures can help you make a better decision. Both exchanges have different approaches to trading, withdrawal, and deposit fees.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bybit | 0.1% | 0.1% |

| DigiFinex | 0.2% | 0.2% |

Bybit offers slightly lower standard trading fees compared to DigiFinex. However, both exchanges provide fee discounts based on your trading volume and if you hold their native tokens.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. DigiFinex tends to have higher withdrawal fees for most cryptocurrencies compared to Bybit.

For popular coins like Bitcoin, Bybit typically charges less for withdrawals. This can save you money if you frequently move funds off the exchange.

Deposit Methods

Both exchanges support crypto deposits with no fees. For fiat deposits:

- Bybit offers bank transfers and credit/debit card options

- DigiFinex has more limited fiat deposit methods in some regions

Fee Reduction Options

You can lower your fees on both platforms. Bybit users can reduce fees by holding BIT tokens. DigiFinex offers similar benefits for DFT token holders.

High-volume traders receive automatic fee discounts on both exchanges. If you trade frequently, these tiered fee structures will benefit you more.

Bybit Vs DigiFinex: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both Bybit and DigiFinex offer various order options to meet different trading needs.

Bybit provides a comprehensive range of order types divided into basic and advanced categories. The basic order types include:

- Market Orders: Execute immediately at the current market price

- Limit Orders: Set a specific price for execution

- Conditional Orders: Trigger when certain market conditions are met

DigiFinex also offers standard order types but with some differences in their advanced trading features. Their platform supports:

- Market Orders

- Limit Orders

- Stop-Loss Orders

Bybit has gained recognition as one of the best platforms for margin trading since its launch in 2018. This reputation stems partly from its diverse order types that cater to complex trading strategies.

For traders looking to implement specific strategies, Bybit’s advanced order types provide more flexibility. These include trailing stops and post-only orders that help you manage risk more effectively.

DigiFinex’s order interface is designed to be user-friendly, making it accessible for beginners while still offering enough options for experienced traders.

When choosing between these exchanges, consider which order types are essential for your trading style. If you rely heavily on advanced conditional orders, Bybit might better suit your needs.

Bybit Vs DigiFinex: KYC Requirements & KYC Limits

Both Bybit and DigiFinex require Know Your Customer (KYC) verification, but they approach it differently.

Bybit KYC Overview:

- Uses verification to identify customers and analyze risk profiles

- Helps prevent money laundering and financing of illicit activities

- Offers different verification levels with varying benefits

- Focuses on creating a secure and compliant trading environment

Bybit’s KYC process is structured to meet regulatory requirements while providing security for users. When you complete higher verification levels, you gain access to increased withdrawal limits and features.

DigiFinex KYC Overview:

- Requires KYC verification before deposits or trades

- Implements standard verification steps similar to other exchanges

- Follows compliance standards to maintain regulatory requirements

DigiFinex makes KYC mandatory from the start. You cannot deposit funds or make trades until you’ve completed their verification process.

Key Differences:

| Feature | Bybit | DigiFinex |

|---|---|---|

| Verification Timing | Tiered approach with basic functions before full KYC | Required before any platform usage |

| Level System | Multiple verification levels | Standard verification process |

| Focus | Security and compliance balance | Strict compliance approach |

For both platforms, completing KYC is essential for accessing full trading capabilities. The main difference lies in when verification is required and how the process is structured.

Bybit Vs DigiFinex: Deposits & Withdrawal Options

When choosing between Bybit and DigiFinex, deposit and withdrawal options play a crucial role in your trading experience.

Bybit offers multiple deposit methods including cryptocurrencies and some fiat options. You can fund your account via bank transfers and selected payment processors. The platform supports major cryptocurrencies for deposits with minimal fees.

DigiFinex similarly supports cryptocurrency deposits with competitive fee structures. It allows users to deposit popular coins like Bitcoin, Ethereum, and various altcoins directly.

For withdrawals, both exchanges process cryptocurrency transactions efficiently. Bybit typically processes withdrawals within 24 hours, while DigiFinex aims for similar timeframes depending on network congestion.

Fee Comparison:

| Exchange | Crypto Withdrawal Fees | Processing Time |

|---|---|---|

| Bybit | Varies by asset | Usually < 24h |

| DigiFinex | Varies by asset | Usually < 24h |

Bybit offers more extensive fiat options in certain regions, making it potentially more accessible for beginners. DigiFinex focuses more heavily on crypto-to-crypto transactions.

Security for deposits and withdrawals is robust on both platforms. You’ll find two-factor authentication and withdrawal address whitelisting available on both exchanges to protect your funds.

Remember to verify withdrawal limits before choosing your platform. Both exchanges implement tiered verification levels that affect how much you can withdraw daily.

Bybit Vs DigiFinex: Trading & Platform Experience Comparison

When choosing between Bybit and DigiFinex, the trading experience differs in several ways. Both platforms offer cryptocurrency trading, but with distinct features.

Bybit provides a more streamlined interface that beginners find easier to navigate. You’ll notice its dashboard is organized with clear menus and trading pairs.

DigiFinex offers more trading pairs but can feel overwhelming to new users. The platform has improved recently but still has a steeper learning curve.

Trading Features Comparison:

| Feature | Bybit | DigiFinex |

|---|---|---|

| User Interface | Clean, modern | Feature-rich, complex |

| Mobile App | Highly rated | Good functionality |

| Trading Types | Spot, futures, options | Spot, futures, margin |

| Charting Tools | Advanced | Intermediate |

Bybit stands out with its test mode, where you can practice trading without risking real money. This is especially helpful if you’re new to crypto trading.

DigiFinex offers competitive interest rates on crypto holdings. You can earn passive income while keeping your assets on the platform, with compounding available.

Load times on Bybit are typically faster, which matters during volatile market conditions when seconds count.

Both platforms support API trading for automated strategies, but Bybit’s documentation is more comprehensive, making it easier to implement trading bots.

You’ll find that customer support is more responsive on Bybit, with faster ticket resolution times compared to DigiFinex.

Bybit Vs DigiFinex: Liquidation Mechanism

Liquidation is a crucial aspect to understand when trading on cryptocurrency exchanges. It occurs when your position can’t meet the margin requirements.

Bybit’s Liquidation Process:

- Uses a tiered liquidation mechanism to protect traders

- Implements partial liquidations when possible instead of closing entire positions

- Offers stop-loss features to help prevent liquidations

- Has a clear liquidation price calculator in the trading interface

Some Bybit users have reported confusion about liquidations even when they had stop-losses in place. This highlights the importance of understanding how different market conditions affect these protective measures.

DigiFinex’s Liquidation Process:

- Uses a standard liquidation model that closes positions when margin requirements aren’t met

- Provides liquidation warnings as your position approaches the threshold

- Offers risk management tools to help you avoid liquidations

- Has a more straightforward but potentially less flexible liquidation system

Both platforms face liquidation risks during extreme market volatility. However, Bybit tends to offer more advanced liquidation features for experienced traders.

When choosing between these exchanges, consider how important partial liquidations and advanced risk management tools are to your trading strategy. Your comfort level with complex liquidation mechanisms should influence your decision.

Remember that market conditions can sometimes make it difficult to withdraw funds or liquidate assets quickly on either platform. Always maintain sufficient margin and use stop-losses appropriately.

Bybit Vs DigiFinex: Insurance

When trading on crypto exchanges, insurance funds are crucial for protecting your assets and trades. These funds help manage risk and protect users from unexpected market events.

Bybit offers a comprehensive insurance fund that safeguards traders from negative equity situations. This is especially important during volatile market conditions when liquidations might occur.

The insurance fund at Bybit works as a buffer against losses that exceed a trader’s collateral. It helps prevent auto-deleveraging (ADL) and ensures the stability of the platform during extreme market movements.

DigiFinex’s approach to insurance is less transparent. While they offer various financial services and trading options, detailed information about their insurance protection is not as readily available as Bybit’s.

For margin traders, Bybit’s clear insurance system provides greater peace of mind. The platform actively maintains and publishes the status of their insurance fund, allowing you to assess the safety level before trading.

When selecting between these exchanges, consider how important insurance coverage is for your trading strategy. If you frequently use leverage or margin trading, Bybit’s established insurance system might be more suitable for your needs.

Remember to always check the current insurance fund status on either platform, as these can change based on market conditions and platform policies.

Bybit Vs DigiFinex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Bybit and DigiFinex offer various support options to help you resolve issues.

Bybit provides 24/7 customer service through live chat, email, and an extensive help center. Their response times typically range from a few minutes to a few hours depending on query complexity.

DigiFinex also features 24/7 support with a live chat option as mentioned in the search results. They maintain a large blog to keep users updated on platform changes and cryptocurrency developments.

Support Channels Comparison:

| Feature | Bybit | DigiFinex |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Knowledge Base | Extensive | Comprehensive |

| Response Time | Generally quick | Variable |

Both platforms offer multi-language support to accommodate their global user base. Bybit currently supports more languages than DigiFinex, which may be important if English isn’t your primary language.

User feedback suggests Bybit’s support team is particularly helpful for new traders, walking you through complex processes step-by-step. DigiFinex’s support team is knowledgeable but sometimes experiences delays during high-volume periods.

For advanced technical issues, both exchanges provide escalation options to specialist teams. You can expect more detailed assistance for complex trading or account problems.

Bybit Vs DigiFinex: Security Features

When choosing between Bybit and DigiFinex, security should be a top priority. Both exchanges have implemented various measures to protect your funds and personal information.

Bybit offers strong security through multi-signature cold wallets, which store most user funds offline. They also use two-factor authentication (2FA) and advanced encryption to secure accounts.

DigiFinex boasts “industry-leading security features” according to search results. They utilize a combination of hot and cold wallet systems with over 95% of assets stored in cold storage.

Key Security Features Comparison:

| Feature | Bybit | DigiFinex |

|---|---|---|

| Cold Storage | Multi-signature wallets | 95%+ of assets in cold storage |

| 2FA | Yes | Yes |

| Anti-phishing | Email verification | Email verification |

| Insurance Fund | Yes | Limited information available |

Both platforms conduct regular security audits to identify and fix vulnerabilities. They also monitor transactions for suspicious activity to prevent fraud.

DigiFinex has received positive mentions for their customer service, which can be important during security-related issues. Quick response times help you resolve problems faster.

For added protection, you should always enable all available security features on either platform. This includes using a strong, unique password and enabling 2FA through an authenticator app rather than SMS.

Is Bybit Safe & Legal To Use?

Bybit operates in a gray area when it comes to regulation. According to the search results, Bybit does not appear to be regulated by any government authority at this time.

For users in the United States, there are important legal considerations. Bybit is not officially available to US residents, and using it may involve legal risks.

The platform does offer some security features that users appreciate:

- Anonymous trading options

- Robust security protocols

- No KYC requirements for basic accounts

However, lack of regulation means your funds don’t have the same protections as on regulated exchanges. There’s no government oversight or insurance for your assets.

The Ontario Securities Commission (OSC) doesn’t list Bybit among registered crypto asset trading platforms in Canada. This suggests caution for Canadian users.

Trading on unregulated platforms always carries additional risk. You should consider whether this aligns with your risk tolerance.

For safer alternatives, look for exchanges registered with financial authorities in your country. These provide better legal protections and recourse if something goes wrong.

Remember that regulations change frequently in the crypto space. What’s legal today might not be tomorrow.

Always do your own research before depositing significant funds on any exchange, including Bybit.

Is DigiFinex Safe & Legal To Use?

DigiFinex is a Hong Kong-based cryptocurrency exchange serving over four million users worldwide. When considering safety, the exchange implements industry-standard security practices to maintain a secure trading environment.

However, DigiFinex’s security profile has some important considerations. The exchange has a lack of mandatory KYC (Know Your Customer) verification, which could potentially attract users involved in illicit activities.

The platform does follow Anti-Money Laundering (AML) and KYC regulations, though implementation appears less strict than other exchanges.

Users from several countries face restrictions on DigiFinex, including:

- United States

- China

- Singapore

- Countries in the Balkan region

According to Traders Union, DigiFinex has a higher-than-average risk score, rating 4.08 out of 10 on their Overall Score system. This indicates some caution may be warranted when using this platform.

Before creating an account, you should verify whether DigiFinex is legal to use in your jurisdiction. Cryptocurrency regulations vary significantly between countries and can change rapidly.

You should also consider enabling all available security features if you choose to use DigiFinex. This includes two-factor authentication and withdrawal limits to protect your assets.

Frequently Asked Questions

Traders considering Bybit or DigiFinex often need specific information about their differences and capabilities. These answers address the most common questions about both platforms based on current 2025 features.

What are the main differences between Bybit and DigiFinex platforms?

Bybit focuses on derivatives trading with advanced futures options and leverage up to 100x. It offers a more polished, user-friendly interface targeted at both beginners and experienced traders.

DigiFinex specializes in spot trading with a wider selection of altcoins and tokens. It provides more niche trading pairs that aren’t available on mainstream exchanges.

The platforms differ in their mobile experiences, with Bybit offering more comprehensive trading tools and charts on its app compared to DigiFinex’s more basic mobile functionality.

Which exchange offers better security features, Bybit or DigiFinex?

Bybit employs multi-signature cold wallets, two-factor authentication, and regular security audits. It maintains an insurance fund to protect users against auto-deleveraging.

DigiFinex uses bank-level SSL encryption, multi-cluster and multi-layer system architecture, and cold wallet storage for 98% of assets. It offers anti-phishing codes in emails for added security.

Both platforms provide similar basic security features, but Bybit’s insurance fund gives traders additional protection for leveraged positions that DigiFinex doesn’t match.

How do the fees compare between Bybit and DigiFinex?

Bybit charges a 0.1% maker fee and 0.6% taker fee for spot trading. Its derivatives fees range from 0.01% to 0.06% depending on your VIP level.

DigiFinex has a flat 0.2% fee structure for both makers and takers in spot markets. Its futures trading fees are slightly higher than Bybit’s.

Bybit offers compounding interest on crypto deposits, while DigiFinex provides competitive but slightly lower rates. Withdrawal fees on both platforms vary by cryptocurrency.

What are the advantages of using DigiFinex over other exchanges?

DigiFinex lists a wider variety of altcoins and emerging tokens than many competitors. You’ll find trading pairs that aren’t available on mainstream exchanges.

The platform offers innovative features like DigiFinex Cloud, allowing institutional clients to launch their own exchanges using DigiFinex’s infrastructure.

DigiFinex maintains strong liquidity across its trading pairs and offers a simplified staking program with competitive yields for long-term holders.

What unique features does Bybit offer to its users?

Bybit’s demo account lets you practice trading with virtual funds before risking real money. This feature is particularly valuable for beginners learning complex derivatives trading.

The platform’s Unified Margin system allows you to share collateral across different positions, improving capital efficiency when trading multiple instruments.

Bybit’s built-in copy trading functionality enables you to automatically mirror the trades of successful traders, which is ideal if you want to learn while earning.

Can users from all countries trade on Bybit and DigiFinex, and what are the restrictions?

Neither platform allows users from the United States due to regulatory constraints. Bybit also restricts access from the UK, Singapore, and Canada.

DigiFinex blocks users from countries under international sanctions including North Korea, Iran, Syria, and Cuba. It maintains stricter KYC requirements for users from high-risk jurisdictions.

Both exchanges may limit certain features based on your location. Always check the current restrictions before registering as regulatory landscapes continue to evolve in 2025.

DigiFinex Vs Bybit Conclusion: Why Not Use Both?

Both DigiFinex and Bybit offer unique advantages for crypto traders. DigiFinex functions as a cryptocurrency exchange and digital asset platform providing trading services and wealth management options.

Bybit, on the other hand, has established itself as a reliable trading platform with its own set of features. Neither platform is perfect, with DigiFinex receiving a TU Overall Score of 4.08 out of 10, indicating higher-than-average risk.

Using both platforms can give you access to a wider range of cryptocurrencies and trading options. You might prefer DigiFinex for certain assets while using Bybit for others.

To get started with DigiFinex on Bybit, you’ll need to:

- Sign up for a Bybit account

- Complete Identity Verification Lv. 1 (KYC requirements)

- Begin trading

Before choosing either platform, consider these factors:

- Trading fees

- Available cryptocurrencies

- Security features

- User interface

- Customer support

It’s worth noting that regulatory status matters. Some crypto asset trading platforms have received exemptive relief to operate in certain regions, like Ontario. Always check if the platform is properly registered in your area.

You don’t need to limit yourself to just one platform. Many experienced traders use multiple exchanges to take advantage of different features, pricing, and available tokens.